Description of some primary risks. Reliability of technical systems and technogenic risk

Read also

Let's consider some of the primary risks listed in the classification scheme of entrepreneurial risks, which is shown in Fig. 3.4.

Technical and technological risks. One of the most dangerous, in terms of the degree of influence on the final results of entrepreneurial activity, constituting an entrepreneurial risk are technical and technological risks. Their action is manifested in causing damage to the enterprise (firm) due to disruption of the normal course of the production process as a result of failures of machinery and equipment, and in the most severe manifestations - the occurrence of emergency situations. This can occur as a result of an explosion, fire, breakdown of mechanisms and equipment, etc.

The reasons for such manifestations can be - deterioration of buildings, machinery and equipment, errors in design and installation, personnel errors, damage to equipment during construction and repair work, etc. natural-climatic and criminal-legal risks.

It should be noted here that the damage from technical and technological risks manifests itself not only in damage or loss of production equipment, transport and buildings, but also in stopping production and reducing or stopping the volume of production. In the most severe cases, a significant part of the costs is the onset of civil liability for damage to the environment, to the personnel of the enterprise, as well as to third parties. At the same time, the material losses of society from accidents and disasters are steadily increasing.

The following examples of the manifestation of technical and technological risks in different countries and various industries, as well as the losses caused by them, are given.

1974, Flixborough (UK)... The explosion of a cyclohexane cloud at a polyethylene plant: complete destruction of the plant, 28 dead, more than 400 injured.

The losses amounted to about US $ 200 million in current prices.

1984, Bhopal (India)... Leak of toxic gases at a pesticide plant: 2,300 dead, 20,000 injured.

$ 470 million was paid in compensation.

1985, Chernobyl (Ukraine)... Nuclear power plant accident: an area with a population of 6.5 million people is contaminated.

According to Belarusian scientists, the losses amount to 700 billion rubles. in 1992 prices (according to foreign experts, they amount to USD 100–150 billion).

1988, Piper Alpha (North Sea)... Explosion and destruction of a drilling platform on the shelf of the North Sea: 167 dead.

Losses - USD 1200 million. The platform was insured for $ 800 million.

These examples could be continued. But, in our opinion, they convincingly confirm the conclusion that, characteristic of the twentieth century, the acceleration of growth and an increase in the scale of material production and consumption, the active use of natural resources has sharply increased the number and scale of industrial accidents and disasters. Therefore, the issues of ensuring the safety of the functioning of technical objects come to the fore.

In recent years, two concepts of risk and security have become most widespread in the world - the concept of absolute security (As Low As Practically Achievable) and the concept of acceptable risk (As Low As Reasonably Achievable).

At the same time, as practice has shown, at present, the concept of absolute safety has become inadequate to the internal laws of the technosphere. The zero probability of an accident is achieved only in systems devoid of stored energy, chemically and biologically active components. At other facilities (most of them), accidents are still possible. That is, as noted earlier, despite the measures taken by society aimed at reducing the likelihood of industrial accidents and disasters and reducing the amount of damage caused by them, accidental events that cause them remain possible, they cannot be excluded by the most expensive engineering and technical measures.

Analysis of the effectiveness of capital investments shows that in many cases it is possible to reduce to a greater extent the negative consequences of the occurrence of technical and technological risk, if more attention is paid to actions in the event of an accident. Since even the most advanced technical systems to prevent it, all the same, do not give absolute guarantees.

In conclusion, it should be noted that in the constructed scheme for the classification of entrepreneurial risk, technical and technological risk is considered as simple - such that at present it is not subject to further division. This situation is a significant simplification of reality. So, the composition of technical and technological risks should include environmental risks in their narrow sense, when, as a result of technogenic factors that have led to harm to the environment, a business entity not only incurs losses, but is also the main carrier of potential danger and civil liability. At the same time, the above analysis and examples indicate that risk factors are fires, explosions, breakdowns of mechanisms and equipment, transport accidents, etc. Here, for example, difficulties arise with the name of individual risks, in particular, the fulfillment of the previously discussed requirement so that the adjective to the word "risk" answers the question - "what is the risk?" The lack of consistency of opinions of specialists regarding the name, definition and content of the risks corresponding to them does not allow considering technical and technological risks as components. This can only be done if the opinions of experts on these issues are agreed in the future.

