EGAIS in retail will be postponed until. Beer: what you need to connect to egais

Readers were notified: the government postponed the introduction of the EGAIS system until April 20 and, accordingly, alcohol retailers may not rush to connect to the EGAIS. However, this information is not true. Let's figure out what really happened and what relaxations the Russian government introduced for alcohol retailers by Decree No. 1459 dated December 29, 2015.

Let us remind you: from January 1, 2016, organizations engaged in the retail sale of alcoholic beverages and individual entrepreneurs engaged in the retail sale of beer and beer drinks, cider, poire, mead are required to record in the Unified State Automated Information System each fact of purchasing alcohol from a supplier. For more details, see "" and "".

According to the Decree of the Government of the Russian Federation dated December 29, 2015 No. 1459, these organizations and individual entrepreneurs can record in the Unified State Automated Information System all facts of alcohol purchases for the first quarter of 2016 no later than April 20, 2016. In our opinion, this formulation means the following.

The retailer should not have any problems if a purchase made in January is recorded in Unified State Information System, say, in March 2016.

- no one has canceled the obligations of retailers to connect to EGAIS by January 1, 2016;

- Retailers are required to record in the EGAIS system all (without exception) alcohol purchases made since January 1, 2016.

Let us also remind you that the emergence of new obligations for alcohol retail to connect to the Unified State Automated Information System does not exempt you from the need to submit “alcohol” reporting. Let us remind you that we are talking about declarations No. 11 and No. 12 (approved by decree of the Government of the Russian Federation), which must be submitted via the Internet in the form of an electronic document with enhanced EPC. You will need to report for the first quarter no later than April 20, 2016 (clause 15 of the rules, approved by decree of the Government of the Russian Federation). Thus, to generate, check and send “alcohol” reporting, you can use the “” system, as well as the “Kontur.Alkosverka” service, which allows you to detect discrepancies in the reporting of retailers and their suppliers (see “”).

We believe that the permissible date for recording purchases in the Unified State Automated Information System “no later than April 20, 2016” provided for by the commented resolution was introduced precisely so that after this date inspectors from the RAR could correlate information from the Unified State Automated Information System with alcohol declarations for the first quarter of 2016. If the data diverges, this could have negative consequences for alcohol retailers (in particular, for those who have not yet connected to the Unified State Automated Information System).

In this article we will talk about all stages of the implementation of EGAIS in retail. What fines are imposed and how to connect to the Unified State Automated Information System in Astrakhan. The material is constantly updated.

In the barcode entry window, you are asked to scan excise stamps (up to 10 pieces per request), after which the codes will be checked against the database, and the answer for each will appear on the screen. It is better to put those bottles whose brands cannot be scanned right away out of harm’s way.

Some time ago, the opinion was actively discussed that the system “won’t take off”, and EGAIS would one way or another be curtailed, or at least put away in a long box. However, as one famous character from Bulgakov’s imperishable story used to say, a fact is the most stubborn thing in the world. And here are a few stubborn figures cited by Gazeta.ru:

The amount of accrued taxes on ethyl alcohol and alcoholic products increased over 5 months of this year by 49% (about 30 billion rubles in absolute terms)

Of the 648.8 thousand deciliters of alcohol tested over 5 months, 269.8 thousand deciliters (about 42 percent) turned out to be illegal. According to the PAP service, 95% of retail organizations with licenses have already connected to the system (which, however, does not mean stable and well-functioning operation).

Based on this, the state will definitely not give up the idea of whitewashing the alcohol market, thus replenishing the budget. So, if EGAIS has not taken off, it is very close to it.

Update from June 15, 2016

The second stage of implementation of EGAIS

Before the echoes of cries of indignation at the first stage of the EGAIS implementation had died down, the second stage loomed on the horizon, playfully waving new problems. Time will tell how difficult it will be, but something tells me that I shouldn’t expect an easy walk.

What exactly are we talking about? For those who have not yet had time to sip grief, I will explain. Starting from January of this year, the state wants to know what kind of alcohol and in what volume trade organizations purchase. For this purpose, the Unified State Automated Information System (USAIS) was developed, which is a database into which information about the circulation of alcoholic beverages is collected via the Internet. Its implementation has already caused a lot of trouble, but the attempts of business to shout to those in power were akin to a quixotic fight against windmills.

EGAIS in retail

In the summer of the same year (more specifically, from July 1), the second act of the Marlezon ballet starts. This time, data on retail sales of alcohol will begin to be transmitted to EGAIS. It will look like this: on the designated day, the program at the checkout will slightly change its behavior. When you try to sell a product that contains a sign of labeled alcoholic beverages in the product group, a window will be displayed on the screen with a hint that in addition to the barcode, you must also consider the excise stamp. The cashier, armed with a 2D scanner, performs the required action. After the receipt is generated, the system will automatically send a request to EGAIS, and upon receiving confirmation, print a receipt with a QR code reflecting the fact of sale and information about a specific product.

How to avoid printing a QR code on a receipt

Some time ago, the topic of the need to print this very QR code was actively discussed on the relevant Internet resources. And as it turned out, there is no such need. The receipt must contain information about the alcohol sold, and the code can be replaced with a link to the FSRAR resource containing such information. That is, from the point of view of the law, there is no need to update the firmware of fiscal devices to print QR codes. However (as practice shows) this does not mean that changes will not be promptly made to the law to state the opposite.

Checking excise stamps for counterfeit goods

The issue of checking excise stamps deserves special attention. At the moment, through the efforts of FSRAR, an appropriate service has been created that allows you to scan an excise tax to determine whether a product is counterfeit. The trouble is that the web interface on this resource is quite slow. Login is carried out through your personal account (how to access it is described in the FSRAR information message).

Moreover, excise stamps are verified one by one. An alternative option is with “CheckMark2” software installed. The cost of such a gadget varies widely, and starts from 80,000 rubles. Taking into account the fact that many organizations have several points of sale, the solution to this issue becomes truly “golden”. However, not everything is so sad. Craftsmen write external processing for 1C day and night, allowing you to enter your personal account, bypassing browser brakes, and upload up to 10 excise stamps per request for verification.

You can only work for three days without the Internet

The question immediately arises - what if the connection with the EGAIS server is lost at the time of sale? After all, the quality of communication channels is not always ideal. In this case, a time buffer of 3 days is provided. During this time, the transport module gives the go-ahead for printing receipts, obediently issues QR codes, and carefully stores sales information. At the moment the connection is restored, it reaches out with all its virtual tentacles to its native server, where it transmits the data. The question to the specialists of the Federal State Unitary Enterprise “CenterInform” about what will happen if the Internet cannot be repaired during this time remains unanswered.

Update from 1.03.2016

Fines in EGAIS

From January 1, 2016Without connecting to EGAIS, alcohol retailers will not be able to legally accept alcohol from the supplier. Violation of the established accounting procedure (Article 14.19 of the Code of Administrative Offenses of the Russian Federation) threatens with an administrative fine:

- for officials it will be from 10,000 to 15,000 rubles,

Selling alcohol without connecting to EGAIS will be illegal. If the store is not able to read the barcode from the bottle and send it to the FS RAR for “approval,” you cannot print and sell a bottle of alcohol.

In accordance with Article 14.19 of the Code of Administrative Offenses of the Russian Federation, the following fines are imposed for violation of the procedure for recording information in the Unified State Automated Information System for reporting on the volume of production and turnover of alcoholic products:

- for individuals (company manager) – up to 15,000 rubles,

- for legal entities - from 150,000 to 200,000 rubles.

