Solution. Using the formula AND

Read also

Irving Fisher is an American economist, a representative of the neoclassical direction in economics. Born February 27, 1867 in Sogertis, pcs. New York. He made a great contribution to the creation of the theory of money, as well as derived the "Fisher's equation" and "the equation of exchange".

His works were taken as the basis of modern methods for calculating the inflation rate. In addition, they greatly helped to understand the laws governing the phenomenon of inflation and pricing.

Fisher's complete and simplified formula

In simplified form, the formula will look like this:

i = r + π

- i is the nominal interest rate;

- r is the real interest rate;

- π - inflation rate.

This entry is approximate. The smaller the values of r and π, the more precisely this equation is fulfilled.

The following record will be more accurate:

r = (1 + i) / (1 + π) - 1 = (i - π) / (1 + π)

Quantitative theory of money

The quantitative theory of money is an economic theory that studies the impact of money on an economic system.

In accordance with the model put forward by Irving Fisher, the state should regulate the volume of money supply in the economy in order to avoid their lack or excessive amount.

According to this theory, the phenomenon of inflation occurs due to non-observance of these principles.

Insufficient or excessive amount of money supply in circulation leads to an increase in the rate of inflation.

In turn, the rise in inflation implies an increase in the nominal interest rate.

- Nominal the interest rate reflects only the current income from deposits, excluding inflation.

- Real the interest rate is the nominal interest rate minus the expected inflation rate.

Fisher's equation describes the relationship between these two indicators and the rate of inflation.

Video

How to apply to calculate the return on investment

Suppose you make a deposit of 10,000, the nominal interest rate is 10% and the inflation rate is 5% per annum. In this case, the real interest rate will be 10% - 5% = 5%. Thus, the higher the inflation rate, the lower the real interest rate.

It is this rate that should be taken into account in order to calculate the amount of money that this contribution will bring you in the future.

Interest calculation types

As a rule, the accrual of interest on profit occurs in accordance with the compound interest formula.

Compound interest is a method of calculating profit interest, in which they are added to the principal amount and then they themselves participate in the creation of new profit.

A short notation of the compound interest formula looks like this:

K = X * (1 +%) n

- K is the total amount;

- X is the initial amount;

- % - percentage of payments;

- n is the number of periods.

At the same time, the real interest that you will receive by making a contribution at compound interest will be the less, the higher the inflation rate.

At the same time, for any type of investment, it makes sense to calculate the effective (real) interest rate: in essence, this is the percentage of the initial investment that the investor will receive at the end of the investment period. Simply put, it is the ratio of the amount received to the amount originally invested.

r (ef) = (P n - P) / P

- r ef - effective interest;

- Pn is the total amount;

- P is the initial contribution.

Using the compound interest formula, we get:

r ef = (1 + r / m) m - 1

Where m is the number of charges for the period.

International Fischer effect

The International Fisher Effect is a theory of the exchange rate put forward by Irving Fisher. The essence of this model is to calculate present and future nominal interest rates in order to determine the dynamics of changes in the exchange rate. This theory works in its pure form if capital moves freely between states, whose currencies can be correlated with each other in value.

Analyzing the precedents of inflation growth in different countries, Fischer noticed a regularity that real interest rates, despite the growth in the amount of money, do not increase. This phenomenon is explained by the fact that both parameters are balanced over time through market arbitrage. This balance is maintained because the interest rate is set taking into account the inflation risk and market forecasts for the currency pair. This phenomenon is called Fisher effect .

Extrapolating this theory to international economic relations, Irving Fisher concluded that changes in nominal interest rates have a direct impact on the rise in price or depreciation of the currency.

This model has never been tested in real conditions. Its main disadvantage it is generally accepted that it is necessary to meet purchasing power parity (the same cost of similar goods in different countries) for accurate forecasting. And, besides, it is not known whether the international Fisher effect can be used in modern conditions, taking into account fluctuating exchange rates.

Inflation forecasting

The phenomenon of inflation is the excessive amount of money circulating in the country, which leads to their depreciation.

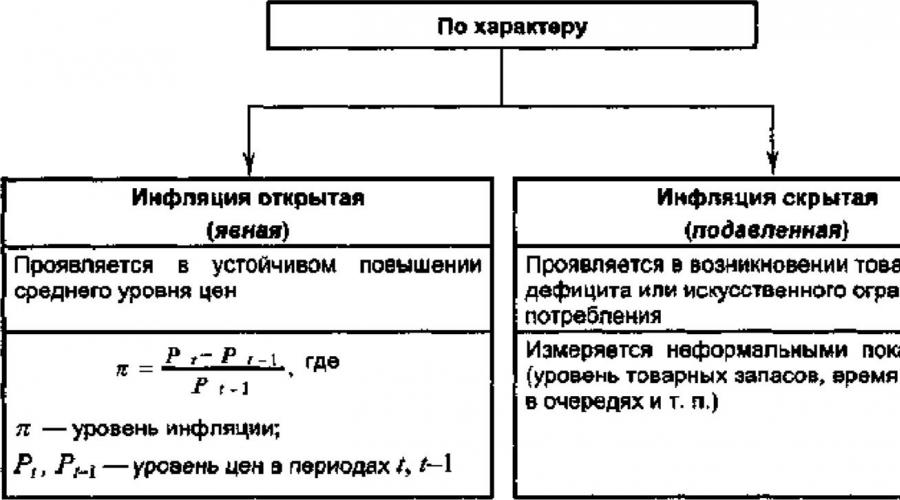

Inflation is classified according to the following features:

Uniformity - the dependence of the rate of inflation on time.

Uniformity - spreading influence to all goods and resources.

Inflation forecasting is calculated using the inflation index and latent inflation.

The main factors in forecasting inflation are:

- change in the exchange rate;

- an increase in the amount of money;

- change in interest rates;

Another common method is to calculate the inflation rate based on the GDP deflator. For forecasting in this method, the following changes in the economy are recorded:

- change in profit;

- changes in payments to consumers;

- changes in import and export prices;

- change in rates.

Calculation of investment returns with and without inflation

The formula for the rate of return without inflation will look like this:

X = ((P n - P) / P) * 100%

- X - profitability;

- P n - the total amount;

- P - initial payment;

In this form, the final profitability is calculated without taking into account the time spent.

X t = ((P n - P) / P) * (365 / T) * 100%

Where T is the number of days the asset was held.

Both methods ignore the impact of inflation on profitability.

Inflation rate(real profitability) should be calculated using the formula:

R = (1 + X) / (1 + i) - 1

- R - real profitability;

- X is the nominal rate of return;

- i - inflation.

Based on the Fisher model, one main conclusion can be drawn: inflation does not generate income.

The rise in the nominal rate due to inflation will never be greater than the amount of money invested that has depreciated. In addition, the high rate of inflation growth implies significant risks for banks, and depositors are responsible for compensating for these risks.

Application of Fisher's formula in international investment

As you can see in the above formulas and examples, the level of high inflation always lowers the return on investment, at a constant nominal rate.

Thus, the main criterion for the reliability of an investment is not the amount of payments in percentage terms, but inflation target.

Description of the Russian investment market by means of the Fisher formula

The above model can be clearly seen on the example of the investment market of the Russian Federation.

The drop in inflation in 2011-2013 from 8.78% to 6.5% led to an increase in foreign investments: in 2008-2009 they did not exceed 43 billion rubles. dollars a year, and by 2013 reached 70 billion rubles. dollars.

The sharp increase in inflation in 2014-2015 led to a decrease in foreign investment to historical lows. Over these two years, the amount of investments in the Russian economy amounted to only 29 billion rubles. dollars.

