Income tax accrual: transactions. Posting - income tax accrual Profit accrual of postings in accordance with the declaration

Read also

Every organization with a commercial bias, regardless of the field of activity, seeks to maximize profits, which must be taxed to the state. It will not be difficult even for dummies to independently carry out the necessary tax calculation using an example.

Income tax is one of the key sources for financing the state budget. Refers to federal taxes and is governed by applicable laws.

Income tax is paid to the state budget from revenues that have been reduced by the amount of expenses, that is, according to the following formula:

- UD - PNO + SHE - IT = TNP UR - PNO + SHE - IT = TNU

These abbreviations are deciphered as follows:

- UD is the conditional amount of income;

- UR - company expenses;

- PNO - permanent tax liability;

- SHE - deferred tax assets;

- IT - deferred tax liabilities;

- TNP - current profit tax;

- TNU - current tax loss.

Taxable income includes those that the company receives from the sale of goods or services, works of its own production and purchased from others. The exceptions are: positive exchange rate or amount differences, penalties or fines, property received free of charge, interest on loans:

All firms pay a percentage of their profits to the budget, with the exception of those that operate under special taxes: Unified Agricultural Tax (unified agricultural tax), UTII (unified tax on imputed income), simplified tax system (simplified system).

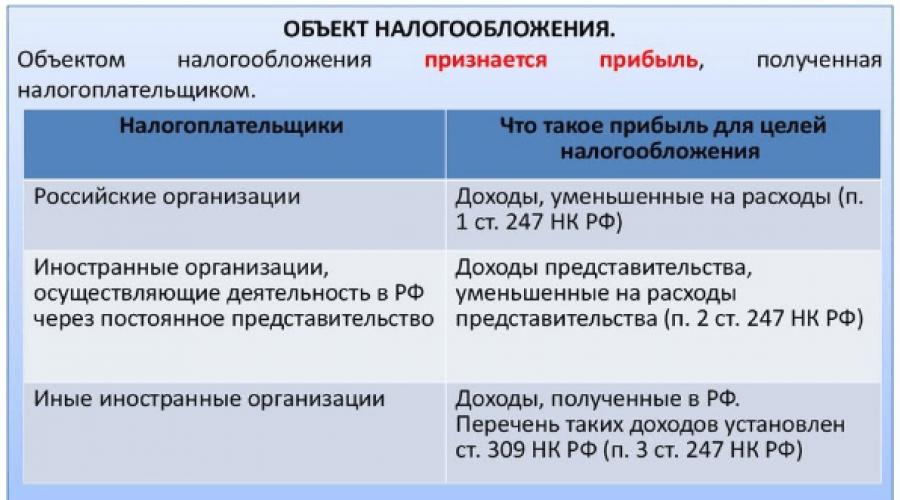

Tax payers are all domestic companies on a common system and foreign ones that make a profit in the state or work through state representations. Individual entrepreneurs, as well as companies participating in the preparation of significant events (Olympiads, the world football championship, etc.) also do not pay:

Get 267 1C video tutorials for free:

According to the latest relevant data, the general income tax rate is 20%, of which 3%, according to the updated legislation, goes to the general budget, and 17% to the regional one. The minimum tax rate of 13.5% to the federal budget may be applicable only for those enterprises that employ disabled people, are engaged in the production of cars, operate in special economic zones and act as residents of industrial parks and technopolises.

Income tax calculation - examples

The firm for the 1st quarter of activity gave income equal to 2,350,000 rubles:

- Of this amount, VAT is 357,000 rubles;

- Production costs - 670,000 rubles;

- Expenses for payment of wages to personnel - 400,000 rubles;

- Insurance premiums - 104,000 rubles;

- Amortization amount - 70,000 rubles;

- In addition, the company issued a loan to another company, for which it received 40,000 rubles. percent;

- The tax reporting loss for the previous period amounted to 80,000 rubles.

Let us calculate the profit of the enterprise using the data obtained: ((2,350,000 - 357,000) + 40,000) - 670,000 - 400,000 - 104,000 - 70,000 - 80,000 = 709,000 rubles. Based on this, we get the calculation of income tax: 709,000 x 20% = 141,800 rubles.

Example with a reduced tax rate option

Suppose a company on OCH and received an income of 4,500,000 rubles for the billing period, having incurred an expense of 2,700,000 rubles. Accordingly, the profit will be: 4,500,000 - 2,700,000 = 1,800,000 rubles. In the case when in the area where the company operates, the regional rate is basic and corresponds to 17%, the local budget will be paid - 1,800,000 x 17% = 306,000 rubles, and to the federal budget - 1,800,000 x 3% = 54,000 rub. For a reduced rate of 13.5%, calculations are performed as follows: 1,800,000 x 13.5% = 243,000 rubles. - for the local budget and 1,800,000 x 3% = 54,000 rubles.

Calculation example with a posting table

In accordance with the reporting in form 2 (profit and loss), the company indicated a profit of 480,000 rubles. Costs and Features:

- RUB 1,000 - permanent tax liability;

- 1 200 rub. - deferred tax asset;

- RUB 28,000 - depreciation, which was accrued on a straight-line basis;

- RUB 42,000 - depreciation calculated in a non-linear way for tax purposes;

- RUB 14,000 - deferred tax liability (42,000 - 28,000).

These business transactions in accounting will be displayed by the following transactions:

Companies file tax returns before the end of the calendar year. There are several options for transferring taxes: immediately after the end of the tax period and monthly deductions throughout the period.

Filling out the declaration - the main nuances

The income tax declaration is submitted by all companies under the general taxation system at the end of the reporting period (first quarter, six months, 9 months and 1 calendar year). Accordingly, the reporting dates in 2017 are April 28, July 28, October 28 and March 28, 2018. The code also provides for the provision of reporting for some organizations once a month:

Companies with up to 100 employees. all others can submit the declaration in paper format - in electronic form. The following sheets must be present:

- Title (sheet 01);

- Subsection 1.1 (time 1);

- Sheet 02;

- Appendices: No. 1, No. 2 related to sheet 02.

