The deal before is not large for the joint-stock company. Big deal for ooo

Read also

A major transaction for a limited liability company requires a special approval and calculation procedure. What is a major deal for an LLC? How is the decision to hold it made? When is it possible to challenge a major transaction? Read the article for details.

On January 1, 2017, amendments to the norms defining the concept and features of major transactions for business entities entered into force in Russia. Changes in federal legislation affected the requirements for the recognition mechanism, decision-making and approval, as well as the form of obtaining permits from government agencies (Federal Law No. 14-FZ "On Limited Liability Companies" dated 02/08/1998). A major deal for an LLC in 2018 is a commercial agreement that is fundamentally different and goes beyond the normal business of the company.

What transaction is considered large for an LLC

The definition and characteristics of a major transaction have general provisions for various types of enterprises, however, the business communities of LLC have their own nuances. To understand how to determine the size of a deal for an LLC, you need to evaluate it in terms of the following criteria:

In a large commercial transaction, there is always the acquisition or alienation of expensive property.

The cost of the acquired or disposed property, which is the object of the transaction, is estimated at an amount exceeding 25% of the total price of the entire state of the LLC. In this case, all types of movable and immovable property, which are in assets and on the balance sheet of the community, are taken into account.

A large commercial and business transaction can be a single one or consist of a chain of smaller commercial agreements.

The decision to carry out transactions with property in an amount exceeding the value of the entire property of the organization is made by the general meeting of participants.

When summing up the value of the property of an LLC, the amount includes not only real estate, material and technical base, but also shares, finance, intellectual property

Small agreements can be combined into one large transaction if the following factors are present:

- have the same mechanism;

- are performed simultaneously or in a short period of time;

- are committed by the same participants;

- united by a single task and ultimate goal.

The essence of the deals can be different:

- agreements on obtaining a loan against collateral;

- purchase of shares for a large amount;

- lease agreement with the withdrawal from use of the organization of real estate;

- purchase and sale of property;

- donation, exchange, surety.

The valuation of the LLC property is made according to the accounting reports for the upcoming agreement period. A major transaction for an LLC may be subject to adjustments and not be recognized as such if higher amounts of permissible business transactions are indicated in the charter of the community. In this case, the transaction, even at a high cost, falls into the category of standard economic and commercial activities of the organization.

When determining the size of a transaction for an LLC, two factors are taken as a basis:

- the cost of a commercial operation is calculated, after which the amount is compared with the total value of the organization's property;

- on a financial and commercial basis, it is determined whether the transaction is outside the standard of business.

Pricing criteria and approval mechanisms for a major transaction in an LLC may be changed, this fact should be reflected in the organization's charter. This means that in any business community, higher price criteria can be set for the recognition of a transaction as large. The decision to conduct transactions with a high price range can be made by directors, meetings of founders, board of directors. But this fact must also be spelled out in the charter.

On amendments to the charter of an LLC with a single founder

Why do I need a separate definition of a major transaction

An important criterion when conducting large transactions is the procedure for their acceptance. A major transaction for an LLC must necessarily obtain consent to the commission and approval of the supreme governing body. For smaller standard business agreements, these conditions are not required.

In most LLCs, management is carried out by the sole executive body - the director, the president. He has the right to make decisions and dispose of the assets of the company, in accordance with the charter of the LLC. The mechanism for making a decision on a major transaction in an LLC is designed to limit the powers of the head, to protect the property and assets of the community. That is, it acts as an instrument of control over the leader by the community members (clause 3.1 of article 40 of Federal Law No. 14).

The terminology of the concepts of consent and approval is determined by the Civil Code of Art. 26 of the Civil Code of the Russian Federation, Art. 157 of the Civil Code of the Russian Federation. The LLC is obliged to determine the size of the transaction and first obtain consent for the commission, and then approval from the supreme body, which is the general meeting of participants. The statutory documents of an LLC limit the powers of the head of the organization. Therefore, in the absence of consent and approval, a transaction with a value exceeding a quarter of the property of the LLC cannot be carried out. Otherwise, it can be challenged, in accordance with paragraph 1 of Art. 174 of the Civil Code of the Russian Federation.

The new rules in some aspects soften the procedure for approval and decision-making on a major transaction. This is dictated by the analysis of judicial practice. Prior to the adoption of the new interpretation of the law, large transactions were often contested in court for very small and unjustified reasons. Thanks to the changes made to Art. 46 of Federal Law No. 14, courts may refuse claims to challenge business agreements if they do not meet the criteria for a major transaction.

Mechanism for approving a major transaction in LLC

If the transaction is recognized as major by all the criteria, then it must be approved by the general meeting of the LLC and consent to conclude additional agreements. When conducting a major transaction, consisting of a chain of interrelated agreements, it becomes necessary to conduct additional commercial operations and conclude labor contracts. You also need to obtain consent for their implementation.

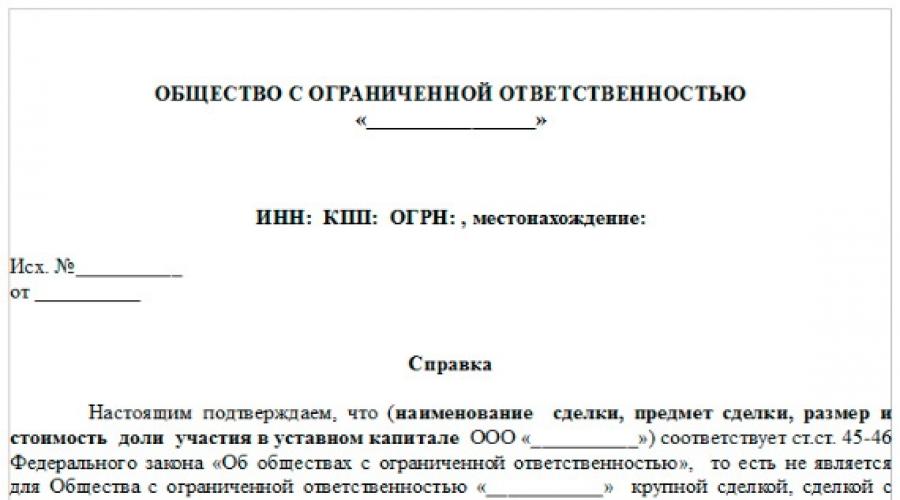

Cost calculations are carried out in advance. They are easier to do if the agreement is one-off. With many interrelated operations, you will have to make calculations for each of them. Based on the accounting reports, the ratio of the transaction amount to the value of the organization's property is calculated. This factor is documented by a certificate of the size of the transaction for the LLC. When registering a transaction, this document may be requested by Rosreestr.

Help example

The procedure for making a decision on a major transaction must be spelled out in the Charter. To approve a major transaction in an LLC, the following actions may be prescribed:

- making a decision by holding a general meeting of founders;

- obtaining consent by voting of the board of directors;

- without the need for special events and additional approvals.

Also, in the constituent documents of an LLC, a higher transaction value may be established in relation to the total capital, at which the operation can be carried out without the approval of the supreme governing body. If a detailed procedure for conducting a major transaction is not spelled out in the charter of the company, you need to be guided by Art. 45-46 of Federal Law No. 14. It is legally established that in the absence of adjustments in the statutory documents, the decision to conduct a major transaction is made by the general meeting of founders. Based on the decision of the general meeting, a protocol is drawn up, which reflects this fact, the procedure is specified in clause 6 of Art. 37, paragraph 1 of Art. 50 of Federal Law No. 50).