At the moment, inflation in Russia has dropped to 2.09%, which has already led to an inflow of new investments from investors.

In this example, it can be noted that in matters of international investment, the main parameter is precisely the real interest rate, which is calculated according to Fisher's formula.

How the inflation index of goods and services is calculated

The inflation index or consumer price index is an indicator that reflects the change in the prices of goods and services purchased by the population.

Numerically, the inflation index is the ratio of prices for goods in the reporting period to prices for similar goods in the reference period.

i p = p 1 / p

- i p - inflation index;

- p 1 - prices for goods in the reporting period;

- p 2 - prices for goods in the reference period.

Simply put, the inflation index indicates how many times prices have changed over a certain period of time.

Knowing the inflation index, one can draw a conclusion about the dynamics of inflation. If the inflation index takes on values greater than one, then prices rise, which means that inflation also grows. Inflation index is less than one - inflation takes negative values.

The following methods are used to predict changes in the inflation index:

Laspeyres formula:

I L = (∑p 1 * q) / (∑p 0 * q 0)

- I L - Laspeyres index;

- The numerator is the total cost of goods sold in the previous period at the prices of the reporting period;

- The denominator is the real value of goods in the previous period.

Inflation, when prices rise, is given a high estimate, and when prices fall, it is underestimated.

Paasche index:

Ip = (∑p 1 * q) / (∑p 0 * q 1)

Numerator - the actual cost of the products of the reporting period;

The denominator is the actual value of the products for the reporting period.

Fisher's ideal price index:

I p = √ (∑p 1 * q) / (∑p 0 * q 1) * (∑p 1 * q) / (∑p 0 * q 0)

Taking inflation into account when calculating an investment project

Accounting for inflation in such investments plays a key role. Inflation can affect project implementation in two ways:

- In kind- that is, entail a change in the project implementation plan.

- In monetary terms- that is, to affect the final profitability of the project.

Ways to influence an investment project in the event of an increase in inflation:

- Change in currency flows depending on inflation;

- Accounting for the inflation premium in the discount rate.

Analysis of the inflation rate and its possible impact on the investment project requires the following measures:

- consumer index accounting;

- forecasting changes in the inflation index;

- forecasting changes in the population's income;

- forecasting the volume of cash collections.

Fisher's formula for calculating the dependence of the value of goods on the amount of money

In general, Fisher's formula for calculating the dependence of the value of goods on the amount of money has the following record:

- M is the volume of money supply in circulation;

- V is the frequency with which money is used;

- P - the level of the cost of goods;

- Q - the number of goods in circulation.

By transforming this record, you can express the price level: P = MV / Q.

The main conclusion from this formula is the inverse proportion between the value of money and its quantity. Thus, for normal circulation within the state, control of the amount of money in circulation is required. An increase in the number of goods and prices for them requires an increase in the amount of money, and, in the event of a decrease in these indicators, the money supply should be reduced. This kind of regulation of the amount of money in circulation is entrusted to the state apparatus.

Fisher's formula as applied to monopoly and competitive pricing

Pure monopoly presupposes, first of all, that one manufacturer has complete control over the market and is perfectly informed about its state. The main goal of a monopoly is to maximize profits with minimal costs. The monopoly always sets the price higher than the value of the marginal cost, and the volume of output is lower than in perfect competition.

The presence of a monopoly manufacturer in the market usually has serious economic consequences: the consumer spends more money than in the conditions of fierce competition, while the rise in prices occurs along with the rise in the inflation index.

If the change in these parameters is taken into account in Fisher's formula, then we get an increase in the money supply and a constant decrease in the number of goods in circulation. This situation leads the economy to a vicious cycle in which an increase in inflation leads to an increase only to an increase in prices, which ultimately further stimulates the rate of inflation.

A competitive market, in turn, reacts to an increase in the inflation index in a completely different way. Market arbitrage brings prices to market conditions. Thus, competition prevents an excessive increase in the money supply in circulation.

An example of the relationship between changes in interest rates and inflation for Russia

On the example of Russia, one can notice the direct dependence of interest rates on deposits on inflation

Thus, it can be seen that the instability of external conditions and the increase in volatility in the financial markets forces the Central Bank to reduce rates when inflation rises.

Inflation is the process of raising the prices of goods and services over time. The inflation index is used to determine its level.

Inflation concept. History of appearance

Inflation as a phenomenon in the financial system was known to the ancient world. However, in those days it was different from what we see today. For example, inflation was caused by over-minting or the use of copper instead of precious metals in their manufacture. Such a process had the common name "coin spoilage". By the way, historians even managed to find data on the depreciation of the currency of Ancient Rome sestertia.

Until the middle of the last century, inflation was perceived by the population as a natural disaster. And only after the introduction of widespread statistical accounting of the activities of business entities in the United States, Japan and many Western European countries, it was possible to curb inflation. At the same time, the producers' property rights were not infringed upon. In addition, the measures taken did not have a negative impact on the level of competition for goods and services in the domestic markets. It should be noted that, in addition to statistical control, the creation of a system of distributed price regulators played an important role in curbing inflation.

Inflation in the USSR

There was no inflation in the Soviet Union. Except for the so-called "deficit". The fact is that in the USSR there was such an organization as the State Price Committee under the Council of Ministers of the USSR. Its functions included regulation of the relationship between producers and consumers. This happened by controlling production costs and profits.

This standardization was carried out by the Scientific Research Institute of Planning and Standards under the USSR State Planning Committee (NIIPiN). His tasks included the development of profit margins that would be scientifically substantiated. In addition, the institute has worked to determine the rates of intermediate consumption, as well as other costs of various institutions and organizations, taking into account their regional, sectoral and technological characteristics.

Inflation forecast

In order to accurately predict the future activities of an enterprise, it is necessary to evaluate not only its own internal resources, but also additional factors that do not depend on the organization. These factors are a consequence of the characteristics of the external environment, but at the same time have a great influence on the performance of each manufacturer. These parameters include inflation, which can be predicted using the formula for calculating inflation.

The source of macroeconomic information is government bodies that analyze and make forecasts regarding the economic and financial situation. In addition, they monitor trends in changes in the exchange rate of the national currency, price increases, as well as assess the structure of the cost of goods and services not only in the country, but throughout the world. In the process of forecasting the financial and economic development of an enterprise, it is necessary to take into account inflationary changes. They have a significant impact on many aspects of an organization's activities.

Inflation index

One of the main and visual indicators of the depreciation of money is the inflation index. The formula by which it is calculated helps to determine the overall increase in the value of goods and services in a certain period of time. It is determined by adding the base price level at the beginning of the reporting period (taken to be equal to one) and the inflation rate for the considered interval. The inflation formula in this case is as follows: II m = 1 + TI m, where

ТИ т - annual inflation rate. This indicator characterizes the general increase in the price level during a given time period and is expressed as a percentage. In turn, this indicator is calculated using the inflation rate formula: TI t = (1 + TI m) 12 -1, where

TI m is the average monthly inflation rate, provided that it is uniform throughout the year.

When planning the company's annual budget, the following indicators should be considered:

1) inflation that changes over time. Here it is necessary to take into account the fact that the dynamics of inflation often does not coincide with fluctuations in exchange rates;

2) the possibility of including several monetary units in the budget;

3) heterogeneity of inflation. In other words, prices for various types of goods, services, resources change in different ways and their growth rates may differ;

4) government regulation of the cost of certain groups of goods and services.

Accounting for inflation when calculating the profitability of financial transactions

When calculating the required level of income from financial transactions, it is necessary to take into account the inflation factor. At the same time, the tools that are used in the calculations are designed to ensure the determination of the amount of the so-called "inflationary premium", as well as the general level of nominal yield. The presence in this formula for calculating the level of inflation allows the company to compensate for inflationary losses, as well as to obtain the required level of net profit.

