Electronic money. What is it and how to use it

With the development of credit treatment, electronic money appear, having certain advantages Compared to Paper:

- an increase in the rate of transmission of payment documents;

- simplifying bank correspondence processing;

- reducing the cost of processing payment documentation.

In economic literature Electronic money is defined as:

- money on the accounts of computer memory of banks, the disposal of which is carried out using a special electronic device;

- electronic storage of cash value using the technical device;

- a new payment tool that allows you to make payment transactions and does not require access to deposit accounts;

- the indefinite monetary commitment of the Financial and Credit Institute, expressed in electronic form, certified by the electronic digital signature and redeemed at the time of the presentation of ordinary money, etc.

In international practice - This is prepaid or stored financial products in which information about funds or cost is stored on an electronic device.

Electronic money - in a broad sense Words are considered as a set of cash subsystems (emission is carried out without the opening of personal accounts) and non-cash money (emission is carried out with the opening of personal accounts) or as a system of monetary calculations through the use of electronic technology.

Electronic money - in a narrow sense Represent a cash subsystem issued into circulation by banks or specialized credit institutions. Here, the main difference is the necessary use of the bank account when paying, when the operation is carried out from the payer to the recipient without the participation of the bank.

Properties of electronic money

The main characteristics of electronic money:

- the money value is fixed on the electronic device;

- it can be used for a variety of payments;

- the payment is final.

Nevertheless, the question of independent allocation of electronic money in a separate species remains discussion, as well as their definition, role in and functions.

In modern electronic money is undeveloped money, have a credit basePerform the functions of the payment tools, circulation, accumulation, have a warranty. The basis of the issuance in the appeal of electronic money is cash and cashless money. Electronic money act as the issuer's monetary obligations when servicing non-cash turnover as a requirement for it. They can be viewed as an element of a cash aggregate. Automatic banking account (enrollment and write-off of funds, transfers from account to the account, interest accrual, monitoring the state of calculations) is carried out by electronic methods (electronic transfers). E-access tools are constantly evolving, nonetheless money is also represented as records on accounts.

Properties of electronic money Based on both traditional cash properties (liquidity, portability, versatility, divisibility, convenience) and on relatively new (safety, anonymity, durability). However, not all of them in the application process meet the requirements of high liquidity and stable purchasing power, and therefore emissions and use in circulation require a special order of regulation and control. Electronic access tools are payment cards, electronic checks, remote banking.

Calculations on the Internet. "Network" electronic money

These calculations are based on the concept of electronic cash. Electronic cash is a digital cash in electronic form used in network calculations, which is electronic bills in the form of a set of binary codes that exist on one or another carrier moving in the form of a digital envelope over the network. Electronic cash technology allows you to pay for goods and services in a virtual economy, passing information from one computer to another. Electronic cash, similar to real cash, anonymous and can be used repeatedly, and digital banknotes are unique. They can be transferred from one person to another, bypassing the bank, but at the same time keeping within network payment systems. When paying for a product or service, digital money is transmitted to the seller, which either transmits them to a bank participating in the system to enroll in or paying them with their partners. Currently, various network payment systems are distributed on the Internet.

Yandex money. In mid-2002, Paycash entered into an agreement with the largest search system of Runet Yandex on the launch of the Yandex project. Money (universal payment system, created in 2002). The main features of the Yandex payment system. Money:

- electronic transfers between user accounts;

- buy, sell and exchange electronic currencies:

- pay for services (Internet access, cellular communication, hosting, apartment, etc.);

- translate funds to a credit or debit card.

The Commission in transactions is 0.5% for each payment operation. When withdrawing funds to a bank account or other way, the Yandex.Money system holds 3% of the total funds withdrawn, moreover, an additional percentage is charged directly by the transfer agent (bank, mail, etc.).

WebMoneyTransfer. - The payment system, which appeared on November 25, 1998, is the most common and reliable Russian electronic payment system for real-time financial operations, created for users of the Russian-speaking part of the World Network. The user of the system can be any person. The calculation means in the system are title signs called WebMoney, or abbreviated WM. All WM are stored so-called electronic wallet. The most common wallets of four types:

- WMZ - dollar wallets;

- WMR - ruble wallets;

- WME - wallets for euro storage;

- WMU - wallets for the storage of Ukrainian hryvnia.

WebMoney Transfer payment system allows you to:

- carry out financial transactions and pay for goods (services) on the Internet;

- pay for mobile operators, Internet and television providers, pay for the media;

- make the exchange of WebMoney title signs on other electronic currencies at a favorable rate;

- make calculations by email to use a mobile phone as a wallet;

- owners of online stores accept payment for goods on their website.

WM is a global property rights transfer information system, open to all wishing to free use. With the help of WebMoney Transfer, you can make instant transactions related to the transfer of property rights to any online goods and services, create your own Web services and networking enterprises, carry out operations with other participants, produce and maintain our own tools.

There are several ways to replenish the WM wallet:

- bank transfer (including through Sberbank of the Russian Federation);

- postal transfer;

- using the Western Union system;

- by exchanging rubles or currency on WM in an authorized bank or exchange office;

- by receiving WM from someone from the participants of the system in exchange for services, goods or in exchange for cash;

- using a prepaid WM card;

- through E-GOLD system.

Rupay- The payment system operating from October 7, 2002 is an integrator of payment systems, where payment systems and exchange points in one system are programmatically combined.

The main features of the Rupay payment system:

- implementation of electronic transfers between user accounts;

- buy, sell and exchange electronic currencies with a minimum commission;

- make payments to other electronic payment systems: WebMoney, PayPal, E-GOLD, etc.;

- accept payments on your site more than 20 ways;

- receive funds from the system account in the nearest ATM;

- manage your account from any computer connected to the Internet. "

Paycash- Electronic payment system. He began its work on the Russian market in early 1998, is positioned primarily as an affordable means of fast, efficient and secure cash payments on the Internet.

The main advantage of this payment system is the use of its own unique development in the field of financial cryptography, highly appreciated by Western experts. Paycash payment system has a number of prestigious awards and patents, among which there is a "certificate of special recognition of the US Congress". At the moment, such well-known payment systems such as Yandex work according to PAYCASH technology. Money (Russia), Cyphermint Paycash (USA), Drambash (Armenia), Paycash (Ukraine).

PAYCASH is based on a digital cash technology. From the user's point of view (seller or buyer), PayCash technology is a lot of "electronic wallets", each of which has its own owner. All wallets are connected to a single processing center, in which information comes from the owners occurs. Thanks to modern technologies, users can perform operations with their money without leaving the computer. The technology allows you to translate digital cash from one wallet to another, store it in an Internet bank, convert, display from the system to traditional bank accounts or other payment systems.

