Accounting for excise taxes at distilleries. Accounting for excise taxes at distilleries Basic alcoholic elements

In accordance with Chapter 22 of the Tax Code of the Russian Federation, alcohol-containing products are recognized as excisable goods. Thus, distilleries are excise tax payers. Accounting for excise tax is a rather labor-intensive process, since it is necessary to comply with all the requirements of tax legislation regarding the calculation and reimbursement of this tax. Specialists from IMC-PROF LLC talk about how the task of automating such accounting was solved at the distillery.

Strict requirements for compliance with production regulations and large document flow at the enterprise forced management to abandon semi-automatic record keeping. It was decided to implement the configuration "Distillery. Production and Accounting" (Certificate "Compatible! 1C:Enterprise program system", information letter dated September 14, 2004 No. 3266). The implementation was carried out by the developer of the configuration, IMC-PROF LLC.

Accounting methodology

To fulfill the requirements of Chapter 22 of the Tax Code of the Russian Federation, it was necessary to solve accounting problems:

- amounts of incoming excise tax, including losses of alcohol, blend and finished products;

- amounts of accrued excise tax (sales and losses of finished products);

- calculation of the amount of excise tax to be reimbursed.

Let's look at these points in more detail:

Input excise tax

When accounting for incoming excise tax, it was necessary to solve the problem of accounting for losses* that are inevitable at different stages of the receipt and processing of alcohol, so that in the future it would be possible to reduce the amount of excise tax payable to the budget by the amount attributable to standard production losses.

Note:

* Consumption and loss standards are specified in the “Collection of standards for alcohol and distillery factories” SN 10-12446-99”, approved by the Ministry of Agriculture and Food of Russia on November 24, 1999. Let us recall that the problem is with the use of natural loss standards adopted before the entry into force of Chapter 25 of the Tax Code of the Russian Federation , decided by Federal Law No. 58-FZ dated 06.06.2005 (read more).

Possible losses in the following areas:

- When transported from the supplier;

- When stored in an alcohol storage facility;

- When preparing a blend;

- When bottling finished products;

- When carrying out analyses;

- When storing finished products in an excise warehouse.

Accrued excise tax

While alcoholic products are in the tax warehouse regime (Articles 196, 197 of the Tax Code of the Russian Federation)*, excise tax is not charged on alcoholic products produced. The tax warehouse regime is a set of tax control measures in the period between the end of the production of alcoholic products and the moment of sale to the buyer or a division of an enterprise that does not have excise status (retail store, wholesale warehouse). The tax warehouse regime applies only to alcoholic products with an ethyl alcohol content of more than 9% by volume. That is, the conditions for charging excise duty are the following events:

- Sales of products, for a buyer who has the status of an excise warehouse, excise tax is charged in the amount of 20% of the excise tax amount, in all other cases 100%. Accordingly, when returning products by the buyer, it is necessary to reverse the accrued excise tax (clause 4 of article 200 of the Tax Code of the Russian Federation).

- The transfer of products from the excise warehouse of an enterprise to a wholesale warehouse or retail store is charged at a rate of 100%.

- If excess product losses occur, excise duty is charged at 100%. In the case of moving products from one excise warehouse of an enterprise to another excise warehouse, excise tax is not charged, since for this case the tax warehouse regime does not cease to apply.

Note:

* Let us recall that from January 1, 2006, the tax warehouse regime is liquidated in accordance with Federal Law No. 107-FZ dated July 21, 2005. In this regard, changes will be made to the configuration to take into account the excise tax.

Alcohol excise tax refundable

The amount of incoming excise tax on alcohol received from suppliers can be accepted for reimbursement (Article 200 of the Tax Code of the Russian Federation) if the following series of conditions are met:

- Alcohol is processed (including regulatory losses).

- Manufactured products must be sold.

- Alcohol must be paid for. If the product is sold, but the alcohol has not been paid for, no deduction is made.

Automation of accounting

Changes in the chart of accounts

To solve the problems of automating excise duty accounting in the chart of accounts, the following changes were made to the standard configuration of "1C: Accounting 7.7".

Tax and accounting accounts have been added to detail the accounting of incoming excise tax:

- SA.OT "Alcohol excise tax on shipped products" - serves to account for the excise tax on alcohol contained in shipped products;

- SA.NP "Alcohol excise tax on standard losses" - serves to account for the excise tax on alcohol contained in production standard losses of alcohol, alcohol-containing semi-finished products and finished products;

- SA.SP "Alcohol excise tax on excess losses" - serves to account for the excise tax on alcohol contained in production excess losses of alcohol, alcohol-containing semi-finished products and finished products;

- 18 “Excise taxes on unpaid material assets” - serves to record the amount of excise duty on accepted, unpaid alcohol.

In the future, data from these accounts will be used when calculating the excise tax deduction.

To account for the accrued excise tax, account 68.3 “Excise taxes” has been changed, to which new accounting sections have been added: “Budget classification codes” (order of the Ministry of Finance of Russia dated August 27, 2004 No. 72n) and “Regions” (letter of the Ministry of Taxes of Russia dated March 10, 2004 No. 07-0 -13/888). In this case, region means the region where the excise warehouse is located.

Changes in the composition of directories

Added reference books are used for detailing:

- products by types of excisable goods with different excise tax rates - directory "Types of excisable goods";

- when selling products to the buyer - the reference book "Objects of Taxation" in the context of budget classification codes;

- location of the manufacturer and buyers - directory "Regions".

Documents for accounting for incoming excise tax amounts

Let us consider in detail, using an example, each operation for accounting for incoming excise tax amounts (receipt of alcohol, payment for alcohol, write-off of alcohol for production, including losses, sales of products).

Example 1

The volume of alcohol according to the invoice was 8,017.60 dl* of anhydrous alcohol, losses within the norms (transportation + drainage) were 5.91 dl of anhydrous alcohol, therefore, the volume of alcohol on the measuring cup was 8,011.69 dl of anhydrous alcohol (amount alcohol accepted for registration).

Note:

* Dkl = 10 liters.

Since the excise tax rate for the group by strength and type of excisable goods is indicated on the basis of liters, it is necessary to make arithmetic calculations to determine the amount of excise tax:

x 8,017.60 (volume of alcohol in dcl of anhydrous alcohol) = RUB 1,563,432.

19.5 (excise tax rate) x 10 liters x 5.91 (volume of alcohol in dl of anhydrous alcohol) = RUB 1,152.45.

To reflect in the program the fact of receipt of alcohol from the supplier, a document “Alcohol Acceptance Certificate” was created (see Fig. 1).

Debit 18 “Accepted unpaid excise duty” Credit 60 “Settlements with suppliers” - 1,563,432 rubles;

Debit SA.NP "Alcohol excise tax on standard losses" - 1,152.45 rubles. (5.91 dl anhydrous alcohol);

At the end of the month, an analysis of alcohol receipts and various types of payments (advances, bills) under contracts and alcohol supplies is carried out.

Example 2

During the month, the enterprise had 15 alcohol intakes, while the last 2 were not paid for.

After payment, they will appear in a similar document for the next month.

As a result of this document, the following transactions will be generated:

Debit 19.5 “Excise taxes on paid MC” Credit 18 “Accepted unpaid excise tax” - RUB 2,372,866.20.