How to calculate a major deal for an LLC

The settlement mechanism consists of several stages:

- First of all, the total cost of the performed operation is determined.

- According to the accounting documents, the value of the community property is displayed.

- A comparative analysis of the ratio of the transaction value to the total value of the LLC assets is carried out.

How to determine the value of an LLC property for a major transaction? Accounting documents for the last reporting period are raised and data is taken on the total value of all the organization's assets on the balance sheet. When calculating assets, the latest report is taken as a basis. When summing up the balance, only the property that currently belongs to the organization, taking into account the residual value, is taken into account. Leased property, as well as LLC debts, are not included in the calculations.

The ratio of the transaction amount to the value of the LLC assets is calculated according to the formula: (a: b) х100 = c, where:

- a - the cost of the transaction;

- b - the value of the LLC property;

- c - percentage.

If the founder of the LLC is one participant, there is no need to determine the cost of a commercial operation, the transaction cannot be recognized as major (clause 7 of article 46 of Federal Law No. 14). To confirm the operation, it is enough to submit an extract from the Unified State Register of Legal Entities to the state authorities. There is also no need to go through the approval procedure for a major transaction. To do this, the founder and concurrently the head just need to write out a permit document on his behalf.

How to challenge a major LLC transaction

If a major transaction has not passed the approval procedure, it can be challenged in court. The deadline for filing a claim is 12 months from the moment one or more members of the community learned about a large-scale operation without common consent.

If a major transaction is not accepted by the general meeting from the first time, the minutes shall indicate details that raise doubts at the general meeting. After making adjustments, the issue of carrying out this operation can be considered again with new calculations and compliance with the approval procedure.

In 2017, the long-forecasted changes in the part of the legislation related to the definition of large transactions came into force. The changes also touched upon the issues of qualifying characteristics, approval procedures, and made adjustments to the process of issuing a decision on the authorization of such transactions by the governing state bodies. Now a deal is qualified as major only if it goes beyond the scope of the company's standard business activities.

The concept of a major transaction for legal entities

Despite a number of common qualifying features, the concept of a major transaction differs depending on the form of the legal entity that intends to make it. This type is carried out by the following organizations:

- Business companies (LLC, JSC).

- Unitary enterprises.

- State and municipal institutions.

As far as LLC is concerned, Art. 46 of the Federal Law No. 14 of 08.02.1998. for them, it represents a major transaction, as one in which property is acquired or alienated for an amount exceeding 25% of the value of the property of the company itself. It is determined on the basis of accounting reports for the period that precedes the date of the transaction. The exception is cases when the Charter of the LLC prescribes a higher amount of a major transaction. If such occurs in the course of ordinary economic activity, then it cannot automatically be considered large.

Thus, a major transaction for an LLC always meets the following criteria:

- With her, the property of the LLC is always acquired or alienated.

- It can be not only single, but also represent a chain of transactions related to each other.

- The charter of the company can make adjustments to the list of possible transactions for that particular organization.

A large deal for JSCs is regulated by Federal Law No. 208 of December 26. 1995 It determines that in this case, such can be considered a transaction in which the property of the company is acquired or alienated in the amount of at least 25% of the total book value of assets. It is calculated from the accounting reports for the last reporting period. The types of such transactions may include loans, credits, etc.

Transactions of unitary enterprises are determined by Federal Law No. 161 of November 14. 2002 In this case, a major transaction is considered when the property of an organization is acquired or alienated for an amount exceeding 10% of its authorized fund or 50 thousand times the minimum wage in Russia. The value of the property is calculated on the basis of accounting reports

Federal Law No. 7 of 12.01. 1996 defines the concept of a major transaction for budgetary organizations. It is recognized as such, provided that it operates with cash or property in an amount exceeding 10% of the book value of the assets of this institution. They are determined on the basis of accounting reports for the last reporting decade. Exceptions will be situations in which the Charter of the organization allows you to recognize a large deal with smaller amounts.

Large transactions of autonomous institutions are considered by Federal Law No. 174 of 03.11. 2006 They are considered as such, provided that in the process of carrying out they operate with monetary amounts or property in an amount equal to or exceeding 10% of the book value of the assets of this institution. An exception is the recognition by the Charter of an autonomous organization of the possibility to consider a smaller deal as large.

What transaction is considered a major one for an LLC

When determining the size of a transaction for an LLC, two main criteria are currently being followed:

- First, the amount of the transaction being carried out is compared with the value of the institution's assets.

- Secondly, it is determined whether it goes beyond the standard economic activities of a given organization.

When considering the amount of alienated or acquired property, it should be understood that these are not only immovable objects, equipment, etc., but also products of intellectual labor, shares, cash, etc.

The following financial transactions can be used as transactions in this aspect:

- An agreement under which property is alienated or acquired (credit, loan, purchase of shares, etc.).

- Agreements in which property is withdrawn from the assets of the organization for a long time (transferred to another institution under a lease agreement, etc.).

Read also: Change of legal address of LLC - step by step instructions in 2019

The company's charter can also provide an individual definition of a major transaction for a specific LLC. Rather, starting from 2017, these can only be principles of their extension to other transactions.

The concluded contract is evaluated according to two main criteria:

- Organizations that acquire and dispose of property.

- Actions that are supposed to be performed with this property.

And the main thing here will be a quantitative criterion, i.e. the ratio of the transaction value and the amount of assets.

The operations of a society that fall into a high price range are necessarily subject to analysis. If they are carried out in a single transaction, then it is easier to analyze them. Difficulties arise when they represent a chain of interrelated transactions. In this situation, the analysis procedure is simplified if the participants are the same.

The following types of LLC transactions will not be recognized as major:

- In cases when they are carried out in the ordinary course of business of the company.

- If during such operations the placement of ordinary shares of the enterprise or equity securities takes place.

- Property donation procedure.

- Credit loans.

- Purchase and sale of goods.

- Property exchange operations.

If the transaction is large, then in addition to its approval, consent will also be required to conclude additional agreements, preliminary agreements and labor contracts.

A number of small transactions can be recognized as one large transaction if they meet the following requirements:

- They have a homogeneous character.

- They were committed simultaneously or in a short time period.

- They involve the same objects and subjects.

- It is possible to trace a single goal in them.

The LLC Charter should clearly state the mechanism for conducting a major transaction:

- The need to obtain the consent of all founders of the company.

- With the consent of the board of directors only.

- No need for additional approvals.

If such information has not been entered into the Charter, then the implementation of the contract must be guided by Federal Law No. 14, which establishes that approval is the right of the general meeting of members of the company. It is possible to fix a higher price ceiling of the transaction in the Charter.

Calculation of a major transaction for LLC

To calculate the size, the following mechanism of action is provided:

- At the first stage, the total cost of the transaction is calculated.

- The amount received is compared with the value of the LLC property. To do this, take the data of accounting reports for the last reporting period. In this case, all assets are taken into account.

Since 2017, a large amount is considered to be an amount that equals or exceeds 25% of the amount indicated in line 700 of the balance sheet.

Before entering into an agreement, the following check should be carried out:

- Calculate the value of assets. Take the latest accounting report as a basis.

- Correlate the amount of the contract with the value of the company's assets.

- Determine the causal relationship with the property.

- If the asset already has contracts with a similar meaning, then a relationship should be established with them.

- Relate the transaction to be concluded with the ordinary economic activities of the company.

