Features and life cycle of a real estate property. Life cycle of a real estate property Life cycles of volumetric planning parts of real estate

Read also

Real estate life cycle (Yanioglo)

Some learned economists believe that real estate as a commodity is a kind of “living organism”, developing, as is known, in the following order: conception - birth - maturity - aging and death. By analogy, the following stages of the life cycle of a real estate property are distinguished: pre-investment (initial) stage of the project (concept, planning, design, etc.), stage of project implementation (construction, installation of equipment), stage of operation of the object (phase of launching to the market, growth, maturity, saturation) and the stage of liquidation (decline). With the help of life cycle theory, it is possible to partially predict the situation, but not in the case of drawing up a forecast model, since in this case the enterprise may lose marketing support.

Life cycle of the real estate market

The rule: “buy low, sell high” applies to real estate as to any other type of investment.

Different market segments behave differently at the same time. For example, construction in one part of the city may rapidly increase in price, while at the same time another part of the city is experiencing stagnation. However, the ability to identify these cycles can provide the customer with additional investment opportunities.

A. Decline cycle. It occurs when the market is oversaturated and the number of vacant buildings begins to increase. The maintenance of unoccupied buildings has a negative impact on the financial condition of the project. This market is a buyer's market. The property owner needs to make intensive efforts in marketing and seeking financial support. A small number of new properties are appearing on the market. Lenders are essentially suspending their operations until the next recovery, and property prices are falling.

B. Absorption cycle. Due to the lack of new construction resulting from the recession cycle, supply and demand in the real estate market is beginning to pick up. The market is moving into a new cycle - the cycle of absorption of the created object. After investment surpluses are absorbed, rental rates will begin to rise. In accordance with the increase in demand and decrease in supply, pre-investment studies are beginning to be carried out on the creation of new real estate properties.

B. New construction cycle. The cycle of new construction corresponds to increased demand in the market for construction projects, along with a reduction in supply for vacant land plots. Rental rates increase along with property prices. During this period, the inflation rate rises and construction costs increase, which increases the selling price of the property.

D. Market saturation cycle. Real estate sales are growing at a slow pace and are eventually declining. There is a surplus of finished construction products and capacity. Employment levels begin to decline and construction activity gradually comes to a halt. The best time to add property is during the acquisition cycle or new construction period.

To assess the efficiency of the real estate market, it is necessary to consider in more detail the life cycle of an object and establish the main critical points in time, the combinations of which will affect the duration of the cycle and the dynamics of changes in costs and results.

Life cycle of a property

Assessing the operating efficiency of any real estate asset (constructed or renovated) involves considering it throughout its entire life cycle. The life cycle of an object from the moment of feasibility study to the moment of physical or moral aging can be divided into three periods:

1 Construction (pre-investment and investment phases);

2 Operation until full payback (entrepreneurial phase of the project);

3Operation with subsequent development of results for the investment (innovation, closure of the facility).

The first period largely determines the efficiency of the object’s functioning. This stage is especially complex, it consists of numerous components, namely: analysis of the conditions for the implementation of the original plan, development of a project concept, assessment of its viability, selection and approval of the location of the facility, environmental justification, examinations, development of a feasibility study, obtaining a construction permit, creation temporary construction infrastructure, creation or renovation of a facility, its commissioning. The second period includes the development of capacity, operation of the facility with stable parameters of its design capacity. Considering the nature of the curve reflecting the change over time in the cost characteristics of the construction and operation of the facility. By determining the relationship between the various phases, it is possible to obtain the comparative effectiveness of the periods of the life cycle of a real estate property, and to analyze the costs and results of the activities of the contractor and the customer.

At the third stage of the object’s life cycle, the period of subsequent development of investment begins. Theoretically, the third period could last quite a long time. A limitation on the feasibility of operating an object is the additional costs of eliminating physical and moral wear and tear.

Duration of real estate life cycle phases (public/private sectors):

Residential buildings– (Conceptual phase 1-4/0.5-2) (Contract phase and detailed design 1-3/0.5 - 4) (Construction 1-4/0.5-1.5)

Industrial facilities- (Conceptual phase 1-4/0.5-6) (Contract phase and detailed design 1-3/0.5-2.5) (Construction 1.5-2.5/0.5-2)

Commercial buildings- (Conceptual phase 0.5-3/1-10)) (Contract phase and detailed design 0.5-2/1-4) (Construction 0.5-1.5/0.5-2)

The duration of the project generally depends on the type of construction; Considerable attention is paid to the conceptual phase of the project in order to obtain maximum efficiency from the invested funds in the future.

Factors in the dynamics of the use value of real estate objects

Without exception, all material objects exist in time and space. Consequently, it is possible to adequately characterize any object only taking into account the spatiotemporal parameters in which it is located and the impacts that are exerted on it. It is also necessary to take into account that although time and space are mandatory conditions for the existence of real estate, they cannot be considered equivalent categories: space (if we consider it not on an abstract-logical level, but in the specifics of natural-material characteristics that have a finite quantitative dimension) itself changes in time. This is a direct consequence of human activity, as a result of which the natural space is consistently transformed with increasing intensity. One of the characteristic features inherent in existence in time (equally related to ongoing processes and material objects) is cyclicality, that is, periodic renewability in time. At the same time, there coexist many cycles that are different in their content, correlating in a certain way, subordinate to each other. The initial ones are natural cycles that have a direct or indirect influence on all others, but are not themselves subject to such influence: a person can actively influence nature in a variety of forms as much as he likes, but it is not in his power to cancel or change the change of seasons or day and night .

Therefore, it is natural that human activity (including economic), which is always carried out in natural conditions, is influenced by these cycles, and sometimes is subject to them. This is most clearly manifested in agriculture and partly in construction, where the entire production process is “tuned” to fluctuations in natural and climatic conditions, and labor results largely depend on these conditions.

At the same time, for the predominant number of specific types of activities, economic cycles are decisive. The very existence, content and dynamics of such cycles are determined by the internal laws of development of the economic system (natural cycles only have a corrective effect in the form of seasonal fluctuations in the market situation). Economic cycles are understood as periodic fluctuations in the intensity of reproduction of economic goods (including the stages of production, exchange, distribution and consumption). The main characteristic of the economic cycle is the rate of economic growth.