Fine for not registering alcohol sales

If a company (LLC or individual entrepreneur) does not keep a log of sales of alcoholic products, it can be fined under Article 14.19 of the Code of Administrative Offenses of the Russian Federation for violating the established procedure for recording ethyl alcohol, alcoholic and alcohol-containing products during their production or circulation (sale).

The fine is:

- from guilty officials - from 10 thousand to 15 thousand rubles,

- from legal entities - from 150 thousand to 200 thousand rubles.

Answers to frequently asked questions

Answers to frequently asked questions about EGAIS from the FSRAR website

Retail trade organizations must, no later than April 20, register in the Unified State Automated Information System the products purchased in the first quarter of 2016.

The movement of alcoholic products from one separate division of an organization to another separate division of an organization carrying out a licensed type of activity and specified in the licenses is carried out only if the documents established by Article 10.2 of the Law are available.

In this connection, information about the circulation of alcoholic products, in this case about internal movement, between separate divisions must be recorded in the EGAIS system.

Information in question-answer format from the forum http://www.carbis.ru/forum

Question: Should organizations keep a sales log in public catering, from what date? What are the features of journaling for catering?

Answer: Organizations must maintain a retail sales journal from 01/01/2016. According to the procedure for filling out the retail sales log: The log is filled out no later than the next day after the fact of retail sale of each unit of consumer packaging (packaging) of alcoholic and alcohol-containing products, or upon opening of the transport container (including reusable containers) used for the delivery and subsequent bottling of products to the consumer (hereinafter referred to as transport packaging).

Question: Does the logbook not take into account the write-off of alcohol?

Answer: Absolutely right, there is no need to write off alcohol in the “Logbook of Sales of Alcoholic Products”. The log records each whole (unopened) container of alcohol sold. When selling alcohol by portion (on tap or as part of cocktails), the container is considered sold at the moment it is opened. This also applies to transport containers, such as beer kegs or large containers of wine.

Question: Where should the magazine be submitted? What if the magazine is lost? (the base flew off, the PC broke, etc.)?

Answer: There is no need to submit the “Alcoholic Products Sales Log.” In case of verification, you must provide it in printed form to the authorized bodies. The magazine must be stored for 5 years. To ensure that the log is not lost, we recommend making archival copies of the database of your accounting system (in which the “Alcohol Products Sales Log” is kept).

Question: Can an organization move alcoholic beverages between separate divisions (from one to another)? What documents are required to document this movement? Need confirmation in EGAIS?

Answer: According to paragraph 16 of Article 2 of the Federal Law of November 22, 1995 No. 171-FZ “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products” (hereinafter referred to as the Law) under the turnover of alcoholic products means procurement (including import), supply (including export), storage, transportation and retail sale, which are subject to the Law.

The movement of alcoholic beverages from one separate division of an organization to another separate division of an organization carrying out a licensed type of activity and specified in the licenses is carried out only if the documents established by Article 10.2 are available.

An active discussion of innovations in the field of alcohol trade is taking place on the forum http://olegon.ruThe movement of products from one separate division of the organization to another division must also be registered in EGAIS from 01/01/2016. At the same time, all separate divisions between which the movement is carried out must be connected to the Unified State Automated Information System, since the movement must be documented with invoices and certificates “B” and recorded in the Unified State Automated Information System.

Here are some interesting user quotes:

PAP is linked everywhere to the address and checkpoint of the retail outlet. It generates certificates using them. At the same time, RAR says that if he came to a store selling alcohol, then there should be a computer on the store premises with a key installed for exchanging data with EGAIS. Not in the next building, not in the central office, but in the store. (This is in that big video I gave a link to on Monday). No computer or key is already a violation and a possible fine.

Each brand of incoming alcohol must be checked through the services of FSRAR, otherwise the retailer is responsible for the leftness and unreadability of the brand;

From 01/01/2016, the fact of purchase (and internal movement between “stores” 1.28) must be reflected by retail trade organizations;

EGAIS inspections have begun

The prosecutor's office has begun checking compliance with legislation in the area of alcohol sales.

On February 19, 2016, information appeared on the website of the Lipetsk Region Prosecutor's Office about its inspection of compliance with federal legislation regulating the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products.

During the inspection, violations were identified that served as the basis for the adoption of prosecutorial response measures - the volume of retail sales of alcohol and alcohol-containing products was not taken into account, i.e. The same “Accounting Journal...” was not filled out.

Update from 02/15/2016

First results of implementation - comments from market participants

On January 1, the Unified State Automated System for Control over the Production and Turnover of Alcoholic Products (USAIS) began operating. From this moment on, all alcohol suppliers and retailers had to connect to the system and enter data about their goods. The system was tested in a number of large chains, including Magnit, Dixy, and X5 Retail Group. And although none of the market players expected the launch to be painless, the collapse in sales of alcoholic beverages, which market participants feared, was avoided. The editors of Retail.ru asked market players to comment on the first results of working with EGAIS. Dmitry Potapenko, CEO Management Development Group, Inc. Boris Rodionov, founder of the private distillery Rodionov and SonsI hate this EGAIS, because I understand that no one needs it, there is no EGAIS anywhere in the world. I produce alcohol in Poland, and sell it all over the world, in England, France, America, and China - there is no EGAIS anywhere. As a result, we have a lot of people involved in EGAIS, they have tortured all the manufacturers and sellers, and this system is constantly not working for them. If social vodka appears, then normal laws will appear, instead of a hysterical fight against counterfeit goods, and then EGAIS will not be needed.

X5 Retail Group, press service representative

Since January 1, all X5 distribution centers have been recording alcoholic beverages in the Unified State Automated Information System. There were minor difficulties, mainly in the first days of the New Year, during the New Year holidays. Subsequently, interaction with suppliers was streamlined and the volume of supplies was brought into line with the schedule. Products that were not previously taken into account by suppliers in the Unified State Automated Information System can be put on the balance sheet during 2016 and thus put into legal circulation. Due to the fact that X5 participated in EGAIS even at the stage of pilot implementation of the system, today there are practically no such products left in the X5 company’s warehouses.

Oksana Tokareva, Head of Corporate and External Communications, METRO Cash & Carry Russia

There are no failures in the operation of the EGAIS system. Since the system began operating, the acceptance of alcoholic beverages has been proceeding as usual. Shopping center employees responsible for working with the EGAIS system have completed all the necessary training in advance. There are no interruptions in the volume of assortment of alcoholic products and delivery times.

"DIXY", press service

Dixie prepared in advance for work in EGAIS and by January 1 completed additional system settings. Today the system is operating in working mode, there are no failures that would affect the presentation of products on the shelves, technical issues are resolved with CenterInform online. The assortment representation on the shelves in all formats of Dixy Group is maximum, there are no missing items or shortages.

We are confident that soon after the system is closed, the share of counterfeit alcohol on the market will begin to rapidly decrease.

Kirill Bolmatov, Director of Corporate Relations, Heineken Russia

At the moment, the system is operating in test mode, but from November 1, 2015, all alcohol wholesalers will have to install the software for EGAIS, and from July 1, 2016 - all retail stores, including sellers of low-alcohol drinks.

