Rules for dismissal by agreement of the parties. Dismissal by agreement of the parties: we part amicably Tax accounting for compensation at the enterprise

Read also

Hello readers of my blog.

In this article, I want to consider the process of calculating the amounts for payment for a dismissed employee.

As always, we will consider the whole process using a specific example.

Example.

In the organization "CJSC Stroykomplekt" on May 15, 2012, by agreement of the parties, an employee is dismissed Samoilov Yury Alexandrovich It is necessary to issue a personnel dismissal and make a final settlement with the employee: accrue severance pay for three days, calculate wages for the month of May and calculate compensation for unused vacation.

I considered how to issue a personnel order for dismissal.

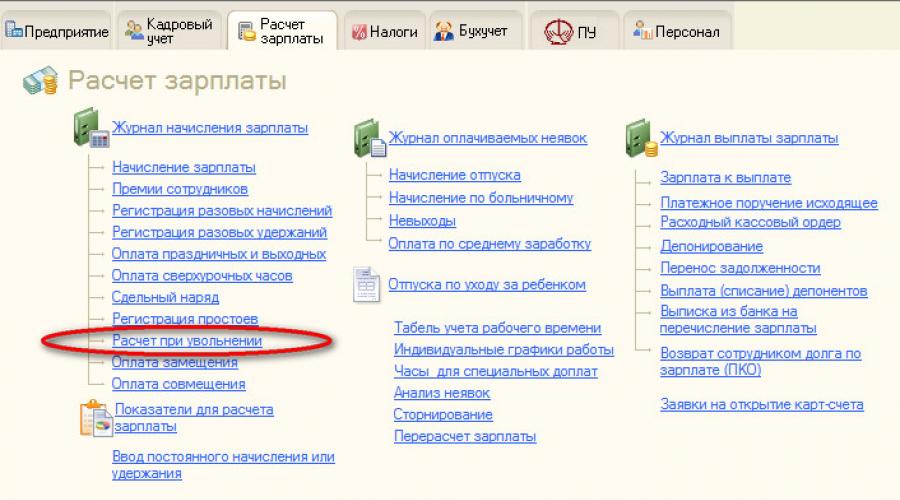

The personnel order was issued, then we proceed to the calculation. If the employee is entitled to any compensation payments (severance pay, compensation for vacation, etc.), then for these purposes it is necessary to use the document “Calculation upon dismissal”. You can find this document on the desktop or in the interface Payroll(main menu - Payroll - Primary documents - Calculation upon dismissal).

Fill in the fields in the new document “Organization, Month of accrual (for our example, this is May), employee”

, on the "Conditions" tab, you must indicate the personnel order for dismissal and in the "Compensation upon dismissal" section, indicate the number of days for severance pay. The number of days of vacation compensation will be filled in from the personnel order.

After the required fields are filled in, try to make the calculation. The calculation is made by clicking the "Calculate" button.

If there were no errors during the calculation, then the entered compensations will be calculated on the “Accruals” tab.

If the data is not calculated, there may be several options:

- The employee leaves in the same month in which he was hired. In this case, the average earnings must be calculated manually from the salary and entered on the first tab "Conditions".

- It is necessary to check whether the database is filled for these types of calculation. You can view the settings in the interface "Payroll" Further "Main menu - Enterprise - Payroll setup - Average earnings" .

After the compensation is calculated, it is necessary to calculate the basic salary. You can do this with a document. "Payroll".

By the button "Fill - Selection of employees" select the dismissed employee and press the button "Calculate (full calculation)".

When the salary and taxes are calculated, it must be paid. Payment of wages is carried out by the document "Salary payable".

1. How is dismissal by agreement of the parties different from dismissal on other grounds.

2. How to formalize the termination of an employment contract with an employee by agreement.

3. In what order are taxes and contributions calculated from compensation paid upon dismissal by agreement.

An employment contract with an employee can be terminated both at the initiative of the employee and at the initiative of the employer, as well as due to circumstances beyond the control of the parties. In addition to these grounds, the Labor Code of the Russian Federation also provides for dismissal by "mutual consent", that is, by agreement of the parties. However, the situation when both the employee and the employer are simultaneously interested in terminating the employment relationship is extremely rare in practice. As a rule, the initiator is still one party, and most often, the employer. Then why do employers prefer, instead of laying off, for example, to reduce the number or staff, "negotiate" with employees? You will find the answer to this question in this article. In addition, we will find out what are the features of the design and conduct of the dismissal procedure by agreement of the parties, how it can be beneficial to the employer and employee.

Article 78 is devoted to dismissal by agreement of the parties in the Labor Code of the Russian Federation. And literally, the content of this entire article is as follows:

The employment contract can be terminated at any time by agreement of the parties to the employment contract.

The Labor Code does not contain any more clarifications regarding the procedure for conducting and formalizing the dismissal of an employee by agreement of the parties. Therefore, when terminating an employment relationship with an employee on this basis, one should be guided by established practice, primarily judicial, as well as explanations given by individual departments, such as the Russian Ministry of Labor.

Features of dismissal by agreement of the parties

To begin with, let's define how dismissal by agreement of the parties is fundamentally different from dismissal on other grounds. These features just explain why employers and employees in certain situations prefer to disperse by drawing up an agreement.

- Ease of design.

