Problems of own and external sources of financing. External financing and internal financing of the enterprise: species, classification and features

Course work in the economy of the enterprise

"External and internal sources

financing the activities of the enterprise "

St. Petersburg

Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3.

Chapter 1. Financial resources of the enterprise. . . . . . . . . . . . . . . . . . . . . . . . . . .four

Chapter 2. Classification of financing sources. . . . . . . . . . . . . . . . . . 7.

2.1. Domestic sources of financing of the enterprise. . . . . . . . . . . . . . . . eight

2.2. External sources of financing of the enterprise. . . . . . . . . . . . . . . . . .12

Chapter 3. Management of financing sources. . . . . . . . . . . . . . . . . . .sixteen

3.1. The ratio of external and internal sources

in the capital structure. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

3.2. The effect of the financial lever. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .nineteen

Conclusion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .22.

List of used literature. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .23.

Application. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.

Introduction

Company - This is a separate technical and economic and social complex, designed to produce beneficial benefits for the Company for profit. When creating it, as well as in the process of management, they solve various issues, one of which is the financing of the activities of the enterprise, that is, providing the necessary financial resources 1 costs for its implementation and development. These resources of business entities are obtained from various sources, without any enterprise cannot exist and work. And, therefore, there is nothing surprising that the question of possible sources of financing is today relevant for many business entities and worries many entrepreneurs.

The purpose of the work is to study existing sources of funds, their role in the process of activity of the enterprise and its development.

The placement of priorities among sources of financing, the choice of the most optimal sources is today a problem for many organizations. Therefore, in this paper, the classification of sources of financing the activities of the enterprise will be considered, the concept of financial resources, which is closely related to these sources, as well as the ratio in the structure of equity and borrowed funds, which has a significant impact on the financial and economic activities of the enterprise.

Consideration of these aspects will make it possible to draw conclusions about a given topic.

Chapter 1. Enterprise Financial Resources

The concept of financial resources is closely connected with the concept of financing the activities of the business entity. Financial resources of the company - This is a combination of own funds and receipts of borrowed and attracted funds intended to fulfill financial obligations, financing the current costs and costs associated with the expansion of capital. They are the result of the interaction of the receipt, spending and distribution of funds, their accumulation and use.

Financial resources play an important role in the reproduction process and its regulation, the distribution of funds in the areas of their use, stimulate the development of economic activities and increase its effectiveness, allow you to control the financial condition of the business entity.

Sources of financial resources are all cash incomes and adventures that have an enterprise or other business entity during a certain period (or on the date) and which are sent to the exercise of cash flow and deductions necessary for production and social development.

Financial resources generated from various sources make it possible to invest in a timely manner to invest in new production in a timely manner, to ensure the expansion and technical re-equipment of the current enterprise, to finance scientific research, development, their implementation, etc.

The main areas of use of financial resources of the enterprise in the process of carrying out activities include:

financing the current needs of the production and trading process to ensure the normal functioning of the production and trade activities of the enterprise through the planned allocation of funds for basic production, production and auxiliary processes, supply, marketing and sales of products;

financing of administrative and organizational measures to maintain a high level of functionality of the enterprise management system by restructuring, allocating new services or reduced management apparatus;

investing funds to the main production in the form of long-term and short-term investments for its development (full renewal and modernization of the production process), creating a new production or reduction of certain unprofitations;

financial investments - investing financial resources for the goals bringing more income to the enterprise than the development of own production: the acquisition of securities and other assets in various segments of the financial market, investment in the authorized capital of other enterprises in order to extract income and obtain rights to participate in the management of these enterprises, venture financing 2, provision of loans from other companies;

formation of reserves, carried out by both the enterprise itself and specialized insurance companies and government reserve funds due to regulatory deductions to maintain a continuous circuit of financial resources, protecting the enterprise from adverse changes in market conditions.

Of great importance to ensure uninterrupted financing of the production process have financial reserves. In the conditions of the market, their role is significant. These reserves are able to provide a continuous circuit of funds in the reproduction process, even if there are huge losses or the occurrence of unforeseen events. The company's financial reserves are created at the expense of their own resources.

Financial provision of reproductive costs can be carried out in three forms: self-financing, lending and government financing.

Self-financing is based on the use of the enterprise's own financial resources. If there is insufficient funds, it can either reduce some of their expenses, or use the funds mobilized in the financial market based on securities operations.

Lending is a method of financial support for reproductive costs, in which expenses are covered by the bank's loan, provided on the basis of return, payability, urgency.

Public financing is carried out on a non-refundable basis at the expense of budget and extrabudgetary funds. Through such funding, the state purposefully redistributes financial resources between the industrial and non-productive spheres, sectors of the economy, etc. In practice, all forms of financing costs can be used simultaneously.

Chapter 2. Classification of financing sources

Financial resources of the enterprise are transformed into capital through the relevant sources of funds 3. Today, their various classifications are known.

Sources of financing can be divided into three groups: used, affordable, potential. The sources used are a combination of such sources of financing the activities of the enterprise, which are already used to form its capital. The range of resources that are potentially real for use are called accessible. Potential sources are those that theoretically can be used for the functioning of commercial enterprises, in the conditions of more advanced financial and credit relations.

One of the possible and most common groups is the division of sources of funds for timing:

sources of short-term appointment;

advanced capital (long-term).

Also in the literature there is a division of sources of financing into the following groups:

own funds of enterprises;

borrowed funds;

involved funds;

budget allocations.

However, the main division of sources is their division to external and internal. In this embodiment, its own funds and budget allocations are combined into a group of internal (own) sources of financing, and under external sources are understood by attracted and (or) borrowed funds.

The fundamental difference between the sources of its own and borrowed funds lies in a legal reason - in the event of the liquidation of the enterprise, its owners have the right to that part of the enterprise property that will remain after settlements with third parties.

2.1. Internal sources of enterprise financing

The main sources of financing the activities of the enterprise are their own funds. Internal sources include:

authorized capital;

funds accumulated by the enterprise in the process of activity (reserve capital, additional capital, retained earnings);

other contributions to legal entities and individuals (targeted financing, charitable contributions, donations, etc.).

Own capital begins to form at the time of the establishment of an enterprise when its authorized capital is formed, that is, a set in monetary terms of deposits (shares at the nominal value) of the founders (participants) in the property of the organization when it is created to provide activities in size defined by the constituent documents. The formation of authorized capital is associated with the peculiarities of organizational and legal forms of enterprises: for partnerships - this is a share capital 4, for joint-stock companies - share capital, for production cooperatives - PAUTION FUND 5, for unitary enterprises - the authorized capital 6. In any case, the authorized capital is the starting capital necessary to start the activities of the enterprise.

Methods for the formation of authorized capital are also determined by the organizational and legal form of the enterprise: by making contributions by the founders or by conducting a subscription to shares, if this is JSC. The contribution to the authorized capital may be money, securities, other things or property rights that have a monetary assessment. At the time of the transfer of assets in the form of a contribution to the authorized capital, the ownership of them proceeds to a business entity, that is, investors lose the real rights to these objects. Thus, in the event of the liquidation of the enterprise or the release of the participant from the Company or the partnership, it has the right only to compensate for his share within the framework of residual property, but not to return objects transferred to them in due time as a contribution to the authorized capital.

