Types of cashier's checks. Correct copies of the check are the key to successful checks

Read also

From July 1, 2019, most trading organizations and individual entrepreneurs will have to use only cash registers that generate receipts in electronic form and can send data on all transactions to the tax authorities in settlements with buyers. We found out for you what an online checkout looks like, what its electronic and paper version is, what details and data the buyer must see.

2017 has become a landmark year for most Russian trading organizations and individual entrepreneurs. From July 1 of this year, at the request of the new edition of Federal Law N 54-FZ on the use of cash registers (KKT), which was amended by Federal Law No. 290-FZ of 03.07.2016, they will have to use cash registers only with the function transferring data over the Internet directly to the tax authorities. In addition to additional costs and the need to conclude an agreement with a data transmission operator, the requirements for "smart cash registers" have led to changes in the fiscal document, which forms the CCP. The details of the online cash register check differ from those provided for old-style documents. Let's consider this issue in more detail.

Requirements for an online cash register receipt

First, let's figure out what the algorithm for the actions of the cashier and the work of the cash register looks like according to the new rules:

- the buyer transfers money or a payment card to the cashier;

- the online cash register generates a receipt with the necessary details;

- a paper version of the check is printed;

- data about the operation and the receipt are recorded in the fiscal drive;

- the check is certified by fiscal data;

- the check is processed by the fiscal accumulator and transferred to the fiscal data operator (OFD);

- OFD sends a signal to the fiscal accumulator about receipt of a receipt;

- OFD processes the information received and sends it to the tax office;

- at the request of the buyer, the cashier sends an electronic check to a mobile device or email.

This algorithm shows that one document is generated in two formats at once: paper and electronic. At the same time, they must carry the same information about the purchase made and the payment for it. The requirements for this information, as well as for the electronic format of the fiscal document, were approved by order of the Federal Tax Service dated March 21, 2017 No. ММВ-7-20 /. In fact, the tax authorities supplemented the previously existing requirements for a paper check with new ones.

What should be in an online checkout receipt that was not in the old paper version? The main difference is the QR code, thanks to which any consumer who has made a payment with cash or a plastic card, if desired, can easily check the legality of his purchase. To do this, you need to install a special mobile application on your smartphone or tablet, available for download on the official website of the online KKT. With its help, it is very easy to check a cashier's receipt for authenticity online: you just need to bring the QR code located in the center of the document to the video camera of your mobile device when the application is turned on. The screen should display information about the purchase, duplicating information from the receipt.

In addition, the tax authorities supplemented the fiscal document with the following mandatory data:

- fiscal document number;

- fiscal attribute of the document;

- shift number;

- serial number of the document for the shift;

- type of taxation of the trading organization.

As a result, a sample of a check in an online checkout will look approximately the same. If the buyer informs the cashier of the information about where he needs to send the electronic version, there should also be a mark about this. Let us consider separately such a variable as the "fiscal attribute of a document". It is formed by the fiscal accumulator. This is a digital code that determines the characteristics of the transaction performed when sending the OFD data and further to the FTS.

In addition, any document must necessarily have a sign of a completed operation. It could be a purchase, a refund, or a correction. The cashier cannot simply cancel an already completed operation that went into the fiscal drive and OFD. He must make a purchase return and break through the correction check. Each document on these transactions will have its own unique characteristics and will be submitted to the tax authorities.