TICKET 44 Construction restrictions in the process of urban space development. ???????(Baranova)

45. The process of reproduction in the field of real estate (Trukhina)

Reproduction is a continuous process of renewing fixed assets and preventing its premature wear. In real estate, this is construction. The essence of the concept of real estate management comes down to obtaining the greatest effect from managing the actions of people who implement the project. WITH economic points of view, construction- the branch of material and technical production in which fixed assets for production and non-production purposes are created: ready-to-use buildings, structures and their complexes. Construction refers to the process of constructing or creating infrastructure facilities. The main stages of this process are land acquisition, design, approval of the project by the authorities, the actual process of constructing a building or structure, and putting the facility into operation. As a rule, the work is carried out by a group of specialists from a construction or engineering company under the leadership of a project manager and is controlled by representatives of technical supervision and development engineers (design engineer or project architect).

Professionals who are involved in the development and implementation of construction projects must establish effective mechanisms for planning, budgeting, document flow, timely delivery of construction materials, logistics, workplace safety, etc. In addition, they need to consider the environmental consequences of their work and create minimum temporary inconvenience for the public during the construction stage of the facility.

Ticket 46. Phases of an investment project in the field of real estate. (Yanioglo)

Investment cycle – the period of time between the start of investment and the moment the property is put into operation.

A project viability analysis is conducted before presenting the project to investors to determine whether the project is worth further investment of time and money, and what sources exist to cover all costs and generate normal profits.

There are 3 phases of the life cycle of an investment project, which themselves consist of stages and phases:

1. Pre-investment phase(feasibility study):

1.1 Pre-investment studies and preliminary project planning

· list of potential investors;

· information about the project - goals, analysis of conditions, etc.;

1.2.Market opportunities: market analysis, price dynamics, supply and demand, etc.;

1.3.Material and labor resources:

· material forms of production (quality, availability of resources);

· determination of the need for labor resources;

1.4. Selection and approval of the location of the facility (analysis of location, environment, final selection of construction site);

1.5.Financial analysis and investment assessment (risk analysis, costs, development of a financial plan);

1.6.Development of a market and technical plan for project implementation (monitoring the implementation of the loan agreement).

2. Investment phase:

2.1. General planning stage, development of design and estimate documentation (development, coordination and approval of a feasibility study, obtaining a construction permit);

2.2.Conducting tenders and concluding contracts (drawing up a proposal for a contract, a contract);

2.3. Stage of implementation and completion of the project (construction):

· quality planning and management structure;

· implementation and delivery of the object.

3. Entrepreneurial phase:

3.1. The developer’s work on managing the finished property (ordering and placing equipment, furniture);

3.2.Owner’s work in property management:

· property management procedure;

· real estate maintenance;

3.4. Property management from the user side (control over the use of premises, organizational and technical support, etc.).

The implementation of investment goals involves the formation of investment projects that provide investors and other project participants with the necessary information to make an investment decision.

The concept of an investment project is interpreted in two ways:

1. as an activity (event) involving the implementation of a set of actions that ensure the achievement of certain goals;

2. as a system that includes a certain set of organizational, legal, settlement and financial documents necessary for carrying out any actions or describing these actions.

There are various classifications of investment projects. Depending on the characteristics underlying the classification, the following types of investment projects can be distinguished.

By attitude to each other:

· independent allowing simultaneous and separate implementation, and the characteristics of their implementation do not affect each other;

· mutually exclusive those. not allowing simultaneous implementation. In practice, such projects often perform the same function. Of the set of alternative projects, only one can be implemented;

· complementary the implementation of which can only occur jointly.

By implementation time(creation and operation):

· short-term (up to 3 years);

· medium-term (3-5 years);

· long-term (over 5 years).

By scale(most often the scale of the project is determined by the size of the investment):

· small projects, the action of which is limited to the framework of one small company implementing the project. Basically, they represent plans to expand production and increase the range of products. They are distinguished by relatively short implementation times;

· medium projects- These are most often projects for reconstruction and technical re-equipment of existing production facilities. They are implemented in stages, for individual productions, in strict accordance with pre-developed schedules for the receipt of all types of resources;

· major projects- projects of large enterprises, which are based on a progressive “new idea” of producing products necessary to meet demand in the domestic and foreign markets;

· megaprojects- these are targeted investment programs containing many interrelated final projects. Such programs can be international, state and regional.

According to the main focus:

· commercial projects, whose main goal is to make a profit;

· social projects oriented, for example, to solving problems of unemployment in the region, reducing crime levels, etc.;

· environmental projects, the basis of which is the improvement of the living environment;

· other

Depending on the degree of influence of the results of the investment project on internal or external markets for financial, material products and services, labor, as well as environmental and social conditions:

· global projects, the implementation of which significantly affects the economic, social or environmental situation on Earth;

· national economic projects, the implementation of which significantly affects the economic, social or environmental situation in the country, and their assessment can be limited to taking into account only this impact;

· large scale projects, the implementation of which significantly affects the economic, social or environmental situation in a particular country;

· local projects, the implementation of which does not have a significant impact on the economic, social or environmental situation in certain regions and (or) cities, on the level and structure of prices in commodity markets.

A feature of the investment process is its association with uncertainty, the degree of which can vary significantly, therefore, depending on the amount of risk, investment projects are divided as follows:

· reliable projects, characterized by a high probability of obtaining guaranteed results (for example, projects carried out under government orders);

· risky projects, which are characterized by a high degree of uncertainty of both costs and results (for example, projects related to the creation of new industries and technologies).

In practice, this classification is not exhaustive and allows for further detail.

However, the development of any investment project - from the initial idea to operation - can be presented as a cycle consisting of three phases: pre-investment, investment and operational (or production). The total duration of the three phases constitutes the life cycle (lifespan) of the investment project.

Characteristics and classification of commercial real estate.

Classification of real estate objects.

THE CONCEPT AND ESSENCE OF REAL ESTATE.

According to part one of paragraph 1 of Art. 130 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation), immovable things include land plots, subsoil plots, isolated water bodies and everything that is firmly connected to the land, that is, objects whose movement without disproportionate damage to their purpose is impossible, including forests, perennial plantings, buildings, structures.

In world practice, real estate is understood as a plot of land and everything that is under it with a projection to the center of the earth, and everything that is above it, extended to infinity, including permanent objects attached to it by nature or man, as well as rights to these objects .

The concept of real estate in world practice can be presented in the form of five blocks, four of which reflect the physical composition, and the fifth – legal content:

1) land

2) objects above the surface of the site

3) property under the surface of the site, including minerals

4) airspace

5) a set of rights to real estate objects

Each real estate object and all of them taken together have significant (generic) characteristics that allow them to be distinguished from movable things, and specific characteristics that characterize the features of objects in homogeneous groups, which are presented in Table 1.2.