Natural and climatic risks associated with the manifestation of the elemental forces of nature. As you know, these include earthquakes, floods, storms, storms, hurricanes, as well as other unpleasant natural phenomena such as frost, ice, hail, thunderstorm, drought, etc. These natural phenomena can have a serious negative impact on business results , become a source of unexpected costs.

Natural and climatic risks refer to force majeure circumstances - force majeure circumstances that can neither be prevented nor eliminated by any measures. Since the onset of force majeure does not depend on the will of the entrepreneur, in accordance with Art. 79 of the UN Convention on Sale and Purchase Contracts, the parties are exempt from contract liability in the event of force majeure.

Compensation for losses caused by force majeure is carried out, as a rule, through insurance transactions in specialized insurance companies.

In the literature, the concept of "risks of force majeure" is widely used, which is one of the ways of dividing or grouping risks. Here, a sign of division is the ability of the entrepreneur to prevent or eliminate the causes that cause the occurrence of risky events. Since force majeure circumstances, by definition, include natural disasters (natural disasters), floods, earthquakes, storms and other climatic disasters, wars of revolution, putsches, strikes, etc., which interfere with entrepreneurial activity, this group may include country, social and other risks are also included.

It should be noted that, as in the case of technical and technological risk, natural and climatic risk is also considered as simple, which is also a simplification of reality. The reasons are the same - the lack of consistency of opinions of specialists regarding the name, definition and content of the risks corresponding to them. Consideration of this risk as a composite one can also be carried out subject to agreement in the future of the opinions of specialists on these issues.

Country risk. Country risks are directly related to the internationalization of business activities. They are relevant for all participants in foreign economic activity and depend on the political and economic stability of the countries - importers, exporters.

The reasons for country risk can be instability of state power, peculiarities of the state structure and legislation, ineffective economic policy pursued by the government, ethnic and regional problems, a sharp polarization of the interests of various social groups in the state, etc.

The results of entrepreneurial activity can be influenced by trade and currency regulation, quotas, licensing, changes in customs duties, etc., carried out by the state.

Currently, there are a number of organizations that, on the basis of systematized and clearly standardized principles, techniques and operations (methods), regularly analyze the level of country risk.

The most well-known country risk assessment systems include the Institutional Investor, Business Environment Risk Index (BERI), Euromoney ratings.

One of the recommended ways to analyze the level of country risk is the BERI index. It is determined by about 100 experts, who four times a year, using various methods of expert assessments, conduct an analysis that allows you to get an idea of all aspects of the political and economic situation in the country - a partner in foreign economic activity.

The BERI rating assesses political stability, attitudes towards foreign investment, nationalization, devaluation, balance of payments, economic growth rates, wage costs, labor productivity, infrastructure, terms of short- and long-term lending, etc.

A similar analysis is carried out regularly, twice a year, by the Euromoney magazine. The analyzed particular indicators include:

The efficiency of the economy, calculated on the basis of the projected average annual change in the GNP of the state;

The level of political risk;

The level of debt, calculated according to the World Bank data, taking into account the amount of debt, the quality of its service, the volume of exports, the balance of foreign trade turnover, etc .;

Availability of bank loans;

Availability of short-term financing;

Availability of long-term loan capital;

Country's creditworthiness;

The amount of unfulfilled obligations to repay the external debt.

Thus, all aspects of the political and economic situation in the partner's country are analyzed.

The results of the analysis are presented in the form of a database characterizing the assessment of the degree of investment risk and the reliability of business relations of various countries, presented in the form of a ranked list of countries with integral scores and partial risk assessments.

A fragment of the corresponding database as of March 2004 is given in table. 3.1 (www.euromoney.com).

As can be seen from this table, Russia has made tangible progress in the rating of investment attractiveness and reliability of business ties. During the period from March 2000 to March 2004, its position changed from 133rd to 66th place. This progress will be even more tangible compared to September 1999, when Russia was ranked 159 out of 188 countries.

For a long period, there has been no tangible progress in the rating of investment attractiveness and reliability of business ties in most of the member states of the former USSR. As the analysis shows, in comparison with 1993, Ukraine, Turkmenistan, Armenia, Moldova, Belarus, Georgia and Uzbekistan have only slightly improved their positions. Worsened

Production risks - risks associated with a loss from stopping production due to the impact of various factors and, first of all, with the loss or damage of fixed and circulating assets (equipment, raw materials, transport, etc.), as well as risks associated with introducing into production new equipment and technology.