Sample online checkout receipt

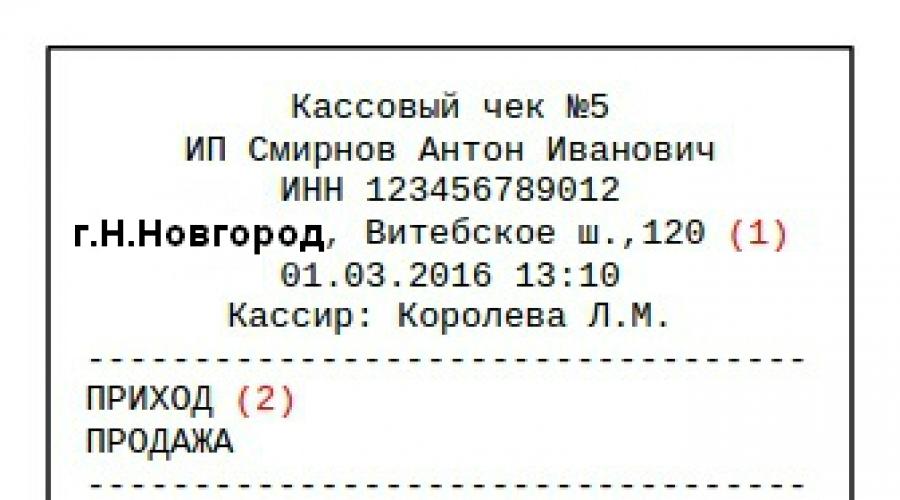

The paper version of the document printed by the new generation cash register should look like this:

Mandatory details and details of the online cash register receipt

It is very important to comply with the requirements for all components of the new sample cash register receipt. It must certainly contain all the required details. In the absence of at least one of them, this cash document will be considered invalid. For clarity, most of them are shown in the sample, but it is better to carefully study their full list:

- the name of the commercial facility (store, kiosk, online seller, etc.);

- the name of the document itself is "cashier's check";

- settlement attribute (arrival, return)

- nomenclature of goods sold.

- quantity of goods sold.

- unit price.

- the cost of a purchased product of one item;

- VAT rate (18%, 10% or 0%);

- allocated amount of VAT;

- the total amount of settlement on the check.

- form of calculation - in cash with the amount.

- form of payment - by bank card with the amount.

- data on the seller's taxation system.

- total amount of VAT per check

- position and surname, name, patronymic of the person who made the calculation;

- shift number;

- TIN of the organization that issued the check;

- ЗН - serial number of KKM;

- the name of the selling organization;

- settlement address.

- website address for checking the check

- serial number of the check.

- date and time of issue of the check.

- registration number of KKT.

- the serial number of the fiscal accumulator.

- fiscal receipt number.

- fiscal data attribute.

- QR code for checking the receipt.

Obviously, there are a lot of required requisites, and familiarization with their full list discards such questions as "is it possible not to highlight the VAT check". However, at some points of detailing this document, it is still necessary to dwell in more detail. In particular, clarify such an issue as the obligation to indicate in the cash document all goods purchased by the buyer. Unfortunately for many organizations and individual entrepreneurs, the list of goods in the check is a mandatory requirement of the Federal Tax Service. You cannot simply indicate the word "product" or the name of the product group. Each purchase must be reported separately. Moreover, the name of the product entered in the CRE database must match the main labeling of the goods sold, that is, contain all the information that allows the buyer and regulatory authorities to uniquely identify the product and its basic characteristics. To do this, trading organizations will have to get to know more closely the product groups, for example, the All-Russian Classifier of Products by Economic Activity.

But for some categories of sellers, the need to detail the nomenclature of goods will arise only from February 1, 2021, this is, in particular, stated in paragraph 1 of Article 4.7 of Federal Law No. 54-FZ. Such lucky ones, for example, include individual entrepreneurs who apply preferential taxation regimes (PSN, UTII), as well as a simplified taxation system. True, if such individual entrepreneurs sell excisable goods, then they will have to take care of the detailed indication of all goods from the purchase right now.

Responsibility for incorrect details

If the FTS inspectorate reveals that a trading organization or individual entrepreneur issues online checkout receipts to buyers without one or more of the mandatory details specified in article 4.7 of Law No. 54-FZ, then such a check may be invalidated. Responsibility for the seller organization and officials in this case will come in accordance with article 14.5 of the Code of Administrative Offenses of the Russian Federation... Guilty officials can pay a fine in the amount of 1.5 thousand to 3 thousand rubles, and organizations and individual entrepreneurs - from 5 thousand to 10 thousand rubles. Probably, it will still be cheaper to set up the check details correctly.