Calculating the "inflationary premium"

To calculate the required inflation premium, the following formula is used:

Pi = P x TI,

where Pi is the volume of the inflationary premium for a specific period of time,

P is the initial value of the money supply,

ТИ - inflation rates for the considered time interval in the form of a decimal fraction.

The formula for accounting for inflation when determining the total required level of income from a financial transaction is as follows: Dn = Dr + Pi,

where Дн is the total nominal volume of the required income of the financial transaction. This takes into account the factor of inflation for the considered time period.

Dr - the real amount of the required income from the financial transaction in the considered period of time. This indicator is calculated using simple or compound interest. The real interest rate is used in the calculation process.

Pi is the inflationary premium for the period under review.

Calculating the required yield

To calculate the required rate of return on financial transactions, taking into account the inflation rate, the formula is as follows:

УДн = (Дн / Др) - 1.

Here UDN is the required degree of profitability from financial transactions taking into account inflation in the form of a decimal fraction, Dn is the total nominal volume of the required income of a financial transaction in the considered period of time, Dp is the real amount of the required income from the financial transaction in a given time interval.

Accounting for the inflation factor using foreign currencies

It should be emphasized that it is rather difficult to make an accurate forecast of inflation rates using the formula. In addition, this process is time consuming, and the result largely depends on the impact of subjective factors. Therefore, you can use another effective financial management tool.

It consists in converting funds that will be received in the form of income from financial transactions into one of the main and stable world currencies. This will completely eliminate the inflation factor. In this case, the current rate at the time of the calculations is used.

Fischer's formula

Fischer's formula for inflation was first published in his 1911 edition of The Purchasing Power of Money. Until today, it is a reference point for those specialists in the field of macroeconomics who are convinced of the dependence of its growth on the amount of money in circulation. The author of the formula is the American economist and mathematician Irving Fisher. The essence of the formula is the definition and attitude to credit funds, interest and crisis phenomena. It looks like this: MV = PQ,

where M is the volume of money supply in circulation, V is the velocity of circulation of the mass of cash, P is the price, and Q is the amount of products and services sold. Fisher's formula for inflation is a macroeconomic ratio and still serves as one of the most important and used tools. In simple terms, this equation shows a directly proportional relationship between the level of prices for goods and services and the volume of their production, on the one hand, and the amount of money supply in circulation, on the other. At the same time, the mass of money is inversely proportional to the speed of circulation of the total mass of cash.

Money supply in Russia

At the moment, the rate of turnover of the money supply in the Russian economy shows a tendency to slow down. At the same time, sharp jumps in this indicator, as a rule, correspond to sudden changes in the ruble exchange rate against major world currencies. The slowdown in the circulation of the money supply has two main reasons. The first is to reduce the growth rate of the gross domestic product. The second reason is the increase in inflation rates. In the future, this state of affairs may lead to a situation where the money supply will simply become immense.

Here it is necessary to return to Fischer's formula and emphasize one curious detail. The rate of turnover of the money supply is a consequence of the parameters of the equation. At the moment, there is no established methodology for monitoring this indicator. Nevertheless, the very formula of inflation, due to its simplicity and ease of understanding, has taken root in modern macroeconomic theory.

One of the main problems of the monetary policy of the RF leadership is the frivolous attitude to the high refinancing rate. This, in turn, is the reason for the fall in the level of industrial production and the stagnation of the agricultural sector of the economy. The country's leading economists understand the pernicious nature of this approach.

But today we have to state with regret that the government officials of the Central Bank and the Ministry of Finance, who are responsible for monetary policy, follow the interests of the monopolists. It is beneficial for these groups of entrepreneurs to preserve the existing alignments in the dynamics of price changes and their structure.

But today we have to state with regret that the government officials of the Central Bank and the Ministry of Finance, who are responsible for monetary policy, follow the interests of the monopolists. It is beneficial for these groups of entrepreneurs to preserve the existing alignments in the dynamics of price changes and their structure.

“Inflation is when you cannot buy as much for your money as in the days when you had no money,” American writer Leonard Louis Levinson sneers.

Admit it, sad as it may seem, it’s true. Constant inflation eats up our income.

We make investments counting on a certain percentage, but what do we have in reality?

Fisher's formula has been developed to answer these and similar questions. Inflation, money supply, price level, interest rates and real profitability - read about this in the article.

The relationship between money supply and prices - Fisher's equation

Regulation of the amount of money in circulation and the level of prices is one of the main methods of influencing the economy of the market type. The relationship between the amount of money and the level of prices was formulated by representatives of the quantitative theory of money. In a free market (market economy), it is necessary to regulate business processes to a certain extent (Keynesian model).

Fischer's formula: inflation

Regulation of economic processes is carried out, as a rule, either by the state or by specialized bodies. As the practice of the XX century has shown, many other important economic parameters depend on the mass of money used in the economy, primarily the level of prices and interest rates (credit prices). The relationship between the price level and the amount of money in circulation has been clearly formulated within the framework of the quantitative theory of money.

Prices and the amount of money are in direct proportion. Depending on different conditions, prices may change due to changes in the money supply, but the money supply may also change depending on price changes.

There is no doubt that this formula is purely theoretical and unsuitable for practical calculations. Fisher's equation does not contain any single solution; within the framework of this model, multivariance is possible. At the same time, given certain tolerances, one thing is certain: the price level depends on the amount of money in circulation. Two tolerances are usually made:

- the rate of turnover of money is a constant value;

- all production facilities on the farm are fully utilized.

The meaning of these assumptions is to eliminate the influence of these quantities on the equality of the right and left sides of the Fisher equation. But even if these two assumptions are met, it cannot be unconditionally asserted that the growth of the money supply is primary, and the rise in prices is secondary. The dependence is mutual.

In conditions of stable economic development, the money supply acts as a regulator of the price level. But with structural imbalances in the economy, a primary change in prices is also possible, and only then a change in the money supply.

Fisher's formula (the equation of exchange) determines the mass of money used only as a medium of circulation, and since money performs other functions, the determination of the general need for money presupposes a significant improvement in the original equation.

Amount of money in circulation

The amount of money in circulation and the total amount of commodity prices are related as follows:

The above formula was proposed by representatives of the quantitative theory of money. The main conclusion of this theory is that in each country or group of countries (Europe, for example) there must be a certain amount of money corresponding to the volume of its production, trade and income. Only in this case will the price stability be ensured. In the case of inequality of the amount of money and the volume of prices, changes in the price level occur:

- MV = PT - prices are stable;

- MV> PT - prices are growing (inflationary situation).

Thus, price stability is the main condition for determining the optimal amount of money in circulation.

Source: "grandars.ru"

Fisher's formula: inflation and interest rates

Economists call bank interest the nominal interest rate, and the increase in your purchasing power the real interest rate. If the nominal interest rate is denoted by i, and the real interest rate - r, inflation - π, then the relationship between these three variables can be written as follows: r = i - π, i.e. the real interest rate is the difference between the nominal interest rate and the inflation rate.

Regrouping the terms of this equation, we see that the nominal interest rate is the sum of the real interest rate and the inflation rate: i = r + π. The equation written in this form is called the Fisher equation. It shows that the nominal interest rate can change for two reasons: due to changes in the real interest rate or due to changes in the rate of inflation.

The quantitative theory of money and Fisher's equation show how the growth of the money supply affects the nominal interest rate. In accordance with the quantitative theory of money, an increase in the growth rate of the money supply by 1% causes an increase in the inflation rate by 1% as well.