Technical and production risks - the risk of damage to the environment (environmental risk); the risk of accidents, fires, breakdowns; the risk of disruption to the functioning of the facility due to errors in design and installation, non-compliance with production technologies and processes, a number of construction risks, etc.

Technical and technological risks - risks of losses caused by violations of the technology of controlled processes, unscheduled shutdowns of equipment, due to difficulties in the technical and technological implementation of the innovation, etc. They are associated with uncertainty factors that affect the technical and technological component of the activity during the implementation of the project, in particular: the reliability of equipment, the predictability of production processes and technologies, their complexity, the level of automation, the rate of modernization of equipment and technologies, they refer to internal risks, i.e., technical and technological. A set of risks corresponding to a certain type of activity can be called a complex of risks. In the domestic literature, the following types of risks are distinguished.

- Environmental risks. Environmental risk is understood as the likelihood of civil liability for damage to the environment, as well as the health of third parties. It can arise during the construction and operation of industrial facilities, space activities and is an integral part of industrial risk.

Environmental damage is expressed in the form of pollution or destruction of forest, water, air and land resources, damage to the biosphere and agricultural land.

Under the "damage to the life and health of third parties" is understood the result of the harmful effects of production factors on the surrounding industrial facility population, expressed in the form of an increase in morbidity and mortality.

It is advisable, together with environmental ones, to consider the related risks of civil liability for causing harm to third parties in the production process or in the implementation of space activities, which can be both legal (organizations) and individuals (population).

The most likely cases, which may result in civil liability, are accidents, excess emissions and leaks of harmful substances at production facilities or during space activities, the impact of which has affected the surrounding area.

The concept of environmental and legal responsibility was first formulated in the RSFSR law "On enterprises and entrepreneurial activity", which provided for compensation for damage from pollution and irrational use of the natural environment. This provision was developed in the Law of the RSFSR "On Environmental Protection", which, in particular, considers three types of damage subject to compensation:

- caused to the environment by a source of increased danger;

- caused to the health of citizens by the adverse impact on the natural environment;

- caused to the property of citizens.

The law of the Russian Federation "On industrial safety of hazardous production facilities" adopted in 1997 stipulates that an enterprise - a source of increased danger - is obliged to provide measures to protect the population and the environment from hazardous influences. In Art. 15 we are talking about compulsory insurance of liability for damage during the operation of a hazardous production facility, and in Art. 16 - that officials of the federal executive body, specially authorized in the field of industrial safety, have the right to act in accordance with the established procedure in court or in an arbitration court as a representative in claims for compensation for harm caused to the life, health and property of other persons as a result of violations of industrial safety requirements.

Thus, at the legislative level, the responsibility of the enterprise for environmental pollution is proclaimed and the possibility of satisfying claims of individuals, organizations and the state against the enterprise - the culprit of causing environmental damage, is provided.

- Industrial risks. Any production activity is associated with the development of new equipment and technologies, the search for reserves, and an increase in the intensity of production. However, the introduction of new equipment and technologies leads to the danger of man-made disasters that cause significant damage to nature, people, and production. Industrial risks are understood as the danger of damage to the company and third parties due to disruption of the normal course of the production process. In addition, they include the danger of damage or loss of production equipment and transport, destruction of buildings and structures as a result of the impact of such external factors as the forces of nature and malicious actions.

For industrial production, the most serious and frequent is the risk of failure of machines and equipment, and in the most severe manifestations - the occurrence of an emergency situation. This can happen at industrial facilities as a result of events of a different nature:

- natural - earthquake, flood, landslides, hurricane, tornado, lightning strike

etc.; - technogenic - deterioration of buildings, structures, machines and equipment, errors in its design or installation, malicious actions, personnel errors, damage to equipment during construction and repair work, falling aircraft or parts thereof, etc.;

- mixed - a violation of the natural balance as a result of man-made human activities, for example, the occurrence of a landslide during construction work.

Technical risks are associated with the possibility of accidents due to a sudden breakdown of machinery and equipment or a failure in production technology. The problem of technical types of insurance is to estimate the frequency of accidents and how to assess the damage from them. Technical types of insurance are universal, that is, they protect an object from many causes of damage (control errors, installation errors, technology violations, negligence in work, etc.), which lead to premature failures, failure of machines and equipment. Thus, technical risks imply damage to property, life and health of people, as well as the financial interests of the enterprise due to interruptions in production and over-standard costs.