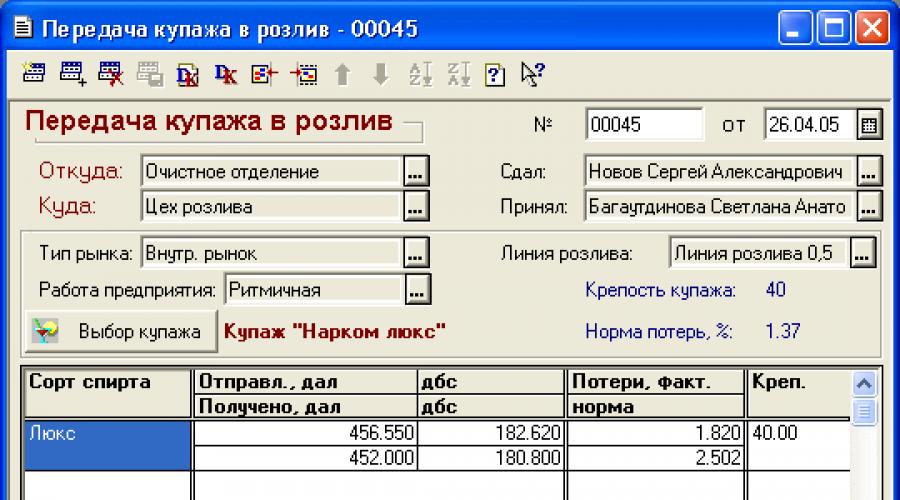

To reflect in the program the fact of transferring the blend from the blending department to the finished product bottling shop and recording the resulting losses, the document “Transfer of the blend to bottling” was created (see Fig. 2).

Example 3

The volume of the prepared blend is 182.62 dl of anhydrous alcohol, standard losses are 2.502 dl of anhydrous alcohol, losses within the norm (losses during preparation) are 1.82 dl of anhydrous alcohol, therefore, the volume of the blend transferred to the bottling shop was 180.80 dl anhydrous alcohol (the amount of blend taken into account).

19.5 (excise tax rate) x 10 liters x 1.82 (volume of alcohol in dl of anhydrous alcohol) = 354.9 rubles.

As a result of this document, the following transactions will be generated:

Debit SA.NP "Alcohol excise tax on standard losses" - 354.9 rubles. (1.82 dl anhydrous alcohol).

To reflect in the program the fact of write-off of the blend, components, losses and acceptance of finished products for accounting, a document “Bottling of finished products” was created (see Fig. 3).

Example 4

The volume of the written-off blend is 180.8 dl of anhydrous alcohol, standard losses are 0.9 dl of anhydrous alcohol, losses within the norms (losses during bottling) are 0.8 dl of anhydrous alcohol. The number of bottles of finished products accepted for accounting is 9,000.

Let us determine the amount of excise tax in standard losses:

19.5 (excise rate) x 10 liters x

x 0.8 (volume of blend in dl of anhydrous alcohol) = 156 rub.

As a result of this document, the following transactions will be generated:

Debit SA.NP "Alcohol excise tax on standard losses" - 156 rubles. (0.8 dl anhydrous alcohol).

If excess losses occur:

Debit SA.SP "Alcohol excise tax on excess losses" - excise tax on excess losses (total losses - standard losses).

To reflect in the program the fact of product sales, a document “Shipment of finished products” was created (see Fig. 4).

Example 5

The quantity of shipped finished products is 20,000 bottles. Strength - 40% vol. Bottle capacity - 0.5 l.

Let's determine the amount of alcohol excise tax on shipped products:

19.5 (excise rate) x 20,000 bottles. x

x 0.5 l. x 40/100 = 78,000.00 rub.

As a result of this document, the following posting will be generated:

Debit SA.OT "Alcohol excise tax on shipped products" - RUB 78,000.00. (20,000 bottles).

The primary information entered by the user into the reviewed documents will be further used by the program to calculate the amount of alcohol excise tax to be reimbursed.

Accounting for accrued excise tax amounts

Postings for excise tax calculation are automatically generated in the program when posting the following documents.

The document "Invoice" reflects the fact of accrual of excise duty on finished products and generates the corresponding transactions (see below).

Documents have been added that record the occurrence of losses during storage and transportation of products, recording losses of finished products ("Inventory of GP", "Rejection of GP").

Let's consider all possible cases of excise tax, depending on the location and type of buyer (excise warehouse, wholesale or retail).

Example 6

Manufacturer "Distillery": location Moscow region, there is an excise warehouse "AS", there is a store "Shop", there is also an joint stock company. warehouse in another region: location Leningrad region "AS LO". Manufactured products: Vodka "Vodka", capacity 0.5 l., strength 40% vol.

Buyers:

- “Buyer1”, location Moscow region, wholesale warehouse;

- “Buyer2”, location Moscow, excise warehouse;

- “Buyer3”, location Leningrad region, excise warehouse.

Excise tax rate = 146 rubles. per liter of anhydrous alcohol (100%).

Excise tax rate for sales to excise warehouses = 146 x 20% = 29.2 rubles. per liter of anhydrous alcohol (20%)

The disposal of 5 bottles from the distillery as a result of excess waste of products during storage should be documented in the document “Inventory of Finished Products”, which will generate the posting:

Debit 90.4 "Excise" Credit 68.3 "Excise" - Amount, rub. = 146 rub. x 5 bottles x 0.5 l x 40/100 = 146 rub.

The release of 200 bottles from the "Distillery" warehouse to the buyer "Store" is completed with the document "Movement of finished products", which generates the posting:

Debit 90.4 "Excise" Credit 68.3 "Excise" - Amount, rub. = 146 rub. x 200 bottles x 0.5 l. x 40/100 = 5,840 rub.

The sale of products previously transferred to your “Store” in the amount of 10 bottles is documented in the “Retail Trade” document; no excise duty postings are made.

The movement of Distillery products to an excise warehouse located in another region ("AS LO") in the amount of 5,000 bottles is documented in the document "Movement of Finished Products", no postings for excise duty are made.

Sales of products from the excise warehouse "AS LO" to the buyer "Buyer3" in the amount of 3,000 bottles are formalized by the document "Invoice", which generates the posting:

Debit 90.4 "Excise" Credit 68.3 "Excise" - Amount, rub. = 29.2 rub. x 3000 bottle x 0.5 l x 40/100 = 17,520 (20% excise tax)

Product losses in "AS LO" in the amount of 7 bottles (excessive waste of products during storage) are documented in the document "Inventory of finished products", posting:

Debit 90.4 "Excise" Credit 68.3 "Excise" - amount, rub. = 146 rub. x 7 bottles x 0.5 l x 40/100 = 204.4

The sale of 5,000 bottles by "Distillery" to the buyer "Buyer2" (location Moscow, excise warehouse) is documented with the document "Invoice", which will generate the posting:

Debit 90.4 "Excise" Credit 68.3 "Excise" - amount, rub. = 29.2 rub. x 5,000 bottles x 0.5 l x 40/100 = 29,200 (20% excise tax)

Sales: "Distillery" - "Buyer1" in the amount of 10,000 bottles. is drawn up with the document "Invoice", posting:

Debit 90.4 "Excise" Credit 68.3 "Excise" - amount, rub. = 146 rub. x 10,000 bottles x 0.5 l x 40/100 = 292,000

Return of products: "Buyer2" - "Distillery" in the amount of 100 bottles. Draws up the document "Invoice", posting:

Debit 90.4 "Excise" Credit 68.3 "Excise" - red reversal method amount, rub. = -29.2 rub. x 100 bottles x 0.5 l. x 40/100 = -584 (20% excise tax).

Calculation of the amount of excise tax to be reimbursed

To calculate the amount of alcohol excise tax for reimbursement, a document “Calculation of alcohol excise tax for reimbursement” was created (see Fig. 5), which is created at the end of each month. It analyzes the amount of sales losses (information on auxiliary accounts of the "SA" group) within the limits of payment for alcohol (account 19.5), in proportion to the shipped products in the context of the KBK and the region.