Table 1.2 - Main characteristics of real estate

| Signs | Contents (status) |

| Essential (generic) | |

| Degree of mobility | Absolute immobility, non-movement in space without compromising functionality |

| Connection with the earth | Strong physical and legal |

| Form of operation | Natural-material and cost |

| State of the consumer form during use | Not consumed, retains its natural form throughout its entire lifespan |

| Duration of the circuit | Reusable and land is endless when used correctly |

| A method of transferring value in the production process or losing consumer properties | Gradually as wear and tear accumulate and depreciation charges accumulate |

| Social significance | The use of an object often affects the interests of many citizens and other owners, whose interests are protected by the state |

| Species (private) | |

| Technical and technological characteristics | They are determined by specific private indicators depending on the type of real estate and the feasibility of extending a special regime of use to other property. Inextricable unity with functionality |

The main fundamental properties of real estate are immobility and materiality, or non-consumability, on which all its other generic and specific characteristics are based. The terms “real estate”, “immovable things”, “real estate” can be used depending on the context to reflect economic, legal or physical relationships. In accordance with the provisions of the Civil Code of the Russian Federation, real estate objects can be classified as follows: Land plots. Subsoil areas Separate water bodies. Forests. Perennial plantings. Artificial structures inextricably linked to the earth. Enterprises. Other property classified by law as real estate and subject to state registration.

Real estate objects can be classified:

1. Natural (natural) objects - land, forest and perennial plantings, isolated water bodies and subsoil areas. These properties are also called “real estate by nature.”

2. Artificial objects (buildings):

a) residential real estate - a low-rise building (up to three floors), a multi-storey building (from 4 to 9 floors), a high-rise building (from 10 to 20 floors), a high-rise building (over 20 floors). A residential property can also be a condominium, a section (entrance), a floor in an entrance, an apartment, a room, a country house;

b) commercial real estate - offices, restaurants, shops, hotels, rental garages, warehouses, buildings and structures, enterprises as a property complex;

c) public (special) buildings and structures:

Medical and health care (hospitals, clinics, nursing homes and children's homes, sanatoriums, sports complexes, etc.);

Educational (kindergartens and nurseries, schools, colleges, technical schools, institutes, children's art centers, etc.);

Cultural and educational (museums, exhibition complexes, cultural and recreation parks, cultural centers and theaters, circuses, planetariums, zoos, botanical gardens, etc.);

Special buildings and structures - administrative (police, court, prosecutor's office, authorities), monuments, memorial buildings, train stations, ports, etc.;

d) engineering structures - reclamation structures and drainage, comprehensive engineering preparation of land for development.

Artificial objects are called “real estate by law,” but this category of real estate is based on “real estate by nature.” Artificial objects can be completely built and ready for operation, may require reconstruction or major repairs, and also refer to unfinished construction projects (unfinished). “Unfinished” refers to objects for which documents on acceptance of the object into operation have not been drawn up in the prescribed manner. Objects of unfinished construction can be divided into two groups: objects where work is underway, and objects where work has been stopped for one reason or another. In accordance with the current procedure, there are two types of cessation of work at a site: conservation and complete cessation of construction. The decision to terminate construction is made by the developer.

Land plots can be divisible and indivisible. A plot is called divisible when it can be divided into parts and form independent plots of land with permission for the intended use.

In relation to residential real estate, several typological constructions are possible. For example, depending on the duration and nature of use of the housing:

Primary housing is a place of permanent residence;

Secondary housing - suburban housing used for a limited period of time;

Tertiary housing - intended for short-term accommodation (hotels, motels, etc.).

In relation to the conditions of large cities, it is customary to distinguish the following typological characteristics: Elite housing. Superior housing. Typical housing. Housing of low consumer quality

There is also a classification of residential real estate depending on the material used for the external walls of the building: houses with brick walls; panel houses; monolithic houses; wooden houses; mixed type houses.

According to Asaulov A.N. Real estate objects can also be classified by status. According to their physical status, they distinguish: land plots; buildings, structures, structures; premises.

A more detailed classification of the stock of real estate objects by purpose contains the following list of types and subtypes of objects:

a) land plots in cities, towns, and other populated areas:

For housing (residential area),

For industrial, transport, service sector enterprises,

For agricultural and defense enterprises (non-residential territory),

For parks and green spaces, water bodies (recreational areas),

For engineering and transport infrastructure (general purpose territory)

b) land plots outside settlements (inter-settlement territories):

For country and garden use,

For residential development,

Industrial and other special purposes (industry, transport, energy, defense, etc.),

Agricultural purposes,

Environmental, nature reserve, health, recreational, historical and cultural purposes,

Forest fund, water fund,

Subsoil areas,

Reserve lands, the purpose of which is not defined

2) housing (residential buildings and premises):

Multi-apartment residential buildings, apartments in them and other premises for permanent residence (in holiday homes, hotels, hospitals, schools, etc.)

Individual and two- to four-family low-rise residential buildings (old buildings and houses of the traditional type - households and new types - cottages, townhouses)

3) commercial real estate:

Office buildings and administrative office premises

Hotels, motels, holiday homes

Shops, shopping centers

Restaurants, cafes and other catering establishments

Consumer service points

4) industrial real estate:

Factory and factory premises, buildings and structures for production purposes

Bridges, pipelines, roads, dams and other engineering structures, parking lots, garages

Warehouses, storage facilities

5) real estate for social and cultural purposes:

Government and administrative buildings

Cultural, recreational, educational, sports facilities

Religious objects.

By type of ownership, real estate is divided into:

Private – owned by citizens and legal entities created as private owners

State - federally owned, owned by federal subjects

Municipal – municipally owned

Public – owned by public associations

Collective (mixed) – jointly or sharedly owned by various property entities (private, state, municipal, public).

According to their legal status, real estate objects are divided, depending on the type, into those used by the owner or tenant, privatized, acquired through a purchase and sale transaction, inheritance, gift, etc.

Rice. 1.1 General classification of real estate

Commercial real estate in Russia began to take shape only with the beginning of the privatization of enterprises. The commercial real estate sector is much smaller than the residential sector, and therefore there are correspondingly fewer transactions, although commercial real estate is the most attractive all over the world. It should be noted that in this sector the predominant form of transactions is rent.

