Small and medium business revenue. The concept of small business in Russia

The criteria for attributing to a small enterprise in 2018 are similar to those acting in 2017. Consider in more detail who belongs to small business entities in 2018 and what are the criteria for the introduction of companies to this kind of activity.

Who belongs to small business entities

According to Art. 4 of the Law "On Development of Entrepreneurship in the Russian Federation" dated 24.07.2007 No. 209-FZ, to the SMP (subjects of small entrepreneurship) various economic entities are counted, namely:

- individual entrepreneurs;

- peasant (farmer) farms;

- household societies;

- economic partnerships;

- consumer cooperatives;

- production cooperatives.

All of them are obliged to comply with the main and additional criteria for small entrepreneurship marked in law 209-FZ. These are related to the fundamental characteristics of the management of any company, namely: the number of employees, the income received and the composition of the authorized capital. On their basis, it is determined whether the organization can be considered small or it needs to be counted among other categories of business entities. Consider what criteria is characterized by a small enterprise, more detailed.

New ruling in legislation to assign an organization to small businesses

In 2016, a decree of the Government of the Russian Federation "On the limit income values \u200b\u200b..." of 04.04.2016 No. 265 was published. It says that now one of the parameters used to date the subject to small businesses seems not to revenue from the sale of goods, providing Works or services, and a more extensive characteristic - the income received over the past calendar year in the implementation of all activities. The maximum value of this criterion has not changed and remains the same compared to 2015-2016: small companies have a yield limit of 800 million rubles.

In connection with the entry into force of the new ruling, 265, we can say that some enterprises lose the status of small and, accordingly, they will not be able to take advantage of the benefits for the conduct of simplified accounting, cash discipline and personnel workshoot. As for other criteria for attributing enterprises to small, medium or large, they remained unchanged.

You can learn about the criteria for micro, small and medium enterprises in the software.

Main and additional criteria indicating small enterprises

In addition to the profitability parameter, the main criteria includes the average number of personnel over the past calendar year. In small enterprises, this characteristic ranges from 16-100 people. The average number is calculated based on a specific rule, namely:

- First, the average number of personnel has been calculated.

- After that, the average number of personnel that had partial employment is determined.

As for additional criteria, they include the total percentage of membership of other business entities in the statutory fund of the subject. First, for economic partnerships or societies, this indicator should have no more than 25% of the total participation of the Russian Federation, the subjects of the Russian Federation or municipalities, public organizations or charitable foundations. Secondly, the fund must have no more than 49% of the total interest of the participation of other legal entities (not considered small enterprises) or foreign companies.

The criteria of a small enterprise may also correspond to legal entities whose activities are associated with intellectual developments in various fields, for example, creating information databases, industrial samples, etc.

With regard to joint-stock companies, they may also have the status of a small organization, only in this situation their shares should relate to the innovative sector of the state economy.

Does the company refer to the SMP (a step-to-step table to determine the status of the company)

Consider the algorithm for determining the category of the company Stephavo.

|

Algorithm |

|

|

1. Determine the average number of personnel over the past calendar year |

Calculated by calculation. Information for calculation is taken from information submitted to the tax inspection. Small enterprises, the indicator fluctuates in the range from 16 to 100 people |

|

2. Calculate the income acquired by the past calendar year from the implementation of all activities |

Information is taken from the tax declaration last year. When combining modes, income is summed up for each declaration. In small enterprises, the value should not exceed 800 million rubles. |

|

3. Determine the percentage of membership of other societies in the company's authorized capital |

1. The percentage of statehood of the state, subjects of the Russian Federation, municipalities, public organizations or charitable foundations is no more than 25%. 2. The percentage of membership of foreign legal entities or Russian legal entities (not having the status of a small enterprise) is no more than 49% |