E.- gOL.d.- Electronic payment system, created in 1996 Gold & Silver Reserve (G & SR). E-GOLD is an American calculated system of electronic money, the main currency of which are valuable metals - gold, platinum, silver, etc., and this currency is physically provided with the appropriate metal. The system is fully international, works with all currencies of the world, and any person can get access to it. The guarantors of the reliability of this payment system are US banks and Switzerland. The main difference between the E-GOLD payment system is that all cash is physically provided with precious metals stored in the Nova Scotia Bank (Toronto). The number of users of the C-GOLD payment system in 2006 amounted to about 3 million people. The main advantages of the E-GOLD payment system are as follows:

- internationalization - regardless of accommodation. Any user has the ability to open an account in E-GOLD:

- anonymity - when opening an account, no mandatory requirements are made to specify the real personal data of the user;

- ease and intuitiveness - the interface is intuitive and friendly with respect to the user;

- no additional software is required;

- universality - the widespread dissemination of this payment system allows it to use it during practically any financial transactions.

You can enter the money into the system in two ways: get a translation from another participant or transfer money in any currency in the E-GOLD system using the mechanism described on the site, through a bank transfer.

You can get or cash money by ordering a bank transfer on the website E-Gold, following the transfer to other systems (PayPal, WebMoney, Western Union) or on any credit or debit card.

Stormpay.- Payment system, open in 2002, any user can register in this system, regardless of the country of residence. One of the advantages of the system is universality and lack of reference to a specific geographical region, as the system works with all countries without exception. Account number in the STORMPAY payment system is the email address. The main drawback is the lack of the ability to convert funds from the StormPay account in E-GOLD, WebMoney or Rupay. This payment system allows you to transfer funds to credit cards.

PayPal.- Electronic payment system, one of the most popular and reliable among foreign payment systems. By early 2006, she served users from 55 countries. PayPal payment system is founded by Peter Tiel (Peter Thiel) and Max Levchin in 1998 as a private company. PayPal provides its users with the ability to receive and send payments using email or mobile phone with Internet access, but, in addition, PayPal payment system users have the opportunity:

- send payments (Send Money): Translate any amount from your personal account. At the same time, the payee can act as another user PayPal and an extraneous face;

- perform a request for payment (Money Request). Using this type of service, the user can send letters to its debtors containing a payment request (write an account for payment);

place on the Web site special tools for receiving payments (Web Tools). This service is available only to the owners of the premier accounts and business accounts and is recommended for the use of online storeholders. At the same time, the user can place the button on its website by clicking the payer hits the payment system website, where it can perform the payment procedure (you can use a credit card), after which it returns to the user's website again;

- use Auction Tools Tools. Payment system offers two types of services: 1) Automatic mailing requests for payment (Automatic Payment Request); 2) The winners of the auction trading can pay directly from the Web site on which the auction is carried out (Instant Purchase for Auctions);

- financial operations using a mobile phone (Mobile Payments);

- perform simultaneous payment to a large number of users (Batch Pay);

- carry out a daily transfer of funds to a bank account (AUTO-SWEEP).

In the future, the possibility of obtaining interest for storing in account of money is considered.

Moneybookers.- The electronic payment system was opened in 2003. Despite its relative youth, it successfully competes in many areas with such a giant as PayPal. The main advantage of this payment system can be considered its versatility. Moneybookers are convenient to use both for individuals and for owners of online stores and banks. Unlike PayPal, Moneybookers payment system serves users of more than 170 countries, including in Russia, Ukraine and Belarus. Moneybookers:

- no additional software installation is required;

- moneybookers user account number is an email address;

- the minimum transfer amount in Moneybookers is 1 Eurocent (either equivalent in another currency);

- the ability to automatically send cash on schedule without user participation;

- the system commission is 1% of the payment amount and is held with the sender.

Electronic money was introduced to simplify the calculations on the Internet. They enjoy to pay for remote workers (freelancers), payment of goods and services. Usually people face them when they are going to make money online. After all, it is precisely such money to pay.

Electronic money - This is a tool that is used when paying for goods and services on the Internet, and it has the same value as real money.

For example, I want to make translations from English via the Internet. I find the site where you can take orders, and start working. Suppose I fulfilled the order and some amount accrued me. So in order to get it, you need to have a personal electronic wallet. I specify it on the site, and earned money come to this wallet. Then they can be spent on the Internet or get cash.

Types of electronic money

All types of electronic money here will not be considered, otherwise it is not an article, but a whole book (very much of them). I will tell only about the most popular, and, it means about those who use the majority.

Yandex money

Yandex.Money is the most popular online payment system in Russia. Instant payments, payment of goods and services on the Internet, transfer to an account in a bank or bank card.

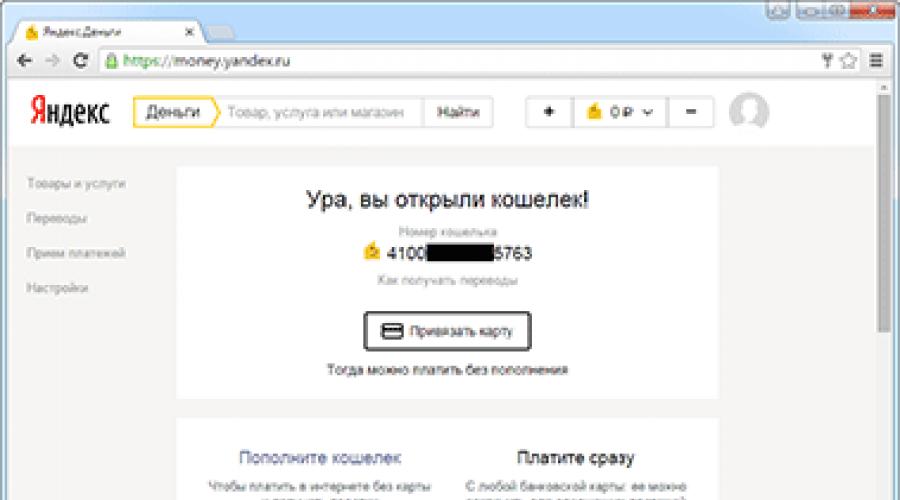

Principle of operation . First you need to register. It is done in the same way as on other sites. After registration, the wallet number is immediately issued - this is a long set of numbers. It must be indicated for mutual calculations.

Example (part of the number is hidden):

That's all - the wallet immediately starts working. It can be replenished and paying for goods and services on the Internet. And also receive and send money transfers.

On a note . If you have mail on Yandex, then you can not register at all. Just go to your box and click on the "Money" link at the top.

Wallet Management is carried out through the site of the Money.yandex.ru system

How to replenish the account:

- Through a bank card;

- Through mobile;

- Cash in Sberbank, Euroset, connected.

In addition, there are other methods of replenishment: through Internet banking, bank transfer, other electronic money, through translation systems (Contact, Unistream, city, Russian Post).

How to make money:

- Turn to the bank card.

- Send to bank account.

- Get cash through Western Union and Unistream.

Directly on the Yandex.Money website you can pay the phone, Internet, any receipts, traffic police fines, taxes, utilities, repay the loan and much more.

You can still order a bank card. Then you will receive a real plastic card attached to the wallet. This makes it possible to shoot Yandex.Money in cash in ATMs and pay them in ordinary stores.

