The essence and functions of the finances of the organization (enterprise). The essence of organization finance

Read also

Finance refers to economic relations,

arising in the process of formation, distribution, redistribution and use of cash income and savings from business entities and the state. The totality of funds of funds at the disposal of the state, enterprises, organizations and institutions is united by the concept of "financial resources" and as a whole constitutes the financial system of the state.

The structure of the financial system is shown in Fig. 8.1.

Rice. 8.1. Financial system

The finances of enterprises and organizations occupy a central place in the financial system. It is in this area that the bulk of the state's financial resources are formed. The insurance system involves the creation of targeted insurance funds at the expense of participants' cash contributions to compensate for possible damage. Public finance is a set of financial resources of the state and its enterprises, organizations and institutions that

used to meet the needs of society (defense, social needs, etc.). It is at the level of public finances that the development and implementation of a unified financial policy of the country takes place, on which the efficiency of enterprises' activities largely depends. Household (citizen) finances are finances of individual families and citizens, which form the corresponding budgets. The main purpose of these budgets is the use of funds (budget revenues) for the purpose of current consumption and for accumulation, i.e. investing by citizens in profitable activities.

Financial management is the management of financial relations with market entities that have arisen in the process of forming and using their own and borrowed financial resources to ensure production and economic activities, and implement social policy. The object of management is financial (monetary) resources, their size, sources of formation, directions of use.

Management results are manifested in the form of cash flows between the enterprise, the budget, capital owners, business partners and other entities. The control subsystem (financial management bodies of the enterprise) analyzes information about the financial condition in accordance with the goals of the enterprise and the state of the external environment, which is formed by the market conditions and regulatory support.

Financial management performs three groups of tasks:

- Financial analysis and financial planning.

- Providing the enterprise with financial resources (management of sources of financial resources).

- Allocation of financial resources (asset and capital management).

All financial relationships that the company enters into are grouped in the following areas:

- relations with other enterprises and organizations related

with the supply of raw materials, materials, fuel, components, the sale of finished products, with the construction of new buildings, workshops, warehouses, housing, with the transportation of goods, etc. This group of relations is the main one, the financial result of the enterprise depends on it; - relations within the enterprise with its subsidiaries, branches, workshops, teams regarding the financing of expenses, participation in the distribution of the enterprise's profits;

- relations with employees of the enterprise on the payment of wages, dividends on shares, withholding taxes;

- relations with the banking system for settlements for banking services, for obtaining and repaying loans. This is not only a system of settlements and lending, but also new forms of relations: factoring, trust, pledges, etc.

- relations with the financial system of the state when paying taxes and other payments to the budgets of different levels;

- relations with insurance companies and organizations for property insurance, certain categories of employees of the enterprise, commercial and financial risks;

- relations with commodity, raw materials and stock exchanges on operations with production and financial assets;

- relations with various investment institutions (investment funds, companies) for privatization and placement of investments, etc .;

- relations with shareholders who are not members of the given work collective.

they:

- are denominated in monetary terms and represent cash flows;

- they are all bilateral in nature and are the result of certain business transactions of the enterprise with other market participants;

- in the process of the movement of funds serving financial relations, the monetary funds of the enterprise are formed, which have various purposes.

simple and extended reproduction is carried out.

In accordance with the legislation of the Russian Federation, the formation of cash

funds of the enterprise begins from the moment of its organization in the form of authorized capital. This is the first and main source of the company's own funds. The name "authorized capital" means that its value is fixed in the charter of the organization and is subject to registration in the manner prescribed by law. From the authorized capital, fixed and circulating capital is formed, which are used for the acquisition of fixed and circulating assets, respectively.

In the course of the enterprise's activity, additional capital can be formed, which forms the monetary fund of the enterprise's own funds, which is received during the year through the following channels:

- increase in the value of fixed assets as a result of their revaluation;

- income from the sale of shares in excess of their par value (share premium);

- monetary and material values received free of charge for production purposes.

In addition, a reserve capital is formed at the enterprise, which is the enterprise's monetary fund, which is formed in accordance with the legislation of the Russian Federation in the amount determined by the charter. The presence of reserve capital in a market economy is the most important condition for maintaining a stable financial position of an enterprise. It is used to cover the company's losses, as well as to pay dividends in the absence of the required profit.

The result of the effective activity of the enterprise is the extraction of profit, which serves as the basis for the formation of the accumulation fund and the consumption fund of the enterprise.

Accumulation fund - intended for the development of production, formed from the net profit of the enterprise. From the accumulation fund, the enterprise provides an increase in working capital, finances capital investments. It is also a source of increase in the authorized capital, since investments in the development of production increase the property of the enterprise.

The consumption fund is money generated from net profit and used to meet the material needs of the company's employees, to finance non-production facilities, and to compensate.

And, finally, the foreign exchange fund is formed at enterprises that receive foreign exchange earnings from the export of products and buy foreign exchange for import operations.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

COURSE WORK

on the topic: "The essence and functions of enterprise finance"

Introduction

Chapter 1. The essence and functions of enterprise finance

1.1 Financial relations of enterprises

1.2 Enterprise finance functions

1.3 The role and place of enterprise finance in the general system of finance and the country's economy

Chapter 2. Organization of enterprise finances

2.1 Principles of organizing enterprise finances

2.2 Factors affecting the organization of the finances of enterprises

2.3 Organization of the financial work of the enterprise

Conclusion

List of sources used

Vconducting

Finance of commercial organizations and enterprises, being the main link of the financial system, covers the processes of creation, distribution and use of GDP in value terms. They function in the sphere of material production, where the aggregate social product and national income are mainly created.

The financial conditions of business have undergone significant changes, which were expressed in the liberalization of the economy, changes in forms of ownership, large-scale privatization, changes in the conditions of state regulation, and the introduction of a system of taxation of commercial organizations and enterprises. All this has led to an increase in the role of distribution relations. The ultimate goal of entrepreneurial activity was to make a profit while preserving equity capital.

In the course of entrepreneurial activities of commercial organizations and enterprises, certain financial relations arise associated with the organization of production and sale of products, the provision of services and the performance of work, the formation of their own financial resources and the attraction of external sources of financing, their distribution and use.

Thus, the direct connection of the finances of enterprises with all phases of the reproduction process determines their high potential activity and a wide possibility of influencing all aspects of the economy.

The relevance of the topic is confirmed by the fact that enterprise finance is an important tool for economic stimulation, control over the country's economy and its management. The possibility of meeting the social needs of society and improving the financial condition of the country depends on the state of the finances of enterprises.

The object of the research is enterprise finance. The subject of research is their essence and functions.

The aim of the course work is to study the essence of enterprise finance. To achieve this goal, the following tasks were set and solved:

Explore the essence of enterprise finance

Consider their functions and role

Analyze the principles of organizing the finances of enterprises

In the first chapter, the essence of enterprise finance is determined, their functions are studied.

The second chapter is devoted to the organization of enterprise finances. Here, its principles and factors affecting the organization of enterprise finances are considered.