Small and Medium Entrepreneurship Nuances

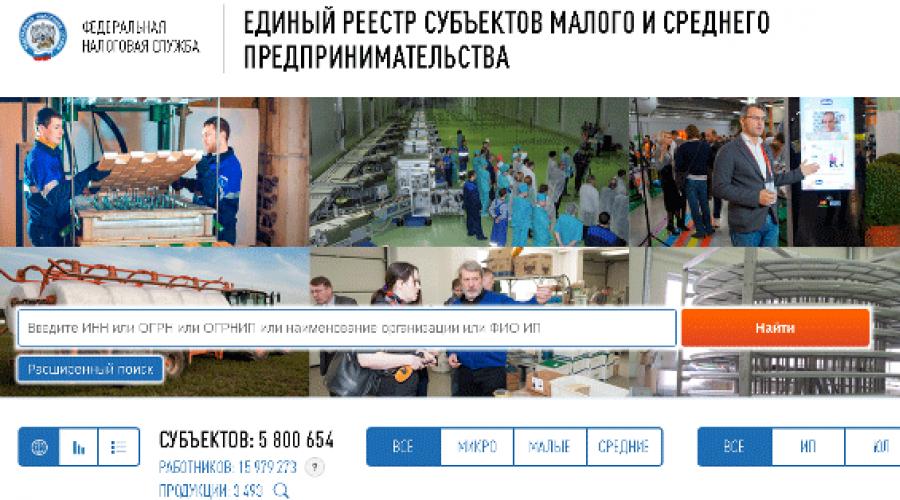

By comparable to a small enterprise, the criteria of 2018, it is made to a special register of small and medium-sized businesses established on August 1, 2016. At the same time, the organization is not obliged to submit any special information into tax authorities or perform other actions - it is automatically assigned to small businesses. Employees of the FTS range to small on the basis of the information provided by them in the usual order to which include:

- the average number of employees;

- data from EGRULT or EGRIP;

- tax Declarations.

It should be noted that enterprises with small status get the right to use certain accuracy in accounting. These include the following items:

- The right not to set the limit of cash balance at the box office. In the event that it has been established earlier, the manual you can publish an order for its cancellation.

- The possibility of doing simplified accounting.

See also: When a small enterprise turns into secondary or large

There are certain circumstances whose offensive will lead to the fact that the organization will lose the status of a small enterprise. Naturally, this is due to the fact that it will not fall under the criteria of small enterprises in 2018. Such conditions include the following points:

- If circumstances are associated with an increase in the interest of participation in the authorized capital above the limit value, the company will lose the status of small businesses. At the same time, the date of the transition to the secondary or large enterprise is the date of making an entry to the Enjoyment about changing the authorized capital of the Organization.

- If circumstances are associated with an increase in the average number of personnel or income from the implementation of all types of entrepreneurial activities higher than the status of limit importance, the status of small persists for the enterprise for three years. After the deadline expires, the small enterprise will lose this status and will become medium or large depending on the value of the criteria, as indicated in paragraph 4 of Art. 4 Law 209-FZ.

RESULTS

In order to have a category of a small enterprise, the company must comply with the criteria specified in the Law 209-FZ. These include the average number of personnel, income from the implementation of all types of activity and the share of participation in the authorized capital. If all conditions comply with the required values, the company automatically receives small status and is made by tax authorities into a special register of small and medium-sized businesses of Russia.

Being a small or medium business entity is very profitable. It is they who have a simplified procedure for conducting accounting, cash discipline and document management. For them, tax rates are reduced, they are resolved by various kinds of "Tax Vacations". We will understand which criteria in 2018 are installed for microenterprises and small business entities.

Download the instructions:

- "Four schemes that tax authorities will search for checks" \u003e\u003e\u003e

- "Seven tax schemes that no longer work" \u003e\u003e\u003e

Small business entities: who applies to them in 2018

In order for your company to be included in the list of small or medium enterprises (SMP), three conditions must be observed. There should be a certain proportion of the participation of the founders, and the average number and all incomes of the company should not exceed the designated, limit.

However, first of all it is necessary to deal with who can be viewed as a small or secondary enterprise.

First of all, to the subjects of micro, small and medium-sized businesses should be attributed:

A more detailed list of subjects can be found in the FZ of the Russian Federation No. 209 Part 1.1 of Article 4.

The first criterion of small and medium enterprises 2018

As for the first of three conditions, this is, of course, the proportion of the participation of the founders. In Article 4 of the FZ-209, it is indicated that the company can get the status of small only if the following rule is followed:

- the total share of participation in the authorized capital of a limited liability company does not exceed 25%. As for foreign capital, its share should not exceed 49% of the total number of shares;

Such a limit of the share of participation can bypass the company's side that other conditions comply with, namely:

- shares of the Company, which are listed on the stock exchange belong to the shares of the innovation sector;

- society or economy is legally considered as a participant in one of Skolkovo projects;

- the activities of economic societies lies in the practical application or implementation of the results of intellectual activity, the exceptional rights to which belong to the founders of such a society.

This criterion helps to attribute the enterprise to small or medium-sized businesses, with the help of legal form. However, there are also two quantitative conditions that IFTS also considers the enterprise to small or medium businesses.

Criteria for small and medium enterprises 2018: Table

The criteria of a small and medium enterprise, which are valid in 2018, we collected in a convenient table.

|

Maximum values \u200b\u200bfor the average number for the previous calendar year |

|

|---|---|

|

micro-enterprise |

|

|

From 16 and to 100 inclusive |

small business |

|

From 101 to 250 inclusive |

middle Enterprise |

|

The amount of income from the company's entrepreneurial activity for 12 months |

|

|

Does not exceed 120 million rubles |

micro-enterprise |

|

Does not exceed 800 million rubles |

small business |

|

Does not exceed 2 billion rubles |

middle Enterprise |

Important: The law allows you to use another indicator instead of income - the balance sheet value of assets (the residual value of fixed assets and intangible assets) for the previous calendar year. The residual value of fixed assets and intangible assets are taken into account, which is assessed by accounting rules. However, it does not indicate the limit values \u200b\u200bof the residual value, so this criterion is often not accepted by departments.