Calculation algorithm:

- analyzes the amount of paid excise tax (account 19.5) - 881,236.08;

- analyzes the amount of incoming excise tax in shipments (account SA.OT) - 140,472.00;

- analyzes off-balance sheet loss accounts (SA.NP account) - 2,110.32.

Thus, the amount of alcohol excise tax to be reimbursed will be 140,472.00 + 2110.32 = 142,582.32

As a result of this document, the following transactions will be generated:

Debit 68.3 “Excise taxes” Credit 19.5 “Excise taxes on paid MC” - 142,582.32 rubles;

Credit SA.NP "Alcohol excise tax of regulatory losses" - 2,110.32 rubles;

Credit SA.OT "Alcohol excise tax on shipped products" - RUB 140,472.00.

The software product "1C:Enterprise 8. Distillery and Winery" is an application solution from the 1C and Computer Technologies 2000 companies, a line of industry solutions based on "1C:Enterprise 8 Production Enterprise Management" produced under the 1C-Sovostvo brand.

The solution was created as a result of analyzing the experience of automation of enterprises involved in the production, as well as the wholesale and retail sale of alcoholic products.

"1C:Enterprise 8. Distillery and winery" allows you to automate various areas of the enterprise's activities: from materials accounting to production planning.

The product "1C:Enterprise 8. Distillery and Winery" is developed on the basis of "1C:Enterprise 8. Manufacturing Enterprise Management" and is a comprehensive solution covering the main contours of management and accounting, allowing you to organize a unified information system for managing various aspects of the enterprise's activities:

Enterprise management (production planning, cost management and cost calculation, product data management), including accounting for the use of ethyl alcohol in the production of low-alcohol products.

Basic functionality

Excise tax accounting:

maintaining a directory of types of excisable products;

highlighting the amounts of incoming excise taxes in receipt documents;

automatic calculation of excise tax amounts when generating documents in accordance with the current settings of the regulatory and reference subsystem;

automatic offset of incoming excise taxes;

registration and tracking of excise tax amounts throughout the entire production cycle of the enterprise;

maintaining a list of contractors’ licenses;

maintaining a log of contracts for the supply of alcoholic beverages with counterparties;

selection of products with the ability to simultaneously select alcohol batches, special brands, bottling dates;

generation of excise tax returns.

Accounting for the turnover of alcoholic products used as raw materials:

classification of alcoholic products in the regulatory and reference subsystem in accordance with the current legislation of the Russian Federation;

registration of receipt and tracking of the movement of alcoholic products throughout the entire production cycle of the enterprise;

formation of a declaration on the production and turnover of alcoholic products.

Management of fixed assets and planning of repairs.

Financial management, including:

budgeting;

cash management;

management of mutual settlements;

accounting and tax accounting;

excise tax accounting;

accounting according to IFRS;

generation of consolidated reporting.

Warehouse (inventory) management, including:

accounting of special brands, marking of goods and materials;

special characteristics of the nomenclature (properties of alcoholic products, quality, classifiers, etc.);

maintaining quantitative records in parallel in four units:

basic (custom) units of measurement (for example, bottles);

decalitres of contents;

deciliters of anhydrous alcohol content by strength;

deciliter of anhydrous alcohol content based on the actual alcohol contained;

accounting of materials in terms of properties (including grade, shelf life);

accounting of finished products in terms of properties (including type of packaging);

accounting of materials in the warehouse;

mechanism for calculating the planned quantity of materials for orders;

accounting of finished products;

ensuring a reserve of inventories (inventory and materials), orders to suppliers, requests from buyers in the context of the region of special brands;

accounting of alcoholic batches by:

storage;

type of excise tax (excise warehouse - not lined, lined, wholesale warehouse);

special federal stamp;

special regional brand;

region special regional brand;

excise stamp;

Management of excise warehouses, including:

accounting of permits for the operation of excise warehouses;

quantitative accounting of excisable products in the context of permits for opening excise warehouses;

labeling of alcoholic products with special marks;

new regulations for the operation of excise warehouses (Order of the Ministry of Taxes of Russia dated March 31, 2003 No. BG-3-07/154);

notifications about shipment/receipt of excisable products;

notification logs;

control of overdue notifications;

report on overdue notifications for excise goods (The report displays a list of overdue notifications from documents, indicating the number of overdue days).

Sales management, including:

control of balances and mutual settlements when shipping products according to orders;

expanded reporting on orders, payment for orders, shipment of orders and sales;

management of road transport.

Procurement management.

Managing relationships with customers and suppliers, including:

maintaining various contact information for the user (special characteristics: licenses, unloading points, etc.);

user calendar;

event reminder mechanism. ABC analysis;

analysis of relationship stages;

performance indicators of managers.

Accounting for control brands TTN, Mosalkogolkontrol.

Production management, including:

blend calculation assistant;

assistant for calculating the amount of anhydrous alcohol;

regulatory loss system;

alcohol accounting in accordance with the “Instructions for acceptance, storage, dispensing, transportation and accounting of ethyl alcohol.”

Regulated reporting, including:

Declaration on the turnover of alcohol (Resolution of the Government of the Russian Federation of May 25, 1999 N 564 “On approval of the Regulations on the declaration of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products” and Temporary rules for filling out declarations on the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products (approved by the Ministry of Taxes and Taxes of the Russian Federation on June 24, 1999);

Formation of a declaration on alcohol turnover and its annexes in electronic form (the format is established by the Ministry of Taxes of the Russian Federation).

Statistical reporting (Resolution of the State Statistics Committee of Russia dated September 3, 2002 No. 172);

Form No. 8-alk – Summary report on the volumes of production and turnover of ethyl alcohol and alcoholic products. Information on trade turnover;

Tax return on excise taxes on excisable goods, with the exception of petroleum products, tobacco products and alcoholic products sold from excise warehouses of wholesale organizations (Appendix No. 1 to Order No. 32n of the Ministry of Finance of the Russian Federation dated March 3, 2005);

Tax return on excise taxes on alcoholic products sold from excise warehouses of wholesale organizations (Appendix No. 3 to Order No. 32n of the Ministry of Finance of the Russian Federation dated March 3, 2005).

Regional industry reporting (reporting to the State Unitary Enterprise "Moscow Quality").

Personnel management, including payroll.

Monitoring and analysis of enterprise performance indicators.

Interface with EGAIS.

data exchange with EGAIS (Unified State Automated Information System, developed by STC "Atlas"), allows you to collect information on the movement of alcoholic products (receipt, release, sales);

generates regulated reporting for uploading to EGAIS;

allows you to print the necessary sets of documents.

The development took into account the requirements of the following regulatory documents:

Decree of the Government of the Russian Federation of April 28, 2006 N 253 “On the requirements for technical means of recording and transmitting information on the volume of production and turnover of ethyl alcohol and alcohol-containing products”;

Order No. 168n dated December 30, 2005 “On approval of tax return forms for excise taxes on excisable goods, with the exception of petroleum products and tobacco products, tax returns on excise taxes on petroleum products and procedures for filling them out and on amendments to the order of the Ministry of Finance of the Russian Federation dated March 3, 2005 No. 32N "On approval of tax return forms for excise taxes and procedures for filling them out"";

Resolution of the Federal State Statistics Service of August 5, 2005 N 59 “On approval of statistical tools for organizing statistical monitoring of domestic and foreign trade for 2006” (as amended on August 22, 2005);

FEDERAL LAW On amendments to the Federal Law "On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products" and on the recognition as invalid of certain provisions of the Federal Law "On amendments to the Federal Law "On state regulation of the production and turnover of ethyl alcohol, alcoholic beverages" and alcohol-containing products." Adopted by the State Duma on July 8, 2005, approved by the Federation Council on July 13, 2005;

Decree of the Government of the Russian Federation of December 31, 2005 N 872 “On the certificate attached to the cargo customs declaration”;

Decree of the Government of the Russian Federation of December 31, 2005 N 864 “On a certificate for the consignment note for ethyl alcohol, alcoholic and alcohol-containing products”;

ResolutionGovernment of the Russian Federation dated December 31, 2005 No. 858 “On the submission of declarations on the volume of production, turnover and use of ethyl alcohol, alcoholic and alcohol-containing products”;

For enterprises of a holding structure, end-to-end management accounting is maintained for all organizations included in the holding. Management accounting is maintained according to data recorded in documents, but does not depend on the methods and the very fact of maintaining regulated accounting. The fact of transactions is entered once and is subsequently reflected in management and regulated accounting.