All that is required for the dismissal by agreement is the will of the employee and the employer, documented. Moreover, the whole procedure can take only one day - if the day the agreement is drawn up is the day of dismissal. Neither the employer nor the employee is obliged to notify each other in advance of their intention to terminate the employment contract. In addition, the employer does not need to notify the employment service and the trade union. Thus, it is obvious that it is much easier for an employer to “break up” with an employee by agreement than, for example, by.

- Opportunity to agree terms of dismissal.

According to the meaning of the very wording “dismissal by agreement of the parties”, termination of the employment contract in this case is possible if the employee and the employer agreed to the conditions put forward by each other, that is, they reached an agreement. In this case, the conditions can be very different. For example, the agreement can provide for the payment of monetary compensation to the employee (severance pay) and its amount, as well as the period of work, the procedure for transferring cases, etc. It should be noted that the payment of severance pay upon dismissal by agreement is not a prerequisite, and its minimum and maximum amounts are not established by law. Also, the term of working off - it may not be at all (dismissal on the day the agreement is signed), or, on the contrary, it can be quite long (more than two weeks). It is obvious how these terms of dismissal by agreement affect the interests of the employee and the employer: for the employee, the advantage is the opportunity to receive monetary compensation, and for the employer, the opportunity to set the necessary period for working off and transferring cases to a new employee.

- Change and cancellation only by mutual agreement.

After the agreement establishing a certain date and conditions for dismissal is signed by the employee and the employer, it is possible to amend or withdraw from it only by mutual agreement. That is, an employee with whom an agreement on termination of an employment contract has been signed cannot unilaterally “change his mind” about resigning or put forward new conditions for dismissal (Letter of the Ministry of Labor of April 10, 2014 No. 14-2 / OOG-1347). This is one of the main advantages of dismissal by agreement of the parties for the employer compared, for example, with the dismissal of an employee of his own free will, in which the employee has the right to withdraw his resignation letter.

! Note: In the event that the employee sends a written notice of his desire to terminate or change the previously signed dismissal agreement, the employer should also respond in writing, arguing his position (to meet the employee halfway or leave the agreement unchanged).

- The absence of "exceptional" categories of workers who are not subject to dismissal by agreement.

The Labor Code of the Russian Federation does not provide for any restrictions on employees who can be dismissed by agreement of the parties. Therefore, being an employee on vacation or on sick leave cannot be considered as an obstacle to terminating an employment contract with him on this basis, in contrast, for example, to dismissal at the initiative of the employer (part 6 of article 81 of the Labor Code). Under the agreement, employees who have concluded both a fixed-term employment contract and an indefinite one, as well as employees during a probationary period, can be dismissed.

Also, from a formal point of view, the legislation does not prohibit the dismissal of a pregnant employee by agreement of the parties: such a ban is valid only upon dismissal at the initiative of the employer (part 1 of article 261 of the Labor Code). However, when terminating a contract with a pregnant woman, the employer should be especially careful: firstly, the consent to terminate the contract must really come from the employee herself, and secondly, if the employee did not know about her pregnancy at the time of signing the dismissal agreement, but found out later and expressed a desire to annul the agreement, the court may recognize her claim as legitimate (Ruling of the Supreme Court of the Russian Federation dated 05.09.2014 No. 37-KG14-4).

- No special justification is required for dismissal.

Unlike, for example, dismissal for disciplinary violations, in which the employer needs to have sufficient evidence of the fact that they were committed by the employee, dismissal by agreement is based solely on the will of the parties and does not require any evidence or confirmation (the main evidence is the agreement itself, signed by the parties) . Thus, if the employee is “guilty”, then dismissal by agreement can be beneficial to both parties: the employee will avoid an unpleasant entry in the work book, and the employer will not have to additionally confirm the legality of the dismissal.

These are the main distinguishing features of dismissal by agreement of the parties, which explain its attractiveness for both parties to labor relations. Employers especially “love” dismissal on this basis: this is the fastest and surest way to part with objectionable employees, which virtually eliminates the possibility for workers to challenge its legitimacy and reinstate their jobs- after all, they personally agreed to terminate the employment contract. Of course, we are talking about the voluntary consent of the employee to dismissal, and not about situations where such consent was obtained under pressure or fraudulently (which, however, the employee will have to prove in court).

The procedure for issuing dismissal by agreement of the parties

- Drawing up an agreement on termination of the employment contract.

Such an agreement between the employee and the employer is the basis for dismissal, so it must be documented without fail. However, the form of the dismissal agreement is not regulated, that is, the parties have the right to draw it up in any form. The main thing that this document should contain:

- grounds for dismissal (agreement of the parties);

- date of dismissal (last working day);

- written will of the parties to terminate the employment contract (signature).

An agreement on termination of an employment contract can be drawn up:

- in the form of an employee's statement with a written resolution of the employer. This option is the simplest, but it is suitable in cases where only the date of dismissal is agreed (which is indicated in the application);

- in the form of a separate document - an agreement on termination of an employment contract. Such an agreement is drawn up in two copies, one for the employee and the employer. In addition to the mandatory components, it may contain additional conditions that the parties have agreed on: the amount of monetary compensation (severance pay), the procedure for transferring cases, granting leave with subsequent dismissal, etc.