All other additional sheets are filled in if necessary. In the title page, you need to fill in the full details of the reporting organization:

- KPP and TIN;

- Adjustment number;

- The reporting (tax) period for which the declaration is filled out;

- Tax authority code to which the declaration will be submitted;

- Full name of the company;

- Type of activity (indication of the corresponding code);

- Number of pages in the declaration;

- The number of additional sheets, where there is confirmation of documents or their copies and other information that will depend on the type of activity of the organization.

The amount of tax that must be transferred to the budget is indicated in section 1. The required data are on lines 270-281 in sheet 02. Advance payments are taken into account. So, if the company in the first quarter transferred 5,000 rubles to the general budget, and the profit tax for six months was 8,000 rubles, then at the end of the half-year the amount of 3,000 rubles is paid. (8,000 - 5,000).

Sheet 02 displays the tax base, which is determined as the difference between the organization's profit and expenses. In line 110, the losses of previous years are carried forward to the moment. In the appendix to this sheet No. 1, all income, including non-operating income, should be displayed. Appendix # 2 indicates all expenses of any type.

According to Art. № 284 of the Tax Code of the Russian Federation, the tax rate for income tax has a value of 20%, with some exceptions. 2% of the amount of the accrued corporate income tax goes to the Federal budget, and 18% is transferred to the local budgets of the Russian Federation.

The tax rate on profits, the funds for which are to be transferred to the local budgets of the Russian Federation, can be reduced by local self-government bodies for certain categories of taxpayers, however, the income tax rate cannot be lower than 13.5%.

Income tax transactions:

- The amount of accrued income (notional) Dt 99 Kt 68, as well as Dt 68 Kt 99

- Permanent tax liability Dt 99 Kt 68

- Deferred tax asset Dt 09 Cr 68

- Deferred tax liability Dt 68 Cr 77

Accounting PNO and PNA

To account for this tax, a sub-account to account 68 is used. In the 1C accounting program, it is assigned the number 68.04, and to it, in turn, two sub-accounts are linked: 68.04.1 "Settlements with the budget" and 68.04.2 "Calculation of income tax".

If you do not apply PBU 18/02, then the question of which income tax account to use is easy to solve: tax is charged by posting Dt 99 Kt 68.04.1, and immediately attributed to the subaccount for accounting for settlements with the budget.

If the company applies PBU 18/02, then the formation of the amount of income tax is carried out in accounting through the system of accounting entries with the participation of subaccount 68.04.2. As a result, on subaccount 68.04.2, when calculating tax payable, the amount recorded in the declaration must be formed. Then the total amount of the sub-account is 68.04.

About what points you need to pay attention to when filling out the declaration, see the material "Nuances of the procedure for drawing up and submitting a profit tax declaration"

When a company does not apply PBU 18/02, in its accounting income and expenses are divided into those taken into account and not taken into account for calculating income tax, which in this case is very simple, as well as checking the correctness of its calculation: it is enough to reconcile the accounting and tax registers.

The use of PBU 18/02 allows you to trace the entire scheme of tax formation, taking into account the differences between accounting and tax accounting, which are permanent and temporary.

Permanent differences arise from income and expenses that are not recognized for tax purposes. Temporary differences arise when the timing of the acceptance of income and expenses in accounting and for tax purposes does not coincide. The overwhelming majority of temporary differences are expenses that are differently accounted for for accounting and tax purposes. A significant part of expenses in accounting is accepted earlier than in tax accounting. But the opposite situations also take place.

All operations for calculating taxes are displayed on the credit of account 68. To display the calculation of income tax, a special sub-account is opened for it. When calculating profit, taking into account the norms of PBU 18/02 (approved by order of the Ministry of Finance dated November 19, 2002 No. 114n), reduction to the total value of the required value calculated in tax and accounting is observed. In order to link the arising differences (temporary and permanent) in the calculation of income tax, various accounting entries are used.

The appearance of these differences is due to the fact that not all expenses in tax accounting reduce taxable profit, at the same time they are taken into account in accounting. It is for the purpose of the subsequent correction of the profit calculated in accounting that it is necessary to take into account all the differences that arise.

Depending on what difference the taxpayer received for the reporting period (deductible or taxable), different postings are applied.

A permanent tax liability arises if, according to the results for the reporting period, the value of profit in tax accounting is greater than in accounting.

![]()

PNO = Prp * NS, where

PNO - permanent tax liability;

Prp - constant difference (positive);

НС - the tax rate, which is equal to 20%.

Dt 99 - Kt 68 - accrual of a permanent tax liability.

In a situation where the profit is less in tax, and not in accounting, respectively, and the constant difference turns out to be negative. A permanent tax asset arises.

Dt 99 - Kt 68 - accrual of notional tax expense.

The value is equal to the profit in accounting multiplied by the tax rate.

Dt 68 - CT 99.

The calculated profit in tax accounting, multiplied by the tax rate, is the current income tax. You do not need to make correspondence to display it.

As a result of the operations carried out, the financial result of income tax becomes equal to the current value of the tax.

For small businesses, income tax transactions look like this: Dt 99 - Kt 68.

PBU 18/02 - Regulation on accounting. Accountants use PBU 18/02 for calculating income tax in 2018. This provision was approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n. The purpose of the regulation is to bring accounting for income tax in line with the European standard.

Income tax is regulated by Chapter 25 of the Tax Code of the Russian Federation. In 2018, the tax rate will be 20%. But there will be significant changes inside the rate. Of the 20% now, 3% are required to be paid to the federal budget, this figure has not changed, and the remaining 17% - to the local budget. At the same time, local authorities still have the right to reduce their share of income tax, but at least to 13.5%

In terms of accounting for the calculation of income tax, these innovations will not make any adjustments. Since our instruction is for dummies, below we give a detailed accounting of income tax calculations in 2018.

But not everything is so simple. Most often, firms have differences in the income and expense indicators of accounting and tax accounting, then the need arises to use additional sub-accounts and postings in accounting, which are discussed below.

The accounting of income and expenses in tax and accounting is subject to various legal provisions. As a result, in the course of accounting for income tax in 2018, inconsistencies in the taxable amounts that pass through accounting and tax accounting, the so-called differences, may form.