And by this moment you will need to have:

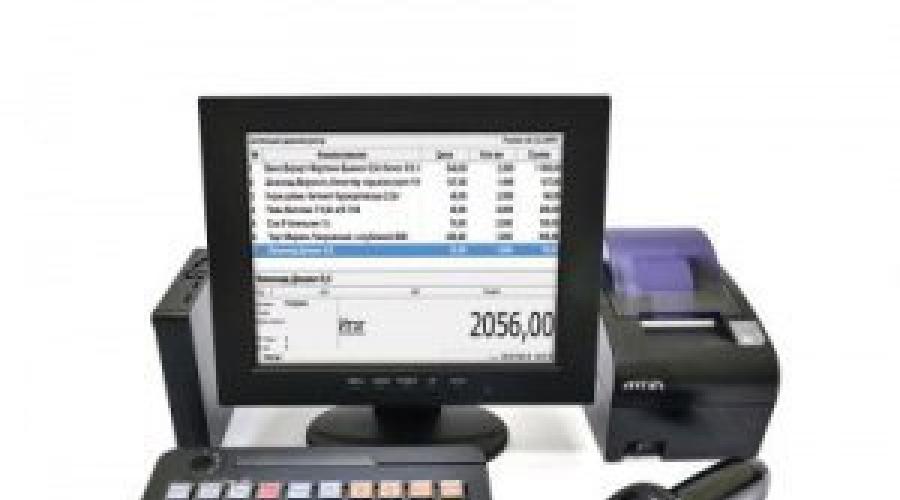

- POS system/ monoblock/ personal computer (),

- Internet connection from 256 kbit/sec and above,

- PDF417 two-dimensional barcode scanner,

- cash register program compatible with EGAIS software,

- installed EGAIS software (free),

- flash drive or smart card with a personal crypto key (electronic signature),

- personal account on the FSRAR website.

Over the coming year, the rules for the sale of alcohol will change dramatically. The state is introducing new strict standards. We have tried to collect the most up-to-date information about changes in legislation.

Alcohol Sales Log

Rosalkogolregulirovanie issued an order (N153) according to which all stores with a license for the retail sale of alcohol must keep a special journal - “Recording the volume of retail sales of alcohol and alcohol-containing products.”

The essence of the order is that from January 1, 2015 (the entry into force of the order has been postponed), stores must keep a log where they record all sales of alcohol (and beer too). Records can be kept both on paper and electronically.

Initial form of the magazine

According to the initial idea, if accounting is not automated, you start another notebook, each entry in it contains 15 fields. Moreover, the journal was to be filled out “as business transactions were completed,” that is, immediately after the alcohol was sold. The log is kept separately for each outlet and must be kept for 5 years. On any day, an employee of Rosalkogol can come in and ask to see the magazine. Failure to fill out the journal is punishable by a fine of 150,000 rubles. for legal entities persons

It is possible to keep a journal in electronic form using a special program - EGAIS (Unified State Automated Information System), it is provided free of charge, but not all accounting programs are able to work with it.

The order caused a storm of indignation among stores, so its implementation was postponed until July 1, 2015 (2 weeks remained, but we did not notice any noticeable movement in stores in this regard).

New draft order

A draft order has been adopted, according to which the keeping of a log of alcohol sales is postponed until January 1, 2016. The same draft proposes to reduce the number of fields to be filled out and to postpone the deadline for filling out the magazine until the next day: “the magazine is filled out no later than the next day after the fact of retail sale.” Draft order

The following changes are also required ():

- When maintaining a paper log, filling out the 68-character code from the alcohol brand becomes optional.

- The columns with the name and TIN of the manufacturer have been removed.

- Added quantity column.

- Added daily summary.

Minimum set of equipment for logging

Computer - 27 tr.A standard office computer will do. It is highly not recommended to use a laptop or netbook. As practice shows, the laptop does not work well with peripheral equipment; one by one the scanner and then the cash register stop working. Therefore, we strongly recommend using a full-fledged computer. And if you need a more compact and neat solution, purchase a POS system.

Barcode Scanner

Simple. Reliable. Barcode scanner tested by hundreds of stores in Astrakhan.

Program

It’s hard to find a cheaper retail automation software:

- It has all the necessary functionality for running a store.

- An interface that every cashier can understand.

- It takes less time to learn and get started with the program.

Installing the program and connecting the scanner is not enough. In the first months of working with 1C, the store gets used to the new accounting system: something happens to the computer and equipment, new questions arise about working in the program. These three months we will solve all problems that arise and help establish stable operation of the store.

All alcohol will be recorded in your 1C database. When selling, the seller scans the barcode from the bottle and the name of the product enters 1C. At any time, you can generate a report in the program for the Alcohol Sales Log and print it on a printer. The entire operation takes less than a minute. Errors due to human carelessness, when the sold product was forgotten to be entered into the journal, are excluded.

The use of an automated accounting system gives many opportunities to the manager.

The logical continuation of the magazine is the widespread implementation of the EGAIS system - “The main fiscal meaning of the retail accounting journal is to stimulate early connection to the EGAIS.” In 1C programs, connection to EGAIS will be implemented in the near future.

When you need to connect to EGAIS, all you have to do is purchase the necessary equipment and install a free program for EGAIS.

EGAIS

EGAIS is a program for state control over the production and sale of alcoholic beverages. By law, retail stores selling alcohol will need to install this program at their cash registers, and it will automatically transfer data on the sale of alcohol to a unified system.

According to Federal Law No. 171-FZ, in order to sell alcohol, retail stores must install a software module at the point of sale, with the help of which data on the sale of alcohol is automatically transferred to a unified system.

How will it work

Each bottle of alcohol - currently only strong and wine, but soon also weak - has a special stamp. It is marked with a PDF417 two-dimensional barcode with detailed information about the manufacturer, license, bottling date and other characteristics of the drink.

The fact of sale of each unit of alcohol must be recorded in the EGAIS system. This is done through the use of a 2D scanner at the checkout. It reads information from the stamp, the EGAIS cash register module processes it and transmits it to the Rosalkogolregulirovaniye server. And thus, accounting is carried out online. To date, the system has been installed and is already operating in some large retail chains, such as Magnit, Dixy and X5 RetailGroup - Perekrestok store.

Connection deadlines

At the moment the system is working in test mode, but:

- from November 1, 2015, all alcohol wholesalers will have to install software for EGAIS,

- from July 1, 2016, all retail stores (for rural areas from July 1, 2017),

- for beer and other fermented drinks, in accordance with the new version of the law, the deadline for mandatory accounting of their turnover in the Unified State Automated Information System has been moved to July 1, 2016.

Who can't connect?

Only retail outlets located in populated areas of less than three thousand people, where it is impossible to ensure uninterrupted data transfer, and public catering establishments are exempt from the need to connect to EGAIS. However, these reliefs are temporary. Equipping remote areas with EGAIS is planned for mid-2017. At the same time, it is planned to connect catering enterprises.

In accordance with 182-FZ, signed by the President on June 29, 2015, the following may not be connected to EGAIS:

- producers of beer and beer drinks, cider, poiret and mead with a volume of no more than 300 thousand deciliters per year;

- producers of wine and sparkling wine (champagne) from their own grapes;

- organizations engaged in the retail sale of beer, beer drinks, cider, poiret, mead, alcohol-containing products (in terms of recording sales);

- organizations engaged in the retail sale of alcoholic beverages while providing catering services.

It turns out that without a 2D scanner and a computer it will be impossible to sell alcohol?

Yes. To sell any alcohol in EGAIS, you need to install a scanner for reading PDF417 two-dimensional barcodes, a computer and a special program.

How real is this?

According to opponents of the law, the required number of scanners to automate all the country's stores simply does not exist in nature. And the very implementation of this system will cost store owners a pretty penny.

It is quite possible that officials from the Federal Alcohol Regulatory Authority will not be able to push through these innovations. But at the moment, all that can be said is that they are making significant efforts to do this.