- Issuing a notice of dismissal

An order for the dismissal of an employee by agreement of the parties, as well as for dismissal for other reasons, is drawn up in the unified form T-8 or T-8a (approved by Resolution of the State Statistics Committee of Russia dated 01/05/2004 No. 1) or according to. At the same time, the order states:

- in the line “The basis for termination (termination) of the employment contract (dismissal)” - “Agreement of the parties, clause 1, part 1, art. 77 of the Labor Code of the Russian Federation”;

- in the line "Basis (document, number and date)" - "Agreement on termination of the employment contract No. ... from ...".

- Filling out a work book

When an employee is dismissed by agreement of the parties, the following entry is made in his work book: “The employment contract is terminated by agreement of the parties, clause 1 of part one of Article 77 of the Labor Code of the Russian Federation”

The dismissal record is certified by the employee responsible for maintaining work books with the seal of the employer, as well as the signature of the dismissed employee (clause 35 of Decree of the Government of the Russian Federation of 04.16.2003 No. 225 “On work books”). The work book is issued to the employee on the day of dismissal (part 4 of article 84.1 of the Labor Code of the Russian Federation), and the fact of its receipt is confirmed by the signature of the employee in the personal card and the register of work books and inserts in them.

Payments upon dismissal by agreement of the parties

On the day the employee is dismissed, that is, on the last working day, the employer must pay him in full (Articles 84.1, 140 of the Labor Code of the Russian Federation). The following amounts are payable:

- wages for hours worked (up to and including the day of dismissal);

- compensation for unused vacation;

- severance pay (if its payment is provided for by agreement of the parties).

! Note: The final settlement with the employee must be made on the day of termination of the employment contract. The employer is not entitled to set a later payment period (after dismissal), even if the employee himself does not object and such a period is provided for by the agreement on termination of the employment contract (Article 140 of the Labor Code of the Russian Federation).

The calculation and payment of wages for the days worked and compensation for unused vacation (withholding for vacation used in advance) upon dismissal by agreement of the parties are no different from similar payments upon dismissal for other reasons. Therefore, we will dwell in more detail on the “specific” payment - monetary compensation in the form of severance pay.

As already mentioned, the amount of severance pay does not have any legally established restrictions and is determined only by agreement of the parties. In practice, most often The amount of severance pay is determined by the employee:

- in the form of a fixed amount;

- based on the official salary (for example, in double the amount of the official salary established by the employment contract);

- based on average earnings for a certain period after dismissal (for example, in the amount of average earnings for two months after dismissal).

! Note: If the amount of the severance pay is established on the basis of average earnings, its amount is determined in accordance with Decree of the Government of the Russian Federation of December 24, 2007 No. 922 “On the peculiarities of the procedure for calculating average wages”. At the same time, the procedure for calculating the average daily earnings for the payment of severance pay differs from that used for calculating vacation pay and compensation for unused vacation. The average daily earnings for the payment of severance pay is calculated by dividing the amount of payments included in the calculation for the last 12 calendar months preceding the day of dismissal by the number actually worked out for this period of days (paragraph 5, clause 9 of Resolution No. 922). Thus, the amount of severance pay depends on the number of working days in the period for which it is paid.

Taxes and contributions from severance pay by agreement of the parties

- Personal income tax from severance pay paid upon dismissal by agreement of the parties

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, not subject to income tax the following payments related to the dismissal of employees:

- severance pay,

- average monthly salary for the period of employment,

- compensation to the head, deputy heads and chief accountant of the organization,

provided that the amount of such payments does not exceed in total three times the average monthly earnings(six times - for employees of organizations located in the regions of the Far North and equivalent areas). Amounts exceeding three (six) times the average monthly earnings are subject to personal income tax in the general manner (Letter of the Ministry of Finance of Russia dated 03.08.2015 No. 03-04-06 / 44623).

! Note: According to the explanations of the Ministry of Finance of the Russian Federation, in order to apply paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, the following must be taken into account:

- If the severance pay due to the employee upon dismissal by agreement of the parties is paid to him in installments, then in order to determine the amount of the allowance not subject to personal income tax, it is necessary sum up all benefit payments, even if they are produced in different tax periods (Letter of the Ministry of Finance of Russia dated August 21, 2015 No. 03-04-05 / 48347).

- To determine the threefold (sixfold) size of the average monthly earnings should be guided by Art. 139 of the Labor Code of the Russian Federation and the procedure for calculating the average wage (average earnings) established by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the features of the procedure for calculating the average wage” (Letter of the Ministry of Finance of Russia dated June 30, 2014 No. 03-04-06 / 31391) . The average daily earnings are calculated in the following order:

* Settlement period - equal to 12 previous calendar months

- Contributions from severance pay paid upon dismissal by agreement of the parties

By analogy with personal income tax, insurance premiums to the PFR, FFOMS and FSS not charged on the amount of payments in the form of severance pay and average monthly earnings for the period of employment, not exceeding in total three times the average monthly salary(six times - for employees of organizations located in the regions of the Far North and areas equated to them) (paragraph “e”, paragraph 2, part 1, article 9 of Law No. 212-FZ, paragraph 2, paragraph 1, article 20.2 of Law No. 125-FZ). The part of the severance pay paid upon dismissal by agreement of the parties, exceeding three (six) times the average monthly salary, is subject to insurance premiums in the general manner (Letter of the Ministry of Labor of Russia dated September 24, 2014 No. 17-3 / B-449).

