Re-registration of KKM in tax step-by-step instructions. Registration of cash register machines with the tax office: step-by-step instructions

Read also

How to install new cash registers.

You can use the cash desk only after the CCP registration card is received from the Federal Tax Service. At the same time, there is no need to carry the cash register itself, as it was before.

When and who needs to register a cash register according to the "new" rules?

According to the new version of the main law on the use of cash registers No. 54-FZ, an individual entrepreneur will have to register a cash desk in two cases:

Entrepreneur opens a business, plans to accept payment in cash, and by Law No. 54-FZ, his activities are not exempted from the use of cash - this was even before the "cash reform". You need to register the cashier before accepting cash.

Do I need to register a cash register for an individual entrepreneur if a “new” type of cash register is installed? Necessary. As before, an entrepreneur can only use cash registers that are registered with the Federal Tax Service. This also applies to online checkouts, but the registration procedure itself has become easier (more on this in the next section of the article).

Previous entrepreneur was exempted from the application of the cash desk, but now the benefit has been canceled... This applies to individual entrepreneurs on UTII, the patent taxation system, individual entrepreneurs who perform work, provide services to the population and write out strict reporting forms instead of the cash register, as well as using vending machines. It is necessary to register and start using the cashier before 01.07.2018 and for individual categories of individual entrepreneurs - until 01.07.2019.

* Until July 1, 2017, the CCP should be modified or changed to a new one (online cash desk) should have been entrepreneurs who had previously used the cash desk. At the same time, a new or modified cash register also underwent a new registration.

Is it obligatory to register a cash register for an individual entrepreneur on the simplified tax system? It depends on the type of activity. The very application of the simplified tax system does not give the individual entrepreneur the right to work without a cash register. But earlier, entrepreneurs providing services (and this, as a rule, individual entrepreneurs on the simplified tax system) could not use the CCP. According to the new rules, for services to the population, you can do without a cash desk only until 07/01/2019, and in some cases - until 07/01/2018.

According to Law 54-FZ (as amended), entrepreneurs engaged in the following activities can work without a cash desk:

- lease (lease) to individual entrepreneurs of residential premises belonging to this individual entrepreneur by right of ownership;

- sale of newspapers and magazines, as well as related products in kiosks (the share of sales of newspapers and magazines is not less than 50% of the turnover, the range of goods must be approved at the regional level);

- sale of securities;

- sale of travel tickets / coupons in public transport;

- catering services during training sessions in educational institutions;

- trade in retail markets, fairs, in exhibition complexes, as well as in other areas designated for trade, with the exception of shops, pavilions, kiosks, tents, car shops, car dealerships, vans, container-type premises and others similarly equipped in these places of trade and ensuring the display and safety of goods of trading places (premises and vehicles, including trailers and semi-trailers), open counters inside covered market premises when trading in non-food products, except for trading in non-food products, which are defined in the list approved by the Government of the Russian Federation;

- retail trade in food and non-food products (with the exception of technically complex goods and food products requiring certain storage and sale conditions) in passenger carriages of trains, from hand carts, bicycles, baskets, trays (including frames protected from atmospheric precipitation, covered with polymer film , canvas, tarpaulin);

- trade in kiosks of ice cream, soft drinks in bulk;

- trade from tank trucks with kvass, milk, vegetable oil, live fish, kerosene, seasonal trade in vegetables, including potatoes, fruits and melons;

- reception of glassware and scrap materials from the population, with the exception of scrap metal, precious metals and precious stones;

- repair and dyeing of shoes;

- production and repair of metal haberdashery and keys;

- supervision and care of children, the sick, the elderly and the disabled;

- realization by the manufacturer of folk art products;

- plowing vegetable gardens and sawing firewood;

- services of porters at railway stations, bus stations, air terminals, airports, sea and river ports;

- IP activity in remote or hard-to-reach areas (with the exception of cities, regional centers, urban-type settlements), the list of such areas is approved by the region.