In the conclusion, all the material presented is summarized, and well-founded conclusions are drawn.

Chapter 1. The essence and functions of enterprise finance

1.1 Financial relations of enterprises

The finances of commercial enterprises and organizations are financial or monetary relations arising in the course of entrepreneurial activity in the process of forming equity capital, targeted funds of funds, their distribution and use.

According to its economic content, the entire set of financial relations can be grouped in the following areas:

Between the founders at the time of the establishment of the enterprise - associated with the formation of equity capital and in its composition of the authorized (shareholder, joint stock) capital. The specific methods of forming the authorized capital depend on the organizational and legal form of management. In turn, the authorized capital is the initial source of the formation of production assets, the acquisition of intangible assets;

Between enterprises and organizations - associated with the production and sale of products, the emergence of newly created value. These are financial relations between a supplier and a buyer of raw materials, materials, finished products, etc., relations with construction organizations in the implementation of investment activities, with transport organizations in the transportation of goods, with communications enterprises, customs, foreign firms, etc. These relations are basic, since the final financial result of commercial activities largely depends on their effective organization;

Between enterprises and its subdivisions (branches, workshops, departments, brigades) - on the financing of expenses, distribution and use of profits, working capital. This group of relationships affects the organization and rhythm of production;

Between the enterprise and its employees - when distributing and using income, issuing and placing shares and bonds of the enterprise, paying interest on bonds and dividends on shares, collecting fines and compensations for material damage caused, withholding taxes from individuals. The efficiency of the use of labor resources depends on the organization of this group of relations;

Between an enterprise and a parent organization, within financial and industrial groups, within a holding, with unions and associations of which the enterprise is a member. Financial relations arise in the formation, distribution and use of centralized targeted funds and reserves, financing targeted industry programs, conducting marketing research, research work, holding exhibitions, providing financial assistance on a repayable basis for the implementation of investment projects and replenishment of working capital. This group of relations is associated, as a rule, with intra-industry redistribution of funds and is aimed at supporting and developing enterprises;

Between commercial organizations and enterprises - associated with the issue and placement of securities, mutual lending, equity participation in the creation of joint ventures. The possibility of attracting additional sources of financing for entrepreneurial activity depends on the organization of these relations;

Between enterprises and the financial system of the state - when paying taxes and making other payments to the budget, forming extra-budgetary funds, providing tax incentives, applying penalties, financing from the budget;

Between enterprises and the banking system - in the process of storing money in commercial banks, obtaining and repaying loans, paying interest on a bank loan, buying and selling foreign currency, and providing other banking services;

Between enterprises and insurance companies and organizations - when insuring property, certain categories of employees, commercial and entrepreneurial risks;

Between enterprises and investment institutions - during the placement of investments, privatization, etc.

Each of the listed groups of relations has its own characteristics and scope. However, they are all bilateral in nature, and their material basis is the flow of funds. The movement of funds is accompanied by the formation of the company's own and in its composition the authorized capital of the enterprise, the circulation of the enterprise's funds begins and ends, the formation and use of funds and reserves.

1.2 Enterprise finance functions

The essence of finance is most fully manifested in their functions. In the economic literature, there is currently a wide scatter in the definition of functions, both in their number and in content. There is unity in only two functions: distribution and control. finance enterprise market economy

In many literary sources the following functions are indicated: formation of capital, income and monetary funds; providing function; resource-saving, etc. Obviously, the listed functions in their content have the same nature and purpose - to provide the necessary sources of financing for the activities of the enterprise. Most economists recognize that enterprise finance has three main functions: the formation of the capital and income of the enterprise; distribution; control.

When finances perform the first function, the initial capital of the enterprise is formed, its increment; attraction of funds from various sources in order to form the volume of financial resources necessary for entrepreneurial activity.

The distribution function is manifested in the distribution of gross domestic product in value terms, the formation of funds of funds, the determination of the main cost proportions in the process of distribution of income and financial resources, ensuring the optimal combination of interests of individual producers, enterprises and organizations and the state as a whole.

The objective basis of the control function is the cost accounting of the costs of production and sale of products, performance of work, provision of services, the formation of income and funds of the enterprise and their use. With the help of this function, control over the formation of the company's equity capital, the formation and targeted use of monetary funds, and changes in financial indicators is carried out.

At the heart of finance are distribution relations that provide sources of financing for the reproduction process (distribution function) and thereby link together all phases of the reproduction process: production, exchange and consumption. However, the size of the income received by the enterprise determines the possibilities for its further development. Effective and rational management of the economy predetermines the possibilities for its further development. And vice versa, the disruption of the uninterrupted circulation of funds, the growth of costs for the production and sale of products, the performance of work, the provision of services reduce the income of the enterprise and, accordingly, the possibility of its further development, competitiveness and financial stability. In this case, the control function of finance indicates the insufficient impact of distribution relations on production efficiency, shortcomings in the management of financial resources, organization of production. Ignoring such evidence can lead to bankruptcy of the enterprise.

Financial control over the activities of an economic entity is carried out by: 1

Directly an economic entity through a comprehensive analysis of financial indicators, operational control over the progress of financial plans, timely receipt of proceeds from the sale of products (works, services), obligations to suppliers of inventories, customers and consumers of products, the state, banks and other counterparties;

Shareholders and owners of a controlling block of shares by monitoring the effective investment of funds, making a profit and paying dividends;

Tax authorities that monitor the timeliness and completeness of the payment of taxes and other obligatory payments to the budget; 2

The Control and Auditing Service of the Ministry of Finance of the Russian Federation, which controls the financial and economic activities of enterprises and organizations using budget funds;

Commercial banks when issuing and repaying loans, providing other banking services;

Independent audit firms for auditing.

A positive financial result of the economic activity of commercial organizations and enterprises testifies to the effectiveness of the applied forms and methods of managing financial resources, and, conversely, a negative result or its absence - about shortcomings in the management of financial resources, the organization of production and the possibility of bankruptcy of the enterprise.

1.3 The role and place of enterprise finance in the general system of finance and the country's economy

The finances of enterprises and sectors of the economy are the initial basis of the country's financial system, since they cover the most important part of all monetary relations in the sphere of social reproduction, where the country's social product is created. The possibility of meeting the social needs of society, improving the financial situation of the country depends on the state of the finances of enterprises. The finances of enterprises carry out the process of distribution and redistribution of the value of the social product at three main levels:

On the state (national);

At the enterprise level;

At the level of production teams.

By distributing and redistributing value at the national level, the finances of enterprises provide the formation of the country's financial resources used to form the budget and extra-budgetary funds.

At the level of enterprises, they provide the sphere of material production with the necessary financial resources and funds for the continuous process of expanded reproduction.

At the level of production teams, with the help of finance, monetary funds are formed - wages, material incentives, programs for the social development of enterprise teams are being implemented.

