Super profitable turbo options strategies. The essence of the turbo options trading strategy

Turbo options are chosen for a reason, since a person has decided to use these tools in his work, which means that he understands and is ready to use their advantages. Such short-term transactions require special approach and attention.

Trading turbo options using indicators is pointless, because the signals will be late, and the trader cannot afford to lose time when the transaction is executed in a matter of minutes. If you leave technical indicators in the strategy, then only to obtain some information about the market, and not to find the best moments for making deals.

The essence of the turbo options trading strategy

Since indicators for trading short-term options are not suitable, and strong price fluctuations on the news do not make it possible to aim for the purchase of a "quick contract" at all, one has to use the features of the market.

The fact is that the market price of any asset is constantly fluctuating, either rising or falling, albeit with different strengths:

Our strategy will be based on this not tricky feature of the price behavior, but first, a few words about the turbo options themselves, which we will need.

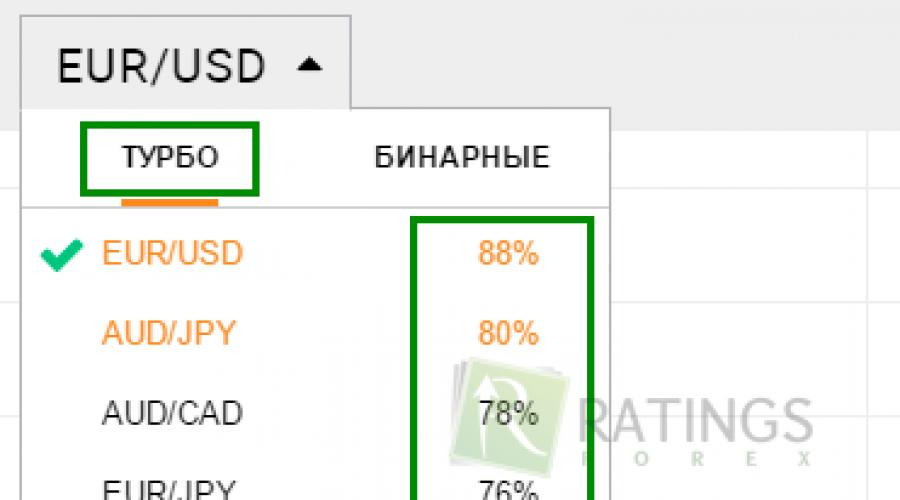

For successful trading with this strategy, turbo options of any duration, starting from 1 minute, are suitable. The highest remuneration for short-term contracts that I have seen on the market is with , which, unlike other companies, offers "turbo" prices that are not understated relative to classic binary options:

The essence of the strategy is to work in the direction of the trend and increase each new rate after closing the loss on the previous option. How does it all look and are the trading results good? I will talk about this in detail in the second part of the review.

The best strategy for "turbo"

First of all, the current market trend is revealed, for which you can use, for example, the technical indicator "Moving Average" (a kind of SMA with a period of 30 to 50) or your own eye, determining the presence of a trend without the use of additional tools.

For examples, I will use the broker's terminal, where you can easily find SMA (50) for an objective assessment of the situation.

It is better to work during the daytime, when the activity of bidders is the highest. For example, let's take turbo options on the EUR/USD asset with a period until expiration of 1 minute. You need to make deals only in the direction of the trend, which we will determine using the SMA technical indicator:

- a strong upward slope - an uptrend;

- a strong downward slope - a downtrend;

- horizontal movement (or close to it) - the absence of a pronounced trend (it is not worth trading).

A minute later, the transaction ends with the loss of the investment ($1), since the price of the asset did not increase, but decreased. Instead of waiting for a new trend to purchase the next binary option, we immediately buy a new contract with the following parameters:

- cost - $2;

- direction - up (in the same direction as the failed trade);

- we don't look at SMA anymore.

If the option closes with a profit, then the profit ($1.7) will be enough to cover the loss ($1), and the profit will remain ($0.7). If the contract turns out to be unprofitable, then you need to re-buy the binary option:

- cost - $5;

- duration - 1 minute (or close value);

- direction is up.

