Strategies for Bollinger strings for binary options. Before analyzing variations of work with an indicator ...

The Bollinger Indicator refers to the most popular tools, among all those used for technical analysis. By applying this indicator, you can find out the exact time for the acquisition of the option and its direction.

A strategy for binary options of the Bollinger band is considered indispensable for trading processes in the market with strong price fluctuations, in other words where enlarged volatility is observed. But, it is also one of the important components of trade in binary options.

Principle of work of Bollinger lines

Two bending bands are progressing from MA (moving average) in the backlog holds the set distance.

It is worth noting that the peculiarities of all elements and components of the Motion Formula of the Bollinger bands are not necessary to remember, since it is already on live graphics, and the lines are formed on their own, the investor only has to include this indicator on the schedule.

Key Components Bollinger Strips

The Bollinger Indicator for binary options consists of three lines:

- The first line Ma (moving average) - passes in the middle.

- The second line from above - here includes a moving average and two ordinary deviations. In mathematics, it is common called Standard Deviation or SD.

- The third line from below is a moving average and two standard deviations.

Features of the settings Bollinger strips

If we talk about settings, then the binary options strategy for Bollinger strings requires the selection of all functions personally for its manner of trade.

In live graph default settings are exhibited in such a way that it turns out a set of functions that were used by the Bollinger himself. In his opinion, these are ideal settings for profitable binary options.

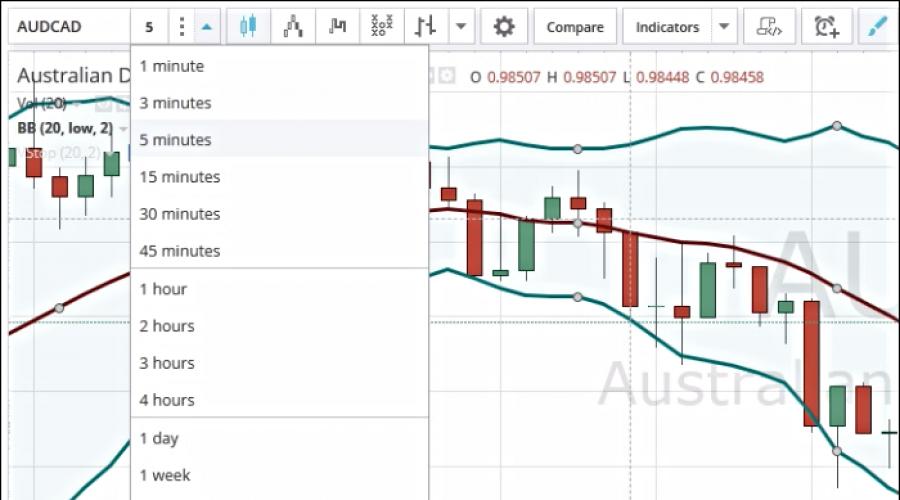

If the trader intends to make adjustments to the settings need to do the following:

- Click on the settings icon located on the right side of standard numbers.

- The trader opens a window that includes the desired adjustments. It all depends on the individual preferences of each broker.

Acquisition of binary options using the Bollinger strip indicator

The essence of the main rule is reduced to the following, the cost has a property to remain inside the corridor, which formed at the expense of the upper and lower strip.

If there are strong changes in the price category in the market, expressing a professional language, high volatility occurs, the Bollinger bands diverge, thereby giving more space to promote cost.

In the case of the other way around, the cost is directed confidently, no significant dousedock and volatility is observed in a low degree, the corridor is smoothly narrowed.

Binary Options Trading Strategy for Bollinger Lands and its Signals

Each trader must remember signals that allow you to buy a call option.

The first signal is at the moment of strong and fast narrowing of the corridor, after which the three first candles were reflected on the cost increase. You can purchase a call in an open minute schedule at the end of an hour or half an hour from the period of the appearance of the first increasing candles.

The second signal - the cost crossed the border of the upper line of the Bollinger. This makes it possible to understand the broker, which is possible in the future the Trend will continue to grow. When a 1-minute schedule is applied to a quick deal of up to five minutes.

The cost jumped from the lower zone. This is a signal that the price is sent to the upper boundary. We purchase the option Call the end of the hour.

Acquire an option in the following signals

1. The corridor instantly decreased, and a downward trend began to appear sharply. We practice on two three candles, in case of further confirmation of the trend, we purchase.

2. The cost crossed the borders of the bottom line of the Bollinger. With this situation, you can start opening a short-term pass.

3. The cost jumped from the upper zone. We test two three candles so that the cost go down, if it happens - we purchase up at the end of the hour.

How to minimize risks?

Since any indicator must be used to, the Bollinger bands are not an exception.