Balance calculation

To post the book value of assets, you need to take the amount from the last balance sheet. At the same time, it should be taken into account that debts are not taken into account in such calculations, i.e. take total assets, but take into account the residual value.

In all such calculations, only property is considered, which is officially the property of a legal entity. Other objects or leased property are not taken into account.

If the company has one founder

Federal Law No. 14 establishes that transactions concluded by LLC, where only one person acts as a founder, cannot be considered large. To confirm this fact, it is enough to submit an extract from the Unified State Register of Legal Entities. If over time the composition of the company expands, then in order to avoid unnecessary claims, it is better to secure the approval of the contract by all participants, even if it is made according to a preliminary agreement concluded with a different composition.

Size certificate

Disputing transactions in court is not uncommon. In such situations, when considering a case, the judge is obliged to consider all the primary accounting documents of the company and appoint the necessary expertise. For this purpose, a certificate of the size of the transaction is requested from the accounting department of the company.

Each chief accountant should know the procedure for its preparation. The document must be certified by the signatures of the head of the LLC and the chief accountant. After receiving the certificate, as a rule, it is provided to Rosreestr in order to record the fact of the transfer of property and rights to it.

Some types of transactions made by LLC are carried out within the strictly specified legal framework. Such transactions can be so-called large transactions (agreements, contracts). If the special procedure is not followed, then they are not recognized as valid. Even before the start of its commission, the lawyer determines the status - whether it is large or not.

Determination of the transaction and the procedure for its execution

In the civil law of the Russian Federation, it is determined big deal concept... A major transaction is considered to be several related transactions, as a result of which property is acquired or alienated. The value of property in such transactions must start at 25 percent or more of the book value of the assets of the Limited Liability Company.

Oddly enough, but the conclusion of an amicable agreement also refers to major transactions. At the same time, the parties and beneficiaries are not always known. This applies to bidding. In this situation, it is permissible not to indicate the mandatory information.

The value of the assets themselves is determined by the balance sheet of the Limited Liability Company, drawn up by an accountant with the most recent date of the report for the past period (last year). Major agreements may include: loan, credit, pledge... But the deals related to the placement on the securities market, despite sometimes even their large volumes, can in no way be classified as large.

The Law "On Limited Liability Companies" clearly defines that transactions made in the course of permanent economic activity cannot be classified as large.

Approval of transactions

To approve the agreement, a general meeting of the company's participants (shareholders) is convened, where the issue of approving a major transaction is resolved. A draft decision on approval of the agreement between subjects. This decision specifies: the price of the acquired property, directly the subject of the transaction itself and the acquirer. If the contract was concluded during the auction, then the beneficiary cannot be indicated in the decision. The same rule applies in some other cases when the beneficiary could not be identified by the time of approval.

An LLC can be created Board of Directors... In this case, all agreements worth from twenty-five to fifty percent of the value of the company's property are under the jurisdiction of the Council. And already the council can decide the approval of major contracts.

The decision taken by the general meeting is ensured by the presence of all participants. Participants must be notified in advance. The head of the enterprise acquaints those present with the agenda of the meeting. The procedure for holding a meeting is determined by the law on LLC, the charter and other documents of the enterprise itself. A break is allowed in the work, not limited in time.

The data on the agreement are drawn up signed minutes of the meeting... The decision is considered legal if it does not contradict the charter and current legislation. Essential conditions not specified in the protocol automatically make the transaction unapproved.

The agreement is considered approved from the moment of signing the protocol.

Recognition of transactions as legitimate

If, in the course of the events, according to the terms of the contract, violation of the law, then the agreement can be declared invalid at the request of the company or any of its participants.

If, in the course of the events, according to the terms of the contract, violation of the law, then the agreement can be declared invalid at the request of the company or any of its participants.

The court appoints the time for holding hearings on recognizing the terms of the contract as invalid. If the hearing is missed, the statute of limitations cannot be restored. This means that you cannot miss the hearing.

The deal is recognized by the court under certain circumstances:

- The voter does not want to admit that the agreement was made correctly, and files a claim in court. The reason for filing a claim is the fact that the vote of the participant in the vote on the recognition of a major transaction did not affect the final result, even if he voted. This circumstance cannot be wrong in any way. All procedures were followed and the decision was taken by a majority vote.

- There is no way to prove (there is no evidence) that the agreement may entail losses to the whole society or its individual participant.

- Evidence in court may require documents for the approval of the contract... If the documents are in good order and executed according to the rules, then the transaction is recognized as legal.

- Everything is considered valid and recognized by the court - even if the transaction was committed with violations, but the other party participating in it did not know about them or should not have found out.

- The charter of the company may stipulate that a decision on the implementation of major transactions is made without a general meeting and the board of directors.

- The possibility of retroactive approval of the contract is not excluded.

The article of the law governing the rules of the procedure for approving agreements, cannot be applied on the following three points:

- A limited liability company consists of one participant who himself carries out all the functions of the enterprise and the execution of transactions.

- The emergence of relations when a share or part of it in the authorized capital is transferred to the company.

- The emergence of relations when there is a merger of companies or a takeover as a result of the reorganization of an LLC.

"Passing" a deal is not always a reason to relax. Sometimes this is just the beginning of problems. Always exists the likelihood of a treaty being invalidated.

The main point for the decision of the general meeting of LLC participants to be recognized as legitimate and not to have problems in the future is the presence of an elementary majority.

If the charter does not require either a general meeting or a decision of the board of directors, then there is a possibility of acquiring illiquid assets or disposing of assets. This option cannot suit the members of the society and will cause a conflict of interest.

If any person related to society is interested in the agreement, the following applies to her. exclusion rules.

Rules determined by the charter of the company

1) The charter regulates the daily business activities of the company... It can also define the lowest and highest thresholds for large contracts, or even abolish the procedure for such processes. In the presence of any of the threshold levels, the figures for the minimum and maximum threshold values should be expressed as a percentage. The decision is made by the general meeting or by the board of directors.

1) The charter regulates the daily business activities of the company... It can also define the lowest and highest thresholds for large contracts, or even abolish the procedure for such processes. In the presence of any of the threshold levels, the figures for the minimum and maximum threshold values should be expressed as a percentage. The decision is made by the general meeting or by the board of directors.

2) Usually the decision on the agreement is made general meeting of members of the company... But when the board of directors is formed, all functions are transferred to it. Changes should be reflected in the charter.

3) New rules governing the negotiation process define a new size threshold. If earlier the threshold was no more than 25 percent, now this rate has grown from 25 percent or more.

4) The charter of the LLC now provides for other types and size of large transactions... These types include: borrowing and real estate transactions. The threshold in such contractual agreements may exceed the established one.

5) According to the statutory rules and current legislation, upon approval of a major transaction, the following must be indicated:

- a) Persons who are beneficiaries. Such persons are not indicated in transactions made at the auction or if they have not been established before the start of approval.

- b) Subject of the auction.

- c) The cost of the transaction.

- d) Special conditions.

Exactly the same norms are specified in the law on joint stock companies. But norm for LLC it is considered more perfect, since in the case of a joint-stock company, the specifics of the agreement at the auction and cases of impossibility to determine the beneficiary at the time of the decision are not taken into account.

6) The Articles of Association may prohibit the alienation of a share or part of a share of a participant in a company in favor of a third party.

The procedure for approving transactions is provided for in Article 45 of the Law on Limited Liability Companies. This article provides for exceptions in case of interest by one of the parties.