Commercial real estate can be divided into income-generating - commercial real estate itself and creating conditions for its extraction - industrial (industrial) real estate.

Income-generating real estate includes:

1. Office premises. When classifying office premises in each region or municipality, various factors are taken into account by which the premises belong to one class or another. This may be location, quality of the building (level of finishing, condition of the facade, central entrance, availability of elevators), quality of management (management company, availability of additional services for tenants), etc.

2. Hotels. Hotel projects in the Russian Federation today are the most complex types of investment in profitable real estate. The construction of new or reconstruction of old hotels of the highest class, their equipment and operating costs are considered a rather risky investment, because the costs of such projects are several times higher than the costs of constructing fashionable shopping complexes or office centers. In addition, five-star hotels have very long payback periods, so the Russian income-producing real estate market gravitates towards hotels with low tariffs and lower capital investments.

To date, for example, the hotel complex of St. Petersburg is very diverse and includes more than 100 objects of various categories with 27 thousand beds. Most of these hotels are small. More or less noticeable include 30 hotels, which account for 55% of the total number of hotel beds in the city. Large mid-level hotels include: Pribaltiyskaya, Pulkovskaya, Moscow, St. Petersburg. There are not enough mid-level hotels in St. Petersburg. Five-star hotels include: Grand Hotel Europe and Nevsky Palace. The return on investment in hotel construction is: for three-star hotels - 8 years; according to five-star ones - no less than 13 - 15 years.

These and other well-known, well-located hotels have cafes, restaurants and bars, equipped recreation areas, casinos, etc. Less popular, smaller hotels located in less prestigious areas tend to provide higher quality accommodation and service and have their own clientele.

3. Parking garages (parking lots) as commercial real estate are practically not being developed in the country, although there are prospects. After all, for every thousand residents, in accordance with the standards, about 150 park spaces are required.

Currently, less than 60% of the passenger car fleet has permanent storage space, of which only 2% are located in underground garages, although the need for them is very high. Due to the high cost of a parking space (4-6 thousand US dollars, and in the city center prices reach 10-12 thousand US dollars), there is no mass construction of car parks. Based on a mass client, the cost of one parking space should be in the range of 2 - 3 thousand US dollars, i.e. amount to about 30% of the cost of the car. Please note that it is currently extremely difficult to re-register a single garage box, because... The State Institution “City Bureau of Real Estate Rights Registration” (GU RBR) does not deal with registration of garages. To solve this problem, it is necessary to create a unified system for registering ownership rights for garages of various types.

4. Shops and shopping complexes. As the experience of large European cities has shown, good conditions for the location of multifunctional shopping centers (MTC) are: the intersection of major highways, the close proximity of metro stations and ground transport stops. Most often, such centers turn out to be located in “dormitory” areas, or outside the city, in fact, in a vacant lot, near a major highway. In the USA, ITCs (“MALL”), as a rule, are located outside the city, which can be explained by a certain number of vehicles per capita, the population of cities and other factors. These differences accordingly affect the requirements both at the stage of forming the overall ITC business strategy -planning, design and promotion, as well as during the construction and operation of a shopping center.For example, the number of parking spaces, the availability and parameters of recreation and entertainment areas, related household services, etc. will be different.

Factors that determine success include:

Correctly chosen location;

Drawing up a functional solution and accumulation - the needs of potential visitors;

A correctly compiled forecast for the development of the territory adjacent to the development site (for 5-10 years);

The general atmosphere of the ITC, which is achieved in the process of design and design development;

Well-designed selection of tenants;

The right management company.

For shopping complexes, in addition to the listed factors, it is especially necessary to provide services to its tenants (for example, constant cleaning of the territory, repair service for scales, 24-hour security, cardboard pressing, etc.).

It should not be assumed that the development of multifunctional shopping centers is a Western invention. It is well known that the considered tradition of the development of large retail premises, arcades, courtyards, where “every” visitor could buy whatever his heart desires, in accordance with needs and income, where one could come “to look at others and show off oneself”, is disappearing roots in the past.

The country's regions are in different economic conditions and develop according to their own complex laws, therefore in modern Russia the process of the emergence of new or modernization of old shopping centers is heterogeneous. Moscow is leading in this process as a global metropolis, existing in comparison with other Russian cities in the most favored investment regime.

The problems causing a shortage of liquid and investment-promising retail real estate in most Russian cities are similar and are associated, first of all, with the structure of the non-residential stock that emerged in the pre-reform period:

A small share of non-residential premises is allocated for profitable entrepreneurship, a significant part of which is occupied by various organizations;

The unsatisfactory location of many objects that are functionally suitable for commercial use does not allow their development;

In large industrial cities, the structure of the non-residential stock has an excessively high share of industrial real estate, the repurposing of which requires significant investments and is often difficult due to an unclear legal status;

Most of the non-residential stock is in unsatisfactory technical condition;

In most cities, investment activity is concentrated primarily in the city center.

At this time, stores with an area of 100 - 200 square meters are in greatest demand. m., then, in descending order - less than 100 sq. m. and in the range of 200 - 400 sq. m. Areas of more than 500 sq. m. m are less in demand. Among the main requirements of tenants are display windows and parking.

5. Industrial (industrial) real estate in Russia is in the initial stage of development, although recently the owner has been determined for the bulk of privatization objects. Before concluding a transaction, it is necessary to conduct a comprehensive analysis of the title documents to ensure that the seller’s rights to the proposed object are indisputable, the possibility of its legal alienation and the rights of the new owner to use this object for its intended purpose. As the process of forming a real owner develops, the volume of transactions in this area will increase. But this is one side of the issue. On the other hand, in almost every city in the country you can see empty buildings of factories and factories of 5 - 8 floors with dilapidated and (or) utility networks that have fallen into disrepair and broken glass windows. They stand and do not find an effective owner. There are several reasons:

Industrial development 60 - 80 years. does not meet the requirements of modern technologies, and reconstruction requires large capital investments.

Currently, the main consumer of industrial real estate is small enterprises that require real estate objects of a certain specificity for their development: high power, the presence of railway access roads, one-story and preferably detached buildings with autonomous communications.

As a rule, the requirements of potential tenants are excessive and do not correspond to the proposed industrial facilities.

Owners of industrial real estate offer properties on the market that are in poor condition, and at the same time set inflated prices.

More or less complete and accurate information about industrial real estate, its legal status, size, condition, etc. absent.