According to PBU 18/02, the permanent difference is the income and expense of the enterprise that goes through accounting, but does not affect the calculation of income tax for both the reporting and the following reporting periods.

When accounting for income tax calculations, in this case, a permanent tax asset (PNA) is formed, equal to the difference obtained from subtracting a smaller value from a larger value and multiplied by 20% (tax rate).

The permanent difference also includes that income and expense, which, on the contrary, is taken into account when determining the amount of income tax, but is not spelled out in the accounting of both the reporting and subsequent reporting periods.

When accounting for income tax calculations, in this case, a permanent tax liability (PNL) is formed, which is calculated in the same way as the PNA, only the tax accounting data will be larger.

According to PBU 18/02, a temporary difference arises when the income and expense data in accounting are recorded in one period, and for tax accounting in another period. Over time, this difference should be eliminated.

Debit 09 Credit 68 (subaccount "Calculations of income tax").

deferred tax liability (DTL) - arises when accounting profit is higher than tax profit. IT is defined in the same way as IT, only accounting data will be considered large in this case.

In July, Limma bought, installed and put into operation a mobile belt conveyor at a cost of 40,000 (excluding VAT), paying an additional 2,000 rubles. the installer of the unit.

According to the Classification of Fixed Assets Included in Depreciation Groups, the director of Limma documents the service life of the device at 30 months.

It turns out that "Limma" spent 42,000 rubles on the purchase of a movable tape, and the amount of 40,000 rubles will be taken into account in the calculation of income tax. Thus, Limma faced a temporary difference and formed a deferred tax liability (DET) in the amount of RUB 400. (2000 * 20% = 400)

In August, for the first time depreciation is charged on the traveling belt, and IT gradually begins to decrease. In this part, you need to be extremely focused, since according to accounting, depreciation is charged in the amount of 42,000 and will be equal to 1,400 rubles (4200: 30 months)

And for tax accounting in the amount of 40,000 rubles. and will be equal to 1333 rubles. (40000: 30)

We calculate IT (1400-1333) * 20% = 13.4 rubles.

Within 30 months (device life), the temporary difference and the deferred tax liability will be fully paid off.

What are the transactions that relate to income tax:

- Income tax was charged - posting Dt99 Kt68, subaccount "Income tax". The source documentation is a corporate income tax declaration, as well as an accounting statement;

- Conditional income tax expense - posting Dt99 Kt68, subaccount “Conditional income tax expense”. The monetary expression of “notional” accounting profit multiplied by the percentage of the income tax rate. It arises as a result of inconsistencies in accounting and tax reporting;

- Deferred tax asset (SHA) is reflected - entry Dt09 Kt68. On the debit of account 09 "Deferred tax assets" SHE is accounted for, on the credit of the account "Calculation of taxes and fees" SHE is repaid. A deferred tax asset is a portion of tax profits that is deferred for payment in a future period. It arises as a result of differences between accounting and tax calculations. The primary documents for filling in the data are tax registers and accounting statements;

- Reduced or completely extinguished SHE - posting Dt68 Kt09;

- Conditional income tax on income - transactions Dt68 Kt99, subaccount "Conditional income tax on income". The amount of “notional” accounting savings multiplied by the income tax rate. It is formed based on the results of inconsistencies in accounting and tax reporting;

- Written off SHE, which should no longer increase profit in the future reporting period, - posting Dt99 Kt09;

- Deferred tax liability (DTL) is reflected - posting Дт68 Кт77. IT arises when the amount of tax profit is not more than the value of the accounting one;

- Reduced or fully repaid IT - posting Dt77 Kt68;

- Written off IT, which should no longer increase profit in the reporting and future periods - posting Dt77 Kt99;

- Advance payments for income tax were paid - posting Дт68 Кт51;

- Income tax paid - posting Dt68 Kt51. Primary documents on the basis of which the calculation is made - payment order and bank statement.

Procedure for calculating and paying tax

Monthly advance payments due during the reporting period must be transferred no later than the 28th day of each month of such period.

All relationships for the payment of taxes to state budgets of different levels are reflected in accounting on a specific account. In the accounting chart of accounts, to display the movement of funds for the payment of all taxes, the 68th account "Calculations of taxes and duties" has been created, in which a subaccount of the same name "Income tax" is created for transactions on income tax.

The calculation and payment of income tax can be done in two ways:

- Four times a year, quarterly advance payments. In this case, the calculation of this tax is made on an accrual basis. The actual difference between the accruals for the current and previous periods is paid quarterly.

- Monthly, based on the actual size of the profit received by the company.

The choice of one of the two payment schedule options is arbitrary and is determined based on the accounting policy of the organization.

Income tax - which account to use for accounting (q)

PBU 18/02 is used to record calculations for income tax in 2018 by all legal entities that are taxpayers (LLC, CJSC, OJSC, individual entrepreneurs, etc.), as well as foreign companies that receive income from the resources of the Russian Federation or through their own representatives in the Russian Federation. Look at what income you can not pay corporate income tax on the main tax system.

The exceptions are non-profit organizations and small businesses. They have the right to choose whether to apply PBU18 / 02 to them or not, but any of their decisions must be necessarily fixed in the accounting policy.

Also, taxpayers who apply special taxation regimes, such as the Unified Agricultural Tax, STS, UTII, payers of tax on gambling and participants in special state projects, do not pay income tax.

Income tax accrual is reflected by posting, example of calculations

To understand which income tax account should be used when applying PBU 18/02, you can use the following algorithm. The tax in this case is formed as follows:

- The tax calculated from the accounting profit is drawn up by posting Дт 99 Кт 68.04.2.

- Tax amounts (permanent tax liabilities) accrued from permanent differences are taken into account:

- Dt 68.04.2 Kt 99 - from income not taken into account for tax purposes;

- Dt 99 Kt 68.04.2 - from expenses not taken into account for tax purposes.

- The amount of tax accrued from temporary differences at the time of their occurrence in accounting is taken into account:

- Dt 09 Kt 68.04.2 - deferred tax assets (for expenses accepted in accounting earlier than in tax);

- Dt 68.04.2 Kt 77 - deferred tax liabilities (for expenses accepted in tax accounting earlier than in accounting).