"1C:Enterprise 8. Distillery and winery" can be used in a number of departments and services of manufacturing enterprises, including:

Directorate (CEO, CFO, Commercial Director, Production Director, Chief Engineer, HR Director, IT Director, Development Director);

Planning and Economic Department;

Production workshops;

Production dispatch department;

Chief Designer Department;

Chief Technologist Department;

Chief Mechanic Department;

Sales department;

Department of material and technical support (supply);

Marketing department;

Warehouses for materials and finished products, excise warehouses;

Accounting;

Human Resources Department;

Department of Labor and Employment Organization;

IT service;

Administrative and economic department;

Capital Construction Department;

Information and analytical department.

The implementation of "KT-2000: Alcohol. Holding 8 (UPP 8)" will have the greatest effect at enterprises with a workforce of several tens to several thousand people, with tens and hundreds of automated workstations, as well as in holding and network structures.

The product “1C:Enterprise 8. Distillery and winery” is a comprehensive solution covering the main contours of management and accounting at a production enterprise engaged in the production, wholesale and retail sale of alcoholic products. The configuration can be recommended for work at enterprises of a holding structure that include organizations involved in the production and trade of alcoholic beverages.

Basic Configuration Functionality

The configuration was created on the basis of the standard configuration “1C:Enterprise 8. Manufacturing Enterprise Management” and includes all the accounting schemes included in the basic configuration, allowing you to organize a unified information system for managing various aspects of the enterprise’s activities.

The configuration “1C:Enterprise 8. Distillery and winery” includes all subsystems of the basic configuration. In addition, the following subsystems were developed: production management, purchasing management, sales management, regulated reporting; basic alcohol elements and subsystems “Accounting for excise taxes” and “Blending acts” were introduced, and service configuration capabilities were expanded.

Basic alcohol elements

- Alcohol characteristics of organizations and contractors (licenses, unloading points).

- Alcohol characteristics of the nomenclature (strength, capacity, EGAIS codes, type of alcoholic products, quality).

Manufacturing control

The “Blending Production” subsystem provides:

- Convenient input of blend analysis indicator values (including the possibility of automated calculation);

- Calculation of standardized blending indicators based on the values of indicators for analyzing the composition of the blend;

- Storing the values of blend analysis indicators for each batch of the blend and its constituent components;

- Storing information about the composition of the blend (materials and semi-finished products);

- Possibility of receiving operational reports in the context of alcohol batches according to standardized indicators.

- Storage and control of quality characteristics of alcoholic nomenclature for the formation of quality certificates.

Sales management

- Operational control of trade operations (availability of valid licenses, a set of accompanying documents, permitted types of activities).

- Selection of products with the possibility of simultaneous selection of alcoholic batches, special brands, bottling dates.

- Accounting for TTN control marks, report to the State Unitary Enterprise “Moscow Quality” (upload in electronic form).

Inventory Management

- Accounting for alcohol batches:

- accounting sections: bottling dates, EGAIS batch codes, ranges of special and excise stamps, arbitrarily specified properties;

- accounting indicators: packaging, deciliters, deciliters of B/S by calculated strength, by standardized indicators (alcohol, sugar, etc.);

- Accounting for finished products.

- Providing a reserve of inventories (materials and materials), orders to suppliers, requests from buyers in the context of the region of special brands.

- Accounting for materials in terms of alcohol properties.

- Quantitative accounting of items in parallel in four units:

- basic (custom) units of measurement (for example, bottles);

- decalitres of contents;

- deciliters of anhydrous alcohol content by strength;

- deciliter of anhydrous alcohol content based on the alcohol actually contained.

Accounting for accrued excise taxes

- Automated calculation of accrued excise taxes:

- in documents reflecting transactions subject to excise taxes, the amount of excise tax is calculated according to the rate of the directory “Types of excise taxation transactions” indicated in the tabular part of the document;

- the rate value is determined automatically according to the configured auto-selection rules (the rules may be different for different organizations, types of products, types of documents, shipping options);

- auto-completion rules are set in the information register “Taxation by excise taxes of organizations”.

- Reflection of accrued excise tax in accounting.

- Setting up accounting entries when recording transactions in accounting:

- the posting template is specified in the reference book “Types of excise tax transactions”;

- the user can control the use of templates in documents.

- The ability to adjust the amounts of accrued excise taxes using standard accounting documents “Accounting Certificate” or a specialized document with an auto-fill function.

- Possibility of batch execution of operations with accrued excise tax.

- The ability to manage the reflection of transactions with accrued excise duty in various sections of the Excise Tax Declaration:

- configured in the directory “Types of excise taxation transactions”;

- the user can manage the values of codes and sections of the Declaration by selecting different types of excise tax transactions.

- Attribution of excise tax on imported goods and materials to the cost price.

- Reflection of accrued excise taxes in regulated accounting for the following operations:

- accrual of excise tax on sales on the territory of the Russian Federation;

- accrual of excise tax on export sales (without bank guarantees);

- accrual of excise tax on export sales (with bank guarantees).

- Possibility of reflecting the following transactions with accrued excise taxes:

- documentary evidence of export operations without bank guarantees (export confirmed);

- documentary evidence of export operations without bank guarantees (export is not confirmed);

- documentary evidence of export operations with bank guarantees (export confirmed);

- documentary evidence of export transactions with bank guarantees (export is not confirmed).

- Clarification of accrued excise tax (corrective entries).

- Restoration of excise duty on returns from customers.

- Registration and tracking of excise tax amounts throughout the entire production cycle of the enterprise.

- Formation of tax returns for excise duties.

Reimbursement of excise duty on purchased valuables

- Identification of incoming excise tax amounts in receipt documents.

- Automated calculation of the amount of excise duty on purchased valuables to be submitted for reimbursement.

- Reimbursement of excise duty on incoming MC:

- accounting for excise tax amounts in documents for the purchase of excisable materials;

- automated calculation of amounts to be reimbursed;

- accounting of excisable materials in warehouses, in semi-finished products (in warehouses and in work in progress), in final products, in sold products.

Accounting for special and excise stamps, marking of goods and materials

- Maintaining separate directories Brand ranges for different types of brands (type of inventory item):

- Receipt of brands at the enterprise (introduction of a new range of brands through a series of special brand nomenclature).

- Pasting with stamps, document “Labelling of alcoholic products”.

Service capabilities

- Operational control of production operations:

- Control of the presence of alcohol in non-alcoholic products;

- Monitoring compliance of quality certificate indicators with standard values.

- Reports for control:

- Control of counterparties' contracts;

- License control;

- Printing a set of industry-specific accompanying documents (certificates A and B, quality certificates, etc.).

- Specifying a custom list of scanned images (eg certificates, licenses, driving directions, etc.) with the ability to control the availability of scanned images.

- Fast printing mechanism with the ability to set fast printing profiles.

- Built-in specialized mechanism for connecting external reports.

- Uploading to EGAIS.

Regulated and additional reporting

- Technological analysis of the movements of alcoholic products for regulated reports.