The functions of stop loss and Take profit reduces the risks of an unsuccessful forecast, if you are sure that the forecast is correct, but the development of events changes, and there is some reason for doubt that it may become incapheterable to the selected expiration time.

Also available to the early closure mode of the transaction, thanks to which the trader can sell the option to the deadlines and at the same time get that income that has been earned to this time. As we see, with this version, you do not need to expect the situation as long as the situation changes.

It is worth remembering that each first contract is scary, but after the first income, there is no emotion to be compared to anything with any fear. In any case, strategy

Bollinger lines are a unique trading method, allowing to succeed in investing, both beginners and experienced investors.

The fact is that the same indicator will provide you with clear signals that define the optimal time to acquire an option, and then, as they say: it remains for small.

Thus, do not miss your chance to increase the volume of regular profits across the use of this method.

We continue to make an overview of the best trading tactics for earning in binary options. Today we will talk about one of them - the strategy of Bollinger and RSI. It is easy to learn and is based on two strongest indicators, which even separately demonstrate excellent performance.

Traders choose a trading strategy solely on an individual basis. It is imperative that the tactics chosen by them fully approached the psychology of trading. Some trade exclusively on the analysis of Japanese candles, other draws of trend lines and conclude transactions on rollbacks from them and support levels and resistance. Well, the vast majority still prefer to draw up a strategy based on indicators.

Indicators analyze the price dynamics based on mathematical formulas. They basically show the past, not the future. However, due to the fact that the price moves waves and is able to periodically repeat its dynamics, the indicators are able to perfectly predict the future.

With the help of indicators, you can build many different trading strategies, as each of them has different market analysis algorithms. The preparation of their own strategy is a whole art, successfully master which not all traders may not be.

We represent you only the best tactics With recommendations regarding the choice of asset, timeframe and expiration terms. However, any of the listed parameters can be changed to the discretion of the trader. It is in the process of practice that any strategy is being finalized and improved depending on the style of trade.

The Bullinger and RSI strategy in this plan is universal, as it can be used both when scalping and long-term trading. It is perfect for overclocking the deposit.

Setting indicators

To begin with, we'll talk a little about the tools themselves, which we will apply in the Bollinger and RSI strategy.

Bollinger Bands is a strong trend indicator. It is three lines. The average shows the direction of movement, and the lower and top talk about the strength of the trend. About 80% of its time price is within the channelbuilt by these lines. And only 20% - it moves up or down, punching the canal. Based on this, the extreme lines can be used as levels of support and resistance.

The RSI relative power index is an oscillator that shows on a specific scale from 0 to 100 stay price relative to its oversold and overbought levelswhich are located at levels from 0 to 30 and from 70 to 100, respectively. When the price goes into one of these zones, with a greater degree of probability, this suggests that the price will soon unfold in the opposite direction.

Signals for conclusion of transactions

Trade on the Bollinger and RSI strategy can be very profitable, since this tactic generates many signals for conclusion of transactions. We will try to list the main of them:

- Rebound candles from extreme Bollinger strips.

- The breakdown of the extreme bands of the Bollinger and movement towards the breakdown.

- The rebound or sample of the middle strip of the Bollinger, which symbolizes about the change of trend.

- The intersection of the RSI line of the average level 50, which also talks about changing the direction of movement.

- RSI output from rebuilt zones and oversold. In this case, the transactions are concluded at the time of intersection with levels 70 and 30.

- Bull and Bear Divergence of the Relative Index.

The Bullinger and RSI strategy shows the best results during the flute. It will be difficult for beginners to catch the origin of the trend and determine, false or not there was a breakdown of the price of one of the extreme levels of Bollinger strips.

So, after a small theory, it's time to go to practice. We apply on the chart the Bullendger and RSI indicators, leave the settings standard. In the future, you can experiment with them, changing the parameters to achieve even better results.

Purchase option above

As we said earlier, for the most part the price does not leave the limits of your channel. Therefore, the best tactics for beginners will trade from the upper and lower lines. It is important that the price is in the FLET, and not in a strong trend. This can be found about the width of the channel. During the increased volatility, its borders are significantly expanding, which is absolutely not on your hand.

In the screenshot above, we see an excellent signal for a raising transaction. The price went to the bottom line of the Ballenger, continuing to fall for some time. At the same time, the RSI indicator went into the oversold zone. The fact that the downward trend ended, we are talking to a reversal pattern of Maribozu, which is represented in the form of a bullish candle formed immediately after bearish exactly the same size. This suggests that the bulls have strength to grow so much to pull the price up.

This signal confirms the RSI output from the oversold zone and the intersection of its line from the level 30 below up.

Purchase option below

Here the situation is completely opposite. We are waiting for the price approaches the top line of the Bollinger and unfolds, forming a turning pattern. The relative strength index is intersecting with a line 70 from top to bottom. These signals suggest that the upward trend is dried, and therefore the price will begin to fall within the next few candles.