Example. Is it possible to attribute the company to small if all the conditions are not met

The company "Romashka" as of the end of 2017 had the following indicators:

For two of the three criteria, the company could be attributed to small business, but the proportion of the founder is twice as much more necessary. Therefore, the "chamomile" does not automatically enter the registry of SMEs. If a joint stock company can reduce the proportion of founders to 24%, it will be attributed to small companies.

Important: It must be remembered if the company has included in the registry, and it does not fit into its limit in a row in a row, then it drops out of it after this period.

In what order of IFTS considers the company to SMP

The company is not required to submit any information to the Tax Office or write an application for the provision of benefits. Using the registry now it happens automatically. Tax Service Employees include companies to small on the basis of their information provided by them as follows:

With the help of the registry located on the official website of the FTS, you can check whether one or another counterparty includes a small type of entrepreneurship or not.

The advantages of a small enterprise

It should be noted that enterprises that have small status get the right to use certain accuracy in accounting. These include the following items:

- The right not to set the limit of cash balance at the box office. In the event that it has been established earlier, the management can be published an order for its cancellation;

- The possibility of conducting simplified accounting;

- Preferential terms of special taxation, which are established at the regional level;

- Reducing the term of verification by government regulatory bodies - for small enterprises, it is 50 hours per year;

- Some categories of individual entrepreneurs receive two-year tax holidays, which should be marked in regulatory regulatory acts.

Observing all the above conditions, the company not only automatically receives the status of small and contribute to the tax authorities into a special register of small and medium-sized businesses of Russia. She also receives a number of pleasant bonuses from the tax authority. Just do not forget that the limit is required for more than two years. Otherwise, the company will automatically stop equivalent to SMEs.

1-2 Head

Small business - Business based on the entrepreneurial activities of small firms, small enterprises formally incoming in association.

Small business (or small business) - This is the sector of the economy, which includes individual entrepreneurship and small private enterprises.

To subjects small business Consumer cooperatives and commercial organizations (with the exception of state and municipal unitary enterprises) contributed to the unified state register (with the exception of state and municipal unitary enterprises), as well as individuals entered into the Unified State Register of Individual Entrepreneurs and carrying out entrepreneurial activities without the formation of a legal entity (hereinafter - individual entrepreneurs), The peasant (farmer) farms corresponding to the following conditions listed below.

Activities of Subjects small business in Russia regulated by the Federal Law 209-FZ "On the Development of Small and Medium Entrepreneurship in the Russian Federation", which indicates criteria classifying an enterprise to small and medium businesses:

Reserved restriction

According to the Decree of the Government of the Russian Federation of July 22, 2008 N 556, from January 1, 2008 for small enterprisesthe limit value of revenues from the sale of goods (works, services) for the previous year without taking into account value added tax - 400 million. rubles.

Restriction on the number of employees

The average number of employees for the preceding calendar year for small enterprises should not exceed hundredman inclusive.

Status restriction

The share of external participation in capital should not exceed 25%

For legal entities - the total share of participation of the Russian Federation, the constituent entities of the Russian Federation, municipalities, foreign legal entities, foreign citizens, public and religious organizations (associations), charitable and other funds in the statutory (share) capital (share fund) of these legal entities must exceed twenty-five percent (with the exception of the assets of shareholder investment funds and closed mutual investment funds), the share of participation belonging to one or several legal entities who are not small and Medium Entrepreneurship Subjectsshould not exceed twenty five percent (This restriction does not apply to business companies whose activities are in the practical application (implementation) of the results of intellectual activity (programs for electronic computing machines, databases, inventions, useful models, industrial designs, selection achievements, topologies of integrated circuits, production secrets (NOU -Hahu), the exclusive rights to which are owned by the founders (participants) of such business companies - budget scientific institutions or established state academies to scientific institutions or budget educational institutions of higher professional education or established state academic institutions of higher education institutions).

http://www.vdcr.ru/important/erminology/small-business.html.

The concept of small business in Russia

Small business is entrepreneurial activities performed by the subjects of a market economy under certainly established criteria. They can be established by law, government agencies, or other representative organizations.

The very concept of "small business", "Entrepreneurship" Many scientific works determines as activities that are executed by a group of persons, or an enterprise managed by one owner. World practice shows that the main indicator is primarily the average number of employees in the enterprise, during the reporting period. They are attributed to small business entities, which is directly the basis of enterprises of various organizational legal forms.