- Declaration of production and turnover of alcohol and alcoholic products (Appendices 1-7).

- Industry alcohol report “Logbook of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products.”

- Tax Declaration on excise duties on excisable goods.

- Statistical industry reporting:

- Form No. 1-alcohol (wholesale);

- Form No. 1-alcohol (monthly);

- Form No. 1-alcohol (urgent).

- Uploading regulated reporting in electronic form (the format is established by the Ministry of Taxes of Russia).

Integration with UTM for EGAIS

- Workplace of the EGAIS operator.

- Integration with ASIiU

- Integration with UTM

- Integration with filling/finishing lines

- K-service

- EGAIS-service

- Integration with TSD and scanners

- Online workplace for TSD

- Interface for interaction with offline TSD (Cleverence, CT marking)

- Support for 2D scanners from EGAIS documents

- Printing labels for packaging

- Label designer

- Group printing with several codes and pictures

- Reprinting in stock

When developing configurations for “1C:Enterprise 8.0. Distillery and Winery" and "1C:Enterprise 8.0 Manufacturing Enterprise Management" took into account both modern international enterprise management techniques (MRP II, CRM, SCM, ERP, ERP II, etc.), and the experience of successful automation of production enterprises accumulated by the company " 1C" and the partner community, including the KT:Alcohol Company, when implementing prototypes of the "1C:Enterprise 8.0. Distillery and Winery" at Ishimsky Wine and Vodka Plant LLC, Vinella CJSC, Soyuzpromimpeks CJSC.

Software products that include the “Distillery and Winery” configuration have been thoroughly tested by 1C for correct operation and ease of use and have a “Compatible!” Certificate. Software system 1C:Enterprise"

Products that include the Distillery and Winery configuration are protected and have portions that cannot be modified by the user.

A full description of “1C:LVZ 8” can be obtained on the 1C company website: link

In addition, “1C:LVZ 8” has all the functional features of the basic software product “1C: Enterprise 8 Manufacturing Enterprise Management” (includes the subsystems “Fixed asset management and repair planning”, “Enterprise management”, “Warehouse (inventory) management”, “ Sales Management”, “Sales Planning”, “Purchasing Management”, “Managing Relationships with Customers and Suppliers”, “Accounting”, “Tax Accounting”, etc.)

From the moment of release to the present day, 1C:LVZ 8 has been supported by the developer in connection with changes in industry legislation (in terms of declared properties), and the release of new releases of the basic software product from 1C.

Delivery features

The main delivery of the software product - "1C:Enterprise 8. Distillery and Winery" includes the "1C:Enterprise 8" platform, the "Distillery and Winery" configuration, a complete set of documentation, protection keys for the platform and configuration, licenses for using the "1C" system :Enterprise 8" and the "Distillery and Winery" configuration in one workplace.

As a rule, to automate management and accounting at a production enterprise, more than one workplace is organized, and, over time, the number of such workplaces can increase. Expanding the use of the main (single-user) delivery of this product to a multi-user one is carried out by purchasing additional licenses for the “1C: Production” configuration and turnover of alcoholic products" and additional licenses for the 1C:Enterprise 8 platform for the required number of jobs. The number of purchased licenses to use the 1C:Enterprise 8. Distillery and Winery configuration and the 1C:Enterprise 8 platform is determined based on needs for the maximum number of concurrent users with the configuration “1C:Enterprise 8. Distillery and Winery” on the “1C:Enterprise 8” platform.

To work in the “client-server” version, you must also purchase a license to use the 1C:Enterprise 8 server.

Purchase procedure

You can purchase “1C:Enterprise 8. Distillery and Winery” from partners of the 1C company who have the relevant competencies. To purchase the main supply, the user must fill out and send to the partner a sample application established by 1C for the purchase of a software product. Based on the user data received, the partner forms an electronic application on the 1C website and receives either permission to purchase software products for the user, or a motivated refusal. If the decision is positive, the declared software products can be shipped to the partner no earlier than two business days.

To switch to "1C:Enterprise 8. Distillery and Winery", users of economic software products produced by 1C - "1C: Accounting" of all versions, "1C: Enterprise versions 7.7 and 7.5" - can purchase software products that include the configuration “Manufacturing enterprise management”, on an upgrade basis (including the full or partial cost of the delivered software products).

Service maintenance

Maintenance of software products "1C:Enterprise 8. Distillery and winery" and user support in terms of working with the platform "1C:Enterprise 8" is carried out through the Information Technology Support of the 1C:Enterprise system (ITS) + ITS Industry 4 categories .

The basic package includes an ITS disk and a coupon for a free subscription to ITS for a period of 3 months. The cost of service for the first 3 months is included in the delivery price. That is, within 3 months after registering the kit, the user has the right to receive consultations through ITS and the developer, as well as program and configuration updates at no additional charge, and after this period, configuration maintenance is paid.

To receive services, the user must register the purchased software product with 1C and sign up for a free three-month subscription to ITS using the coupon included with the software product.

ITS service includes:

- Consultation line services by phone and email;

- Obtaining new program releases and configurations;

- Obtaining new reporting forms;

- Monthly receipt of an ITS disk containing methodological materials on setting up and operating the system, various consultations and reference books on accounting and taxation, the legal database “Garant” and much more.

At the end of the free service period, in order to continue receiving the listed services, you must subscribe to a paid subscription to the ITS.

You can get more detailed information from our managers.

Industry Opportunities- Enterprise management (production planning, cost management and cost calculation, product data management), including accounting for the use of ethyl alcohol in the production of low-alcohol products.

- Excise tax accounting :

- maintaining a directory of types of excisable products;

- highlighting the amounts of incoming excise taxes in receipt documents;

- automatic calculation of excise tax amounts when generating documents in accordance with the current settings of the regulatory and reference subsystem;

- automatic offset of incoming excise taxes;

- registration and tracking of excise tax amounts throughout the entire production cycle of the enterprise;

- maintaining a list of contractors’ licenses;

- maintaining a log of contracts for the supply of alcoholic beverages with counterparties;

- selection of products with the ability to simultaneously select alcohol batches, special brands, bottling dates;

- generation of excise tax returns.

- Accounting for the turnover of alcoholic products used as raw materials :

- classification of alcoholic products in the regulatory and reference subsystem in accordance with current legislation;

- registration of receipt and tracking of the movement of alcoholic products throughout the entire production cycle of the enterprise;

- formation of a declaration on the production and turnover of alcoholic products.

- , including:

- accounting of special brands, marking of goods and materials;

- special characteristics of the nomenclature (properties of alcoholic products, quality, classifiers, etc.);

- maintaining quantitative records in parallel in four units:

- basic (custom) units of measurement (for example bottles);

- decalitres of contents;

- deciliters of anhydrous alcohol content by strength;

- deciliter of anhydrous alcohol content based on the actual alcohol contained;

- accounting of materials in terms of properties (including grade, shelf life);

- accounting of finished products in terms of properties (including type of packaging);

- accounting of materials in the warehouse;

- mechanism for calculating the planned quantity of materials for orders;

- accounting of finished products;

- ensuring a reserve of inventories (inventory and materials), orders to suppliers, requests from buyers in the context of the region of special brands;

- accounting of alcoholic batches by:

- storage;

- type of excise tax (excise warehouse - not lined, lined, wholesale warehouse);

- special federal stamp;

- special regional brand;

- region special regional brand;

- excise stamp;

- Excise warehouse management, including:

- accounting of permits for the operation of excise warehouses;

- quantitative accounting of excisable products in the context of permits for opening excise warehouses;

- labeling of alcoholic products with special marks;

- new regulations for the operation of excise warehouses (Order of the Ministry of Taxes of Russia dated March 31, 2003 N BG-3-07/154);

- notifications about shipment/receipt of excisable products;

- notification logs;

- control of overdue notifications;

- report on overdue notifications for excise goods (The report displays a list of overdue notifications from documents, indicating the number of overdue days).