Major deals for various forms of companies

Various approaches are applied to the concept of "major deal". it depends on the form of the legal entity.

For LLC

For this type of society, the assessment has already been given and the rules for regulating approaches have already been given so as not to repeat themselves.

For this type of society, the assessment has already been given and the rules for regulating approaches have already been given so as not to repeat themselves.

Major contracts are approved by the general meeting or, if any, by the board of directors. Amount upon approval is from 25 to 50 percent.

Disputes on contestation are resolved in court.

The presence of one participant in the company provides for a simple written approval without a protocol.

For unitary enterprises

This type of legal entity is subject to the rules of the law “ On state and municipal unitary enterprises ".

For state-owned enterprises, an agreement becomes large as a result if the transactions are interconnected. At the same time, it is acquired or alienated, and there is also the possibility of alienating property. Property in contracts of this kind is estimated at more than 10 percent of the authorized capital of the enterprise in the first version. And in the second option, fifty thousand times or more must exceed the minimum wage.

The value of the alienated property is determined as a result of the accounting of the enterprise. If the property is purchased, then its value is determined based on the price of the property.

To make a decision, the consent of the owner of the enterprise is required. This owner is the municipality (local authorities).

The lack of consent of the owner means the bankruptcy of the transaction.

For state and municipal institutions

The law "On non-profit organizations" applies to this form of enterprise. A major transaction for such an enterprise is several interrelated transactions, if they are related to money, alienation of property or transfer of property, use or pledge.

The law "On non-profit organizations" applies to this form of enterprise. A major transaction for such an enterprise is several interrelated transactions, if they are related to money, alienation of property or transfer of property, use or pledge.

The price of such a deal or the value of property (alienated or transferred) must exceed the value of the assets of a budgetary institution on the balance sheet of the enterprise. The cost is determined by the accounting reports with the latest date. The charter of such an enterprise may provide for a smaller amount of the contractual agreement.

The budgetary organization implements its contracts with the prior consent of the founder. The founder is: federal executive bodies, the executive body of a constituent entity of the federation and local self-government bodies.

To participate in the agreement, the founder of a budgetary organization should submit to the Ministry of Finance package of documents:

- An appeal from the head of the institution for preliminary approval. This document indicates: the price and terms, the subject of the transaction and the parties, the financial justification for the feasibility. A list of documents must be attached to the appeal.

- Certified copies of the budget statements for the last year with the latest reporting date. The chief accountant certifies the forms of budget reporting.

- Draft agreement, which contains all the terms of the transaction.

- A report on the appraisal of the market value of the property. The assessment is carried out no earlier than three months before the submission of the report.

- Indication of all types of debts, debtors and creditors.

The decision on preliminary approval is considered and adopted by the commission after the documents are accepted, within a month. The decision is drawn up by order of the Minister of Finance.

For an autonomous institution

Regulated the law "On autonomous institutions"... The deal for this enterprise is large when it is associated with the disposal of funds raised under a loan, the alienation of property and the transfer of its use (or as a pledge). The conditions for this are as follows: the price or value of property (transferred or alienated) exceeds 10 percent of the value of assets on the balance sheet of the enterprise. The value of assets is determined, as elsewhere, by the balance sheet with the latest reporting date. A lower threshold can be specified in the bylaws.

Regulated the law "On autonomous institutions"... The deal for this enterprise is large when it is associated with the disposal of funds raised under a loan, the alienation of property and the transfer of its use (or as a pledge). The conditions for this are as follows: the price or value of property (transferred or alienated) exceeds 10 percent of the value of assets on the balance sheet of the enterprise. The value of assets is determined, as elsewhere, by the balance sheet with the latest reporting date. A lower threshold can be specified in the bylaws.

In an autonomous institution, the right to conduct is decided with the approval of the supervisory board... The council considers the proposal of the head for 15 calendar days. The council consists of five to eleven people.

The members of the supervisory board are: representatives of this institution, executive bodies of local self-government or state power, representatives of the public.

A transaction made in violation is invalidated at the suit of an autonomous institution or its founder.

Special rules

Transactions require special attention. Article 46 defines and enshrines a number of rules.

- A major transaction is not only one transaction involving a loan, loan, pledge or surety, but several related transactions for acquisition or disposal.

- The value of the property must be 25 percent or more of the value of the property as of the last reporting date.

- Responsibility for whether the transaction is large or not rests with the LLC. Accounting expertise will help to understand the conflict that has arisen. Companies working on the "simplified" are not obliged to keep accounting.

- The charter helps effectively control all economic and financial activities of the LLC.

- The court-approved settlement is a major deal. You can dispute such a deal only by filing a complaint with the court.

- A problem for the activities of an LLC can be the line between economic activities and large transactions. It is rather difficult to define and the threat of failure (non-recognition) invariably arises.

- Major transactions are not recognized where a large amount of money is contributed to the authorized capital in the form of property, a pledge agreement for real estate or the purchase of leased premises.

Legal regulation of large transactions

The regulation of large transactions is paid attention to by such a document as the "Concept for the Development of Civil Legislation" of the Russian Federation.

The regulation of large transactions is paid attention to by such a document as the "Concept for the Development of Civil Legislation" of the Russian Federation.

This document states that schema agreements used to abandon those committed earlier, although they must preserve the property of the society. Property turnover is violated and is contrary to the interests of counterparties and creditors.

The protection of its interests by the company when concluding a major transaction by way of challenging is possible when the company cannot be aware of violations of the order, that is, it is a bona fide counterparty.

The accountant and lawyer involved in the transaction must be aware of the pitfalls and adhere to the accounting and reporting data.

A transaction will be considered major if it goes beyond the boundaries of ordinary economic activity and at the same time is associated with the purchase or sale of the property of a joint-stock company (more than 30% of shares) or provides for the transfer of property for temporary use or under a license (clause 1 of Art. 46 No. 14- FZ). Moreover, in both cases, the price of such transactions must be at least 25% of the book value of the assets of the limited liability company (LLC).

If required, large transactions are approved in accordance with the legislation of the Russian Federation (14-ФЗ, 174-ФЗ, 161-ФЗ, etc.) or according to the rules established in the Charter of the procurement participant. In other cases, this is done by a supplier representative authorized to obtain accreditation for.

In an LLC, approval falls within the purview of the general meeting. If the organization has a board of directors, then on the basis of the Charter, the adoption of agreements on such operations can be transferred to its jurisdiction.

On June 26, 2018, the Supreme Court issued the Plenary Resolution. In this document, he disclosed the main disputes over the approval of major transactions and agreements in which there is an interest.

Download Resolution of the Plenum of the Supreme Court No. 27 dated 26.06.2018

When you need such approval in the contract system

To start participating in public procurement, you need. For this, a general package of documents is provided, which includes consent to the transaction. Moreover, this is always required, including when the purchase does not belong to the category of large ones. As for suppliers who were accredited before 12/31/2018, they are required to register in the EIS by the end of 2019. Both will need an up-to-date sample of a decision on a major deal 44-FZ.

Information must be included in the second part of the application if it is required by legislation or constituent documents, as well as when and or, and the contract itself will be large for the participant. In the absence of this information at any stage before the conclusion of the contract. The auction commission of the customer is responsible for checking the data (clause 1, part 6, article 69 No. 44 FZ).