And the system allows you to open a virtual map for free. This is an analogue of a plastic card, but it is possible to use it only on the Internet: pay for purchases on the site, where cards are accepted for payment (eBay, App Store, Google Play and others).

On a note . When registering with the wallet you get an account in Yandex. And, it means, also mail, Yandex.Disk (cloud storage) and access to other services.

WebMoney

WebMoney is the largest electronic calculation system in Russia. Payment services, translations, loans. Webmani is not only in Russian rubles, but also in another currency: dollars, euros, hryvnia, Belarusian rubles, Kazakhstan tenge.

Principle of operation . We register and immediately get a number in a system called WMID. Next, you will need to create a wallet in the desired currency. They can be somewhat for both one currency and for different. Each wallet will have its own unique number. So he is needed to send and receive money.

Wmid you can attach a bank card, a bank account or an electronic wallet from another system. And you can also release a virtual map to make purchases on the Internet.

Account Management occurs through WebMoney.ru website or mobile application. You can also use a special computer program Keeper WinPro, but it is more difficult to work with it.

From the disadvantages it should be noted that this system is not so simple as others. It seems to be written available, but in practice there are difficulties. All these certificates, restrictions, types of wallets. In general, you have to deal with some time.

PayPal.

PayPal is the most popular electronic money system in the world. Suitable for calculations between foreigners and purchases in foreign online stores (eBay and others).

Principle of operation . We register on the site. This procedure is more difficult than in other systems - you need to specify your full data (name, address, telephone and other). After that, the system will open. It is without a number, instead of it will be used specified when registering an email address.

To pay for purchases and services via PayPal, you need to tie a plastic card to your account on the site. Money will be charged directly from it.

If you plan not to spend, but to receive money, they will be credited to the internal account in the system. Then they can be displayed on their bank account.

Management occurs through a personal account on PayPal.com or through a mobile application.

QIWI

QIWI - another popular system in Russia. Very convenient for personal use. Easy, intuitively understandable.

Registration occurs at a mobile phone number, it is an account in the system. This account is easy to replenish through the payable terminal, a bank card or from a mobile balance.

You can release a virtual or ordinary plastic card, pay directly on the site mass of services (telephone, Internet, games, credit and others), send money transfer. In general, to do almost all the same as in the Yandex.Money system.

Account Management occurs through the personal account on Qiwi.com or through a mobile application.

What system to choose

For work . In the Russian-speaking Internet, Webmoney or Yandex.Money, in English-speaking - PayPal is most often used. If there is a choice, then I recommend to stop on Yandex.Money. They are easier to put and remove them. Yes, and the system itself is easier.

For life . If electronic money is needed to pay for games, buying shackles in classmates or votes VKontakte, it is better to choose QIWI or Yandex.Money.

Through these systems, you can instantly release a virtual card and make payment throughout the Internet, including on foreign sites (eBay, Aliexpressas and others).

Safety

Despite the fact that currently the electronic money system Well, oh-very reliable, users still manage to lose their money. Cause either in ignorance of banal rules of safe operation in the network, or in laziness. Therefore, then I will give simple, but effective ways to protect.

Antivirus. Such a program must be installed on the computer. And it is necessary that it is updated, that is, there has always had topical antivirus bases. It is better, of course, using paid products such as Kaspersky Anti-Virus, but if there is no such possibility, use free Avast.

Reliable password. Use a password consisting of a minimum of eight characters. Better to be and letters and numbers. And letters and capital and lowercase. Do not use the date of birth, phone number or other personal data.

Identification. This procedure that allows the payment service to see in you a respectable user. It concerns mainly Russian electronic money systems. Its meaning is that you need to specify real passport data and show the document to the authorized person. Then your status will change and this will give certain advantages.

In addition, it will provide additional protection against fraudsters. After all, according to the law, the money is made from the account of the identified user, the system is obliged to return them (provided that he will contact the support service no later than 24 hours after writing off the money and the system will confirm the fact of hacking).

In Yandex.Money and QIWI, the procedure for confirming their identity is identification, and in WebMoney - certification.

By the way, many payment services strongly cut off opportunities for Anonymous. For example, Yandex.Money prohibits such users to receive and send funds to other wallets, make translations to bank cards and accounts.

Verification address. Before entering your wallet number (login) and password to log in, check if the site is right open.

Often fraudsters send fake letters allegedly from electronic money support. For example, the payment of or, on the contrary, is that the invoice is blocked. Such messages may look very believable, but when you go on a link from the letter, a fraudulent site opens. And usually it looks just like a real one.

Different only address of the site. And if the user does not notice this and introduces its data, the attacker will immediately receive them and will be able to make money. Therefore, before entering your wallet, look at the address bar of the browser. There must be written the correct address of the payment system.

An example of the correct address of Yandex.Money:

Additional protection. If the payment service has additional protection, it should be turned on. It is done in the settings of the wallet. Usually this input protection or payment confirmation via SMS message. That is, until the code is entered, sent in the message, the operation will not be executed. In this case, even if the attacker enters your password, he will not be able to remove anything from the account.

And most importantly: Never inform your password from the wallet and data cards!

And finally

Commission. Almost every system has commissions. Take some percentage of replenishment, translation, removal from the account. To avoid surprises, carefully read the information on the site - everything is written there.

Wash and not copy. Electronic money is not supported by the golden stock of the state. It can be said that this appearance of a particular organization, and only it is responsible for them. Therefore, they should be used only as a means of means, rather than cumulative. And also should not be made by large payments with such money.

P.S.

Often, people actively use the Internet, but they have no electronic money. And this is normal, because now almost all goods and services can be paid by the card. It is much easier than to start some wallets there and understand them.

But if you are going online to earn or order services from other people, the electronic currency is the first one, with which you have to encounter. After all, this is the easiest and safest method of calculation.

If a couple of decades ago, we would report that in the future, humanity will be able to use not only "real" for settlements, but also electronic moneySurely most would have referred to this forecast skeptical. Meanwhile, today use of electronic money It is perceived as a completely ordinary fact - with their help you can pay for goods and services, to receive wages or, on the contrary, to pay remuneration to the employee, engage in charitable activities and conduct many other financial transactions. Today electronic money systems diverse. Each of them has its own characteristics, advantages and disadvantages. And since without the use of electronic money, a modern person is definitely not to do, it is important to know how the payment systems of this type are functioning when and how they can make life easier for us, and what types of electronic money exist today ...

About such a term as "electronic money", we learned relatively recently.

Their stormy development began in 1993, and already 10 years later, according to research conducted, electronic money began to be used in 37 countries of the world.

This is not surprising, because they allow you to quickly carry out mutual settlements with correspondents that can be almost anywhere in the globe. Electronic money in Russia It was quickly gained popularity, because with their help you can significantly reduce the costs of time and strength for transfers and payments. As a relatively recently, it became possible to acquire goods in online stores for electronic money, pay for the phone or the Internet. Now these payment products are no longer inferior to "real" analogues - such money has a similar value, although at a certain stage of the settlement, they have no material expression.

Electronic and non-cash money: Is there any difference?