There are several criteria, which is based on enterprises refer to small business:

number of personnel in the enterprise;

the magnitude of the authorized capital;

the amount of assets;

profit volume (income, turnover).

On July 24, 2007, the Federal Law on the Development of Small and Medium Entrepreneurship in the Russian Federation No. 209-FZ entered into force. A small business entities began to determine the commercial enterprise, in the authorized capital of which the proportion of the subjects of the Russian Federation, public and religious organizations, charitable and other funds should not exceed 25%. If the proportion belongs to one or more legal entities who were not parties to small businesses, the average number of employees during the reporting period does not exceed the limit level, also should not be more than 25%.

in the industry of the national economy (industry) - 100 people;

in construction - 100 people;

in the transport sector - 100 people;

in agricultural (rural) economy - 60 people;

in the scientific and technical field - 60 people;

in wholesale trade - 50 people;

in domestic content and retail of the population - 30 people;

in other industries and when performing other activities, 50 people.

Persons who are engaged in entrepreneurship without the formation of legal entities, individual entrepreneurs, may be parties to small businesses without the formation of legal entities, "on state support for small businesses in the Russian Federation".

Under entrepreneurship, they understand - a special type of economic activity (reasonable activities aimed at making a profit), which is based on an independent initiative, responsibility and innovation in the entrepreneurial idea.

As a rule, the initial stage of a special type of economic activity is connected only with the idea (the result of mental activity), which in the future should take the material form. This is the main role of small entrepreneurship.

The presence of an innovative moment, one of the features of small businesses, business. This may be the manufacture of a new product, the formation of a new enterprise or a change of activity profile. The introduction of the latest methods for organizing production, a different management system, quality, new technologies are very important innovative moments.

This economy model creates the necessary competition atmosphere capable of creating new jobs, instantly respond to any changes in market conditions, filling out the formed niche in the field of consumer and be the main source of the formation of the middle class, to increase the social base of the ongoing reforms.

First, it provides high efficiency due to the necessary mobility, creates a deep classification and cooperation, in the conditions of the market. Secondly, he knows how to not only fill out niches, which are formed in the consumer sphere, but also quickly recoup them. Thirdly, to make an atmosphere of explicit competition. Fourth, is the most important and most important thing, without which the market economy is in principle possible, it creates the necessary atmosphere and spirit of entrepreneurship.

The importance of entrepreneurship is that while small businesses lead a cruel competitive struggle for survival in the market, they are forced to develop all the time, improving and adapt to current market conditions, because in order to survive, we need funds to exist, and they are required Be better than others to get maximum profits.

On the scale of Russia, the modern market structure of the economy implies 10-12 million small business entrepreneurs, but, unfortunately, there are only 300-400 thousand. What can be seen from that as a special sector in a market economy, small business has not yet been fully formed, and this means that its potential is not used by the cavity.

The classic tasks determine the role of small business, which in developed countries a small business solves itself. First of all, this is the development of a healthy competitive environment in the economy, reproducing strong incentives in motivation for more rational use of knowledge, skills, hard work and population energy. And this, it allows you to more actively develop and apply available resources, material, organizational, technological and personnel. Mitigation of oscillations of economic conjuncture using a special mechanism for balanced demand and suggestions. Creation of a high-quality system of organizational, industrial and domestic services. To form a greater number of new jobs, the creation of an important interlayer of society as the middle class. Introduction of new forms of organization, financing and sales. The development of the innovative potential of the economy.

Small business prosperity gives stimulation for economic growth, promotes the diversity and saturation of local markets, moreover, allows you to reimburse the costs of a market economy, such as crisis phenomena, conjunctural oscillations, unemployment.

Small business has great opportunities to optimize ways to develop society and the economy as a whole. A distinctive feature of small business is a continuous desire to use all species resources, a constant desire to increase their quantity and quality, ensuring the most appropriate proportions for these conditions. In practice, it looks like this: in a small enterprise there can be no surplus of raw materials, unused equipment, unnecessary workers. In achieving the best indicators of the economy as a whole, this circumstance is one of the most important factors.

With existing rigid restrictive criteria for enterprises to small, small business itself is antitrust. In a market economy, this distinctive feature of small business, carries out its position in maintaining a competitive environment.

It makes sense to specifically indicate the regional orientation of small entrepreneurship. In the region of the current base of the market economy is a small economy. Local budget small business brings a very important income. Often, small entrepreneurs are very interested in intensive and fruitful cooperation with local authorities, because The main problems in the development of small entrepreneurship are associated with the solution of some issues of regional and local importance.

Small business structure

Based on the direction and maintenance and maintenance of business, investment in objects and obtaining certain results, the coherence of entrepreneurial activities with the main stages of the production process, are distinguished by some types of individual entrepreneurship:

Production. If the entrepreneur uses some objects or tools as execution, manufactures products, produces goods, provides services (legal, accounting, household and other), some types of work, provides information, engaged in creative activities and many others, which will not entail The threat of life and health of citizens, and carries out further sale (implementation) to buyers, consumers, commercial organizations. This type of entrepreneurship is called production.