According to Fisher's equation, a 1% increase in inflation in turn causes a 1% increase in the nominal interest rate. This relationship between the inflation rate and the nominal interest rate is called the Fisher effect.

It is necessary to distinguish between two different concepts of the real interest rate:

- the real interest rate that the borrower and lender expects when the loan is issued (real interest rate exante) - i.e. expected, estimated;

- actual real interest rate - expost.

Lenders and borrowers are not in a position to predict the future rate of inflation with complete certainty, but they have certain expectations in this regard. Let us denote by π - the actual rate of inflation in the future, and through e - the expected future rate of inflation. Then the real interest rate exante will be equal to i - πе, and the real interest rate expost will be equal to i - π х v.

How is the Fisher effect modified to account for the difference between expected and actual future inflation rates? The Fisher effect can be more accurately represented as follows: i = r + πе.The demand for cash in real terms depends on both the level of income and the nominal interest rate. The higher the income level Y, the greater the demand for the stock of cash in real terms. The higher the nominal interest rate i, the less demand for them.

Source: "infomanagement.ru"

Nominal and real interest rates - the Fisher effect

The nominal interest rate is the market interest rate, excluding inflation, and reflects the current valuation of monetary assets.

Real interest rate is the nominal interest rate minus the expected inflation rate.

For example, the nominal interest rate is 10% per annum, and the projected inflation rate is 8% per annum. Then the real interest rate will be: 10 - 8 = 2%.

The difference between the nominal rate and the real one makes sense only in conditions of inflation or deflation.

The American economist Irving Fisher put forward an assumption about the relationship between the nominal, real interest rate and inflation, called the Fisher effect, which states: the nominal interest rate changes by the amount at which the real interest rate remains unchanged.

As a formula, the Fisher effect looks like this:

For example, if the expected inflation rate is 1% per year, then the nominal rate will increase by 1% for the same year, therefore, the real interest rate will remain unchanged. Therefore, it is impossible to understand the process of making investment decisions by economic agents without taking into account the difference between nominal and real interest rates.

Let's look at a simple example: let's say you intend to lend someone a one-year loan in inflationary conditions, what is the exact interest rate you set? If the growth rate of the general price level is 10% per year, then by setting a nominal rate of 10% per annum with a loan of 1000 CU, you will receive 1100 CU in a year.

But their real purchasing power will no longer be what it was a year ago. Nominal income gain of CU100 will be "eaten" by 10% inflation. Thus, the distinction between the nominal interest rate and the real one is important for understanding how contracts are made in an economy with an unstable general price level (inflation and deflation).

Source: "economicportal.ru"

Fisher effect

The effect, as a phenomenon, as a regularity, was described by the great American economist Irving Fisher in 1896. The general idea is that there is a long-term relationship between expected inflation and the interest rate (the yield on long-term bonds). Content - an increase in expected inflation causes about the same increase in the interest rate and vice versa.

Fisher's Equation is a formula for quantifying the relationship between expected inflation and the interest rate.Simplified equation: if the nominal interest rate N is 10, the expected inflation I is 6, R is the real interest rate, then the real interest rate is 4 because R = N - I or N = R + I.

Exact equation. The real interest rate will differ from the nominal one as many times as the prices change. 1 + R = (1 + N) / (1 + I). If you open the brackets, then in the resulting equation the value of NI at N and I is less than 10% can be considered tending to zero. As a result, we will get a simplified formula.

Exact equation calculation with N equal to 10 and I equal to 6 will give the following value for R.

1 + R = (1 + N) / (1 + I), 1 + R = (1 + 0.1) / (1 + 0.06), R = 3.77%.

In the simplified equation, we get 4 percent. It is obvious that the boundary of the application of the simplified equation - the value of inflation and the nominal rate is less than 10%.

Source: "dictionary-economics.ru"

The essence of inflation

Imagine that in a secluded northern village, all workers have their wages doubled. What will change in a local store if the supply remains the same, for example, chocolate? How would its equilibrium price change? Why is the same chocolate getting more expensive? The money supply available to the population of this village has increased, and the demand has increased accordingly, while the amount of chocolate has not increased.

As a result, the price of chocolate has increased. But the rise in price of chocolate is not inflation yet. Even if all foodstuffs in the village rise in price, this will not yet be inflation. And even if all goods and all services in this village become more expensive, this will not be inflation either.

Inflation is a long-term sustained increase in the general price level. Inflation is the process of devaluation of money, which occurs as a result of overflowing the circulation channels with money supply. How much money must circulate in the country for the price level to be stable?

The exchange equation - Fisher's formula - allows you to calculate the money supply required for circulation:

where M is the amount of money in circulation;

V is the velocity of money circulation, which shows how many times 1 ruble changes hands over a certain period of time;

P is the average price per unit of manufactured products;

Y is the real gross domestic product;

RU - nominal GDP.

The exchange equation shows that each year the economy needs as much money as is required to pay the value of the GDP produced. If more money is released into circulation or the speed of their circulation has increased, then the price level rises.

When the growth rate of the money supply exceeds the growth rate of the commodity supply: MU> RU,

equilibrium is restored as a result of rising prices: МУ = Р | У.

The overflow of the channels of money circulation can occur if the velocity of circulation of money increases. The same consequences can be caused by a reduction in the supply of goods on the market (a drop in production).

The extent to which money is depreciated is determined in practice by measuring the rate of price increase.

For the price level in the economy to be stable, the government must maintain the growth rate of the money supply at the level of the average growth rate of real GDP. The amount of money supply is regulated by the Central Bank. Emission is the release into circulation of an additional amount of money.

Depending on the rate of inflation, inflation is conventionally distinguished:

- moderate

- galloping

- high,

- hyperinflation.

If prices rise slowly, up to about 10% per year, then they usually talk about moderate, "creeping" inflation.

If there is a rapid and abrupt increase in prices, measured in double digits, then inflation becomes galloping. With such inflation, prices will not more than double.

Inflation is considered to be high, when the price increase exceeds 100%, that is, prices rise several times.

Hyperinflation occurs when the process of depreciation of money becomes self-sustaining and uncontrollable, and the rate of growth of prices and money supply becomes extremely high. Hyperinflation is usually associated with war, economic disruption, political instability, and erroneous state policies. The growth rate of prices during hyperinflation exceeds 1000%, that is, prices rise more than 10 times during the year.

The intensive development of inflation causes distrust of money, and therefore there is a massive desire to turn it into real values, and "flight from money" begins. There is an increase in the velocity of circulation of money, which leads to an acceleration of their depreciation.Money ceases to fulfill its functions, and the monetary system is in complete disarray and decline. This is manifested, in particular, in the introduction into circulation of various monetary surrogates (coupons, cards, other local currency units), as well as hard foreign currency.

The collapse of the monetary system as a result of hyperinflation, in turn, causes the degradation of the entire national economy. Production falls, normal economic ties are disrupted, and the share of barter transactions is growing. There is a desire for economic isolation of various regions of the country. Social tension is growing. Political instability manifests itself in a lack of trust in government.

This also reinforces distrust and depreciation of money.

A classic example of hyperinflation is the state of monetary circulation in Germany after the First World War in 1922-1923, when the rate of price growth reached 30,000% per month, or 20% per day.

Inflation manifests itself in different ways in different economic systems. In a market system, prices are formed under the influence of supply and demand; the impairment of money is open-ended. In a centralized system, prices are formed by directive, inflation is suppressed, hidden. Its manifestations are a shortage of goods and services, an increase in monetary savings, and the development of a shadow economy.

The factors causing inflation can be both monetary and non-monetary in nature. Let's consider the main ones. Demand inflation is the result of excessive increases in government spending, consumer spending and private investment. Another cause of demand inflation may be the emission of money to finance government spending.With cost inflation, prices rise as a result of rising production costs for firms. For example, wage growth, if it outstrips productivity growth, can cause cost inflation.