By the way about the terms of expiration. Deal conclude on 3-5 subsequent candles After closing the signal. That is, if you analyze a 5-minute schedule, then the expiration period in this case will be equal to 15 minutes. This is necessary in order to avoid market noise, when the price is trample in one place, and wait for a real reversal of the trend.

The Bollinger and RSI strategy is so universal that it is capable of issuing a lot of additional signals. In the screenshot, they are marked with circles. They are that the candle intersects with the middle line of the Bollinger, while RSI intersects with its neutral level 50 that a kind of signals changes to the change of movement of the movement.

This Bullinger and RSI strategy can show up to 80% of profitable transactions With the right application. And this will allow the trader to go into stable earnings after the first month of trade. It is perfect for beginners because of its simplicity. With experience you will learn how to define false signals. And to increase efficiency will help the development of technical and graphic analysis for binary options!

Bollinger Waves in Binary Options - Strategy "Night Bullinger"

Day trading, made an option of option trading with trend and volatility present in the market. Of course it is. However, the strategy " Night Bullinger"Replies in the opposite, demonstrating profitably at times higher than day trade strategies. So night, this time is not only for sleep ...

Bollinger Waves - Excellent Free Indicator for Binary Options

So what can be said about? This is a pretty accurate indicator suitable for binary options, and without redrawing, which is channel, and displays the price of the asset and those levels where the price is maximally deviated from the average. In this way this indicator is displayed on the schedule:

But the additional plus of this indicator is that the most accurate, and therefore profitable trading signals it generates at night.

That is, when quotes are moving well in a night channel, reaching its oscillations of its borders, denoting the maximum deviations of quotes from the average price value, and, reaching these borders, return back to the middle of the channel, that is, to the average price value.

This nature of the night quotations is due to the sleeping sometimes of almost all financial sites of the world, so the bidding is suspended, for the quotations take almost horizontal position in motion. It is during this period that a free indicator for binary options - the Bollinger waves are obtained to give out signals by which you can close the profits from 10 transactions. A chic result, isn't it? So, to receive it, you can refuse a few hours of sleep.

Bollinger Waves in Trending Binary Options - Best Broker Selection for Trade

The problem is that almost all of this profitable indicator for options is rare. Moreover, the possibility in trade in trade in graphics is available in trading terminals of the entire small number of brokerage offices of the Optional Market. And you, for excellent earnings, must be armed with a trading terminal on which technical indicators are available. We managed to find such a terminal - broker Binomo..

All screenshots in this article are made from the platform of the specified broker. And if you are also a novice trader and you need binary options with minimal investments in trade, then the Binomo broker can find the most suitable trading conditions - the minimum 1USD transaction, and the minimum deposit is 10USD.

How to trade?

Because at night, the quotes are walking through the night horizontal channel, and the Bollinger waves show the maximum deviations of the price from their main level, you can receive profitable signals, stirling the joint movement of quotations with the indicator lines. Therefore:

For a deal down:

There is first the dynamic growth of quotes upwards, crossing the limits of the upper channel wave of the Bollinger.

After crossing the bolranger channel limits, the quotation candle is closed below the top channel line.

And only after the conditions described above will be executed, the trader can make a deal on the Binomo terminal to enter into:

For a deal up:

The dynamic drop of quotes down first occurs, crossing the limits of the bottom channel of the Bollinger.

After crossing the limits of the Bollinger Channel, the quotation candle is closed above the bottom channel line.

And only after the conditions described above will be executed, the trader can make a deal on the binomo terminal to conclude:

The scenario of the night movement of quotations is such that return prices back to the Bollinger Channel, after the release of quotes directly beyond its limits, occurs in 90% of cases. Therefore, it is most profitable to conclude transactions according to the tactics of the "Night Bullinger" tactics, which will help make profits of 80% of transactions from 100.

Open an account in binomo HERE

Expiration time

Use for transactions is a 60-second expiration period, which the Binomo platform sets the default.

Manage capital correct

Thanks to the Bollinger Waves in binary options, you can earn great. However, even such a high profitability does not allow the risks of the overestimated amounts of transactions. That is, only 3% of the deposit amount should be used on the transaction, which will help to avoid its overload. And if you have a small deposit - Binomo on the platform can be traded with a 1USD transaction.,

Be sure to look:

Strategy using the Bollinger Indicator

The task of each trader trading in binary options is to be able to correctly determine the beginning and end of the ascending and downward price trends. For these purposes, it is customary to use trend indicators. The most informative and accurate among them are waves, lines or Bollinger bands. A strategy that works on the basis of this indicator is able to bring a consistent income to the trader.