Extremely common misconception is the identification of electronic and non-cash money. In fact, it is not. Electronic money do not act as substitutes for ordinary financial resources. They are issued in the same way as non-cash money. The difference consists only that a specialized organization is attended in this process, and in the case of non-cash money, the Central State Bank is in the status of the issuer.

Also should not be confused by electronic money with credit cards. The cards themselves act as methods of using the client's bank account, and all operations in this case are manufactured using ordinary money. As for electronic money, they act as a separate payment agent.

Advantages and disadvantages of electronic money

Of course, many will be interested in why it is generally necessary electronic payment systems And electronic money, if with cash or non-cash, they are connected only indirectly and, at first glance, do not differ from them? Meanwhile, electronic money has a large number of indisputable benefits:

1. Compactability and divisibility - the use of electronic money allows you to do without issuance.

2. The low value of the issue is missing the need for coins, the release of banknotes and the cost of paint, paper, metals and other materials in connection with this.

3. High portability - in contrast to cash financial resources, the amount of electronic money is not related to their weight or overall dimensions.

4. Ease in the process of calculations - no electronic money is needed, since this process is automatically carried out using the payment instrument.

5. Easy to organize the physical security of electronic means of payment.

6. Reducing the impact of the human factor - the moment of payment is always fixed by the electronic system.

7. Saving space and time - electronic money does not need to be packaged, transport, recalculate or leave in storages.

8. The impossibility of shelting funds from taxation is about payments carried out through fiscalized acquiring devices.

9. High-quality homogeneity - electronic money cannot be damaged, such as banknotes or coins.

10. Ideal persistence - your own qualities of electronic money can be saved for a long period of time.

11. High security - electronic money is protected from changing the nominal, fake or theft, which is provided with electronic and cryptographic means.

12. Exchange of electronic money for cash is simple - today electronic money can be displayed on a bank card or account, as well as get cash, using the services of specialized organizations.

But, like any other type of means of payment, electronic money has a number of shortcomings:

1. Lack of stable legal regulation - Today, many countries have not yet fully defined the status of electronic money and, therefore, did not develop a number of laws that could regulate the process of mutual settlements carried out through the use of electronic payment systems.

2. The need to use special handling and storage tools.

3. The impossibility of restoring the money value in the physical destruction of the carrier of electronic money - however, this shortage is not deprived of and cash.

4. Lack of recognition - the amount of electronic money is impossible to determine without special technical means.

5. High likelihood that personal data of payers can track scammers.

6. A low level of security - in the absence of necessary protection measures, electronic money is fairly easy to steal directly from the owner's account.

Forms of electronic money

It is believed that modern electronic money can exist in two basic forms: based on networks and on the basis of smart cards. There are also such forms of electronic money as fate and non-pity money. The first are a kind of money of a certain payment system and are expressed in the form of one of the state currencies.

Since it is the state in its laws that obliges citizens to take fate money for payment, their emission, repayment and appeal is carried out in accordance with the rules of the current legislation and the Central Bank.

As for non-phate money, they act as a unit of the value of non-state payment systems. Such electronic money is a kind of credit funding and are regulated by the rules of non-state payment systems, which in each country are different.

Types of electronic money

The types of electronic money are quite diverse. A few years ago, a limited number of payment systems existed in the world. Today their number is constantly growing. For convenience, all electronic money and systems are advisable to divide into domestic and foreign.

Electronic money in Russia are represented by the following systems:

1. Webmoney is perhaps today it is one of the most popular payment systems operating with electronic money.

The system does not establish any restrictions, allows you to carry out instantaneous money transfers, and to make a transaction, it is not at all optional to open a bank account or report full information. Users of the system can conduct correspondence and conduct operations on protected channels by creating electronic wallets WMZ (dollars), WMR (rubles), WME (euro) and so on. Safety level when performing operations using WebMoney is quite high. However, often wallets of users are wedged by hackers. It is later very difficult to return the money - the exception is cases when the account owner or the management of the system finds himself a criminal in "hot trails". Should I say that it is not easy? But, at the same time, Webmoney constantly informs users about those measures that they can take for their protection. And they really work.

2. Yandex-money is another popular payment system, which is largely similar to WebMoney.

Yandex Money allows you to carry out instant payments within the system action. The ability to manage a wallet directly from the official site, a high degree of protection and confidentiality, the speed of settlements between users of the system is that the main advantages, thanks to which Yandex-money has gained popularity in Russia.

3. RBK Money is a kind of prototype of the Rupay payment system.

Electronic transfer of money in this case is performed instantly. All cash equivalents ruble, but you can withdraw them on a bank card or account. Mobile phone is used to make a transaction, computer, communicator. The main advantage of RBK Money is the ability to make payments for utilities, telephone, Internet quickly and easily.

4. Assist is a system created by Reksoft, which is the leader in system integration and consulting in the development of software solutions and the introduction of information technology.

One of the main tasks of this system is to ensure payments on credit cards when purchasing purchases in the Ozon online store. True, the development of electronic money subsequently led to the fact that the Assist began to be used to pay for goods and services of various character.

Less well-known, but no less popular in Russia are also considered:

5. CG PAY.

6. Chronopay.

7. CyberPlat.

8. E-PORT

9. Monymail

10. RUNET.

11. Simmp

12. Z-payment

13. Pilot

14. Telebank

15. Rapida

16. Rambler.

As for foreign species of electronic money and payment systems that work with them, their choice is also great:

1. PayPal is a major debit electronic payment system that allows you to work with 18 national currencies. Since 2002, PayPal has been a division of the famous EBay company.

Paypal payments are made through a secure connection. The registration procedure provides for the transfer of a small amount of money from the user card to the account. After the identity of the account holder and the card is confirmed, the funds will be returned. Registration and transfer of funds using the PayPal system are free. The commission pays only the beneficiary, and its size depends on the country of its residence and status in the PayPal system.

2. Mondex - This system was developed by British banks and operates, for the most part, in Europe and Asia.

Mondex assumes the issuance of a special smart card to the customer, on which the chip is located - a peculiar analog of the electronic wallet. It is on it that Electronic Cash is stored - cash, which in the system acts as a monetary equivalent status. The benefits of Electronic Cash are able to purchase purchases over the Internet, the storage of electronic money at once in five currencies, the transfer of funds to the correspondent without intermediaries. Mondex Cashs take many restaurants, shops, airlines, hotels, gas stations - 32 million enterprises all over the world who carry out their activities in the field of trade and service.

3. Visa Cash is a prepaid smart card that allows you to quickly and easily pay minor costs. With Visa Cash, you can pay for tickets to cinema or theater, telephone calls, newspapers, goods and services. Ease of use of Visa Cash lies in the fact that it can be quickly translated by a rather large amount from a personal bank account.