All this gives the industrial real estate market a spontaneous and unpredictable character.

Office buildings can belong to different classes. Assignment to one class or another depends on a number of criteria:

1. High quality standard finishes, modern building engineering systems including BMS (Building Management System);

2. Professional building management;

3. Good location of the building within the boundaries of the office district, convenient access and transport links;

4. Air conditioning system: at least two-pipe, or its equivalent;

5. Suspended ceilings;

6. Height from floor to suspended ceiling on average 2.7 m;

7. Efficient open floor plan (structure with load-bearing columns);

8. Three-section box for electrical, telephone and computer cables, or a raised floor (or the possibility of installing it);

9. Modern, high-quality windows, their rational arrangement;

10. Modern high-speed elevators with a waiting period of no more than 30 seconds;

11. Underground parking;

12. High-quality materials used in the decoration of common areas;

13. The ratio of parking spaces (ground and underground) is at least 1 space per 100 sq. m. m. rentable area of the building;

14. Loss factor (ratio of used and rented space) no more than 12%;

15. High-quality telecommunications service provider in the building;

16. Two independent power supplies or an uninterruptible power supply; (the power supply power for the tenant’s low-voltage networks must be at least 50 W per 1 sq.m. of usable area + 20 W additionally allocated for lighting);

17. Permissible load on interfloor ceilings: 400-450 kg per 1 sq.m.;

18. Modern security systems and access control to the building;

19. Cafeteria/canteen for employees and other amenities;

20. The depth of the floor from window to window is no more than 18-20 meters.

A Class A office building must meet or exceed a minimum of 16 of the 20 standard criteria, and a Class B office building must meet at least 10 of the 20 specified criteria. A Class C office building meets less than 8 of the 20 criteria given.

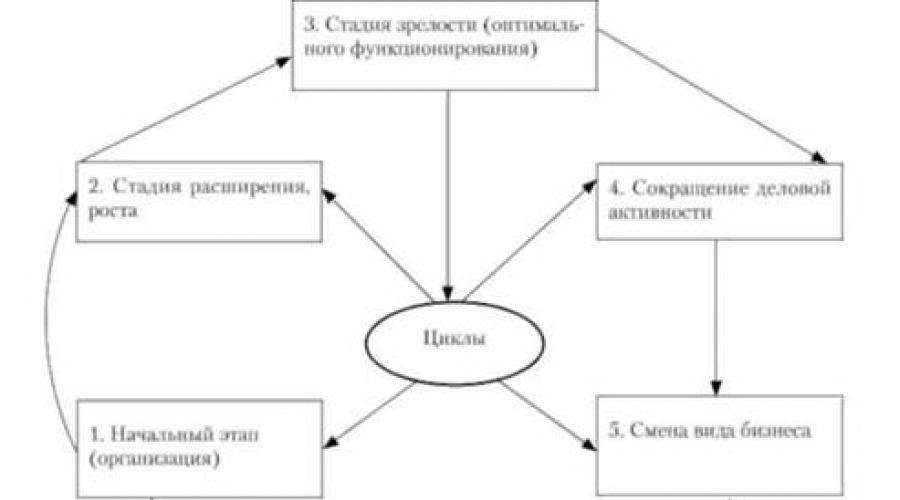

Life cycle- this is a complete sequence of processes of the existence of real estate from commissioning (from creation) to termination.

In theory and practice, there are five types of cycles:

Ø life cycle of an enterprise as a property complex;

Ø life cycle of a business type;

Ø business cycle;

Ø life cycle of real estate (product) as a physical

object;

Ø approximate life cycle of real estate as a property.

Some learned economists believe that real estate as a commodity is a kind of “living organism”, developing, as is known, in the following order: design - birth - maturity - aging and death. By analogy, the following stages of the life cycle of a real estate property are distinguished:

Ø pre-investment (initial) stage of the project (concept, planning, design, etc.),

Ø project implementation stage (construction, installation of equipment),

Ø stage of operation of the facility (phase of launching into the market, growth, maturity, saturation)

Ø stage of liquidation (decline).

With the help of life cycle theory, it is possible to partially predict the situation, but not in the case of drawing up a forecast model, since in this case the enterprise may lose marketing support.

Assessing the operating efficiency of any real estate asset (constructed or renovated) involves considering it throughout its entire life cycle. The life cycle of an object from the moment of feasibility study to the moment of physical or moral aging can be divided into three periods:

I. Construction (pre-investment and investment phases);

II. Operation until full payback (entrepreneurial phase of the project);

III. III.Operation with subsequent development of results for the investment (innovation, closure of the facility).

In Fig. 2.1. The life cycle of a property is schematically represented.

Rice. 2.1. Stages of the life cycle of a real estate property

The first period largely determines the efficiency of the object’s functioning. This stage is especially complex, it consists of numerous components, namely: analysis of the conditions for the implementation of the original plan, development of a project concept, assessment of its viability, selection and approval of the location of the facility, environmental justification, examinations, development of a feasibility study, obtaining a construction permit, creation temporary construction infrastructure, creation or renovation of a facility, its commissioning.

The second period includes the development of capacity, operation of the facility with stable parameters of its design capacity. Considering the nature of the OA curve, A 2 A 3 A 4, reflecting the change over time in the cost characteristics of the construction and operation of the object, we see that at the first stage of the life cycle, the OA curve falls and corresponds to the investor’s costs for creating or updating the property. Point A corresponds to the total volume of investment. Since the most important principle of the reproduction of an object in dynamics is the integrity of the cycle and its development over time, all types of costs and results are plotted along the t axis. To analyze the life cycle of an object, several phase values should be used, which characterize the time intervals for the manifestation of critical points from two life cycle values. Such a key point is considered to be the time of putting the object into operation A, in relation to it the following phases are determined: t t - preparation and construction of the object, t 2 - development of capacity (payback period), t 3 - start of making a profit (achieving the planned cost level, return on investment during the period of development), t 4 – the beginning of moral and physical wear and tear of the object. Particularly important are the phases that characterize the time of creation (updating) of an object and its lifetime during operation. By determining the relationship between the various phases, it is possible to obtain the comparative effectiveness of the periods of the life cycle of a real estate property, and to analyze the costs and results of the activities of the contractor and the customer. At the third stage of the life cycle of object A 2, A 4, a period of subsequent development for investment begins.

Theoretically, the third period could last quite a long time. A limitation on the feasibility of operating an object is the additional costs of eliminating physical and moral wear and tear.