According to the species composition of fixed and circulating assets, in which technical risks are manifested, they are subdivided:

- for machinery and equipment - industrial risks;

- buildings, structures, transmission devices - construction (construction and installation) risks;

- devices, computers, communication facilities - electrical risks;

- vehicles - transport risks (hull insurance);

- agriculture - risks of diseases of animals and plants, loss of livestock, damage to crops, etc.

Technical risks include:

- the likelihood of losses due to negative research results;

- the likelihood of losses as a result of failure to achieve the planned technical parameters in the course of design and technological developments;

- the probability of losses from low technological capabilities of production, which does not allow mastering the results of new developments;

- the likelihood of losses as a result of the emergence of secondary or delayed problems during the use of new technologies and products;

- the likelihood of losses due to failures, equipment breakdown, etc.

All human experience shows that the repetition of types of disasters means that they can partially be predicted and managed at different levels. Compiling such a classification of the types of disasters, it can be shown that risk management of these disasters is possible only at a certain level of human organization.

Since the possibilities of any state are limited, its integration with other states seems to be necessary. This integration makes it possible to manage cross-border and supranational risks, which is a prerequisite for the transition to a higher level of management. A good example of international integration is international cooperation in the observation and research of earthquake precursors on a regional and global scale. There are other major international projects:

- creation of animals with pre-planned properties; in the modern scientific literature, several types of risk are considered, each of which has its own characteristics.

Technical and technological risks

Technological risk is associated with the characteristics of the technologies used by companies.

Technical risk - the risk caused by disruptions in the organization of production, technological disasters and changes in the intensity of production.

Technical risk is expressed:

- in sudden production stops;

- in failures and breakdowns of equipment;

- in failure to achieve the desired parameters of the organization's activities with a significant level of technology;

- in the interaction of technology with existing technical means.

Its peculiarity is that it is not able to cover losses at the expense of the amortization fund; does not lead to losses; may be due to human factors.

Effective entrepreneurial activity is traditionally associated with the development of new equipment and technology, the search for reserves, and an increase in the intensity of production. At the same time, the introduction of new equipment and technology leads to the danger of man-made disasters that cause significant damage to nature, people, and production. In this case, we are talking about technical risk. Do not forget that it will be important to say that technical risk belongs to the group of internal risks, since an entrepreneur can directly influence these risks and their occurrence traditionally depends on the activities of the entrepreneur himself.

Note that the technical risk is determined by the degree of organization of production, the implementation of preventive measures (regular preventive maintenance of equipment, safety measures), the possibility of repairing equipment on its own by an entrepreneurial firm.

The document ICH Q9 "Quality risk management" proposes the use of different tools for risk management (appendix), including technical risks:

- basic quality management tools;

- Failure Modes and Effects Analysis (FMEA);

- Failure Modes, Effects and Severity Analysis (FMECA);

- Fault Tree Analysis (FTA);

- hazard analysis and critical control points (HACCP);

- Hazard and Operability Analysis (HAZOP);

- statistical control tools (SPC). Uncertainty manifests itself in the parameters of information at all stages of its processing and, accordingly, at all stages of the technological cycle of management decisions. It is difficult to measure. Usually it is assessed qualitatively of the type more or less, for example, the uncertainty of information is 30%.

A high probability of risk occurrence corresponds to a minimum of quality information. To increase the accuracy of the risk analysis, the following process algorithm is used:

- I. Risk capture

When assessing financial and economic activities, it is proposed to fix risks, that is, to limit the number of existing risks, using the principle of "reasonable sufficiency". This principle is based on taking into account the most significant and most common risks for assessing the financial and economic activities of the enterprise. It is recommended to use the following types of risks: regional, natural, political, legislative, transport, property, organizational, personal, marketing, production, settlement, investment, foreign exchange, credit, financial.

- Drawing up an algorithm for the decision

This stage in assessing the risks of financial and economic activities is intended for the phased division of the planned solution into a certain number of smaller and simpler solutions. This action is called composing a decision algorithm.

III. Qualitative risk assessment

Qualitative risk assessment implies: identification of risks inherent in the implementation of the proposed solution; determination of the quantitative structure of risks; identification of the most risky areas in the developed decision algorithm. Risk analysis can be divided into two mutually complementary types: qualitative and quantitative. Qualitative analysis aims to define (identify) factors, areas and types of risks. A quantitative risk analysis should make it possible to numerically determine the size of individual risks and the risk of the enterprise as a whole.