You can trade with Bollinger strips on the electronic sites of many brokerage companies. After all, the indicator in question is included in the set of standard tools for technical analysis on many of them. We tested the strategy below at the Olymp Trade trader site.

As the experience shows, the price of any investment asset will almost always move within the price channel formed by three indicator lines of the Bollinger. In those rare moments when it will disturb its borders, the trader will receive signals for opening trading positions.

At the Olymp Trade broker platform, when you activate this indicator, the settings you need will already be set. SMA period equals 20, and the standard deviation is 2.0. You can set the color and thickness of the lines by any. The main thing is that the indicator is displayed on the live quotation schedule comfortably for you.

As you see on the applied screen, the Bollinger bands are formed by three lines. The center is the usual curve moving average. In our example, it is painted in blue. On top and bottom from it within the specified standard deviation, two more lines are located, which form the price channel. In our example, they are painted in purple color.

A strategy operating on the basis of signals from Bollinger bands is universal. You can apply it to any timeframes convenient for you.

Existing nuances

Before we introduce you to shopping strategies, you should voice a number of aspects that need to be taken into account when trading on the basis of Bollinger bands. Understanding these nuances can significantly increase the efficiency of trading trader.

Remember, the price of the selected basic asset in most situations seeks to move within the price corridor formed by the indicator lines.

In a situation where serious excitements begins on the stock exchange, which are characterized by an increase in volatility (increased variability) of the asset quotations The extreme lines of the Bollinger tend to discrepancy. That is, the price channel is expanded. Often, such changes are precursors of a new powerful trend.

On the contrary, when everything is calm on the stock exchange, the level of volatility of the investment asset is reduced. Coming on a similar tendency, the extreme lines of the Bollinger begin to converge. The price channel is narrowing. Often, such changes are precursors of the beginning of the side movement or Flat.

How strategy №1 works

The best results considered the trading system brings for 15-minute timeframes. At the same time, the expiration date of the purchased option is half an hour.

The trader must be pressed on the Call button when the body of a bearish or red candle is completely closed under the bottom indicator line.

The trader must be pressed on the PUT button when the body of a bull or green candle is completely closed above the upper indicator line.

In this strategy, pay attention to three points.

1. The trading signal for us is the closure of a red candle under the bottom line, and green above the top. Never on the contrary.

2. Over or under the indicator line of the Bollinger must be the body of the candle. Shadows can return to the price corridor. For us, this is not fundamentally.

3. The term of expiration on the concluded transaction should be twice as long than the timeframe exposed on the schedule of quotations. If the timeframe is M15 or 15 minutes, then we buy an option on M30 or 30 minutes.

Also pay attention to the first market entry point marked on the screensome placed above. In this situation, 2 green or bull candles left on top of the price corridor. So we can safely conclude two deals on a decrease. As you can see, this decision was 100% justified. Both transactions closed with profit.

There are no such trading signals. Nevertheless, when they arise you can calmly open trading positions. It should be understood, there are no strategies that give a 100% successful result. This trading system has an effectiveness of 80-85%, which is an excellent result.

How strategy №2 works

We understand, not every particularly novice trader is ready to trade on Timeframes M15. Especially for such investors, we will look at a strategy with minute Japanese candles. It should be remembered than shorter timeframes are given on live chart, the more risks increase.

For those who want to increase their own deposit as soon as possible, the Martingale principle should be brought into this trading system. Under this principle, upon receipt of an open position loss, we increase the size of the following transaction by 2.5-3 times. This approach will allow us to overlap losses in any case and always stay with profit. In other words, with unsuccessful transactions, we will consistently increase the amount of bets: 1, 3, 7, 12 dollars and so on.

The principle of trade in accordance with this system is simple. The trader must wait for the situation at which three candles in a row will close above either below the corresponding indicator line.

Now let's consider the specific situation on the live chart. As soon as the third bull or a green Japanese candle closes above the price corridor, we open a transaction to lower the quotations by pressing the PUT button.

As soon as the third bear or a red Japanese candle closes below the price corridor, we conclude a deal on an increase in the asset quotes by pressing the Call button.

If you analyze the situation in the screensome placed above, you will see that after three red candles there was another fourth, which also closed with a decrease in price. That is, a perfect deal of 1 dollar brought us a loss.

However, it was here that we took advantage of the Martingale system and opened a re-position for an increase for 3 dollars. As you can see, the next candle closed already with profit. Thus, we played the money lost on the first binary option and received our income.

In this situation, the use of the Martingale principle is justified by the fact that in our trading strategy we rely on the Bollinger band indicator. As you already understood, the price cannot long be outside the price corridor, it means that the use of such risk reception is more than justified.

Use the Bollinger bands, trade on binary options and make a profit!