Table 2.1 shows the duration of the first period of the life cycle of various types of projects.

Introduction

The problem of effective real estate development, including the tasks of management, financing and personnel training, is a pressing topic both today and for the long term. This relevance is directly determined by the essence of real estate and its role in the national economy. The main characteristics of real estate can be presented as follows:

Real estate is the functional basis of national wealth and the most important element of cultural and historical heritage;

The real estate market is a kind of generator of the country’s economic growth;

Real estate performs a vital social function, as it ensures the satisfaction of the basic needs of all members of society without exception.

It follows from this that real estate is a special object of market turnover, ownership and management.

The understanding of real estate as the foundation of national wealth can be traced back over many centuries.

As the market economic system developed, urgent needs for solving problems related to real estate required large-scale training of specialists. A natural consequence was the founding of an institute for training surveyors in London in 1868. In 1881 it was awarded the title of royal and since then it has been called the Royal Institution of Chartered Surveyors. Surveyors perform the functions of collecting, providing and processing information about real estate, urban planning, preparation and implementation of development projects, assessment and management of real estate, repair, reconstruction and modernization of buildings, construction inspection, and take part in the sale and rental of commercial real estate.

A real estate property and, moreover, their totality are a complex system that is influenced by various factors during its life cycle. Determining the cost equivalent in this case becomes possible only as a result of applying a systematic approach to real estate analysis. The concept of this approach has received the name surveying in world science and practice (from the English Survey - surveying, survey, inspection).

The purpose of this work is to analyze what happens to a property during its life cycle.

1. General pattern of real estate functioning over time

The general pattern is obvious: consumer properties that are consistently lost over time (and they cannot not be lost, since there are no eternal things) lead to a decrease in the usefulness of real estate, i.e. to a decrease in its use value. Changes similar in nature to the dynamics occur with the value equivalent, since use value and value are two integral characteristics of any product of labor. The decrease in value, in turn, leads to a change in the value equivalent of a specific type of use (the price of a product or the amount of total income) (it is called “value in use”). Thus, all links of a single cause-and-effect relationship: use value -> total value -> value in use are subject to the general pattern of change over time. It is not difficult, however, to notice that the substantive characteristics of these changes are different. The consumer characteristics of a real estate object are embodied in its “physical body”, therefore, the real consumer value can only be determined through a survey, an examination of the actual state of this “physical body”. We should also not forget that the usefulness of a particular thing is never a completely objective category. It is necessarily formed with the participation of the potential consumer’s ideas, i.e. is influenced by consumer preferences.

If we turn to the substantive side of the change in value, we must immediately note that it is directly influenced by the conditions of reproduction - in different periods of time, the creation of real estate objects with similar consumer properties requires less and less labor input. A distinctive feature of real estate in this regard is that the volume of living labor remains significant; the replacement of living labor with materialized labor (i.e., the replacement of human physical costs with the work of machines and mechanisms) occurs at a slower pace compared to other industries. However, the general pattern remains unchanged - the cost of the finished property consistently decreases over time. Naturally, the actual value of the cost can be determined only by conducting a detailed analysis of the conditions of reproduction.

The process of changing the value in use is also very unique and specific. If for real estate - a good - it actually coincides with the dynamics of value, then for real estate - a product and real estate - a source of income, this is not the case. The reason is obvious: the product and source of income are realized in their own independent environment, namely, in the corresponding market. Determining the parameters for finding value in use also involves conducting appropriate examinations.

The location also has its own special dynamics. Although it is unchanged for a particular object, this does not mean that its impact on value is equally unchanged. An object always exists in a spatial environment, which develops over time, losing some characteristics and acquiring others. The content and extent of these changes have their own significant specificity associated with consideration of the city as a whole. Accordingly, the examinations carried out must have their own content.

There is another aspect of dynamics - the possibility of changing the type of use of a property at different stages of the life cycle. This means that previous influencing factors cease to operate and new ones appear. We can say that in this case, the value in use moves to another “dynamic trajectory” with changed parameters.

At each specific moment of the life cycle, the influence of factors will be very complex and ambiguous, which significantly complicates the determination of the cost equivalent. It is clear that the dynamics of consumer value will be the calmest. The dynamics of income will be more active, and the greatest variability is characterized by the value equivalents of objects - goods (that is, market prices). Let us emphasize once again that any type of value is multidimensional; it can be quantified only on the basis of determining a large number of diverse examinations.

Technical expertise. This group includes all types of examinations of the “physical body” of real estate objects. They are the starting point for determining any cost indicators and therefore should be considered strictly mandatory. Without determining the real utility of a property, no other type of value can be determined. Technical examinations also include those examinations that are associated with the analysis of the technical parameters of the reproduction of real estate objects (the composition and productivity of the machines and mechanisms used, the proportions of living and embodied labor, etc.).

Economic expertise. These include all types of analysis related to the cost (monetary) assessment of influencing factors. These include fluctuations in market conditions, determination of the amount of costs by type of reproductive activities, parameters of the financial system, level of taxation, and all classes, types, types of risks, etc.

Location expertise. Their peculiarity can be considered a significant share of expert methods. The city cannot be accurately “measured”, and the need for such “measurement” exists, since not a single real estate object exists outside of its spatial environment. Location expertise includes: infrastructure, ecology, government regulation, zoning, topography, boundary description, etc.

If we briefly define the essence of all examinations, then they represent one or another assessment of a property at a specific point in its life cycle. It must be especially emphasized that in this case the term “assessment” has a fundamental difference from the widespread interpretation, according to which assessment is understood as the determination of market value. From the perspective of real estate economics, valuation should be understood as determining the level of use value, total value or value in use compared to the maximum value. Vmax occurs at the beginning of the life cycle, then it steadily decreases. In general, the examination of a property is carried out at a subsequent point in time in relation to the beginning of the life cycle, which means the purpose of the examination is to determine the degree of loss of Vmax, assessing its real level.

2. Stage of problem formulation based on the concept of servicing

Surveying is the implementation of a systematic approach to the development and management of real estate. It includes all types of planning (general, strategic and operational) for the functioning of real estate, as well as activities related to the full range of technical and economic examinations of real estate objects, ensuring the maximum social effect.

Historically, surveying was first formed in England in the 15th-16th centuries. and at the initial stage included the functions of specially authorized government officials for land surveying, registration of land property and rights to them. This is understandable, since in that era land was considered the main wealth, the basis of life and the main source of income. One of the founders of economic science, W. Petty, expressed this in wonderful words: “Labor is the father and active principle of wealth, and land is its mother.” The basis for the development of the English economic school and practice were issues related to real estate.