It is important to note that individual entrepreneurs, unlike LLCs, do not belong to legal entities. Therefore, they are exempted from the obligation to submit such a document for accreditation on the ETP.

Approval of a major transaction from the sole founder

LLCs, in which there is only one founder, who acts as the sole executive body, are not required to draw up such a document (clause 7 of Art. 46 No. 14-ФЗ).

At the same time, in paragraph 8 of Part 2 of Art. 61 № 44-ФЗ states that in order to be accredited on the ETP, participants in an electronic auction must submit such information, regardless of the form of ownership. Otherwise it will be impossible.

But it is not necessary to include this information in the second part. It is considered that if the supplier did not provide such data, then the conclusion of the contract does not fall into the category in question. But, as practice shows, even the decision of the only participant to approve a major transaction, just in case, is attached to the general package of documents. The important thing here is not to make a mistake. Otherwise, there is a risk of rejection of the auction participant due to the fact that he provided inaccurate information. Such cases are challenged by the FAS, but the period for concluding a contract is increased.

What to look for when drawing up: form and content

First of all, it should be noted that the legislation of the Russian Federation does not contain a single sample of a decision on a major transaction. But clause 3 of Art. 46 No. 14 FZ explains that such a document should indicate:

- The person who is the party to the agreement and the beneficiary.

- Price.

- Subject of the agreement.

- Others or the order in which they are defined.

The beneficiary may not be indicated if it is impossible to determine him by the time the document is agreed, and also if the contract is concluded based on the results of the auction.

At the same time, Art. 67.1 of the Civil Code of the Russian Federation establishes that the decision taken by the executive bodies of the LLC must be confirmed by notarization, unless another method is provided for by the Charter of such a company or by a decision of the general meeting, which was unanimously adopted by the participants.

Item 4, Art. 181.2 of the Civil Code of the Russian Federation fixes the list of information that must be reflected in the decision of the in-person meeting of the founders. The protocol requires the following information:

- date, time and place of the meeting;

- persons who participated in the meeting;

- the results of voting on each item on the agenda;

- persons who counted the votes;

- persons who voted against the approval of the agreement and demanded that a record be made.

In 2019, it happens that customers reject a participant if the decision indicates the total amount of approved transactions, and not each agreement separately. Therefore, we recommend using the wording “Approve transactions on behalf of the Limited Liability Company“ _______________ ”based on the results of the procurement procedures for goods, works, services. The amount of each such transaction should not exceed the amount of ____________ (_____________) rubles 00 kopecks. "

The General Director has the right to conclude transactions on behalf of the organization without any additional approvals from its owners. But if we are talking about a so-called major transaction, he must first obtain permission (consent) from the business owners to conclude it. Otherwise, such a transaction, made without proper approval by the owners, may subsequently be invalidated. How to properly execute a large deal and prevent possible mistakes?

It is necessary to inform the owners of this legal entity about the intention to conclude a transaction on behalf of the organization that meets the criteria for a major one and obtain their approval for such a transaction. Business owners, that is general meeting of participants (shareholders) business society, and in some cases board of directors (supervisory board) must discuss and approve the very possibility of concluding a major transaction and its main conditions: parties, subject, transaction price and other essential conditions. It is not their responsibility to agree on other terms and conditions of a major transaction. If several transactions are subsequently concluded, certainty must be reached as to which transaction was approved.

The procedure for classifying transactions as large and the procedure for approving large transactions differ depending on the organizational and legal form.

Major transaction concept

A major transaction is one or several interrelated transactions related to the acquisition, alienation or the possibility of alienation by a company, directly or indirectly, of property, the value of which is 25% or more of the total value of the property of this company. The value of the property is determined on the basis of the company's financial statements for the last reporting period preceding the day the decision was made on the transaction. This definition of a major transaction is guided by. The basis is clause 1 of Art. 46 of the Federal Law of 08.02.1998 N 14-ФЗ "On Limited Liability Companies" (hereinafter - Law N 14-ФЗ).

A similar but not a similar concept is established for in paragraph 1 of Art. 78 of the Federal Law of December 26, 1995 N 208-FZ "On Joint Stock Companies" (hereinafter - Law N 208-FZ).

Despite the fact that significant changes were made to the norms of legislation on limited liability companies (in Articles 87 - 94 of the Civil Code of the Russian Federation and Law No. 12/30/2008 N 312-FZ) and in terms of large transactions they are in many respects close to the norms in force in relation to joint-stock companies, some fundamental differences between the two above definitions are still preserved (Table 1 on pp. 60 - 61).

Table 1. Features of the conclusion of large transactions by limited liability companies and joint stock companies

|

Characteristic |

Limited company |

Joint-stock company |

|

Deal, |

One or more |

One or more |

|

Transactions, |

Transactions made |

Transactions (clause 1 of article 78 of the Law |

|

Increase |

Allowed (clause 1 of article 46 |

Not allowed (Ch. X |

|

Expansion by statute |

Allowed (clause 7 of article 46 |

Allowed, but without |

|

Statement in the articles of association |

Allowed (clause 6 of article 46 |

Not allowed (Ch. X |

|

Indicator (base) |

The value of the entire property |

Book value of all |

|

Comparison object |

Offer price |

Purchase price |

|

Comparison object |

Alienable value |

Alienable value |

|

Who should |

General meeting of participants |

Board of Directors |

|

Who should approve |

General meeting of participants |

General Meeting of Shareholders |

|

Who should approve |

The only participant |

Sole shareholder |

|

Who should |

Approval of the transaction |

Approval of the transaction |

|

Subsequent |

Allowed (clause 5 of article 46 |

Allowed (clause 6 of article 79 |

|

Who has the right to submit |

Society itself |

The joint-stock company itself |

Note. Transactions of joint-stock companies related to the placement by subscription or sale of ordinary shares of the company, and transactions related to the placement of equity securities convertible into ordinary shares of the company, are not large, regardless of their price (clause 1 of article 78 of Law N 208-FZ ).

Transactions that can be considered large

Some types of transactions that can be recognized as large and require approval by the owners of a business entity are listed directly in clause 1 of Art. 46 of Law N 14-FZ and clause 1 of Art. 78 of Law N 208-FZ. Among them, in particular, are named transactions under loan, credit, pledge and surety agreements... However, the above list is not exhaustive... This is indicated in clause 30 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation of November 18, 2003 N 19 (hereinafter - Resolution N 19). Certain types of transactions, which, with the corresponding amount of the transaction, can be recognized as large, are given in clause 30 of Resolution No. 19 and clauses 1, 4, 6 and 7 of the Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 13, 2001 No. 62 (hereinafter - Information letter N 62).

Note! Ordinary business transactions are not considered large

Transactions made by a limited liability company or joint stock company in the ordinary course of business cannot be recognized as major transactions regardless of the value of the property acquired or disposed of under such transactions. This is established in paragraph 1 of Art. 46 of Law No. 14-FZ and clause 1 of Art. 78 of Law N 208-FZ. What is meant by these transactions? The answer to this question is not contained either in Law No. 14-FZ, or in Law No. 208-FZ. The Plenum of the Supreme Arbitration Court of the Russian Federation in paragraph 30 of Resolution N 19 explained that transactions carried out in the ordinary course of business may, in particular, include transactions:

On the acquisition by the company of raw materials and materials necessary for the implementation of production and economic activities;

Sales of finished products;

Obtaining loans to pay for current operations (for example, obtaining a loan by a trading company aimed at purchasing wholesale lots of goods intended for their subsequent sale through a retail network).