The list of basic details, which must include a cashier's receipt printed on new cash register machines with the function of online data transfer, is named in Art. 4.7 of the Law No. 54-ФЗ dated May 22, 2003. Issuance of a check, without reflecting the necessary information in it, may entail bringing an entrepreneur or a company to responsibility under Art. 14.5 of the Administrative Code of the Russian Federation.

Organizations and individual entrepreneurs that use online cash registers in their activities are obliged to issue checks to customers that meet the requirements established by law. The check can be generated either in paper or electronic form. By default, the document is printed on paper, but if the buyer asks to send it to him by phone or e-mail, form. Let's consider what an online checkout looks like and what information must be reflected in it without fail.

What information should be contained in the document that draws up settlements with the buyer

The list of details that must be included in the cash register receipt generated by the cash register with the function of online data transfer is named in Art. 4.7 of Law No. 54-FZ. These include, in particular:

- The name of the document and the serial number for the shift;

- Shift number;

- Date, time and place of settlement with the buyer;

- The name (full or abbreviated) of the organization and the full name of the individual entrepreneur;

- TIN of the entrepreneur or organization that issued the check;

- Taxation system applied by a company or individual entrepreneur;

- Calculation attribute;

- Name of goods, services rendered or work performed;

- The amount of VAT included in the price of the goods;

- Form of payment (non-cash or cash);

- The position and initials of the person who issued the check, except for settlement with the buyer via the Internet or a vending machine);

- Registration number of cash register and fiscal accumulator;

- Fiscal document number and fiscal sign of the message;

- The address of the website on the Internet, which checks the cash register receipts online for authenticity;

- Phone number or website address (e-mail) of the buyer, if the document is sent to him in electronic form at his request;

- The e-mail address of the individual entrepreneur or organization that sent the check to the buyer in electronic form.

In the event that the activity is carried out in an area remote from the communication networks, an electronic check can be generated without specifying the site address for its verification.

Information required to be included in a check for paying agents

In addition to the above data, the paying agent must reflect the following information in the document issued (sent) to the client:

- The amount of remuneration that the agent receives from the client;

- Customer, agent, supplier and operator phone numbers;

- The name of the operation and its amount;

- Name, TIN, address of the operator transferring funds to the client

: how to make a payment by card through the cashier.

Sample online checkout

Table No. 1. List of requisites of a new-type cash register receipt

| Line number | Required props |

| 1 | Name of the company or individual entrepreneur that issued the settlement document |

| 2 | Individual taxpayer number (TIN) |

| 3 | Tax system |

| 4 | Address for settlement with the buyer |

| 5 | The number of the shift in which the document was stamped |

| 6 | Check number |

| 7 | Position and initials of the employee or other person who issued the document |

| 8 | Calculation type |

| 9 | Time and place of issue of the document |

| 10 | Name of the purchased item |

| 11 | Cost of goods including VAT |

| 12 | Indication of the tax included in the price of goods (services) |

| 13 | Total purchase amount |

| 14 | Total VAT included in the price |

| 15 | The amount of funds received from the buyer by bank transfer |

| 16 | The amount of cash transferred by the buyer |

| 17 | The site where you can check the issued document for authenticity |

| 18 | Registration number of KKT |

| 19 | Fiscal accumulator number |

| 20 | Fiscal document number |

| 21 | Fiscal attribute of a document |

| 22 | Fiscal data operator name |

| 23 | Fiscal data operator website |

You can briefly familiarize yourself with the changes made to Law No. 54-FZ of 05/22/2003, including how the checks knocked out at the online cash register differ from the checks issued earlier, in the following video.

They also entail additional requirements for cash register receipts and forms of strict reporting. The data of the OFD to which the online cash register is connected are included in obligatory details of BSO and cashier's receipt in 2019... Now you need to specify different parameters in the documents. In receipts, you need to punch the names of goods, for this you need a cash program that can do this. Our free application Kassa MoySklad supports this and all other requirements of 54-FZ. Download and try it now.