- Sales management, including:

- control of balances and mutual settlements when shipping products according to orders;

- expanded reporting on orders, payment for orders, shipment of orders and sales;

- management of road transport.

- Accounting for control brands TTN, Mosalkogolkontrol .

- Manufacturing control, including:

- blend calculation assistant;

- assistant for calculating the amount of anhydrous alcohol;

- regulatory loss system;

- alcohol accounting in accordance with the “Instructions for acceptance, storage, dispensing, transportation and accounting of ethyl alcohol.”

- Regulated reporting, including:

- Declaration on turnover of alcohol (Resolution of the Government of the Russian Federation of May 25, 1999 N 564 “On approval of the Regulations on the declaration of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products” and Temporary rules for filling out declarations on the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products ( approved by the Ministry of Taxes and Taxes of the Russian Federation on June 24, 1999);

- Formation of a declaration on alcohol turnover and its annexes in electronic form (the format is established by the Ministry of Taxes of the Russian Federation);

- Statistical reporting (Resolution of the State Statistics Committee of Russia dated September 3, 2002 N172);

- Form N 8-alk - Summary report on the volumes of production and turnover of ethyl alcohol and alcoholic products. Information on trade turnover;

- Tax return on excise taxes on excisable goods, with the exception of petroleum products, tobacco products and alcoholic products sold from excise warehouses of wholesale organizations (Appendix No. 1 to Order No. 32n of the Ministry of Finance of the Russian Federation dated March 3, 2005);

- Tax return on excise taxes on alcoholic products sold from excise warehouses of wholesale organizations (Appendix No. 3 to Order No. 32n of the Ministry of Finance of the Russian Federation dated March 3, 2005).

- Regional industry reporting (reporting to the State Unitary Enterprise "Moscow Quality") .

- Interface with the Unified State Automated Information System (USAIS, developer - STC "Atlas"):

- data exchange with EGAIS allows you to collect information on the movement of alcoholic products (receipt, release, sales);

- generates regulated reporting for uploading to EGAIS;

- allows you to print the necessary sets of documents.

The development took into account the requirements of the following regulatory documents :

- Decree of the Government of the Russian Federation of April 28, 2006 N 253 "On the requirements for technical means of recording and transmitting information on the volume of production and turnover of ethyl alcohol and alcohol-containing products"

- Order dated December 30, 2005 N 168n “On approval of tax return forms for excise taxes on excisable goods, with the exception of petroleum products and tobacco products, tax returns on excise taxes on petroleum products and procedures for filling them out and on amendments to the order of the Ministry of Finance of the Russian Federation dated March 3, 2005 of the year N 32N "On approval of tax return forms for excise taxes and procedures for filling them out""

- Resolution of the Federal State Statistics Service of August 5, 2005 N 59 “On approval of statistical tools for organizing statistical monitoring of domestic and foreign trade for 2006” (as amended on August 22, 2005)

- FEDERAL LAW On amendments to the Federal Law "On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products" and on the recognition as invalid of certain provisions of the Federal Law "On amendments to the Federal Law "On state regulation of the production and turnover of ethyl alcohol, alcoholic beverages" and alcohol-containing products." Adopted by the State Duma on July 8, 2005, approved by the Federation Council on July 13, 2005

- Decree of the Government of the Russian Federation of December 31, 2005 N 872 “On the certificate attached to the cargo customs declaration”

- Decree of the Government of the Russian Federation of December 31, 2005 N 864 “On a certificate for the consignment note for ethyl alcohol, alcoholic and alcohol-containing products”

- Decree of the Government of the Russian Federation of December 31, 2005 N 858 "On the submission of declarations on the volume of production, turnover and use of ethyl alcohol, alcoholic and alcohol-containing products"

Taking into account the successful practice of using the product "1C:Enterprise 8. Manufacturing Enterprise Management" at enterprises involved in the production of alcoholic beverages, it is expected that the greatest effect of implementing "1C:Enterprise 8. Distillery and Wine Factory" can be achieved in enterprises with a staff of 50 or more up to 2000 people, with automation from 5 to 150 or more user workplaces, as well as in holding and network structures.

Software products including the “Distillery and Winery” configuration have been thoroughly tested by 1C for correct operation, ease of use and have a Certificate “Compatible! 1C:Enterprise software system” (see information letter N 5459 dated 06/01/2006) .

Products that include the Distillery and Winery configuration are protected and have portions that cannot be modified by the user.

Functionality

Manufacturing control

One of the most effective ways to reduce production costs is building and optimizing a product production plan. This allows the enterprise to reduce the level of downtime of equipment and highly qualified specialists, reduce the lead time of orders, avoid disruptions to the sales plan due to overload of production resources, optimize the movement of materials and warehouse balances, and make the production process transparent and manageable.

The production management subsystem is designed to plan production processes and material flows in production, reflect the processes of the enterprise's production activities and build a normative production management system.

The functionality of the subsystem can be used by employees of the planning and economic department, production shops, production dispatch department and other production departments.

Implemented in the subsystem "Production Management" "production planning mechanisms provide:

- Scenario planning to develop various options for production strategy or take into account possible changes in the operating conditions of the enterprise;

- Rolling planning, expanding the planning horizon as the next planning periods approach;

- Project planning of production;

- Fixation of planned data from changes (according to scenarios and periods);

- Integration with the budgeting subsystem.

Production planning

The subsystem is designed for medium- and long-term production planning and resource requirements, as well as for conducting plan-fact analysis of the execution of production plans. When planning production, it is possible to take into account many parameters, control feasibility and track the implementation of the plan at various stages in several sections simultaneously:

- By departments and managers;

- By projects and subprojects;

- By key resources;

- By item groups and individual item units.

Formation of an enlarged production plan

- Based on the sales plans generated in the “Sales Management” subsystem, estimated production volumes are generated by product groups (and, if necessary, individual product items);

- Differences between enlarged and updated plans, a package of planned shift-daily tasks, and actual production data are identified;

- Production assignments are generated, their execution is monitored, and production backlogs are assessed.

Resource planning

- It is possible to generate tables of consumption and availability of main (key) types of resources in the production of item groups and individual types of items;

- The integrated production plan is monitored for compliance with limiting factors, for example, the consolidated availability of main (key) types of resources;

- Records are kept of the availability of key resources.

Shift production planning

The subsystem is designed for production planning in the short term in the context of individual product items, as well as for conducting a plan-fact analysis of the execution of production plans by the production dispatch department. In this subsystem, a detailed shift schedule of production and consumption is formed, and its feasibility is assessed taking into account the planned resource load.

Among the shift planning capabilities provided by "Manufacturing Enterprise Management":

- Planning taking into account the availability of capacity in planning sub-periods and changes in the summary duration of operations along the technological tree. In case of insufficient capacity in subperiods, planned operations are transferred to subperiods with available free capacity;

- Formation of a detailed production and operations schedule;

- Planning "on top" of existing production and operations plans or complete re-planning;

- Ability to plan operations for geographically remote units;

- Planning taking into account transportation time between warehouses and departments.

Formation of a shift production plan

- Formation of a production plan, refined to individual product items with the calculation of exact production times;

- Determination of break points of explosion procedures in the production technological tree for all products planned in the “assembly to order” mode;

- Formation of a schedule for loading production capacity and production needs for raw materials and components;

- Formation of a final assembly schedule with clarification of production dates.