The main purpose of this stage of the assessment is to identify the main types of risks affecting financial and economic activities. The advantage of this approach is that already at the initial stage of the analysis, the head of the enterprise can visually assess the degree of riskiness by the quantitative composition of risks and already at this stage refuse to implement a certain decision.

- Quantitative risk assessment

Risk analysis can be divided into two mutually complementary types: qualitative and quantitative. Qualitative analysis aims to determine (identify) factors, areas and types of risks. A quantitative risk analysis should make it possible to numerically determine the size of individual risks and the risk of an enterprise as a whole.

The quantitative risk assessment is proposed to be based on the methodology used in auditing, namely: risk assessment by control points of financial and economic activities. The use of this method, as well as the results of a qualitative analysis, allow for a comprehensive assessment of the risks of financial and economic activities.

Risk classification More than 40 different criteria are distinguished

risks and more than 220 types of risks

Main criteria:

time of occurrence

risk acceptability

main factors of occurrence

nature of accounting

nature of the consequences

sphere of origin

2016

2

Risk classification

Operating rooms (associated withproduction and market

activities of the company)

Financial (dependence of the company

from interest, rates and prices for

market)

2016

3

Risk classification

"Known" - identified, estimated"Unknown" - not

identified, not

predicted

Objective - do not depend on

project participants

Subjective - internal

characteristic of the organization

2016

4

Risk classification

By regionsoccurrence:

2016

Manufacturing

Marketing

Financial

Technical

Political

Legal

Specific,

Force Majeure

Depending on the

uniqueness:

General

Typical (for

certain

groups of projects)

Specific

(for a specific

project)

5

Internal

External

2016

6

INTERNAL RISKS

Choosing the best marketingstrategies, policies and tactics

Production potential

Technical equipment,

Specialization level,

Labor productivity level,

Safety precautions.

2016

7

EXTERNAL RISKS

Wednesday directimpact

1. Suppliers

2. Trade unions

3. Competitors

4. Government agencies

2016

The environment of the indirect

impact

1. STP

2. Political environment

3. Economic

Wednesday

4.socio-cultural

Wednesday

5. International

developments

8

External risks of the company

CompetitionNatural risks;

Currency risks;

Legal risks

Litigation and arbitration risks;

Risks of enforcement of judicial

decisions

Industry risks

2016

9

External business risks

Country risksCurrency risks

Tax risks

from the standpoint

entrepreneur and

states

2016

10

Currency risks

The value of the currencyrisk associated with loss

purchasing

currency abilities =>

The gap matters

in time between

term of imprisonment

deal and moment

payment.

2016

11

Tax risks

Entrepreneur's tax risk- changes in tax policy

(the emergence of new taxes, liquidation

or reduction of tax incentives, etc.),

as well as changes in the amount of tax

rates.

The tax risk of the state is

possible reduction in income

budget as a result of change

tax policy and / or magnitude

tax rates.

2016

12

Risk of force majeure

floods,earthquakes,

storms,

climatic

cataclysms, wars,

revolutions, coups,

strikes, etc.,

which hinder

entrepreneur

exercise its

activity.

2016

13

Criterion: time of occurrence

retrospectivecurrent

promising

Criterion: degree of acceptability

Acceptable risk

- threat of loss

entrepreneur

sky arrived in

smaller

expected

arrived. Deal

remains

economically

expedient

2016

Critical Risk - Threat

loss in size

costs incurred for

implementation of this type

entrepreneurial

activity or individual

transactions.

Catastrophic

risk - threat of loss

in a size equal to

or more

all property

condition

enterprises. He

can lead to

bankruptcy

company

14

Net (statistical, systematic)

risks:

have a relatively constant

the nature of the manifestation and are determined

factors influencing which management

the company usually cannot.

suggest getting negative or

zero result.

These risks include environmental, political, transport and

part of commercial risks (property,

production, trade).

2016

15

Criterion: possible outcome

Speculative (dynamic,non-systematic)

Reflect accepted by the management of the company

solutions and manifest in areas

activities related to market

conjuncture.

They are expressed in the possibility of obtaining as

positive and negative

result.

These risks include financial risks.16

2016

Natural and ecological risks risks associated with the manifestation

elemental forces of nature (hurricanes,

earthquake, flood, etc.) and

pollution risks

environment.