Will the requirements for receipts for alcoholic beverages change?

Yes. Along with the receipt, the buyer must be given a slip with a QR code. The buyer can scan the code, follow the link on the Internet and read information about the drink on the EGAIS website. "EGAIS Retail" independently displays the necessary information on the slip. There is no need to install additional programs to print receipts.

Will any special maintenance be required?

No. Rosalkogolregulirovanie will launch a system for remote automatic updating of EGAIS software. There will be no mandatory tariffs for maintaining the system (as in 2006). For stable operation, the efforts of the store's full-time engineers are sufficient.

What equipment will make working in EGAIS easier?

“If one of the suppliers sends a batch of alcohol with counterfeit or incorrect barcodes, then if the “wrong” product is sold, EGAIS will send a signal to Rosalkogolregulirovanie. The store will have to pay a fine for the violation.

To avoid such situations, you should buy a data collection terminal with a built-in 2D scanner. Employees will be able to check alcohol while receiving goods at the warehouse and prevent violations.”

We need a reinforced EPC

Any reports that the company submits via telecommunication channels, from January 1, 2014, are signed only with an enhanced CES (qualified electronic signature). A strengthened qualified electronic signature is created using cryptographic means confirmed by the FSB and has a certificate from an accredited certification center, which acts as a guarantor of the authenticity of the signature.

In the event of a malfunction...

In the event of a system failure, the EGAIS program goes into offline mode, accumulating data to be sent to the server after operation is restored. The transfer delay period is no more than three days. However, this deadline is not final. It is installed for the period of test work of EGAIS. Further, it can be revised both up and down in accordance with the quality of communication at the location of the outlet.

Moratorium until January 1, 2019

Dmitry Medvedev proposed introducing a moratorium on the implementation of the Unified State Automated Information System (USAIS) in retail trade.

Industry participants do not have a clear opinion on this issue, says RBC’s source in the management of AKORT (the association unites the largest Russian networks). According to him, the decision to postpone EGAIS for retail looks correct, but a number of companies, participating in the pilot project, have already invested in the program and by the end of the year their points will be fully equipped. On the other hand, most companies are not yet ready to implement EGAIS, said a representative of the association.

The moratorium was not accepted.

There is less and less time until the system is fully launched, but the work of EGAIS still raises many questions. Rosalkogolregulirovanie is in no hurry to publish clear and precise instructions for connection. We will continue to collect data and keep you updated on changes.

You can express your opinion or ask a question in the comments.

How does EGAIS reflect information and supplies of ethyl alcohol, alcohol and alcohol-containing products made to recipients who are not participants in EGAIS within the framework of subclause 4 of clause 2.1 of Article 8 of Federal Law No. 171-FZ of November 22, 1995?

In accordance with paragraph eight of paragraph 2 of Article 8 of the Federal Law of November 22, 1995 No. 171-FZ “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products” (hereinafter referred to as the Law), equipment for accounting for the volume of turnover and (or) use for own needs of ethyl alcohol, alcoholic and alcohol-containing products must be equipped with technical means of recording and transmitting information on the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products to the Unified State Automated Information System.

At the same time, the requirement specified in paragraph eight of paragraph 2 of Article 8 of the Law does not apply to recording the volume of purchases of ethyl alcohol, alcoholic and alcohol-containing products for the purpose of using them as raw materials or auxiliary material in the production of non-alcohol-containing products or for technical purposes or other purposes not related to with the production and (or) circulation (except for the purchase) of ethyl alcohol, alcoholic and alcohol-containing products (subclause 4 of clause 2.1 of Article 8 of the Law).

Thus, organizations purchasing ethyl alcohol, alcoholic and alcohol-containing products for the purpose of using them as raw materials or auxiliary material in the production of non-alcohol-containing products or for technical purposes or other purposes not related to production and (or) turnover (except for purchases) ethyl alcohol, alcoholic and alcohol-containing products are exempt from the obligation to submit information about such turnover to the Unified State Automated State Information System.

In turn, suppliers of ethyl alcohol, alcoholic and alcohol-containing products, when making deliveries to recipients who do not have a license and are not members of the Unified State Automated Information System, after recording information on the shipment of such products in the Unified State Automated Information System (UTM), receive a corresponding notification (receipt). Based on this receipt, the corresponding quantity of shipped products is written off from the supplier’s balance sheet. In this case, additional confirmation from the buyer in the Unified State Automated Information System of information about receipt of products is not required.

Question: When is it necessary to install EGAIS software?

Answer: organizations engaged in the circulation and (or) retail sale of alcoholic products (including public catering organizations), as well as individual entrepreneurs, in accordance with current legislation, are required to record information in the Unified State Automated Information System starting from January 1, 2016.

A detailed list of types of activities, the nature of the information transmitted to EGAIS, as well as the dates for the entry into force of individual obligations are posted on the official website of Rosalkogolregulirovanie at the address.

Question: How to obtain and connect to EGAIS software?

Answer: organizations engaged in the circulation and (or) retail sale of alcoholic products (including public catering organizations), as well as individual entrepreneurs, transfer information to EGAIS using a specially developed universal transport module (UTM).

In order to debug the mechanisms of working with UTM in the process of turnover of alcoholic products, it is currently possible to connect to the Unified State Automated Information System in test mode until January 1, 2016.

Installation of UTM can be carried out independently without contacting Rosalkogolregulirovanie or territorial bodies of Rosalkogolregulirovanie through your personal account on the specialized portal http://egais.ru/.

Detailed video instructions with the procedure for registering in your personal account and installing UTM for transferring information to EGAIS are available at http://egais.ru/news/view?id=8.

Question: What technical means should an organization have to be able to connect to EGAIS?

Answer: To enable UTM to function in the process of transferring information to EGAIS, the technical means of organizations engaged in the circulation and (or) retail sale of alcoholic products (including public catering organizations), as well as individual entrepreneurs, must have the following characteristics:

|

Equipment type and components |

Name of parameters and characteristics |

|

Hardware - communication workstation |

|

|

CPU |

32-bit 1.9 GHz or higher |

|

2 GB or more |

|

|

Network Controller |

Ethernet controller, 100/1000 Mbps, RJ45 connector |

|

Disk drive |

Total volume of at least 50 Gb |

|

Cryptographic equipment |

Hardware crypto key |

|

Software |

|

|

Operating system |

Windows 7 Starter and higher |

|

System-wide software |

Java 8 and above |

|

EGAIS software |

Issued by Rosalkogolregulirovanie free of charge and installed independently. No additional software installation required |

|

Accounting program of the organization |

Must be able to generate a file of the established format for sending to EGAIS |

Question: What information and at what point must be transferred to EGAIS?

Answer: a list of information transmitted to EGAIS using UTM, as well as mechanisms for working with the system in the process of circulation of alcoholic products, are given in the Technical documentation for organizations engaged in the circulation and (or) retail sale of alcoholic products (including public catering organizations), as well as individual entrepreneurs located in their personal account on the specialized portal of Rosalkogolregulirovanie http://egais.ru/.

The list of required information and deadlines for recording information in EGAIS are reflected in the draft regulations posted on the website egais.ru ( http://egais.ru/npa).

Question: How to reflect retail sales of beer, beer drinks, cider, poire and mead in EGAIS?

Answer: beer retail sales, beer drinks, cider, poire and mead in EGAIS not required.

In terms of reflection fact of purchase beer, beer drinks, cider, poire and mead require connection to EGAIS using UTM.

Question: Is it necessary to reflect the retail sale of alcoholic beverages in public catering organizations in the Unified State Automated Information System?