- The tax amounts are taken into account on previously accrued temporary differences, for which it became possible to close in this period. Which account is closed - deferred tax assets or deferred tax liabilities - depends on the type of temporary difference:

- Dt 68.04.2 Kt 09 - deferred tax assets (for expenses accepted in accounting earlier than in tax);

- Dt 77 Kt 68.04.2 - deferred tax liabilities (for expenses accepted in tax accounting earlier than in accounting).

Thus, the answer to the question of which income tax account is used to record it depends on the specific situation. In particular, for these purposes, the debit of account 68 is actively used.

- Dt99 Kt68 - accrual;

- Dt68 Kt51 - payment.

However, income tax is accounted for on an accrual basis from the beginning of the year. Therefore, with quarterly payments, in the first quarter, you scatter the tax amount that you received for this period directly on the transactions.

But for half a year and subsequent periods, you will have to do the following operation, calculate the difference between the amount of tax for the reporting period and the one that you gave in the previous period. This difference will need to be reflected further.

1st quarter - 150,000 rubles;

Half-year - 273,000 rubles;

9 months - 400,000 rubles;

Annual - 600,000 rubles

If the company suffers losses, and the difference between the present and the past period is negative, use the operation CUT. The correction is done all on the same accounts: Dt99 Kt68 for the amount of the loss.

For example: in the 1st quarter the profit of the LLC was 80,000 rubles, and for the six months - 57,000 rubles. The loss amounted to 23,000 rubles. (80,000 - 57,000).

The accountant shall enter interest on income tax in the following entries: Dt99 Kt68 or Kt69 to the subaccount "Fines and penalties accrued".

You may find it useful: "An accounting policy will help save income tax"

Related article: Income Taxes in 2019: New Rates, Table

When a company applies PBU 18/02 just to post income tax on the accounts, it will not succeed. She is obliged to reflect on accounting all components of the tax amount. First of all, we are talking about conditional income tax and its transactions.

- Notional income tax is divided by income tax expense - this is the amount that increases the tax amount, and income tax income - the amount that reduces the income tax.

- Deferred tax liabilities and assets (IT and IT) also belong to the same song. These are the amounts that, at the beginning of the reporting period, increase or decrease income tax, and by the end of the year do the opposite. Their important characteristic is temporality.

- But there are still constant values that either reduce or make the tax amount more all the time - these are permanent tax liabilities (PSA) and permanent tax assets (PSA).

They are taken from the difference between tax and accounting. When some income or expenses that decrease or increase the tax base are recognized as such in one accounting, but are not recognized in another. There are many situations when such a difference may arise: a difference in the time of depreciation write-off, gratuitous transfer of property from a third party, etc.

All these temporary and permanent components of income tax must be disclosed in accounting entries as follows.

In accordance with generally accepted norms, profit is calculated as income minus expenses. This taxable income is inherently taxable. Tax profit is calculated in accordance with the provisions of the Tax Code of the Russian Federation and is determined on the basis of primary documents, as well as the results of accounting.

Accounting transactions for income tax are reflected in the database, which contains all changes in the state of accounting objects. The main account assignments (accounting entries) in this tax segment are: “income tax is listed - posting Dt99 Kt68” and “payment of income tax - posting Dt68 Kt51”.

The tax period for calculating income tax is the calendar year. Reporting periods can be both quarterly and monthly intervals. All profit materialized in monetary terms is the tax base. When, at the end of the annual tax period, the amount of expenses turns out to be greater than the amount of income, a zero value is assigned to the tax base. The accrual of income tax is reflected by the entry Dt 99 Kt 68.

Income tax was charged posting: the debit amount is reflected on account 99 “Profits and losses”, account 68 “Calculations of taxes and duties” is credited for the same amount. The advance payment for this transaction is calculated by multiplying the amount of profit received for the period by the current tax rate under the law.

| Account Dt | Account CT | Description of wiring | Transaction amount, rub. | A document base |

| 99 Profit and loss | 68, subaccount Income tax | Accrual of advance on income tax for the first quarter | 10 000,00 | Help-calculation |

| 68, subaccount Income tax | 51 Current account | Transfer to the budget of an advance payment for the 1st quarter | 10 000,00 | Payment order |

| 99 | 68, subaccount Income tax | Accrual of an advance on income tax for six months | 15 000,00 | Help-calculation |

| 68, subaccount Income tax | 51 | Transfer of 6 months advance payment to the budget | 15 000,00 | Payment order |

| 99 | 68, subaccount Income tax | 25 000,00 | Help-calculation | |

| 68, subaccount Income tax | 51 | 25 000,00 | Payment order | |

| 99 | 68, subaccount Income tax | Calculation of the annual amount of income tax | 40 000,00 | Help-calculation |

| 68, subaccount Income tax | 51 | Transfer of the total annual amount | 40 000,00 | Payment order |

| Account Dt | Account CT | Description of wiring | Transaction amount, rub. | A document base |

| 99 | 68, subaccount Income tax | Accrual of advance on income tax for three quarters | 25 000,00 | Help-calculation |

| 68, subaccount "Income taxes" | 51 | Transfer to the budget in advance for 9 months | 25 000,00 | Payment order |

| 99 | 68, subaccount Income tax | Adjustment (reversal) of the amount of income tax for 9 months | 40 000,00 | Adjustment declaration |

In order to determine which entries reflect the accounting differences in the calculation of income tax, it is required to establish what kind of difference the company received - taxable or deductible. If the profit calculated in tax accounting exceeds the indicator of "accounting" profit, then the temporary difference is deducted.

The amount of temporary difference x 20% (tax rate) = SHE

SHE is reflected in the accounting by the following correspondence: Dt 09 Kt 68

If the "tax" profit does not exceed the amount of "accounting" profit, then a deferred tax liability (IT) appears.

Dt 68 Kt 77 accrued by IT.

When a permanent difference appears, it is required to establish the nature of this value, a positive difference or a negative

If the profit for tax accounting exceeds the "accounting" indicator, then the permanent difference is positive. In this case, a permanent tax liability (PSL) arises.