4. E-GOLD is an international payment system that involves investing in precious metals.

Playing gold courses, you can receive electronic money and exercise with their help various financial transactions. The main advantages of the E-GOLD system are anonymity, transnationality and availability of a profitable affiliate program. At the same time, the Commission is charged for storing money in the system every month. The same applies to transfers - for each transaction will have to pay a certain percentage. You can always replenish the account using translations from Yandex-money systems, WebMoney, etc. Also with this feature, electronic money exchangers are also coping

In addition, among the famous foreign payment Internet systems are:

5. Cashkassa.

6. Alertpay.

7. Easypay.

8. Emoney

9. Liberty.

10. Moneybookers.

11. Checkfree

12. Cybermint.

13. Datacash.

14. Digitcash

15. EPASPORTE.

16. Fethand.

17. Goldmoney

18. Google-Check

19. Netcash

20. PAYMER.

21. Pecunix

If you decide to use electronic money: a few tips for beginners

The first thing you need to remember is that electronic money is quite "real", and their loss can very much to harm you.

That is why, not be lazy to study the instructions of a specific payment system, you pay close attention to ensuring the security of your account or account. It is sometimes easier to purchase a special anti-virus program or a utility for the detection of hacker attacks than to subsequently lose a large amount of money, which is simply stolen from the account.

Second - study the conditions of the output, input and exchange of electronic money.

Each payment system offers the user to the user. Today, the exchange of electronic money within two systems or currencies can be performed on favorable terms. The same applies to the input and withdrawal of electronic means of payment. In the first case, the terminals can be used, and in the second - transfer money to the card, a bank account or to receive cash, turning to specialized organizations.

And finally, the third - do not refuse to use electronic money.

Today, they are successfully used in various countries of the world as a means of calculating goods, work, services. Already, experts say that in the following years the number of people who use electronic money for settlements will steadily grow. This is not surprising, because it is only one time to try to carry out any financial operation with electronic money, and you will also understand that it is convenient and easy!

Electronic money today: legislation news

A few years ago, electronic money was not equated to their paper analogue. However, in connection with the expansion of their use, new ideas about the payment facilities have emerged, and there was a need to resolve such relations in the legislative order. Since on June 27, 2011, President of the Russian Federation Dmitry Medvedev signed a new one, which will make it possible to regulate the procedure for making payments using electronic money.

This bill was adopted in December last year, but as a result of the amendments that were made in it for a long period of time, the document was signed only in June 2011. The main objective of the law "On the National Payment System" is to establish requirements for payment systems in the field of their functioning and organization.

The draft law describes the rules for transferring funds, and the concept of "Clearing Center" is also introduced. This status is an organization that provides acceptance for the execution of applications of the participants in the payment system at a time when they translate their cash using electronic forms of calculations. In addition, through the law, 3 types of payment tools are introduced, which can be used in the process of electronic calculations (lists the properties of the systems below):

1. Neversonified electronic means of payment:

- user identification is not performed;

- the maximum balance at any time is 15 thousand rubles;

- limit on the turnover of cash per month is equal to 40 thousand rubles;

- Use for mini payments.

2. Personalized electronic means:

- customer identification is carried out;

- The maximum amount of cash on the account is 100 thousand rubles per month.

3. Corporate electronic means of payment:

- can be used by legal entities with their preliminary identification;

- the maximum balance of funds at the end of the working day is 100 thousand rubles;

- Allow the reception of electronic money as payment for services and goods.

It should be noted that the law "On the National Payment System" will have its impact on the regulation of mobile payments. The electronic payment system operator will be able to conclude an agreement with the cellular operator. Based on this, he will be eligible for an increase in the remnant of electronic facilities of an individual, which is a subscriber of this operator, due to financial resources paid to the Advancement Operator. You can even say that the new bill has created all the conditions in order to use a mobile phone as a device for making payments of various types.

In general, it can be noted that every year electronic payment systems and electronic money are becoming increasingly popular. Do not miss the opportunity to feel comfort from their use, because e-payments are really able to make the calculation process more convenient!

Term electronic money (as well as electronic cash, or digital cash) Refers to the transactions of funds made using electronic communications. Electronic money may be debit or credit. Digital cash can be some currency, and to start using them, you need to convert a number of ordinary money into digital. Such conversion is similar to buying foreign currency.

Electronic money:

- they are not money, but are or checks, or gift certificates, or other similar payment resources (depending on the legal model of the system and the limitations of legislation).

- can be issued by banks, NPOs, or other organizations.

The fundamental difference between electronic money and ordinary non-cash funds: electronic money is a payment agent issued by any organization (monetary surrogate), while ordinary money (cash or cashless) is issued by the central state bank of a particular country.

The term electronic money is often inaccurately used in relation to a wide range of payment instruments based on innovative technical solutions in the field of retail payment.

Digital Cash (Digital Cash)

Digital cash - electronic money that will produce states themselves.

Electronic money market market in Russia

2012: Yandex.Money rule the market

2011: Law 161-FZ "On the National Payment System"

On September 29, 2011, Federal Law No. 161-FZ "On the National Payment System" of June 27, 2011 became the key to the industry, which consolidates the definition of electronic funds (EMC), consolidated key requirements for the transfer of EMF, as well as electronic money operators. If earlier the activities were regulated by many laws and individual articles in various laws, the law "On the National Payment System" became a single regulatory document for the entire industry of electronic payments.

2012

The system of identifying users of electronic wallets can be tightened. This was announced in November 2012, the head of the Bureau of Special Technical Events (BSTM) of the Ministry of Internal Affairs of Russia Alexey Moshkov. According to Alexei Moshkov, the use of anonymous payment systems greatly facilitates the activities of fraudsters, because in some cases the personification of the virtual wallet holder is difficult or impossible.

"The criminals use anonymous payment systems for collecting and cashing money, distribution and confusing financial flows. In addition, such virtual wallets are used to anonymous acquisition of goods prohibited to turnover and internal calculations between members of criminal groups."

Legal and economic status of electronic money

From a legal point of view, electronic money - the indefinite monetary obligations of the Issuer on the bearer in electronic form, the release (emission) in the appeal of which is carried out by the issuer both after receiving funds in the amount of at least the amount of obligations and the shape of the loan provided. The appeal of electronic money is carried out by concession of the right to the issuer's claim and generates the obligations of the latter to fulfill monetary obligations in the amount of electronic money. Accounting for monetary obligations is made in electronic form on a special device. From the point of view of their material form, electronic money represent information in electronic form at the disposal of the owner and stored on a special device, as a rule, on a hard disk of a personal computer or a microprocessor card, and which can be transmitted from one device to another with the help of telecommunication lines and other electronic means of transmitting information.

In an economic sense, electronic money is a payment tool possessing, depending on the implementation scheme, properties of both traditional cash and traditional payment instruments (bank cards, checks, etc.): Cash money Rodnitis the possibility of settlements by The banking system, with traditional payment instruments, is the possibility of holding calculations in non-cash through accounts opened in credit institutions.

Views and classification of electronic money

There are 2 types of electronic money:

- Emitated in electronic payment certificates, or checks. These certificates have a certain nominal value, stored in an encrypted form, and signed by an electronic signature of the issuer. When calculating certificates are transmitted from one member of the system to another, while the transfer itself can go outside the framework of the Issuer's payment system.