Commercial trading. Since manufactured products (goods) must be implemented (selling) or change to other types of products (goods). Accordingly, industrial entrepreneurship is closely related to the business in the field of circulation. As the second main type of Russian entrepreneurship, the commercial-trading business should develop in large pace.

Financial and credit. A special form of commercial entrepreneurship is financial entrepreneurship. As a subject of sale, sales may be national money (Russian ruble, American dollar, etc.), securities (promotions, bills, bank certificate and other), sold by an entrepreneur or the buyer given to the buyer. In financial transactions, such as selling or buying a foreign currency for rubles, an important role is occupied by an unpredictable range of operations, covering all the diversity of exchange and sales of money, or other types of cash (foreign currency), sharing securities.

Intermediary. Entrepreneurship in which the businessman himself does not produce and does not sell the goods, speaking only the link between the seller and the buyer in the process of commercial exchange and monetary operations - is called mediation.

Insurance. A number of action of the entrepreneur in the event of events leading to grave consequences, material damage, loss of property, health, life and other types of losses, which, in accordance with the legislation and the contract concluded, guarantees the insured the compensation of losses, is called insurance entrepreneurship. To do this, make a specific fee and draw up an insurance contract. The importance of insurance is that, receiving an insurance premium, the entrepreneur pays insurance only under certain circumstances described in the contract. The possibility of insurance claims in practice is not very big, so the received payment is formed by the entrepreneurial income.

The intensity of the development of small businesses in the modern Russian economy is one of the most important indicators. In support of this, continuous amendments in legislation aimed primarily on favorable conditions for the independent development of small businesses and medium-sized businesses.

The future of small business development promises a lot. The introduction of the latest production technologies will contribute to an annual increase in production volumes, the creation of new jobs, and an increase in the number of small business entities.

http://mbgar.ru/malyj-bizNes.html.

The development of small and medium-sized businesses in various industries is one of the main sources of economic growth of the state, and without his participation it is impossible to build an innovative economy. In economically developed countries, small and medium-sized businesses play a very important economic and social role, and the share of such firms there is approximately 70-80% of the total number of organizations.

Over the past years, reforms in Russia, small and medium-sized businesses have proven its effectiveness and public utility, even despite the past crises in 1998 and the global financial crisis in 2008. And in modern conditions of modernization of the economy, it will play a significant role as in many developed countries.

http://www.creativeconomy.ru/articles/11515/

Small and medium-sized business (SMEs) in the late 2000s became the object of increased interest of the state. In 2008, a special commission was established under the Government of Russia, which is now headed by First Deputy Prime Minister I.I. Shuvalov. Similar organs began to be created in the regions. The President of the country has become more or less regularly to hold meetings regarding the political and economic aspects of the development of SMEs. On one of them D.A. Medvedev even stated that "without a small and medium-sized businesses our country has no future" 1.

The activity of the state regarding the development of SME in part reflects the desire of the authorities to increase the efficiency of the economy with the help of small and medium enterprises. Although similar measures have been repeatedly undertaken in the past, the significance of SMEs for the country is still small. His share in Russian GDP is 21%, while in the EU, developed Asian countries, the United States and Mercosur states, this indicator is in the range from 40 to 70%. The tendency to support ISB by the state is characteristic of many countries. According to the World Bank, for the period 2005-2006 in 112 countries of the world, 213 stimulating reforms were conducted in this area.

Measures to increase the role of SME in the Russian economy were partly and concrete anti-crisis orientation. The state wanted through the support of a small and medium-sized entrepreneur to solve some current socio-economic problems, exacerbated in the crisis of 2008-2009. Perhaps the Russian government took into account the conclusion of organizing economic cooperation and development (OECD), according to which countries in which the share of small and medium-sized businesses is 60-70% of GDP, more efficiently overcome crises, compared with those where these indicators are less.

The main damage to the domestic economy was caused by the crisis of 2008-2009 as a result of impact on major enterprises. SMEs under these conditions had a number of "anti-crisis" properties. Small and medium companies are more flexible compared to large corporations. They can more quickly make changes to the pricing policy, product range, change suppliers, sales system, absorb released labor resources. In the newest Russian history there were periods when entrepreneurship contributed to the achievement of socio-economic stability in the state during crises. For example, in the 1990s, the problems of the commodity deficit (and a number of social problems) contributed "Clauses" - individual entrepreneurs who purchased goods abroad (in China, South Korea, Turkey, Poland) and resell them in the USSR.

