Can margin be more than 100 percent. What is margin

The feasibility of the company's functioning is estimated by economic indicators. The main criterion applied to monitoring activities is margin.Its regular control makes it possible to identify business problems in a timely manner, identify its weaknesses and strengthen strong positions. The parameter is used to assess the profitability of the industry, as well as to substantiate the adoption of an important decision. The margin is always determined when analyzing the financial condition of the business entity.

What is margin

What is margin

The margin is identified as the difference in indicators to estimate the parameters of the functioning of the business and its profitability. When it is determined, the preferential position of one of the indicators taken into account in the analysis is taken into account. The consistency assessment of the company is carried out by comparing two criteria assigned to the economic and financial category. The varieties of the parameter are determined by the scope of management to be analyzed efficiency.

The concept of margin is used in many areas of activity.Distinguish between several types of economic indicators:

- gross;

- variational;

- pure percentage;

- warranty;

- credit;

- bank;

- birzheva.

Production

Economists define margin by the difference between the price of the product and its cost. When analyzing the results of the subject of entrepreneurship, the gross variety of parameter is used, since it affects the net profit used to invest in order to increase the fixed capital. Such a decision contributes to the development of the company and an increase in its profitability.

Banking

The concept of credit margin is applicable in the banking sector. It is relevant when issuing a lending agreement and is determined by the difference between the value of the financial benefits of the contract and the amount paid by the borrower, taking into account the accrued interest.

At pledge lending, the calculations takes into account the warranty margin corresponding to the difference in the value of the collateral and the amount of the issued loan.

In the field of deposit, the concept of a bank margin is relevant. It is calculated by the difference between the parameters of the credit and deposit interest rate. The indicator allows you to balance the profit received by the Bank as a result of the investment by adjusting the amount of interest rate.

The main criterion for the success of the financial institution is a pure interest margin. To determine it, it is necessary to divide the difference in income and expenses related to the category of commissions for assets. In the calculations, all assets or only those that are currently bringing profit can be taken into account.

See also: What shows the profitability of the main activity

Stock Exchange

In stock activity applies a variation margin. The parameter is distinguished by inconsistency and may have a positive or negative value. It is determined by the amount of collateral, at the expense of which the possibility of obtaining a monetary or commodity loan to make financial transactions of a speculative nature during marginal trading is provided. Margin is expressed as a percentage of collateral to the magnitude of the open position.

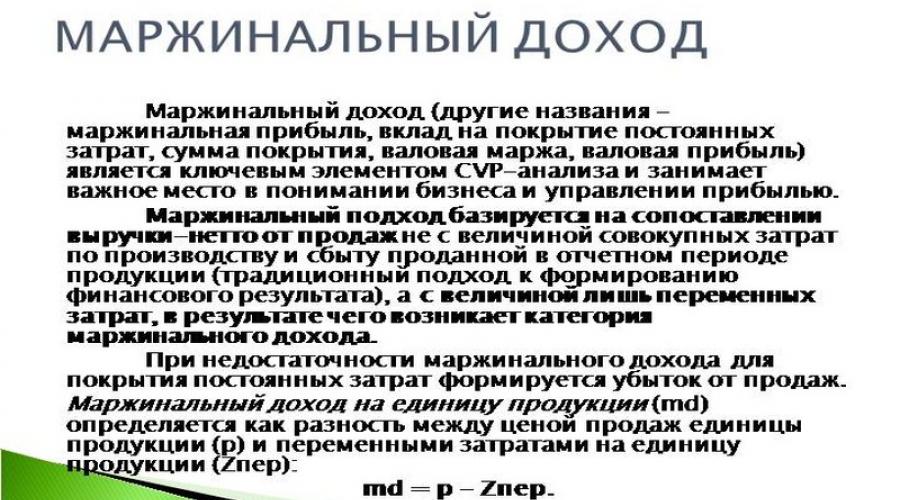

The concept of margin income

The parameter determines the amount of funds in the transaction that can be freely disposed due to the lack of their attitude to the commitment of the trader. With closed orders, the value objects do not relate to them, therefore the entire amount is presented in the form of a free margin. It is used by traders to open positions and is determined by the difference between means relating to the category of assets and a pledge that is a passive.