Since the authorized capital minimally guarantees the rights of the company's creditors, its lower limit is limited. For example, for LLC and CJSC, it cannot be less than 100 times the size of the minimum monthly remuneration (Moton), for JSC and unitary enterprises - less than 1000 times the size of the MOTT.

Any adjustments to the size of the authorized capital (an additional share emission, a decrease in the nominal value of shares, making additional contributions, receiving a new participant, the accession of the part of the profit, etc.) is allowed only in cases and procedure provided for by the current legislation and constituent documents.

In the process of activity, the company invests money in fixed assets, buying materials, fuel, pays for workers' work, resulting in goods produced services, work, work, which, in turn, are paid by buyers. After that, the money spent in the composition of revenue from sales is returned to the enterprise. After reimbursement, the enterprise receives a profit, which goes to the formation of its various funds (reserve fund, accumulation funds, social development and consumption) or forms a single enterprise fund - retained earnings.

In a market economy, the magnitude of profits depends on many factors, the main of which is the ratio of income and expenses. At the same time, in existing regulatory documents, it is the possibility of a certain regulation of the company's management. Such regulatory procedures include:

accelerated depreciation of fixed assets;

the procedure for assessing and depreciation of intangible assets;

the procedure for assessing the contributions of participants to the authorized capital;

selection of the method of assessing production reserves;

accounting procedure for interest loans used to finance capital investments;

the composition of overhead and the method of their distribution;

Profit is the main source of formation of the reserve fund (capital). This fund is designed to compensate for unforeseen losses and possible losses from economic activities, that is, is insurance by nature. The procedure for the formation of reserve capital is determined by regulatory documents regulating the activities of this type of enterprise, as well as its statutory documents. For example, for JSC, the value of the backup capital should be at least 15% of the authorized capital, and the procedure for the formation and use of the reserve fund is determined by the Charter of JSC. The specific dimensions of annual contributions to this fund is not determined by the Charter, but they must be at least 5% of the net profit of the joint-stock company.

The accumulation funds and the social fund found at the enterprises at the expense of net profit and are spent on financing investments in fixed assets, replenishment of working capital, bonuses of employees, salary payments to individual employees in excess of the wage fund, providing material assistance, payment for insurance premiums for additional medical programs Insurance, payment of housing, purchase of apartments to employees, organization of food, payment for transport on transport and other goals.

In addition to funds formed by profits, an integral part of the company's own capital is additional capital, which in its financial origin has different sources of formation:

em session income, i.e. funds received by the joint-stock company - the issuer in the sale of shares above their nominal value;

amounts of non-current assets that arise as a result of an increase in property value during its revaluation at market value;

course difference associated with the formation of authorized capital, i.e. The difference between the ruble assessment of the debt of the founder (participant) on the contribution to the authorized capital, estimated in the constituent documents in foreign currency, calculated at the rate of the Central Bank of the Russian Federation at the date of receipt of the amount of deposits, and the ruble assessment of this contribution in the constituent documents.

Funds of additional capital can be directed to an increase in the authorized capital; to repay a loss of identified by the results of work for the year; on the distribution between the founders. Regulatory documents are prohibited to use additional capital on the purpose of consumption.

In addition, enterprises can receive funds for the implementation of targeted activities from higher organizations and individuals, as well as from the budget. Budgetary help may be allocated in the form of subventions and subsidies. Subvention - Budgetary funds provided by the budget of another level or enterprise on a free and irrevocable basis for the implementation of certain target expenses. Subsidy - Budget funds provided to another budget or enterprise on terms of validity funding of targeted costs.

Target funding and receipts are consumed in accordance with approved estimates and cannot be used non applications. These funds are part of the equity equity, which expresses the residue of the owner's rights to the property of the enterprise and its income.

2.2. External sources of financing of the enterprise

The company cannot cover its needs only at the expense of its own sources. This is due to the peculiarities of the flow of cash flows in which the moments of receipt of payments for goods, services and work on the enterprise do not coincide with the terms of repayment of the enterprise's obligations, unforeseen delays of payments may arise. An additional need for sources of funding can also be due to inflation when the means entering the enterprise as a means are depreciated and cannot provide the cost of enterprises in cash in connection with the increase in raw materials price and materials. In addition, the expansion of the enterprise requires the involvement of additional resources. Thus, borrowed sources of financing appear.

The loan capital, depending on the loan time, is divided into long-term (long-term liabilities) and short-term (short-term liabilities). Long-term liabilities, in turn, are divided into bank loans (subject to repayment more than 12 months) and other long-term liabilities.

Short-term liabilities consist of borrowed funds (bank loans and other loans to be repurchased within 12 months) and the accounts payable to suppliers and contractors, before the budget, by pay, etc.

An important source of financing of the enterprise is a bank loan. Previously, many enterprises (especially industry and agriculture) could not take advantage of commercial bank loans, since the cost of loans (the level of interest rates) was great. But now they have the opportunity to lead a more active policy to attract borrowed funds, as in 2002-2003. The level of interest rates decreased dramatically. Foreign loans were hung to Russia. Offering enterprises lower rates and long credit terms than Russian commercial banks, foreign banks seriously declared themselves in the Russian credit market.

From 2001 to 2004 The refinancing rates 7 declined almost 2 times, but it is not only in the amount of rates, an important trend is to eliminate the periods of lending to enterprises, which is predetermined by the long-term stabilization of the political and economic situation in the country, improving the urgency of the liabilities of the banking system.

In accordance with the Civil Code of the Russian Federation, all loans are issued to borrowers subject to the conclusion of a written loan agreement. Lending is carried out by two methods. The essence of the first method is that the question of the provision of a loan is solved every time individually. The loan is issued to satisfy a certain target need for funds. This method is used in providing loans for specific deadlines, i.e. Urgent loans.

In the second method, the loans are provided within the credit limit borrower installed for the borrower by opening a credit line. An open credit line allows you to pay for any settlement and monetary documents provided for by the loan agreement concluded between the Client and the Bank at the expense of the loan. The credit line opens mostly for a period of one year, but can be opened for a shorter period. During the term of the credit line, the client may at any time get a loan without additional negotiations with the bank and any decorations. It opens to customers with a sustainable financial situation and a good credit reputation. At the request of the client, crediting limit can be revised. The credit line can be renewable and non-renewable, as well as target and non-target.

Enterprises receive loans on terms of payability, urgency, repayment, targeted use, to ensure (guarantees, security deposit and other assets of the enterprise). The Bank conducts an inspection of a credit application for legal creditworthiness (legal status of the borrower, the size of the authorized capital, the legal address, etc.) and financial creditworthiness (an assessment of the enterprise's capabilities to return a loan to a timely manner), after which the decision on the provision or refusal to provide loan .

The disadvantages of the credit form of financing are:

the need to pay interest on the loan;

complexity of registration;

the need to ensure;

the deterioration of the balance structure as a result of attracting borrowed funds, which can lead to the loss of financial sustainability, insolvency and, ultimately, to the bankruptcy of the enterprise.