On the patent taxation system;

On UTII;

Carrying out work, providing services to the population (when issuing strict reporting forms);

- "trading" using vending machines.

If the entrepreneur had the right not to apply the CCP according to the "old" law (that is, according to 54-FZ as amended up to 15.07.2016), then he has the right to work without a cash desk until 01.07.2018.

Instructions on how to register a cashier for an individual entrepreneur according to the new rules: 3 simple steps

To register the cashier, you must submit an application to the Federal Tax Service. This can be done in two ways:

- electronic:

- through the service of the operator of fiscal data (OFD - an organization that will ensure the transfer of data from the cash register to the tax office, often provides an online registration service);

- through the "Personal Account" on the FTS website (nalog.ru);

- in paper form: to any tax office (previously you could only contact your FTS, now - to any one) personally, through a representative, or by mail.

For any of the options, registration takes place in 3 simple steps. But first you need to buy a cash register or upgrade an existing one.

Step 0. Buy a new cashier or modify the existing one.

If the cash register has already been used and it is planned to revise it, the cash register must be modernized and then registered.

Step 1 . Conclude an agreement with a fiscal data operator.

Fiscal data operator (OFD / Operator) is an authorized organization that transmits data to the Federal Tax Service. The whole point of using new cash registers is the transfer of information about cash transactions to the tax office in real time, i.e. online. This will be provided by the Operator. The FTS website has it.

Step 2. Apply for registration of KKM

The application can be filled out and submitted to the tax office in paper form (in person), in electronic form - on the OFD website or on the FTS website.

A new application form for registration (re-registration) of cash register equipment is being prepared, the draft document can be found at http://regulation.gov.ru/. The form approved in 2017 is still valid.

The application for registration of the CCP is a simple document from the Title and 3 sections, below the form and illustrations.

REGISTRATION OF A TAX OFFICE IN MOSCOW AND MO

Registration of the cash register with the tax office of all popular manufacturers of CCP: Atol, Evotor, Mercury, Shtrikh, etc. is offered in 1 day! Low price for one of the important procedures for working at the checkout in our ASC. From 01.02.2017, INFS stopped registering old-style cash registers. The rules for registering new CCPs have now changed. Registration of the cash register in 2019, at present, is carried out according to other rules, the regulations of which are determined by law.

In order for our clients to understand how the registration of cash register with the tax office takes place, we tried to describe this process. So, you have a new cash register or fiscal registrar with online data transfer mode. In order to start working at the checkout, you need to register it. This requires:

- register in the taxpayer's personal account on the IFTS website using an EDS key (electronic digital signature);

- enter information about the cash register in the LC so that the registration of the cash register through the personal account of the Federal Tax Service Inspectorate is successful;

- provide the agreement concluded with the OFD;

- get a registration number at the checkout;

- enter the data of the registration number directly at the cash desk, thereby entering the tax inspector's code into the cash register with long-term fiscal memory;

- send the registration check to the tax office;

- get access to the registration card of the CCP in the personal account of the Federal Tax Service;

- configure data transfer from the cash register to the OFD using the online data transfer mode.

Especially for you, in order to make life easier and not to suspend your business, we offer a choice of several options for checkout registration packages, as well as a number of additional services that allow you to carry out the registration procedure as correctly and efficiently as possible:

The service package "Registration of cash register with the tax office" includes:

1.

Putting the cash register into Operation: commissioning, checking the serviceability and functioning of cash register equipment, sealing, drawing up an act of commissioning

2.

Registration of the cash desk at the tax office through the taxpayer's personal account on the FTS website using the client's digital signature. Further, filling out and submitting an application for registration. Numbers indicating the name of the OFD, obtaining a registration number

3.

Setting up a cash register for connecting to the Internet via WiFi, GSM, Ethernet, USB

4.