Determining available resource capacity

- Maintaining a list of work centers and technological operations;

- Support for availability calendars of individual work centers and input of resource availability according to these calendars;

- Combining work centers into groups with setting priorities for planning;

- Calculation of work center loads during the determination of the material requirements schedule.

Execution control

- Formation of a schedule of production needs;

- Formation of production assignments, shift-daily assignments;

- Plan-actual analysis of production progress, control and analysis of deviations.

Cost management and costing

One of the most important factors in competition is reduction of production costs, cost management. The presence of a management accounting system that reflects real production costs allows the enterprise to develop effective measures to reduce production costs and product costs, and increase business profitability.

The cost management subsystem is designed to account for the actual costs of the enterprise and calculate the cost products based on management accounting data.

Main functions of the subsystem:

- Accounting for actual costs of the reporting period in the required sections in value and physical terms;

- Operational quantitative accounting of materials in work in progress (WIP);

- Accounting for actual balances of work in progress at the end of the reporting period in the required sections;

- Accounting for defects in production and warehouses;

- Calculation of the actual cost of production for the period of main and by-products (semi-finished products, defects) - incomplete and full production costs and the actual full cost of sales of products, incl. calculation of the cost of production from processors;

- Calculation of the cost of production during the month according to release documents - according to direct costs or according to the planned cost;

- Accounting for processing of customer-supplied raw materials;

- Calculation of the actual value of work in progress balances at the end of the reporting period;

- Providing data (reports) on the procedure for generating cost;

- Generating a shift report on production output and services in production;

- Providing data on the production cost structure to assess deviations from specified standards.

Product data management

An important tool for production management is the management of data on the composition of products and semi-finished products, routes for the passage of products through production departments and warehouses.

Standardization of product composition allows you to control the write-off of materials into production (limit cards), plan production costs, analyze discrepancies between planned and actual costs and identify their causes.

Setting a route (technological) map allows plan the production chain of multi-use products, at each stage assessing its feasibility taking into account the equipment load and the availability of resources necessary for production.

The functionality of the subsystem can be used by the chief engineer and employees working in the departments of the chief designer and chief technologist.

As part of production management, the function of accounting for standard costs of materials during production and analysis of deviations from standards has been implemented. Material consumption standards are laid down in product manufacturing specifications.

The standard composition of products is used:

- when analyzing deviations from standards to control product quality;

- for calculating costs - as a basis for the distribution of indirect costs.

For the purposes of shift planning, the entire technological process can be represented as a set of sequences of operations. This set sets the route map for the production of products. Each operation can be characterized by its own set of material requirements at the input and a set of products at the output.

Management of fixed assets and repairs

Fulfillment of the production program on time and optimal use of resources is possible with high-quality planning of maintenance and repair of fixed assets (fixed assets) of the enterprise. Using the capabilities of the repair management subsystem, enterprises can carry out planning and accounting of equipment maintenance and repair activities:

- Maintain a regulatory framework for OS maintenance;

- Plan OS maintenance and resources for its implementation;

- Take into account the results of the OS maintenance performed;

- Analyze deviations in the timing and scope of OS maintenance.

The subsystem allows you to automate all typical operations of accounting for fixed assets:

- acceptance for accounting;

- change of state;

- depreciation calculation;

- changing the parameters and methods of reflecting depreciation costs;

- accounting for actual production of fixed assets;

- completion and disassembly, relocation, modernization, decommissioning and sale of OS.

Wide supported range of methods for calculating depreciation:

- linear method;

- proportional to the volume of production;

- according to uniform depreciation rates;

- reducing balance method;

- by the sum of the numbers of years of useful life;

- according to an individual depreciation schedule.

When calculating depreciation, you can specify not only the calculation method, but also the need to use a distribution schedule for the amount of annual depreciation by month.

The subsystem allows you to obtain detailed information about the condition of fixed assets, analyze the degree of their wear and monitor the implementation of equipment maintenance work.

Financial management

Organizing effective financial management is one of the highest priority tasks of any enterprise. Availability of a financial management system focused on comprehensive solution to problems of accounting, control and planning of income and costs, allows the enterprise to effectively use its own funds and attracted investments, improve the overall manageability of the business, its profitability and competitiveness.

The use of a financial management subsystem together with mechanisms for supporting geographically distributed information databases allows you to establish effective financial management of holdings and corporations, increasing transparency of their activities and investment attractiveness.

The functionality of the subsystem can be used by the financial director, employees of the accounting and economic planning department, as well as other financial services of the enterprise.

Budgeting

The subsystem implements the functions necessary to build a financial planning system at an enterprise:

- planning the movement of enterprise funds for any period in terms of time intervals, financial responsibility centers (FRC), projects, residual and current indicators, additional analytics (items, counterparties...);

- monitoring the actual activities of the enterprise in the same areas in which planning was carried out;

- preparation of summary reports based on monitoring results;

- monitoring compliance of requests for spending funds with the work plan for the period;

- the financial analysis;

- analysis of cash availability;

- analysis of deviations of planned and actual data.

Cash management

The cash management subsystem (treasury) performs the following functions necessary for effective cash flow management in the enterprise, control over payments made:

- multi-currency accounting of cash flows and balances;

- registration of planned receipts and expenditures of funds;

- reserving funds for upcoming payments in current accounts and cash registers;

- placement of funds in expected incoming payments;

- formation of a payment calendar;

- registration of all necessary primary documents;

- integration with bank client systems;

- the ability to post (manually or automatically) the amount of a payment document across several agreements and transactions.

Settlement management

An important element when working with counterparties is the settlement management function. A flexible credit policy implemented using the mutual settlements management subsystem allows you to increase the attractiveness of the enterprise for customers and its competitiveness in the market.

The settlement management subsystem can be used in the financial, supply and sales structures of an enterprise, allowing you to optimize financial and material flows.

Using the subsystem allows analyze changes in debt in time and operates with two types of debt - actual and projected (deferred). The actual debt is associated with settlement operations and moments of transfer of ownership rights. Deferred debt arises when events such as a purchase order or transfer of inventory items to commission, an application for receiving funds, and other similar ones are reflected in the system.

The main purpose of the mutual settlements subsystem:

- recording the debt of the counterparty to the company and the company to the counterparty;

- accounting for the causes of debt;

- support for various methods of debt accounting (under contracts, transactions, and individual business transactions);

- analysis of the current state of debt and the history of its changes.

Accounting

The accounting capabilities implemented in the system are designed to ensure full compliance with both Russian legislation and the needs of real business. The adopted methodology is a further development of accounting solutions implemented in the products of the 1C:Enterprise 7.7 system, which have become an industrial standard in the Russian Federation.

Accounting subsystem ensures record keeping in accordance with Russian legislation in all areas of accounting, including:

- Bank and cash desk operations;

- Fixed assets and intangible assets;

- Accounting for materials, goods, products;

- Cost accounting and cost calculation;

- Currency operations;

- Settlements with organizations;

- Calculations with accountable persons;

- Payments to personnel regarding wages;

- Calculations with the budget.

The organization of the accounting subsystem provides a high degree of automation in the formation of financial statements.

Supports accounting for several legal entities in a single information database. This organization of accounting allows you to automate enterprises with a fairly complex organizational structure.

Tax accounting

Tax accounting for income tax in configuration maintained independently of accounting. Business transactions are reflected in parallel in accounting and tax accounting. The documents registering business transactions in accounting and tax accounting provide that for tax accounting purposes, data can be entered and reflected in accounting later.

To be able to compare accounting and tax accounting data, accounting methods and information storage mechanisms are as close to each other as possible. The basis of the accounting and tax accounting systems in the configuration are charts of accounts, separate for each type of accounting. At the same time, the coding of tax plan accounts is done in such a way as to ensure comparability of the data summarized on them with accounting data. This approach significantly facilitates compliance with the requirements of PBU 18/02 “Accounting for income tax calculations.”