The means can be obtained not only by taking loans, but also by issuing bonds and other securities. Bonds - This is a kind of securities produced as debt obligations. Bonds may be short-term (for 1-3 years), medium-term (for 3-7 years), long-term (for 7-30 years). At the end of the term of appeal, they are repaid, that is, the owners pay their nominal value. Bonds can be coupons for which periodic income is paid. Coupon - a tear-off coupon, which indicates the date of interest payments and its size. There are also infectious bonds, the periodic income on which is not paid. They are placed at a price below the nominal, and are repaid at par. The difference between the placement price and the face value forms the discount is the income of the owner. The disadvantage of this method of financing is the existence of the issuance of securities, the need to pay interest on them, deterioration in the liquidity of the balance.

In addition, the source of financing the activities of the enterprise is the Credit Debt, i.e. Deferred payment, as a result of which the cash is temporarily used in the economic trafficking of the debtor's enterprise. Accounts payable- This is the debt of the staff of the enterprise for the period from the accrual of salary before its payment, suppliers and contractors, debt to budget and extrabudgetary funds, participants (founders) on income payments, etc.

The golden rule of payables management lies in the maximum possible increase in the maturity of the debt without possible financial consequences. In this case, the enterprise uses "other people's" means as if for free.

The use of accounts payable as a source of funding significantly increases the risk of liquidity loss, since these are the most urgent obligations of the enterprise.

Chapter 3. Management of Financing Sources

The company's financial policy strategy is a nodal moment in assessing the permissible, desired or projected rates of increasing its economic potential.

To finance their activities, the enterprise can use three main source of funds:

the results of their own financial and economic activities (reinvestment of profits);

an increase in the authorized capital (additional share emissions);

attracting funds of third-party individuals and legal entities (bond issue, receiving bank loans, etc.)

Of course, the first source is a priority - in this case, all earned profits, as well as the potential profit belongs to the present owners of the enterprise. In case of attracting the second and third sources, part of the profit has to sacrifice. The practice of large Western firms shows that most of them extremely reluctantly resorting to the release of additional shares as a permanent part of financial policies. They prefer to count on their own capabilities, that is, the development of the enterprise mainly due to reinvestment of profits. There are several reasons for this:

Additional share emission is a very expensive and time-long process.

Emissions may be accompanied by a decline in the market price of the issuer's share.

As for the relationship between its own and attracted sources of funds, it is determined by various factors: national traditions in financing enterprises, sectoral affiliation, enterprise sizes, etc.

Various combinations of using sources of funds are possible. If the company is focused on its own resources, then the main share in additional sources of funding will be on reinvested profits, and the ratio between sources will be changed towards a decrease in funds involved from the part. But such a strategy is hardly justified, so if the enterprise has a well-established structure of sources of funds and considers it to be optimal, it is advisable to maintain it at the same level, that is, with an increase in its own sources to increase in a certain proportion and the size of the attracted.

The rate of increasing economic potential of the enterprise depends on two factors: profitability of equity and reinvestment coefficient of profits. These factors give a generalized and comprehensive characteristics of various parties to the company's financial and economic activity:

production (return of resources);

financial (structure of sources of funds);

relations of owners and managerial personnel (dividend policy);

the position of the enterprise in the market (profitability of products).

Any enterprise is steadily functioning for a certain period, has completely established values \u200b\u200bof selected factors, as well as trends in their change.

3.1. The ratio of external and internal sources

financing in capital structure

In the theory of financial management distinguish two concepts: "Financial Structure" and "Capitalized Structure" of the enterprise. Under the term "financial structure" implies a way to finance the activities of the enterprise as a whole, that is, the structure of all sources of funds. The second term refers to a narrower part of funding sources - long-term liabilities (own sources of funds and long-term borrowed capital). Own and borrowed sources of funds differ in a variety of parameters 8.

The structure of capital has an impact on the results of the financial and economic activity of the enterprise. The ratio between sources of own and borrowed funds is one of the key analytical indicators characterizing the risk of investing financial resources in this enterprise, and also defines the prospects for the organization in the future.

Questions of the possibility and feasibility of managing the structure of capital have long been debated among scientists and practitioners. There are two main approaches to this problem:

traditional;

moodigaliani theory - Miller.

The followers of the first approach believe that: a) the capital price depends on its structure; b) There is a "optimal capital structure". The weighted capital price depends on the price of its components (own and borrowed funds). Depending on the capital structure, the price of each of the sources changes, and the rate of change is different. Numerous studies have shown that with an increase in the share of borrowed funds in the total amount of long-term capital sources, the price of equity is constantly increasing increasing pace, and the price of borrowed capital, remaining almost unchanged, then also begins to increase. Since the price of borrowed capital is on average lower than the price of its own, there is a capital structure, called the optimal, in which the indicator of the weighted capital price has the minimum value, and, consequently, the price of the enterprise will be maximum.

The founders of the second approach of Modigliani and Miller (1958) approve the opposite - the price of capital does not depend on its structure, that is, it cannot be optimized. With the substantiation of this approach, they introduce a number of restrictions: the availability of an effective market; lack of taxes; the identical amount of interest rates for individuals and legal entities; rational economic behavior, etc. In these conditions, they claim, the capital price is always leveling.

In practice, all forms of financing costs can be used simultaneously. The main thing is to achieve between them optimal for this period of relation. It is believed that the optimal ratio between its own and borrowed means is a 2: 1 ratio. In other words, our own financial resources should exceed borrowed twice. In this case, the financial position of the enterprise is considered sustainable.

3.2. Effect of financial leverage

Currently, large enterprises usually have the ratio of their own and borrowed funds as 70:30. The larger the share of own funds, the higher the financial independence coefficient. When increasing the share of borrowed capital increases the likelihood of bank bankruptcy, which forces creditors to increase interest rates for credit by increasing credit risks.

But at the same time, enterprises having a high proportion of borrowed funds have certain advantages over enterprises with a high share of equity in assets, since, having the same amount of profit, they have a higher profitability of 9 equity capital.

This effect arising in connection with the advent of borrowed funds in the amount of capital used and allowing the enterprise to receive additional profits on its own capital, is called the effect of financial leverage (financial leverage). This effect characterizes the effectiveness of the use of borrowed funds.

In general, with the same economic profitability, the profitability of equity capital depends on the structure of financial sources. If the organization has no paid debt, and interest is not paid on them, then the growth of economic profits leads to a proportional growth of net profit (provided that the amount of tax is directly proportional to the size of the profit).

If the company, with the same total amount of capital (assets), is funded at the expense of not only its own, but also borrowed funds, profits before tax decreases due to the inclusion of interest into costs. Accordingly, the amount of income tax is reduced, and the profitability of equity can increase. As a result, the use of borrowed funds, despite their pay, makes it possible to increase the profitability of own funds. In this case, they talk about the effect of the financial lever.

Effect of financial leverage - This is the ability of borrowed capital to generate profits from the investments of equity, or increase the profitability of equity due to the use of borrowed funds. It is calculated as follows:

E FR \u003d (R E - I) * to C,

where R E is economic profitability, I - the percentage of the loan, to C - the ratio of the value of borrowed funds to the magnitude of their own funds, (R E - I) is differential, to the leverage.

The differential of the financial lever is an important information impulse that allows you to determine the level of risk, for example, to provide loans. If economic profitability is higher than the level of interest for a loan, then the effect of financial leverage is positive. With the equality of these indicators, the effect of the financial lever is zero. In case of exceeding the level of interest for a loan over economic profitability, this effect becomes negative, that is, the increase in borrowed funds in the capital structure brings the enterprise to bankruptcy. Consequently, the more differential, the less risk and vice versa.