Finances play an important role in ensuring a balance in the national economy between material and monetary funds intended for consumption and accumulation. The stability of the ruble, money circulation, the state of payment and settlement discipline in the national economy largely depend on the degree of security of such a balance.

The direct connection of the finances of enterprises with all phases of the reproduction process determines their high potential activity and a wide possibility of influencing all aspects of the economy. They serve as an important tool for economic stimulation and control over the country's economy and its management.

Chapter 2. Organization of enterprise finances

2.1 Principles of organizing enterprise finances

There is no consensus in the economic literature about the principles of organizing finance. Their number differs significantly in different economic textbooks and teaching aids. Most of the authors believe that the financial activity of enterprises is based on the following principles: economic independence; self-financing; material responsibility; in the results of activities; formation of financial reserves; control over financial and economic activities.

Economic independence presupposes that, regardless of the organizational and legal form of management, the enterprise independently determines its economic activity, the direction of investment of funds in order to make a profit. In a market economy, the rights of enterprises in the field of commercial activities, investments, both short-term and long-term, have significantly expanded. The market stimulates enterprises to search for more and more areas for capital investment, to create flexible production facilities that meet consumer demand. However, one cannot speak of complete economic independence. The state regulates certain aspects of the activities of enterprises. Thus, the legislation regulates the relationship of enterprises with budgets of different levels, off-budget funds; the state determines the depreciation and tax policy.

Self-financing means full self-sufficiency of costs for the production and sale of products, performance of work and provision of services, investment in the development of production at the expense of its own funds and, if necessary, bank and commercial loans. The implementation of this principle is one of the main conditions for entrepreneurial activity, which ensures the competitiveness of an economic entity. In developed market countries, at enterprises with a high level of self-financing, the share of own funds exceeds 70%. The main own sources of financing for commercial enterprises in the Russian Federation include profit and depreciation charges. But the total amount of own funds is not sufficient for the implementation of serious investment programs. Currently, not all enterprises are able to fully implement this principle. Enterprises in a number of sectors of the national economy, producing products and providing services needed by the consumer, for objective reasons cannot ensure their sufficient profitability. These include individual enterprises of urban passenger transport, housing and communal services, agriculture, and the defense industry. Such enterprises receive allocations from the budget on different terms.

The principle of material interest - the objective necessity of this principle is ensured by the main goal of entrepreneurial activity - making a profit. Interest in the results of entrepreneurial activity is manifested not only by its participants, but also by the state as a whole. At the level of individual employees of the enterprise, the implementation of this principle can be ensured by a high level of remuneration. For an enterprise, this principle can be implemented as a result of the state's implementation of an optimal tax policy, an economically sound depreciation policy, and the creation of economic conditions for the development of production. The enterprise itself can contribute to the implementation of this principle by observing economically justified proportions in the distribution of newly created value, the formation of a consumption fund and an accumulation fund. The interests of the state can be respected by the profitable activities of enterprises, the growth of production and the observance of tax discipline. It is obvious that currently there are weak preconditions for the implementation of this principle: the existing taxation system is of a pronounced fiscal nature, due to the complexity of the economic situation in the country, many commercial organizations and enterprises do not fulfill their obligations to their employees to pay wages on time and Finally, the drop in production does not allow ensuring the interests of the state, the completeness and timeliness of tax payments to the budget.

The principle of material responsibility means the existence of a certain system of responsibility for the conduct and results of financial and economic activities. The financial methods for implementing this principle are different and are regulated by Russian law. Enterprises that violate contractual obligations, settlement discipline, terms of repayment of received loans, tax legislation, etc., pay penalties, fines, and penalties. Bankruptcy proceedings can be applied to unprofitable enterprises that are not able to meet their obligations.

Heads of enterprises are administratively liable for violation of tax legislation in accordance with the legislation of the Russian Federation. A system of fines is applied to individual employees of enterprises and organizations in cases of admitting marriage, deprivation of bonuses, dismissal from work in cases of violation of labor discipline.

This principle is most fully implemented at the present time.

The principle of providing financial reserves is dictated by the conditions of entrepreneurial activity, associated with certain risks of non-return of funds invested in business. In the conditions of market relations, the consequences of the risk fall on the entrepreneur, who voluntarily and independently at his own peril and risk implements the program developed by him. In addition, in the economic struggle for a buyer, entrepreneurs are forced to sell their products at the risk of not returning their money on time. Financial investments of enterprises are also associated with the risk of non-return of the invested funds, or receiving income below the expected one. Finally, there may be direct economic miscalculations in the development of the production program. The implementation of this principle is the formation of financial reserves and other similar funds that can strengthen the financial position of the enterprise at critical moments of management.

Financial reserves can be formed by enterprises of all organizational and legal forms of ownership from net profit, after paying tax from it and other obligatory payments to the budget.

All the principles of organizing the finances of enterprises are in constant development and for their implementation in each specific economic situation, their forms and methods are applied, corresponding to the state of productive forces and production relations in society.

2.2 Factors affecting the organization of the finances of enterprises

The organization of the finances of enterprises is influenced by two factors: the organizational and legal form of management and sectoral technical and economic features.

The organizational and legal form of business is determined by the Civil Code of the Russian Federation, according to which an organization is recognized as a legal entity that owns, economically or operatively manages, separate property and is responsible for its obligations with this property. It has the right, on its own behalf, to acquire and exercise property and personal non-property rights, bear obligations, be a plaintiff and a defendant in court. The legal entity must have its own balance sheet or estimate. Legal entities can be organizations: 1) pursuing profit-making as the main goal of their activities - commercial organizations, 2) not having profit-making as such a goal and not distributing profits between participants - non-profit organizations.

Commercial organizations are created in the form of business partnerships and societies, production cooperatives, state and municipal unitary enterprises.

Financial relations arise already at the stage of formation of the authorized (share) capital of an economic entity, which, from an economic point of view, is the property of an economic entity at the date of its creation. A legal entity is subject to state registration and is considered created from the moment of its registration.

The organizational and legal form of management determines the content of financial relations in the process of forming the authorized (joint-stock) capital. The formation of the property of commercial organizations is based on the principles of corporation. The property of state and municipal enterprises is formed on the basis of state and municipal funds.

Business partnerships and companies. The participants in a full partnership create the charter capital at the expense of the participants' contributions, and in essence the charter capital of a full partnership is the joint capital. By the time of registration of a full partnership, its participants must make at least half of their contribution to the pooled capital. The rest must be contributed by the participant within the time frame specified in the founding document. If this rule is not met, the participant is obliged to pay the partnership 10% per annum from the amount of the unpaid part of the contribution and reimburse the losses incurred. A participant in a full partnership has the right, with the consent of the rest of its participants, to transfer his share in the pooled capital or part of it to another participant in the partnership or to a third party.

The founding agreement of a limited partnership stipulates the conditions for the amount and composition of the contributed capital, as well as the size and procedure for changing the shares of each of the general partners in the contributed capital, the composition, terms of making contributions and liability for breach of obligations. The procedure for the formation of the authorized capital is similar to the procedure for its formation in a full partnership. Management of the activity of a limited partnership is carried out only by general partners. Contributing participants do not take part in entrepreneurial activity and are, in essence, investors.