Fiscalization of the cash register (the procedure for entering a fiscal registrar or cash register with a fiscal accumulator into operation with an indication of the OFD)

5.

Obtaining a registration card for KKT

6.

Programming check parameters

The service package "Connection to OFD" includes:

1.

Creation and activation of the OFD personal account (conclusion of an agreement with the selected OFD)

2.

Connecting the cash register to the OFD

3.

Verification of data transfer to OFD, test sale

Also, a prerequisite for registering a cash register with the Federal Tax Service under the new procedure is the presence of an EDS and a valid agreement with the OFD (fiscal data operator).

Obtaining an electronic digital signature is possible through the service on our website by clicking on the link: "EDS issue"

You can order the service of connecting to the OFD on our website by clicking on the link: "Agreement with the OFD"

When is the registration of the cash desk in the personal account of the Federal Tax Service considered completed?

Registration is considered complete when the CCP registration card is received from the Federal Tax Service Inspectorate.But is it possible to immediately work at the checkout after receiving the registration card?

When the registration card is received, it is necessary to connect the CCP to the Fiscal Data Operator.

To do this, the cash register is first connected to a PC. Data ports are configured. The first check is broken through, information about which is sent through the OFD to the IFTS.

In fact, the registration of the cash register took place earlier, but it is only now possible to work at KKT under the new law.

If the connection between the cash register and the FDO is configured incorrectly, the data is not transferred to the FDO. So, after 30 calendar days, if the configuration error has not been eliminated, the fiscal drive is automatically blocked, respectively, the cash register is also blocked. To restore the operation of the FN, it is necessary to eliminate the causes of blocking.

As can be seen from the above, registering a cash register is far from the last step to working with a cash register under 54-FZ.

DOCUMENTS REQUIRED FOR REGISTRATION OF CCP

In 2019, the following documents will be needed to register a cash desk with the tax office:

- Passport (form) to the registered cash desk.

- Passport to the Fiscal Drive (FN).

- Organization card (IP) with the obligatory indication of the phone number of the person in charge, with whom you can quickly contact to clarify the data and a valid e-mail, which will receive the Agreement and the invoice from the OFD.

- Lease agreement (or title deed) for the premises where the online cash register will be installed. If you are an individual entrepreneur and are engaged in off-site trade, registration of a cash register for an individual entrepreneur is made at your home address (original and copy).

- Certificate of registration of a legal entity (original and copy).

- Tax Registration Certificate (original and copy).

After all the documents for registration of the CCP have been submitted to the Federal Tax Service, the tax inspector sends the registration number to the cash register.

This number is entered into the cash register. After that, a registration check is made at the checkout, which is subsequently sent to the Federal Tax Service Inspectorate to confirm that the checkout has passed the fiscalization procedure. After that, in the taxpayer's personal account, a registration card for the CCP is formed, which can be downloaded online from the site.

The registration of the cash register with the tax office via the Internet is considered to be successfully completed.

Refusal to register a cash register ,

mainly occurs when there are data entry errors during the fiscalization process.

IS THE CASH REGISTRATION DIFFERENT FOR IE AND LLC?

Is not different. The procedure for registering a cash register for an individual entrepreneur and an LLC is the same, although, as it becomes clear from the above, for registration of a cash register with the tax office, an electronic digital signature is required, the list of documents for the release of which is different for an individual entrepreneur and an LLC.

WHO NEEDS REGISTRATION OF THE CASH REGISTER UNDER 54-FZ?

Registration of cash registers for individual entrepreneurs, as well as those who work on UTII and STS, is a mandatory procedure. This condition for registration of CCP is valid from July 1, 2018. In 2019, a condition is added for the need for a cash register for an individual entrepreneur on a patent. They will also need registration.

The purchase and registration of a cash register in 2019 is not required for those who conduct specific activities. For example, this includes the sale of live fish, vegetables, fruits, milk, butter, beer on tap, the sale of newspapers and magazines (the full list of activities is set out in the law).