Positive constant difference x 20% = PND

In the accounting, this is reflected by the following entry: Dt 99 Kt 68 - PNO accrued

If the profit in tax accounting does not exceed the value in accounting, then the constant difference is negative.

|

Debit |

Credit |

Source documents |

|

|

Income tax has been charged (based on accounting profit). |

Profit tax declarations of organizations, accounting information. |

||

|

Deferred tax asset is recorded. |

|||

|

Decreased (fully extinguished) deferred tax asset. |

Tax registers, accounting information. |

||

|

A deferred tax asset has been written off in the amount by which taxable profit will not be reduced in the reporting and subsequent periods. |

Tax registers, accounting information. |

||

|

Deferred tax liability recorded. |

Tax registers, accounting information. |

||

|

Decreased (fully extinguished) the deferred tax liability. |

Tax registers, accounting reference |

||

|

A deferred tax liability has been written off in the amount by which taxable profit for the reporting and subsequent periods will not be increased. |

Tax registers, accounting information. |

||

|

Advance income tax payments have been paid. |

Bank statement on the current account. |

||

|

Income tax paid. |

Payment order (0401060), bank statement on the current account. |

Undestributed profits

At the end of the year, the balance of account 99 is credited to retained earnings (loss) with the following entries.

Dt 99 Kt 84 - write-off of net profit by final turnovers

Dt 84 Kt 99 - write-off of loss

Retained earnings recorded on account 84 can be written off to different items by the following transactions:

- Dt 84 Kt 75 - accrual of dividends to participants

- Dt 84 Kt 70 - accrual of various bonuses and material assistance to employees at the expense of net profit

- Dt 84 Kt 84 - coverage of losses of previous years

- Dt 84 Kt 80 - increase in the authorized capital

- Dt 84 Kt 82 - formation or replenishment of the organization's reserve fund.

The distribution of profits, reflected by these transactions, is permissible only with the decision of the founders of the organization

The uncovered loss reflected in the debit of account 84 can be repaid from various sources at the decision of the owners.

- Dt 75 Kt 84 - writing off the loss due to dividends or contributions from participants

- Dt 84 Kt 84 - write-off of the loss at the expense of the profit of previous years

- Dt 82 Kt 84 - writing off the loss at the expense of the reserve fund

Income tax percentage

Income tax

The percentage of income tax will not change, it still amounts to 20%, while the bulk of it, namely 18%, goes to the budget of the constituent entities of the Russian Federation, and only 2% goes to the budget of the federation. When calculating corporate income tax, the proceeds are taken without taking into account excise rates and VAT.

Tax rates on income of foreign companies that are not associated with activities in the Russian Federation through a permanent establishment:

- 10% of the lease, maintenance, use (charter) of ships, aircraft and other vehicles, as well as containers for international transportation;

- 20% from other income (with some exceptions);

On income received in the form of dividends, the following rates are:

- 0% on income received by Russian companies in the form of dividends, if the condition is met: on the day of the decision regarding the payment of dividends, a company that is a recipient of dividends for a period of at least 365 calendar days continuously owns shares (contribution) of more than 50% in the authorized capital of the organization paying dividends or in depositary receipts, which in turn give the right to receive dividends, in an amount that is at least 50% of the total amount of dividends paid by the company.

- 9% - on income received in the form of dividends from foreign and Russian companies by Russian companies;

- 15% - on income received in the form of dividends from Russian companies by foreign organizations.

Payment of income tax

Let's figure out what are the ways to calculate the payment of income tax.

The 1st method is set by default for all organizations and provides that the reporting periods are the 1st quarter, half a year and 9 months. Advance payments are accepted at the end of each reporting period. Amount of payment at the end of the 1st quarter = tax on profits that were received in the 1st quarter.

Half-year advance payment = tax on profit earned for the half-year, deducting the first quarter advance payment. Amount of payment based on the results of 9 months = tax on profit for 9 months minus advance payments for the 1st quarter and six months.

The second method is based on the actual profit, this method can be adopted by the organization on a voluntary basis, you just need to notify the tax service no later than 31.15 that during the next year the company is switching to calculating monthly advance payments based on the profit, which is actually received. With this method, the reporting periods will be a month, 2 months, 3 months and then until the end of the calendar year.

Advance payment for January = tax on profits actually received in January; for January-February = tax on profits actually received in January-February minus the advance payment for January. And so on until December.

Monthly advance payments due during the reporting period must be transferred no later than the 28th day of each month of such period.

The organization maintains tax records, calculates income tax, pays it and reflects it in the tax return in accordance with the rules of tax legislation. The calculated amount of income tax from the point of view of accounting is a fait accompli in business life. About how the calculated income tax is taken into account in accounting, how the application of the provisions of PBU 18/02 affects accounting entries when calculating tax, and how the analytical accounting of calculations with the budget for income tax is organized in "1C: Accounting 8" version 3.0 , say 1C experts.

Calculations with the budget for income tax

To summarize information about calculations with the budget for corporate income tax in "1C: Accounting 8" is intended account 68.04.1 "Settlements with the budget", subordinate to account 68.04 "Income tax".

The credit of account 68.04.1 reflects the accrual of income tax. The debit of account 68.04.1 reflects the amounts actually transferred to the budget (including advance tax payments).

Analytical accounting on account 68.04.1 is maintained:

- by type of payment (subconto Types of payments to the budget (funds)). To reflect transactions on the accrual and payment of tax (advance payments), the type of payment is used (we will consider other possible types of income tax payments below);

- on budgets to which tax is payable (subconto Budget levels). For income tax it is Federal budget and Regional budget.

Transactions for calculating income tax in the program are generated automatically when performing a monthly routine operation Income tax calculation included in the processing Close of the month.

Income tax transactions are calculated as follows:

- According to tax accounting data, the taxable base is determined monthly on an accrual basis from the beginning of the year (regardless of the procedure for making advance payments and the procedure for recognizing reporting periods in accordance with Articles 285 and 286 of the Tax Code of the Russian Federation).

- Income tax is calculated for each budget.

- The calculated amounts are compared with the tax amounts calculated in the last month of the current tax period (for each budget). If a positive difference is found, then transactions are entered for the "additional accrual" of tax. If the difference turns out to be negative, then a decrease in the previously accrued tax amounts is reflected.