The authorized capital of a limited liability company is also formed at the expense of the contributions of its members. The minimum amount of the authorized capital in accordance with the legislation is set at 100 minimum wages on the day of registration of the company and must be paid at the time of registration by at least half. The rest must be paid during the first year of the company. If this procedure is violated, the company must either reduce its authorized capital and register this decrease in accordance with the established procedure, or terminate its activities by liquidation. A company participant has the right to sell his share in the authorized capital to one or more company participants or to a third party, if it is stipulated in the charter.

The charter capital of a company with additional liability is formed in a similar way.

Open and closed joint stock companies form the authorized (joint stock) capital based on the par value of the company's shares. The minimum amount of the authorized capital of an open joint stock company in accordance with the current legislation is set at 1000 minimum salaries on the day of registration of the company. The authorized capital is formed by placing ordinary and preferred shares. The share of preferred shares in the total amount of the authorized capital must not exceed 25%: Public subscription to the shares of an open joint-stock company is not allowed until the authorized capital has been paid in full. This restriction is directed against the creation of fictitious joint stock companies. When founding a joint stock company, all of its shares must be distributed among the founders. At the end of the second and each subsequent financial year, if the value of net assets turns out to be less than the authorized capital, the joint-stock company is obliged to declare and register, in accordance with the established procedure, a decrease in its authorized capital. If the value of the said assets of the company becomes less than the minimum authorized capital determined by law, the company is subject to liquidation. An open joint-stock company has the right to conduct an open subscription to the shares issued by them and to carry out their free sale on the stock market. Shares of a closed joint stock company are distributed only among its founders. The authorized capital of a closed joint stock company cannot be less than 100 minimum salaries established at the time of its registration.

Production cooperatives and unitary enterprises. In such spheres of entrepreneurial activity as production, processing and marketing of industrial and agricultural products, trade, consumer services, etc., the preferred form of entrepreneurial activity is a production cooperative. The property of a production cooperative consists of the shares of its members in accordance with the charter of the cooperative. A production cooperative can create indivisible funds at the expense of a certain part of the property, if this is stipulated in its charter. By the time of registration of the cooperative, each of its members must pay at least 10% of their share contribution, and the remainder within a year from the date of registration.

A fundamentally different procedure for the formation of unitary enterprises (state and municipal enterprises) They can be created on the basis of the right of economic management by decision of an authorized state or municipal body and, accordingly, the property is in state or municipal ownership. A unitary enterprise is managed by a manager appointed by the owner or his authorized representative. The size of the authorized capital of a unitary enterprise must be no less than the amount specified in the law on state and municipal unitary enterprises. The authorized capital must be fully paid by the time of registration of the unitary enterprise.

Unitary enterprises based on the right of operational management (state enterprises) are created by the decision of the Government of the Russian Federation. Their property is owned by the state. Enterprises have the right to dispose of their property only with the consent of the owner.

The issue of profit distribution is also solved in different ways. The profit of commercial organizations remaining after its distribution in the general established order is distributed among the participants on the basis of corporate principles. The profit of unitary enterprises after payment of income tax and other obligatory payments remains entirely at the disposal of the enterprise and is used for industrial and social development.

Branch technical and economic features. Industry specificity affects the composition and structure of production assets, the duration of the production cycle, the features of the circulation of funds, sources of financing for simple and extended reproduction, the composition and structure of financial resources, the formation of financial reserves and other similar funds.

So, in agriculture, natural and climatic conditions dictate the need for the formation of financial reserves both in cash and in kind; natural conditions determine the natural cycle of development of plants and animals and, consequently, the circulation of financial resources, the need for their concentration by certain periods, which in turn necessitates the attraction of borrowed funds.

Transport enterprises and institutions carry out financial and economic activities on the principle of combining state regulation and market relations. The finished product to be sold in transport is the transport process itself. Thus, the production and sale of products coincide in time and the circulation is carried out in two stages instead of three. The costs of social labor associated with the transportation of products increase its value by the amount of transport costs, which, in addition to the additional new value, also contain a surplus product. In transport, there is a large proportion of fixed assets, the reproduction of which requires significant funds. The peculiarities of settlements for transport services, reproduction of fixed assets determine the need to centralize part of the funds at the level of the Ministry of Railways with their subsequent redistribution, which is reflected in the financial plan of the transport company.

Organizations and enterprises in the sphere of commodity circulation, being a link between the production of goods and their consumption, contribute to the completion of the circulation of a social product in a commodity form and thereby ensure its continuity. The specificity of trade is the combination of operations of a production nature (sorting, packing, packaging, processing and storage of agricultural products, etc.) with operations associated with a change in the forms of value, that is, directly with the sale of products. The cost of purchased goods is not included in the costs of trade enterprises. A trading company buys already produced goods, incurring costs only for bringing them to consumers. There are peculiarities in the composition and structure of working capital, a significant part of which is invested in inventories. A feature of the sectoral structure of fixed assets is the combination of own and leased fixed assets. All these features are taken into account in the formation of financial resources and their use.

Finances of construction organizations also have a number of significant features due to the technical and economic features of construction production. The construction industry is characterized by a long production cycle compared to industry, a large proportion of work in progress in the composition of working capital The need for working capital has large fluctuations both for individual objects and for technological cycles, which affects the structure of sources of financing for working capital. The implementation of the construction of objects in different climatic and territorial zones determines the individual cost of objects and leads to an uneven receipt of proceeds. Financing of construction is carried out on the basis of the estimated cost of construction and installation work. The specifics of pricing in construction determine the normative procedure for planning profits.

2.3 Organization of the financial work of the enterprise

The financial work of an enterprise in modern conditions acquires a qualitatively new content, which is associated with the development of market relations. In a market economy, the most important tasks of financial services are not only fulfillment of obligations to the budget, banks, suppliers, their employees, but also the organization of financial management.

Financial management is a system of optimal management of cash flows arising in the process of financial and economic activities of an enterprise in order to achieve a set goal and maximize profits.

The object of management in financial management is the cash flow of an economic entity. It involves the development of a rational financial strategy and tactics of the enterprise based on the analysis of financial statements, forecast estimates of cash receipts and payments, their dependence on changes in the structure of assets and liabilities of the enterprise.

This changes the previous ideas about the structure of the financial service and its place in the enterprise management system. The specific structure of the financial service depends on the organizational and legal form of management, the size of the enterprise, the volume of production, the amount of money turnover.

The functions of the financial service include: 1

Participation in the development and execution of a business plan;

Development of a financial development program;

Determination of credit policy;

Management of cash flows arising from current (main), investment and financial activities;

Development of monetary policy;

Financial planning;

Settlements with suppliers, buyers, commercial banks, the budget and other counterparties;

Providing insurance against financial and other risks;

Analysis of financial and economic activities;

Control over the targeted and efficient use of funds.