- Inflation is a general rise in prices. It is caused by the excess of the growth rate of the money supply over the mass of goods.

- According to the rate of price growth, four types of inflation are distinguished, of which the strongest is hyperinflation, which destroys the economy.

- Inflation is unpredictable. Fixed income people suffer the most from its consequences.

Source: "knigi.news"

How to calculate real profitability after taking into account inflation

Probably everyone knows that real profitability is profitability minus inflation. Everything is getting more expensive - products, goods, services. According to Rosstat, prices have increased 5 times over the past 15 years. This means that the purchasing power of money that was simply lying in the nightstand all this time has decreased by 5 times, earlier they could buy 5 apples, now 1.

In order to somehow preserve the purchasing power of their money, people invest it in various financial instruments: most often these are deposits, currency, real estate. More advanced people use stocks, mutual funds, bonds, precious metals. On the one hand, the amount of investments is growing, on the other, they are depreciated due to inflation.

If you subtract the inflation rate from the nominal rate of return, you get the real rate of return. It can be positive or negative. If the return is positive, your investment has increased in real terms, that is, you can buy more apples, if it is negative, it has depreciated.

Most investors calculate real returns using a simple formula:

Real yield = Nominal yield - Inflation

But this method is imprecise. Let me give you an example: take 200 rubles and put them on a deposit for 15 years at a rate of 12% per annum. Inflation for this period is 7% per year. If we count the real profitability according to a simple formula, we get 12-7 = 5%. Let's check this result by counting on our fingers.

In 15 years at a rate of 12% per annum, 200 rubles will turn into 200 * (1 + 0.12) ^ 15 = 1094.71. During this time, prices will rise by (1 + 0.07) ^ 15 = 2.76 times. To calculate the real profitability in rubles, we divide the amount on the deposit by the inflation rate 1094.71 / 2.76 = 396.63. Now, to translate the real profitability into interest, we consider (396.63 / 200) ^ 1/15 -1 * 100% = 4.67%. This differs from 5%, that is, the check shows that the calculation of the real profitability in a “simple” way is not accurate.

where Real Rate of Return is the real profitability;

nominal rate - nominal rate of return;

inflation rate - inflation.

We check:

(1 + 0.12) / (1 + 0.07) -1 * 100% = 4.67% - Converges, then the formula is correct.

Another formula that gives the same result looks like this:

RD = (nominal rate-inflation) / (1 + inflation)

The greater the difference between nominal yield and inflation, the greater the difference between the results calculated using the “simple” and “correct” formula. This is common in the stock market. Sometimes the error reaches several percent.

Source: "activeinvestor.pro"

Calculating inflation. Inflation indices

The inflation index is an economic indicator that reflects the dynamics of prices for services and goods that the population of the country pays for, that is, for those products that are purchased for further use, and not for overproduction.

The inflation index is also called the consumer price index, which is an indicator that measures the average price level of consumer goods over a certain period of time. Different methods and formulas are used to calculate the inflation index.

Calculation of the inflation index using the Laspeyres formula

The Laspeyres index is calculated by weighting the prices of 2 time periods for the same consumption volumes of the base period. Thus, the Laspeyres index reflects the change in the cost of services and goods of the base period, which occurred during the current period.

The index is defined as the ratio of consumer spending on the purchase of the same set of consumer goods, but at current prices (∑Qo × Pt), to the cost of purchasing goods and services of the base period (∑Qo × Po):

where Pt are prices in the current period, Qo are prices for services and goods in the reference period, Po is the number of services and goods produced during the reference period (as a rule, 1 year is taken for the reference period).

It should be noted that the Laspeyres method has significant drawbacks due to the fact that it does not take into account changes in the consumption structure.

The index only reflects changes in the level of income, not taking into account the substitution effect, when prices for some goods fall, and this leads to an increase in demand. Consequently, the method of calculating the inflation index by the Laspeyres method in some cases gives a slightly overestimated value.

Calculation of the inflation index using the Paasche formula

Another way of calculating the inflation index is based on the Paasche formula, which also compares the prices of two periods, but already according to the consumption volumes of the current period:

where Qt - prices for services and goods in the current period.

However, the Paasche method also has a significant drawback: it does not take into account price changes and does not reflect the level of profitability. Therefore, when prices for some services or products fall, the index gives an overestimate, and when prices rise, an underestimate.

Calculating the inflation index using Fisher's formula

In order to eliminate the shortcomings inherent in the Laspeyres and Paasche indices, the Fisher formula is used to calculate the inflation index, the essence of which is to calculate the geometric mean of the 2 above indices:

![]()

![]()

Many economists consider this formula to be ideal, since it compensates for the shortcomings of the Laspeyres and Paasche formulas. But, despite this, experts from many countries prefer choosing one of the first two methods.

For example, for the preparation of international reporting, the Laspeyres formula is used, since it takes into account that some goods and services may, in principle, fall out of consumption in the current period for one reason or another, in particular during the economic crisis in the country.

Gross domestic product deflator

An important place among inflation indices is occupied by the GDP deflator - the price index, which includes all services and goods in the consumer basket. The GDP deflator allows you to compare the growth of the general level of prices for services and goods over a certain economic period.

This indicator is calculated in the same way as the Paasche index, but measured as a percentage, that is, the resulting number is multiplied by 100%. As a rule, the GDP deflator is used by state statistical offices for reporting.

Big Mac Index

In addition to the above official methods of calculating the inflation index, there are also such unconventional methods of determining it, such as, for example, the Big Mac or hamburger index. This method of calculation provides an opportunity to study how the same products are priced in different countries today.

The well-known hamburger is taken as a basis, and all because it is he who is sold in many countries of the world, has almost everywhere a similar composition (meat, cheese, bread and vegetables), and the products for its manufacture, as a rule, are of domestic origin.

So, the most expensive hamburgers are sold today in Switzerland ($ 6.81), Norway ($ 6.79), Sweden ($ 5.91), the cheapest are in India ($ 1.62), Ukraine ($ 2.11), Hong Kong ($ 2.12). As for Russia, the cost of a hamburger here is $ 2.55, while in the US a hamburger costs $ 4.2.

What does the hamburger index say? About the fact that if the cost of the Russian Big Mac in terms of dollars is lower than the cost of a hamburger from the United States, then the official exchange rate of the Russian ruble is underestimated in relation to the dollar.

Thus, it is possible to compare the currencies of different countries, which is a very simple and easy way to recalculate national currencies.Moreover, the cost of a hamburger in each country directly depends on the volume of production, prices for raw materials, rent, labor and other factors, so the Big Mac index is one of the best ways to see the discrepancy in the value of currencies, which is especially important in a crisis, when a “weak” currency gives some advantages in terms of prices and costs for products, and expensive currency becomes simply unprofitable.

Borscht index

In Ukraine, after carrying out, to put it mildly, unpopular reforms, an analogue of the Western Big Mag index was created, which has the patriotic name “borscht index”. In this case, the study of price dynamics is carried out solely on the basis of the cost of the ingredients that make up the national Ukrainian dish - borscht.

However, if in 2010-2011 the borscht index could “save the situation” by showing the people that a plate of borscht now began to cost a little cheaper, then in 2012 the situation changed dramatically. Thus, the borscht index showed that in September 2012 the average borsch set consisting of vegetables costs as much as 92% more than in the same period last year.

Such a rise in price led to the fact that the volume of purchases of vegetables by the population in Ukraine decreased by an average of 10-20%.