The Presidium of the Supreme Arbitration Court of the Russian Federation also confirmed that the transaction under the loan agreement entered into by the company in the course of its ordinary business activities is not large, regardless of the amount of the loan received. This is indicated in paragraph 5 of Information Letter No. 62.

After analyzing the above explanations, we come to the conclusion that the rules for approving large transactions also apply to transactions:

Purchase and sale (including real estate, securities, an enterprise as a property complex);

Donation;

Assignment of the right to claim;

Debt transfer;

Making a contribution to the authorized capital of another business company against payment of shares (shares) in it;

Credit;

Sureties;

Property pledge;

Other types of transactions aimed directly or indirectly at the acquisition or alienation of the organization's property or providing for the possibility of foreclosure on its property with the subsequent alienation of this property.

The obligation to coordinate any of these agreements with the business owners arises only if, as a result of the conclusion of such an agreement, the organization has the opportunity to acquire or alienate property, the value of which is at least 25% of the total value of the property (assets) of the company. An exception to this rule is transactions made by the organization in the course of ordinary business activities. Such transactions, regardless of the amount, can be concluded without the consent of the business owners (clause 1 of article 46 of Law N 14-FZ and clause 1 of article 78 of Law N 208-FZ).

Similarities and differences in definitions

So, starting from July 1, 2009, both in limited liability companies and in joint-stock companies, a transaction or several interconnected transactions made with property, the value of which is 25% or more of the total value of the property of the company, is recognized as large. Recall that before that date, the transaction of a limited liability company with property, the value of which was equal to 25%, was not considered large and, therefore, was not subject to prior approval by the owners.

Note. Several transactions that are concluded between the same persons within a short period on identical terms, have the same nature of the obligations of the parties and entail the same consequences for the organization are considered to be related transactions. If the total value of the property acquired or disposed of under such transactions is 25% or more, these transactions must be approved by the owners of the organization.

As before, the charter of a limited liability company may provide for a higher amount of the transaction, recognized as large (clause 1 of article 46 of Law No. 14-FZ). For example, the charter of a company may indicate that a transaction is considered major and, therefore, before conclusion, it must be approved by the participants of the company if it is related to the acquisition or alienation of property worth more than 30% of the total value of the property of the company.

Moreover, a limited liability company has the right not to agree with its owners at all on plans to conclude major transactions if its charter stipulates that such transactions do not require a decision of the general meeting of participants or the board of directors (supervisory board) of the company. The basis is clause 6 of Art. 46 of Law N 14-FZ. In joint-stock companies, this is not allowed, just as it is not allowed by the charter of a joint-stock company to increase the maximum amount of transactions attributed to large ones.

The charter of a limited liability company or a joint stock company may provide for other types of transactions, which are subject to the established procedure for approving large transactions (clause 7 of article 46 of Law No. 14-FZ and paragraph 1 of article 78 of Law No. 208-FZ). So, in the company's charter, it can be indicated that any transactions on the alienation and pledging of real estate, regardless of value, must be coordinated with the participants (shareholders) or with the board of directors (supervisory board) of the company.

Note. A loan agreement can be recognized as a major transaction if the amount of the loan provided under it and the prescribed interest for using the loan (excluding interest for delayed loan repayment) is 25% or more of the book value of the property (assets) of the company.

With what to compare the cost of the transaction, or Base for comparison

Another difference is the metric used for comparison. Limited liability company compares the value of the property that is the subject of the transaction with the value of the entire property of the company, determined according to the financial statements for the last reporting period preceding the day the decision was made on the transaction (clause 1 of article 46 of Law N 14-FZ).

The joint-stock company must compare the value of the property acquired or alienated under the transaction with the book value of all assets of the company as of the last reporting date (clause 1 of article 78 of Law N 208-FZ). The total value of the property of the limited liability company and the total value of the assets of the joint-stock company are determined according to the accounting data for the last reporting period preceding the day the decision was made on the transaction.

Note. When deciding whether to classify a transaction as a large value of the property that is the subject of the transaction, it should be compared with the book value of the property (assets) of the company, and not with the size of its authorized capital.

Obviously, the book value of all assets of an organization is a broader concept than the value of its assets. Indeed, in addition to the property itself (fixed assets, raw materials, materials, finished products, cash, etc.), the company's assets also include accounts receivable, costs in work in progress, deferred expenses and other indicators.

The Presidium of the Supreme Arbitration Court of the Russian Federation in clause 3 of Information Letter No. 62 confirmed that joint stock companies compare the value of property acquired or disposed of in a major transaction with the total amount of the company's assets according to the last approved balance sheet without reducing it by the amount of debts (outstanding obligations). That is, as a basis for comparison, joint stock companies use the balance sheet currency (the sum of all current and non-current assets) as of the last reporting date preceding the day of approval of a major transaction.

Please note: when classifying transactions as large, the book value of the assets of a joint-stock company should not be equated with the value of its net assets (Letter of the Federal Commission for the Securities Market of Russia dated 16.10.2001 N IK-07/7003). After all, the value of net assets is an independent indicator that is used, for example, when deciding whether to pay dividends on shares or when distributing the profits of a limited liability company between its members. The amount of net assets does not affect the procedure for approving large transactions.

Note. The value of the net assets of a business entity is understood to mean the book value of its property (all of its assets), reduced by the amount of the company's liabilities.

What to Compare, or Comparison Object

Unlike the base for comparison, the object of comparison itself (that is, the value of property acquired or alienated on the basis of a transaction) and limited liability companies and joint stock companies are determined according to uniform rules. These rules differ only depending on the type of the transaction being made (clause 2 of article 46 of Law N 14-FZ and paragraph 2 of clause 1 of article 78 of Law N 208-FZ).

If the transaction is aimed at the acquisition of property, then when referring it to a large one with the total value of the property (assets) of the company, it is necessary to compare the acquisition price (offer price) of the property specified in the agreement. This price does not include additional charges (fines, penalties, forfeits), claims for payment of which may be presented in connection with non-fulfillment or improper fulfillment by the parties of their obligations (Such explanations are given in clause 31 of Resolution No. 19).

Example 1 ... LLC "Promtorg", the main activity of which is wholesale trade in food products, decided to acquire another warehouse. In October 2010, such a room was found. An individual entrepreneur, who owns it, is ready to sell it for 9,100,000 rubles. The main indicators of the balance sheet asset of Promtorg LLC as of September 30, 2010 are given in table. 2. Deferred expenses and costs in work in progress (included in the total amount of inventories on line 210 of the balance sheet) amounted to 100,000 rubles as of the indicated date.

(thousand roubles.)

|

Balance sheet indicator |

Code |

|

|

I. Non-current assets |

||

|

Intangible assets |

||

|

Fixed assets |

||

|

Construction in progress |

||

|

Long-term financial investments |

||

|

Other noncurrent assets |

||

|

Total for sect. I |

||

|

II. Current assets |

||

|

Receivables |

||

|

Receivables |

||

|

Short-term financial investments |

||

|

Cash |

||

|

Other current assets |

||

|

Total for sect. II |

||

When calculating the total value of the property as of the last reporting date preceding the day the transaction was approved (as of September 30, 2010), Promtorg LLC does not take into account the amount of accounts receivable, prepaid expenses and work-in-progress costs. Thus, the total value of the property of the organization, determined according to the balance sheet, is equal to 28,000,000 rubles. (36,400,000 rubles - 300,000 rubles - 8,000,000 rubles - 100,000 rubles).