Providing a systematic approach to real estate, its detailed analysis, and the development of effective management strategies are a pressing task for Russia, which is forming a market economic system. That is why the consideration of issues of real estate economics in this textbook is carried out in accordance with the concept of surveying.

Since the main thing in surveying is a systems approach, first of all it is necessary to characterize surveying in terms and categories of systems.

Hereinafter, a system is understood as an ordered set of elements that are in relationships and connections with each other, which form a certain integrity, unity. The most significant characteristic of a system is its emergence, which means the irreducibility of the properties of the system to the properties of its constituent elements (indicators of individual elements of an object, as a rule, do not reflect the properties that are inherent in the object under consideration as a whole). The types of elements and connections can be very different, and their choice for analysis depends on the formulation of the specific problem. A system may consist of various subsystems, subsystems, and may itself be a subsystem of another system. The composition of elements and the order of connections between them is called the structure of the system. Elements influence objects using resources (potential). From the point of view of complexity (type, number of elements and connections), simple, complex and super complex systems are distinguished. Depending on the degree of predictability of behavior, systems are divided into: deterministic (functional), all results whose actions can be precisely determined, and probabilistic (stochastic), for which these results can only be predicted within the limits of some diagnosis of possible values. In accordance with this division, there are two types of connections - functional (each value of a factor characteristic corresponds to a well-defined non-random value of an effective characteristic) and stochastic (each value of a factor characteristic corresponds to a set of values of an effective characteristic).

There are abstract and concrete systems. An abstract system is a system without input and output streams (for example, a system of enterprise goals, a mathematical system of equations, etc.). A specific system is built on connections between elements through process (actions) on input and output streams.

The state of the system is determined by the totality of the states of all its elements and connections, and the system is evaluated depending on its intended purpose by reliability. For example, to evaluate technical systems (machines, mechanisms, etc.) the concept of technical reliability is used. All business entities, according to their intended purpose, are economic systems and, accordingly, are assessed by economic reliability. The economic reliability of a particular system means its ability, with the help of production, organizational, financial and other decisions, to achieve the desired result with a given probability under conditions of risk and some uncertainty within the given boundaries of the area of effective combination of the main parameters of the system - its profitability and sustainability.

If we consider the system as a goal-oriented integral structure, then obtaining the output (functioning result) of the system is possible only with the interaction of various resources necessary to solve the assigned tasks, coordinated in time and space. Ensuring effective interaction of resources is carried out by managing this process.

The goal of managing a production system is to ensure a state of the system in which the highest possible output with the required quality parameters and the necessary economic reliability will be obtained. The basis of management is planning, during which a model of the state of the system is created for the upcoming time period or for the entire period of its life cycle.

Methodology (from ancient Greek “methodos” - method of action and “logos” - teaching, science) is the study of structure, logical organization, methods and means of activity. The most important points of application, practical manifestations of the methodology are:

formulation of the problem;

construction of the object and subject of research;

building a scientific theory;

checking the result obtained from the point of view of its truth, i.e. compliance with the object of study.

The servicing theory is a form of organization of scientific knowledge that gives a holistic understanding of the patterns and existing connections in the creation, use and operation of real estate at all stages of the life cycle.

The very development of the concept of Surveying as a system is the subject of meta-planning, including general target planning and planning of functional strategies for the establishment and development of real estate. This approach makes it possible to determine the hierarchy of system elements, the type and number of subsystems, their content, permanent and temporary relationships. In this case, the specific features and capabilities of each property separately must be taken into account.

The complexity of economic, organizational and technical relationships between elements of systems and subsystems predetermines the need to take into account the specific features of real estate when studying the process of functioning of Surveying as a system, namely:

Firstly, the properties of a system are not a simple sum of the properties of its elements; the system also has other properties that arise precisely because of the presence of relationships between its elements (the law of emergence);

Secondly, the complexity of the formation and development of real estate, as a really existing object of research, requires simplification, displaying only the most important, from the point of view of a specific research task, properties and relationships of elements and the system as a whole;

Thirdly, Surveying as a system cannot function without interactions with the external environment, which has a very significant impact on the conditions and results of the formation and development of real estate.

Therefore, servicing is an open system that is in continuous interaction with other systems, being a subsystem of a more general (macroeconomic) system.

3. Goals, objectives and tools of the servicing system

real estate surveying planning time

The system is constantly affected by multidirectional forces: on the one hand, there is a desire of the system for self-preservation, which is manifested in the fact that any economic system (for example, an enterprise) prefers not to change the established rhythm of production, to maintain the existing range of commercial products for as long as possible, etc. ., since, other things being equal, this helps reduce costs and maximize profits and, in addition, makes the operation of the enterprise much more predictable and stable. However, at the same time, the enterprise is affected by “disturbing” factors that objectively induce the enterprise to change (changes in market conditions, the emergence of new technologies, etc.).

The first of these factors are internal; they are aimed at maintaining the system in its existing form. At the same time, a system whose connections between its elements are stronger and closer (for example, a system of mass construction) has a higher ability for self-preservation.

Second, the factors affecting the system are external. They cause changes, which can be overcome by improving the structure, flexibility, replacing elements and changing the connections between them.

The relationship between the properties of persistence and variability in each system must be such as to ensure its most efficient and sustainable functioning while maintaining the necessary economic reliability.

Management is defined as the process of will-formation and implementation of will, that is, it is nothing more than a process of solving problems to achieve set goals. The most important goals of real estate economics are:

Cost (monetary) goals - expected future financial results (profit, value of capital, profitability, cash flow, availability of working capital, etc.);

Consumer goals - achieving certain material goals through the implementation of production tasks (housing construction, reconstruction of buildings and structures, commercial real estate, real estate for temporary residence, mixed-use buildings, etc.);

Social goals are the social responsibility of a business entity to society (development of a project and its implementation in accordance with the social and historical setting of society, tasks for protecting the environment, landscape and compositional features of the territory, use of materials and structures taking into account the requests of local customers, etc.

Cost and social goals are realized only through consumer goals and other goals - actions.

Property management is an ongoing and communicative process and can be broadly represented as a planning process with the following sequential stages:

Analysis and formulation of the problem;

Search for alternative solutions;

Assessment and decision making (decision examination).