The shoulder of the financial lever carries fundamental information. Big shoulder means a significant risk.

The effect of the financial leverage is higher than the lower the cost of borrowed funds (interest rate on loans), and the higher the income tax rate.

Thus, the effect of a financial lever allows you to determine the possibility of attracting borrowed funds to increase the profitability of our own and related financial risks.

Conclusion

Any enterprise needs sources of funding for its activities. There are various sources of funds. Internal include: authorized capital, funds accumulated by the enterprise, targeted financing, etc. External sources are bank loans, bonds and other securities, payables. It should be noted that internal and external sources of financing are interconnected, but not interchangeable.

Today, the important task of the financial policy of the enterprise is to optimize the structure of liabilities, that is, rationalization of sources of financing. The larger the share of own funds, the higher the coefficient of financial independence of the enterprise, but economic entities with a high share of borrowed funds also have certain advantages. Borrowed funds for the enterprise although they are a paid source of financing. Practice shows that their use is more efficient than their own.

Each enterprise independently defines the structure and methods for financing its activities, it depends on the industry's industry characteristics, its size, the duration of the production cycle of products, etc. The main thing is to properly arrange priorities among funding sources, calculate enterprises' possibilities and predict possible consequences.

List of used literature

Large Economic Dictionary / Ed. Azrigan A.N. - M.: Institute of New Economics, 1999.

Ermasova N.B. Financial management: allowance for passing the exam. - M.: Yurait-Edition, 2006.

Karelin V.S. Corporation Finance: Textbook. - M.: Publishing and trading corporation "Dashkov and K", 2006.

Kovalev V.V. Financial Analysis: Capital Management. Choosing an investment. Reporting analysis. - M.: Finance and Statistics, 1998.

Romanenko I.V. Finance of the enterprise: the abstract of lectures. - SPb.: Publisher Mikhailova V.A., 2000.

Selezneva N.N., Ionova A.F. The financial analysis. Financial management: Tutorial for universities. - M.: Uniti-Dana, 2006.

Modern economy: textbook / ed. prof. Mamedova O.Yu. - Rostov-on-Don: publishing house "Phoenix", 1995.

Chuev I.N., Chechevitsyn L.N. Enterprise Economy: Tutorial. - M.: Publishing and trading corporation "Dashkov and K", 2006.

Economy and management in SCS. Scientists of the economic faculty. V.7. - St. Petersburg: Publishing House of SPbGUP, 2002.

Enterprise Economy (Firms): Textbook / Ed. prof. Volkova O.I. and Assoc. Devyatkina O.V. - M.: Infra-M, 2004.

http://www.profigroup.by.

application

Table "Key differences

between the types of sources of funds "

Scheme "Sources and Movement

financial resources of the enterprise "

1 Financial resources- cash in cash and cashless form.

2 Venture financing - investment in high-risk projects and at the same time high yield.

3 See: application, Scheme "Sources and Movement of Financial Resources of the Enterprise".

4 Folded Capital - A set of contributions of participants in the full partnership or partnership on the faith in the partnership to implement its economic activities.

5 Unit trust - a set of mutual contributions of members of the production cooperative to joint entrepreneurial activities, as well as acquired and created in the process of activity.

enterprisesDegree work \u003e\u003e Financial sciencesBelieve that get outdoor financing In the current situation, it is possible ... Theoretical aspects of the study of factoring as source financing activities enterprises) 1.1 Essence and types ... for all types of factoring - internal (with regression and without regression ...

And disadvantages of various sources financing activities enterprises Problem of choice source Attracting funds in ... the needs of companies. TO internal sources Amortization also includes ... external sources. The exception is ...

On the financing Economic activities. Sources financing enterprises divide on internal (equal capital) and external (borrowed and attracted capital). Domestic financing assumes ...

Resources enterprises; - Analyze sources financing activities enterprises; - offer directions for improvement sources financing activities enterprises. ... by sources attraction they are divided into external and internal; ...

... "Problems sources financing enterprises Modern tools have been studied in Russia financing enterprises and investigated the problem of attracting long-term source financing activities enterprises in Russia...

In Russian practice, the company's capital is often divided into capital active and passive. From a methodological point of view, this is incorrect. This approach is the reason for the underestimation of the place and the role of capital in the business and leads to a surface consideration of capital formation sources. Capital cannot be passive, as it is a value that brings the surplus value in motion in constant turnover. Therefore, it is more reasonable here to apply the concepts of sources of capital formation and functioning capital.

Economic funds of the organization are formed at the expense of sources, i.e. financial resources. Distinguish:

- - sources of own funds (own capital);

- - Sources of borrowed funds (borrowed capital).

Schematically, they can be represented as follows (Fig. 1).

Fig. one.

Capital enterprises can be considered from several points of view. First of all, it is advisable to distinguish capital real, i.e. existing in the form of means of production, and capital cash, i.e. The existing in the form of money and used to acquire means of production as a set of sources of funds to ensure the economic activity of the enterprise. Consider first money capital.

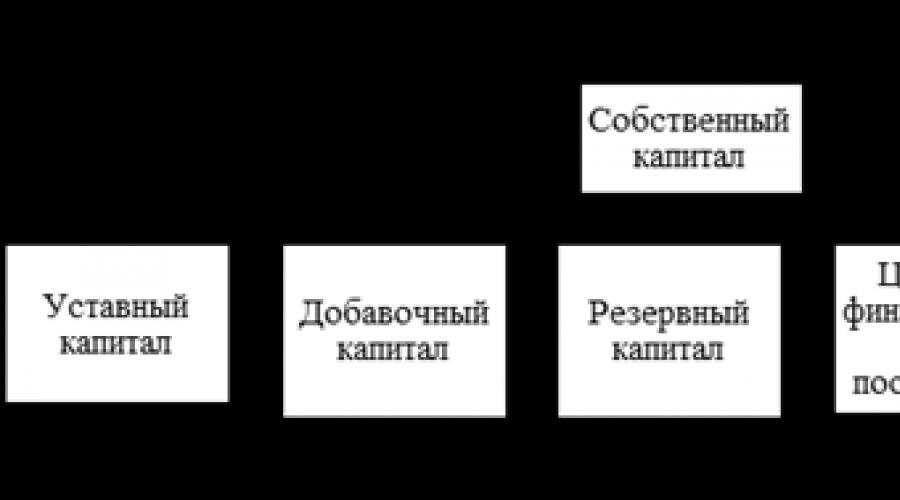

Own capital is the source of the assets remaining after subtracting from the total assets of all obligations; Some use this term wider, including its obligations. Own capital consists of statutory, additional, reserve capital; targeted financing and revenues retained earnings. The structure of equity can be represented as a scheme (Fig. 2).

Fig. 2.

As part of its own capital, the main place occupies the authorized capital.

The authorized capital is the amount of capital, determined by the Agreement and the Charter of the Organization, which allocate joint-stock companies and other enterprises to start activity. The authorized capital in the organizations created at the expense of owners is a set of contributions of founders (participants) of economic partnerships and economic societies (in the form of joint-stock companies, limited liability companies, etc.), municipalities, states.