There are no unified forms for new details in online cash register receipts and strict reporting forms, but they must contain certain data. This is the data that was added with the entry into force of Law 54-FZ. Here are the new details in online cash register receipts:

- The taxation system applied by the organization.

- Calculation attribute: sale / return.

- Fiscal data serial number.

- Fiscal data attribute.

- List of purchased items with cost, price and applied discounts.

- VAT for each item.

- Fiscal accumulator serial number.

- Fiscal document number.

- Fiscal data transfer code.

- VAT amount and tax rate.

- The name of the OFD.

- OFD website address.

- QR code that serves as additional verification of the check's authenticity.

At the same time, the law does not include a QR code in the list of mandatory details of an online cash register's check, however, the section on requirements for cash registers states that a cash register must “provide the ability to print a two-dimensional bar code (QR - a code of at least 20X20 mm in size), containing in a coded form the details of checking a cash register receipt or a strict reporting form in a separate dedicated area of a cash register receipt or a strict reporting form. " Thus, there may not be a QR code on new receipts from online cash registers, but online cash registers should be able to print it.

What should be encrypted in the QR code on the cashier's receipt according to the new rules? The law says that it must contain information about the purchase (date and time of payment, serial number of a fiscal document, a sign of settlement, a calculation amount, a serial number of a fiscal accumulator, a fiscal sign of a document).

Mandatory details of a cash register receipt in 2019

Here is a list of check details - 54-FZ strictly prescribes them to be printed on each document confirming the sale:

- settlement attribute (income or expense),

- date, time and place of settlement,

- information about the seller's tax system,

- the serial number of the fiscal accumulator,

- nomenclature of goods (services),

- the amount of the calculation with a separate indication of the rate and amount of VAT,

- form of payment (cash or electronic payment),

- serial number FN,

- registration number of KKT,

- OFD website address ,.

- fiscal attribute of the document,

- the serial number of the fiscal document,

- shift number,

- fiscal sign of the message,

- if the buyer wanted to receive a check by e-mail or SMS, then his e-mail address or phone number must be indicated, and in this case the e-mail address of the sender of the check must be indicated.

This check contains the following details:

- "Trade object" - the name of the store.

- "Cashier's check" - the name of the document.

- Arrival is a sign of settlement.

- "Carrots" - product range.

- Quantity of goods.

- Unit price.

- Cost of goods.

- % VAT.

- VAT amount.

- The total amount of the calculation.

- Calculation form - in cash with the amount.

- The form of payment is by card, also with the amount.

- Information about the seller's tax system.

- Separately, the total amount of VAT.

- Full name of the cashier and his position.

- Shift number.

- TIN of the trading company that issued the check.

- ЗН - serial number of the cash register.

- The name of the organization that issued the check.

- Calculation address.

- Site address where you can check the receipt.

- The serial number of the check.

- Date and time of issue of the check.

- Registration number of KKT.

- Fiscal accumulator serial number.

- Fiscal receipt number.

- Fiscal data attribute.

- QR code for checking the receipt.

All these data are obligatory details of the online cash register check. If at least one of them is missing on the check, then, according to the law, the check is considered invalid, and the entrepreneur will have to make every effort to prove the use of the online cash register to the inspection body, otherwise he will be fined for non-compliance with the new law. More details about the details of the check required by 54-FZ can be found in the text of the law itself. At the same time, even the buyer himself can control the compliance of the details on the checks with the law, so not only entrepreneurs need to be aware of which details should be on the cash register receipt.

Obligatory details of BSO

As for the mandatory details of the SSO, if the organization is located in a hard-to-reach area, the last three items from the list of mandatory details of an online cash register check may not be indicated. In addition, the Government of the Russian Federation warns in the law that it may supplement the list with one more obligatory requisite - the commodity nomenclature code - if it is defined. Otherwise, all the details of the BSO are no different from the details of the online checkout.

Namely:

- Document's name.

- A six-digit document number.

- The name and form of ownership of the organization that issued the check.

- Company address.