Answer: in accordance with the current legislation of the Russian Federation, volume accounting retail sales alcoholic products in organizations Catering in EGAIS not required.

In terms of reflection fact of purchase alcoholic products require connection to EGAIS using UTM.

Question: Is it possible to transfer information to the Unified State Automated Information System for all separate divisions carrying out activities from one workstation?

Answer: in accordance with the draft Requirements for technical means of recording and transmitting information on the volume of production and turnover of alcoholic products into a unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products if the organization has separate divisions - software and hardware of the organization, transmitting information to the Unified State Automated Information System must be installed, transmit information and located within each separate division.

In this regard, using one workstation with installed UTM to transmit information to several places of activity is not possible.

Question: Is it possible for an individual entrepreneur to install EGAIS software at home or is it necessary to install UTM in each store of an individual entrepreneur?

Answer: for individual entrepreneurs purchasing beer and beer drinks, cider, poire and mead for the purpose of subsequent retail sale of such products, it is possible to install one data exchange workstation with an installed UTM, regardless of the number of places of activity.

Rosalkogolregulirovanie does not impose requirements for the location of such a data exchange workstation with an installed UTM for individual entrepreneurs.

Question: Is it necessary to install several workstations with installed UTM in one separate division that carries out several types of activities and (or) has several licenses?

Answer: in each separate division one UTM is installed, regardless of the number of licenses and types of activities carried out by these separate divisions.

Question: What electronic signature is used to work with EGAIS? Should it be obtained for each separate division or for the organization as a whole?

Answer: Rosalkogolregulirovanie accepts an enhanced qualified electronic signature (ECES), issued by any certification center accredited by the Ministry of Telecom and Mass Communications of Russia, which complies with the requirements of the Federal Law of 04/06/2011 No. 63-FZ “On Electronic Signatures”.

UKEP must be installed at each separate division of the organization.

Individual entrepreneurs can use one UKEP at all places of business.

Question: How can I add a counterparty to EGAIS that is not a retail licensee or a licensee of Rosalkogolregulirovanie? What to do if the EGAIS directory contains false information or the organization has disappeared from the EGAIS directory?

The entry of a counterparty into the EGAIS directories is carried out at various levels depending on the types of activities carried out and the availability of appropriate licenses.

Reference information on organizations engaged in the production and (or) circulation (including retail sale) of ethyl alcohol, alcoholic (except for beer, beer drinks, cider, poire and mead) and alcohol-containing products is automatically synchronized with information from the State Consolidated Register of issued , suspended and canceled licenses for the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products.

If you identify inaccurate information in the EGAIS directory regarding organizations engaged in the retail sale of alcoholic beverages, you must contact the authority of the constituent entity of the Russian Federation that exercises the authority to issue retail licenses.

Reference information on counterparties or their separate divisions that are not licensees of Rosalkogolregulirovanie or authorities of constituent entities of the Russian Federation can be added independently through the mechanism in your personal account on the specialized portal of Rosalkogolregulirovanie http://egais.ru/.

Detailed video instructions for working with EGAIS directories, including mechanisms for adding a counterparty, are posted on the specialized portal of Rosalkogolregulirovanie at http://egais.ru/news/view?id=7.

If there is a recipient in the EGAIS directories with the correct details (TIN, KPP, actual address, etc.), it is possible to use any corresponding entry in the EGAIS directories.

If there is no consignee for the products in the EGAIS directories, it is necessary to add a counterparty using the functionality implemented in the personal account on the specialized portal of Rosalkogolregulirovanie http://egais.ru/.

Question: What regulatory legal acts regulate the functioning of the Unified State Automated Information System in the field of turnover and retail sale of alcoholic products?

Answer: Obligations to record information in the Unified State Automated Information System by organizations engaged in the circulation and (or) retail sale of alcoholic products (including public catering organizations), as well as individual entrepreneurs, come into force starting from January 1, 2016.

The legal basis for the circulation of alcoholic products is established by the Federal Law of November 22, 1995 No. 171-FZ “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products” (hereinafter referred to as the Federal Law).

The rules for the functioning of the Unified State Automated Information System are approved by Decree of the Government of the Russian Federation of August 25, 2006 N 522 “On the functioning of a unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products” and are applied to the extent that does not contradict the Federal Law.

At the same time, the regulatory framework is currently being modernized. Draft regulatory legal acts undergoing approval procedures within Rosalkogolregulirovanie are posted on the specialized portal http://egais.ru/npa.

Regulatory legal acts undergoing public discussion and other procedures necessary for their adoption are posted on the official website for posting information on the preparation of draft regulatory legal acts by federal executive authorities and the results of their public discussion http://regulation.gov.ru/.

Question: How to record the initial balances of alcoholic beverages as of January 1, 2016?

Answer: Remains of alcoholic products must be entered into the EGAIS system only by organizations engaged in the wholesale sale of alcoholic products. There is no need to enter residues of alcoholic beverages into the EGAIS system by organizations engaged in the retail sale of alcoholic beverages.

Leftovers alcoholic products in stock as of January 1, 2016 must be recorded in the EGAIS system before shipment of alcoholic products by:

Receipt of an invoice from the sender of the product and confirmation of receipt by the recipient;

Balancing with blot scanning of each bottle covered with a federal special or excise stamp;

Balancing in volume terms, in terms of products that are not covered with a federal special or excise stamp (beer, beer drinks, cider, poiret and mead).

Question: How to record in EGAIS identified discrepancies when accepting alcoholic beverages at the wholesale and retail levels from manufacturers and importers of alcoholic beverages ?

Answer: If the quantity of products actually delivered is less than the quantity indicated in the consignment note (hereinafter referred to as the consignment note) and the recipient of the products wishes to accept such products, then the recipient, according to the TTN, generates a “Certificate of Discrepancy” (clause 1.9.3 of the Technical documentation for the universal transport module), in which he indicates only the actual quantity of products delivered. At the same time, the product supplier must generate a new version of the “Shipment Information” document in the Unified State Automated Information System software of manufacturers and importers, which indicates the quantity of products actually delivered. If the quantity of products indicated by the recipient in the “Certificate of Discrepancy” coincides with the quantity of products in the new version of the “Shipment Information” created by the product supplier, this document will be recorded in the Unified State Automated Information System automatically.

In the case of , then the recipient of the product TTN may refuse. Then the product supplier needs to generate a new version of the “Shipment Information” document in the EGAIS software of manufacturers and importers, in which to indicate the quantity of products actually delivered.

If the recipient of the product took TTN, then the further movement of products to the supplier is reflected through the creation of returnable consignment notes. Or the supplier needs to create a new Shipping Details document with the missing quantity of products.

Question: How to record in EGAIS the identified discrepancies when accepting alcoholic products at the wholesale and retail levels from an organization engaged in the wholesale sale of alcoholic products?

Answer: If the quantity of products actually delivered is less than the quantity indicated in the consignment note (hereinafter referred to as the consignment note) and the recipient of the products wishes to accept such products, then the recipient, according to the TTN, generates a “Certificate of Discrepancy” (clause 1.9.3 of the Technical documentation for the universal transport module), in which he indicates only the actual quantity of products delivered. In turn, the product supplier must confirm this “Certificate of Discrepancy”.

If the recipient of the products does not wish to accept such products, then the recipient of the product must refuse the TTN.

When if the quantity of products actually delivered is greater than the quantity specified in the sales form, then the supplier needs to create a new TTN with the missing quantity of products, or the supplier needs to create a new TTN in case of refusal by the recipient.