The structure of borrowed sources can be represented as a schema (Fig. 3).

Fig. 3.

The borrowed capital is capital, which is attracted by the enterprise from loans, financial assistance, the amounts obtained on bail, and other external sources for a specific period, under certain conditions for any guarantees.

The group of bank loans includes short-term and long-term bank loans. Loans are issued by the Bank on strictly defined goals, for a certain period and with the condition of return.

All discussed sources of economic funds make up the balance of the balance.

The amount of economic funds organization and the amount of sources of their formation are equal, for the organization cannot have more economic funds than sources of their formation, and vice versa.

Capital in material and real incarnation is divided into primary and working capital.

The fixed capital serves for a number of years, revocable - fully consumed during one production cycle.

The fixed capital is in most cases identified with the main funds (main means) of the enterprise. However, the concept of fixed capital is wider, since in addition to fixed assets (buildings, structures, machinery and equipment), which represents its significant part, and in-departed construction and long-term investments are also included in the main capital - cash aimed at capital gains.

Now consider ways and sources of financing the activities of the enterprise.

Classification of financial resources for the sources of formation

At the occurrence Financial resources of the company are classified on:

- domestic financing;

- external financing.

Internal financingensures the use of those financial resources, sources of kum are formed in the process of financial and economic activities of the Organization. An example of such sources can serve net profit, depreciation, payables, reserves of upcoming expenses and payments, income of future periods.

For external financing Cashs entering the organization from the outside world can be used. Founders, citizens, states, financial and credit organizations, non-financial organizations can be sources of external financing.

Grouping financial resources of organizations sources of their formation Presented in Figure below.

The financial resources of the organization, in contrast to material and labor, differ interchangeability and exposure to inflation and devaluation.

Today, the relevant problem for domestic industrial enterprises will be the state of the main production facilities, the worniness of the kum reached 70%. When we are talking not only about the physical, but also on moral wear. There is a need to re-equip Russian enterprises with new high-tech equipment. At ϶ᴛᴏ, the selection of the source of financing of the specified re-equipment is important.

Allocate the following sources of financing:

- Domestic sources of the enterprise (Net profit, depreciation deductions, implementation or lease of unused assets)

- Involved funds (Foreign investment)

- Borrowed funds (Credit, leasing, bill)

- Mixed (integrated, combined) financing.

Internal sources of enterprise financing

We note the fact that in modern conditions of the enterprise independently distribute the profits remaining at their disposal. The rational use of profits implies the accounting of such factors as the implementation of plans for the further development of the enterprise, as well as the observance of the interests of owners, investors and workers.

As a rule, the more profit is sent to the expansion of economic activity, the smaller the need for additional financing. The magnitude of retained earnings depends on the profitability of economic operations, as well as from the dividend policy adopted at the enterprise.

TO advantages of internal financing enterprises should be attributed lack of additional costs associated with attracting capital from external sources, and maintaining control over the activities of the enterprise from the owner.

Disadvantage This type of financing of the enterprise will be not always possible its use in practice. The depreciation fund lost to the value because the depreciation rates for most types of equipment used in Russian industrial enterprises are underestimated and can no longer serve as a full source of financing, and the permitted accelerated depreciation methods cannot be used for existing equipment.

Second internal source of financing - Profit of the enterprise that remained after payment of taxes. As practice shows, most enterprises lack their own internal resources to update fixed assets.

Involved funds

When choosing as a source of financing a foreign investor, the company should consider the fact that investor is interesting to high profits, the company itself and its share of ownership in it. The higher the share of foreign investment, the less control of the owner of the enterprise remains.

Remains financing from borrowed fundsWhen it comes to a choice between leasing and credit. Most often in practice, the effectiveness of leasing is determined by comparing it with a bank loan, which is not entirely correct, because for each specific transaction has to take into account specific conditions.

Credit - as a source of financing of an enterprise

Credit - The loan in monetary or commodity form provided by the lender by the borrower on the terms of return, most often with the payment of a borrower for the use of the loan. By the way, this form of financing will be the most common.

Credit Benefits:

- the credit form of financing is of greater independence in the application of the received funds without any special conditions;

- most often, the loan offers a bank serving a specific enterprise, so the process of obtaining a loan becomes very operational.

The lack of loan can be attributed to the following:

- loan period in rare cases exceeds 3 years, which will be unbearable for enterprises aimed at long-term profit;

- to obtain a loan, the company requires the provision of a deposit, often the equivalent amount of the loan itself;

- in some cases, banks offer to open a settlement account as one of the conditions for bank lending, which is not always favorable to the company;

- with this form of financing, the company may use the standard depreciation scheme of the acquired equipment, which obliges to pay tax on property during the entire period of use.

Leasing - as a source of financing of an enterprise

Leasing It is a special integrated form of entrepreneurial activity that allows one side to the lessee - to effectively update the main funds, and the other is the lessor - to expand the boundaries of activities on mutually beneficial conditions for both parties.

The advantages of leasing:

- Leasing suggests 100% lending and does not require immediate payments. When using a regular loan to buy property, the company should pay about 15% of the cost at the expense of own funds.

- Leasing allows an enterprise that does not have significant financial resources, to start implementing a large project.

For the enterprise it is much easier to obtain a contract for leasing than a loan - after all providing the transaction is the equipment itself.

Lessing Agreement more flexibly than a loan. The loan always assumes limited sizes and maturities. When leasing, the company can calculate the arrival of income and to work out with the lessor that the funding scheme is convenient for it. Repayment can be carried out from the funds coming from the sale of products, which is made on equipment taken into lease. The company offers additional possibilities for expanding production capacity: payments under the lease agreement are distributed over the entire validity period of the contract and, thereby, additional funds are found for investing in other types of assets.

Leasing does not increase the debt in the balance sheet of the enterprise and does not affect the ratios of its own and borrowed funds. Does not reduce the possibility of an enterprise to receive additional loans. It is very important that the equipment acquired under the lease agreement may not be listed on the balance sheet of the lessee during the entire term of the contract, and therefore does not increase assets that it becomes an enterprise from paying taxes to the acquired funds.

The Tax Code of the Russian Federation stored the right to choose the balance sheet accounting of property obtained (transmitted) to the financial lease on the balance of the lessor or the lessee. The initial value of the property, which is the subject of leasing, recognizes the amount of the costs of the lessor for its acquisition. Excluding the above, since 2002, regardless of the chosen method of taking into account the property of the lease agreement (on the planner of the leaser or lessee), leasing payments reduce the taxable base (Art. 264 of the Tax Code of the Russian Federation) Article 269 of the Tax Code of the Russian Federation introduced a restriction on the amount of interest on loans, kᴏᴛᴏᴩy The lessor can relate to a decrease in the taxable base, but in other cases the lessor can attribute interest on the loan to reduce the taxable base.

Leasing platessupplied by the enterprise entirely on production costs. If the property obtained on leasing is taken into account on the lessee balance sheet, the enterprise may benefit related to the possibility of accelerated depreciation of the leased object. Depreciation charges for such property can be accrued based on its value and norms approved in the prescribed manner, increased by no higher than 3 coefficient.

Leasing companies In contrast to banks no pledge needIf this property or equipment is liquid in the secondary market.

