Sample of filling out the sheet and declaration 3 personal income tax. Taxpayer information

Read also

Individual entrepreneurs are individuals who run their own business and are registered as individual entrepreneurs. All individuals are recognized as personal income tax payers, individual entrepreneurs are no exception - no later than April 30, they submit a declaration to the Federal Tax Service on income from their business activities (clause 1 of article 229 of the Tax Code of the Russian Federation). In 2017, this deadline was moved to May 2 due to weekends and holidays.

Should an individual entrepreneur always file a declaration of his income and how to fill out 3-NDFL for an individual entrepreneur - this is what our article is about.

When an individual entrepreneur needs a 3-NDFL declaration

Declaration 3-NDFL is submitted by an entrepreneur if during the tax period he received income subject to personal income tax. Let's consider in what cases an individual entrepreneur has an object of taxation.

When an individual entrepreneur applies the general taxation system (OSNO), instead of income tax, he pays personal income tax, which is assessed on business income. The 3-NDFL declaration form for individual entrepreneurs on OSNO is no different from the tax return for ordinary individuals used in 2017.

Individual entrepreneurs who switched to OSN during the reporting year as a result of losing the right to use a special regime(UTII, “simplified” or patent), must also submit form 3-NDFL for individual entrepreneurs. For example, having exceeded the permissible income limit for the simplified tax system in 2016, or physical indicators for calculating UTII, an individual entrepreneur loses the right to a special regime, which means he must recalculate taxes for a certain period of 2016 in accordance with the simplified tax system, including he will have to pay and Personal income tax.

If there were no violations of the application of the special regime, and the individual entrepreneur applied it throughout 2016, then income received from “simplified”, “imputed” or patent activities is not subject to personal income tax. But even in this case, there is a possibility that the obligation to submit 3-NDFL for individual entrepreneurs will still arise:

- An individual entrepreneur can receive income related to the special regime, but subject to personal income tax: for example, having sold a car used in “imputed” activities, personal income tax should be withheld from the income from the sale, but it should not be subject to UTII;

- An individual entrepreneur can sell his personal property, not related to his business (house, plot of land, etc.), then the income from the sale will be subject to personal income tax;

- Individual entrepreneurs can receive an interest-free loan, then personal income tax is imposed on the benefit from saving on interest.

In all of the above cases, the individual entrepreneur must submit a declaration for 2016 no later than May 2, 2017.

Declaration 3-NDFL for individual entrepreneurs is necessary when he wants refund part of previously paid tax as a simple individual. An individual entrepreneur can submit a 3-NDFL declaration for a refund for treatment (when paying from personal funds for medical services, medicines and paying contributions for voluntary health insurance), declare a property deduction through 3-NDFL when purchasing an apartment (refund of part of the costs of purchasing housing and mortgage interest) , about deductions for training expenses, as well as for receiving other property and social deductions provided for in Chapter. 23 Tax Code of the Russian Federation.

If an individual entrepreneur uses 3-NDFL only to claim a tax deduction, without declaring his income, then he can submit a declaration on any day of 2017.

Filling out 3-NDFL for individual entrepreneurs

The declaration for 2016 must be submitted in an updated form, taking into account the requirements of the Procedure for filling it out (Order of the Federal Tax Service of the Russian Federation dated December 24, 2014 No. ММВ-7-11/671 as amended on October 10, 2016).

When filling out the title page, individual entrepreneurs indicate a special taxpayer category code - “720”. In 3-NDFL for individual entrepreneurs on OSNO, in addition to sections 1 and 2 that are mandatory for all, sheet “B” on income from business activities is filled out. The remaining sheets of the declaration are filled out by the individual entrepreneur as necessary.

Sheet B

It is advisable to fill out this sheet of the 3-NDFL declaration for 2016 for individual entrepreneurs first, and then, after filling out Sheet B and, if necessary, other sheets of the declaration, calculate the tax base and tax in section 2.

On page 010 the code of the type of activity for individual entrepreneurs is indicated - “1”.

On page 020, indicate the OKVED code, which can be found in the extract from the Unified State Register of Individual Entrepreneurs and the Classifier OK029-2014. If there are several types of activities, then Sheet B of the declaration 3-NDFL 2016 for individual entrepreneurs is filled out for each of them separately, and paragraph 3 “Results” is filled out on the last of Sheets B.