When if during the acceptance and transfer of alcoholic beverages by the recipient misgrade detected(inconsistency of the delivered products with the names specified in the accompanying documents), the recipient of the products must refuse the TTN, and the supplier must create a new TTN with the actual name of the delivered product.

Question: How to reflect products that were sold before 01/01/2016?

Answer: In order to form correct balances, products sold before 01/01/2016 can be written off using the document “Write-off act”.

Question: How to record the arrival of alcoholic beverages in EGAIS?

Answer: organizations involved in the circulation of alcoholic beverages, as well as individual entrepreneurs, record consumable TTN in the Unified State Automated Information System. The volume of shipped products is reserved on the balances of the sender in the Unified State Automated Information System.

The recipient organization of alcoholic products (organizations engaged in the wholesale and retail sale of alcoholic products (including public catering organizations), as well as individual entrepreneurs) through its own accounting system, or in another way, through UTM EGAIS receives all TTN sent to the address of the place of business .

If the consignee agrees to accept the products specified in the consignment note, the organization confirms receipt. If an actual shortage of products is detected in comparison with the volumes indicated in the electronic invoices, if the organization wishes to accept such products, a statement of discrepancies with the corrected quantity is generated. The act, through the UTM, reaches the sender of the product, and the sender can agree with the act. In this case, only the amount agreed with the recipient will be debited from the sender’s balance. If the sender does not agree with the statement of discrepancies, he refuses the statement and then the entire TTN is rejected and the entire volume remains on the sender’s balances.

If an actual excess of products is detected compared to the volumes specified in the electronic TTN, if the organization wishes to accept such products, the recipient organization confirms the TTN. For excess quantity, the sender generates an additional TTN.

In case of disagreement to accept the products specified in the consignment note, the recipient organization refuses the incoming invoice. Refused products remain on the sender's inventory.

Rosalkogolregulirovanie processes all incoming documents and, through UTM, returns receipts for recording data in EGAIS to the organization.

Question: What accounting systems can be used to work with UTM and what are the requirements for them?

Answer: To work with UTM, it is possible to use any existing (including independently developed) system capable of transmitting information through UTM in accordance with the format presented in the technical requirements for UTM (http://egais.ru/files/documentation1_4.pdf).

Question: Should a register be kept for the retail sale of alcoholic beverages and what technical means are needed to maintain it electronically?

Answer: maintaining a journal for the retail sale of alcoholic products is established by order of the Federal Alcohol Regulation Agency dated June 19, 2015 No. 164 “On the form of the journal for recording the volume of retail sales of alcohol and alcohol-containing products and the procedure for filling it out.” This order comes into force on January 1, 2016.

The accounting journal can be maintained manually, as well as using any technical and software tools.

In the case of using EGAIS technical tools, the ability to automatically generate an Accounting Journal through the Personal Account (https://service.egais.ru) has been implemented.

Question: Is it possible to postpone connection to EGAIS until July 1, 2016 for organizations engaged in the production and circulation of beer and beer drinks, cider, poire, mead, and individual entrepreneurs purchasing beer and beer drinks, cider, poire, mead for the purpose of subsequent retail sale of such products?

Answer: connection to EGAIS must be made:

- for organizations producing beer and beer drinks, cider, poire, mead with a production capacity of more than 300 thousand decaliters per year from October 1, 2015;

- for organizations producing beer and beer drinks, cider, poire, mead with a production capacity of less than 300 thousand decaliters per year from January 1, 2016;

- for organizations importing and trading beer, beer drinks, cider, poire and mead from January 1, 2016.

Until July 1, 2016, it is possible that the above organizations may not fully transfer information to EGAIS in the event of a technological failure.

Question: What are the requirements for warehouse premises for the installation of Unified State Automated Information System?

Answer: Operating conditions of technical equipment (TS) of the Unified State Automated Information System, determined by the Technical Conditions in the field of production and circulation of ethyl alcohol, alcohol and alcohol-containing products in terms of equipping the main technological equipment for the production of ethyl alcohol, alcohol and alcohol-containing products, as well as equipment for recording the volume of turnover and (or ) use for own needs of ethyl alcohol, alcoholic and alcohol-containing products by technical means of recording and transmitting information on the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products into a unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products, approved by order of Rosalkogolregulirovanie dated February 20, 2012 No. 31 (hereinafter referred to as the Technical Conditions), do not establish requirements for the premises for placing the EGAIS vehicle.

Question: Is it necessary to undergo operator training to work with EGAIS?

Answer: Due to the fact that UTM involves integration with the existing software and hardware of the organization, the need for advanced training or any other training for the personnel of the organization engaged in wholesale and (or) retail circulation of alcoholic products, in order to work with its own accounting system, the organization determines and conducts independently.

Obtaining a certificate of completion of a professional course preparation for the operation of UTM EGAIS software for the person operating it not required.

Question: How can I find out if a counterparty has connected to the EGAIS system?

Answer: Every week, in the Personal Account on the official website of Rosalkogolregulirovanie on the Internet https://service.egais.ru a list of organizations connected to EGAIS is posted in XML format.

Question: Which cash registers or fiscal printers are suitable for working with EGAIS?

Answer: Order of Rosalkogolregulirovanie dated December 3, 2015 No. 413 approved the format for submitting applications for recording information in the Unified State Automated Information System. If the approved format is observed when using cash register equipment, Rosalkogolregulirovanie does not provide additional requirements for cash register equipment.

Question: What is the algorithm for a cashier’s actions when selling alcoholic beverages?

Answer: When selling alcoholic beverages, the cash register software must determine that the product belongs to the “Alcoholic Products” group. Next, the cashier must use a scanner to read the barcode from the federal special or excise stamp. After successful scanning, data on closing a check is automatically transferred to EGAIS in accordance with the approved format. The universal transport module returns data to the cash register program, which is printed on the receipt in the form of a QR code. The check is closed.

The cash register software will block the sale if the universal transport module has returned data to the cash register program about the lack of recording of information in the Unified State Automated Information System.

Question: What responsibility is provided for the circulation of alcoholic products without recording information in the Unified State Automated Information System?

Answer: Article 26 of the Federal Law of November 22, 1995 No. 171-FZ establishes that turnover of alcoholic products, information about which is not recorded in the Unified State Automated Information System, prohibited.

In accordance with Article 25 of the Federal Law of November 22, 1995 No. 171-FZ, alcoholic beverages subject to seizure from illegal traffic without recording and transferring information to the Unified State Automated Information System.

Violation of the procedure for accounting for alcoholic products entails administrative liability in accordance with the Code of Administrative Offenses of the Russian Federation.

Question: Can an organization move alcoholic beverages between separate divisions (from one to another)? What documents are required to document this movement? Need confirmation in EGAIS?

Answer: According to paragraph 16 of Article 2 of the Federal Law of November 22, 1995 No. 171-FZ “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products” (hereinafter referred to as the Law), the turnover of alcoholic products means the purchase (including imports), supplies (including exports), storage, transportation and retail sales covered by the Law.

The movement of alcoholic products from one separate division of an organization to another separate division of an organization carrying out a licensed type of activity and specified in the licenses is carried out only if the documents established by Article 10.2 of the Law are available.

In this connection, information about the circulation of alcoholic products, in this case about internal movement, between separate divisions must be recorded in the EGAIS system.

Question: Is it possible to equip only one cash register out of several working in one store with an alcohol scanner and only through it can a receipt for sold alcohol products be punched?

Answer: Maybe.

Question: is equipment for recording the retail sale of alcoholic beverages in the Unified State Automated Information System subject to certification?