Even if several options closed unsuccessfully for us in a row, just one profitable trade will be enough to stay in the black. This strategy is not in vain considered best for turbo options, because with its help it is quite possible to earn good money every day.

Even "standing up against the trend", we do not lose the deposit, since only one binary option is enough for a positive closing of a series of transactions, which will end with a profit. It is this calculation that forms the basis of the strategy.

For our example (yield of 85% on the asset), you can choose the following option values: $1, $2, $5, $11, $24, etc. If the yield on the asset you have chosen is different (more or less than 85%), then the size of transactions will need to be calculated separately.

Even a beginner can use the best strategy for turbo options, the main thing is to follow the rules of the system and not be greedy, because overestimating the cost of the first transaction can lead to sad consequences (the cost of subsequent operations will have to be significantly increased). The size of the trader's deposit should be such that it would be enough for 5-7 transactions within one series, then trading will delight you with its results.

Perhaps it is turbo options that cause beginners to have an irresistible, burning desire to spend their money. And no wonder - after all, this is the shortest way to get a successful or unsuccessful deal.

Turbo options are binary options with short expiration times, typically 1 to 3 minutes. In other words, these are short-term options. Well, the designation “turbo”, which sounds cool, is used by brokers like IQ Option and many others.

If you are serious about learning how to make money with turbo options, there are a few important points. You must understand them before switching to the turbo mode of your trading.

What are turbo options really

For beginners, turbo options are a high risk instrument. This is a field of greed and excitement in which they can take too many risks. In other words:

If you have just started to get acquainted with binary options - work with turbo options only with even, small rates.

Yes, I understand that I want to earn everything at once. That you are in a hurry, that you urgently need a white BMW and you need to put a lot and more.

But here is an example of how it is done correctly, especially when you are learning:

In experienced hands, turbo options work wonders. In inexperienced - will lead to early disappointment. And it's not that there is no reliable strategy - there are some. And in psychology - greed overwhelms, the beginner loses control over himself and off we go.

In short, it is:

- incredibly profitable;

- contraindicated for nervous individuals.

This is an extremely popular and profitable segment in. This is how hundreds of successful transactions are made. But that's how they quickly squander the deposit, losing their heads from greed. So keep yourself in hand.

To work with short-term options, we will first examine the following components:

- support/resistance lines;

- Japanese candles;

- Bollinger bands;

- 3 candles strategy.

Well, you can, if desired, add a trend oscillator like or a similar class to this.

Preparing for turbo trading

Turbo timing is everything. The account goes literally for seconds. A successful entry point may exist for several moments. This means that you should have everything ready for lightning trading.

Since brokers are in no hurry to let us trade in terminals like Metatrader, we have to use their interface with buttons Higher lower. And if in medium and long-term options this is normal, then in a turbo it is not particularly convenient.

However, they allow you to work with BO directly through Metatrader.

Your trading place must be prepared. Do you have 2 monitors? Wonderful. On 1 we display the broker window, on 2 - the chart. However, even with one monitor, you can make a convenient window.

In Windows 7 and 8, there is a very convenient option to split the screen into two equal parts. Let there be a broker in one, and a live chart in the second. How to do it?

Launch 2 browser windows and in each press the key combination “Win + left arrow” or right.

The result will be like this, 2 windows next to each other will occupy 50% of the screen:

Everything is ready for trading. Now let's move on to signals and indicators.

The best signals and indicators for turbo options

You need to work with turbo options on a 1-minute timeframe. However, before that, you should evaluate the picture on a 5-minute scale to see the big picture.

On the 5-minute chart, we will draw support and resistance lines to see the corridor in which the price is moving.

Support and resistance lines

What are these lines? We draw them ourselves. We select this element of the side menu and in it horizontal line.

Now look on the chart for a place where the price could not break through the conditional line below - and there we draw support line . It seems to support the price, which bounces off the line like a trampoline.

Why do we need this? Then, if the price approaches this area, therefore, you need to keep your ears open and prepare for a sharp change in price movement.

Drawn in the same way resistance lines - this is the top line. It seems to resist the price movement, does not allow it to grow up.

By the way, pay attention to the last attempt of the price to break through the line (marked with a red arrow). This is called a false break. The price seems to have broken through the line, but then returned back and began to fall very cheerfully down.