Paragraph 2 indicates the indicators for calculating tax: the amount of income (p. 030), the amount of expenses as part of the professional deduction with a breakdown by type (p. 040-090). If an individual entrepreneur cannot document his expenses, then the professional tax deduction is defined as 20% of the total amount of business income (p. 100).

In clause 3, the lines are summed up for all completed Sheets B of form 3-NDFL 2016 (see below for a sample of filling out for individual entrepreneurs). On page 130, the amount of advance payments for personal income tax is indicated in accordance with the tax notice, and on page 140, advances paid are reflected on the basis of individual entrepreneurs' payment documents.

The information in paragraph 4 is intended for heads of peasant farms: the year of registration of the farm and tax-free income are indicated.

Clause 5 must be filled out only if the individual entrepreneur independently adjusted the tax base and the amount of personal income tax in accordance with clause 6 of Art. 105.3 Tax Code of the Russian Federation.

The data obtained in the final paragraph 3 of Sheet B is transferred to section 2.

Sheets A-B and D-G

When filling out 3-NDFL for individual entrepreneurs on OSNO, it is possible to fill out the remaining sheets of the declaration. This is necessary in case:

- if the individual entrepreneur had taxable income outside of his business activities during the tax period, and the tax agent did not report for them;

- if an individual entrepreneur declares his right to a property or social deduction as an individual.

3-NDFL for individual entrepreneurs: example

To give an example of a declaration for an individual entrepreneur, take the following data:

IP Petrov P.P. in 2016, he conducted business activities in only one direction with the OKVED code 66.22. His income for 2016 is 550,000 rubles, material expenses are 21,000 rubles, other expenses are 4,000 rubles. In total, the professional deduction amounted to 25,000 rubles. According to the notification of the Federal Tax Service, advance tax payments are 40,000 rubles, which IP Petrov paid on time. Tax rate – 13%. We use these indicators for the 3-NDFL 2016 declaration, a sample of which is given below.

First, fill out Sheet B as indicated above.

in line 010 – 550,000 rub.,

on page 040 – 25,000 rub.

We make the calculation on line 030 and on line 060 we get the tax base - 525,000 rubles. (income minus professional deduction).

Personal income tax on line 070 = 68,250 rubles. (RUB 525,000 x 13%).

We transfer the amount of advance payments to line 100 - 40,000 rubles. and we receive on page 121 the amount of personal income tax for additional payment: 28,250 rubles. (RUB 68,250 – RUB 40,000).

In section 1 we indicate KBK, OKTMO and transfer to page 040 the amount of personal income tax payable from section 2 - 28,250 rubles.

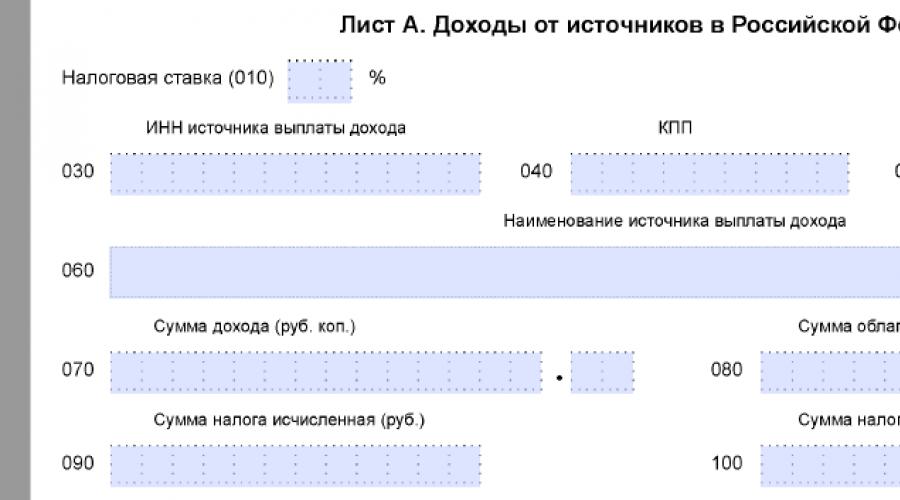

There is no doubt that a sample of Sheet A from 3-NDFL, which will be discussed in our consultation, will be a good help when filling out this income declaration for 2016. After all, almost all individuals submit it with this Sheet.