Answer: Certification of equipment for recording the retail sale of alcoholic beverages in EGAIS is not required.

Question: Are there detailed user instructions for the system and how it will be maintained?

Answer: Due to the fact that UTM involves integration with the organization’s existing software and hardware, the organization determines user instructions for working with its own accounting system independently. The organization maintains its own accounting system on its own.

Technical documentation for the EGAIS universal transport module is located in your personal account on the portal http://egais.ru

Question: What should I do if EGAIS stops working or crashes?

Answer: Currently, the deadlines for recording data in EGAIS are set with a reserve of time, which makes it possible to eliminate technical failures without stopping business activities.

Question: Which cash registers or fiscal printers are suitable for working with EGAIS? Is it possible to reprogram previously used cash registers or is it necessary to purchase new equipment?

Answer: Order of Rosalkogolregulirovanie dated December 3, 2015 No. 413 approved the format for submitting applications for recording information in EGAIS. If the approved format is observed when using cash register equipment, Rosalkogolregulirovanie does not provide additional requirements for cash register equipment.

An organization has the opportunity to use existing cash registers if additional logic is implemented in their operation in accordance with the technical documentation for the universal transport module.

Question: In what format and with what frequency should information be transmitted to EGAIS?

Answer: The format for submitting applications for recording information in EGAIS was approved by order of Rosalkogolregulirovanie dated December 3, 2015 No. 413. The draft order establishing the procedure and deadlines for submitting applications for recording information in EGAIS is undergoing an approval procedure within Rosalkogolregulirovanie and is posted on the specialized portal http://egais.ru /npa.

Question: How to fill out the Logbook for recording the volume of retail sales of alcoholic and alcohol-containing products on paper?

Answer: A sample of filling out the Logbook for recording the volume of retail sales of alcoholic and alcohol-containing products on paper. (xlsx, 0.016Mb)

All fields are required.

Today, at a meeting with Dmitry Medvedev, a decision may be made on a moratorium until 2019 on the introduction of a trade tax, Unified State Information System for retail chains and 18 more requirements for business worth 1.8 trillion rubles. in year.

What can be canceled

Last week, First Deputy Prime Minister Igor Shuvalov announced a meeting with the Prime Minister scheduled for June 1, dedicated to optimizing non-tax payments and additional requirements for business. The Ministry of Economic Development sent the final list of proposals to the government on May 29. He ended up at the disposal of RBC.

The list contains 20 items, in relation to which it is proposed to introduce a moratorium until January 1, 2019. The total savings for entrepreneurs from such a measure are estimated by the ministry at 1.8 trillion rubles. in year.

The Ministry of Economic Development considers the most expensive relief for business to be the proposal to postpone expenses for meeting transport security requirements to 2019. They are valued at 1.2 trillion rubles. (see inset). The abolition of fees for negative environmental impact is estimated at another 351 billion per year.

Another fee is proposed to be reduced. From November 15, 2015, a new “road toll” will come into force in Russia. For 1 km traveled on federal roads from a truck with a maximum permitted weight of over 12 tons, you will have to pay 3.73 rubles. The additional burden on business is estimated at 50 billion rubles. per year, the increase in transportation costs is from 2 to 20% in addition to the already existing increase in tariffs, which from the beginning of the year to the end of March already increased to 15%. The Ministry of Economy proposes to limit the minimum fee to 64 kopecks.

The moratorium may also be extended to the implementation of the Unified State Automated Information System (USAIS) in retail trade. The representative of Rosalkogolregulirovanie did not hide his surprise upon learning of the existence of such a proposal. The department is not familiar with such proposals, he told RBC.

According to current legislation, mandatory accounting of alcohol sold at retail begins on July 15, 2016. The documents for the meeting indicate that the one-time financial burden is estimated by experts at 5 billion rubles, and additional costs for maintaining the system are at least 2 billion rubles. in year.

Industry participants do not have a clear opinion on this issue, says RBC’s source in the management of AKORT (the association unites the largest Russian networks). According to him, the decision to postpone EGAIS for retail looks correct, but a number of companies, participating in the pilot project, have already invested in the program and by the end of the year their points will be fully equipped. On the other hand, most companies are not yet ready to implement EGAIS, said a representative of the association.

The list retains a proposal for a moratorium on one of the most resonant fees - trading, which the Moscow authorities are going to introduce on July 1, 2015. Back on May 29, officials from the government’s financial and economic bloc told RBC that it had been excluded from the final version. The estimated damage to capital entrepreneurs from this fee is estimated at 2 billion rubles. By 2019, it is proposed to conduct an additional analysis of its feasibility and prepare mechanisms for its administration (if the decision to introduce it is nevertheless made).

How the payments were handled

The Ministry of Economic Development submitted the first report on the optimization of non-tax payments to the White House in early April 2015. That version included significantly more payments. The list was prepared by a working group of the ministry, which included representatives of business associations.

As a government source told RBC, the latest version of the list was finalized at meetings with First Deputy Prime Minister Igor Shuvalov. On May 27, at a meeting of government members with Vladimir Putin, Shuvalov explained the need for a moratorium by saying that “we are not yet seeing sustainable economic growth” and “many companies are not doing well.”

The version of the list presented to Medvedev has undergone significant changes compared to the April version. Now it is proposed to extend the moratorium to the entire list; previously it was proposed to extend it only to part of the payments. The moratorium period was stated to be shorter - until January 1, 2018.

From the April report, only 13 payments were retained in its latest version. The document was supplemented with seven new payments; another 17 were not included in the tables of the Ministry of Economic Development.

The RSPP has not yet studied the latest edition of the list. A source close to the union's board of directors told RBC that business will also discuss the final proposals and arguments of the Ministry of Economic Development on Monday, June 1.

The most expensive payments for which it is proposed to introduce a moratorium

Costs of complying with transport security requirements

Expected savings: RUB 1,160 billion.

The Law “On Transport Security” gives the government the right to introduce mandatory requirements for carriers to ensure transport security, including the anti-terrorist protection of facilities. For business, this means two types of costs: the actual compliance with safety requirements and the responsibility for training and certification.

In March 2015, the government introduced a bill to the State Duma that would postpone the deadline for meeting such requirements until January 1, 2017, but only if they relate to the transportation of the population. It is proposed not to limit the moratorium only to this category of transport, but also extend it to aviation, river and sea transport, and also extend it until January 1, 2019.

Payment for negative impact on the environment

Expected savings: RUB 351 billion.

The Ministry of Natural Resources has formulated criteria designed to determine waste hazard classes based on the degree of negative impact on the environment. The orders regarding them have not yet been registered with the Ministry of Justice, and the government has instructions to finalize them. The orders introduce new criteria for the waste classification catalogue. The problem is that this catalog has not yet been created, although work on its creation has been going on since 1998 and companies have already spent several hundred billion rubles, and now it is actually proposed to start everything from scratch. Additional costs for these activities are estimated at 351 billion rubles. excluding the costs of obtaining permits, while, for example, in 2012, the fee for waste disposal amounted to only 14 billion rubles. It is proposed not to revise the classification until January 1, 2019 and to cancel the orders of the Ministry of Natural Resources.

Additional to the Deposit Insurance Fund

Expected savings: RUB 112 billion.