With the help of lines, we have identified a corridor in which our price will rush.

But how to understand when the price will reverse when it touches the support or resistance line? This will help us special Japanese candles. You can find them yourself, these combinations in which the price either repels or bounces off the line.

The price goes up and hits a resistance line. We see two candles of almost the same size - green and red. The price reversed and went down.

And a mirror situation - the price falls, hits the support line, a long red candle follows a long green candle - the price goes up.

And another very common option. I call it "ice cream" - the candle looks like a popsicle on a stick. See what a long shadow, this stick under the candles? If the candle grows such a shadow when it touches the support line, the price decides to reverse. And then cheerfully scratches up.

And vice versa. The price hits the resistance line, the candle gives out a long shadow, it cannot break through the line and goes down. Here is a very illustrative example:

Best Turbo Options Trading Strategy: 3 Candles

Now, here's our strategy. It is called “3 candles” or " 1-2-3 ". This is a kind of modern, adapted for short-term options, they are also turbo.

But remember - any strategy should be considered only in the context of market movement. It's not a cash button, it's not the easiest way to become a millionaire. This is just the direction you need to explore.

What is its essence. When the price is in a trending move(rather than trampling sideways), then when it travels along the Bollinger band, you need to wait for the appearance of three candles of the same color, green or red.

And when the 3rd candle closes, there is a great opportunity to make a purchase (or several purchases) 1-2 minutes ahead.

Bollinger bands are opened with a button indicators – Bollinger Bands.

The trend movement is a wide Bollinger band and a clear trend. And the lateral movement is just such a narrow, unattractive gut. It is better not to use the rule of 3 candles in it.

Let's see specific examples. The first red candle touches or breaks the lower Bollinger band. We wait until 3 candles appear.

Did the 3rd show up? Does it also touch the Bollinger band or go beyond it? When there are 10-20 seconds left before its completion, buy the Put (“Down”) option for 1 minute. As you can see, 2 more candles will work perfectly in the direction we need.

Exactly the same situation. Note that the Bollinger band (colored area) has become wide – a great trading field.

Like clockwork, isn't it? We start counting with a candle, which first breaks the Bollinger band or touches it .

Let's see if the price rises up. Now we count green candles.

Don't yawn - sometimes after thirds there will be only one fourth green candle. But it will be enough for us if the expiration time is 1-2 minutes and we enter 20 seconds before the end of the 3rd candle.

By the way, if the price bounced off the lower Bollinger band and briskly moved up, crossing the middle band, the three-candle rule also works great.

Do not count 3 candles anywhere. There are only two situations - all three candles behind the Bollinger band or a rebound (from the lower or middle band), as shown below.

But the rebound from the middle line, the 3rd candle closes behind the upper Bollinger line, everything is perfect.

Another successful example. When the first green candle follows a full red and almost rebounds from the middle line, then crosses the Bollinger band, bam, that's it. This means that the price will have enough strength to rise and the rule of three candles will definitely work. The first candle is always an indicator.

And another example. See how important the first candle is? The longer it is, the stronger the momentum it gives to the price.

Exceptions in strategy

Are there situations where 3 candles won't work? Yes. There are three main problem situations:

- the first candle in an uptrend with a too long shadow;

- square candle with shadows;

- doji.

When the first candle in our sequence has a too long shadow and opens on an extension of the Bollinger Band, that's bad. Here's how it is here.

What does it say? The price “doubts”, fluctuates. And it won't last long. So it is - only enough for 3 candles.

And here the candle has a very long lower shadow, and the previous red one let us down, also a long shadow, but in the opposite direction, plus, there is almost no body. As a result, also only 3 candles.

And the second dangerous situation is a candle with a short (almost square) body and shadows above and below. If she is 2nd or 3rd in the sequence, it is best to ignore her. See:

See? This square green body managed to spoil the sequence of three candles for us 2 times. No wonder - this is a candle of uncertainty, which looks like a spinning top that does not know where to go.

And finally doji . This is such a special candle without a body at all. Therefore, you cannot start counting from it.