General form

In 2017, a report on the relevant income is submitted in form 3-NDFL. It was approved by order of the Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671. The declaration, together with the completed Sheet A, will tell the tax authorities about:

- income received from all sources in Russia for 2016;

- the corresponding personal income tax amounts that are calculated and withheld at the source of income for 2016.

An unfilled example of Sheet A of the 3-NDFL declaration looks like this:

Over the past 2 years, the Federal Tax Service has not made any adjustments to this Sheet.

Please note that Sheet A of the 3-NDFL declaration for 2016 and other periods is filled out only by:

- Based on income from Russian sources – individuals, individual entrepreneurs, legal entities.

- Ordinary individuals are tax residents and non-residents of the Russian Federation for income tax.

For individual entrepreneurs, lawyers and private practitioners, Sheet B of the 3-NDFL declaration is intended for similar purposes.

Peculiarities

Initially, Sheet A 3-NDFL includes 3 identical parts:

Each specific example of how to fill out Sheet A 3-NDFL in 2017 will differ from each other. If only because some had one source of income, others had several. In the latter case, the rules established by the order of the Federal Tax Service dated December 24, 2014 No. ММВ-7-11/671 require the declaration of receipts from all sources of payment.

Thus, Sheet A of the 3-NDFL declaration can take up several pages. That is, the number of corresponding parts (see above) of which it consists depends on:

- number of sources of income in 2016;

- the size of the tax rate to which this or that income falls on the basis of Art. 224 Tax Code.

The procedure established by the Federal Tax Service for filling out Sheet A of the 3-NDFL declaration requires only capital block letters. In addition, the income received amounts to pennies. The situation is the opposite with personal income tax amounts: less than 50 kopecks are discarded, and more are considered as 1 ruble.

A specific example of filling out Sheet A 3-NDFL

Let's take some of the most common situations. Let's assume that E.A. Shirokova in 2016:

| Part 1 Sheet A | Sold to A.B. for 5 million rubles. Sokolov’s apartment, which she owned for less than the last three years. This means that in 2016 she had income subject to personal income tax at a rate of 13%. However, this tax is not withheld. |

| Part 2 Sheet A | Sold by E.L. Korotkova bought her car for 700,000 rubles, which she owned for less than 3 years. At the same time, Shirokova can document that she purchased it for 600,000 rubles. That is, taxable income (p. 080) will be 100,000 rubles. (700,000 rub. – 600,000 rub.). |

| Part 3 Sheet A | As an employee of Guru LLC, she received wages in 2016 in the total amount of 570,000 rubles. Shirokova's employer did not make deductions (not required). She takes all the information for filling out this part of Sheet A from the 2-NDFL certificate from Guru LLC for 2016. |

Until April 30, 2014, some categories of citizens are required to declare income received in 2013 and submit form 3-NDFL to the tax office at their place of residence. We will tell you in the article who reports on this form and how to fill out the declaration.

Note! You can easily prepare and submit reports using the online service “My Business” - Internet accounting for small businesses. The service automatically generates reports, checks them and sends them electronically. You will not need to personally visit the tax office and funds, which will undoubtedly save not only time, but also nerves. You can get free access to the service using this link.

The 3-NDFL declaration form, which must be used to report in 2013, was approved by order of the Federal Tax Service of Russia dated November 10, 2011 No. ММВ-7-3/760@. But please note that by order of the Federal Tax Service of Russia dated November 14, 2013 N ММВ-7-3/501@, changes were made to it.

Before we start talking about filling out the declaration, let’s consider who, where, how and within what time frame submits Form 3-NDFL.

Who reports on Form 3-NDFL

In addition, some citizens may submit Form 3-NDFL on their own initiative. These include those who wish to receive, for example, the following tax deductions:

- standard (if during the tax period these deductions were not provided to an individual or were provided in a smaller amount than provided for in Article 218 of the Tax Code);

- professional;

- social (when paying for treatment, education, when transferring your own funds to charity, etc.);

- property (when purchasing housing).

Where and when should the declaration be submitted?

You must submit the completed Form 3-NDFL to the tax office at your place of residence or place of stay (clause 5 of Article 227, clause 3 of Article 228, clauses 1, 3, 6 and 7 of Article 83 of the Tax Code of the Russian Federation).

The same procedure is provided for those who submit a declaration on their own initiative (clause 2 of Article 229 of the Tax Code of the Russian Federation).

In accordance with paragraph 4 of Article 80 of the Tax Code, the declaration can be submitted on paper (in person or through an authorized representative, as well as by mail) or electronically (via telecommunication channels).