- Tax accounting of compensation upon dismissal by agreement of the parties

Employers using both DOS and STS, are entitled to expense to pay the amount of severance pay to employees dismissed by agreement of the parties (clause 6 clause 1, clause 2 article 346.16; clause 9 article 255 of the Tax Code of the Russian Federation). The main condition: the payment of such benefits must be provided for by an employment or collective agreement, an additional agreement to an employment contract or an agreement on termination of an employment contract. The severance pay is taken into account for tax purposes in the full amount without any restrictions.

Do you find this article useful and interesting? share with colleagues on social networks!

Remaining questions - ask them in the comments to the article!

Yandex_partner_id = 143121; yandex_site_bg_color = "FFFFFF"; yandex_stat_id = 2; yandex_ad_format = "direct"; yandex_font_size = 1; yandex_direct_type = "vertical"; yandex_direct_border_type = "block"; yandex_direct_limit = 2; yandex_direct_title_font_size = 3; yandex_direct_links_underline = false; yandex_direct_border_color = "CCCCCC"; yandex_direct_title_color = "000080"; yandex_direct_url_color = "000000"; yandex_direct_text_color = "000000"; yandex_direct_hover_color = "000000"; yandex_direct_favicon = true; yandex_no_sitelinks = true; document.write(" ");

Normative base

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

- Federal Law No. 212-FZ dated July 24, 2009 “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”

- Federal Law No. 125-FZ of July 24, 1998 “On Compulsory Social Insurance against Occupational Accidents and Occupational Diseases”

- Decree of the Government of the Russian Federation of April 16, 2003 No. 225 “On work books”

- Decree of the Government of the Russian Federation of December 24, 2007 No. 922 "On the peculiarities of the procedure for calculating the average wage"

- Decree of the State Statistics Committee of the Russian Federation dated 05.01.2004 No. 1 “On approval of unified forms of primary accounting documentation for accounting for labor and its payment”

- Determination of the Supreme Court of the Russian Federation of 05.09.2014 No. 37-KG14-4

- Letters from the Ministry of Labor

- No. 14-2/OOG-1347 dated April 10, 2014

- dated September 24, 2014 No. 17-3 / V-449

It should be noted that dismissal by agreement of the parties (UPS) appeared in the Labor Code of the Russian Federation since 2001, and precedents for its use have taken place since 2002. However, this wording of the legal basis for dismissal has the most law-enforced practice today as a ground for dismissal. Moreover, it is, frankly, preferred by both personnel officers and heads of commercial companies.

Employment contract form attribute

Dismissal by agreement of the parties (Article 77 of the Russian Labor Code) is often encountered in connection with the spread of the contract form of employment in the Russian labor market. This form of contractual relationship between employers and staff is an indispensable element of the market system.

Is this leadership in the labor market justified? Is the ease of interruption of labor relations inherent in this form of dismissal positive: employer-employee? This is a moot point. According to official statistics, the unemployed make up 2-3% of the entire working-age population.

These data are objectively underestimated all over the world. The fact is that not all unemployed are registered at the labor exchange for various reasons. Therefore, it is a generally accepted fact that the data of the International Labor Organization are 4-5 times higher than the official statistics on unemployment.

And it is the dismissal by agreement of the parties that is absolutely in the lead in terminating labor relations. The features of this type of dismissal in the conditions of the existence of the labor market are more clearly visible in comparison with other forms of termination of labor relations.

By downsizing and by agreement of the parties

It is well known that dismissal during staff reduction is a companion of economic crises and their consequences - optimization of the organization's staff structure. Its legal justification (see paragraph 2 of Article 81 of the Russian Labor Code) is quite organizationally complex and time-consuming.

The employer is obliged to warn in advance the staff being reduced in this way and, in addition, to offer candidates for dismissal an alternative staff position (note that the existing staff is often characterized by a shortage of vacant positions).

He must also identify the personnel to whom the law guarantees the preferential right to remain in the state, and implement it. Therefore, some employers, optimizing their staff, are trying to replace the “downsizing” with an “agreement of the parties”, achieving certain benefits for the company to the detriment of the dismissed.

Paragraph 1 of Article 77 of the Russian Labor Code offers a less organizationally biased way - dismissal by agreement of the parties. This method of termination of labor relations involves a short time frame, joint regulation of the process of dismissal by the company's management and the employee. At the same time, the administration is not required to comply with the above formalities and the participation of the trade union organization.

At their own request and by agreement of the parties

The absence of a mandatory working period distinguishes the method we are studying from dismissal of one's own free will, in which only the employee himself writes the application.

In case of dismissal of one's own free will (UPSZH), such a statement is drawn up fourteen days before the agreed date of leaving work. During the aforementioned two weeks, the staff member continues to perform his/her previous duties. He also has the right to take a vacation for this period. However, even if the employee is on sick leave, the 14-day period will not be considered interrupted.

Dismissal by agreement of the parties has also been significantly simplified with respect to the UPSZH. First of all, the difference lies in the absence of a two-week period of work - until the date of dismissal. The date of departure from work is negotiable, and the director also negotiates some additional conditions with the dismissed employee by mutual agreement. The employment relationship can be terminated on a date agreed upon in advance, even if the employee is on vacation or on sick leave.