Leasing allows an enterprise on completely legal grounds to minimize taxation, as well as to attribute all the costs of servicing equipment on the lessor.

As mentioned above, the main internal sources of financing for business companies are profit and depreciation. Profit As an economic category reflects net income, created in the field of material production in the process of entrepreneurial activity, and performs certain functions.

First of all, the profit characterizes the economic effect obtained as a result of the activities of the entrepreneurial company.

Profit performs and social function, as it is one of the sources of formation of budgets of different levels. It enters the budgets in the form of taxes and along with other income receipts is used to finance social needs, ensuring the state of its functions, state investment, industrial, scientific and technical and social programs. The social profit function is also manifested in the fact that it serves as a source of charitable activities a firm aimed at financing individual non-profit organizations, social institutions, providing material assistance to certain categories of citizens.

The stimulating profit function manifests itself in the fact that the profit is both financial results at the same time, and the main element of the company's financial resources. Indeed, profit is the main internal source of the formation of financial resources of the company ensuring its development. The higher the level of generation of the enterprise's profits in the process of its economic activity, the less its need to attract funds from external sources, and the higher the level of self-financing of the enterprise, ensuring the implementation of the strategic goals of this development. At the same time, unlike other internal sources of formation of financial resources of the company, the profit is a constantly reproducible source, and its reproduction under successful management is carried out on an extended basis.

Profit is the main source of increasing the market value of the firm. The ability of the initiation of capital costs is ensured by capitalization of the part of the received profit. The higher the amount and the level of capitalization received by the profit received, the more increasing the cost of its net assets, and, accordingly, the market value of the company as a whole, determined on its sale, merger, takeover and in other cases.

Profit is a major protective mechanism that protects the firm from the threat of bankruptcy. Although the threat of bankruptcy may occur in the conditions of profitable economic activities of the company, but, with other things being equal, the company is much more successful and faster from the crisis condition at a high level of profit. Due to the capitalization of the profit received profit, the company can rapidly increase the share of highly liquid assets, increase the share of equity with the corresponding reduction in the volume of borrowed funds used, as well as to form reserve financial funds.

Thus, in the conditions of a market economy, the value of the profit is enormous. The desire to obtain profits orients commodity producers to increase the volume of production, the necessary consumer, reducing production costs. For business companies, profits is an incentive for investing funds in those areas of activity that make profits.

Profit is the end result of the production and economic activity of the company, an indicator of its effectiveness, the source of funds for investment, the formation of special funds, as well as payments to the budget. Profit profit is the main goal of the activities of the entrepreneurial organization.

The total amount of profit (loss) received by the enterprise for a certain period, i.e. Gross profit consists of:

- profits (loss) from the sale of products, services performed;

- profits (loss) from other realization;

- Profit (loss) from non-engineering operations.

Profit (loss) from product sale(works, services). Determined as the difference between the revenue from the sale of products (works, services) without value-added tax and excise taxes and costs for the production and implementation included in the cost of production (works, services).

Profit (loss) from other implementation. The enterprise may form unnecessary material values \u200b\u200bas a result of changes in the volume of production, disadvantages in the supply system, implementation and other reasons. Long storage of these values \u200b\u200bin inflation conditions leads to the fact that revenues from their implementation will be lower than the acquisition prices. Therefore, not only profit is formed from the realization of unnecessary inventive values, but also losses.

As for the implementation of excessive fixed assets, the profit from this implementation is calculated as the difference between the selling price and the initial (or residual) cost of funds, which increases with the appropriate index, the legally mounted depending on the growth rate of inflation.

Profit (loss) from non-engineering operations. It is calculated in the form of a difference between income and expenses on non-deactive operations. The income (expenses) from non-engineering operations includes revenues received from equity participation in the activities of other enterprises, from renting property; income (dividends, interest) on shares, bonds and other securities owned by the enterprise; Profit received by the investor in the execution of the Production Decision Agreement, as well as other income (expenses) from operations directly related to the production of products, services, work, and selling property.

The income from non-revenue operations includes amounts of funds received from other enterprises in the absence of joint activities with the exception of funds enrolled in the authorized funds of enterprises with its founders in the manner prescribed by law; funds obtained as gratuitous assistance (assistance) and confirmed by the relevant certificate; funds received from foreign organizations in order of gratuitous assistance to Russian education, science and culture; funds received by privatized enterprises as an investment as a result of investment contests (trading); funds transferred between the main and subsidiary enterprises provided that the share of the main enterprise is more than 50% in the authorized capital of subsidiaries; funds transmitted to the development of the production and non-production base within one legal entity.

Nhernalization costs include fines, penalties, penalties for violation of contracts that are recognized by the debtor's enterprise; reimbursed losses caused by the enterprise; losses of past years identified in the reporting year; the amount of receivables at which the limitation period has expired; other debts unreal for recovery; Course differences arising from the revaluation in the prescribed manner and obligations expressed in foreign currency; losses from write-off previously awarded debts by the embezzlement on which the executive documents were returned by the court due to the inconsistency of the defendant; losses from theft of material and other values, the perpetrators of which are not established for court decisions; legal costs, etc.

The total profit received by the enterprise is distributed between the enterprise and the federal, regional and local budget by paying income tax with taxable profits.

Taxable profit - This is the difference between the total (gross profit - in accordance with the Federal Law "On the Company's Profit Tax and Organizations" - and the amount of profit taxable income tax (on securities and on equity participation in joint ventures), as well as the amount of benefits Profit tax in accordance with tax legislation, which is periodically revised.

Net profit - Profit remaining at the disposal of the enterprise after paying all taxes, economic sanctions and deductions to charitable funds.

The magnitude of gross profits is influenced by the set of many factors dependent and independent of entrepreneurial activities. Important profit growth factors, depending on the activities of enterprises, are: growth of products manufactured in accordance with contractual conditions, a decrease in its cost, improving the quality, improvement of the range, improving the efficiency of the use of industrial funds, the growth of labor productivity.

The factors that do not depend on the activities of entrepreneurial firms include changes in prices for realized products regulated by government agencies, the influence of natural, geographical, transport and technical conditions for the production and sale of products, etc.

The procedure for distribution and use of profit on the company is fixed in the charter of the company, in accordance with which firms can make estimates of expenses funded from profits, or to form specialized funds: fund accumulation funds and consumption funds. The estimates of the costs financed from profits include the cost of developing production, the social needs of the labor collective, on the material promotion of workers and charitable goals.

The costs associated with the development of production include expenses for research, design, design and technological work, financing the development and development of new types of products and technological processes, the cost of improving the technology and organization of production, the modernization of equipment, etc. The expenditures on the repayment of long-term loans of banks and interest on them, as well as the costs of environmental activities, etc. are included in the same group of expenses.

The distribution of profits for social needs includes: the expenditure of social and household facilities on the balance sheet; Financing the construction of non-production facilities, organization and development of subsidiary agriculture, holding wellness, cultural events, etc.

The costs of material encouragement include: one-time promotion for the performance of production tasks, the payment of premiums, the costs of providing material assistance to workers and employees, premiums for pensions, compensation for food cost employees, etc.

An important role in the composition of internal sources of financing is also played. depreciation deductionswhich are a monetary expression of the value of the depreciation of fixed assets and intangible assets and are an internal source of financing both simple and expanded reproduction. Objects to accrual depreciation are facilities of fixed assets in the focus on the right of ownership, economic management, operational management.