Many people ask the question: is the registration of a cash register in the tax office in 2018 necessary for those who are engaged in vending and Internet business? The law establishes a clear calculation procedure for online stores. Even in the case when the interaction between the buyer and the seller takes place remotely, a check is required. It is sent to the buyer by e-mail or by courier in case of home delivery.

Although after registration with the Federal Tax Service it is quite legitimate, it will not be able to fully work. Additionally, the data from the KKT card must be entered into the settings of the personal account on the OFD website. Only then will the entrepreneur be able to fulfill the requirements for transferring data to the FTS servers.

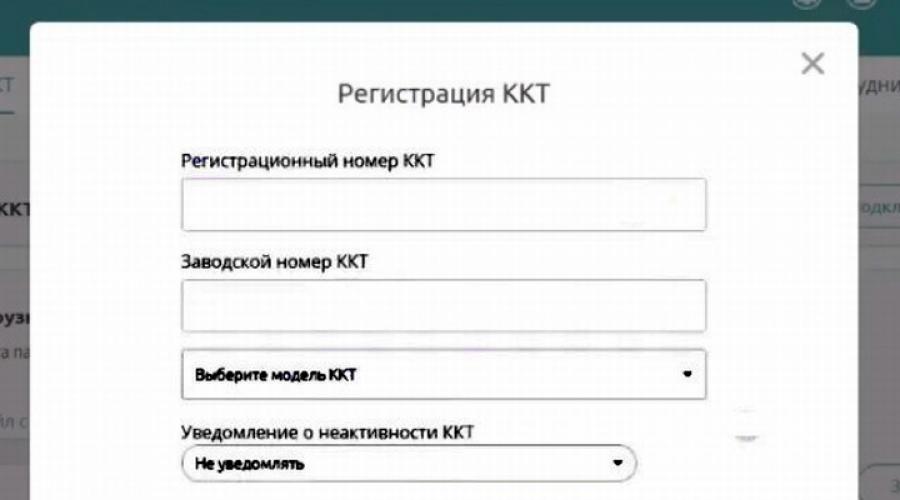

The procedure takes place in fact in one stage. In the menu "Registration of cash register" you need to enter the following data of cash registers:

- The assigned registration number.

- Model.

- Passport serial number of KKT.

- Individual number of the fiscal accumulator.

- Arbitrary name.

A trip to the Federal Tax Service for registration of a cash register

It is easy to register a cash register online, but sometimes there is no way for this: there is no normal Internet, a computer is broken, or you just want to take a walk. The law allows registering the cash register in the old way - by submitting a paper application. For this, only the KND-1110061 form is used.

When submitting an application, you may need a technical passport for the equipment, as well as a document confirming the authority of the entrepreneur or employee of the enterprise. You can ask for help at any branch of the Federal Tax Service, regardless of the place of registration of business and equipment. The tax office is given 5 days to process the application, after which you can come and pick up the paper registration card of the CCP. Her data does not need to be additionally entered in the LC on the FTS website.

Whatever the method of registering an online cash register at the tax office, as a result, the taxpayer receives a CCP registration card in his hands. It contains data for configuring and connecting it to the OFD. Since the CCP requires periodically changing the parameters, it is better to learn how to carry out registration actions on the tax website yourself. This will save both time and money.

We have a ready-made solution and equipment for

Try all the features of the EKAM platform for free

Privacy agreement

and processing of personal data

1. General Provisions

1.1. This agreement on confidentiality and processing of personal data (hereinafter referred to as the Agreement) is freely accepted and of its own free will, applies to all information that LLC Inseils Rus and / or its affiliates, including all persons belonging to the same group with LLC "Inseils Rus" (including LLC "EKAM service") may receive information about the User while using any of the sites, services, services, computer programs, products or services of LLC "Inseils Rus" (hereinafter referred to as the Services) and the course of execution of any agreements and contracts with the User by Insales Rus LLC. The User's consent to the Agreement, expressed by him in the framework of relations with one of the listed persons, applies to all other listed persons.