Thus, the amount of the calculated tax indicated in line 180 of sheet 02 of the income tax declaration (approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3 / [email protected]) for the reporting (tax) period, must coincide with the credit turnover of account 68.04.1 by type of payment Tax (contributions): accrued / paid for the corresponding period.

The procedure for reflecting operations for calculating corporate income tax in 1C: Accounting 8 depends on whether the organization applies the Accounting Regulation "Accounting for calculations of corporate income tax" PBU 18/02 (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

Note

The Ministry of Finance of Russia, by order of November 20, 2018, No. 236n, approved the new version of PBU 18/02. The changes approved by Order No. 236n should be applied from the reporting for 2020. Organizations can keep records under the new rules earlier, for example, from 2019 or from 2018. Read more about PBU 18/02 as amended. Order No. 236n and support in 1C: Accounting 8 (rev. 3.0) see the article.

Accounting entries when calculating income tax

If the organization applies PBU 18/02

The procedure for applying PBU 18/02 is configured in the information register Accounting policy(chapter The main thing). If the organization applies the provisions of PBU 18/02, then the switch should be set in one of the positions:

- Conducted by the balance method;

- Conducted by the costly method (deferral method). In the program, this method can also be applied after 2019, since PBU 18/02 does not contain restrictions for the organization to use any of these methods of its choice (Information message of the Ministry of Finance of Russia dated December 28, 2018 No. IS-accounting-13).

If a costly method is set in the program, then the routine operation Income tax calculation performs two functions at once: tax calculation for payment to the budget (according to tax accounting data), and calculations according to PBU 18/02 (according to accounting data).

If the organization uses the balance sheet method, then the processing Close of the month two separate routine operations are included:

- Income tax calculation - performs only tax accrual based on tax accounting data for payment to the budget;

- - performs only calculations according to PBU 18/02 according to accounting data (according to a new algorithm, that is, the balance method) for financial statements.

In any case, the calculated amounts of income tax are accrued by posting:

Debit 68.04.2 Credit 68.04.1.

Simultaneously, the tax amounts are distributed among the budgets of different levels.

A decrease in the amounts due to be paid to the budget is reflected in a reversal entry with a simultaneous distribution to the budgets:

STORO Debit 68.04.2 Credit 68.04.1.

Account 68.04.2 "Calculation of income tax" is specially used in the program to summarize information on the procedure for calculating corporate income tax in accordance with the provisions of PBU 18/02. Analytical accounting for account 68.04.2 is not provided.

Calculations according to PBU 18/02 include the following operations:

- recognition (extinguishment) of deferred tax assets (SHA) and deferred tax liabilities (IT). To summarize information about the presence and movement of IT and IT, accounts 09 "Deferred tax assets" and 77 "Deferred tax liabilities" are intended. Analytical accounting of IT and IT is carried out by types of assets or liabilities, in the assessment of which a temporary difference has arisen;

- determination of the conditional expense (income) for income tax. Conditional expense (income) for income tax is calculated as the product of accounting profit for the reporting period and the income tax rate. To summarize information on the amounts of conditional expense (income) for income tax in the program, there are accounts 99.02.1 "Conditional expense for income tax" and 99.02.2 "Conditional income for income tax";

- recognition of permanent tax expense (income) for income tax. The permanent tax expense (income) for income tax is calculated as the product of the permanent difference that occurred in the reporting period and the income tax rate. To summarize information about the amount of recognized permanent tax expense (income), the program uses account 99.02.3 "Permanent tax liability".

Note

About the advantages of the balance method and how in "1C: Accounting 8" edition 3.0 this method is used when determining temporary differences, see articles and.

Transactions related to calculations according to PBU 18/02 using the balance sheet method are presented in the table.

table

Postings generated in the program "Calculation of deferred tax according to PBU 18 / 02 "

note that income tax is charged in whole rubles, and the amount of conditional income tax expense (income), IT and IT, constant tax expense (income) - in rubles and kopecks. As a result, a difference may arise on account 68.04.2 (even if permanent and temporary differences are correctly recorded in the accounting). The resulting balance is automatically debited to account 99.09 "Other profits and losses" by posting:

Debit 99.09 Credit 68.04.2 or

Debit 68.04.2 Credit 99.09.

Thus, after performing routine operations Income tax calculation and Calculation of deferred tax according to PBU 18/02 account 68.04.2 is always closed.

Let us consider, using a specific example, how the calculations for income tax are performed when PBU 18/02 is applied in 1C: Accounting 8, version 3.0, and what transactions are generated at the same time.

Example 1

|

LLC "Trading House" Kompleksny "" applies OSNO and the provisions of PBU 18/02 in accordance with the new edition, approved. Order No. 236n. The income tax rate is 20% (including 3% - to the Federal budget, 17% - to the regional budget). In January 2019, the following financial indicators are reflected in the accounting of the organization:

The following indicators are reflected in the tax accounting registers:

The deductible temporary difference for the asset type "Deferred income" is:

The taxable temporary difference for the type of asset "Fixed assets" is:

|

Let's calculate income tax for January 2019 according to tax accounting data:

- RUB 700,000 - tax base (1,000,000 rubles - (72,000 rubles + 228,000 rubles)).

- RUB 140,000 - income tax (700,000 rubles x 20%), including 21,000 rubles. - to the Federal budget (700,000 rubles x 3%); RUB 119,000 - to the regional budget (700,000 rubles x 17%).

When performing a routine operation Income tax calculation wiring will be automatically generated (see fig. 1).

Rice. 1. Calculation of income tax in correspondence with account 68.04.2

- RUB 1,600 - repayment of SHE ((112,000 rubles - 104,000 rubles) x 20%).

- RUB 400 - repayment of IT ((118,000 rubles - 116,000 rubles) x 20%).

- RUB 706,000 - profit according to accounting data ((1,000,000 rubles + 8,000 rubles) - (230,000 rubles + 72,000 rubles)).

- RUB 141,200 - conditional income tax expense (706,000 x 20%).

When performing a routine operation Calculation of deferred tax according to PBU 18/02 the following transactions will be automatically generated (see fig. 2).