As for meat, on average it has risen in price by 15-20%, however, already by this winter, a rapid rise in price up to 30-40% is expected due to the rise in prices for feed grains. On average, borsch made from potatoes, meat, beets, carrots, onions, cabbage, tomatoes and a bunch of greens is used as a basis for assessing changes in the price level according to the borscht index.

Source: "provincialynews.ru"

Exchange rate and inflation

Inflation is the most important indicator of the development of economic processes, and for foreign exchange markets it is one of the most significant benchmarks. The data on inflation are monitored by currency dealers very closely. From the point of view of the foreign exchange market, the impact of inflation is naturally perceived through its relationship with interest rates.

Since inflation changes the ratio of prices, it also changes the actual benefits obtained from the income brought by financial assets. This influence is usually measured using Real Interest Rates, which, unlike conventional (nominal, Nominal Interest Rates) interest rates, take into account the depreciation of money that occurs due to the general rise in prices.

The rise in inflation reduces the real interest rate, since a certain part must be subtracted from the income received, which will simply go to cover the rise in prices and does not give any real increase in the received goods (goods or services).The simplest way to formally take into account inflation is that the nominal rate i minus the inflation rate p (also specified as a percentage) is considered as the real interest rate,

A more accurate relationship between interest rates and inflation is given by Fisher's formula. For obvious reasons, the markets for government securities (interest rates on such securities are fixed at the time of their issuance) are very sensitive to inflation, which can simply destroy the profit from investments in such instruments.

The effect of inflation on the government securities markets is easily transmitted to the foreign exchange markets closely related to them: the dumping of bonds denominated in a certain currency crs, which occurred due to an increase in inflation, will lead to an excess in the market of cash in this currency crs, and, consequently, to its fall. exchange rate.

In addition, the inflation rate is the most important indicator of the "health" of the economy, and therefore it is closely monitored by central banks.

A means of combating inflation is to raise interest rates. The increase in rates diverts part of the cash from the business turnover, as financial assets become more attractive (their profitability increases along with interest rates), loans become more expensive; As a result, the amount of money that can be paid for produced goods and services decreases, and consequently the rate of price growth also decreases.

Because of this close relationship with central bank rate decisions, foreign exchange markets keep a close eye on inflation indicators. Of course, individual deviations in inflation levels (for a month, a quarter) do not cause a reaction from central banks in the form of rate changes; central banks follow trends, not individual values.

Thus, low inflation in the early 1990s allowed the FED to keep the discount rate at 3%, which was beneficial for the economic recovery. But as a result, inflation indicators have ceased to be significant benchmarks for foreign exchange markets.Since the nominal discount rate was low, and its real variant reached 0.6% in general, this meant for the markets that only the upward movement of inflation indices made sense. The downtrend in the US discount rate was only broken in May 1994 when the FED raised it along with the federal funds rate as a proactive measure to combat inflation. True, the rise in rates then could not support the dollar rate.

The main published inflation indicators are the consumer price index, producer price index, and GDP implicit deflator. Each of them reveals its own part of the overall picture of price increases in the economy. Figure 1 shows, for illustration, a graph of the rise in consumer prices in the UK over the past 12 years.

Figure 1. UK consumer prices

This figure directly shows the cost of a certain consumer basket; the growth rate of this basket value is the commonly published consumer price index. On the chart, the growth rate is depicted by the slope of the trend line along which the main trend of price growth goes.

It is clearly seen that after overcoming the problems of 1992, which led to the exit of England from the European monetary union, the reforms carried out brought the economy to a different growth line, along which the rise in prices (the slope of the right trend line) is much less than it was at the end of the previous decade and in features - in 91-92 years.

An example of a central bank's actions based on its position on inflationary processes and the resulting foreign exchange market response is shown in Figure 2, which shows a graph of the British pound against the dollar.

Figure 2. Chart of the British pound; Bank of England rate hike on September 8, 1999 and reaction to rumors of a new increase

On September 8, 1999, a meeting of the Bank of England Monetary Policy Committee took place. None of the experts predicted then an increase in interest rates, since economic indicators did not show obvious signs of inflation, and the pound rate was already estimated too high. True, on the eve of the meeting there were many comments that the Bank of England rate hike in 1999 or early 2000 was inevitable.

But no one predicted it for this meeting. Therefore, the decision of the Bank to raise its main interest rate by a quarter of a percent came as a surprise to everyone, as shown by the first sharp rise in the pound rate.

The Bank explained its decision by the desire to prevent further price increases, the signs of which were seen in the overheated housing market, strong consumer demand and the possibility of inflationary pressure from wages, since unemployment in England was at a fairly low level. Although it is possible that the Bank's decision was influenced by the recently implemented increase in FED rates.

The second rise in the chart the next day was caused by active discussion in the market about the inevitability of a new rate hike soon (rate hike - in market slang, the usual designation for raising rates of central banks); there were, apparently, many who wanted not to be late to buy a pound until it rose in price even more. The fall in the pound rate at the end of the week is due to the reaction to the data on US inflation, which will be discussed later.

Inflation and interest rates

The relationship between inflation and the conditions of monetary circulation can be demonstrated on the basis of the basic equation of the theory of money, if we write it down for the relative changes in the values included in it, which shows that under these conditions, the rise in prices (inflation) is completely determined by the regulatory actions of the central bank through changes in the money supply.

In reality, of course, the causes of inflation are quite complex and numerous, the growth of the money supply is only one of them.

Suppose a certain amount S for the same period was invested at an interest rate i (which is called the nominal interest rate), that is, the amount S will turn over the same period into S -> S (l + i). At the beginning of the period under review (at the old prices), the amount of S could be purchased for the quantity of goods Q = S / P.

The real interest rate is called the interest rate in real terms, that is, determined through the increase in the volume of goods and services. In accordance with this definition, the real interest rate r will give a change in the volume Q for the same period under consideration,

Having collected all the above relations, we obtain

Q (l + r) = S (l + i) / P (l + p) = Q * (1 + i) / (1 + p),

whence we get the expression for the real interest rate in terms of the nominal interest rate and the inflation rate,

r = (l + i) / (l + p) -l.

The same equation, written in a slightly different form,

characterizes the Fisher effect known in macroeconomics.

Fisher's formula and monopoly price increases

There seem to be two kinds of prices: competitive and monopoly. The mechanism of competitive pricing is well researched. With a stable money supply, it never leads to an irreversible increase in prices. With a market deficit of any product, the enterprises producing it can temporarily inflate prices.

However, after a certain period of time, the capital will flow into this branch of the economy, that is, where the high rate of profit has temporarily formed. The inflow of capital will make it possible to create new capacities for the production of scarce goods, and after a certain time, an excess of these goods will form on the market. In this case, prices may even fall below the general level, as well as below the cost price level.

Ideally, with the complete absence of monopolies in the market and with some constant technological progress, in the absence of excess money in circulation, the market economy does not produce inflation. On the contrary, such an economy is characterized by deflation.Monopoly is another matter. They discourage competition and can arbitrarily inflate prices. The rise of monopolies is often a natural consequence of competition. When weak competitors die, and only one winner remains in the market, he becomes a monopolist. Monopolies are general and local. Some of them are natural (irreparable).

Other monopolies are established for a time, but this does not make it easier for consumers and the entire economy of the country. Monopolies are being fought. All countries with developed market economies have antitrust laws. However, this is an acknowledgment of the fact that market methods alone cannot cope with monopolies. The state forcibly splits large monopolies. But in their place oligopolies can form.

Price collusion is also pursued by the state, but it is not easy to prove. Sometimes some monopolies, especially those involved in energy, transport and military production, are placed under strict state control, just as it was done in the socialist countries.