1.2 Using the Services means the User agrees with this Agreement and the terms and conditions specified therein; in case of disagreement with these conditions, the User must refrain from using the Services.

"Insales"- Limited Liability Company "Inseils Rus", PSRN 1117746506514, INN 7714843760, KPP 771401001, registered at the address: 125319, Moscow, Akademika Ilyushin st., 4, building 1, office 11 (hereinafter - "Insales" ), on the one hand, and

"User" -

or an individual who has legal capacity and is recognized as a participant in civil legal relations in accordance with the legislation of the Russian Federation;

or a legal entity registered in accordance with the legislation of the state of which such a person is a resident;

or an individual entrepreneur registered in accordance with the legislation of the state of which such a person is a resident;

which has accepted the terms of this Agreement.

1.4 For the purposes of this Agreement, the Parties have determined that confidential information is information of any nature (production, technical, economic, organizational and others), including the results of intellectual activity, as well as information about the methods of carrying out professional activities (including, but not limited to: information about products, works and services; information about technologies and research projects; information about technical systems and equipment, including software elements; business forecasts and information about prospective purchases; requirements and specifications of specific partners and potential partners; information, related to intellectual property, as well as plans and technologies related to all of the above) communicated by one party to the other in writing and / or electronic form, explicitly designated by the Party as its confidential information.

1.5. The purpose of this Agreement is to protect confidential information that the Parties will exchange during negotiations, concluding contracts and fulfilling obligations, as well as any other interaction (including, but not limited to, consulting, requesting and providing information, and performing other instructions).

2. Obligations of the Parties

2.1. The Parties agree to keep secret all confidential information received by one Party from the other Party during the interaction of the Parties, not to disclose, disclose, disclose or otherwise provide such information to any third party without the prior written permission of the other Party, with the exception of cases specified in the current legislation, when the provision of such information is the responsibility of the Parties.

2.2. Each of the Parties will take all necessary measures to protect confidential information at least using the same measures that the Party applies to protect its own confidential information. Access to confidential information is provided only to those employees of each of the Parties who reasonably need it to perform their official duties for the implementation of this Agreement.

2.3. The obligation to keep confidential information in secret is valid within the term of this Agreement, the license agreement for computer programs dated 01.12.2016, the agreement of accession to the license agreement for computer programs, agency and other agreements and for five years after termination their actions, unless the Parties separately agree otherwise.

(a) if the information provided has become publicly available without violating the obligations of one of the Parties;

(b) if the information provided has become known to the Party as a result of its own research, systematic observations or other activities carried out without the use of confidential information received from the other Party;

(c) if the information provided is lawfully obtained from a third party without the obligation to keep it secret until it is provided by one of the Parties;

(d) if information is provided at the written request of a public authority, other state body, or local self-government body in order to perform their functions and its disclosure to these bodies is mandatory for the Party. In this case, the Party must immediately notify the other Party of the received request;

(e) if the information is provided to a third party with the consent of the Party, the information about which is being transferred.

2.5. Insales does not verify the accuracy of the information provided by the User and is unable to assess his legal capacity.

2.6. The information that the User provides to Inseils when registering in the Services is not personal data, as they are defined in the Federal Law of the Russian Federation No. 152-ФЗ dated 07/27/2006. "About personal data".

2.7 Insales reserves the right to amend this Agreement. When changes are made in the current edition, the date of the last update is indicated. The new version of the Agreement comes into force from the moment it is posted, unless otherwise provided by the new version of the Agreement.

2.8. By accepting this Agreement, the User realizes and agrees that Inseils can send the User personalized messages and information (including but not limited to) to improve the quality of the Services, to develop new products, to create and send personal offers to the User, to inform the User about changes in Tariff plans and updates, to send the User marketing materials related to the Services, to protect the Services and Users and for other purposes.