The margin is a key factor in pricing and evaluating the effectiveness of marketing costs.It allows you to analyze the profitability of the subject and predict its overall profitability. The economic indicator is a relative value expressed in percentage measurements. It corresponds to private profit and income adjusted by 100 percent.

Formula for calculating margin income

The margin coefficient is calculated with the orientation per unit of production, which is produced and implemented by the company, the effectiveness of which is estimated. It is not a characteristic of the economic structure of a business entity, however, allows you to identify profitable and unprofitable types of product in terms of obtaining potential profits.

Example

There is a fact that the company's margin corresponds to 20 percent. This data suggests that in each ruble, revenue contains 20 kopecks. The remaining funds belong to the category of expenses.

Operating Martha

The formula of the operating margin allows you to calculate the coefficient identifying the level of profitability of the company of the entity of entrepreneurship in the process of carrying out operating activities in standard mode.

To determine it, it is necessary to calculate the share of profits from sales when conducting management by finding private profits to revenue. In the calculation, the profit parameter is applied before taxes and interest on loans. It includes the cost of realized products, as well as expenses attributed to the commercial, general and administrative category.

Calculation of sales marginity

Marginal markup

If the results of the company's activities are represented by an expanded range of products, then to estimate sales profitability, it is recommended to use the marginity coefficient. Evaluation of the parameters calculated for all categories of goods or services separately will allow you to determine which products brings the greatest income, and do not waste financial resources for the manufacture of unclaimed goods. Analysis of the coefficients is relevant in determining the production volumes of each product from the assortment series in the case of the application of the same technologies and the use of identical raw materials.

Quite often, entrepreneurs begin their business on the basis of good marginity. It estimates the profitability of the business. In this article we will talk in detail about the margin, as well as about some features related to it.

It all does not matter how many income brings your business, it is important that there is less money as possible on its production. For example, if you get 100 million dollars a year, and spend 100 million and one dollar, then you will not work on such a business. In order for your business for a long time existed, he must generate income. No firm will work for a long time if it brings a small income. The profit allows you to stay afloat.

Each entrepreneur, starting his business should evaluate the expected yield. That your business is successful, this is a prerequisite. Therefore, before the start of your case, you need to calculate the expected marginality. This check will help you save your money and evaluate possible risks. Often it is possible to observe such a situation when the business begins without the miscalculation of risk. We recommend that you do this on the initial fucking launch of your business.

Definition of margin

Margin is an increase in monetary equivalent, taking into account the costs and cost of goods. However, such a concept will not give you the complete definition of this money tool. Marginalness increases if production costs decrease and the price of products increases. So, you need to ensure maximum profit, by reducing costs. We will analyze this definition in more detail.

First you need to supplement the above concept.  Usually under marginality understand the increase in money capital per unit of goods.

Usually under marginality understand the increase in money capital per unit of goods.

That is, the marginality of this difference between all costs that were spent on the production and profit gained.

The process of counting margin will be made both at the start of your business and throughout its existence.

The more often you will determine the margin, the more qualitative will be your business, because you will correctly evaluate the expected cash increase.

Formula of calculation

To understand the essence of this procedure, you need to specify the formula for counting marginality:

Mar \u003d Doh-ed

This formula provides us with a visual understanding of the process of counting margin. There is nothing complicated in the counting margin. You will be enough two indicators to determine the profitability of your business.

Consider a specific example.

Suppose you need to produce 2000 units of goods, the market price of which is 20 rubles. Total production costs of 25 thousand rubles.

Substituting the data to the formula specified earlier:

Mar \u003d 2000 * 20-25000 \u003d 15 000 rubles.

Thus, we found that the margin of our company will be 15 thousand rubles.

It is also necessary to indicate that the margin can count not in the monetary equivalent, but in the percentage.

Consider another example.

Suppose the broker suggests you buy 500 shares of $ 1 per piece. In addition, he said that their cost will be $ $ 3 next month.

It turns out that you had $ 500, with the investment in the stock market, your amount was equal to $ 1,500.

In formula form: Mar \u003d 1500 * 100/500 \u003d 300%

That is, when investing in stock, your marginality will be 300%. Any businessman will tell you that this is a great investment. We will not consider the possibilities of the stock market, but you need to understand that this occupation has a kind of risks. Therefore, whether to help you with money in it - your business.

The purpose of the calculation of margin

The purpose of the calculation of marginity is to assess the profitability of the business.