Legal differences between the two types of dismissals

Dismissal by agreement of the parties involves the procedure for terminating the employment contract between the employer and the employee in accordance with Article 78 of the Russian Labor Code. Employers more often use it in cases of labor violations by employees (absenteeism, appearing at the workplace in a state of intoxication, failure to perform official duties). However, even more often, this layoff is initiated by the employees themselves. It, as you noticed, has similar features with dismissal of one's own free will. However, there are differences (see table 1)

Table 1. Comparative characteristics of UPSS and UPSZH

When analyzing the information contained in the above table, pay attention to the detail: it is impossible to challenge the dismissal by agreement of the parties unilaterally (unlike the UPSZh). It was adopted jointly under the UPSS, and therefore ceases to operate by mutual agreement.

At the request of one of the parties, dismissal cannot be prevented. However, if it is carried out under the compulsion of the employer, it can be challenged in court. In this case, the employee is reinstated in his previous position with the payment of average earnings for forced absenteeism.

Payment of compensation

If there is a dismissal by agreement of the parties, compensation for unused vacation must be paid to the employee. In addition to her, he is obligatorily paid accrued wages for the current month to the last day of work, as well as bonuses and various bonuses (for length of service, qualifications) taken into account in the organization's wages. Then the employee receives a work book and a certificate of average monthly wages.

However, not only mandatory payments promise an employee dismissal by agreement of the parties. Compensation in the amount of one salary is often stipulated by the employer in orders for the organization.

However, not only mandatory payments promise an employee dismissal by agreement of the parties. Compensation in the amount of one salary is often stipulated by the employer in orders for the organization.

The legislation does not establish a specific framework for such payments, therefore, the agreement between the employer and the employee may establish a contractual amount of additional compensation.

It is no secret that this type of dismissal is more beneficial for the employer than for the employee. The motivation is well known: the employee cannot independently withdraw the written application, and the trade union, in turn, cannot influence this process in any way.

Therefore, an employee who has chosen dismissal by agreement of the parties must necessarily consider compensation as a section of the contract with the employer. Federal Law No. 330-FZ of November 21, 2011 established the procedure for taxing personal income tax compensation. In accordance with paragraph 8 of clause 3 of Article 217 of the Russian Tax Code, compensation not exceeding three employee salaries is exempt from taxation.

Article 178 of the Labor Code governs the payment of such termination benefits. According to it, provisions for its payment can be included in the collective labor agreement. The second option for regulating such compensation is stipulated directly in the documents that accompany a specific dismissal by agreement of the parties. At the same time, in accordance with paragraph 3 of Article 217 of the Tax Code of the Russian Federation, personal income tax was not levied on severance pay not exceeding three salaries, and for the regions of the Far North - six salaries.

Registration of dismissal

The current practice of processing such a dismissal does not provide for any standard documents. However, the preferred design option is an agreement drawn up jointly by the employee and the employer. An indication of the desired legal consequences of termination of employment due to mutual agreement of the parties, an indication of the date accompany the dismissal by agreement of the parties. Payments of the amount of severance pay, the timing of the transfer of cases and positions to a new employee are also negotiated. Consider an example of the above convention.

Agreement on termination of the employment contract

The employer - Alfa-Trade LLC represented by the director Pavlov Konstantin Borisovich, acting on the basis of the charter, and the employee - merchandiser Marina Viktorovna Selezneva came to an agreement that:

- The employment contract of 21.02.2010 N 35 will be terminated by agreement of the parties.

- The employment contract is terminated on July 20, 2014.

- The employee is paid compensation in the amount of one official salary.

The agreement is made in 2 copies with equal legal force, 1 for each party.

Director Print Pavlov Konstantin Borisovich

Worker Selezneva Marina Viktorovna

The initiator of the dismissal is an employee

However, the proposed method of registration can often be preceded by a written application by the employee or a corresponding appeal from the administration to him. At the same time, there is no single sample on how to write a letter of resignation by agreement of the parties. Therefore, we present an example of such a document.

employee application form

Director of Alfa-Trade LLC

Pavlov Konstantin Borisovich

Statement

I ask for your consent to terminate the employment contract with me from July 20, 2014, respectively, paragraph 1 of Art. 77 of the Labor Code (reason - by agreement of the parties).

I consider it expedient to establish a severance pay in the amount of two salaries.

Until I have received your written consent, I reserve the right to withdraw this application at any time.

Merchandiser Selezneva

Marina Viktorovna.

The agreement, as an option, may also be preceded by an appeal from the administration, initiating dismissal by agreement of the parties. The sample text is similar to that presented in the application.

Administration Letter

Dear Marina Viktorovna!

We suggest you terminate the employment contract, guided by paragraph 1 of Art. 77 of the Labor Code (i.e. by agreement of the parties) from July 20, 2014

Compensation is established, according to the collective labor agreement, in the amount of two salaries.

Director

Pavlov K.B.

Issuing a notice of dismissal

Based on the agreement, the head of the organization signs the corresponding order. Dismissal by agreement of the parties is gaining legal force at this moment. Often, along with this order, an order is issued on the acceptance and transfer of cases and an inventory.

Alfa-Trade LLC

07/20/2014 No. 15-k

Moscow

On the dismissal of Selezneva M.V.

FIRE:

Selezneva Marina Viktorovna, merchandiser, 07/20/2014 by agreement of the parties (Article 37 of the Labor Code).

The accounting department to pay Selezneva M.V. monetary compensation in the amount of three salaries.