The crisis is most often considered as a negative phenomenon. At the same time, it can be the basis for the beginning of a new stage of development, nomination of new initiatives. This thesis is applicable to small and medium entrepreneurship. The crisis as an opportunity for subjects of SMEs involves the emergence of new ways to enter into a more dense economic environment, an increase in the volume of activity, entering new markets. The crisis as a threat is determined by the lack of credit resources and resources for the development, risks associated with labor relations.

Analysis of the possibilities and limitations of the development of SMEs requires the determination of its socio-economic characteristics and distinctive features. These include, firstly, the fact that small and medium-sized enterprises make a significant contribution to the stabilization of the social situation in the country, solving the most acute problems associated with tensions in society (primarily the issue of employment), without requiring significant costs from State budget.

Secondly, the SME produces and delivers a wide range of goods and services, creates new markets, contributing to the expansion of the range of goods and services.

Thirdly, small and medium-sized companies contribute to increasing the economic efficiency, acting as a subcontractor and supplier of large enterprises. Fourth, SME helps to reduce the transaction costs of interaction between subjects in the market, which flexibly responding to changes in external conditions, changing requests and the needs of client groups, providing information openness and proximity to the consumer. Separately, it is necessary to mention the properties of a small business to create and implement innovations and its role in the formation of the "Spirit of Entrepreneurship" in the society.

The economy of developed countries is a two-level system, one level of which is large companies, and the other are small and medium enterprises. Overall efficiency is determined by the quality of each of these levels. Large (transnational) companies often enjoy the support of governments, form an individual institutional environment for themselves in order to obtain competitive advantages in world markets. Such companies, mainly adhering to general economic rules, deviate from them in coordination with the state, if one does not prevent supranational organizations and institutions.

Unlike large, small and medium-sized enterprises of developed countries ensure the welfare of the majority of the population. They are more likely to operate in domestic regional markets, without having the exit and influence on the central government. However, adequate conditions for the development of SME are created through effective public-private interaction: governments are attracted by the company in the preparation and change in the institutional environment.

The above features are characteristic of SMEs in developed countries. In Russia, they take some other outlines.

(1) One of the important factors affecting the effectiveness of the interaction of the state with small and medium-sized businesses in Russia is a brief, if compared with developed countries, the period of the existence of the Institute of Entrepreneurship itself. The legislative framework for business in our country was laid in 1987 with the adoption of the laws of "On Individual Labor Activities" and "On Cooperation in the USSR". Obviously, for a little more than twenty-year period difficult to build an effective system of public-private interaction. The "aggaring" factor was that the formation of relations between power and entrepreneurship was accompanied by frequent change of socio-economic and political realities in the conditions of the immaturity of the business environment.

Low efficiency of public-private interaction at the initial stage can be illustrated. By the decision of the Council of Ministers in 1987, it was allowed to create advocacy centers of scientific and technological creativity of young people. According to the plan it was assumed that they would become the basis for the innovative development of the economy. However, soon the centers moved away from the initial orientation, engaged in various forms of commercial activities, for example, reselligents of raw materials purchased at the state price. At the same time, they did not pay taxes, only deducting a part of income into local foundations, which encouraged the semi-legal activities of the centers of this kind.

In the future factors that impede the development of entrepreneurship in Russia, the underdevelopment of the legal environment, the lack of the necessary infrastructure, administrative barriers, crime, socio-economic instability. It is significant that the increase in small and medium-sized enterprises in the country occurred until 1994, and in the subsequent period their number was at the level of about 1 million. In the late 1990s, world economic conjuncture contributed to an increase in the interest of the authorities to large businesses, and not to small and medium. It was strengthening the positions of bureaucracy, combined with the strengthening of administrative pressure on a small and secondary entrepreneurship. In the early 2000s, small and medium-sized businesses were on the periphery of Russian politics and economics.

(2) A special feature of interaction with SMEs in Russia is "his own" - the desire of individual representatives of small and medium-sized businesses to form individual conditions for themselves when working with officials. Such relations under which the general rules of the game for the SME are violated to the detriment of the interests of individual players, significantly limit the possibilities of economic growth of the country. First, they suppress competitiveness and competition as a fundamental property of small and medium businesses. Secondly, they create barriers to entry into the market of new participants.

The formation of this model is, apparently, a consequence of a transformational doubler of the domestic economy in conditions where the possibilities of collective participation of SMEs in agreed cooperation were limited to obtaining general economic benefits. Each SME entity survived alone. With low quality institutional environment, it led to the vicious practice of "solving specific issues with specific officials."

(3) A characteristic feature of Russian small (mainly) and medium-sized businesses is the "third-party" of its innovative function. In the US, the share of small enterprises accounts for half of the patented innovation. In Russia, small enterprises - the sphere of "economic survival" for a significant part of the population. Innovation of small businesses in Russia is to actively implement and adapt foreign technologies. Small business turns out to be a kind of "sponge", absorbing and spreading innovations created abroad at the local level. The weakness of the innovative component of the SMEs of Russia is related to the fact that low-indemnial activities in this sector (trade, public catering) are much less risky and more profitable. The second reason for the weakness of the "intellectual" business stems from the absence or weakness of the relevant infrastructure.