In a narrow sense, management can be presented as a process of project implementation, including the stages:

Implementation of the chosen alternative;

Formation and control;

The process of operation with the stages of operation and development of the property.

Planning occupies a central place in Surveying theory and represents a regularly repeated decision-making process in which various types of management activities take place.

Implementation is part of the planning process, consisting of the stages of developing a detailed implementation plan, implementation itself and control, including a set of measures to analyze probable deviations from planned indicators.

Management as an activity is understood as the process of solving problems in achieving goals, expressed in receiving, processing and transmitting information.

Conclusion

After analyzing this work, we can draw the following conclusion: the nature of changes (general dynamics) of use value, total cost and cost in use throughout the life cycle is the same, but the rate of change of these indicators is different. This is explained by the fact that the changes themselves take shape under the influence of various influencing factors, which makes specific processes of change diverse in nature. This conclusion can be formulated in another way: both use value, total value, and value in use change under the influence of the same factor - time, but this influence manifests itself differently for each type of value.

The problem of real estate economics can be formulated as an economic interpretation of the influence of all significant factors on a real estate property at a specific point in the life cycle.

The activities of surveyors cover all stages and forms of manifestation of the life cycle of real estate, providing an interconnected solution to all practical issues.

List of used literature

Kozhukhar V.M. Expertise and property management. Introduction to the specialty. – M., Publisher: Dashkov and Co., 2008

Chernyak V.Z. Property management. – M., 2007

Economics and real estate management. – M., 2006

Life cycle- this is a complete sequence of processes of the existence of real estate from commissioning (from creation) to termination. In theory and practice, five types of cycles are distinguished: business, life cycle of a product, type of business and enterprise as a property complex, as well as real estate as an object of property (diagrams 1.14-1.18). The duration of the cycle is influenced by production periods, physical and moral wear and tear, capital capital of the facility, operating conditions, market conditions and other factors.

Since real estate objects have a triple nature, during the entire period of their existence they are subject to physical, economic and legal changes, respectively. As a result, each immovable thing (except land) goes through the following four enlarged stages of its life cycle:

- o formation - construction, creation of a new enterprise, acquisition (purchase, allocation, etc.) of a land plot;

- o operation - operation and development (expansion, reconstruction, change of activity, reorganization, etc.);

- o change, perhaps more than once, of owner, owner or user;

- o cessation of existence - demolition, liquidation, natural destruction.

The first, third and fourth stages of the life cycle of real estate as a product also provide for state registration of the fact of creation or liquidation of the object, as well as a change of owner.

Life cycle of commercial real estate property, property from the point of view of one current owner, who makes his own subjective journey with the object from purchase, say, to sale or exchange, can be repeated many times, each time with a new owner, until the end of the economic or physical life of the object.

Change of owners of property complexes of enterprises in the process of reforms carried out in Russia, privatization, bankruptcy, transfer of a controlling stake from hand to hand

Scheme 1.14.

accompanied by significant and sometimes destructive changes in organization, management, technology and the basic means of production themselves.

For objects - historical monuments, the physical lifespan is more important, and not the change of owner, ownership

Scheme 1.15.

ca and the user, since they are protected by the state. The use of objects of world and national significance is permitted without violating their cultural and historical functions, and their formation is associated with reconstruction, research and restoration work. Natural complexes - monuments can exist forever. The cessation of the existence of such objects means their inclusion in new, more extensive, historical and cultural complexes or destruction as a result of natural disasters.

Each stage of the real estate life cycle includes a number of stages, events and activities. For example, creating

Scheme 1.16.

Scheme 1.17.

The property complex of an enterprise consists of four main stages, divided into interrelated sections, organizational and legal actions (Table. 1.5).

Organizationally, the creation of an enterprise as a real estate object consists of eight to nine stages.

Scheme 1.18.

The life cycle of real estate is subject to certain laws and includes, as defined by G. Harrison, economic, physical, chronological and remaining economic life.

Economic lifespan is a period of profitable use of the property, when improvements made contribute to the value of the property. Good repairs, refurbishment and optimization of conditions increase, but poor maintenance shortens the economic life of the facility. It is abandoned when improvements no longer contribute to the value of the property due to its general obsolescence.

Physical lifespan- this is the period of real existence of an object in a functionally suitable state before its demolition (destruction). It can be normative, actual, calculated (predicted) and increase due to modernization and improvement of conditions.

Table 1.5. Stages of forming a new enterprise

|

No. |

Searching for a new idea and evaluating it |

Drawing up a business plan |

Attracting the necessary resources |

Control creation enterprises |

|

Factors for the emergence of a new idea, timing |

Market segment, its size and price characteristics |

Available resources: money capital, raw materials, equipment, labor, etc. |

Organizational structure, group composition, goals, deadlines, stages, constituent documents |

|

|

Compliance of the idea with personal goals, knowledge and skills |

Marketing plan, production plan of the enterprise and its divisions |

Missing resources and potential suppliers |

Key success factors and ways to activate them |

|

|

Analysis of the real and potential value of an idea |

Financial plan and financial support |

Ways to attract resources by type |

Weaknesses and ways to overcome them |

|

|

Risk assessment and benefit forecast |

Form of ownership and legal form |

Forecasting new sources and suppliers |

System of quality control and timing of work |

|

|

Comparison with products competitors |

Market penetration strategy |

Formation of authorized (share) capital |

Legal status, licensing, state! this registration |

The effective age is based on an assessment of the appearance and technical condition of the structure. This is the age corresponding to the actual preservation of the object, its condition at the time of the transaction, evaluation. For example, when a 60-year-old brick house looks as if it were 18 years old, then its effective age is 18 years. Effective age may be greater or less than chronological age.

Chronological age- this is the period from the day the object was put into operation until the date of the transaction or assessment.

Scheme 1.19.

The remaining economic life of the building is calculated from the date of assessment (analysis) until the end of its economic life. Repairs and re-equipment extend (increase) this period.

The physical and economic lifespan of buildings are objective in nature, which can be regulated, but cannot be canceled. All stages of the life cycle and life span are interconnected and when one of them changes, the others change accordingly (Diagram 1.19).

The location of real estate at one or another stage of the life cycle must be taken into account by the owner in order to implement adequate measures to ensure the preservation and increase of the profitability of the property.

The length of the physical lifespan, the economic and effective age of real estate (except land) depend on the inexorably increasing processes of wear and tear, which have the force of the laws of nature.

Scheme 1.20.