The cost of the acquired premises is 9,100,000 rubles, which is 32.5% (9,100,000 rubles: 28,000,000 rubles x 100) of the value of the entire property of the company. Since the value of the purchased property exceeds 25% of the total value of the property of Promtorg LLC, this transaction is large for the company and must be approved by the owners before it is made.

Example 2 ... Let's use the condition of example 1. Suppose that the legal form of the Promtorg company is not a limited liability company (LLC), but a closed joint stock company (CJSC). To resolve the issue of recognizing a transaction, large joint-stock companies compare the transaction price with the value of all current and non-current assets (with the balance sheet currency) as of the last reporting date preceding the day the transaction was approved. The cost of the premises, which ZAO Promtorg plans to acquire, is exactly 25% (9,100,000 rubles: 36,400,000 rubles x 100) of the value of all assets of the organization. This means that the transaction for the purchase of this premises is recognized as major, which means that it is subject to prior approval by the owners of the organization.

Note. To determine whether several interconnected transactions are a single large transaction, it is necessary to sum up the value of the property acquired (disposed of) under all interconnected contracts, and compare the resulting indicator with the total value of the property (assets) of the organization.

Let us assume that the subject of the transaction is the alienation or the possibility of alienation of property belonging to the company. In this case, the value of the alienated property, calculated on the basis of accounting data, is compared with the total value of the property (all assets) of the company, and not the market value of the property being sold and not the actual value at which the property is sold.

Example 3 ... Let's use the condition of example 1. Suppose, in October 2010, Promtorg LLC received a bank loan for the purchase of a consignment of goods. As collateral under the loan agreement, the organization offered to pledge to the bank a part of the office space that it owns (acquired in 2004). The initial cost of the office space, at which it was accepted for accounting, is equal to 10,700,000 rubles. From the beginning of the operation of the premises until September 2010 inclusive, the accounting accrued depreciation in the amount of 2,140,000 rubles.

The conclusion of a pledge agreement by an organization creates, directly or indirectly, the possibility of alienating the property being pledged. Indeed, in case of non-fulfillment of the loan agreement by the company, the bank has the right to foreclose on the pledged office space with its alienation in the manner prescribed by law (clause 4 of Newsletter No. 62).

To resolve the issue of whether it is a major transaction to transfer office premises to the bank as collateral, Promtorg LLC needs to compare the cost of the premises, calculated on the basis of accounting data, with the total value of the entire property of the company. Since this issue was resolved in October 2010, the organization used the information reflected in the balance sheet as of September 30, 2010.

The residual value of the office space as of September 30, 2010 - 8,560,000 rubles. (10,700,000 rubles - 2,140,000 rubles). The total cost of the organization's property on the same date is 28,000,000 rubles. The value of the property pledged was 30.57% (8,560,000 rubles: 28,000,000 rubles x 100) of the total value of the property. Consequently, the conclusion of a pledge agreement for office premises was a major transaction for Promtorg LLC and was subject to prior approval by the owners of the organization.

Note. If the debtor fails to fulfill the obligation secured by the pledge, the creditor (pledgee) has the preferential right to receive satisfaction from the value of the pledged property over other creditors of the person who owns the specified property (the pledger). The basis is clause 1 of Art. 334 of the Civil Code of the Russian Federation.

Example 4 ... Let's use the condition of example 3. Suppose the company "Promtorg" is a closed joint stock company (CJSC). Unlike limited liability companies, joint stock companies, when deciding whether to recognize a transaction as major, compare the transaction price with the value of all assets. The residual value of the pledged office space amounted to 23.52% (8,560,000 rubles: 36,400,000 rubles x 100) of the total value of the organization's assets, that is, less than 25%. This means that for CJSC "Promtorg" the deal on pledging office premises was not a major one and could have been concluded without prior approval by the owners of the company.

Procedure for approving a major transaction in a limited liability company

In a limited liability company, a major transaction must be approved by the general meeting of the participants in this company. So it is said in paragraph 3 of Art. 46 of Law N 14-FZ. A transaction is considered approved if a simple majority of the total number of votes of the company's participants voted for the decision to approve it (clause 8 of article 37 of Law N 14-FZ).

Reference. Requirements for the execution of a decision to approve a major transaction

In the decision to approve a major transaction, the following information must be specified (clause 3 of article 46 of Law No. 14-FZ and paragraph 4 of article 79 of Law No. 208-FZ):

List of persons who are parties to the transaction;

The list of persons who are beneficiaries of the transaction (that is, persons in favor or in the interests of whom this transaction was concluded);

Price and subject of the transaction;

Other material terms of the transaction.

These requirements apply to both limited liability companies and joint stock companies. There is a special rule for limited liability companies. If a major transaction of such a company is to be concluded at the auction or at the time of its approval the parties (beneficiaries) of the transaction have not yet been determined, in the decision to approve the transaction it is possible not to indicate the persons who are the parties (beneficiaries) of the transaction (clause 3 of article 46 of Law No. 14- FZ).

In limited liability companies that create a board of directors (supervisory board), approval of major transactions can be attributed by the charter of the company to the competence of the board of directors (supervisory board). But such an opportunity is provided only for transactions related to the acquisition or alienation of property, the value of which ranges from 25 to 50% of the total value of the company's property (clause 4 of article 46 of Law N 14-FZ). Transactions aimed at the acquisition or alienation of property, the value of which exceeds 50% of the total value of the company's property, are subject to approval exclusively by the general meeting of the company's participants.

Note. The charter of a limited liability company may stipulate that for the conclusion of large transactions, neither the decision of the general meeting of the company's participants nor the decision of the board of directors (supervisory board) of the company is required (clause 6 of article 46 of Law N 14-FZ).

Suppose a limited liability company has only one participant and this participant performs the functions of the sole executive body of this company, that is, it is its director or general director. In pp. 1 p. 9 art. 46 of Law No. 14-FZ states that in such a situation, approval is not required to conclude a major transaction. If the only member of the company is not its director or general director, the written consent of this member to its conclusion is sufficient to conclude a major transaction (clause 11 of Information Letter No. 62).

The procedure for approving large transactions does not apply to legal relations arising (subparagraphs 2 and 3 of paragraph 9 of article 46 of Law No. 14-FZ):

When transferring to the company a share or part of a share in its authorized capital in the cases provided for by Law N 14-FZ;

Transfer of property rights in the course of the company's reorganization (including under merger or acquisition agreements).

The procedure for approving a major transaction in a joint-stock company

In a joint-stock company, a major transaction must be approved by the board of directors (supervisory board) or the general meeting of shareholders of the company (clause 1 of article 79 of Law No. 208-FZ). If the subject of a major transaction is property, the value of which ranges from 25 to 50% of the book value of all assets of the company, the decision to approve such a transaction is within the competence of the board of directors (supervisory board) of the company. This is indicated in paragraph 2 of Art. 79 of Law N 208-FZ. This decision must be taken unanimously by all members of the board of directors (supervisory board) of the company. In this case, the votes of the retired members of the board of directors (supervisory board) of the company are not taken into account.

Note. Retired, in particular, are members of the board of directors (supervisory board), whose powers were terminated early by the decision of the general meeting of shareholders in accordance with paragraphs. 4 p. 1 of Art. 48 of Law N 208-FZ.