Arbitrary rise in prices by monopolies is an important point in the theory of cost inflation.

So, suppose there is a certain monopoly that intends to use its market position to raise prices, that is, in order to increase its share of income in the total national income of the country. It could be an energy, transport, or information monopoly.8 It could be a union that could actually be considered a monopoly on the sale of labor. (John Keynes himself considered trade unions the most aggressive monopolies in this respect).

Monopolies include the state, which levies taxes as payment for the services it provides to maintain security, order, social security, and so on. Let's start with one of the possible cases. Let's say a private monopoly has raised its tariffs (or the state has increased taxes, or the trade unions have achieved a wage increase). In this case, we will accept the condition that the money supply M remained constant.

Then, for one turnover of the money supply, the following condition is fulfilled:

Thus, all changes in the equation, if any, will have to occur on the right side of the equation (p * q). There is a change - it is an increase in the weighted average price p. Consequently, an increase in price will necessarily lead to a decrease in the volume of goods sold q.

- In conditions of the invariability of the money supply for one period of circulation, a monopoly increase in prices leads to a reduction in the sale (and production) of goods.

- However, one more, more optimistic conclusion can be made: Inflation caused by monopolies, with a constant money supply, cannot last as long as inflation caused by money emission. A complete shutdown of production cannot be beneficial to the monopolies. There is a limit to which it is beneficial for a private monopoly to raise tariffs.

In support of the conclusions from Fisher's formula, we can find as many examples in the history of economics as we like. Strong inflation is usually accompanied by a decline in production. However, at the same time, money issue almost always joined the monopoly price increase. At the same time, when inflation is strong, there is often a relative reduction in the money supply.

Using the formula of I. Fisher, you can get the formula for finding the real rate of return

Example

What real level of profitability will an investor provide if the predicted inflation rate is 12% per year, and the declared profitability is 16%?

Thus, when determining the integral indicators of the efficiency of an investment project, both nominal and real discount rates can be used as the discount rate. The choice depends on the nature of the cash flow. If the cash flow is presented in basic and deflated prices, then the real discount rate should be used. If the cash flow is presented at a projected price level, then the nominal discount rate should be used.

4.5. Analysis of the financial condition of the company -

project participant

The need to analyze the financial condition in investment planning arises when a loan application is filed with a bank. The borrowing company must prove its solvency. In addition, the assessment of the effectiveness of the investment project should be supplemented by calculations on the impact of the project implementation on the main financial indicators of the enterprise - the project participant.

In accordance with the Methodology for evaluating investment projects, four groups of indicators are used to solve the problem:

1. Liquidity ratios that characterize the company's ability to repay its short-term liabilities:

Current liquidity ratio;

Quick liquidity ratio;

Absolute liquidity ratio.

The methodology for calculating liquidity ratios is described in detail in section 3.5 of the textbook.

2. Indicators of solvency and financial stability, used to assess the company's ability to meet its long-term obligations:

- the ratio of debt and equity funds;

- the coefficient of long-term attraction of borrowed funds;

- coefficient of coverage of long-term liabilities.

The methodology for calculating the ratio of borrowed and own funds is given in section 3.6 of the textbook.

Long-term borrowing ratio () is calculated by the formula

where - long-term liabilities; - equity.

Long-term liabilities coverage ratio () is calculated by the formula

where P H- net profit; A- depreciation; D SC- increase in equity capital during the year; D ZS- increase in borrowed funds during the year; TO- the amount of investments made in the reporting year; PDO- payments on long-term obligations (repayment of loans and payment of interest on them).

3. Turnover rates, are used to assess the effectiveness of operating activities:

- capital turnover ratio;

- equity capital turnover ratio;

- inventory turnover ratio;

- the ratio of accounts receivable turnover;

- the average turnover period of accounts payable.

The methodology for calculating the turnover ratios is described in detail in section 3.9 of the textbook.

4. Indicators of profitability, are used to assess the current profitability of an enterprise - a project participant:

- profitability of sales by profit before tax and by net profit;

- return on assets (capital) in terms of profit before tax and in terms of net profit;

- return on equity.

The methodology for calculating profitability indicators is described in detail in section 3.8 of the textbook.

The specified list of indicators can be supplemented at the request of individual project participants and financial structures.

The indicators are analyzed in dynamics and compared with the indicators of similar enterprises.

The methodology for a more complete analysis of the financial condition of the enterprise is given in section 3 of this textbook.

Topic 7. Special issues of financial management

Methodical instructions

Getting started looking at examples and solving problems on your own, you need to carefully read the content on the relevant issue of the topic. The basic concept in this topic is the concept of the time value of money, the concept of a trade-off between risk and reward. The most important concepts: inflation, level, rate and inflation index, financial condition, financial insolvency, bankruptcy, financial restructuring, enterprise value, business value. These concepts should be learned and understood in their relationships.

This topic is final. Therefore, here are tasks that raise questions of the preceding topics.

In solving problems, formulas are used, the explanation of which is presented in the content. To make it easier to find the necessary clarifications in the content, the numbering of formulas and designations in the workshop are the same as in the content.

7.1. Financial management in an inflationary environment

This section uses the following conventions:

d - rate of return,%;

- the minimum allowable profitability,%;

- risk-free profitability,%;

F (FV) - future (accrued) value, den. units;

Inflation index,%;

P (PV) - present (discounted) value, den. units;

r - real rate of return,%;

- rate adjusted for inflation (nominal),%;

- the minimum allowable profitability,%;

- inflation rate,%;

V is the increase in value (the amount of interest received), den. units

In some problems, additional designations are introduced.

Task 7.1.1.

The minimum required yield is 12% per annum. The inflation rate is 11%. What should be the nominal rate?

Methodical instructions:

Answer: The nominal rate must be at least 24.32%.

Task 7.1.2.

Determine the nominal interest rate for a financial transaction if the efficiency level is to be 7% per annum, and the annual inflation rate is 22%.

Methodical instructions: use formula (7.1.10).

Answer: The nominal rate is 30.54%, while the real rate is 7%.

Task 7.1.3.

Deposits are accepted at 14%. What is their real rate of return at 11% inflation?

Methodical instructions: use formula (7.1.10).

Note that the real return is less than the simple difference between the interest rate and the inflation rate:

Answer: The real return is 2.7%.

Task 7.1.4.

The expected inflation rate is 2% per month. Determine the quarterly and annual inflation rate.

Methodical instructions:

1) using the inflation rate per month:

2) using the inflation rate per quarter:

Answer: The quarterly inflation rate is 6.12%, the annual inflation rate is 26.82%.

Task 7.1.5.

Determine the real profitability when placing funds for a year at 14% per annum, if the inflation rate for the year is 10%.

Methodical instructions:

Answer: The real yield is 3.63% per annum.

Task 7.1.6.

The client invests 20 thousand rubles in the bank for a year, inflation is 18%. The client wants his contribution to bring 6% of annual income. What percentage should the client make a deposit?

Methodical instructions: use formula (7.1.10).

Answer: To receive an annual income of 6% per annum, the rate on a loan, adjusted for inflation, must be at least 25.08%.

Task 7.1.7.

The client invests 20 thousand rubles in the bank for a year. at 6% per annum, inflation is 18%. What result will the depositor get from this operation?

Methodical instructions: use formulas (2.1.1), (2.1.3) and (7.1.10).

3. Real interest:

Answer: Nominally (countably), the client receives 1200 rubles. in addition to its 20 thousand rubles. However, the depreciation of money as a result of inflation leads to the fact that the real value of the amount received is less than the invested amount by 2033.9 rubles.

Task 7.1.8.

The inflation rates in the next 5 years are projected annually as follows: 14%, 12%, 8%, 7%, 5%. How will prices change over the next five years?