Rice. 2. Calculations using PBU 18/02

Figures 3 and 4 show Account analyzes 68.04.1 and 68.04.2.

Rice. 3. Analysis of account 68.04.1

Rice. 4. Analysis of account 68.04.2

The presented postings and standard reports on income tax settlement accounts demonstrate that account 68.04.2 plays a purely technical (auxiliary) role in the program. For example, in the recommendation R-102/2019-KpR "The procedure for accounting for income tax", adopted by the Committee on the recommendations on 26.04.2019 of the fund "NRBU" BMTs "", account 68.04.2 is not used at all.

If the organization does not apply PBU 18/02

If the organization does not apply the provisions of PBU 18/02, then the switch Accounting for deferred tax assets and liabilities (PBU 18 "Accounting for calculations of corporate income tax") should be set to position Not conducted.

In this case, when performing a routine operation Income tax calculation account 68.04.1 corresponds with account 99.01.1 "Profits and losses from activities with the main taxation system" (with the value of the type of subconto ). The accrual of the amounts of the current income tax payable is reflected by the entry with the simultaneous distribution to the budgets:

Debit 99.01.1 Credit 68.04.1.

Accordingly, the decrease in the amounts payable is reflected in the entry with the distribution to the budgets:

STORO Debit 99.01.1 Credit 68.04.1.

Let's change the conditions of Example 1 and consider how calculations of income tax are reflected in 1C: Accounting 8, version 3.0, if the provisions of PBU 18/02 are not applied.

Example 2

In this situation, when performing a routine operation Income tax calculation wiring will be automatically generated (see fig. 5).

Rice. 5. Calculation of income tax in correspondence with account 99.01.1

Regardless of the procedure for applying the provisions of PBU 18/02, the credit turnover of account 68.04.1 by type of payment Tax (contributions): accrued / paid for the reporting (tax) period coincides:

- with the amount of calculated income tax indicated in line 180 of sheet 02 of the income tax declaration;

- with the amount of the current income tax specified in the statement of financial results (the form was approved by order of the Ministry of Finance of Russia dated 02.07.2010 No. 66n).

If the organization is acting as a tax agent

An organization that calculates dividends to a company participant (shareholder) - a legal entity must fulfill the duties of a tax agent and withhold income tax when paying dividends.

A separate account 68.34 “Income tax in the performance of duties of a tax agent” is intended to summarize information on calculations with the budget for income tax when paying dividends. Dividend tax is always paid to the Federal budget, therefore analytical accounting on account 68.34 is kept only by types of payments to the budget.

For limited liability companies, the accrual of dividends and withholding tax on the payment of income from participation can be registered in the program automatically using a document Dividend accrual ndov (section Operations).

For joint stock companies, the accrual of dividends on shares and withholding tax should be reflected in a document Operation(chapter ).

In any case, the withholding of income tax in the performance of the duties of a tax agent in the payment of dividends must be reflected by the entry:

Debit 75.02 Credit 68.34.

Account 75.02 "Calculations for the payment of income" is intended to summarize information on the payment of income to the founders (participants) of the organization (shareholders of a joint-stock company, participants in a general partnership, members of a cooperative, etc.).

Thus, the "agency" tax is accounted for separately and does not affect the turnover of account 68.04.1.

Analytical accounting of calculations with the budget for income tax

Now let's take a closer look at the types of payments that can be used for analytical accounting of settlements with the budget. The type of payment is selected from a list predefined by the program, and for income tax it can take the following value:

- Tax (contributions): accrued / paid;

- Tax (contributions): additionally assessed / paid (independently);

- Penalty: accrued / paid;

- Penalty interest: additionally accrued / paid (independently);

Payment type Tax (contributions): accrued / paid is used to reflect transactions for the accrual and payment of tax (advance payments), and the transactions in the program are generated automatically when performing a monthly routine operation Income tax calculation included in the processing Close of the month... Despite this, some users are trying to manually calculate monthly advance payments due in the next quarter in order to quickly monitor the status of settlements with the budget. You should not do this - you can violate the accounting. In addition, such actions are meaningless: when performing a routine operation Income tax calculation tax is calculated on an accrual basis from the beginning of the tax period, including taking into account manual entries and adjustments to the tax base of the current period.

It is a different matter if the organization discovers an error in the declaration of the previous tax period, which led to an underpayment of tax. In this case, it is required not only to adjust the balance of settlements with the budget for income tax (that is, to independently accrue and pay additional tax for previous years), but also to separately reflect in the accounting and reporting the tax that is not related to the current tax period. We remind you that in the statement of financial results (the form was approved by order of the Ministry of Finance of Russia dated 02.07.2010 No. 66n), the amount of additional income tax due to the discovery of errors of previous years, which does not affect the current income tax of the reporting period, is reflected in a separate article of the report after current income tax items (clause 22 PBU 18/02). To fulfill these requirements, a separate type of payment should be used - Tax (contributions): additionally assessed / paid (independently).

In "1C: Accounting 8" (rev. 3.0), additional accrual of income tax from an increase in the tax base, which occurred as a result of corrections made to tax accounting, is performed using the document Operation(chapter Operations - Operations entered manually).

In the period of detection of an error, you need to enter accounting records, distributing the tax payable by budget levels:

Debit 99.01.1 Credit 68.04.1

- with the type of payment Tax (contributions): additionally charged / paid (independently), fig. 6.

Rice. 6. Additional accrual of income tax due to a mistake of previous years

Regardless of whether the organization applies the provisions of PBU 18/02 or not, when self-charging additional income tax, account 68.04.1 must correspond with account 99.01.1 "Profits and losses from activities with the main taxation system" with the value of the type of subconto Income tax and similar payments... In this case, the calculations for income tax for the current year will not be affected.

If the due taxes are paid on time later than those established by the legislation on taxes and fees, then the organization must independently calculate and pay penalties (clause 1 of article 75 of the Tax Code of the Russian Federation). For the purposes of taxation of profits, expenses in the form of penalties for late payment of taxes are not taken into account (clause 2 of article 270 of the Tax Code of the Russian Federation).