- TIN of the company that issued the document.

- The type of service provided to the client.

- Service cost.

- The amount deposited by the client.

- Position and full name of the employee who accepted the payment.

- Other characteristics of the service (optional).

If the document form does not have a detachable part, then a copy must be made when filling it out. It is prohibited to duplicate the series and number of the document form. In addition, SRF must be made either using an automated system, or printed in a printing house - in the last version, it must contain information about this printing house (name, TIN), print circulation, order number and year of its execution.

All about the changes in the federal law "On the use of cash registers" - in the recording of our webinar.

For more details on the registration of SRF, see the Regulations on the implementation of cash settlements and (or) settlements using payment cards without the use of CCP Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

Each individual entrepreneur should know that accepting cash from buyers and clients must be properly formalized. The documents confirming the transaction between the parties are contracts. Cash and sales receipts of individual entrepreneurs - proof of payment. Due to the innovations, many businessmen cannot understand for sure whether they will have to apply everything? What will the new checks be? Is it possible to accept a sales receipt without a cash register, as it used to be for some categories of entrepreneurs? What threatens for the lack of a cash register? Let's look at these questions.

Definitions and differences between a cash register and sales receipt

Until now, many are at a loss as to whether an individual entrepreneur should issue cash receipts, should all individual entrepreneurs install new cash registers? Therefore, first we will give an answer to the main question:

Attention! Since mid-2018, all organizations and entrepreneurs under the general taxation system are required to use online cash registers. Similar requirements apply to the vending business. Regardless of the regime, catering and retail should have switched to a new format, provided that there were hired personnel on the staff. The postponement was received by payers of the PSN and UTII, as well as merchants on the simplified tax system, employed in the service sector. Until July 2019, owners of retail stores and food service outlets may also not change their equipment if they have not signed employment contracts.

The purpose of a cashier's check is to establish the fact of receipt of cash or electronic money. This document must be drawn up in compliance with the requirements of the Federal Tax Service for the presence of mandatory details. The cashier's receipt is printed on a special cash register, which must be correctly configured and registered with the tax inspectors.

Important! Old cash registers cannot be used. The production of obsolete equipment stopped at the beginning of 2017.

Previously, the cashier's check did not provide for detailed disclosure of information about the settlement transaction. Therefore, the appendix to this document was a sales receipt. It was not necessary to attach it to every cash transaction; it was issued in the case of:

- a buyer's or client's request;

- making an advance payment if the transaction has not yet been completed;

- confirmation of acceptance of cash, when the mandatory use of CCP is not provided.

Now this form has lost its relevance. All information about the transaction is contained in the cash document. The persons named in clause 7.1 are entitled to issue a sales receipt or SRF. Art. 7 of Law 290-ФЗ dated 03.07.16. The list includes entrepreneurs and organizations that have received a deferral in the installation of online cash registers until July 2019. The conditions for the validity of the document are listed in the letters of the Ministry of Finance of the Russian Federation No. 03-11-06 / 2/26028 dated 06.05.15 and No. 03-01-15 / 52653 dated 16.08.17.

Cashier Receipt: Sample and Requirements

Since the cashier's check is the main payment document, its form must meet certain requirements. They relate to the presence of the necessary details, which have significantly increased in contrast to the checks of old samples. It also leaves the cash register, but first, the KKM itself must receive accreditation from the tax office and assign it a registration number.

Together with the usual details of old cash register receipts, such as serial number, date and time of purchase, full name. and the TIN of the individual entrepreneur and the purchase amount, the new one must contain (Article 4.7 of Law 54-FZ of 05.22.03):

- title;

- tax regime;

- calculation attribute (income, expense, etc.);

- the name of the product, work, service;

Attention! Individual entrepreneurs in all special modes, except for sellers of excisable goods, until 02/01/2021 can skip this requisite.

- type of payment: cash or non-cash;

- cashier data (full name, position or number), shift number;

- number received in the tax office during the registration of the cash register;

- fiscal data: attribute, serial number;

- Internet links: the FTS website is required, the address of the online store that issued the check, the IP address of the individual entrepreneur, if the buyer received the check to his e-mail;

- QR code.