- Entries on the current account of the system member. Calculations are made by writing off a certain number of payment units from a single account, and bring them to another account within the payment system of the electronic money issuer.

Electronic money schemes:

- in which information transfer technology in electronic form is implemented monetary obligations Issuer from the device of one holder to the device of another holder. These include Mondex (firm development Mondex Internationalbelonging to the 51% MasterCard company and 49% of the largest banks and financial institutions of the whole world) and the ECASH network product of the company DIGICASH.

From the world famous electronic money operators allocate:

Unlike ordinary non-cash money, electronic money

The main characteristics of electronic money:

the money value is fixed on the electronic device;

it can be used for a variety of payments;

the payment is final.

Nevertheless, the question of independent allocation of electronic money in a separate species remains discussion, as well as their definition, role in payment system and functions.

In modern monetary systems Electronic money is undeveloped money, have a credit basePerform the functions of the payment tools, circulation, accumulation, have a warranty. The basis of the issuance in the appeal of electronic money is cash and cashless money. Electronic money act as the issuer's monetary obligations when servicing non-cash turnover as a requirement for it. They can be viewed as an element of a cash aggregate. Automatic banking account (enrollment and write-off of funds, transfers from account to the account, interest accrual, monitoring the state of calculations) is carried out by electronic methods (electronic transfers). E-access tools are constantly evolving, nonetheless money is also represented as records on accounts.

Properties of electronic money Based on both traditional cash properties (liquidity, portability, versatility, divisibility, convenience) and on relatively new (safety, anonymity, durability). However, not all of them in the application process meet the requirements of high liquidity and stable purchasing power, and therefore emissions and use in circulation require a special order of regulation and control. Electronic access tools are payment cards, electronic checks, remote banking.

Calculations on the Internet. "Network" electronic money

These calculations are based on the concept of electronic cash. Electronic cash is a digital cash in electronic form used in network calculations, which is electronic bills in the form of a set of binary codes that exist on one or another carrier moving in the form of a digital envelope over the network. Electronic cash technology allows you to pay for goods and services in a virtual economy, passing information from one computer to another. Electronic cash, similar to real cash, anonymous and can be used repeatedly, and digital banknotes are unique. They can be transferred from one person to another, bypassing the bank, but at the same time keeping within network payment systems. When paying for a product or service, digital money is transmitted to the seller, which either transmits them to a bank participating in the system to enroll in or paying them with their partners. Currently, various network payment systems are distributed on the Internet.

Yandex money. In mid-2002, Paycash entered into an agreement with the largest search system of Runet Yandex on the launch of the Yandex project. Money (universal payment system, created in 2002). The main features of the Yandex payment system. Money:

electronic transfers between user accounts;

buy, sell and exchange electronic currencies:

pay for services (Internet access, cellular communication, hosting, apartment, etc.);

translate funds to a credit or debit card.

The Commission in transactions is 0.5% for each payment operation. When withdrawing funds to a bank account or other way, the Yandex.Money system holds 3% of the total funds withdrawn, moreover, an additional percentage is charged directly by the transfer agent (bank, mail, etc.).

WebMoneyTransfer.- The payment system, which appeared on November 25, 1998, is the most common and reliable Russian electronic payment system for real-time financial operations, created for users of the Russian-speaking part of the World Network. The user of the system can be any person. The calculation means in the system are title signs called WebMoney, or abbreviated WM. All WM are stored so-called electronic wallet. The most common wallets of four types:

WMZ - dollar wallets;

WMR - ruble wallets;

WME - wallets for euro storage;

WMU - wallets for the storage of Ukrainian hryvnia.

WebMoney Transfer payment system allows you to:

carry out financial transactions and pay for goods (services) on the Internet;

pay for mobile operators, Internet and television providers, pay for the media;

make the exchange of WebMoney title signs on other electronic currencies at a favorable rate;

make calculations by email to use a mobile phone as a wallet;

owners of online stores accept payment for goods on their website.

WM is a global property rights transfer information system, open to all wishing to free use. With the help of WebMoney Transfer, you can make instant transactions related to the transfer of property rights to any online goods and services, create your own Web services and networking enterprises, carry out operations with other participants, produce and maintain our own tools.

There are several ways to replenish the WM wallet:

bank transfer (including through Sberbank of the Russian Federation);

postal transfer;

using the Western Union system;

by exchanging rubles or currency on WM in an authorized bank or exchange office;

by receiving WM from someone from the participants of the system in exchange for services, goods or in exchange for cash;

using a prepaid WM card;

through E-GOLD system.

Rupay- The payment system operating from October 7, 2002 is an integrator of payment systems, where payment systems and exchange points in one system are programmatically combined.

The main features of the Rupay payment system:

implementation of electronic transfers between user accounts;

buy, sell and exchange electronic currencies with a minimum commission;

make payments to other electronic payment systems: WebMoney, PayPal, E-GOLD, etc.;

accept payments on your site more than 20 ways;

receive funds from the system account in the nearest ATM;

manage your account from any computer connected to the Internet. "

Paycash- Electronic payment system. He began its work on the Russian market in early 1998, is positioned primarily as an affordable means of fast, efficient and secure cash payments on the Internet.

The main advantage of this payment system is the use of its own unique development in the field of financial cryptography, highly appreciated by Western experts. Paycash payment system has a number of prestigious awards and patents, among which there is a "certificate of special recognition of the US Congress". At the moment, such well-known payment systems such as Yandex work according to PAYCASH technology. Money (Russia), Cyphermint Paycash (USA), Drambash (Armenia), Paycash (Ukraine).

PAYCASH is based on a digital cash technology. From the user's point of view (seller or buyer), PayCash technology is a lot of "electronic wallets", each of which has its own owner. All wallets are connected to a single processing center, in which information comes from the owners occurs. Thanks to modern technologies, users can perform operations with their money without leaving the computer. The technology allows you to translate digital cash from one wallet to another, store it in an Internet bank, convert, display from the system to traditional bank accounts or other payment systems.

E-GOLD.- Electronic payment system, created in 1996 Gold & Silver Reserve (G & SR). E-GOLD is an American calculated system of electronic money, the main currency of which are valuable metals - gold, platinum, silver, etc., and this currency is physically provided with the appropriate metal. The system is fully international, works with all currencies of the world, and any person can get access to it. The guarantors of the reliability of this payment system are US banks and Switzerland. The main difference between the E-GOLD payment system is that all cash is physically provided with precious metals stored in the Nova Scotia Bank (Toronto). The number of users of the C-GOLD payment system in 2006 amounted to about 3 million people. The main advantages of the E-GOLD payment system are as follows:

internationalization - regardless of accommodation. Any user has the ability to open an account in E-GOLD:

anonymity - when opening an account, no mandatory requirements are made to specify the real personal data of the user;

ease and intuitiveness - the interface is intuitive and friendly with respect to the user;

no additional software is required;

universality - the widespread dissemination of this payment system allows it to use it during practically any financial transactions.

You can enter the money into the system in two ways: get a translation from another participant or transfer money in any currency in the E-GOLD system using the mechanism described on the site, through a bank transfer.