The tax return is submitted no later than April 30 of the year following the expired tax period (clause 1 of Article 229 of the Tax Code of the Russian Federation). And the tax must be paid before July 15 of the current year (clause 4 of article 228 of the Tax Code of the Russian Federation).

But there are exceptions to this rule. Thus, if business activities (private practice) or payments specified in Article 228 of the Tax Code are terminated before the end of the tax period, the declaration must be submitted within five days from the date of termination of activities or payments. This applies to Russian citizens. But foreigners planning to leave the territory of Russia must report no later than one month before leaving the country. This is stated in paragraph 3 of Article 229 of the Tax Code. Both need to pay the tax no later than 15 calendar days from the date of filing such a declaration (clause 3 of Article 229 of the Tax Code of the Russian Federation).

For each month of failure to submit a declaration, a fine of 5% of the tax amount is provided (Clause 1, Article 119 of the Tax Code of the Russian Federation). Failure by a taxpayer to submit a tax declaration to the tax authority at the place of registration within the deadline established by the legislation on taxes and fees shall entail the collection of a fine in the amount of 5 percent of the amount of tax subject to payment (surcharge) on the basis of this declaration, for each full or partial month from the day established for its submissions, but not more than 30% of the specified amount and not less than 1,000 rubles. (clause 1 of Article 119 of the Tax Code of the Russian Federation). In this case, the lower limit of the fine is 100 rubles, and the upper limit cannot exceed 30% of the tax amount. However, this rule applies if the declaration is submitted late by up to 180 days.

If you are late with the report by more than 180 days, the fine will increase. It will be 30% of the tax amount plus 10% for each month of delay (clause 2 of article 119 of the Tax Code of the Russian Federation).

Filling out the declaration

General rules. The taxpayer indicates in the declaration all income received during the tax period, sources of their payment, tax deductions, tax amounts withheld by tax agents, amounts of advance payments actually paid, tax amounts subject to payment (addition) to the budget or refund from the budget (clause 4 Article 229 of the Tax Code of the Russian Federation).

The declaration submitted on paper is filled out with a black or blue ballpoint or fountain pen. It is also possible to print out the completed declaration form on a printer. But please note that double-sided printing is not allowed. This is stated in paragraph 1.1 of section 1 of the Procedure for filling out the tax return form for personal income tax (form 3-NDFL), approved by order of the Federal Tax Service of Russia dated November 10, 2011 No. ММВ-7-3/760@ (hereinafter referred to as the Procedure).

Corrections in the declaration are not allowed! Only one indicator is entered in each line and its corresponding columns. If there are no indicators provided for in the declaration, a dash is placed in the corresponding line. All cost indicators are given in rubles and kopecks, except for personal income tax amounts, which are calculated and shown in full rubles.

When filling out the declaration by hand, please note the following.

Fill in the text fields of the declaration with capital printed characters.

If to indicate any indicator it is not necessary to fill out all the cells of the corresponding field, a dash is placed in the unfilled cells on the right side of the field.

Example

When specifying the ten-digit TIN of the organization 5024002119 in the TIN field of twelve cells, the indicator is filled in as follows: “5024002119--”.

Fractional numeric indicators are filled in similarly to the rules for filling in integer numeric indicators. If there are more cells for indicating the fractional part than numbers, then a dash is placed in the free cells of the corresponding field.

Example

If the indicator “share in ownership” has a value of 1/3, then this indicator is indicated in two fields of three cells each as follows: “1--” - in the first field, the sign “/” or “.” between the fields and "3--" - in the second field.

If you fill out the declaration on a computer, then align the values of the numerical indicators according to the right (last) space. And when printing on a printer, it is allowed that there is no border around cells or dashes for unfilled cells. Signs must be printed in Courier New font with a height of 16-18 points.

The taxpayer at the top of each completed page of the declaration must indicate the TIN (if any), as well as his last name and initials, and at the bottom, in the field “I confirm the accuracy and completeness of the information specified on this page,” put the date of completion and signature .

As for page numbering, it must be continuous (clause 1.14 of section 1 of the Procedure).

Declaration structure. The declaration in form 3-NDFL consists of a title page, six sections and 13 additional sheets - A, B, C, G1, G2, G3, D, E, G1, G2, G3, Z, I. However, taxpayers fill out and do not represent all sections and sheets, but only those that reflect indicators for the operations they carry out. In this case, the title page and section 6 of the declaration are required to be completed by everyone (clause 2.1, section 2 of the Procedure).