2016

17

Criterion: the main cause of occurrence

Political risks are associated withthe political situation in the country and

state activities

include: the threat of war and

nationalization, social

conflicts, government resignation,

change of political system and related

with this changes in economic

politics, impossibility to implement

economic activity due

exacerbation of internal political

situation in the country, unfavorable

changes in legislation, introduction

currency restrictions, etc.

2016

18

Criterion: the main cause of occurrence

Transport risks - risks,associated with the transportation of goods.

Commercial risks are

there is a risk of loss in the process

financial and economic activities

company

2016

19

Commercial risks

Property risks - risks,implying the possibility

damage to property

entrepreneur (for example,

due to fire, under the influence

human factor).

2016

20

Commercial risks

Production risks - risks,related to the opportunity

inflicting losses in the event

interruptions in production

process.

2016

21

Commercial risks

Trading risks are risks that arise inthe process of selling goods and services,

produced or purchased

entrepreneur.

Reasons: decrease in sales volume

due to changes in market conditions or other

circumstances, an increase in the purchase price

goods, loss of goods in the process

circulation, increase in distribution costs and

dr.

2016

22

Commercial risks

Financial risks - likelihoodloss of income, capital, credit and

solvency, financial

sustainability and even cost

companies due to volatility and

uncertainty of financial

activities

financial

Systematic

arise from independent

from the enterprise reasons

2016

Unsystematic

depend on the actions of the enterprise

23

and amenable to diversification

Types of entrepreneurial risks

InsurablesUninsured

2016

24Insurance risk - probable

an event or set of events,

in case of which

insurance is carried out.

Taking over the insured

risk is a potential

source of profit

entrepreneur

2016

25Losses as a result

insurance risk

covered by

insurance payments

companies, and losses in

the result

insured risk

reimbursed from

own funds

entrepreneurial

firms

2016

26

Key findings: RISK = RESOURCE = CAPITAL

Correct risk managementproduces surplus value and

the risk management service is the source

arrived.

Risk management is more than

insurance.

Risk management is a science and

art.

2016

Technological risks include errors in measurements, calculations and (or) accounting, violation of the deadlines for the submission of information, software failures, loss of a database, as well as any other violation of technological conditions associated with the performance of the CMO of its services under the contract (agreement). Consider the following classification.

Operational risks arise due to imperfect organization of processes, personnel errors, and unfavorable external events.

Technical risks are the result of technical malfunctions, poor-quality repairs, physical and moral deterioration of the equipment.

Business continuity risks are caused by violations of the normal mode of performance of ECL business processes during such a period of time when there is a possibility of its non-compliance with the technological conditions of the contract (agreement). These risks require special study and cannot be predicted from the performance of Russian CMOs due to the lack of representativeness of the information available.

Operational and technical risks are associated with the use of measuring and information systems in the activities of CMOs. At the same time, the so-called "scale effect" is observed, when specific difficulties arise in the integration of a number of local relatively simple systems into a complex system. The creation of a powerful IT support for the activities of the CMO, the connection of all new AIIS KUE to the databases entails the risks of the appearance of new effects that could not have been foreseen when designing the information system.

The risk of liquidation of OKU due to improper performance of the functions of the main activity

It can be realized due to miscalculations in the organization of CMOs, gross errors in operating activities, as well as in the absence of an adequate response to changes in market rules. An adverse event in a core business of CMOs cannot happen overnight, so risk is easily manageable with proper customer service. However, this requires constant monitoring of the external environment (legislation, the economic situation in the country, the progress of the electricity reform) and the quality of the services provided.

Risk management system

It is advisable to build CMO risk management on an integrated basis. It should include the following controls:

internal control environment - raising employee awareness of risk management and control system. The internal control system must become part of the corporate culture;

identification of risks and control objectives - timely identification of risks, distribution of powers to manage them and the establishment of clear control objectives;

information and reporting - receiving timely, reliable and adequate information on risks. The audit trail should be communicated to predetermined recipients from among the management;

internal control procedures - procedures that ensure complete and accurate accounting of transactions, compliance with the requirements of laws and regulations, the reliability of data processing and the integrity of information;

monitoring and adjustment

- identification of changes in the external and internal conditions of activity, requiring appropriate modifications of the internal control procedures, identifying deficiencies and making adjustments.

When determining the effectiveness of the internal control system, it is necessary to take into account not specific methods and technologies, the number of inspections carried out or identified errors, but the actions (or inaction) of management and owners of ECOs aimed at introducing internal control in all business processes, timely assessment of risks and the effectiveness of control measures applied to mitigate their impact.