Depending on the size of the enterprise, its industry affiliation, the goals set, the listed functions can be detailed and expanded.

Conclusion

The finances of enterprises form the financial basis that ensures the continuity of the production process aimed at meeting the demand for goods and services. Part of the financial resources formed by the enterprise is directed to consumption, thus, with the help of enterprise finances, the social tasks of the development of society are implemented in a decentralized manner.

The finances of enterprises can serve as the main instrument of state regulation of the economy. With their help, the regulation of the reproduction of the produced product is carried out, the financing of the needs of expanded reproduction is provided on the basis of the optimal ratio between the funds allocated for consumption and accumulation. The finances of enterprises are used to regulate sectoral proportions in a market economy, to create new industries and modern technologies. The finances of enterprises provide an opportunity to use the monetary savings of citizens to invest in profitable financial instruments issued by individual enterprises.

The finances of enterprises in the branches of the national economy are the initial basis of the entire financial system of the country. They occupy a decisive position in this system, since they cover the most important part of all monetary relations in the country, namely: financial relations in the sphere of social reproduction, where a social product, national wealth and national income are created, are the main sources of the country's financial resources. Therefore, the ability to meet the social needs of society and improve the financial condition of the country depends on the state of the finances of enterprises.

List of sources used

1. Civil Code of the Russian Federation. Parts one and two. - M .: Prospect, 1998

2. Tax Code of the Russian Federation (part one) "dated July 31, 1998 N 146-FZ (as amended on December 28, 2010) //" Collected Legislation of the Russian Federation ", N 31, 08/03/1998, Art. 3824.

3. Federal Law "On Joint Stock Companies" dated December 26, 1995 No. 208-FZ (as amended on December 28, 2010) // Rossiyskaya Gazeta. - 1995. - No. 248

4. Enterprise finance. Nikolaeva T.P. - M.: MMIEIFP, 2003 .-- 158 p.

5. Finance: Textbook for universities / Ed. Prof. L.A. Drobozina. - M.: UNITI, 2001 .-- 527 p.

6. Finances of organizations (enterprises): Textbook for universities / N.V. Kolchin, G.B. Polyak, L.M. Burmistrova and others; Ed. Prof. N.V. Kolchina. - 3rd ed., Rev. And add. - M.: UNITY-DANA, 2005 .-- 368 p.

7. Finances of organizations (enterprises) / Ed. N.V. Kolchina. - 4th ed., Rev. And add. - M.: UNITY-DANA, 2009 .-- 383 p.

8.www.consultant.ru

Posted on Allbest.ru

...Similar documents

The role of enterprise finance in the general system of finance and the country's economy. Distribution and control functions of finance. Distribution and redistribution of the value of the social product at the levels: national, enterprises and collectives.

term paper added on 10/03/2014

The concept of finance of enterprises of sectors of the national economy. The content of financial and credit relations. Functions of enterprise finance and principles of their organization. The relationship of enterprises with commercial banks. The tasks of the financial services of enterprises.

abstract, added 06/15/2010

Principles and forms of organization of enterprise finances. Distribution, regulatory and control functions of finance. Evolution of theoretical views on the essence of organization finance. The connection of finance with the development of commodity-money relations.

test, added 08/06/2014

Stages of development of enterprise finance. The consequences of the reform of the 60s. Methods for enhancing the impact of profits on production. The general concept of the financial and credit mechanism. State regulation of finance, state and problems at the present stage.

term paper added 01/21/2013

The principles of organizing the finances of enterprises, their development in market conditions. Financial resources of enterprises, their composition, structure, sources of formation, distribution procedure. Organization of financial work and tasks of financial services at the enterprise.

abstract added 03/03/2013

Functions of enterprise finance. Financial strategy concept. Analysis of the peculiarities of the financial condition of state-owned enterprises in the Republic of Belarus. Organization of finances of a state educational institution as a non-profit organization.

term paper, added 11/21/2012

The essence and functions of enterprise finance. The principles of their organization: self-financing, economic independence, material interest and responsibility, financial control, efficiency, their reflection in the industry specifics of enterprises.

term paper, added 07/07/2008

The essence and necessity of finance in terms of commodity-money relations, their distribution and control functions. Financial mechanism and its elements. The role of finance in solving social problems. The impact of finance on the economy of the Russian Federation.

term paper, added 04/17/2011

What is Enterprise Finance? Functions of enterprise finance. Fundamentals and principles of organization of enterprise finance. Indicators of the financial activity of the enterprise. Responsibility of enterprises. The system of financial relations.

abstract, added 09/06/2006

The principles of organizing the finances of enterprises, their development in market conditions. Financial resources of enterprises, their composition, structure, sources of formation, distribution. Organization of financial work and tasks of financial services at the enterprise.

The finances of enterprises (firms) function within the financial system of the state and form the basis of the entire financial system, since they serve the sphere of material production, where the gross national product and national income are created - a source of financial resources for other links of the financial system.

The finances of enterprises represent monetary relations associated with the formation and distribution of financial resources, which are formed from such sources as their own and equivalent funds, funds mobilized in the financial market, and funds received in the order of redistribution (insurance benefits, budgetary allocations, funds of extra-budgetary funds of an economic nature and others).

The finances of an enterprise are economic monetary relations that arise in the process of financial and economic activities of an enterprise regarding the formation of fixed and working capital, the accumulation, distribution and use of monetary funds, as well as control over this process.

Enterprise finance plays an important role in ensuring the effective economic and social development of the country. This role is manifested in the following:

financial resources, concentrated by the state and used by it to finance various public needs, are mainly formed at the expense of the finances of enterprises (firms);

enterprise finances form the financial basis for ensuring the continuity of the production process aimed at meeting the demand for goods and services;

part of the financial resources formed by enterprises (firms) are directed to consumption purposes, thus, with the help of firms' finances, the social tasks of the development of society are implemented in a decentralized manner;

enterprise finance can serve as the main instrument of state regulation of the economy. With their help, the regulation of the reproduction of the produced product is carried out, the financing of the needs of expanded reproduction is provided on the basis of the optimal ratio between the funds allocated for consumption and for accumulation;

enterprise finances are used to regulate sectoral proportions in a market economy, contribute to the creation of new industries and modern technologies;

enterprise finances make it possible to use money savings of households by providing an opportunity to invest them in profitable financial instruments (securities) issued by individual enterprises.

The finances of the organization as an economic category are manifested in the functions they perform.

In modern economic literature, the following functions of enterprise finance are distinguished:

providing;

distribution;

control.

The supporting function consists in the systematic formation of the required amount of funds from various alternative sources to ensure the current economic and financial activities of the enterprise and the implementation of the strategic goals of its development. The prerequisite for distribution and its beginning is the accumulation of capital - the formation of resources that form the firm's cash funds.

The distribution function is closely related to the providing function and is manifested through the distribution and redistribution of the total amount of generated financial resources.