His sample looks like this:

From January 2019, product codes should have appeared on the cashier's receipt. For ordinary products, sellers were instructed to indicate designations in accordance with the EAEU nomenclature. However, the government decree has not yet been signed. The businessmen received a reprieve.

It should be reminded that the introduction of the labeling system is also expected this year. Unique product identifiers will appear on the receipts. The first amendments to the legislation will be applied by sellers of tobacco products. The instructions for them will take effect from March.

All data on the document must be clearly printed so that they can be easily disassembled. For printing, special thermal paper is used, which does not hold characters for a long time, they fade. Article 4.7 of Law 54-FZ establishes the requirement to retain information on a document for at least 6 months. Therefore, if it is necessary for a long time, it is better to scan or take a photocopy.

An individual entrepreneur's cashier's check is drawn up without a seal. It allows you to clearly represent the entire transaction. At the same time, it is not forbidden to indicate related information on the document, for example, the terms of promotions, the amount of discounts, the hotline phone number, gratitude for the purchase.

Sales receipt: sample and requirements

Since the sales receipt has long been a cash register application, it contains additional information. Forms were printed in advance and filled in by the person in charge. Entrepreneurs and organizations that have received a deferral for online cash registers are entitled to adhere to the previous rules until July 2019.

Requirements for the details are as follows:

- title;

- number in order;

- date;

- data of an individual entrepreneur: full name and TIN;

- full description of the purchased product: quantity, unit price, article;

- total amount.

Blank blanks of sales receipts can be prepared in advance, as soon as the need arises, you only need to write down the decryption of the goods. Templates can be created on your own on your computer and printed, you can buy forms at a kiosk or order at a printing house.

A standard sample can be used:

Important! In addition to the required details, the sales receipt must contain the signature of the individual entrepreneur and, if any, this gives it legal force. Unfilled lines in the form must be crossed out so that you cannot write down any other names there.

Some businessmen may issue a sales receipt of an individual entrepreneur without a cash register until July 2019 in order to confirm their income. These are entrepreneurs in special regimes who do not have hired workers, with the exception of those who are engaged in retail trade and catering. Sales receipts may be replaced by receipts.

A sales receipt without a cash register can be issued by the individual entrepreneur specified in Art. 2 of Law 54-FZ. Such participants in the turnover are allowed to refuse the CCP.

Many do not understand what is the difference between, therefore, they believe that replacing one document with another is legitimate. However, it is not. The purpose of the invoice is to confirm that the goods have been transferred to the buyer. It is usually used by customers and suppliers when making a deal. The invoice does not provide for an indication of the amount of payment, therefore it cannot be considered a confirmation of the receipt of money for the goods.

The same conclusion arises when comparing a sales receipt and a cash receipt order. Documents arising from the maintenance of the cash desk, such as receipts and, reflect the movement of money within the cash desk, but do not replace documents for conducting cash transactions.

What checks are issued under different tax regimes?

In 2019, everyone, including merchants, will switch to new online checkouts on a deferral basis. However, this will affect individual entrepreneurs selling goods at retail and managing their own cafe, canteen or restaurant. All others have been granted a grace period until July 2019.

Attention! Some types of entrepreneurial activity are completely exempted from compliance with cash discipline. It can not be used by nannies, nurses, points of reception of secondary raw materials and glass containers (except for the reception of scrap metal).

Let's consider how cash transactions should be formalized in different special modes.

On the simplified tax system

One of the most common taxation regimes is the STS, which is used by a large number of individual entrepreneurs. The use of a simplified taxation system does not in itself exempt entrepreneurs from the mandatory use of online cash registers, so sooner or later all individual entrepreneurs will need to acquire special devices, especially shop sellers and cafe owners should hurry up.

- household services (plumbing, apartment cleaning, garbage disposal);

- car wash and repair;

- Taxi;

- cargo transportation and services of loaders.