To build a risk management system, it is advisable to apply a set of measures that includes the following main components.

1. Formation of a risk management policy at the level of the board of directors with the definition of risk tolerance in the main areas of the CMO activities, associated with the management hierarchy and resources of the company.

2. Typology, identification and ranking of risk groups by main areas of activity at the level of top management

3. Assessment of the main risk groups and determination of risk management methods (evasion, compensation, minimization, etc.) at the level of executive management.

4. Formation of integrated maps of authority and responsibility for risk management throughout the management hierarchy and various functional divisions of the company.

providing sales, grid and generating companies with special conditions for the provision of services;

implementation of only economically feasible investment projects for the development of AIIS KUE and IT support;

implementation of measures to reduce costs in the provision of services;

creation of a personnel recruitment system with several stages of testing, interviews and other activities that will allow recruiting the most trained specialists with work experience and the necessary skills in the CMO;

creation of a system for training employees, improving their qualifications, annual certification;

introduction of modern information support for electricity metering based on advanced IT solutions;

tracking changes in the regulatory framework and operational changes in customer service schemes;

development of an effective system of regulatory documentation, which includes provisions on divisions, job descriptions, operating procedures indicating the tasks, functions and responsibilities of managers for the timeliness and correctness of decision-making to minimize risks in their area of competence;

expansion of the client base (network organizations, power supply companies, GC, NP "ATS", CO and companies providing heat, water and gas supply);

expanding the range of services offered (commercial metering of gas, water, heat energy, communication services)

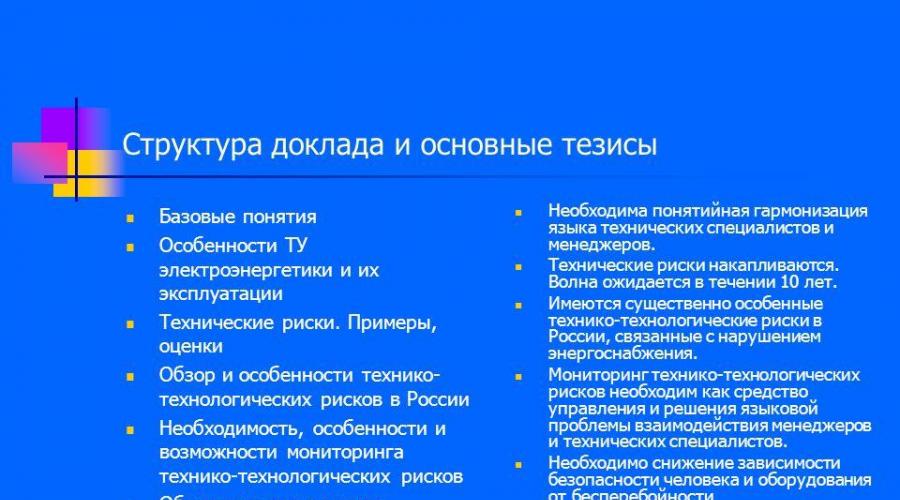

The structure of the report and the main theses Basic concepts Peculiarities of technical specifications of the electric power industry and their operation Technical risks. Examples, assessments Overview and specifics of technical and technological risks in Russia Necessity, specifics and possibilities of monitoring technical and technological risks About risk management Conceptual harmonization of the language of technical specialists and managers is necessary. Technical risks are piling up. The wave is expected within 10 years. There are essentially special technical and technological risks in Russia associated with power supply disruptions. Monitoring technical and technological risks is necessary as a means of managing and solving the language problem of interaction between managers and technical specialists. It is necessary to reduce the dependence of human and equipment safety on the uninterrupted centralized power supply

Basic concepts Risk - the possibility of not achieving goals (management factor). Technical risk - the possibility of losing the adequacy of the technical specifications to the conditions of its application. (RTN). (Risk of futility and danger of use). Technological risk - the possibility of ineffective use of technical conditions. (RTL). (Risk of technological errors). Monitoring - object observation and risk assessment at the pace of the process

Reproduction of production facilities with uniform input of capacities (idealization) Average service life years, taking into account extensions of years. Total commissioned capacities 200 thousand MW Cost of reproduction of gen. powerful (at 1000 $ / kW) 200 billion dollars. The cost, taking into account electrical and heating networks, is 400 billion dollars. The cost of annual reproducible capacities is 400/50 = 8 billion dollars.