The accrual of depreciation on the facilities of fixed assets under the lease is made by the landlord (with the exception of depreciation deductions produced by the tenant for property under the company's lease agreement, and in cases provided for in the Financial Rental Treaty).

The accrual of depreciation on property under the company's lease agreement is carried out by the tenant in the manner adopted for fixed assets in the organization on the right of ownership. The depreciation of leasing property is made by the lessor or lessee, depending on the conditions of the lease agreement.

According to the facilities of the fixed assets obtained under the contract of donation and free of charge in the process of privatization, housing stock, on external improvement facilities and similar objects of forestry, road management, specialized buildings of the shipping situation and other facilities, productive livestock, buffaloms, whales and deer, long-term plantations under the operational age, as well as on acquired publications (books, brochures, etc.), depreciation is not charged.

The depreciation objects of fixed assets, the consumer properties of which are not changed over time (land plots, objects of environmental management).

Depreciation deductions for fixed assets start from the 1st day of the month following the month of adoption of this facility to accounting accounting. The accrual of depreciation deductions is made until the cost of this object is fully repayed to or write off this facility from accounting in connection with the termination of ownership or other real law. Depreciation deductions on the facility of fixed assets are terminated from the 1st day of the month following the month of full repayment of the value of this object or write off this object with accounting.

In accordance with the methodological instructions on accounting records of fixed assets approved by the Order of the Ministry of Finance of the Russian Federation, the depreciation of fixed assets can be carried out in one of the following four ways to accrual depreciation deductions:

1) linear;

2) reduced residue;

3) write-off costs for the sum of the number of years of useful use;

4) the write-off of value is proportional to the volume of products (works).

The use of one of the methods for a group of homogeneous facilities of fixed assets is made throughout its useful use. The accrual of depreciation deductions is not suspended during the useful use of fixed assets, except for their events for reconstruction and modernization by decision of the head of the company, and on fixed assets transferred to the decision of the Organization's head for conservation with a duration that can not be less than 3 months.

For linear The method of depreciation is uniformly, and the annual amount of depreciation charges is determined from the initial value of the object of fixed assets and the rate of depreciation, calculated on the basis of the useful use of this object.

With the method reduced residue The annual amount of accrual depreciation deductions is determined from the residual value of the object of fixed assets at the beginning of the reporting year and the depreciation rate, calculated on the basis of the useful use of this object, and the acceleration coefficient established in accordance with the legislation of the Russian Federation.

The acceleration coefficient is applied to the list of high-tech industries and effective types of machinery and equipment established by the federal executive bodies. According to movable property, which constitutes a financial leasing object and applied to the active part of fixed assets, can be applied, in accordance with the terms of the lease agreement, the acceleration coefficient is not higher than 3.

The essence of this method is that the proportion of depreciation contributions attributable to the cost of production will decrease with each subsequent year of exploitation of the object of fixed assets for which the depreciation is charged by the method of reduced residue.

With the method writing the cost of the amount of the number of years of useful use The annual amount of depreciation deductions is determined on the basis of the initial value of the object of fixed assets and the annual relation, where the number of years remaining until the end of the service life of the object, and in the denominator - the amount of the number of years of the service life of the facility.

The accrual of depreciation deductions for fixed assets during the reporting year is made monthly regardless of the method of accrual in the amount of 1/12 of the above annual amount.

This method of depreciation is preferable to the fact that it allows at the beginning of operation to write off most of the cost of fixed assets, then the pace of write-off slows down, which ensures a decrease in the cost of products.

With the method writing the value in proportion to the volume of products (works) The accrual depreciation is made on the basis of the natural indicator of the volume of products (works) in the reporting period and the ratio of the initial value of the object of fixed assets and the intended volume of products (works) for the entire useful use of the facility of fixed assets.

This method of depreciation can also be used in the case of a seasonal nature of the equipment operation, if the technical documentation provides for the dependence of the service life of equipment from the number of products.

In accordance with the Federal Law of June 14, 1995 No. 88-FZ "On State Support for Small Entrepreneurship in the Russian Federation", small businesses are entitled to accrue depreciation of the main production facilities in the amount, twice the norms established for the relevant types of fixed assets, And also to write off additionally as depreciation deductions up to 50% of the initial value of fixed assets with a useful life of more than 3 years.

The cost of special tools, special devices and interchangeable equipment is repaid only by the method of writing off the value in proportion to the volume of products (works, services). The cost of special tools and special devices intended for individual orders or used in mass production is allowed to fully repay at the time of transfer to the production of appropriate tools and devices.

The cost of items intended for renting under a rental agreement is repaid only by a linear way.

The cost of intangible assets is also repaid by depreciation during the established period of useful use. According to which cost repayment is made, depreciation deductions are determined by one of the following methods: a linear method based on the norms calculated by the organization based on their useful life; The way to write off the cost is proportional to the volume of products (works, services).

According to intangible assets, according to which it is impossible to determine the useful life, depreciation rates are established per 10 years (but no more period of the organization's activities). According to the intangible assets obtained under the contract of donation and free of charge in the process of privatization acquired using budget allocations and other similar means (in terms of the value per value for these funds), and the depreciation is not charged on intangible assets of budgetary organizations.

Of the four depreciation methods provided by the legislation of the Russian Federation, two are methods of accelerated depreciation: the amount of the amount of useful use and the method of a reduced residue. Despite the greatest popularity of accelerated depreciation in world practice, in Russia it did not receive due propagation.

This is due to the fact that the use of accelerated depreciation significantly worsens the financial and economic indicators of the activities of the entrepreneurial company by increasing the cost of products, since in the first years of operation of the facility of fixed assets most of them are written off.

In accordance with part of the second Tax Code of the Russian Federation (the head of "income tax") amortized property is distributed on depreciation groups in accordance with the timing of its useful use as follows.

First group - All short-lived property with a useful life of 1 year to 2 years inclusive.

Second group - Property with a useful life over 2 years to 3 years inclusive.

Third Group - Property with useful use of over 3 years to 5 years inclusive.

Fourth group - Property with useful life over 5 years to 7 years inclusive.

Fifth group - Property with useful use of over 7 years to 10 years inclusive.

Sixth group - Property with a useful life of over 10 years to 15 years inclusive.

Seventh group - Property with a useful life of over 15 years to 20 years inclusive.

Eighth group - Property with a useful life of over 20 years to 25 years inclusive.

Nine Group - Property with useful life over 25 years to 30 years inclusive.

Tenth group - Property with useful life over 30 years.

For other fixed assets that are not specified in depreciation groups, useful life is established by the enterprise in accordance with the specifications and recommendations of manufacturers.

In order to tax the enterprise, depreciation is accrued by one of the following methods:

1) linear;

2) nonlinear.

Linear The depreciation method is applied to buildings, structures, transfer devices included in the eighth - the tenth depreciation groups, regardless of the time of entering these facilities. The enterprise has the right to apply one of two depreciation methods in accordance with the accounting policies adopted at the enterprise to the rest of the main funds.

Moscow Humanitarian and Economics

Kaluga branch

Department Finance and Credit

COURSE WORK

in the discipline "Finance of organizations (enterprises)"

Sources of financing of economic activities

Kaluga 2009.