When filling out a declaration, all indicator values are taken from certificates of income and withheld amounts of taxes issued by tax agents, settlement, payment and other documents available to the taxpayer, as well as from calculations made on the basis of these documents. Therefore, we advise you to request in advance from the accounting department a certificate in form 2-NDFL for the previous year.

Taxpayers have the right not to indicate in the tax return income that is not subject to taxation (exempt from taxation) in accordance with Art. 217 of the Tax Code, as well as income upon receipt of which the tax is fully withheld by tax agents, if this does not prevent the taxpayer from receiving tax deductions provided for in Art. 218 - 221 Tax Code.

Title page. When filling out the title page of the declaration, indicate:

- taxpayer identification number (TIN). You can find out your TIN on the website of the Federal Tax Service of Russia www.nalog.ru on the page of the “Find out your TIN” service;

- adjustment number (when preparing the initial tax return, “0” is indicated, when updating the declaration - the value according to the serial number of the updating declaration for the corresponding reporting period);

- reporting tax period - the calendar year for which the declaration is submitted;

- tax authority code - code of the tax office at the place of residence (place of stay) of the taxpayer;

- taxpayer category code:

- “720” - an individual registered as an individual entrepreneur;

- “730” - a notary engaged in private practice, and other persons engaged in private practice in accordance with the procedure established by current legislation;

- “740” - a lawyer who established a law office;

- “760” - another individual declaring income in accordance with Art. 22 8 of the Tax Code, as well as for the purpose of obtaining tax deductions in accordance with Art. 218-221 of the Tax Code or for another purpose;

- “770” is an individual registered as an individual entrepreneur and is the head of a peasant (farm) enterprise.

When filling out the “OKTMO Code” indicator, the free cells to the right of the code value, if it has less than eleven characters, are filled with zeros.

The taxpayer can determine the code of the tax inspectorate and OKTMO at the address of his place of residence (place of stay) using the Internet service “Address and payment details of your inspection”, located on the website of the Federal Tax Service of Russia www.nalog.ru in the “Electronic Services” section.

General information about the taxpayer by filling in the following fields:

- last name, first name and patronymic;

- contact phone number indicating telephone code;

- date and place of birth, citizenship;

- information about the identity document;

- taxpayer status (tax resident/non-resident of the Russian Federation);

- address of residence (place of stay).

Sections 1, 2, 3, 4, 5, 6 are filled out on separate sheets and serve to calculate the tax base and tax amounts on income taxed at various rates, as well as tax amounts subject to payment/addition to the budget or refund from the budget:

- in Section 1 on income taxed at a rate of 13%;

- in Section 2 on income taxed at a rate of 30%;

- in Section 3 on income taxed at a rate of 35%;

- in Section 4 on income taxed at a rate of 9%;

- in Section 5 on income taxed at the rate

Section 6 is completed after completing Sections 1, 2, 3, 4 and 5 of the declaration form.

Sheets A, B, C, G1, G2, G3, D, E, G1, G2, G3, G, I are used to calculate the tax base and tax amounts when filling out sections 1, 2, 3, 4 and 5 of the declaration form and are filled out as necessary.

Sheet A is filled out for taxable income received from sources in the Russian Federation, with the exception of income from business activities, advocacy and private practice.

Sheet B is filled out for taxable income received from sources outside the Russian Federation, with the exception of income from business activities, advocacy and private practice.

03/20/2019, Sashka Bukashka

On February 18, 2018, the order of the Federal Tax Service of Russia dated October 25, 2017 N ММВ-7-11/822@ came into force, which introduced changes to the tax return form for personal income tax (form 3-NDFL). These changes are also valid in 2019 for declaring income received in 2018. Let's look at how to fill out the form taking into account the new requirements.

Personal income tax is a personal income tax paid to the state by working citizens, and is a declaration that is submitted to the tax service by people receiving income in Russia. This article describes how to fill out the 3-NDFL declaration and why it is needed.

Who needs to submit a tax return 3-NDFL

The declaration is submitted upon receipt of income on which personal income tax must be paid, as well as to return part of the tax previously paid to the state. 3-NDFL is submitted:

- Individual entrepreneurs (IP), lawyers, notaries and other specialists who earn their living through private practice. What these people have in common is that they independently calculate taxes and pay them to the budget.