The financial resources of the enterprise are subject to distribution in order to fulfill monetary obligations to the budget, creditors, and counterparties. The result of the redistribution is the formation and use of targeted funds of funds, maintenance of an effective capital structure.

The control function is implemented through the implementation of financial control over the results of production and financial activities of the enterprise, as well as over the process of formation, distribution and use of financial resources in accordance with current and operational plans. The control function is implemented in the following areas:

control over the receipt of proceeds from the sale of products and services;

control over the level of self-financing, profitability and profitability;

control over the correct and timely transfer of funds to monetary funds for all established sources of funding;

control over the targeted and efficient use of financial resources and others.

The organization of the finances of an enterprise (firm) is based on certain principles. The principle of self-sufficiency and self-financing. Self-sufficiency assumes that the funds that ensure the operation of the enterprise must pay off - bring income that corresponds to the minimum possible level of profitability.

Self-financing means full recoupment of the costs of production and sale of products (services), investment in the development of production at the expense of their own funds and, if necessary, at the expense of bank and commercial loans. In countries with developed market economies, the level of self-financing is considered high if the share of the entrepreneurial firm's own funds reaches 70% or more.

The principle of economic independence lies in the independent determination of development prospects, planning of their activities; in ensuring industrial and social development; in the independent determination of the direction of investment of funds in order to make a profit, and more. In a market economy, the economic independence of enterprises has expanded, but certain areas of economic activity are determined and regulated by the state (for example, the regulation of the economic activity of natural monopolists, etc.).

The principle of material responsibility means the existence of a certain system of responsibility of enterprises for the conduct and results of economic activity. In accordance with the current Russian legislation (Federal Law of the Russian Federation "On Insolvency (Bankruptcy)", 2002), firms that violate contractual obligations, settlement and tax discipline are prosecuted and a bankruptcy case may be initiated by an arbitration court on the initiative of creditors.

The interest in the results of the activity is inherent in the employees of the enterprise, the management and the state. This principle is implemented through the development of forms, systems and amounts of remuneration, incentive and compensatory payments, social guarantees for the team of workers. The interest of the state is manifested in the fact that an enterprise is a potential taxpayer, which, through the creation of a system of favorable conditions for its functioning, is provided with rhythmic and efficient activity. The financial mechanism plays an important role here.

The principle of exercising control over the financial and economic activities of the company is implemented in the process of performing the control function by the finances.

More on 7.1. The essence, functions and principles of organization of the company's finances:

- 12.1 Objectives and functions of enterprises in market conditions. The essence and functions of enterprise finance, the principles of their organization. Types of enterprise financial relations Enterprise finance

1. The essence and functions of enterprise finance

Enterprise finance is an economic category, the peculiarity of which lies in its scope and inherent functions. They express monetary distributional relations, without which the circulation of social production assets cannot take place.

The finances of enterprises are the most important component of the financial system of the Russian Federation. Their functioning is due to the existence of commodity-money relations and the operation of the law of value. Enterprise finance shares the same traits as finance categories in general.

The finances of enterprises are a set of monetary relations arising from specific economic entities associated with the formation of cash income and savings and their use to fulfill obligations.

The finances of enterprises arise in real money circulation and their functioning is aimed at achieving the general goals of the effective development of enterprises.

Money turnover is an economic process that causes a movement in value and is accompanied by a flow of cash payments and settlements.

In the economic literature, there is also an unrealistic money turnover (quasi-turnover), which is understood as “black cash” settlements and barter.

The finances of enterprises perform distribution and control functions and provide

The supporting function is the systematic formation of the required amount of funds to ensure the current economic activities of the company and the implementation of the strategic goals of its development.

The distribution function is manifested in the process of distributing the value of the social product and national income. This process occurs through the receipt of cash proceeds by enterprises for the products sold and use it to reimburse the expended means of production, the formation of gross income. The financial resources of the enterprise are also subject to distribution in order to fulfill monetary obligations to the budget, banks, counterparties. The result of the distribution is the formation and use of targeted funds of funds (compensation fund, wages, etc.), maintenance of an effective capital structure. The main object of the distribution function is the profit of the enterprise.

Under the control function of enterprise finances, one should understand their inherent ability to objectively reflect and thereby control the state of the economy of an enterprise, industry and the entire national economy with the help of such financial categories as profit, profitability, cost, price, revenue, depreciation, basic and working capital.

The control function of enterprise finance contributes to the choice of the most rational mode of production and distribution of the public product and national income at the enterprise and in the national economy.

The control function of finance is implemented in the following main areas:

Control over the correctness and timeliness of the transfer of funds to the funds of funds for all established sources of funding;

Control over the observance of the given structure of funds of funds, taking into account the needs of the production and social nature;

Control over the targeted and efficient use of financial resources.

2 Principles of organization of enterprise finances

The organization of the finances of business entities is carried out on the basis of a number of principles that correspond to the essence of entrepreneurial activity in market conditions:

Economic independence. The implementation of this principle is ensured by the fact that an economic entity, regardless of the form of ownership, independently determines the directions of its expenses, the sources of their financing, guided by the desire to maximize profits. In a market economy, the rights of enterprises, commercial activities, investments, both short-term and long-term, have significantly expanded. The market stimulates enterprises to search for more and more areas for capital investment, to create flexible production facilities that meet consumer demand. However, one cannot speak of complete economic independence. The state determines certain aspects of the activities of enterprises, for example, the depreciation policy. Thus, the legislation regulates the relationship of enterprises with budgets of different levels, off-budget funds.

Self-financing. This principle means full recoupment of the costs of production and sales of products, investment in the development of production at the expense of our own funds and, if necessary, bank and commercial loans. The implementation of this principle is one of the main conditions for entrepreneurial activity, ensuring the competitiveness of the enterprise.

Currently, not all enterprises are able to fully implement this principle. Organizations in a number of sectors of the national economy, producing products and providing services needed by the consumer, for objective reasons cannot ensure their sufficient profitability. These include individual enterprises of urban passenger transport, housing and communal services, agriculture, defense industry, and extractive industries. Such enterprises receive allocations from the budget on different terms.

Material liability. It means the presence of a certain system of responsibility for the conduct and results of economic activity. Financial methods for implementing this principle are different for individual enterprises, their managers and employees of the enterprise. In accordance with Russian legislation, enterprises that violate contractual obligations, settlement discipline, allow late repayment of loans, repayment of bills of exchange, violation of tax legislation pay fines, penalties, and fines. In case of ineffective activity, the bankruptcy procedure can be applied to the enterprise. For the heads of the enterprise, the principle of material responsibility is implemented through a system of penalties in cases of violation of tax legislation by the enterprise. A system of fines, deprivation of bonuses, dismissal from work in cases of violation of labor discipline, admitted marriage are applied to individual employees of the enterprise.