Reproduction wave of production facilities taking into account the actual schedule of capacity commissioning Average depreciation of production facilities in 2005 50% Average service life years, taking into account extensions of years. Total commissioned capacities 200 thousand MW Cost of reproduction of gen. powerful (at 1000 $ / kW) 200 billion dollars. The cost, taking into account electrical and heating networks, is 400 billion dollars. The cost of annual reproducible capacities in the years 400/50/4 = 2 billion dollars. / year in / 50 = 8 billion dollars. / year in / 50x2 = 16 billion dollars. / year in /50x1.5= 12 billion dollars. /year

Review of risk factors Meta-level Inadequacy to demand High physical and obsolescence of the production facility Insufficient observability and controllability of processes Insufficient competence of personnel Incorrectness of object models in decision-making The most significant factors of the first approximation Balance inadequacy of generation, a high proportion of unregulated generation in the European part Increased accidents and downtime of worn out equipment Balance inadequacy of the electrical network in terms of active power (many related sections with insufficient throughput) Balance inadequacy of the electrical network of 330 kV and higher in reactive power (insufficiency and poor controllability of reactive power compensation means) Insufficient observability of the modes of distribution electrical networks (110 kV and below) Inadequacy of distribution networks power transmission networks Insufficient emergency controllability of the mode in terms of active power Insufficient feedback (m monitoring of reliability, readiness and participation in management) Excessive dependence of life-supporting and hazardous industries on uninterrupted power supply Fuzzy responsibility

Features of the risks of power supply disruptions in Russia. Management Cohesion of heat and power supply Limited substitution of heat supply and power supply for heating Extreme cold weather and their unpredictability Lack of local backup facilities for life support and systems for the safe completion of technological processes Uncertainty of responsibility for safety in case of violations Reducing the degree of dependence of life support on centralized power supply: Preparation of TR on safety in case of power failures. Development and application of local (reserve) sources. Application of systems for the safe completion of TP. Advance development of action plans and establishment of emergency response headquarters. Creation of systems for risk monitoring and early warning of threats. Dissemination of knowledge about individual and group actions, methods of survival in extreme conditions.

The need to monitor RTN and RTL is due to the aging of equipment Violation of the continuity of operation during the change of generations (not transfer of experience) Increased targeting of responsibility Changes in the modes of generation and transmission of electricity Implementation of power supply to the regions by many entities Complication of technical devices and technologies Mismatch of the dynamics of reform, revision of the regulatory and technical framework for design and operation power facilities, training and retraining of personnel.

Monitoring model 1. Group A (Fuel supply) A1. Mismatch (deficit) of real and planned-normative reserves of fuel and energy resources (FER) (coal, fuel oil). A2. Current and possible future shortages of gas, fuel oil. AZ. Current and possible future coal shortages. 2. Group В (Condition of fixed assets of the fuel and energy complex) 2.1. Sources of thermal and electrical energy. AT 11. The ratio of the maximum load and the available power. AT 12. Load Bearing Availability Ratio. B13. Residual service life of the equipment. B14. The ratio of the development and restoration of the operational resource. B15. The ratio of unit operating costs to the average regional level. В 16. The ratio of the level of harmful emissions with the regional average. 2.2 Heating systems. AT 21. The ratio of throughput and maximum load. B22. Factor of localization of accidents in distribution networks (presence and condition of shut-off equipment). B23. Residual service life of the heating network (pipelines, channels, heating units, pumping stations). B24. The ratio of the development and restoration of the operational resource. B25. The share of make-up in the coolant circulation. B26. The share of heat loss in a useful vacation. 2.3 Power grids B31. The ratio of network bandwidth and maximum capacity. B32. Load Bearing Availability Ratio. B33. Residual service life. B34. The ratio of the development and restoration of the operational resource. B35. The ratio of the unit operating costs for energy transmission with the average regional level. B36. The share of energy losses in network bandwidth.

Monitoring RTN and RTL Requirements: Comprehensive coverage of relevant processes. A high degree of their structuredness, providing an opportunity for holistic perception and understanding of a multidimensional and heterogeneous phenomenon. Layered presentation of what is happening with efficient aggregation and consideration of relationships. Visualization of the situation (Example) for one time slice (D1) ABC a) normal state b) dangerous states c) critical states A B C