In order to correctly calculate marginality, you do not need to have great knowledge in the field of economics or investment financing. All you need is to take advantage of the above formulas. We recommend using the formula to determine the margin in the percentage ratio.

Such an option to allow you to competently appreciate the possibilities of your money investment. The Margin interest rate will help determine the expected income over time. Guided by the correct assessment of the situation, you can choose the right decision.

Difference margin from extra charge

The markup is the difference between the wholesale and retail price. And we have established earlier that marginality is the difference between profit and spent costs. So the markup is defined as the difference in relation to the cost, and the margin will be determined by the difference between the valuable and cost.

Thus, we have established formulas for determining marginality. Which option to choose is to solve you. Properly defined marginality will allow you to settle your money more competently.

Noscova Elena

In the profession of an accountant for 15 years. He worked as chief accountant in the group of companies. I have experience in passing checks, receiving loans. Familiar with the spheres of production, trade, services, construction.

In economists working in various financial, commercial structures, the concepts of "margin" and "profit" are often used in the field of management.

More specifically, with such terms we face, for example:

- When discussing the Forex market.

- In banking.

- In principle, in any serious occupations associated with the economy.

So, anyone would not prevent anyone to know what it is, in terms of the concepts of differences. All these concepts are related and apply to the assessment of the economic activity of companies, there is a need to deal with them in more detail.

This term is considered an important pricing criterion, an indicator of the work of an enterprise, firm, bank. Knowing margin, you can calculate other indicators of the company or, for example, an insurance company. The word margin is translated from the English Margin or French Marge - margin, markup. For example, the expression "Bank Margin" is translated as a bank margin, i.e. The difference in interest rates on loans and deposits.

The concept of "margin" is used quite often, say, in the trading, insurance and banking business, operations with securities on the stock exchange and other types of commercial operations. Each type of activity the word margin has its own specifics. In economic terminology, this concept indicates the difference in any indicators. If an enterprise manufactures the goods, the difference between the sale price with the amount of costs for the manufacture and sale of goods, i.e. The cost of this product, and there is a margin. It is indicated or in absolute values, or in percent.

If the margin is expressed as a percentage, it is calculated as the ratio of the difference value of the sale price and cost price to the sale price multiplied by 100%. For example, if the company's margin is 32%, then the company receives 32 kopecks to each ruble, and 68 kopecks make up costs. It is possible that the margin cannot be equal to 100%, because In this case, the cost of goods will be zero. The margin is of great importance in assessing the company's work, since the most important indicator depends on its value.

When evaluating the work of the enterprise, the concept is used " gross margin". It can be calculated if the amount of revenue from the sale of products subtract the amount of expenses for its manufacture. Knowing this indicator, you can calculate the net profit of the company or company. If you take the ratio of gross profit and revenue and express it as a percentage, then the profitability of sales, which characterizes the quality of the company's activity.

The ultimate goal of the functioning of the company, the company, another commercial organization is to receive profits. It is determined by the difference between the cumulative income and total costs for the manufacture, storage, acquisition, sales of goods or services during a certain period.

Profit - indicator characterizing final results Enterprises, organizations, companies or firms. Unlike margin, the company's profit (enterprises) is made otherwise. To calculate the profits, the cost of deductible costs, various costs, costs for managerial activities, paid interest, other expenses, add other income.

If we obtain taxes from the resulting value, we obtain an indicator of the efficiency of the enterprise and a certain period of time - net profit. It can be used to pay remuneration, interest shareholders, investment in development and other purposes. This indicator is most important for most company managers.

RESULTS

Thus, the margin takes into account only those production costs (variable costs for production), of which the cost is consistent. As for profits, it involves the accounting of all costs and revenues in the process of production activities.

Analysis of the results of management accounting is shifting that with an increase in margin, the company's profit is directly incremented. The more margin, the big profit is expected at the end of the reporting period, the profit always turns out to be below the margin. Gross margin, profit - important indicators of the evaluation of the work of the enterprise. They allow not only to assess the costs produced in the manufacture of goods / provision of services, but also efficiency, the results of the organization (company), for example, for the year. It depends on the accuracy and timeliness of calculations and analysis of margin.

Margin and profit what's the difference

In any business there are concepts of margin and profits. Some equates them to each other, others prove that they cannot be compared. Both indicators are strategic importance for the economic success of the enterprise or bank.