Please note: a major transaction, the subject of which is property worth 25 to 50% of the book value of all assets of the company, must be approved unanimously by all members of the board of directors (supervisory board) of the joint-stock company, and not only by those present at a specific meeting of the board (clause 2 Art.79 of Law No. 208-FZ). Let's say the board of directors (supervisory board) of a joint-stock company did not come to a unanimous decision to approve a major transaction. Then the question of its approval can be submitted to the general meeting of shareholders of the company. In this case, the decision to approve a major transaction is made by a majority vote of shareholders - owners of voting shares participating in the general meeting of shareholders of the company (clause 2 of article 79 of Law N 208-FZ).

Large transactions for which property is acquired or alienated with a value of more than 50% of the book value of all assets of the company can be approved only by the general meeting of shareholders of the company (clause 3 of article 79 of Law No. 208-FZ). Moreover, the decision to approve such a transaction must be made by a majority of 3/4 of the votes of shareholders - owners of voting shares participating in the general meeting of shareholders.

The Presidium of the Supreme Arbitration Court of the Russian Federation in paragraph 10 of Information Letter No. 62 and the Plenum of the Supreme Arbitration Court of the Russian Federation in paragraph 32 of Resolution No. 19 also indicated that such transactions cannot be concluded on the basis of a decision of the board of directors (supervisory board) of a joint-stock company. To carry them out, in all cases, a decision of the general meeting of shareholders is required, adopted by a majority of 3/4 of the votes of shareholders - owners of voting shares participating in the general meeting of shareholders.

Approval is not required if the joint-stock company has a sole shareholder who owns 100% of the company's shares and is at the same time its director or general director (clause 7 of article 79 of Law N 208-FZ). From the sole shareholder who is not a director or general director of the company, it is enough to obtain his written consent to conclude a major transaction.

If a major transaction was concluded without the approval of the owners

Major transaction entered into by a limited liability company or joint stock company in violation of the established approval procedure, can be declared invalid by the court... The company itself or its participant or shareholder has the right to file a corresponding claim to the court. This is provided for in paragraph 5 of Art. 46 of Law N 14-FZ and clause 6 of Art. 79 of Law N 208-FZ.

Note. A statement of claim declaring a major transaction invalid cannot be brought to court by third parties.

So, a major transaction entered into without the approval of the business owners can be challenged (clause 1 of article 166 of the Civil Code of the Russian Federation). The limitation period for a claim to declare a voidable transaction invalid and to apply the consequences of its invalidity is one year (clause 2 of article 181 of the Civil Code of the Russian Federation). This means that a limited liability company (joint-stock company) or its participant (shareholder) has the right to go to court with a claim to invalidate a major transaction within one year from the day when the plaintiff learned or should have learned about the circumstances that are the basis for recognizing the transaction as invalid ... Similar explanations are provided in paragraph 36 of Resolution N 19.

Please note: the limitation period established for filing a claim for recognizing a major transaction as invalid, if missed, cannot be restored (clause 5 of article 46 of Law N 14-FZ and clause 6 of article 79 of Law N 208-FZ).

Note! In what cases will the court refuse to recognize a major transaction as invalid?

The court has the right to refuse the company, its participant or shareholder to satisfy the claim for invalidating a major transaction, which was concluded in violation of the established procedure for approving major transactions, if at least one of the circumstances exists (clause 5 of article 46 of Law N 14-FZ and p. . 6 article 79 of the Law N 208-FZ):

The vote of a participant (shareholder) of the company who filed a claim to invalidate a major transaction could not affect the voting results, even if this participant (shareholder) took part in the vote on approving this transaction (provided that the decision to approve the transaction is adopted by the general meeting of participants (shareholders), and not by the board of directors (supervisory board) of the company);

It has not been proven that the completion of this transaction has entailed or may entail the infliction of losses on the company or the participant (shareholder) of the company who filed the relevant claim, or the occurrence of other unfavorable consequences for them;

By the time the case is considered in court, evidence of the subsequent approval of this transaction has been presented in the manner prescribed by Laws N N 14-FZ or 208-FZ;

During the consideration of the case in court, it was proved that the other party to this transaction did not know and should not have known about its completion in violation of the requirements provided for in Art. 46 of Law no.14-ФЗ or art. 79 of Law N 208-FZ.

A transaction recognized by a court as invalid is such from the moment of its completion (clause 1 of article 167 of the Civil Code of the Russian Federation). This means that the parties to the transaction must be returned to the position in which they were before its conclusion. That is, each of the parties is obliged to return to the other everything received under the transaction, and if it is impossible to return what was received in kind (including if the received is expressed in the use of property, work performed or service provided), reimburse its value in cash (clause 2 of article 167 of the Civil Code RF). If the property is returned in kind, its condition should be taken into account. In addition, it is necessary to compensate for the deterioration (damage) of the property, taking into account normal depreciation, as well as to compensate for the improvements made to the property.

Note. An invalid transaction does not entail legal consequences, with the exception of those related to its invalidity, and is invalid from the moment of its execution (clause 1 of article 167 of the Civil Code of the Russian Federation).

Subsequent approval of a major transaction entered into without the approval of the owners

Civil law does not exclude the possibility of subsequent approval of an already concluded transaction. So, in Art. 183 of the Civil Code of the Russian Federation states that a transaction made by an unauthorized person may subsequently be approved by the person in whose interests it was concluded. In the absence of subsequent approval, the transaction is considered concluded in the name and in the interests of the person who made it.

The possibility of subsequent approval of a major transaction concluded on behalf of a limited liability company is stated in paragraph 5 of Art. 46 of Law N 14-FZ. The said paragraph states that the court will refuse to satisfy the claim for recognizing a major transaction as invalid if it was concluded in violation of the procedure for the mandatory approval of a major transaction, but by the time the case was considered in court, it was approved in the manner prescribed by Law N 14-FZ. A similar rule concerning joint-stock companies is provided for in paragraph 6 of Art. 79 of Law N 208-FZ.

Recall that the above provisions appeared in Laws N 14-FZ and 208-FZ from October 21, 2009. Prior to this date, subsequent approval of a major transaction was allowed only in limited liability companies. The fact is that before October 21, 2009, such a possibility was indicated in paragraph 20 of the joint Resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Court of the Russian Federation of 09.12.1999 N 90/14, which provides explanations to the courts on some issues of the application of Law N 14-FZ.

Similar clarifications on the procedure for the application of Law No. 208-FZ, including the subsequent approval of a major transaction, were contained in paragraph 14 of the joint Resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Court of the Russian Federation dated 02.04.1997 No. 4/8. However, in 2003 the said joint Resolution became invalid. Instead, Resolution No. 19 is in effect, which does not contain a rule on the admissibility of approving a major transaction concluded on behalf of a joint-stock company in violation of the requirements of Law No. 208-FZ. Now the possibility of the subsequent approval of such a major transaction is said directly in paragraph 6 of Art. 79 of Law N 208-FZ.

At the same time, the Federal Commission for the Securities Market of Russia recommends that joint stock companies approve all major transactions even before they are made. After all, the lack of prior approval of a major transaction makes it voidable, which creates the risk of the transaction being declared invalid and creates instability in relations between society and counterparties. This is indicated in section 1.2 of Ch. 6 of the Code of Corporate Conduct of 05.04.2002, the provisions of which the FCBC of Russia recommends to be guided by all joint-stock companies established on the territory of the Russian Federation (Order of 04.04.2002 N 421 / r).