- Tax residents who received income in other states. Tax residents include those citizens who actually live in Russia for at least 183 days a year.

- Citizens who received income from the sale of property: cars, apartments, land, etc.

- Persons who received income under a civil contract or from renting out an apartment.

- Lucky people who win the lottery, slot machines or betting must also pay tax on their winnings.

- If necessary, obtain a tax deduction: for, for, and so on.

Do not confuse this document with . They have similar names and usually come in the same set of documents, but they are still different.

Where to submit the 3-NDFL declaration

The declaration is submitted to the tax service at the place of permanent or temporary registration (registration). It is handed over in person or sent by mail. You can also submit your tax return online. To fill out 3-NDFL online, obtain a login and password to enter the taxpayer’s personal account at any tax office. To receive your login and password, come in person and don’t forget your passport.

Deadlines for filing 3-NDFL in 2019

In 2019, the personal income tax return in Form 3-NDFL is submitted by April 30. If the taxpayer completed and submitted the report before the amendments to the form came into force, he does not need to submit the information again using the new form. If you need to claim a deduction, you can submit your return at any time during the year.

Sample of filling out 3-NDFL in 2019

You will be assisted in filling out the 3-NDFL declaration by the “Declaration” program, which can be downloaded on the website of the Federal Tax Service. If you fill out 3-NDFL by hand, write text and numeric fields (TIN, fractional fields, amounts, etc.) from left to right, starting from the leftmost cell or edge, in capital printed characters. If after filling out the field there are empty cells, dashes are placed in them. For a missing item, dashes are placed in all cells opposite it.

When filling out the declaration, no mistakes or corrections should be made; only black or blue ink is used. If 3-NDFL is filled out on a computer, then the numerical values are aligned to the right. You should print in Courier New font with a size set from 16 to 18. If you do not have one page of a section or sheet of 3-NDFL to reflect all the information, use the required number of additional pages of the same section or sheet.

Amounts are written down indicating kopecks, except for the personal income tax amount, which is rounded to the full ruble - if the amount is less than 50 kopecks, then they are discarded, starting from 50 kopecks and above - rounded to the full ruble. Income or expenses in foreign currency are converted into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of actual receipt of income or expenses. After filling out the required pages of the declaration, do not forget to number the pages in the “Page” field, starting from 001 to the required one in order. All data entered in the declaration must be confirmed by documents, copies of which must be attached to the declaration. To list documents attached to 3-NDFL, you can create a special register.

Instructions for filling out 3-NDFL. Title page

A cap

In the “TIN” paragraph on the title and other completed sheets, the identification number of the taxpayer - an individual or company - is indicated. In the item “Adjustment number”, enter 000 if the declaration is submitted for the first time this year. If you need to submit a corrected document, then 001 is written in the section. “Tax period (code)” is the period of time for which a person reports. If you are reporting for a year, enter the code 34, the first quarter - 21, the first half of the year - 31, nine months - 33. “Reporting tax period” - in this paragraph, indicate only the previous year, the income for which you want to declare. In the “Submitted to the tax authority (code)” field, enter the 4-digit number of the tax authority with which the submitter is registered for tax purposes. The first two digits are the region number, and the last two are the inspection code.

Taxpayer information

In the “Country Code” section, the code of the applicant’s country of citizenship is noted. The code is indicated according to the All-Russian Classifier of Countries of the World. The code of Russia is 643. A stateless person marks 999. “Taxpayer category code” (Appendix No. 1 to the procedure for filling out 3-NDFL):

- IP - 720;

- notary and other persons engaged in private practice - 730;

- lawyer - 740;

- individuals - 760;

- farmer - 770.

The fields “Last name”, “First name”, “Patronymic”, “Date of birth”, “Place of birth” are filled in exactly according to the passport or other identity document.

Information about the identity document

The item “Document type code” (Appendix No. 2 to the procedure for filling out 3-NDFL) is filled in with one of the selected options:

- Passport of a citizen of the Russian Federation - 21;

- Birth certificate - 03;

- Military ID - 07;

- Temporary certificate issued instead of a military ID - 08;

- Passport of a foreign citizen - 10;

- Certificate of consideration of an application to recognize a person as a refugee on the territory of the Russian Federation on its merits - 11;

- Residence permit in the Russian Federation - 12;

- Refugee certificate - 13;

- Temporary identity card of a citizen of the Russian Federation - 14;

- Temporary residence permit in the Russian Federation - 15;

- Certificate of temporary asylum in the Russian Federation - 18;

- Birth certificate issued by an authorized body of a foreign state - 23;

- Identity card of a Russian military personnel/Military ID of a reserve officer - 24;

- Other documents - 91.