Remember: the account is kept from the first candle that touched or broke through the upper or lower Bollinger band.

Turbo Options at IQ Option

Let's briefly consider the features of using turbo options in . You can select them, as you already know, in the left menu.

At the top, as usual, select an asset, expiration time in the menu on the right. The best option is up to two minutes, 10-20 seconds before the completion of the 3rd candle.

In turbo options, the art of expiration is important. You can correctly guess the price movement, but not guess with the expiration and fly like plywood over Paris. This comes with experience, usually a minute and a half in 90% of cases will give the best results.

slippage

Some brokers have such nonsense as slippage. The point is simple. You have found the ideal entry point, press, say, the “Down” button, but the price on the chart falls too quickly and the purchase price instead of the desired point is lower than you wanted.

Sometimes it's not scary, sometimes it will cost you money. This is another risk of turbo options. When you work with a 5-minute timeframe or more, slippage almost does not play a role. Starting from 15 minutes, it doesn't matter at all. But on a turbo - every delay and “sagging” is fraught.

If the broker has powerful servers and a normal platform, the problem is not relevant. However, be on the lookout.

At the most inopportune moment, everything can hang:

- browser;

- live chart;

- broker website.

Get yourself a browser without unnecessary add-ons and tabs, which will be used only for binary options trading.

Everything must be ready to trade. In Forex, people who work with the scalping technique generally buy dedicated servers in Western data centers and connect to them via a remote desktop in order to eliminate the freezing factor of their computer and so that the server is a few milliseconds “closer” to the broker’s servers.

In the end, the ideal situation for a 1-2-3 strategy. After the narrow gut, the price shoots up and gives us a lot of opportunities.

breakneck speed

Here they are, turbo options. Crazy, difficult, contraindicated for greedy people. Gold in experienced hands, ash in novice hands.

Over time, you will figure out for yourself if turbos are right for your trading style. Remember - this is not a game, not a way to frolic. Although if you have extra money and want to donate it to a broker, then you are welcome. Everyone else needs to learn not just the right trading, but also composure. Nervous, hysterical, gambling is not the place. Turbo speeds are too high.

Not just one strategy? Understand. How about on the forum?

In fact, it's like Formula 1. In case of success - the podium, fame and busty girls. In case of failure - a pile of iron on the side of the road and mourning on their faces. Soberly assess your chances and then fast turbo options will give you everything that you would like to achieve.

Trading binary options should be easy, right? So why complicate them? Binary options should bring you quick profits. So why use long term time frames?

Binary options should be fun like roulette. So why not take the Martingale approach… Yes, we are going to make binary options fun, so we are going to talk about a simple 60 second options trading strategy combined with Martingale.

I just "invented" it... Of course, I have no idea if it's profitable, and if it has high accuracy, but we're going to have some fun. Martingale and 60-second trading are those things that “we love to hate” or “hate to love”, I don’t remember exactly ... Everyone uses them one way or another!

How to use the G60S strategy?

For this strategy, we will be using two exponential moving averages (EMAs) and a regular Meta Trader 4 indicator called the Retracement Finder, which is available for download at the bottom of this article.

I think everyone is familiar with moving averages, so I'm not going to waste time explaining the formulas or what they do, but what you should know is that Gone in 60 Seconds uses the 50 period EMA and the 200 period EMA to determine the trend. . When the 50 EMA is above the 200 EMA, the trend is up, and when the 50 EMA is below the 200 EMA, the trend is… you guessed it: down.

Once we have identified the trend, we need to find a pullback. This is exactly what Retracement Finder does. A move above or below the zero level means a retracement of this indicator, so in an uptrend we will wait for the Retracement Finder to move below zero, and then rise back up above this level (opposite for a downtrend). I almost forgot: we will use the setting of 20 for this indicator (the first line in the list of settings). Here's what your graph will look like:

On the chart there is a blue EMA 50 line and a green EMA 200 line. When the EMA 50 is above the EMA 200, then there will be an uptrend. Now we need a pullback lower: this signal is given by the Retracement Finder, which goes below zero. The first bar that rises above zero is our trigger to enter the trade (vertical blue lines). Summarize:

Enter CALL:

EMA 50 above EMA 200

We enter with PUT:

EMA 50 below EMA 200

Retracement Finder goes above zero

Retracement Finder drops below zero

End time: 60 seconds

Capital Management: regular martingale — we double all losing trades.