They may not install cash registers until July 2019 if they confirm payment with strict reporting forms. When concluding an employment contract, 30 days are allotted for registering a device (Article 7 of Law 290-FZ).

On UTII

A similar system for the timing of the establishment of CCP, as for the STS, operates on UTII:

If an individual entrepreneur is single-handedly engaged in an area not related to retail and restaurant business, he issues receipts or sales receipts at the request of the client until mid-summer 2019.

If it carries out such activities with officially registered employees, it establishes an online cashier by mid-2018.

If he works in the provision of services to the population, he applies the BSO until July 2019.

In each region, the scope of UTII may differ, since local authorities have the authority to establish the types of activities in which entrepreneurs can switch to imputation.

On PSN

The tax system based on the purchase of a patent for a certain period is considered the simplest and cheapest. The limitation is that only individuals can be clients of a businessman on a patent. He will not be able to conclude large contracts with other entrepreneurs and firms. But for starting a business, PSN is a good start. The conditions for cash discipline are the same as for the STS and UTII.

Checks for cashless payments through acquiring

The acquiring system assumes payment by plastic card through a special terminal. By itself, an acquiring check is a fiscal document sent to the FTS website when making non-cash payments. For its formation, a terminal is used, in which an online cash register is already built. Therefore, the answer to the question whether checks are needed when paying by bank transfer through acquiring is obvious.

Penalties

The most common violation of cash discipline is the failure to issue a check, which indicates that the cash transaction was not carried out. For this comes administrative responsibility: a fine for the entrepreneur of 1.5-3 thousand rubles. The same punishment is applied if the issued check does not contain all the required details or is printed on a device that has not been registered with the Federal Tax Service. In the first case, inspectors may limit themselves to a warning if the individual entrepreneur has valid reasons, for example, lack of electricity or temporary failure of the apparatus.

For work without a cash register, much tougher sanctions are provided. imposes a fine on entrepreneurs from ½ to ¼ of the purchase amount, but not less than 10 thousand rubles. Organizations are threatened with recovery of up to 100% of unaccounted transactions, and the minimum is set at 30 thousand. In case of a repeated violation, the culprit risks facing suspension of activities for 90 days and disqualification of officials.

Thus, in the near future, almost all entrepreneurs, with rare exceptions, will have to issue cashier's checks. Service representatives, UTII and PSN payers have time for installation, but it remains less and less. I would like to give good advice to those who know that from July they will have to install a cash register: closer to the set date, prices for new cash registers will predictably increase. Therefore, it is worth deciding the issue of purchasing and installing new equipment in advance, it is useless to expect that there will be any more amendments about the postponement of the dates.

The essence of the article: you can order an online check template from us!Ready template - 2t.r.! (photo of the template below) According to your template - 2.5 tons.Take advantage of it! At first it will work, but then it is not known.

Electronic check 54 FZ - OFD, online cash desks

Until July 1, 2017, entrepreneurs will have to switch to using an online checkout. Article 4.7. Law No. 54-FZ as mandatory details.

Who is exempt from switching to online checkouts

In addition, business representatives who are currently exempt from the use of KKM (payers of UTII or patent) will have to register online cash registers no later than July 1, 2018.

Payers of UTII and PSN, who are not yet required to issue cashier's checks, will need an online cash register from July 1, 2018.

New checks - what to do? How to make a new check? What are the options, bypass solutions?

The peculiarity of the new check is that instead of eccles, they put a qr-code in which a link to the OFD website is encoded.

Data from QR code, in fact:

1) t = 20170413T185300 & s = 352.00 & fn = 8710000100035210 & i = 40611 & fp = 1541605060 & n = 1

2) https://consumer.test-naofd.ru/v1/?t=20160201T192100&s=82.80&fn=00000000000037&i=0000000001&fp=0000000165&n=0 - Can't connect to the site.