The items “ ”, “Date of issue”, “Issued by” are filled out strictly according to the identity document. In “Taxpayer Status,” number 1 means a tax resident of the Russian Federation, 2 means a non-resident of Russia (who lived less than 183 days in the Russian Federation in the year of income declaration).

Taxpayer phone number

In the new form 3-NDFL, fields for indicating the taxpayer’s address have been removed. Now you do not need to indicate this information on the form. Simply fill out the “Contact phone number” field. The telephone number is indicated either mobile or landline, if necessary, with the area code.

Signature and date

On the title page, indicate the total number of completed pages and the number of attachments - supporting documents or their copies. In the lower left part of the first page, the taxpayer (number 1) or his representative (number 2) signs the document and indicates the date of signing. The representative must attach a copy of the document confirming his authority to the declaration.

3 main mistakes in 3-NDFL that we usually make

Expert commentary specifically for Sashka Bukashka’s website:

Evdokia Avdeeva

StroyEnergoResurs, chief accountant

The most common errors can be divided into three groups:

- Technical errors. For example, a taxpayer forgets to sign on required sheets or skips sheets. The tax office will also refuse to provide deductions without supporting documents. The costs of purchasing property, treatment, training, insurance must be confirmed by contracts and payment documents.

- Incorrect or incomplete filling of data. “Top” of such shortcomings:

- on the title page in the line “adjustment number” when submitting the declaration for the first time, put 1, but it should be 0;

- incorrect OKTMO code.

Such shortcomings are not so terrible, and in the worst case they will lead to refusal to accept the declaration. But incompletely filling out some data can lead to the tax office “misunderstanding you” and instead of providing a deduction, it will require you to pay tax.

For example, if the taxpayer in the section “Income received in the Russian Federation” does not indicate the amount of income, the amount of tax calculated and the amount of tax withheld, then instead of refunding the tax, the taxpayer will calculate it for himself as an additional payment.

- Ignorance of laws and rules for applying deductions. For example, a citizen paid for training in 2017, but wants to receive a deduction for 2018. However, the tax benefit is provided specifically for the year in which the applicant paid for education, medical care or other services.

Filling out 3-NDFL when declaring income and filing tax deductions

The procedure for filling out 3-NDFL depends on the specific case for which you are filing a declaration. The declaration form contains 19 sheets, of which you need to fill out the ones you personally need.

- Section 1 “Information on the amounts of tax subject to payment (addition) to the budget/refund from the budget”;

- Section 2 “Calculation of the tax base and the amount of tax on income taxed at the rate (001)”;

- Sheet A “Income from sources in the Russian Federation”;

- Sheet B “Income from sources outside the Russian Federation, taxed at the rate (001)”;

- sheet B “Income received from business, advocacy and private practice”;

- sheet D “Calculation of the amount of income not subject to taxation”;

- Sheet D1 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate”;

- Sheet D2 “Calculation of property tax deductions for income from the sale of property (property rights)”;

- sheet E1 “Calculation of standard and social tax deductions”;

- sheet E2 “Calculation of social tax deductions established by subparagraphs 4 and 5 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation”;

- sheet J “Calculation of professional tax deductions established by paragraphs 2, 3 of Article 221 of the Tax Code of the Russian Federation, as well as tax deductions established by paragraph two of subparagraph 2 of paragraph 2 of Article 220 of the Tax Code of the Russian Federation”;

- sheet 3 “Calculation of taxable income from transactions with securities and transactions with derivative financial instruments”;

- Sheet I “Calculation of taxable income from participation in investment partnerships.”

In addition to paying personal income tax, the declaration will be useful to receive a tax deduction. By law, every citizen can return part of the tax previously paid to the state to cover the costs of education, treatment, purchase of real estate or payment of a mortgage loan. You can submit documents to receive a deduction any day after the end of the year in which the money was spent. The deduction can be received within three years.

In this article we will figure out how to fill out the 3-NDFL declaration and who should fill it out. You can also download a completed sample declaration for 2014 and the 3-NDFL form itself, current for 2015.