At the end of 2014, a law was adopted that differentiates the rates of contributions to the Mandatory Deposit Insurance Fund: an additional rate is introduced (up to 50% of the base) and an increased rate (up to 500% of the base). From July 1, 2015, they begin to be used for contributions depending on the value of the maximum rates on deposits, and from January 1, 2016 - also depending on the stability indicators of banks. This could lead to an increase in interest rates on deposits, which is exacerbated by the bank cleanup and the fact that government measures to increase bank liquidity “affect only a small number of large banks.” If a moratorium is not introduced before January 1, 2019, private banks will be forced to increase costs by 28 billion rubles. per quarter, which will lead to a decrease in the capital of private banks from the top 50 by an average of 1.5%, and the budget will lose 14 billion rubles. in the quarter of income tax receipts.

Payment for network power reserve

The Ministry of Energy has come up with a way to compensate energy companies for their refusal to use power: in addition to the already paid cost of electricity transmission services, it is proposed to oblige consumers to compensate for the difference between actual consumption and maximum power according to technical connection documents. At the same time, the tariff for energy transmission already takes into account the costs of network organizations. The ferrous metallurgy industry alone will lose about 16 billion rubles from this. per year, the entire economy - more than 100 billion, and the additional expenses of some companies will not be offset by reductions in the expenses of others, and network companies will not incur any additional expenses. This is actually a subsidy for network organizations, so it is proposed to continue working on the ministry’s proposals, but so that they are not implemented before January 1, 2019.

Environmental fee

Expected savings: RUB 100 billion.

At the end of 2014, legislators introduced the concept of an environmental fee - companies must pay it if they do not recycle their goods themselves. According to the draft government decree, which regulates the calculation of the amount of the fee, its rate can range from 1.5 to 4.5% of the cost of production. But “there are no conditions yet for the collection, processing and use of even 10% of the listed types of waste,” according to the materials of the Ministry of Economic Development. The introduction of the fee will lead to an increase in prices for consumer goods, including food, by an average of 3-15%, and businesses will be forced to additionally spend at least 50-60 billion rubles. per year excluding indirect costs. It is proposed to introduce the following moratorium: until January 1, 2019, establish a zero collection rate and a zero recycling standard for all goods except batteries, tires and paper (for them the recycling standard is no more than 5-10% of the output volume).

Prior to this, the topic of non-tax payments was discussed at a closed meeting of Vladimir Putin with the heads of business organizations last week at the Business Russia forum - the president himself raised this topic at the plenary session. “At a closed meeting, we proposed systematizing the approach to non-tax payments according to the principle of what is now being done with tax payments - the principles are described in the Main Directions of Tax Policy,” one of the participants in the meeting with Putin told RBC.

Unequal removal

Officials did not completely forget about the 17 excluded payments - six of them are mentioned separately in the documents of the Ministry of Economic Development for the meeting. We are talking, in particular, about royalties for phonograms and audiovisual works and insurance contributions to extra-budgetary funds. Previously, it was proposed to modify the mechanism for administering the first, and for the second, to return to the situation in 2014 (since 2015, in particular, contributions to the Compulsory Medical Insurance Fund have increased). The status of this list is not explained in detail in the documents.

Businesses are concerned about the existence of a separate list of payments, the position for which has not been formulated. “We have already presented our position and argumentation on them,” says a source at the RSPP. He does not rule out that entrepreneurs will seek a revision of the list after studying the arguments for each item. A representative of the Ministry of Economic Development refused to confirm or comment on the contents of the documents.

The result of today's meeting may be a clarification of the list of payments that may be subject to a moratorium until 2019. In addition, the Ministry of Economic Development may be instructed to prepare a “road map” for reducing the non-tax burden on business, “including taking into account previously submitted proposals.” One of the participants in the discussion of amendments to the RSPP believes that a separate list of payments for which the government has not submitted a position is an attempt to keep issues on the agenda.

Box of wine

Interruptions in alcohol sales may begin on January 1, 2016 due to the fact that wholesalers do not have time to connect to the Unified State Automated Information System for recording the volume of production and turnover of ethyl alcohol, alcohol and alcohol-containing products (USAIS) and master the program for transmitting data on the turnover of alcohol drinks, Alexey Nebolsin, a member of the presidium of the public organization “Opora Rossii”, which unites entrepreneurs, told Izvestia.

According to him, from the new year the system should begin to work for manufacturers and wholesalers. However, now less than 5% of the country's wholesale enterprises supplying alcohol are connected to the system, Nebolsin says. He is convinced that most wholesalers will not have time to register in two months. As Nebolsin says, from January 1, unregistered distributors will not be able to accept shipments from manufacturers and legally supply both spirits and wine, beer, cider, mead and poiret at retail.

He also says that many trade enterprises, especially small and medium-sized businesses in the regions, are either not informed about how to connect to EGAIS or cannot bear the costs associated with this procedure. Nebolsin gives an example: connecting one retail space with one cash register to the system costs at least 250 thousand rubles. These expenses, according to him, include payment for a cash register connected to EGAIS, payment for software, and payment for subscriber services.

The general director of the official distributor of the Baltika company, the Golden Standard company, and the executive director of the Union of Beer and Soft Drinks, Kamal Lebedev, also speak about the impending collapse in the supply of alcohol, Izvestia writes.

He said that last week a meeting of the subcommittee of the Chamber of Commerce and Industry on alcoholic products was held on the topic of Unified State Automated Information System. All industry alcohol unions, producers of beer, wine, and spirits participated. Based on the results of the meeting, the participants write a letter to the State Duma and the government. The letter, he said, “screams” that “we are facing an unconditional collapse in the alcohol market.” Potential users of EGAIS are confused by the fact that there is still no regulatory framework regulating the deadlines for submitting information, as well as resolving controversial situations, he said.

In addition, as the expert says, the module itself for transmitting data from a wholesale or retail enterprise to the PAR, under a contract with the developer FSUE CenterInform, should be delivered on December 23, 2015. That is, now wholesalers and retailers are connecting to test modules. The appeal will discuss the need to delay the implementation of EGAIS until the module and regulatory framework are approved and the system is tested for trading companies.

The business’s appeal states the need to postpone the implementation of the Unified State Automated Information System for wholesalers to October 1, 2016, for retail trade in urban areas to July 1, 2018, and for retail in rural areas to July 1, 2019.

Business representatives compare the volume of operations and the load on EGAIS with the load on the servers of the social network Facebook, Izvestia writes. “About two billion units of alcoholic beverages per day currently pass through cash registers throughout the Russian Federation. This number of requests from cash registers to the EGAIS system correlates with the number of requests to one of the world's largest social networks, Facebook. Considering the network of data centers of the latter, which are hangars of tens of thousands of square meters, filled with from 120 to 180 thousand servers, it is puzzling how Rosalkogolregulirovanie will receive such a number of messages,” the letter from market participants says.

The press service of the RAR told Izvestia that the connection of market participants to EGAIS is proceeding as planned, 15 thousand cash desks and 860 computers are registered in the system. The department noted that they see no reason for a collapse and predict the successful connection of all trading enterprises within the established time frame.

Let us recall that in July, Russian President Vladimir Putin signed a law on the implementation of the Unified State Automated Information System (EGAIS) to control the circulation of alcohol. The law establishes a requirement for mandatory recording of information on the volume of production and turnover of relevant products in the Unified State Automated Information System for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products for producers of beer and beer drinks, cider, poire and mead, as well as data on wholesale supply and import of alcoholic and alcohol-containing products, retail sale of alcoholic products. From January 1, 2016, the law introduces EGAIS for all alcoholic products in the wholesale market. With regard to the retail sale of alcoholic beverages in urban settlements, registration in the Unified State Automated Information System will become mandatory from July 1, 2016, and a year later - in rural settlements. About this Expert Center for Electronic State.