You can get or cash money by ordering a bank transfer on the website E-Gold, following the transfer to other systems (PayPal, WebMoney, Western Union) or on any credit or debit card.

Stormpay.- Payment system, open in 2002, any user can register in this system, regardless of the country of residence. One of the advantages of the system is universality and lack of reference to a specific geographical region, as the system works with all countries without exception. Account number in the STORMPAY payment system is the email address. The main drawback is the lack of the ability to convert funds from the StormPay account in E-GOLD, WebMoney or Rupay. This payment system allows you to transfer funds to credit cards.

PayPal.- Electronic payment system, one of the most popular and reliable among foreign payment systems. By early 2006, she served users from 55 countries. PayPal payment system is founded by Peter Tiel (Peter Thiel) and Max Levchin in 1998 as a private company. PayPal provides its users with the ability to receive and send payments using email or mobile phone with Internet access, but, in addition, PayPal payment system users have the opportunity:

send payments (Send Money): Translate any amount from your personal account. At the same time, the payee can act as another user PayPal and an extraneous face;

perform a request for payment (Money Request). Using this type of service, the user can send letters to its debtors containing a payment request (write an account for payment);

place on the Web site special tools for receiving payments (Web Tools). This service is available only to the owners of the premier accounts and business accounts and is recommended for the use of online storeholders. At the same time, the user can place the button on its website by clicking the payer hits the payment system website, where it can perform the payment procedure (you can use a credit card), after which it returns to the user's website again;

use Auction Tools Tools. Payment system offers two types of services: 1) Automatic mailing requests for payment (Automatic Payment Request); 2) The winners of the auction trading can pay directly from the Web site on which the auction is carried out (Instant Purchase for Auctions);

financial operations using a mobile phone (Mobile Payments);

perform simultaneous payment to a large number of users (Batch Pay);

carry out a daily transfer of funds to a bank account (AUTO-SWEEP).

In the future, the possibility of obtaining interest for storing in account of money is considered.

Moneybookers.- The electronic payment system was opened in 2003. Despite its relative youth, it successfully competes in many areas with such a giant as PayPal. The main advantage of this payment system can be considered its versatility. Moneybookers are convenient to use both for individuals and for owners of online stores and banks. Unlike PayPal, Moneybookers payment system serves users of more than 170 countries, including in Russia, Ukraine and Belarus. Moneybookers:

no additional software installation is required;

moneybookers user account number is an email address;

the minimum transfer amount in Moneybookers is 1 Eurocent (either equivalent in another currency);

the ability to automatically send cash on schedule without user participation;

the system commission is 1% of the payment amount and is held with the sender.

1. Titched money. The concept of electronic money Digital (hereinafter electronic) Money fully simulates real money. At the same time, the issuer's emission organization - issues their electronic analogs, called different systems in different systems (for example, coupons). Next, they are bought by users who pay for purchases with their help, and then the seller reaches them from the issuer. When emissions, each monetary unit is assigned to electronic printing, which is verified by the publishing structure before repaying. One of the features of physical money is their anonymity, that is, they are not specified, who and when they used them. Some systems, by analogy, allow the buyer to receive electronic cash so that it is impossible to determine the connection between it and money. This is carried out using a blind signature scheme. It should be noted that when using electronic money, there is no need for authentication, since the system is based on the release of money in appeal before their use. Below is the payment scheme using digital money. Buyer shares real money to electronic. Calculation storage can be carried out in two ways, which is determined by the system used: on the hard disk of the computer. On smart maps. Different systems offer different exchange schemes. Some open special accounts to which the funds from the buyer's account are listed in exchange for electronic bills. Some banks can emiate electronic cash. At the same time, it is emissors only at the request of the client, followed by its transfer to a computer or a map of this client and the removal of money equivalent from his account. When implementing the blind signature, the buyer himself creates electronic bills, forwards them to the bank, where, when you receive real money, they are assigned to the seal and sent back to the client. Along with the amenities of this storage, it also has disadvantages. The damage of the disk or smart card turns into a non-reflectible loss of electronic money. The buyer lists the seller's online money for the purchase. Money is presented to the issuer who checks their authenticity. In the case of the authenticity of electronic bills, the seller's account increases by the amount of purchase, and the buyer is shipped by the product or the service is provided.  One of the important distinguishing features of electronic money is the ability to carry out microplates. This is due to the fact that the nominal bill may not correspond to real coins (for example, 37 kopecks). Elimine electronic cash can both banks and non-bank organizations. However, the unified system of converting different types of electronic money has not yet been developed. Therefore, only the issuers themselves can extinguish electronic cash issued by them. In addition, the use of such money from non-financial structures is not provided with guarantees from the state. However, the small cost of the transaction makes the electronic cash to the attractive tool of payments on the Internet. Credit systems Internet credit systems are analogues of conventional systems working with credit cards. The difference is to carry out all transactions over the Internet, and as a result, in the need for additional security and authentication. The general payment scheme in such a system is shown in the figure. In payments over the Internet with credit cards involved: Buyer. A client with a computer with a web browser and Internet access. Bank-Issient. Here is the buyer's current account. The bank-issuer releases cards and is the guarantor of the fulfillment of the financial obligations of the Client. Sellers. The sellers are understood by e-commerce servers, on which catalogs of goods and services are conducted and customer orders are accepted. Banks Equileele. Banks serving sellers. Each seller has a single bank in which he holds his current account. Internet payment system. Electronic components that are intermediaries between the rest of the participants. Traditional payment system. A set of financial and technological means for servicing cards of this type. Among the main tasks solved by the payment system - ensuring the use of cards as a means of payment for goods and services, using banking services, carrying out customizations, etc. Participants in the payment system are individuals and legal entities united by relationships on the use of credit cards. Processing Center of the Payment System. An organization that provides information and technological interaction between the participants of the traditional payment system. Estimated payment system bank. A credit institution that performs mutual settlements between the participants of the payment system on behalf of the processing center.