Why is "G60S" a bad strategy?

The answer to this question is extremely obvious: he uses Martingale and 60 second binary options. How to eliminate this shortcoming? Again, the answer couldn't be more obvious: don't use Martingale and use longer expiration dates.

Why is the G60S good?

The EMA 200 and EMA 50 are considered among the most reliable moving averages and for good reason, while the Retracement Finder gives accurate entry data.

Act like a maniac!

Maybe you want to know why I created this strategy for turbo options and martingales if I don't like them. Heh, I don't have an answer... I just woke up thinking of an easy strategy, and then I asked myself a couple of questions: Can I use this strategy for a 60 second expiration? What happens if I use martingale on it...? As a result, you see this article.

I immediately warn you that this strategy in its purest form has the maximum risks for your account. But you are already over 18 years old and you yourself know what to do with your money! And be smart!

You can trade this strategy with different brokers, but the best charts and indicators provided by binary options broker Binomo

The pattern should form at the end of a directional move. If the price moves in a horizontal corridor 10-20 points wide and suddenly a candle with large shadows forms, then it is better to simply ignore it.

The next example is good because the price before the formation of absorption approached a strong level, a loss of a couple of points can be ignored. The absorption itself is also not bad - the low of the previous candle was rewritten, and the body of the bullish candle completely absorbed the previous 2. At the same time, it has very small shadows and a pattern has formed at the end of a strong movement, there is every reason to believe that if not a reversal, then at least a correction is being prepared.

By choosing an expiration time at the level of 1-3 minutes, it was possible to make a profit at the level of 80-90% of the bet without any problems.

Trading binary options based on divergences

For this, indicators such as MACD, CCI, RSI and other algorithms are suitable, on which it is convenient to determine divergences. On the MACD example:

Add the MACD indicator to the chart with standard parameters;

Similarly, you can use the Keltner channel in trading. It is also built on the basis of the moving average, but its width is somewhat smaller, so the price often goes beyond it. Here you can focus on the maximum price overshoot beyond the channel, that is, you will have to work with statistics.

Indicator strategy for m1

For the following strategy, you will need a whole set of indicators:

3 exponential moving averages with periods of 62, 102 and 165;

On the Stochastic, the lines should cross and exit from the oversold zone;

Additionally, the signal can be strengthened by candlestick patterns.

Although the work is carried out on m1, this strategy allows you to enter the market quite accurately, while transactions are not very frequent, so you can use it simultaneously on several currency pairs to increase the frequency of trading.

As for the expiration time, it is better to choose it equal to at least 4-5 minutes.

In the two noted examples, transactions could be concluded immediately after the Stochastic left the oversold zone. In the first example, the signal was strengthened by the fact that the body of the bullish candlestick completely engulfed the body of the bearish candlestick.

The next couple of examples are not so successful. In the 3 marked market entries, everything would depend on the selected expiration date.

In the 1st trade, success could bring an expiration time of 60 seconds, in the 2nd one - profit could be obtained with an expiration time of 1-3 minutes, in the 3rd one - 60 seconds. So, as in the case of the previous strategies, success by 50% depends on the correctly chosen expiration period.

Working with Parabolic and MACD

Another simple way to work with turbo options has migrated from forex. There is a pipsing strategy on Parabolic + MACD, in this case, work is carried out on a minute chart, and on MACD, a confirmation of the signal received from Parabolic SAR is sought.

For sales, the following rules must be met:

The parabolic must be above the price;

Good afternoon, dear visitors and readers of our site. Today we will talk about indicators for turbo options. First of all, I consider it appropriate to talk a little about what turbo options are in general, and why they attract the target audience so much.

It's no secret that absolutely every trader who was interested in the field of binary options, and even tried his hand, started with turbo options. Of course, it is this type of options that attracts a huge number of traders. This is primarily due to the fact that these options make it possible to theoretically earn 75-85% of the bet in just 30-60 seconds.