Introduction

Chapter 1. Theoretical foundations of sources of financing

1.1 Essence and classification of enterprise financing sources

1.3 borrowed sources of financing of the enterprise

Chapter 2. Management of enterprise financing sources

2.1 Manage your own and borrowed funds

2.2 Shares Emissary Management

2.3 Managing Bank Credit Management

Chapter 3. Problems of sources Financing enterprises in Russia

3.1 Modern tools for financing enterprises

3.2 Problems of attracting long-term sources of funding for the activities of Russian enterprises in the context of the financial crisis

Settlement

Conclusion

List of used sources and literature

Introduction

Relevance of the research topic. In the context of the formation of a market economy, the situation of economic entities is fundamentally changing compared to the one they occupied earlier in the command-administrative system. Transformation processes occurring in the Russian economy and the emergence of various forms of ownership determined the diversity of economic behavior of economic entities.

But the final result of their activities is always reduced to profit and increase profitability, which largely depends on the amount of financial resources and on sources of financing.

The presence of a sufficient financial resource, their effective use, predetermine the good financial position of the company solvency, financial sustainability, liquidity. In this regard, the most important task of enterprises is to find reserves for increasing their own financial resources and their most effective use in order to improve the efficiency of the enterprise in general.

Each enterprise in the process of its formation and development should determine which volume of equity should be invested in turnover. The feasibility of attracting a financial source must be compared with the indicators of the profitability of the investments of this species and the value of this source. The needs of the enterprise in its own and attracted means is an object of planning, respectively, the decision of this issue has a direct impact on the financial condition and the possibility of the survival of the enterprise.

The choice of methods and sources of financing of the enterprise depends on many factors: the experience of the work of the enterprise in the market, its current financial condition and development trends, the availability of certain sources of financing.

However, it should be noted the main thing: the company can find capital only under the conditions at this time, operations are really implemented on financing similar enterprises, and only from those sources that are interested in investment in the relevant market (in the country, industry, region).

Goal goal Study of sources of financing the economic activity of the enterprise and problems from attracting.

In accordance with the goal, the decision is provided for the following tasks :

Consider theoretical foundations of sources of financing;

Examine the methods of control of sources;

Investigate the problems of sources of financing of Russian enterprises.

Subject of study - Sources of financing of economic activities

Research methodology. The theoretical and methodological basis of the study was the dialectical method of knowledge and systemic approach. When performing the work, general scientific and special research methods were used.

Information sources. As sources of information, the works of domestic scientists on the basics of capital management and the study of dividend policies of organizations, periodicals are used.

The volume and structure of the course work. Course worked on 53 sheets of typewritten text and contains 1 drawing.

The introduction reflects the relevance of the theme, its study, goals and objectives of the course work, the subject of research, as well as research methods, the literature used, the structure and content of the course work.

In the first chapter, the "Theoretical Fundamentals of Funding Sources" addressed the classification of sources of financing and composition of own and borrowed funds.

The second chapter "Management of sources of financing" provides the main mechanisms for managing the sources of economic activity of enterprises.

In the third chapter "Problems of sources of financing enterprises in Russia", modern tools of financing enterprises were studied and the problem of attracting a long-term source of financing enterprises in Russia was investigated.

The conclusion contains the main conclusions and application of the course work.

The reference list consists of 27 sources.

1. Theoretical foundations of funding sources

1.1 Essence and classification of enterprise financing sources

Financing of economic activities of the enterprise is a set of forms and methods, principles and conditions for financial support of simple and expanded reproduction.

When choosing sources of financing of the enterprise, it is necessary to solve five main tasks:

Determine the needs in short and long-term capital;

Identify possible changes in the composition of assets and capital in order to determine their optimal composition and structure;

Ensure constant solvency and, consequently, financial stability;

With maximum profit to use your own and borrowed funds;

Reduce the cost of financing economic activities.

Organizational forms of financing :

Self-financing (retained earnings, depreciation deductions, reserve capital, additional capital, etc.).

Joint-stock or share financing (participation in the authorized capital, purchase of shares, etc.).

Borrowed funding (bank loans, placement of bonds, leasing, etc.).

Budget financing (loans on a return basis from federal, regional and local budgets, allocations from budgets at no level, targeted federal investment programs, government borrowing, etc.).

Special forms of financing (project financing, venture financing, financing by attracting foreign capital).

The initial source of financing of any enterprise is authorized (share) capital (foundation), which is formed from the deposits of founders. Specific ways of formation of authorized capital depends on the organizational and legal form of the enterprise. The minimum value of the authorized capital on the Company's registration day is:

In a limited liability company (LLC) - 100 minimum wages (minimum wage);

In a closed joint-stock company (CJSC) - 100 minimumts;

In an open joint-stock company (OJSC), less than 1000 minimum wage.

The founders of a joint-stock organization or other society are obliged to fully make the authorized capital during the first year of activity.

Decision to reduce authorized capital 2/3 of the votes of owners of voting shares are accepted and is implemented in one of two ways:

Reducing the nominal value of shares;

The acquisition and repayment of the part of the shares (if it is provided for by the Charter of the Organization).

Decision on the increase in authorized capital Takes the general meeting of shareholders. This is happening either by increasing the nominal value of shares, or by placing an additional declared emission of shares. However, for the development of business, there is not enough possession of the initial capital made by the founders (shareholders). The enterprise in the process of its activities it is necessary to accumulate other available sources of financing (Fig. 1).

|

||

|

||

|

||

1.2 Content of own sources of financing of the enterprise

Undestributed profits It is a reinvested source of own funds to replace equipment and new investments.

The profit of the enterprise depends on the ratio of income obtained on the basis of activities, and consistent with these income. Eliminate gross profits, sales profit, operating profit, profit before tax (according to accounting), taxable profit (according to tax accounting), retained (pure) profits of the reporting period, reinvested (capitalized retained) profits.

Profit remaining at the disposal of the organization is a multi-purpose source of financing its needs. However, the main directions of the distribution of profits are the accumulation and consumption, the proportions between which the prospects for the development of the enterprise are determined.

The formation of funds of accumulation and consumption, as well as other cash funds, may be provided for by the constituent documents and adopted enterprise accounting policies, then their creation must, or the decision to send profits to these funds is made by the meeting of shareholders on the submission of the Board of Directors (participants).

The presence of retained earnings depends on the profitability of the joint-stock company and the coefficient of dividend payments. The payment ratio of dividends characterizes the adopted organization dividend Policy, The content of which will be discussed later.

Profit also serves as the main source of reserve capital formation (Fund).

Reserve capital - part of own capital allocated from profits to cover possible losses. The source of the formation of reserve capital is net profit, that is, the profit remaining at the disposal of the organization.

Subject to the reserve fund create only joint-stock companies. The minimum amount of the reserve fund is 5% of the authorized capital. At the same time, the amount of annual mandatory contributions to the reserve fund cannot be less than 5% of net profit until the amount established by the Company's Charter.

Means of the Company's Reserve Fund are used:

To cover losses of society;

Repayment of bonds;

The repurchase of shares of the joint stock company in the absence of other funds.

Reserve capital cannot be used for other purposes.

Voluntary reserve funds can create all enterprises. The size and procedure for the formation of funds is established in the constituent documents.