The user has the right to refuse to receive the above information by notifying this in writing to the email address of Inseils -.

2.9. By accepting this Agreement, the User understands and agrees that the Inseils Services may use cookies, counters, other technologies to ensure the performance of the Services in general or their individual functions in particular, and the User has no claims against Inseils in this regard.

2.10. The user is aware that the equipment and software used by him to visit sites on the Internet may have the function of prohibiting operations with cookies (for any sites or for certain sites), as well as deleting previously received cookies.

Insails has the right to establish that the provision of a certain Service is possible only provided that the acceptance and receipt of cookies is permitted by the User.

2.11. The user is solely responsible for the security of the means chosen by him to access the account, and also independently ensures their confidentiality. The User is solely responsible for all actions (as well as their consequences) within or using the Services under the User's account, including cases of voluntary transfer of data by the User to access the User's account to third parties on any terms (including under contracts or agreements) ... At the same time, all actions within or using the Services under the User's account are considered to have been performed by the User himself, except for cases when the User has notified Inseils about unauthorized access to the Services using the User's account and / or about any violation (suspicions of violation) of the confidentiality of his account access means.

2.12 The User is obliged to immediately notify Insails about any case of unauthorized (not authorized by the User) access to the Services using the User's account and / or about any violation (suspicion of violation) of the confidentiality of his account access means. For security reasons, the User is obliged to independently carry out a safe shutdown under his account at the end of each session of work with the Services. Insales is not responsible for possible loss or damage to data, as well as other consequences of any nature that may occur due to violation by the User of the provisions of this part of the Agreement.

3.Responsibility of the Parties

3.1. A Party that has violated the obligations stipulated by the Agreement regarding the protection of confidential information transferred under the Agreement is obliged to compensate, at the request of the affected Party, for real damage caused by such a violation of the terms of the Agreement in accordance with the current legislation of the Russian Federation.

3.2. Compensation for damage does not terminate the obligations of the offending Party to properly fulfill its obligations under the Agreement.

4.Other provisions

4.1. All notifications, inquiries, requirements and other correspondence under this Agreement, including those that include confidential information, must be made in writing and delivered in person or by courier, or sent by e-mail to the addresses specified in the license agreement for computer programs dated 01.12.2016, the agreement of accession to the license agreement for computer programs and in this Agreement or other addresses that may be further indicated by the Party in writing.

4.2. If one or more provisions (conditions) of this Agreement are or become invalid, then this cannot serve as a reason for the termination of other provisions (conditions).

4.3 The law of the Russian Federation shall apply to this Agreement and the relationship between the User and Insales arising in connection with the application of the Agreement.

4.3. All suggestions or questions regarding this Agreement, the User has the right to send to the Inseils User Support Service or to the postal address: 107078, Moscow, st. Novoryazanskaya, 18, p. 11-12 Business Center "Stendhal" LLC "Inseils Rus".

Date of publication: 01.12.2016

Full name in Russian:

Limited Liability Company "Insales Rus"

Abbreviated name in Russian:

LLC "Insales Rus"

Name in English:

InSales Rus Limited Liability Company (InSales Rus LLC)

Legal address:

125319, Moscow, st. Academician Ilyushin, 4, building 1, office 11

Mailing address:

107078, Moscow, st. Novoryazanskaya, 18, p. 11-12, BC "Stendhal"

INN: 7714843760 Checkpoint: 771401001

Bank details:

Registration of KKM in Moscow is mandatory for all organizations working with cash. If your organization accepted cash without breaking the cashier's check, then the tax authorities may impose an administrative penalty on it in the form of a fine in the amount of 30 to 40 thousand rubles, and on officials - from 3 to 4 thousand rubles, in addition to this tax authorities can bring the organization to tax liability for "gross violation of the rules for accounting for income", which also entails a fine of 15 thousand rubles (the upper limit of the fine is not limited).