3) t = 20170425T1958 & s = 112.00 & fn = 8710000100069182 & i = 24581 & fp = 232762229 & n = 1 -It does not go over by itself. Perhaps I mean - https://www.nalog.ru/t=20170413T185300&s=352.00&fn=8710000100035210&i=40611&fp=1541605060&n=1. Ne works. As well as the link from the real check. And apparently it will not work soon :)

You can make such a template for an online check:

qr code - z You can sew any text, link, character set. Can be copied from original. We do it.

CONCLUSIONS: Perhaps you can give to those who do not ask to send a copy? Or close internal reporting? You can recover receipts! Tax reporting can be closed for another year with checks from individual entrepreneurs (UTII and PSN). You don't have to give an email check if you weren't given an email or phone number - and many are afraid of spam.

Open an IP and buy a patent and give old checks! (And we are not obliged to issue checks at all)

|

№0 |

Making your templates for receipts, cash fonts to order! |

2,000 - 2,500 rubles |

|

№1 |

BASE OF CHECKS FILLING STATIONS ALL OVER RUSSIA! THE MOST COMPLETE! BY REGION! Stamps, forms, checks! |

7,000 rubles (instead of 25,000 rubles) |

|

№2 |

Database of new online checks - Gas station, gasoline, fuel, car wash! |

|

|

№3 |

A set of new online templates - construction! |

7,000 rubles (instead of 18,000 rubles) |

|

№4 |

Sberbank, post office, terminals - legalization, fines, ... |

7,000 rubles (instead of 14,000 rubles) |

|

№5 |

A set of new online templates - shops, services, … |

7,000 rubles (instead of 20,000 rubles) |

|

№6 |

UNIVERSAL BASE (No. 2 + 3 + 4 + 5) |

20,000 rubles (instead of 26,000 rubles) |

|

№7 |

BASE OF CHECKS FOR ALL CASES OF LIFE (No. 1 + 2 + 3 + 4 + 5) |

24,000 rubles (instead of 33,000 rubles) |

Examples of new checks, check sample

What is online checkout

Online checkout is a cash register that meets the new requirements:

sends electronic copies of receipts to the OFD and buyers,

has a fiscal storage device built into the case,

freely interacts with accredited OFDs.

The online sales process now looks like this:

The buyer pays for the purchase, the online cash register generates a receipt.

The check is written into the fiscal accumulator, where it is signed with fiscal data.

The fiscal drive processes the check and transfers it to the OFD.

The OFD accepts the check and sends a return signal to the fiscal drive that the check has been received.

OFD processes the information and sends it to the Federal Tax Service.

If necessary, the cashier sends an electronic check to the customer's mail or phone.

FTS representatives receive information through the fiscal data operator. Its tasks include assigning a unique number for each check and storing all information on a single server.

What should be in the check of the new online cash register

If the buyer asked to send an electronic copy of the receipt, then the paper one must indicate the client's e-mail or his subscriber number.

The sales address varies depending on the type of trade. If the cash register is installed indoors, then you must specify the address of the store. If trade is carried out from a car, then the number and name of the car model are indicated. If the goods are sold by an online store, then the website address must be indicated on the check.

The surname of the cashier does not need to be indicated on receipts from online stores.

Thus, a check for the new 54 FZ will look like this:

In addition to a paper check, the buyer, upon his request, can receive an electronic version of the check to the e-mail address or subscriber number specified by him:

Thus, from the check it is clear that according to the new 54 FZ, it will not be possible for organizations to release products, simply by keeping a total account. Cash register equipment must use software (software) that allows displaying information about the range of goods sold, i.e. the cash register software must be integrated with any commodity accounting system (1C, Doleon, etc.), or the cash register software must allow such records to be kept at the cash register.

New penalties:

The level of fines for conducting a transaction without a CCP is increasing. For all business representatives, this amount will be 75-100% of the amount of money received bypassing the cash register. In this case, the minimum amount of the fine will differ:

For employees - 1.5 thousand rubles.

For officials - 10 thousand rubles.

For the organization - 30 thousand rubles.

In addition, a fine awaits entrepreneurs who do not send an electronic check to the consumer.