Reason: statement by Selezneva M.V. dated July 15, 2014.

Director of Alfa-Trade LLC Pavlov K.B.

Selezneva M.V. has read and agrees with the order.

By means of such an order, dismissal is carried out by agreement of the parties. At the same time, the entry in the work book must necessarily mention clauses 1 of part 1 of article 77 of the Labor Code.

Should the wording “dismissal by agreement of the parties” be avoided when dismissing?

This question, of course, is controversial and associated with myths.

Myth No. 1: an employee dismissed by agreement of the parties is a violator of labor discipline.

Myth No. 2: An employee who terminates an employment relationship in this way is underskilled.

The reason for the emergence of these prejudices was the practice of employers to “cut down” negligent employees under Article 77 of the Labor Code. However, if an employee is confident in his qualifications, as well as in the fact that he will be immediately employed elsewhere, then these myths are insignificant. On the contrary, a person will be able to quickly get the expected job.

Conclusion

Is the OPS in its current form ideal as a labor market tool? Based on macroeconomic patterns, its parameters (for example, non-participation of trade unions in its process) are incorrect with a significant level of unemployment.

To fully operate such a market mechanism in the labor market, ideally, a growing economy and a sufficient level of supply of competitive jobs are needed. However, the simplified organizational aspects that accompany the UPSS are in many cases preferable for the prompt termination of labor relations. This factor determines its wide application.

A person dismissed by agreement of the parties should take into account that in some cases an incorrectly executed agreement and, accordingly, an order to dismiss by agreement of the parties may ignore the payments or benefits due to him. Therefore, everything should be foreseen and taken into account.

Dismissal in 1C is a procedure that every accountant faces in his work. In today's article, we will take a closer look at how to perform this operation in a 1C configuration: Salary and personnel management 8.3. Let's consider the following questions:

1. Where is the document for dismissal in 1C

The procedure for dismissing an employee in 1C ZUP 8.3 is carried out in one document. You can go to it both through the main menu and through the positions “All personnel documents” or “Receptions, transfers, dismissals”.

2. Creation of the document “Dismissal”

Let's start creating a document. Specify the month in which the final settlement with the employee will be made; choose the employee. On the “Terms of dismissal” tab, we prescribe the date of dismissal and its reason, which we select from the corresponding directory.

3. Compensation for basic leave

4. Compensation or deduction calculation

The 1C program automatically indicates the sign of compensation for unused vacation and calculates the entire block based on the balances throughout the company. You will need to adjust that the refund or withholding is for an integer number of days.

5. Severance pay

Severance pay, as a rule, is used either by agreement of the parties, or in case of staff reduction. The number of working days is specified manually.

Information about additional holidays fill in the document table

6. Calculation of accruals and deductions

In the calculations section, you can see all the information on accruals and deductions; they are calculated automatically based on the data entered earlier. To see how the calculation took place, click on the “pencil” in the right corner.

7. Payment of accruals

8. Details of calculations

On the “Accruals and deductions” tab, you can familiarize yourself with all the details of these operations; Please note that all bookmarks are filled in automatically.

9. Document-the basis for dismissal

On the “Additional” tab, indicate the document that became the basis for dismissal. In the future, this will be reflected in the printed form of the order. In the signature section, we indicate information about the director and other employees (if necessary).

10. Document holding

We carry out the document and voila - the employee is fired. Then you can use the printed forms offered by the program.

11. Certificate of income, certificate for calculating benefits

Based on the document, you can create other documents: income certificate, certificate for calculating benefits, etc.

12. Group dismissal

If you need to carry out a group dismissal, go to the "Admissions, transfers, dismissals" journal and select the position you need by clicking the "Create" button.

In the future, each time you add an employee to dismiss, the same form will open in front of you as with a single dismissal. The dismissal algorithm remains the same.

13. Dismissal order

When you add and fill in the data on all employees, the document will be posted, and you will be able to print the dismissal order in the form No. T-8a.

Thus, the dismissal of an employee in 1C ZUP is carried out. We hope this article was helpful to you.

Termination of an employment contract is an ordinary operation in many large enterprises. From a legal point of view, this procedure is easier to carry out by agreement of the parties, i.e. when the employee and the employer express a desire to terminate cooperation. After termination of the contract, the employee will receive monetary compensation, the amount of which is determined from the number of days worked.

What is an agreement on termination of an employment contract by agreement of the parties

The termination of the relationship between the employer and the specialist can be carried out in different ways. One of them is the termination of the employment contract by agreement of the parties. The procedure is carried out with the written consent of the boss and employee. Dismissal by agreement of the parties with the payment of compensation is convenient not only for the employer, but also for the employee. The employee and the boss can agree on the amount of compensation payments, the procedure for transferring the work book and other aspects of the procedure.

Compilation rules

The dismissal can be initiated by a superior or a subordinate. The party initiating the procedure is obliged to inform the other party that it wishes to terminate the contract. For this purpose, a notification is made. The written proposal does not contain the exact date of termination of work, because. the parties clarify this point at the meeting. The document is filled in in any form. The following information is included in the agreement:

- number, date of drawing up the employment contract;

- the expected date of completion of the work of the employee with all the details of the company;

- a clearly formulated desire of both parties to voluntarily terminate the employment contract;

- the reason for dismissal, indicating the article of the labor code;

- additional conditions (the amount of compensation payments, the need to return equipment provided for the duration of work, etc.).