Thanks to them, the financial result of the work is estimated, the efficiency of using available resources and the overall result. With definitions of profits and margins, you can often encounter when discussing the issues of Forex, in banking business and other classes related to finance and economies. To understand which of the indicators that shows, we will analyze each of them.

What is margin?

This term came from Europe translated from the English Margin or French Marge margin means markup. Margin is found in banking and insurance business, commercial operations and operations with securities and so on. Economists call a margin difference from the company's income received and the cost of manufactured products. Often the words "margin" replace "gross profit." The principle of calculation margin is simple: cost is subtracted from the total amount. The obtained value indicates how much real money is received by the organization from the sale of products without taking into account additional costs.

The importance of margin should not be underestimated. It shows how effective one or another business is. The company's revenues are directly related to the margin and its activities are estimated.

Bank employees talk about margin when they compare the difference of loans and deposit rates. Signally speaking, if the bank wants to attract customers with high rates on deposits, he is forced to offer high loan rates.

Margin plays a large role in assessing the efficiency of the company. From its size will be directly proportional to the thorough profits. The margin underlies the formation of development funds. The percentage value of margin (or percentage) will be calculated by the cost ratio to revenue. If you calculate the gross "dirty" profit to the revenue, then it turns out an important indicator - the margin coefficient. In percentage, the profitability of sales, and this is the main indicator of the work of any organization.

If you take the concept of margin on the stock exchange, for example, forex, then it means temporary mortgage cooperation. During it, the participant receives the necessary amount for the operation. The principle of margin deals is that the participant does not have to pay for the entire cost of the contract. He enjoys the resources provided to him and a small part of his own money. As soon as the transaction closes, the received income will be on a deposit on which they were posted. If the transaction becomes unprofitable, then the loss will be covered by borrowed funds, which then still have to return.

Now the figures were the indicators of the "front margin" and "back margin", which are connected with each other. The first indicator reflects the acquisition of income from the markup, and the second - from the shares and bonuses.

Thus, these indicators are calculated during the work of any company. They have formed a separate direction of management accounting - margin analysis. Thanks to the margin, the company manipulates variable costs and costs, thereby affecting the final financial result.

What is profit?

The final goal of any business is profit. This is a positive financial result. Negative will be referred to. To see the difference margin from profits can be in the income statement (form No. 2). To make a profit, you need to clean the margin from all expenses. The calculation formula will look like this:

The final goal of any business is profit. This is a positive financial result. Negative will be referred to. To see the difference margin from profits can be in the income statement (form No. 2). To make a profit, you need to clean the margin from all expenses. The calculation formula will look like this:

Profit \u003d revenue - cost-commercial costs - managerial costs-paid interest + gained interest - non-revenue costs + non-dealer income- other expenses + other income.

The resulting value is subject to taxation, after which net income is formed. Next, it goes to pay dividends, postponed to the reserve and is investing in the development of the company.

If, when calculating margin, only the cost of production (cost) is taken into account, then all types of income and expenses are involved in profit.

In the process of business, there are several types of profits, but a net profit is important for the leadership, which shows the difference between revenue and all costs. If the revenue has more nominal value and expressed in monetary terms, then all other costs include the costs of production and tax deductions, excise taxes, and so on.

Gross profit reflects the difference between the amount received and expenditures for production without taking into account taxes and other deductions. According to its calculation, it is similar to marginal profit. Unlike the gross "dirty" income, margin data takes into account variable expenses, for example, on fuel, electricity, wages, the cost of materials for production, etc. Those companies who are counting margin income, look not only on its sum, but also at speed Consume money.

What is the difference between margin?

Unlike profit, the margin takes into account only the production costs, of which only the cost of products is consumed. Profit takes into account all the costs that appear in the course of doing business. Analysis of the results shows that the profit of the company increases with the increase in the margin. The larger the margin, the higher the profit will be. In terms of profit, there is always less margin.

Unlike profit, the margin takes into account only the production costs, of which only the cost of products is consumed. Profit takes into account all the costs that appear in the course of doing business. Analysis of the results shows that the profit of the company increases with the increase in the margin. The larger the margin, the higher the profit will be. In terms of profit, there is always less margin.