Material interest. This principle is objectively predetermined by the main goal of entrepreneurial activity - making a profit. An interest in the results of economic activity is equally inherent in the employees of the enterprise, the enterprise itself and the state as a whole. At the level of individual workers, the implementation of this principle should be ensured by decent wages from the wage fund and profit directed to consumption in the form of bonuses, bonuses based on the results of work for the year, length of service, material assistance and other incentive payments. For an enterprise, this principle can be implemented through the stimulation of its investment activities. The interests of the state are ensured by increasing revenues to the budgets of various levels of the corresponding amounts of tax payments.

Providing financial reserves. This principle is associated with the need to form financial reserves to ensure entrepreneurial activity, which is associated with risk due to possible fluctuations in market conditions.

The principle of flexibility. Consists in such an organization of financial management of the enterprise, which provides a constant opportunity to maneuver in the event of deviation of the actual sales volumes from the planned ones, as well as in case of exceeding the planned costs for its current and investment activities.

The principle of financial control. The implementation of this principle at the enterprise level provides for such an organization of finance that provides the ability to carry out internal financial control based on internal analysis and audit. At the same time, in-house analysis and audit should be carried out continuously, cover all areas of financial and economic activities and be effective.

3 The financial mechanism of the enterprise

The financial mechanism of an enterprise is a system for managing the finances of an enterprise in order to achieve maximum profit.

Strategic goals of the organization's financial management:

1) profit maximization;

2) achieving financial stability and financial independence of the organization;

3) ensuring the required level of liquidity;

4) balance of movement of material and cash flows;

5) formation of the required volume of financial resources and their effective use.

The most important areas of financial work at the enterprise are:

Financial planning - is carried out on the basis of the analysis of information about the finances of the company, obtained from accounting, statistical and management reporting.

In the planning area, Treasury performs the following tasks:

development of financial plans with all the necessary calculations,

identification of sources of financing for economic activities,

development of a capital investment plan with the necessary calculations,

participation in the development of a business plan,

drawing up cash plans.

Operational work - the following main tasks are performed:

ensuring timely payments to the budget, banks, employees, suppliers, etc .;

securing funding for the costs of the plan;

registration of loans in accordance with agreements;

maintaining daily operational records of financial plan indicators;

drawing up certificates on the progress of the plan and the financial condition of the enterprise.

Control and analytical work - together with the accounting department, the correctness of the budgeting, calculation of the return on capital investments is checked, all types of reporting are analyzed, the observance of financial and planning discipline is monitored.

The structure of the financial service largely depends on the organizational and legal form of the enterprise, its size, type of activity and tasks set by the company's management.

In small enterprises, for reasons of economic feasibility, there is no deep division of managerial labor and financial management is carried out by the head himself with the help of an accountant. The main goal of small business finance management is to set up and maintain accounting records and optimize taxes.

With the growth of business, it becomes necessary to manage costs, introduce budgeting and management accounting into financial policy, work with accounts receivable, and formulate credit policy.

In a medium-sized enterprise, financial management is carried out by the financial director, the accounting service, and the planning and economic department. Financial management tasks: planning and optimization of cash flows, cost management, raising additional funds, setting and maintaining management accounting, financial planning, investment calculations.

The larger the business, the more relevant it is to ensure the transparency and manageability of its divisions. For large business, one of the primary tasks is to promptly obtain information on the current state, the results of the activities of individual divisions and the company as a whole.

At large enterprises, the structure of the financial service is more complex and, in general, can be represented by the financial department with the following structural divisions: financial controlling department - planning and forecasting the financial activities of the organization; accounting; corporate finance department; IFRS department; tax planning department; internal audit department; risk management department.

5 Organization of the financial service at the enterprise

Financial relations in an enterprise require certain organizational forms. The latter are expressed in the creation of various specialized units within the management structure.

The financial service of the company is engaged in:

· Planning;

· Making settlements;

· Analysis of financial statements;

· Development of innovative methods, etc.

A study of the practice of foreign firms (USA, Japan) shows that they have special financial services, which are very authoritative and which determine the financial policy of firms.

In a self-financing environment, business structures should pay attention to the availability of special services for financial issues. The existing practice shows that there are still few such services, there are not enough trained specialists, and until now the problems of managing monetary resources are being solved at a simplified amateur level.

Until now, the chief accountant has been essentially a financial manager. The development of a financial management system for business structures is underway. The compulsory drawing up of business plans has now begun. Systematic financial planning emerged.

The presence of a tax and credit system obliges enterprises to make calculations and justifications for the payment of taxes, interest, etc.

Since 1994, attention has been paid to auditing in Russia. Many audit companies have appeared, legislation has been sufficiently developed; many enterprises turn to auditors for services, trying to solve their problems with their help. Financial structures in enterprises.

The financial structures that exist in the West and, to some extent, in real large firms in Russia, are subdivided according to the size of the firm itself.

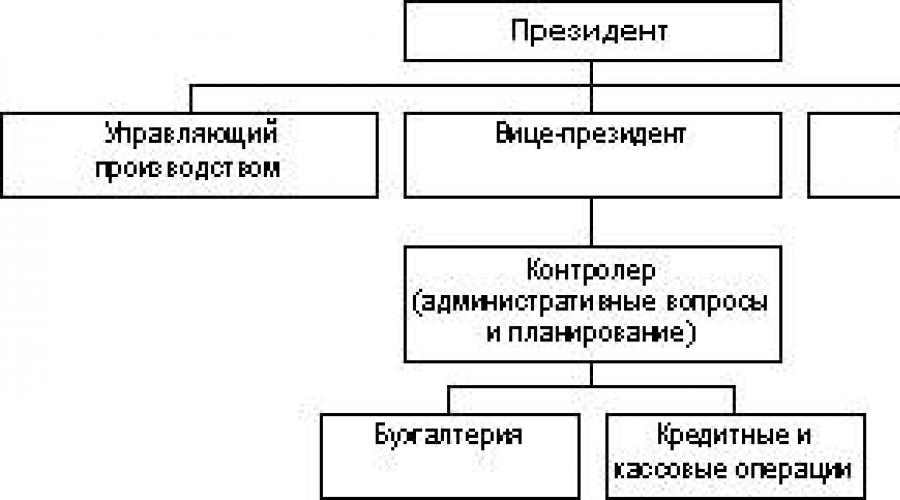

For large firms, the following structure is characteristic.

Responsibilities of the Vice President of Finance.

1. Addressing issues of strategic financial planning.

2. Organization of all financial work.

3. Gives opinions on the analysis of financial documents for management.

At the mid-firm level (by size), the finance function is run by a vice president (treasurer).

For small businesses, there is the following scheme.

For small firms, solving financial issues falls within the competence of the manager (owner) and the accountant. However, with an increase in the scale of firms, it may become necessary to attract specialists who solve certain problems; this is the controller who is engaged in setting up general accounting, is responsible for developing estimates, evaluating the costs of the enterprise and planning revenues.

For domestic enterprises, there is the following scheme.

The structure of the financial department of a machine-building enterprise.

Training of specialists in financial management (Germany).