The agreement is drawn up in two copies. One remains with the initiator of the procedure. When writing a letter of resignation by mutual agreement of the parties, there are always many problems with the wording of proposals. It is important for an employee not only to express a desire to terminate activities in the company, but also to protect financial interests, so the amount of compensation payments must be written in the text.

Why is it necessary

The agreement is drawn up to protect the rights of the employee and the employer. After the document is signed, any claims from the side will be considered invalid. It is impossible to change the terms of the agreement unilaterally. With this type of dismissal, a two-week working off is not mandatory, but it can be assigned if a similar clause is specified in the employment contract. The agreement contains information about payments, about the time of termination of work.

Regulatory and legal framework

The procedure for dismissal by agreement of the parties is described in detail in article No. 78 of the Labor Code of the Russian Federation (LC). Under the law, an employment contract can be terminated at any time if there is the consent of the director and employee. Compensation upon dismissal by agreement of the parties is provided without fail. Information on the procedure for payments contains articles No. 78, 181, 279, 307 of the Labor Code. The amount and features of the provision of severance pay are specified in the contract with the company. If there is no information about such compensation, then the employer is not obliged to provide it.

Distinctive features

One of the features of this procedure is that it is not regulated by the trade union organization, therefore, all disputes with the employer will be resolved by state bodies in accordance with the judicial procedure for considering labor complaints. Cases related to violations of working conditions are considered by the court of first instance within 2-3 weeks from the date of receipt of the application. Other salient features of consensual dismissal:

- Ease of design. To terminate the contract, you must obtain a written expression of the will of a hired specialist or employer. You do not need to inform the trade union or the employment service.

- Termination of the contract occurs by agreement. The very wording of this procedure assumes that both parties have agreed to the terms put forward to each other. For example, the CEO decides to grant an employee's request for severance pay.

- You can cancel or change the terms of the procedure with the consent of both parties. Once the agreement is signed by the employee and the boss, it cannot be corrected. For this reason, lawyers recommend re-reading it 2-3 times before signing a document. Employers often forget to provide information about the due payments, and then provide compensation of the minimum amount, which causes dissatisfaction with the dismissed person, but it will not work to change its amount even through the court after signing the agreement.

- Justification is not required to terminate an employment contract. Unlike dismissal for disciplinary offenses, the director does not have to look for evidence of the subordinate's misconduct. In this procedure, the evidence will be an agreement signed by both parties.

Who can be the initiator

The procedure involves mutual agreement to terminate the employment relationship, but often the boss wants to fire the subordinate. From a practical point of view, it is beneficial for the director to terminate the contract if there is an agreement, because the employee will not be able to challenge the decision of the company, because. I myself agreed with him. An employee by mutual agreement can quit even in case of temporary disability or while on a business trip. The trade union or any other persons cannot interfere in the dismissal process.

The procedure for terminating an employment contract

One of the parties is obliged to send a proposal for dismissal. The next step is to obtain written consent for the procedure. The document must contain the signature of the second party, the date of signing. Next comes the agreement. Both parties are required to participate in the execution of the document.. An employee does not have to immediately agree to the requirements of the employer. A citizen can think for 3-4 days and make a counter offer. After all the nuances are settled, and the agreement is signed, the employer needs to do the following:

- Issue a dismissal order. The document is drawn up on the day entered in the agreement.

- Familiarize the employee with the issued order. The citizen is obliged to put his signature on the document. If the employee refuses to sign the order, an act is drawn up.

- Register information about the dismissal in the employee's personal card. The first part of the form No. T-2 is filled out when a specialist is hired by the enterprise, and the second part - when the contract is terminated. After making an entry, a citizen must show a personal card, and then get his signature confirming that he has read the document. The form remains in the personnel department.

- Make an entry in the workbook. It is obligatory to refer to the first part of article No. 1 of the Labor Code. In the work book, the manager, at will, can make his own review, both negative and positive. It will not affect the amount of compensation in any way.

- Make a final settlement with the employee. The employer is obliged to pay remuneration for the last working month, money for unused vacation, severance pay.

- Issue the following documents to the citizen:

- work book;

- certificate in form 182H for sick leave;

- certificate of the amount of contributions to the Pension Fund;

- certificate SVZh-STAZH with information about the length of service of the employee (introduced since 2017);

- a certificate for the employment service on the three-month salary;

- copies of internal documents of the organization at the request of the employee.

- Inform the recruiting office that the citizen has been fired. This is done if the employee is liable for military service.

Payments upon dismissal by agreement of the parties

The accounting department gives the employee a salary for the hours worked. Compensation is calculated based on the labor rate. With a piece-work form of cooperation, a citizen receives money for the work actually performed. If the scope of work provides for the receipt of interest from the transaction, then the accounting department is also obliged to pay them within 2 weeks from the date of dismissal. The employee is entitled to the following types of compensation upon termination of the contract:

- For unused vacation. The amount of compensation is calculated based on the average daily earnings for the past year.

- severance pay. This compensation is paid by agreement of the parties. The employer sets the amount of the benefit at his own request.

- Pay for hours worked. Compensation is calculated inclusive up to the day of termination of the contract.

- Payment for periods of temporary disability. The money will be provided to the citizen if the citizen was on sick leave in the month of termination of the contract.