If the profit shows the net result of the business, the margin refers to the fundamental pricing factors, on which the profitability of marketing costs, the analysis of client flow, as well as the income forecast. In management accounting there is an important pattern that all changes that occur with the revenue are proportional to the gross margin. The margin, in turn, is proportional to the growth or decline in profits. The ratio of gross margin to profits. Economists called the effect of the operating lever. It is used to assess the effectiveness of the use of available resources and the general result.

Thus, all financial indicators are their own meaning. These calculation will be influenced by the methods of analysis and accounting rules. The correct interpretation of the dynamics of all indicators is necessary for competent business planning. And margin, and profits say a lot about the work of the organization.

Calculations of these indicators are recommended to be carried out regularly in set periods to compare the values \u200b\u200band detect patterns. Seeing this or that dynamics, the head can trace the market trends and carry out the necessary permutations and adjustments to the activities of the organization, pricing policies and other aspects affecting the success of the company. The result of all work depends on how on time and correctly will be calculated and evaluated indicators of margin and profits.

Margin is one of the determining factors of pricing. Meanwhile, not every novice entrepreneur can explain the meaning of this word. Let's try to correct the situation.

The concept of "margin" operates the specialists of all areas of the economy. This is usually a relative value that is an indicator. In trade, insurance, margin banking has its own specifics.

How to calculate marzhu

Economists understand Margin as the difference between the goods and his vacation price. It serves as a reflection of the efficiency of commercial activities, that is, the indicator of how successfully the company converts to.

Margin - relative value expressed as a percentage. The formula for calculating margin looks like this:

Profit / Income * 100 \u003d margin

We give the simplest example. It is known that the company's margin is 25%. From this we can conclude that each ruble revenue brings the company 25 kopecks. The remaining 75 kopecks refer to expenses.

What is gross margin

Assessing the profitability of a company, analysts pay attention to the gross margin - one of the main performance indicators of the company. Gross margin will find out by subtracting the amount of production costs from the amount of revenue from its sale.

Knowing alone only the magnitude of the gross margin, it is impossible to draw conclusions about the financial condition of the enterprise or to assess the specific aspect of its activities. But with this indicator, others can be calculated, no less important. In addition, the gross margin, being an analytical indicator, gives an idea of \u200b\u200bthe company's efficiency. The formation of gross margin occurs due to the production of goods or the provision of services by employees of the company. It is based on labor.

It is important to note that the formula for calculating the gross margin takes into account such revenues that are not a consequence of the sale of goods or the provision of services. Nonealization income is the result:

- debt write-offs (receivables / payables);

- measures to organize utilities;

- providing services that are not related to industrial.

Knowing gross margin, you can learn and clean profits.

Also, the gross margin serves as the basis for the formation of development funds.

Speaking of financial results, economists pay due margin of profits, which is an indicator of profitability of sales.

Profit margin - This is the percentage of profits in the general capital or revenue of the enterprise.

Margin in banking

Analysis of the activities of banks and sources of their profits is associated with the calculation of four margin options. Consider each of them:

- 1. Banking margin, that is, the difference between the loan and contribution rates.

- 2. Credit margin, or the difference between the amount recorded in the contract, and the amount issued by the Client in reality.

- 3. Margin warranty - The difference between the value of the collateral and the amount of the loan issued.

- 4.

Margin Pure Interest (CPM) - One of the main indicators of the success of the banking institution. For its calculation, the following formula is used:

CPM \u003d (commission income - commission costs) / assets

When calculating the net percentage margin, all assets without exception or only those are used (income generated) are currently being taken into account.

Margin and trade margin: what's the difference

Oddly enough, not everyone see the difference between these concepts. Therefore, one is often replaced by another. To figure out once and for all, in contractions between them, let us remember the calculation formula of the margin:

Profit / Income * 100 \u003d margin

(Selling price - cost) / income * 100 \u003d margin

As for the formula for the calculation of the markup, it looks like this:

(Selling price - cost) / cost * 100 \u003d trade markup

For clarity, we give an easy example. The goods are purchased for 200 rubles, and is sold for 250.

So, this is what in this case will be margin: (250 - 200) / 250 * 100 \u003d 20%.

But what will be a trade markup: (250 - 200) / 200 * 100 \u003d 25%.

The concept of margin is closely related to profitability. In the broad sense of the margin - this is the difference between the received and given. However, the margin is not the only parameter that serves to determine efficiency. Having calculated by Margin, you can learn other important indicators of the company's business.