One of the important distinguishing features of electronic money is the ability to carry out microplates. This is due to the fact that the nominal bill may not correspond to real coins (for example, 37 kopecks). Elimine electronic cash can both banks and non-bank organizations. However, the unified system of converting different types of electronic money has not yet been developed. Therefore, only the issuers themselves can extinguish electronic cash issued by them. In addition, the use of such money from non-financial structures is not provided with guarantees from the state. However, the small cost of the transaction makes the electronic cash to the attractive tool of payments on the Internet. Credit systems Internet credit systems are analogues of conventional systems working with credit cards. The difference is to carry out all transactions over the Internet, and as a result, in the need for additional security and authentication. The general payment scheme in such a system is shown in the figure. In payments over the Internet with credit cards involved: Buyer. A client with a computer with a web browser and Internet access. Bank-Issient. Here is the buyer's current account. The bank-issuer releases cards and is the guarantor of the fulfillment of the financial obligations of the Client. Sellers. The sellers are understood by e-commerce servers, on which catalogs of goods and services are conducted and customer orders are accepted. Banks Equileele. Banks serving sellers. Each seller has a single bank in which he holds his current account. Internet payment system. Electronic components that are intermediaries between the rest of the participants. Traditional payment system. A set of financial and technological means for servicing cards of this type. Among the main tasks solved by the payment system - ensuring the use of cards as a means of payment for goods and services, using banking services, carrying out customizations, etc. Participants in the payment system are individuals and legal entities united by relationships on the use of credit cards. Processing Center of the Payment System. An organization that provides information and technological interaction between the participants of the traditional payment system. Estimated payment system bank. A credit institution that performs mutual settlements between the participants of the payment system on behalf of the processing center.  The buyer in the electronic store forms a cart of goods and chooses a payment method "Credit Card". Next, the credit card parameters (number, owner name, the expiration date) must be transferred to the Internet payment system for further authorization. This can be done in two ways: through the store, that is, the parameters of the card are entered directly on the store website, after which they are transmitted by the Internet payment system (2a); On the payment system server (2B). The benefits of the second path are obvious. In this case, information about maps do not remain in the store, and, accordingly, the risk of receiving them by third parties or deception by the seller is reduced. And in that, in another case, when the credit card details are transmitted, there is still the possibility of their intercepting attackers on the network. To prevent this data when gear is encrypted. Encryption, naturally, reduces the ability to intercept data on the network, so the buyer's connections / seller, the seller / Internet payment system, the buyer / Internet payment system is desirable to carry out protected protocols. The most common one today is the SSL (Secure Sockets Layer) protocol. It is based on an open key asymmetric encryption scheme, and the RSA algorithm is used as an encryption scheme. Due to the technical and licensed features of this algorithm, it is considered less reliable, so now the Secure Electronic Transaction Protected Electronic Transactional Transactions is gradually introduced, designed with time to replace SSL when processing transactions related to calculating credit cards on the Internet. Among the advantages of the new standard, it is possible to mark security enhancement, including the ability to authenticate all transaction participants. His minuses are technological difficulties and high cost. The Internet payment system conveys a request to authorize the traditional payment system. The subsequent step depends on whether the bank-issuer leads an online database (bd) accounts. If the database is presented, the processing center transmits a request to the issuing bank to authorize the map (4B) and then, (4a) receives its result. If there is no such database, the processing center itself keeps information about the status of account holder accounts, stop-sheets and performs requests for authorization. This information is regularly updated by issuing banks. The result of authorization is transmitted to the Internet payment system. The store gets the result of authorization. The buyer receives the result of authorization through the store (7a) or directly from the Internet payment system (7B). With a positive result of authorization, the store provides a service, or shipping the goods (8a); The processing center transmits information about the perfect transaction (8B) to the settlement bank. The money from the buyer's account in the issuer's bank is listed through the settlement bank at the expense of the store at the Equaire Bank. For such payments, in most cases, special software is required. It can be supplied to the buyer, (called the electronic wallet), the seller and its maintenance bank. For example, consider the WebMoney Transfer electronic payment system.

The buyer in the electronic store forms a cart of goods and chooses a payment method "Credit Card". Next, the credit card parameters (number, owner name, the expiration date) must be transferred to the Internet payment system for further authorization. This can be done in two ways: through the store, that is, the parameters of the card are entered directly on the store website, after which they are transmitted by the Internet payment system (2a); On the payment system server (2B). The benefits of the second path are obvious. In this case, information about maps do not remain in the store, and, accordingly, the risk of receiving them by third parties or deception by the seller is reduced. And in that, in another case, when the credit card details are transmitted, there is still the possibility of their intercepting attackers on the network. To prevent this data when gear is encrypted. Encryption, naturally, reduces the ability to intercept data on the network, so the buyer's connections / seller, the seller / Internet payment system, the buyer / Internet payment system is desirable to carry out protected protocols. The most common one today is the SSL (Secure Sockets Layer) protocol. It is based on an open key asymmetric encryption scheme, and the RSA algorithm is used as an encryption scheme. Due to the technical and licensed features of this algorithm, it is considered less reliable, so now the Secure Electronic Transaction Protected Electronic Transactional Transactions is gradually introduced, designed with time to replace SSL when processing transactions related to calculating credit cards on the Internet. Among the advantages of the new standard, it is possible to mark security enhancement, including the ability to authenticate all transaction participants. His minuses are technological difficulties and high cost. The Internet payment system conveys a request to authorize the traditional payment system. The subsequent step depends on whether the bank-issuer leads an online database (bd) accounts. If the database is presented, the processing center transmits a request to the issuing bank to authorize the map (4B) and then, (4a) receives its result. If there is no such database, the processing center itself keeps information about the status of account holder accounts, stop-sheets and performs requests for authorization. This information is regularly updated by issuing banks. The result of authorization is transmitted to the Internet payment system. The store gets the result of authorization. The buyer receives the result of authorization through the store (7a) or directly from the Internet payment system (7B). With a positive result of authorization, the store provides a service, or shipping the goods (8a); The processing center transmits information about the perfect transaction (8B) to the settlement bank. The money from the buyer's account in the issuer's bank is listed through the settlement bank at the expense of the store at the Equaire Bank. For such payments, in most cases, special software is required. It can be supplied to the buyer, (called the electronic wallet), the seller and its maintenance bank. For example, consider the WebMoney Transfer electronic payment system.

4.

The popularity of digital money. Development prospects According to some analysts, in a short time, electronic means of calculations will completely outpace cash from the market and checks, as they represent a more convenient way to pay for goods and services. According to the estimates of ABA / DOVE companies, electronic payments can soon displace cash and checks, since each second purchase in the store is performed using electronic payment. Cash remain the main means of payment in traditional stores only for 33% of buyers. While most online shopping is performed using credit cards, almost half of the respondents are used in e-commerce checks and cash postal transfers, and a quarter of virtual buyers use P2R payments. Two thirds of consumers pay at least one monthly account by electronic means, including credit / debit cards, direct payments or use online banks. Analysts believe that by 2003 online bills will achieve significant amounts, since most users begin to use or increase the use of this payment option. Along with this, the use of "paper" payments is significantly reduced - 21% of respondents said they intend to refuse to pay for their checks on checks. At the same time, Yankee Group analysts note that 8.7% of American consumers pay their accounts today online, whereas last year there were 5.1%. Marketing efforts are beginning to bring their results: 29% of consumers have already expressed interest in using electronic accounts for accounts for accounts (EBPP), and 14.9% is called the main prompting motive to reduce time costs. However, experts warn that in this field the banks will face competition from financial service providers, given that the provider that will provide users with a convenient and simple interface will be able to hold them for a long time. An increase in the revolutions of e-commerce "Business to Consumer" in Russia, million dollars (according to The Economist, Boston Consulting Group):  Growth of e-commerce in the BUSINESS TO Consumer sector, billion dollars (according to Emarketer):

Growth of e-commerce in the BUSINESS TO Consumer sector, billion dollars (according to Emarketer):  The share of e-commerce in the US GDP (GDP) (according to Emarketer):

The share of e-commerce in the US GDP (GDP) (according to Emarketer):