(4) As a feature of the domestic SME, it is possible to distinguish the specifics of competition. The development of competition in the entrepreneurial environment between companies is the essential property of SMEs in the economy of developed countries. In Russia, SME introduces a weak contribution to the formation of a competitive field as "its" and in common with a large business. This is due to the fact that, first of all, the activities of corporations and small companies are located in the Russian economy in different economic niches. Secondly, domestic representatives of SMEs tend to use non-market competition methods. In particular, domestic small enterprises are inclined to focus on the prices of competitors, and not demand.

One of the defining SMEs in Russia is a sociocultural factor. According to polls, the share of those who want to become entrepreneurs in Russia is no more than 2% of the population. Obviously, this desire directly determines the potential for the development of SMEs in the country. For example, in the United States wishing to do about 70% of the population. At the same time, if the share of small entrepreneurship in our country accounts for about 14% of GDP, then in the USA - about half. Apparently, the impact on the desire to engage in entrepreneurship is provided not only by the low quality of the institutional environment. Abroad, the spirit of entrepreneurship in combination with developed individualism largely predetermines a large desire of people to do business. In general, according to experts, the development of Russian small businesses occurs according to the model inherent in the countries of "developing markets".

In the early 2000s, the government's interest in small and medium businesses resumed. This was due to the fact that the Russian economy exhausted reserves on which the economic growth of the previous period was based. At that time, small and medium-sized entrepreneurship was outside of politicians, however, the deterioration of the economic situation in the country demanded the search and use of additional resources to raise the economy. In addition to the reduction in the share of inefficient state property and foreign investment, the development of small and medium-sized businesses was considered as measures to overcome serious socio-economic conditions.

In taxation, they can count on state support in some areas of activity. Last year, the requirements were changed that organizations and the PI should comply with small and medium-sized businesses. The criteria of 2017, which determine whether the subject includes a small business, is contained in the updated provisions of the Law of July 24, 2007 No. 209-FZ and the Decree of the Government of the Russian Federation of 04.04.2016 No. 256 on income limits. In our article, we will consider these criteria and the procedure for their use.

Law 209-FZ: criteria for attribution to small enterprises

IP, Organizations, KFH, production and consumer goods can be attributed to small and medium-sized enterprises if they meet certain conditions and limits established by law No. 209-FZ, and their income does not exceed the limits established by the Decree of the Government of the Russian Federation No. 265. System used Taxation does not affect this status.

The main criteria of a small enterprise, this is:

- the proportion of other organizations in capital (not applied to the IP),

- last year average number of employees (not applied to IP without workers),

- the amount of income last year.

The first criterion for attributing an enterprise to small businesses - limit share of participation - does not apply to the following enterprises:

- JSC, whose shares belong to the shares of the innovative sector of the economy,

- organizations that apply in practice the results of intellectual activity, the rights to which belong to their founders - budget, educational and scientific institutions,

- enterprises - participants of the project "Skolkovo",

- organizations whose founders provide state support for innovation activities.

Such criteria for attributing to small enterprises as the number of employees and income from 01.08.2016. Defined in a new way:

- instead of the average number of employees, it is now necessary to take into account the average number, which does not include external partners and employees under GPC agreements;

- revenue as an independent criterion of classifying an enterprise to small business entities no longer applies - now it is necessary to take into account the total amount of income of the enterprise: revenue, non-dealer income, the cost of free property, dividends and other income listed in Art. 250 NK RF. An income indicator is taken from the tax declaration.

Criteria of the Small Enterprise 2017 (Table)

|

Criterion |

Maximum limit of values |

||

|

Micro-enterprise |

Small business |

Middle Enterprise |

|

|

The total share of participation in the authorized capital of LLC: RF, constituent entities of the Russian Federation, municipalities, public, religious organizations, charitable and other funds; Foreign legal entities, legal entities that are not small and medium enterprises (PP. "A" of paragraph 1 of 1.1 of Art. 4 of Law No. 209-FZ) |

|||

|

The average number of employees of the IP and organizations over the past year (paragraph 2 of Part 1.1 of Art. 4 of Law No. 209-FZ) |

up to 100 people. |

||

|

The income of the IP and organizations received over the past year (Decree of the Government of the Russian Federation of 04.04.2016 No. 265) |

120 million rubles. |

800 million rubles. |

2 billion rubles. |

What criteria for small enterprises in 2017 applies FTS

The tax service in 2016 created a single register of small businesses, to familiarize themselves with whom on the FTS website. It is formed on the basis of these EGRULT and EGRIP, declarations, report on the average number and other indicators. The tax authorities explained how the registry would be formed, taking into account the new criteria for attributing enterprises to small businesses in his letter dated 18.08.2016 No. 14-2-04 / 0870.