Just think, you bet 100 bucks, and in a minute you can earn an average of 80 bucks. Of course, such profitability, and even in such a short time, is really attractive. But the question always remains open, how stable can you earn on turbo options? And here, by the way, is a very interesting moment. Personally, I don’t know a single person at all who manages to consistently make money on turbo options.

What is the motivation of traders on turbo options

Personally, I have always believed that these types of options are made only as a kind of lure. Yes, my opinion is subjective, but it does not claim to be the truth. Personally, I would not consider options at all with expiration below 30 minutes. If you are a novice trader at all, then I would generally recommend starting with options, with expiration per day.

But let's face it, for what kind of newbie would consider daily and even hourly options. He comes to the market with a couple of tens of dollars in his pocket, and wants to immediately start tearing big. Somewhere he heard that you can disperse the deposit, and forever say goodbye to poverty.

Of course, this kind of judgment is largely erroneous, but here people can be understood to a certain extent. It’s all about options advertising, which constantly tells us that you can get rich on options without doing anything special, and having a strictly limited small amount.

Advertising is lying: is it possible to make money?

In fact, all these advertising tales, all this is bullshit. The main task is to attract as many target audiences as possible through advertising. Moreover, you should understand that it is profitable for a binary options broker when clients merge. Why? Let's start with the fact that the broker does not take your trades anywhere. All your trades are processed by the broker itself, so your gain is a loss on the part of the broker. It's just that there are very large companies with millions of daily turnover, because they will not pay attention to you if you earn several thousand dollars a month.

But if you contacted a small company, and start tearing up large sums, then they will do everything to drain you. All in all, turbo options are a good way to drain your clients. To begin with, when using turbo options, the broker can manipulate quotes in every possible way, and you will not prove anything.

In addition, to predict something for such a short period of time, not exceeding a minute, is quite difficult, I would even say impossible. In addition, you must understand that trading turbo options is a rather aggressive way of trading. Plus, even with a complete lack of skills and knowledge, this is a direct way to drain the deposit. As I said, this is exactly what the broker needs! The experience of thousands of traders has already proven that it is unrealistic to earn consistently on turbo options.

Believe me, it is better to make one and conscious, balanced trade than to open a dozen of some incomprehensible trades, which can certainly end in failure.

The search for better tools is the search for the grail

Now the interesting point is the indicators for turbo options. This question is often discussed by many traders, because everyone is so stubbornly looking for the very indicators that will make it possible to always earn. Roughly speaking, the main idea is that there is an indicator or a certain set of indicators that allows you to win the deal in the vast majority of cases.

Watch a video review about the indicator

This is akin to searching for some kind of holy grail that would bestow an advantage over other market participants. True, the problem is that there is no such grail. The best indicators for turbo options - this kind of request often appears on the Internet. But here you should face the truth, because there are no better indicators, moreover, there are no indicators that can guarantee you a stable income on binary options.

Indicators for turbo options are only assistants that give you the opportunity to analyze the situation on the market. Moreover, one specific indicator will not give you anything sensible. You definitely need to have a systematic approach that allows you to find the moments when you can open a quality trade. No indicator or systematic approach will give you a guarantee that your trade will close with a profit.

Other articles on the philosophical topic of binary options:

There are no such indicators, there are no such systems that will allow you to always exit a trade with a profit. There will still be losses, because they are part of trading. Yes, you can minimize them in every possible way, but you won’t be able to completely eliminate the possibility of a loss, even with a great desire.

There are no indicators that are head and shoulders above their competitors. Each person has his own approach to trading, respectively, the same indicator in the hands of one person can become a formidable weapon in the fight for profit, and in the hands of another person it can become a real machine for draining money.

conclusions

The first thing you should focus on is developing your trading approach. You need to find what specifically works for you. There is no single and trouble-free way that would allow each person to make a profit. It often happens that you can give the same system to two people, but one will earn with it, and the other will only lose through it. Therefore, there are no any best indicators, do not assign tasks to indicators for which it is not designed. You need to find what works specifically in your case, find what will give you a constant and stable result. I understand that this is not easy, however, this is the truth.

Get out of your head all the search for the grails, they are not. Look for your approach that will give results specifically for you!