- Premiums, bonuses, allowances provided for by local regulatory legal acts. Each organization has its own system for calculating this type of compensation.

Deadlines for the final settlement with the employee

The algorithm for granting payments depends on the grounds for termination of employment. In any case, compensation upon dismissal by agreement of the parties is paid after the issuance of the order. The employer must prepare the document in advance. According to Article 140 of the Labor Code, the final settlement with the employee is carried out no later than the day of dismissal specified in the order.

Upon termination of the employment relationship, the employee is paid a severance pay equal to the average earnings for the month. If a specialist was not on site on the day of dismissal due to the illness of his own or a close relative, then, according to the law, his position is retained until the final payment. Percentage of sales and other additional payments under the contract are provided to the employee within 2 weeks.

Is severance pay upon dismissal by agreement of the parties mandatory

This payment refers to the additional, i.e. the employer can provide it at will. The decisive factor is the reason for dismissal. For example, pregnant women are often given severance pay upon dismissal. According to Article 178 of the Labor Code, the employer is obliged to provide this payment if the termination of the employment contract occurs for one of the following reasons:

- the employee was called up for military service;

- the company is subject to liquidation;

- there are planned layoffs;

- the specialist who previously performed this work was reinstated;

- the citizen refused further work due to changes in the terms of the employment contract;

- an individual does not have sufficient qualifications for the position held;

- the employee refused to be transferred to a branch of the organization.

Severance pay is legally equal to two weeks' wages. If the reason for dismissal is the liquidation of a company or a reduction in staff, then the payment is equal to monthly earnings. In some regions of Russia, severance pay is provided for seasonal workers and employees who left of their own free will. This legislative norm is valid in the Far North, in the Republic of Karelia and in settlements equated in status to them. The company will not pay severance pay if it is declared bankrupt.

How is the amount of compensation determined upon dismissal by agreement of the parties

The amount of compensation is calculated by the accounting department. The procedure is not unified, i.e. the head of the enterprise himself decides for what period the compensation will be presented and how its amount will be determined. If the employment contract states that as a result of dismissal, the employee will be paid a fixed amount of money, then it will be so. An exception is situations where the agreement contains information on the provision of compensation. Accountants determine the amount of payments as follows:

- by average earnings for a certain period of time;

- in the amount of the official salary (double, triple, etc.);

- in the form of a fixed amount specified in the employment contract.

Fixed amount

A number of organizations prescribe a certain amount of compensation in a collective or individual labor contract. The director can change its size if information about this is present in the concluded agreement. The legislation does not provide for any restrictions on the fixed amount of compensation. Often it is equal to the value of the tariff rate for one working month.

In the amount of salary

The value of the tariff rate is prescribed in the employment contract. If a citizen was promoted several times during work or the salary was increased, then this is displayed in this document. Compensation will be equal to the salary in the last specialty. Regular employees are often given triple pay, but directors and top managers are paid compensation equal to six times the salary.

By average earnings for a certain time

With this method, it is important to correctly determine the amount of compensation. The accounting department calculates the amount of payment based on the established monthly salary and the number of days worked in the month. For example, a manager has a salary of 25,000 rubles. He will be fired on February 20, 2019. According to the production calendar, this month accounts for 20 working days. For the period from February 1 to February 20, there are only 14 of them. The accountant will calculate the average earnings according to the following formula: 25,000/20 * 14 \u003d 17,500 rubles.

Taxation of payments upon dismissal by agreement of the parties

Labor costs include any accruals and allowances to employees. Based on article 255 of the Tax Code, compensation provided to an employee upon termination of employment may be included in the tax return. Contributions to the Social Insurance Fund (FSS) and the Pension Fund (PFR) are also withheld from these amounts. Reimbursement for unused vacation is subject to personal income tax (PIT) only. Other contributions from this amount are not withheld.

What amounts are not subject to income tax

Under current law, an individual is required to pay tax on all types of profits, but upon dismissal, this rule works differently. The unemployed are classified as socially unprotected segments of the population, so the state exempts them from part of the mandatory deductions from wages. Personal income tax will not be charged on the following types of compensation:

- Compensation not exceeding three times the monthly salary for ordinary members of the team and six times for the heads of departments, the chief accountant.

- Payments to the head, deputy heads, chief accountant, top manager.

- Average monthly earnings for the period of employment. Under the law, a citizen after registering as unemployed can receive money for 2 months until he finds a job.

Insurance premiums

Severance payments provided by the employer in local documents are not exempt from deductions to the FSS if their amount is more than three months' wages. Insurance contributions are not deducted from premiums, bonuses and material assistance to an employee if its amount does not exceed 4,000 rubles. From benefits for sick leave, for pregnancy, childbirth or child care received before dismissal, contributions to the FSS are not made.

Tax accounting of compensation at the enterprise

All payments to members of the work team are expenses of the enterprise. When collecting income tax, the money paid to the employee is deducted from the taxable amount, i.e. the company's contributions to the state budget are reduced. Compensation can be added to the list of expenses if it is provided for by a collective / individual labor contract or a concluded agreement.

The tax authority will check the economic justification for payments. The amount of compensation must be adequate, i.e. not exceed six monthly wages. Large enterprises often pay large compensation to top managers, but similar transactions to an employee of a small company will raise questions from government officials. The tax authority may send a request to provide a justification for dismissal if the procedure is initiated by the employer.

Video