Registration of cash register machines in Moscow

Registration of cash register with the tax office is a process that takes from 4 days to 2-3 weeks, depending on the queue of those wishing to register cash register and deregister it. A list of documents is added to the queues, which must be prepared for registering the cash register with the tax office. Please note that below is a unified list of documents for registering cash register in the tax office. However, when filling out the documents, it is necessary to be guided not only by the official explanations of the Inspectorate of the Federal Tax Service, but also by the wishes of a specific tax authority.

List of documents for registering cash register machines

Today, in 2013, for registration and registration of a KKM with the tax authorities, you will need the following list of documents:

1. - 2 copies. in printed form;

2. - 1 copy. in printed form;

3. Technical passport (form) for KKM with a completed commissioning certificate;

4. Agreement with the technical service center (original or notarized copy + regular copy certified by the seal of the organization);

5. Check with meter readings (if the machine was previously in operation);

6. The register of the cashier-operator in the filled form (form KM-4);

7. Register of calls of technical specialists (form KM-8);

8. (services) sold by the organization;

9. Power of attorney (if the documents are not submitted by the officials specified in the application);

10. Certificate of state registration (original or notarized copy);

11. Certificate of registration with the tax office (original or notarized copy);

12. Passport of the reference version on KKM, consisting of two sheets (original + double-sided photocopy with the seal of the organization);

13. Premises lease agreement (original or notarized copy);

In addition, some tax authorities may require

1. Lease agreement for a legal address (a copy certified by the seal of the organization);

2. Accounting and tax statements for the last reporting period (photocopies with the mark of the inspector or, if the statements were submitted by mail - the original signed by the head and chief accountant + a photocopy of the postal receipt).

List of documents for registration of a new EKLZ and replacement

1. Three acts of KM-2;

2. Act of technical conclusion;

3. Copies of Z-reports before and after replacing EKLZ;

4. Brief report on the old EKLZ;

5. Activation of the new EKLZ;

6. Magazines KM-4, KM-8;

7. CCP registration card;

8. CCP form;

9. Passport for a new EKLZ;

10. in 2 copies;

11. Double-sided copy of the additional sheet of the passport of the version, certified by the seal of the organization;

12. Power of attorney (except for the general director).

For more information on registering cash register you can get from our specialists by phone: 500−84−55; (495) 644−33−17

We save you time and money!

According to the new legislative requirements, in Russia, businessmen and entrepreneurs must necessarily have cash registers registered with the tax service.

We will tell you in detail how to register cash registers on the website of the tax authorities.

Checkout equipment must necessarily comply with the requirements and norms of the current legislation. The checkout must be connected to the Internet, have modern software and be multifunctional and universal.

The Meta technical service center employs highly qualified specialists who will help you choose high-quality equipment for your type of business.

Stage 2. Modernization of the cash register

You can also modify the existing POS printer model without buying a new one.

If you have not yet decided which option to choose, we advise you to familiarize yourself with. It will help you decide if your checkout can be upgraded.

If you have any doubts, call the consultants of the Meta Center.

Stage 3. Registration and execution of documents in the IFTS

Please note that the registration procedure applies not only to the new online cash register, but also to the updated, old one. All the same, you will also have to confirm the modernization.

The registration procedure can take place in different ways:

- Personal appeal to the tax office. It will be necessary to prepare a written statement and documentation package before going to the inspection.

- Registration of equipment through the website of the Federal Tax Service. You will need to register on the official website of the tax service and conduct transactions through your personal account. Remember, you must have received a UKEP (enhanced qualifying electronic signature), otherwise you will not be able to use this method.

- ... Usually this service is paid.

- Registration of documentation through technical service centers. With this option, you do not need to deal with the documents, since the specialists will independently collect the necessary papers and send them to the Federal Tax Service. All you need is your consent to provide this service.