The organization of batch accounting ensures the independence of methods for assessing inventories when written off for accounting and tax accounting purposes.

To summarize tax accounting data, the configuration includes specialized reports - analytical tax accounting registers that comply with the recommendations of the Ministry of Taxes of the Russian Federation.

Tax accounting for value added tax is implemented in accordance with the norms of Chapter 21 of the Tax Code of the Russian Federation, including under the conditions of applying a 0% VAT rate.

Accounting according to international standards

The accounting subsystem according to international standards, developed by 1C with the consulting support of PricewaterhouseCoopers, provides the financial services of an enterprise with a ready-made methodological basis for accounting in accordance with international financial reporting standards (IFRS) and can be adapted to the specifics of the application of standards at a particular enterprise.

The subsystem includes separate chart of accounts in accordance with IFRS, which can be customized by the user, and provides:

- maintaining financial records and preparing both individual and consolidated financial statements in accordance with IFRS;

- translation (transfer) of most of the accounts (entries) from the accounting subsystem (RAS) according to rules that can be flexibly configured by the user;

- parallel accounting according to Russian and international standards in those areas where the differences between Russian standards and IFRS requirements are significant (for example, accounting for fixed assets, intangible assets);

- Carrying out your own regulatory documents (for example, accrual of expenses, accounting for reserves, accounting for impairment of assets and a number of others), as well as making adjusting entries in a “manual” mode.

The capabilities of the subsystem allow:

- minimize the labor intensity of accounting according to IFRS through the use of Russian accounting data;

- compare data from Russian accounting and accounting under IFRS, thereby facilitating data reconciliation before preparing financial statements under IFRS;

- Consolidate the reporting of a group of enterprises.

The subsystem can also be configured for accounting and financial reporting in accordance with other foreign standards, including US GAAP.

Personnel management and payroll

Today, more and more enterprises are realizing the importance of building effective personnel management systems, since qualified, proactive and loyal employees can significantly increase the efficiency of an enterprise. Managing data on hundreds and thousands of employees, carrying out activities for the selection and training of personnel, assessing the qualifications of production and management personnel, requires the use of software products that allow you to effectively plan and implement the personnel policy of the enterprise.

Employees of the HR department, labor organization and employment department and accounting department can use the personnel management subsystem in a single information space for daily work.

The subsystem is designed to provide information support for the company's personnel policy and automate settlements with personnel. Among the capabilities of the subsystem:

- personnel needs planning;

- planning employment and vacation schedules for employees;

- solving problems of providing business with personnel - selection, questioning and assessment;

- personnel records and personnel analysis;

- analysis of the level and causes of staff turnover;

- maintaining regulated document flow;

- calculation of wages for company employees;

- automatic calculation of charges, deductions and taxes regulated by law;

- automatic calculation of unified social tax and insurance contributions for compulsory pension insurance.

Recruitment

The business HR subsystem is designed to document and automate the process of selecting and evaluating candidates carried out by the HR department. Within this subsystem the following functions are provided:

- storage of personal data about candidates as individuals;

- storage of materials that appear in the process of working with a candidate, from resumes to survey results;

- planning meetings with candidates and recording decisions made until hiring.

Personnel records and personnel analysis

The company's personnel accounting subsystem provides storage of various information about employees:

- personal data about employees as individuals;

- information about the department and position of the employee, the number of positions occupied;

- office phone numbers, email addresses and other contact information.

Based on the accumulated data about employees, you can build a variety of reports: these are lists of employees, analysis of personnel; vacation reports (vacation schedules, use of vacations and execution of the vacation schedule).

Maintaining regulated personnel document flow

The regulated document flow subsystem allows you to automate personnel operations in accordance with current regulatory documents:

- concluding and maintaining employment contracts with each employee of the organization;

- formation of approved labor forms;

- personalized accounting for the Pension Fund;

- maintaining military records.

Salary calculation

At a manufacturing enterprise, an important aspect of business management is the construction of a system of motivation for workers, focused on increasing the volume of products produced with the appropriate level of quality, providing for the interest of personnel in advanced training. To implement staff motivation strategies, tariff and piece-rate remuneration systems are often used; a payroll calculation subsystem is designed to accurately calculate accruals in accordance with accepted rules.

The subsystem allows automate the entire complex of settlements with personnel, starting from entering documents on actual production, payment of sick leave and vacations, up to the generation of documents for payment of wages and reporting to government supervisory authorities.

The results of payroll calculations are reflected in management, accounting, and tax accounting with the required degree of detail:

- Reflection of the results of calculating managerial salaries in management accounting;

- Reflection of the results of calculating regulated wages in accounting;

- Reflection of the results of calculating regulated wages as expenses taken into account for the purposes of calculating income tax (single tax). Reflection of the results of calculating the regulated salary for the purposes of calculating the unified social tax.

Sales management

In the context of expanding sales markets and the range of products, an important aspect of the enterprise’s activities is management of customer orders and product sales: planning and analysis of actual indicators in various analytical aspects.

The use of the subsystem by the commercial director, sales department employees and warehouse workers will improve the efficiency of their activities.

The sales management subsystem provides end-to-end automation of the product sales process and goods in manufacturing, wholesale and retail trade. The subsystem includes tools for planning and controlling sales and allows you to solve problems of managing customer orders. Various schemes for selling products and goods are supported - from a warehouse and to order, sales on credit or by prepayment, sales of goods accepted on commission, transfer for sale to a commission agent, etc.

Sales planning

The subsystem is designed for planning:

- sales volumes in physical and value terms, including based on sales data for previous periods, information on current warehouse balances and customer orders received for the planning period;

- selling prices, including based on information about the current prices of the company and competitors;

- cost of sales, taking into account information on supplier prices, planned or actual cost of production for a certain period.

Sales planning can be carried out both for the enterprise as a whole and for divisions or groups of divisions, for individual goods and product groups, for certain categories of buyers (by region, by type of activity, etc.). The subsystem ensures the consolidation of individual plans into a consolidated sales plan for the enterprise.

To monitor the implementation of developed plans, the system provides developed tools for comparative analysis of data on planned and actual sales.

Planning can be carried out with time detail from a day to a year, What allow:

- move from strategic plans to operational ones, while maintaining information about the indicators established at each stage of planning;

- carry out planning both taking into account and without taking into account seasonal fluctuations in demand.

Customer order management

Fulfilling orders on time and being transparent about the progress of each order is gradually becoming an increasingly important aspect of the activities of many manufacturing enterprises.

The order management functionality implemented in the system allows you to optimally place customer orders and reflect them in the production program in accordance with the company's order fulfillment strategy and work patterns (work from warehouse, to order).

All stages of the order and its adjustments are recorded in the system with relevant documents. The manager can at any time:

- receive complete information about the progress of the order;

- track the history of relationships with clients and suppliers;

- evaluate the efficiency and reliability of working with counterparties.

Using analytical reports built into the program, the manager can receive information about the payment of customer orders, the placement of orders in production and the progress of their implementation, and the distribution of orders to suppliers to ensure customer orders.

Pricing

The pricing subsystem allows the commercial director and head of the sales department to determine and implement the pricing policy of the enterprise in accordance with available analytical data on supply and demand in the market.

Basic functionality of the subsystem:

- construction of various pricing and discount schemes;

- formation of selling prices taking into account the planned cost of production and profit margins;

- monitoring compliance by company employees with the established pricing policy;

- storing information about competitors' prices;

- storage of information about suppliers' prices, automatic updating of purchase prices;

- comparison of the enterprise's selling prices with the prices of suppliers and competitors.

Procurement management