The category of a small business entity may change if within 3 years in a row the limit values \u200b\u200bof the income criteria and the number of employees will be higher or lower than established. This means that the status of a small business entity will continue, even if for medium, small enterprises and microenterprises criteria will be exceeded during the year or two years.

In 2016, IP and organizations, whose revenues and the number of employees did not exceed the limits during 2013-2015, were recognized as small enterprises. The new criteria for the classification of the enterprise to the category of small enterprises in 2017, the FTS takes into account when incorporated into the register of newly created IP and organizations, and the first changes in the statuses of current small enterprises will occur only in 2019.

Confirm your status Small businesses if they are included in the Unified Registry, should not.

AO - Small Enterprise (classification criteria)

A joint-stock company can be attributed to the small business sector if it meets the requirements of Art. 4 of Law No. 209-FZ. For an AO criterion that determines the belonging to a small enterprise is an income, as well as the number of employees, corresponding to the same limits as for other organizations (paragraph 2 and 3 part 1.1 of Art. 4 of Law No. 209-FZ, the Decree of the Government of the Russian Federation from 04.04.2016 № 265).

Mandatory Audit: Criteria 2017 for Small Enterprise

Should small enterprises undergo a mandatory audit? According to the Law of December 30, 2008 No. 307-FZ, compulsory audit, in particular, are subject to (Article 5 of Law No. 307-FZ):

- all joint-stock companies

- organizations whose revenue without VAT exceeded 400 million rubles for previous reporting year, or the amount of balance assets at December 31 of the previous year exceeded 60 million rubles.

Small enterprises, criteria in 2017, which correspond to those listed, the audit is obliged to undergo.

Benefits of small and medium enterprises

The criteria of 2017, with their observance, allow to remain a small business entity unlimited time. This status gives II and organizations, in particular, the following advantages:

- the use of low tax rates when using specials, if provided for by the Regional Law,

- maintaining a simplified accounting, the application of the cash method, the presentation of simplified forms of balance and report on the finisults in the IFSN (except for small enterprises subject to mandatory audit),

- until December 31, 2018, the planned audits of supervisory authorities are not threatened: fire inspections, licensed control and other (Art. 26.1 of the Law of December 26, 2008 No. 294-FZ),

- receiving state subsidies, participation in small business support gelashes.

In compliance with certain conditions, the organization and IP may be attributed to small or medium-sized entrepreneurship entities (hereinafter - the SMP). Criteria, relevant for limited liability companies (LLC), are shown in the table (part 1, paragraphs. "A" of paragraph 1, paragraph 2, paragraph 3 of Part 1.1 of Article 4 of the Law of July 24, 2007 No. 209- FZ, paragraph 1 of the Decisions of the Government of the Russian Federation of 04.04.2016 N 265).

| Condition | Limit values | ||

|---|---|---|---|

| middle Enterprise | small business | micro-enterprise | |

| Total share of the participation of the Russian Federation, subjects of the Russian Federation, municipalities, public and religious organizations, charitable and other funds in the authorized capital | No more than 25% | No more than 25% | No more than 25% |

| The total proportion of participation of foreign legal entities and / or legal entities that are not SMP in the authorized capital | No more than 49% | No more than 49% | No more than 49% |

| The average number of employees of the organization for the preceding calendar year | 101-250 people. | Up to 100 people. | Up to 15 people |

| Income, determined by all LLC activities, for the preceding calendar year (excluding VAT) | No more than 2 billion rubles. | No more than 800 million rubles. | No more than 120 million rubles. |

The change in the category of the SMP (average, small or microenterprise) is possible if the organization does not comply with the condition of income or the average number of employees for 3 calendar years in a row (part 4 of Article 4 of the Law of July 24, 2007 No. 209-FZ ). That is, for the first time, the category can be changed only in 2019, if the subject in 2016-2018. It will not be laid in the above limits (a letter of FTS from 07.09.2016 N SD-4-3 / [Email Protected]).

Entrepreneurs - SMP.

The category of the SMP for individual entrepreneurs is determined by the average number of employees and the amount of income received from entrepreneurial activities. In the absence of employees, the value of only the income of the IP (Part 3 of Article 4 of the Law dated July 24, 2007 No. 209-FZ) has a value. The limit values \u200b\u200bare set as the same as for LLC ().

Joint Stock Company - SMP

Joint-stock company can also be a subject of small or medium-sized businesses. For this, firstly, it should fall into one of the categories in terms of the average number of employees and income (p. 2, paragraph 3 of Part 1.1 of Art. 4 of the Law of July 24, 2007 No. 209-FZ). And secondly, he should keep one of the conditions listed in