Methodical instructions:

2) introduce the notation: - the inflation rate in the t -th year, - the price index in the t -th year, - the price index for n n years; - average one-day rate of price change.

Given: |

Solution: The price index for 5 years is calculated as the product of annual indices: And the annual index, in turn, is equal to:, hence Thus, over the five-year period, prices will increase by 1.55 times, or by 55% (for comparison, we calculate the simple sum of the inflation rates, which turns out to be significantly lower than the calculated one: 14 + 12 + 8 + 7 + 5 = 46 < 55). |

Let's find the average annual inflation rate for the five years:

![]() , i.e., the average annual inflation rate is:

, i.e., the average annual inflation rate is:

1 — 1,0916 = 0,0916 = 9,16 %.

Let's find the average daily inflation rate over 5 years:

That is, the average daily inflation rate is 0.024%.

Let's find the average daily inflation rate in the 2nd year of the analyzed five-year period:

![]() , that is, the average daily inflation rate in the 2nd year is 0.031%.

, that is, the average daily inflation rate in the 2nd year is 0.031%.

Answer: Over the five-year period, prices will increase 1.55 times or 55%, while the average annual rate of growth in prices will be 9.16%, the average daily rate - 0.024%.

Task 7.1.9.

There is a project that requires an investment of 20 million rubles. The minimum allowable yield is 5% per year. Income from the project will be received in 2 years in the amount of 26 million rubles. Risk-free rate of return - 8% per year. The beta is 0.9. The expected inflation rate is 10%. The average market rate of return on similar projects is 18% per annum.

Methodical instructions

d

Given: P = 20 million rubles. F = 26 million rubles.

Accept the project? |

Solution: The nominal profitability of the project is:

The assessment of the feasibility of implementing a project can be done in three ways:

Let's consider these methods. |

First way. To find the real profitability of the project, we will use the formula for determining the future value (2.1.7), taking into account inflation (7.1.8) and risk (2.5.13):

Transforming this formula, we get:

To calculate d, you must first calculate the risk premium (formula 2.5.13):

The real profitability is not only less than the minimum allowable, but in general this project is relatively unprofitable, so its implementation is not advisable.

Second way. Based on the formula (*), we determine the maximum acceptable investment:

The result obtained means that the project is not acceptable if investments are available on the market.

If we do not take into account the conditions of investments in the market (average profitability, risk), but take into account only inflation, then the profitability of the project will be:

And in this case, the expected profitability is less than the minimum allowable, that is, the project is unacceptable.

The third way... Based on the average market conditions and the amount of investments, we will calculate the minimum acceptable income and compare it with the expected one.

Acceptable income (f. (*)) With an investment of 20 million rubles. will be:

This result once again confirms the conclusion made about the unacceptability of the project in question.

Answer: The project is unacceptable.

Task 7.1.10.

You can buy a package of zero-coupon bonds for 9 thousand rubles. The bonds mature in 2 years. The nominal price of the package is 12 thousand rubles. The expected inflation rate is 10%. Is it worth buying a package of bonds if you need a real income of at least 4% per annum?

Methodical instructions:

Answer: The package of bonds should be purchased, since its real yield is higher than the minimum allowable.

Task 7.1.11.

The investor invests 1 million rubles in the investment object for 3 years. Required real interest rate of return 5% per annum. The projected average annual inflation rate is 10%. Determine the minimum amount of money that this investment object should bring to the investor so that it makes sense for the investor to invest money in it, and evaluate the feasibility of investing money in the investment object, which, in accordance with the business plan, should bring the investor 1,500 thousand rubles in 3 years. R.

Methodical instructions: use formulas (2.1.7), (7.1.10);

Answer: In order for the investment to be expedient, the project must bring at least 1.54 million rubles in three years, so the investment is impractical.

Task 7.1.12.

The rise in prices for 3 years was 7%. Estimate the average annual rate and inflation index.

Methodical instructions: 1) use formulas (2.1.7) and (2.1.9);

2) introduce the notation: - average annual inflation rate, - inflation rate for n years.

We get: ![]()

Answer: The average annual inflation rate is 2.28%, the annual inflation rate is 1.0228, or 102.28%.

Task 7.1.13.

The citizen has entered into a deposit agreement at 15% per annum. The forecasted inflation rate is 1% per month. Estimate the real interest rate.

Methodical instructions: 1) use formulas (2.1.7) and (2.1.9);

2) introduce the notation: - inflation rate per month, - annual inflation rate.

We find the real return (interest rate) using Fisher's formula:

Answer: Real interest rate (yield) 2.04% per year.

Task 7.1.14.

The need for the company's working capital in the reporting year was $ 1.2 million, the profit was $ 0.5 million. The inflation rate was 15%. Can a company withdraw all profits from circulation and use them for social needs?

Methodical instructions: 1) use the formula (2.1.7);

2) introduce the notation: - annual inflation rate, OBSo - the need for working capital in the reporting year, OBSP - the planned need for working capital, Po - profit in the reporting year, Ps - profit for social needs.

ObS = ObSp - ObSo = 1.32 - 1.2 = 0.12 million dollars.

Consequently, the following can be directed to social needs:

Ps = Po - obS = 0.5 - 0.12 = 0.38 million dollars.

Answer: An enterprise can spend no more than 380 thousand dollars for social needs.

Task 7.1.15.

Assess the impact of inflation on the balance sheet of an enterprise for a certain period. Build models that describe the financial condition of the enterprise at the end of the period, as well as calculate the profit or loss it received as a result of price changes. During the period under review, no business transactions were made. The inflation rate was 12%. The rate of change in the current valuation of non-monetary assets was 18%. The balance of the enterprise at the initial moment t 0 is presented in table. 7.1.1.

Table 7.1.1 - The balance of the enterprise at the moment t 0, mln.

Methodical instructions: 1) study clause 7.1.2 of the content; 2) take into account that inflationary profit is an increase in capital due to price increases, as well as due to inflationary growth in the excess of monetary liabilities over monetary assets; 3) introduce the designations: NA - non-monetary assets; MA - monetary assets; SK - equity capital; MO - monetary liabilities; B0 - balance sheet currency (advanced capital) at the beginning of the period; B 1 - balance sheet currency at the end of the period; P and - inflationary profit.

MA + HA = SK + MO |

12 + 85 = 30 + 67 |

Inflationary profit is zero (P and = 0), since the impact of inflation is not reflected in the accounting and reporting.

Situation 2. Accounting is carried out in monetary units of the same purchasing power (methodology GPL) , taking into account the general price index.

There are two possible options for consideration. V first this option assumes the recalculation of non-monetary assets taking into account the price index. The balance equation will take the form:

MA + HA (1 + Ti) = SK + HATi + MO |

12 + 85 (1 + 0,12) = 30 + 850,12+67 |

Received change ONTi= 85 0.12 = 10.2 million rubles. can be interpreted as a change in the owners' capital (SK - revaluation of non-current assets) and, accordingly, as inflationary profit (P and).

Second The (more rigorous and methodologically correct) option involves taking into account the impact of inflation by comparing monetary assets and monetary liabilities. This approach is due to the fact that monetary liabilities in an inflationary environment bring indirect income, and monetary assets - an indirect loss. In this version, the balance equation will be as follows:

MA+ HA (l + Ti) = MO+ SC (1+ Ti) + Ti(MO - MA) |

12 + 85 1,12 = 67 + 30 1,12 + 0,12 (67 — 12) |

12 + 95,2 = 67 + 33,6 + 6,6 |

Due to inflation, the amount of advanced capital increased by:

B = B 1 - B 0 = 107.2 - 97.0 = 10.2 million rubles.