So, who should report for their income according to the 3-NDFL declaration:

- Individual entrepreneur on the general taxation system;

- persons engaged in private practice, such as lawyers;

- individuals, reporting on their income, fill out the 3-NDFL declaration when selling an apartment, see, and when selling a car.

The declaration form is drawn up at the end of the year and submitted to the tax office by April 30 of the year following the reporting year.

When filling out the 3-NDFL form, you must adhere to the general rules:

- indicate cost indicators in rubles and kopecks, and tax amounts in full rubles;

- if the declaration is filled out manually, then all letters and numbers must be large enough and clear;

- dashes are placed in all empty cells remaining after filling;

- the declaration is submitted in person, by mail or electronically;

- the declaration form must be current as of the reporting date; changes occur periodically, so you need to monitor the updates;

- be guided when filling out the Procedure for filling out a tax return form 3-NDFL - an official document specially created to help individuals. You can download the procedure for filling out 3-NDFL at the end of the article.

Let's look at how this declaration is filled out using the example of an individual entrepreneur working on a special purpose tax system. The reporting of individual entrepreneurs on the OSN is presented.

Sample of filling out 3-NDFL for individual entrepreneurs on OSNO:

The declaration form consists of many sheets, but not all need to be filled out, but only those that correspond to the income reported by the individual.

For individual entrepreneurs on OSN, it is mandatory to fill out pages 1-2, sections 1.6 and sheet B.

Filling out 3-NDFL begins with the title page. The declaration has a standard title page. You can see how to fill it out in detail.

720 - for individual entrepreneurs;

730 - for a notary;

740 - for a lawyer;

770 - head of a peasant farm;

760 - all other individuals.

On this page of the form you need to indicate data regarding the individual on whose income 3-NDFL is being filled out.

As a rule, questions about filling out this sheet usually do not arise.

We fill out the sheet in the 3-NDFL declaration:

Before filling out sections 1 and 6 of the form, let's turn to sheet B. Here you indicate information about income on the basis of which, that is, the tax base from which the tax should be calculated is indicated. This sheet must be completed by individual entrepreneurs and individuals engaged in private practice.

“Type of activity” – for individual entrepreneurs we set “1”.

clause 2.1 Amount of income (030) - write the amount of income from business activities.

clause 2.2 Expenses (040) - this paragraph indicates the expenses taken into account when calculating the tax.

clauses 2.2.1-2.2.4 - expenses are disclosed in more detail.

clause 2.3 Expenses (100) – this item is filled in for expenses that are not documented.

Please note that either clause 2.2 or 2.3 is filled out in the form.

Below, in line 110 “total amount of income”, income data from page 030 is transferred. In line 120, “professional deduction amount”, either data from page 040 or from page 100 is transferred.

If the individual entrepreneur accrued and paid advance payments, then pages 130 and 140 are filled in.

This page of the form contains information about the tax base and calculated tax at a rate of 13%. You can read in detail about personal income tax rates.

010 (amount of income): in our case, the data is taken from the completed sheet B of the declaration form, clause 3.1.

020 (income not subject to taxation): for individual entrepreneurs is not filled out.

030 (total income): repeats line 010.

040 (expenses and tax deductions): we take the data from clause 3.2 of sheet B.

050 (tax base): income and expenses (deductions), that is, line 030 minus line 040. If expenses exceed income and the result is negative, then put “0” in line.

060 (amount of tax payable): tax base (line 050) multiplied by the rate of 13%.

080 (advance payments): we take the data from clause 3.4 of sheet B.

100 (amount of tax to be refunded from the budget): the sum of lines 070, 075, 080, 090 minus line 060, if the result is negative or equal to zero, put a dash.

110 (amount of tax payable to the budget): line 060 minus the sum of lines 070, 075, 080, 090. If the result is less than or equal to 0, put a dash.

This sheet of the declaration form reflects the total amount of tax that is subject to either payment to the budget or reimbursement from the budget. This section is completed last, based on all other sections and sheets.

“Budget classification code”: for personal income tax from the activities of individual entrepreneurs and persons engaged in private practice, KBK - 18210102020011000110.

“OKATO code” is a territorial code, that is, the code for the place of residence and tax payment; we indicated the same OKATO code on the title page.

“Tax payable”: take line 110 from section 1.

“Tax subject to reimbursement”: take line 100 from section 1.

Filling out the 3-NDFL form is completed, the resulting sample can be viewed below.