There are two points of view regarding the accrual of penalties in accounting:

- Penalties on taxes payable to the budget are reflected in the same manner as sanctions for non-compliance with tax legislation, that is, they are reflected in the debit of account 99 in correspondence with account 68 (see Instructions on the application of the Chart of accounts for financial and economic activities of organizations , approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n; clause 83 of the Regulations for the maintenance of accounting and financial reporting, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

- Penalties are a way to ensure the fulfillment of the obligation to pay taxes and fees and are not a tax sanction (clause 1 of article 75, clauses 1, 2 of article 114 of the Tax Code of the Russian Federation). The amounts of penalties accrued by the organization in connection with the incomplete payment of tax on time meet the definition of the expense given in paragraph 2 of PBU 10/99, approved. by order of the Ministry of Finance of Russia dated 06.05.1999 No. 33n. Accrued penalties in the program are reflected in the debit of account 91.2 "Other expenses" in correspondence with account 68.

Guided by professional judgment, the organization independently determines the procedure for calculating penalties and approves it in its accounting policy.

For self-accrual and payment of penalties in the program, you should also use the document Operation and an independent type of payment Penalty interest: additionally accrued / paid (independently).

If the organization calculates penalties on the debit of account 99.01.1 in the program, then the value must be selected as the analytics Tax sanctions due(fig. 7).

Rice. 7. Calculation of penalties

In this case, the penalties will not underestimate the taxable base, and the program will calculate the tax in accordance with the rules of Chapter 258 of the Tax Code of the Russian Federation. Reflect persistent difference in resource Amount Dt PR: 99.01.1 not required.

Income tax, as well as penalties and interest under an on-site or in-house audit act should be charged manually using the appropriate types of payment:

- Tax (contributions): additionally assessed / paid (according to the inspection certificate);

- Penalty: accrued / paid;

- Penalty: accrued / paid (according to the verification act).

Thus, the turnover of account 68.04.1 may reflect not only the accrual and payment of income tax for the current tax period, but also the amount of taxes related to previous years, as well as penalties and tax penalties. However, thanks to analytical accounting, which is supported in the program, these types of payments are accounted for separately (Fig. 8).

Rice. 8. Analytical accounting of calculations with the budget for income tax

When calculating income tax, this operation must be posted on accounting entries. However, due to the differences in tax and accounting, this is not always easy to do, and mistakes are fraught with the fact that at the end of the year the total amount of tax will not converge. Therefore, read what postings to do in a given situation.

Income tax transactions are described in PBU 18/02 "Accounting for calculations of corporate income tax", approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n. All enterprises are obliged to keep records in accordance with PBU 18/02, except for:

- Small business organizations;

- Low-cost enterprises;

- Companies participating in the Skolkovo project.

At the same time, all the listed organizations should not be included in the list of clause 5 of article 6 of Law No. 402FZ. These companies carry out the calculation of income tax on three accounts 68, 99 and 51, indicating there only the finished amount.

All others apply PBU 18/02, which means that when calculating income tax, transactions must reflect all operations that form or at least somehow affect the tax base. We will now see how it is done in practice.

Income tax accounting entries

To account for income tax, the accountant uses the following entries:

- Dt99 Kt68 - accrual;

- Dt68 Kt51 - payment.

Attention! In the instructions for the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, it is said that the transactions for calculating income tax must be formed on the last day of the reporting period.

However, income tax is accounted for on an accrual basis from the beginning of the year. Therefore, with quarterly payments, in the first quarter, you scatter the tax amount that you received for this period directly on the transactions.

But for half a year and subsequent periods, you will have to do the following operation, calculate the difference between the amount of tax for the reporting period and the one that you gave in the previous period. This difference will need to be reflected further.

Let's give an example. LLC has the following profit indicators:

1st quarter - 150,000 rubles;

Half-year - 273,000 rubles;

9 months - 400,000 rubles;

Annual - 600,000 rubles

Let's make income tax transactions:

If the company suffers losses, and the difference between the present and the past period is negative, use the operation CUT. The correction is done all on the same accounts: Dt99 Kt68 for the amount of the loss.

For example: in the 1st quarter the profit of the LLC was 80,000 rubles, and for the six months - 57,000 rubles. The loss amounted to 23,000 rubles. (80,000 - 57,000).

The accountant shall enter interest on income tax in the following entries: Dt99 Kt68 or Kt69 to the subaccount "Fines and penalties accrued".

Conditional income tax transactions in PBU 18/02

When a company applies PBU 18/02 just to post income tax on the accounts, it will not succeed. She is obliged to reflect on accounting all components of the tax amount. First of all, we are talking about conditional income tax and its transactions.

- Notional income tax is divided by income tax expense - this is the amount that increases the tax amount, and income tax income - the amount that reduces the income tax.

- Deferred tax liabilities and assets (IT and IT) also belong to the same song. These are the amounts that, at the beginning of the reporting period, increase or decrease income tax, and by the end of the year do the opposite. Their important characteristic is temporality.

- But there are still constant values that either reduce or make the tax amount more all the time - these are permanent tax liabilities (PSA) and permanent tax assets (PSA).

All enterprises and organizations in our country (including foreign ones that receive income on the territory of Russia) that have any financial earnings and work according to the standards of the general taxation system are obliged to pay income tax to the regional and federal budget of the Russian Federation. To calculate and correctly formalize this segment of taxation, there are accounting entries for income tax.

Income tax - transactions. Basic concepts

In accordance with generally accepted norms, profit is calculated as income minus expenses. This taxable income is inherently taxable. Tax profit is calculated in accordance with the provisions of the Tax Code of the Russian Federation and is determined on the basis of primary documents, as well as the results of accounting. Accounting transactions for income tax are reflected in the database, which contains all changes in the state of accounting objects. The main account assignments (accounting entries) in this tax segment are: “income tax is listed - posting Dt99 Kt68” and “payment of income tax - posting Dt68 Kt51”.

Tax on the profit of the organization was charged - posting Dt68 Kt51. The payment order contains the following data: the amount of 59,986 rubles was transferred to the federal budget, the amount of 339,924 rubles was transferred to the local regional budget.

For income tax transactions DT99 and KT68 accounts are used in every organization that uses the "income minus expenses" taxation system.