For the tax department, the main financial directorate, specialists of the highest, high and middle level are trained. High-ranking officials graduate from higher specialized institutes, receive legal education at the university, and undergo a two-year judicial practice. Additionally, they study the course of the Federal Financial Academy. High-ranking officials are trained in a dual system: theoretical and practical knowledge. The training lasts for three years. For mid-level specialists, there is also a dual training system, but for two years. The main requirement for financial professionals: communication skills. The subject of work with personnel is the main one. They are hired on a competitive basis. They are tested, they take an oath to abide by the constitution, to serve the interests of the country.

When choosing candidates for their men and women, preference is given to women

7 FINANCIAL RESOURCES OF ENTERPRISES AND SOURCES OF THEIR FORMATION

The production and financial activity of enterprises begins with the formation of financial resources.

The financial resources of an enterprise are monetary incomes and receipts at the disposal of a business entity and intended to fulfill financial obligations, implement costs for expanded reproduction and economic incentives for workers. The formation of financial resources is carried out at the expense of own and equivalent funds, the mobilization of resources in the financial market and the receipt of funds from the financial and banking system in the order of redistribution.

Financial resources are divided into:

- capital;

- consumption costs;

- investments in the non-production sphere;

- financial reserve.

Capital is a part of financial resources allocated for production and economic purposes (current expenses and development). Capital is money meant to make a profit. The capital structure includes funds invested in:

- fixed assets;

- intangible assets;

- revolving funds;

- circulation funds.

The set of property rights owned by an enterprise represent the assets of the enterprise. The assets include fixed assets, intangible assets, circulating assets.

Fixed assets are funds invested in fixed assets. Fixed assets are means of labor that are repeatedly used in the economic process and transfer their value in parts, as they wear out to the value of the products (services) created. This process is called depreciation.

Intangible assets are the value of industrial and intellectual property and other property rights. These include rights arising:

- from patents for inventions, industrial designs, trademarks and trade marks, trade marks;

- from the rights to know-how, goodwill;

- from the rights to use land plots and natural resources, etc.

Working capital (working capital) - part of the company's capital invested in its current assets. Part of the circulating capital has been advanced into the sphere of production and forms circulating production assets, the other part is in the sphere of circulation and forms circulation funds.

Revolving production assets are raw materials, materials, fuel, etc. - i.e. objects of labor, as well as tools of labor, taken into account in the composition of low-value and quickly wearing items (MBE). Revolving production assets serve the sphere of production and completely transfer their value to the cost of finished goods, changing the original form during the production cycle.

Circulation funds, although they do not participate in the production process, are necessary to ensure the unity of production and circulation. These include: finished products in the warehouse, goods shipped, cash at the cash desk of the enterprise and in accounts with commercial banks, accounts receivable, funds in settlements.

The net assets of an enterprise are assets less debt.

Liabilities of an enterprise are a set of debts and liabilities of an enterprise, consisting of borrowed and borrowed funds, including accounts payable.

Financial resources are generated from various sources. According to the form of ownership, two groups of sources are distinguished:

- own;

- borrowed and attracted (strangers).

The main sources of own funds are the authorized capital (authorized capital), profit and depreciation charges. Other people's funds include accounts payable, loans and borrowings.

The initial formation of financial resources occurs at the time of the establishment of the enterprise, when the statutory fund is formed. Its sources, depending on the organizational and legal forms of management, are: equity capital, shares of members of cooperatives, sectoral financial resources (while maintaining sectoral structures), long-term credit, budget funds.

The size of the authorized capital shows the size of those funds - fixed and circulating - that are invested in the production process.

The main source of financial resources at operating enterprises is the cost of products sold (services rendered), various parts of which, in the process of distributing proceeds, take the form of cash income and savings. Financial resources are formed mainly from profits (from core and other types of activities) and depreciation charges.

Profit and depreciation deductions are the result of the circulation of funds invested in production. Optimal use of depreciation and profit for the intended purpose allows you to resume production on an extended basis.

The purpose of depreciation deductions is to ensure the reproduction of fixed assets and tangible assets. Unlike depreciation deductions, profit does not remain completely at the disposal of the enterprise, a significant part of it in the form of taxes goes to the budget.

The profit remaining at the disposal of the enterprise is a multi-purpose source of financing its needs, but the main directions of its use can be defined as accumulation and consumption. The proportions of the distribution of profit for accumulation and consumption determine the prospects for the development of the enterprise.

The sources of financial resources of enterprises are also:

- proceeds from the sale of retired property,

- stable liabilities;

- various targeted income (payment for the maintenance of children in preschool institutions, etc.).

- mobilization of internal resources in construction, etc.

Significant financial resources, especially for newly created and reconstructed enterprises, can be mobilized in the financial market. The forms of their mobilization are: sale of shares, bonds and other types of securities issued by this enterprise, credit investments

The use of financial resources is carried out by the enterprise in many areas, the main of which are:

- payments to the bodies of the financial and banking system, conditioned by the fulfillment of financial obligations. These include: tax payments to the budget and off-budget funds, payment of interest to banks for using loans, repayment of previously taken loans, insurance payments, etc .;

- investing own funds in capital expenditures (reinvestment) associated with the expansion of production and its technical renovation, the transition to new progressive technologies, the use of know-how, etc .;

- investing financial resources in securities purchased on the market: shares and bonds of other firms, government loans, etc .;

- the direction of financial resources for the formation of incentive and social funds;

- use of financial resources for charitable purposes, sponsorship, etc.

The essence of organization finance

Finances of enterprises (organizations). Real money turnover. Financial resources of organizations. Sources of the formation of financial resources. Functions of organizations' finance. The principles of organizing the finances of enterprises. Financial relations of organizations. Financial mechanism of organizations.

Finances of enterprises (organizations)- This is a set of financial and economic relations arising in real money circulation regarding the formation, distribution, and use of financial resources.

Real money turnover- an economic process that causes cash flow and is accompanied by a flow of cash payments and settlements. The object of real money turnover is financial resources.

Financial resources- these are all sources of funds accumulated by an organization to form the assets it needs in order to carry out all types of activities, both at the expense of its own income, savings and capital, and at the expense of various types of receipts.

By sources of formation financial resources are divided into own and borrowed. Own financial resources are the funds of the organization, formed at the time of its creation in the form of authorized capital. These funds are at the disposal of the organization throughout its existence. Own sources of replenishment of financial resources of the organization are retained earnings of the reporting year and previous years, share premium, as well as funds of new investors (owners). Sources of replenishment, equated to their own, are accounts payable, constantly at the disposal of the organization (stable liabilities), targeted financing from the budget and higher organizations. In the event of a shortage of funds from their own sources, organizations can attract borrowed funds in the form of long-term and short-term loans and loans from banks, budget loans and loans to legal entities and individuals.

Financial resources are used by the organization in the course of its activities. They are in constant motion and remain in cash only in the form of cash balances on accounts in commercial banks and in the cash desks of organizations.

The essence of the finances of organizations is manifested in their functions: