Inventory inventory turnover formula. What is turnover

The processes of production, circulation and consumption in society occur continuously. But these processes do not coincide either in space or in time. Therefore, to ensure their continuity, inventory is required.

Commodity stocks - this is a part of the commodity supply, which is the aggregate of the commodity mass in the process of its movement from the sphere of production to the consumer.

Inventories are formed at all stages of the movement of goods: in warehouses of manufacturing enterprises, on the way, to and from enterprises.

Compliance is achieved through inventory. Inventories in wholesale and retail should serve as a real supply of goods, ensuring their uninterrupted sale.

The need for the formation of inventory caused by many factors:

- seasonal fluctuations in the production and consumption of goods;

- mismatch between the production and trade assortment of goods;

- especially in the territorial location of production;

- conditions for the transportation of goods;

- links of commodity circulation;

- possibilities for storing goods, etc.

Classification of inventory

The classification of commodity stocks is based on the following characteristics:

- location(in or; in industry; on the way);

- timing(at the beginning and at the end of the period);

- units(absolute - in value and kind, relative - in days of turnover);

- appointment, including:

- current storage - to meet the daily needs of the trade,

- seasonal use - to ensure uninterrupted trade during periods of seasonal changes in demand or supply,

- early delivery - to ensure uninterrupted trade in remote areas during the period between the delivery of goods,

- target stocks - for the implementation of certain targeted activities.

Inventory management

The location of commodity stocks has recently become very important. At the moment, most of the inventory is concentrated in the retail trade, which cannot be considered a positive factor.

Inventories should be gradually redistributed between trade links in such a way that a large share of owned by wholesale the following reasons.

The main purpose of the formation of inventories in the wholesale trade is to serve consumers (including retailers), and in retailers they are needed to form a wide and stable assortment to meet consumer demand.

The size of stocks is largely determined by the volume and structure of the trade organization or enterprise turnover. Therefore, one of important tasks of trade organizations or enterprises — maintaining an optimal proportion between the value of turnover and the size of inventory.

To maintain inventory at an optimal level, a well-established inventory management system is required.

Inventory management means the establishment and maintenance of such a size and structure that would meet the tasks set for the trading company. Inventory management involves:

- their rationing - those. development and establishment of their required sizes for each type of inventory;

- their operational accounting and control - maintained on the basis of the current forms of accounting and reporting (accounting cards, statistical reports), which reflect the balances of goods at the beginning of the month, as well as data on receipts and sales;

- their regulation- keeping them at a certain level, maneuvering them.

At insufficient amount stocks, difficulties arise with the commodity supply of the turnover of an organization or enterprise, with the stability of the assortment; surplus stocks cause additional losses, an increase in the need for loans and an increase in the cost of paying interest on them, an increase in the cost of storing stocks, which together worsens the general financial condition of trade enterprises.

Consequently, the question of quantitative measurement of the value of commodity stocks and determination of the correspondence of this value to the needs of commodity circulation is highly relevant.

Stock indicators

Inventories are analyzed, planned and accounted for in absolute and relative terms.

Absolute indicators are expressed, as a rule, in value (monetary) and natural units. They are convenient when performing accounting operations (for example, inventory). However, absolute indicators have one big drawback: with their help it is impossible to determine the degree to which the value of the inventory corresponds to the needs of the development of commodity circulation.

Therefore, relative indicators, allowing you to compare the size of the inventory with the turnover of trade organizations or enterprises.

The first relative indicator used in the analysis is the amount of inventory, expressed in days of turnover. This indicator characterizes the supply of commodity stocks for a certain date and shows for how many days of trade (with the prevailing commodity turnover) this stock will be enough.

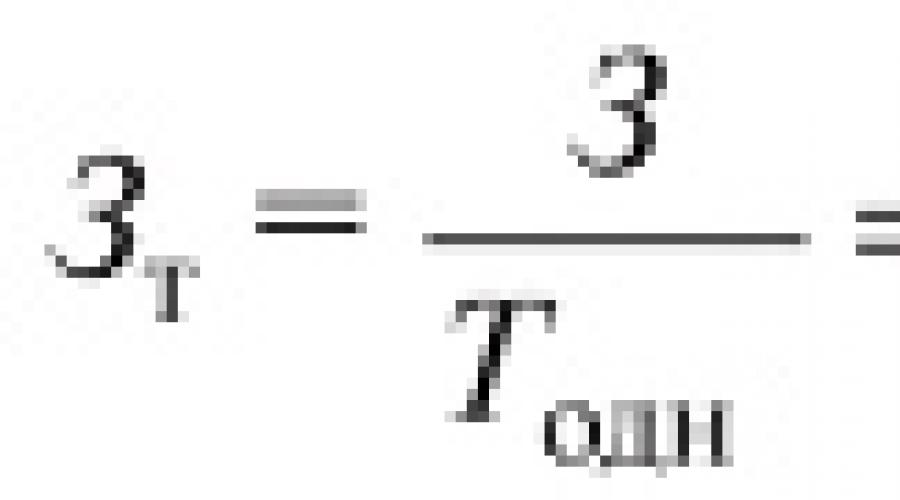

The value of the inventory is calculated 3, in days of turnover according to the formula

![]()

- 3 - the size of inventory as of a certain date;

- T one - one-day turnover for the period under review;

- T is the volume of trade for the period under review;

- D is the number of days in the period.

The second most important relative indicator characterizing inventory is turnover. Until the moment of sale, any product belongs to the category of inventory. From an economic point of view, this form of existence of a commodity is static (physically, it can be in motion). This circumstance, in particular, means that the commodity stock is a variable quantity: it is constantly involved in commodity circulation, is sold, and ceases to be a stock. Since the inventory is replaced by other consignments of goods, i.e. regularly renewed, they are a permanent value, the size of which varies depending on specific economic conditions.

The circulation of goods, the change of the static form of the stock to the dynamic form of the commodity turnover constitute the economic content of the process of commodity turnover. Turnover allows you to evaluate and quantify two parameters inherent in inventory: the time and speed of their circulation.

Time of commodity circulation - it is the period during which a product moves from production to consumer. The circulation time consists of the time of movement of goods in various links of commodity circulation (production - wholesale trade - retail trade).

Time of commodity circulation, or turnover, expressed in days of turnover, is calculated by the following formulas:

![]()

where 3 tcr is the average value of inventory for the period under review, rubles.

The average inventory used in the calculations is due to at least two reasons.

Firstly, in order to bring to a comparable form data on the turnover recorded for a certain period, and inventory, recorded for a certain date, the average value of the inventory for this period is calculated.

Secondly, within each set of goods there are varieties with different circulation times, as well as random fluctuations in the size of stocks and the volume of goods turnover, which must be smoothed out.

Turnover, expressed in days of turnover, shows the time during which stocks are in circulation, i.e. the average inventory is wrapped. Commodity circulation speed, i.e. The turnover, or the number of revolutions for the period under review, is calculated using the following formulas:

![]()

There is a stable inversely proportional relationship between time and the speed of commodity circulation.

Reducing the time and increasing the speed of commodity circulation allow for a greater volume of commodity circulation with smaller stocks, which helps to reduce commodity losses, reduce costs for storing goods, pay interest for using loans, etc.

The amount of inventory and turnover are interrelated indicators and depend on the following factors:

- internal and external environment of a trade organization or enterprise;

- the volume of production and the quality of products of industrial and agricultural enterprises;

- seasonality of production;

- import volumes;

- the breadth and renewability of the assortment;

- links of commodity circulation;

- fluctuations in demand;

- saturation of commodity markets;

- distribution of stocks between wholesale and retail trade links;

- physical and chemical properties of goods, which determine their shelf life and, accordingly, the frequency of deliveries;

- the price level and the ratio of supply and demand for specific goods and product groups;

- the volume and structure of the turnover of a particular organization or trade enterprise and other factors.

Changes in these factors can affect the amount of inventory and turnover, both improving and deteriorating these indicators.

For different products and product groups, the turnover rate is not the same. The share of product groups with a lower turnover rate is higher in inventory and vice versa. The decision to phase out slow-selling product groups and replace them with fast-selling ones seems obvious, however, retailers are not very active in getting rid of slow-selling product groups for the following reasons:

- there is no opportunity to change product specialization;

- there will be a sharp narrowing of the range and the circle of buyers;

- it is impossible to maintain selling prices at the level of competitors.

This requires systematic control and verification of stocks, i.e. the ability to know and analyze their value at any time.

Methods of analysis and accounting for the amount of inventory

In trade, the following methods of analysis and accounting of the amount of commodity stocks are traditionally used:

Calculation method

Calculation method, which analyzes the amount of inventory, turnover and their change. Various formulas are used to carry out this analysis;

Inventory, i.e. total counting of all goods, and quantitative assessment if necessary. The data obtained are estimated in kind in current prices and are summarized by product groups in the total amount. The disadvantages of this method are high labor intensity and disadvantage directly for the organization or enterprise, since during the inventory, the enterprise, as a rule, does not function. Accounting for the physical movement of goods is laborious, but extremely important both for commercial services and for managers of trade enterprises.

The use of two types of accounting (value and in-kind) allows:

- identify which product groups and product names are in greatest demand, and, accordingly, make reasonable orders,

- optimize capital investment in inventory,

- make informed decisions to optimize the assortment through the purchase of goods;

Removal of residues or operational accounting, i.e. reconciliation by financially responsible persons of the actual availability of the goods with the data of commodity accounting. Moreover, not goods are counted, but commodity items (boxes, rolls, bags, etc.). Then, according to the relevant norms, a recount is made, the quantity of goods is determined, which is evaluated at current prices. The disadvantages of this method include less accuracy than inventory;

Balance method

Balance method, which is based on the use of a balance sheet formula. This method is less laborious than the others, and allows for operational accounting and analysis of inventory in conjunction with other indicators.

The disadvantage of the balance sheet method is the impossibility of excluding various undetermined losses from the calculation, which leads to some distortions in the amount of inventory. To eliminate this deficiency, the balance sheet data must be systematically compared with the inventory data and the withdrawal of balances. Using the balance method, it is easy to carry out operational control over the movement of goods. The named method is especially effective for automated accounting based on a computer network.

To manage inventory, determine their optimal value, the following are used:

- technical and economic calculations using well-known formulas, mathematical methods and models;

- system with a constant order size;

- system with a constant frequency of order repetition;

- (S "- S) system.

First group methods are applicable in both retail and wholesale. The most well-known method of technical and economic calculations is the sequential determination of the optimal value of inventory at each stage of commodity circulation, followed by summing up the results obtained for each stage.

Second and third ways used primarily in the retail trade, as they require constant checks of the availability of goods, which is possible mainly in the retail trade.

The meaning of these methods is that to bring the amount of inventory to the required level, you should order the same amount of goods at any intervals, as needed, or order the required amount of goods at regular intervals.

Fourth way used to manage inventory at wholesale trade enterprises.

At the same time, two levels of stock availability in the warehouse are established:

- S" - the limit level below which the size of inventory does not fall; and

- S- maximum level (in accordance with the established design norms and standards).

The availability of stock is checked at regular intervals and the next order is made if the amount of stock falls below S or S - S ".

In the practice of trade, the amount of stocks that you need to have is determined in several ways:

- as the ratio of inventory on a specific date to the volume of sales on the same date for the previous period (usually at the beginning of the month);

- as the number of trading weeks that a given stock will last. The initial data is the target turnover;

- accounting of sales for the most fractional commodity groups. Therefore, cash registers are used in the nodes for calculating stores, which make it possible to take into account the sale of goods on several grounds.

In addition to the listed methods of inventory management, there are others, and none of them can be called absolutely perfect. Trade enterprises should choose the one that best suits the conditions and factors of their functioning.

Both actual and planned inventories are reflected in absolute amounts, i.e. in rubles and in relative terms, i.e. in days of stock.

In the process of analysis, the actual availability of stocks of goods should be compared with the standard of stocks, both in absolute amounts and in days of stock. As a result of this, excess stocks or the amount of non-fulfillment of the standard are determined, an assessment of the state of commodity stocks is given, and the reasons for deviations of the actual stocks of goods from the established standards are established.

The main reasons for the formation of excess stocks of goods there may be the following: non-fulfillment of turnover plans, delivery of goods to a trade organization in quantities exceeding the demand for them, violation of the delivery time of goods, incompleteness of supplied goods, violation of normal conditions for storing goods, leading to a deterioration in their quality, etc.

The initial data for the analysis of commodity stocks is presented in the following table: (in thousand rubles)Based on the data in this table, we will conclude that the actual commodity stocks comply with the standard. It should be borne in mind that the planned value of inventory in the amount of 3420.0 thousand rubles. was established in accordance with the planned daily sale of goods in the amount of 33.3 thousand rubles. However, the actual daily sale of goods was 34.7 thousand rubles. It follows from this that in order to maintain the increased volume of sales of goods, it is necessary to have a larger amount of inventory than it was provided for by the plan. As a consequence, the stock of goods at the end of the year must be compared with the actual one-day sales of goods, multiplied by the planned amount of inventory in days.

Therefore, in the analyzed trade organization, taking into account the increased turnover, there is an excess inventory in the amount of:

4125 - (34, 7 * 103) = 551 thousand rubles.

Now let's look at the relative indicators - stocks in days (balances in stock days). The amount of inventory in days is influenced by two main factors:

- change in the volume of trade;

- change in the absolute value of inventory.

The first factor has the opposite effect on the amount of stocks in days

From the last table, it follows that the amount of inventory, expressed in days, increased by 14 days. Let us determine the influence of the named factors on this deviation.

Due to the increase in the amount of retail turnover, the relative value of current storage stocks decreases by the value: 3420 / 34.7 - 3420 / 33.3 = -4.4 days.

Due to the increase in the absolute amount of current storage stocks, the relative value of these stocks increased by 4060/12480 - 3420/12480 = +18.4 days.

The overall influence of the two factors (balance of factors) is: - 4.4 days + 18.4 days = +14 days.

So, the stocks of goods, expressed in days, increased solely due to the growth of the absolute amount of commodity stocks. At the same time, an increase in the amount of retail turnover has reduced the relative value of inventories.

Then it is necessary to establish the influence of individual factors on the value of the average annual stocks of goods. These factors are:

- Change in the volume of trade... This factor has a direct impact on the value of the average annual inventory.

- Change in the structure of turnover... If the share of goods with a slow turnover increases in the total amount of turnover, then stocks of goods will increase, and vice versa, with an increase in the proportion of goods with a faster turnover, stocks of goods will decrease.

- Turnover of goods(turnover). This indicator roughly characterizes the average time (average number of days) after which the funds allocated for the formation of stocks are returned back to the trade organization in the form of proceeds from the sale of goods.

We have the following values of the goods turnover indicator:

- according to plan: 3200 x 360/1200 = 96 days.

- actually: 4092 x 360/12480 = 118 days.

Consequently, in the analyzed one there was a slowdown in the turnover of goods in comparison with the envisaged plan by 118 - 96 = 22 days. When analyzing, it is necessary to establish what reasons caused the slowdown in the turnover of goods. Such reasons are the accumulation of excess inventory (as in the example under consideration), as well as a decrease in the amount of turnover (this phenomenon did not take place in the analyzed trade organization)

First, you should consider the turnover for all goods as a whole, and then - for individual types and groups of goods.

Let us define by the method of chain substitutions the influence of the above three factors on the value of the average annual stocks of goods. Initial data:

1. Average annual inventory:

- according to the plan: 3200 thousand rubles.

- actual: 4092 thousand rubles

2. Retail turnover:

- according to plan: 12,000 thousand rubles

- actually: 12,480 thousand rubles

3. The plan for retail turnover was fulfilled by 104%. the turnover is:

- according to plan: 96 days;

- actually 118 days.

Thus, the average annual stock of goods increased in comparison with the plan by the amount: 4092 - 3200 = + 892 thousand rubles. This was due to the influence of the following factors:

- increase in the volume of trade: 3328 - 3200 = + 128 thousand rubles.

- changes in the structure of trade in the direction of increasing the share of goods with a faster turnover in it: 3280 - 3328 = - 48 thousand rubles.

- slowdown in the turnover of goods: 4092 - 3280 = +812 thousand rubles.

The total influence of all factors (balance of factors) is: + 128-48 + 812 = +892 thousand rubles.

Consequently, the average annual stock of goods increased due to an increase in turnover, as well as due to a slowdown in the turnover of goods. At the same time, the change in the structure of trade in the direction of an increase in the share of goods with a faster turnover in it reduced the value of the average annual stock of goods.

Analysis of the supply of goods by individual suppliers, by type, their quantity, timing of their receipt can be carried out as of any date or for any period of time (5, 10 days, etc.).

If for certain suppliers there are repeated facts of violations of the terms of delivery, then the analysis should use information about the claims made against these suppliers and about the measures of economic impact (sanctions) applied to them for violation of the terms of contracts for the supply of goods. The analysis should evaluate the possibility of refusal to conclude in the future contracts for the supply of goods with suppliers who previously committed repeated violations of the terms of the concluded contracts.

Inventory turnover (inventory turnover) shows how many times during the period under review the company used the available average inventory balance. characterizes the quality of the company's stocks, the efficiency of their management, allows to identify the remains of unused, obsolete or substandard stocks. The importance of the indicator is connected with the fact that profit arises with each "turnover" of inventories (ie, use in production, operating cycle).

Most theoretical sources inventory turnover ratio calculated as the ratio of the cost of production to the average for the period amount of stocks, work in progress and finished goods in the warehouse (inventory turnover at cost - Oz):

Oz = C / ((Znp + Zkp) / 2)

Where,

C - the cost of goods produced in the billing period;

Знп, Зкп - the amount of inventory balances, work in progress and finished goods in the warehouse at the beginning and end of the period.

The total value of goods sold during a given period, usually for a year (it is preferable to take the cost of goods sold, rather than the volume of sales, since the latter includes gross profit, which leads to an overestimation of the turnover rate), divided by the average inventory during of the same period, gives a number showing how many times the product has been wrapped.

The reverse indicator is more visual and convenient for analysis - the period of stock circulation in days (Pos). It is calculated using the formula:

Pos = Tper / Oz

where, Тп - the duration of the period in days.

The higher the inventory turnover, the more effective its activities are, the lower the need for working capital and the more stable the financial position of the enterprise, all other things being equal.

The calculated periods of turnover of specific components of current assets and current liabilities have a real economic interpretation.

For example, a period of inventory turnover equal to thirty days means that, with the volume of production prevailing in this analysis period, the enterprise has created inventories for 30 days.

Several types of inventory turnover:

- turnover of each item of goods in quantitative terms (by pieces, by volume, by weight, etc.);

- turnover of each product by value;

- turnover of a set of items or the entire stock in quantitative terms;

- turnover of a set of items or the entire stock at a cost.

Evaluation of turnover is the most important element of the analysis of the efficiency with which the company disposes of inventories. Acceleration of turnover is accompanied by additional involvement of funds in turnover, and deceleration is accompanied by the diversion of funds from economic circulation, their relatively longer necrosis in stocks (otherwise, immobilization of own circulating assets). In addition, it is obvious that the company incurs additional costs for storing stocks associated not only with storage costs, but also with the risk of spoilage and obsolescence of the goods.

As a result, during inventory management, stale and slow-moving goods, which are one of the main elements of immobilized (i.e. excluded from active economic turnover) working capital, should be subject to special control and revision.

V western banking practice analysts usually use an alternative formula - the ratio of the amount of inventory to revenue, multiplied by 365 days. The formula is:

Oz = (Inventory / Net Revenue) x 365

The amount of reserves is taken at the end of the period, as it is usually estimated over time. The amount of inventories is correlated not with the cost price, but with the revenue as one of the most important factors for credit analysis (this provides a unified approach to companies that sell goods and services, because for the latter, most of the costs are accounted for not by the cost price, but by the general commercial and Administrative expenses). Many believe that the correlation with the cost price gives a more accurate result, since there is a trading margin in the revenue, which artificially increases the turnover, but, on the other hand, the approach remains uniform (for example, the asset turnover is the revenue divided by the amount of assets), in addition, this method is convenient for calculating the operating cycle.

In principle, it is possible that at the beginning of the period and at the end of the period, the stocks are equal to zero. Then the turnover rate can be calculated by taking the average inventory in the period (of course, if you have access to this data).

It used to be unconditionally believed that speeding up warehouse turnover was a good thing. Inventory turnover characterizes the mobility of funds that an enterprise invests in creating inventories: the faster the money invested in inventories returns to the enterprise in the form of proceeds from the sale of finished products, the higher the business activity of the organization. What gives us a closer look at the processes occurring with the warehouse? Turnover by itself does not say anything - you need to track the dynamics of the coefficient change, taking into account the following factors:

- the coefficient decreases - there is an overstocking of the warehouse;

- the coefficient is growing or very high (shelf life is less than one day) - work "on wheels", which leads to failures in the shipment of goods to customers.

In conditions of constant shortage, the average value of the warehouse stock can be zero: for example, if demand is growing all the time, and the company does not have time to bring the goods. As a result, there are failures in the warehouse, there is a shortage of goods and an unsatisfied demand. If the size of the order decreases, the costs of ordering, transportation and handling of goods increase. Turnover is on the rise, but availability problems remain. There are options for a justified increase in stocks - in times of high inflation or expectations of sharp changes in exchange rates, as well as on the eve of seasonal peaks of buying activity.

If a company is forced to store goods of irregular demand in a warehouse, goods with a pronounced seasonality, then achieving a high turnover is not an easy task. To ensure customer satisfaction, the company will be forced to have a wide range of seldom-sold items, which will slow down the overall inventory turnover. Also, situations are not excluded when the supplier provides a good discount (for example, 5-10%) for a significant volume plus a significant delay in payment (in a crisis it is difficult to refuse such an offer).

Also, for the store, the terms of delivery of goods play an important role: if the purchase of goods is made using its own funds, then the turnover is very important and indicative. If in a loan, then own funds are invested to a lesser extent or not invested at all - then the low turnover of goods is not critical, the main thing is that the loan repayment period does not exceed the turnover rate. If the goods are taken mainly on the terms of sale, then first of all it is necessary to proceed from the volume of warehouse space and the turnover for such a store is the last indicator of importance.

In fact, it is helpful to remember more often that the numbers themselves do not say anything about the effectiveness of inventory management. For example, in retail trade, bread and expensive cognac have completely different indicators - the turnover of bread is several times higher than that of cognac. It is obvious that bread has one "task" in the store, while cognac has a completely different one and, perhaps, the store earns more from one bottle of cognac than from selling bread in a week.

Money is the only and universal measure, and by no means kilograms, pieces, cubic meters, etc. Companies invest in a product and want to get the most out of it (return on investment).

An indicator such as inventory turnover characterizes the quality of management of the company's inventory and production stock. It can be used to understand how effectively the procurement and sales services interact. To correctly assess the situation, you need to be aware of what this coefficient means, how it is calculated and controlled.

Coefficient characteristic

The inventory turnover ratio (K about) is understood as the number of revolutions that a certain type of inventory makes in a specified time. When the indicator is too low, it indicates an inefficient use of enterprise resources.

This could be a sign that:

- commodity or production stocks are in excess;

- sales have worsened;

- warehouse management is ineffective.

A high turnover ratio, on the contrary, characterizes the mobility of the company's funds: for a certain period of time, turnover occurs quickly, which is beneficial for the company. Why?

Because each turnover involves the following processes:

That is, each such cycle brings profit to the company. And the more there are, the greater the proceeds from the sale of finished products. Accordingly, the company's financial position is improving.

On the other hand, if inventories and inventories are insufficient, the company will begin to balance on the brink of shortages, which can lead to the loss of customers or unreasonably high costs for prompt renewal. And this is also unprofitable. Therefore, it is necessary to supply goods in sufficient quantities, and the inventory turnover ratio is constantly monitored.

How to calculate

The indicator can be determined based on sales revenue or cost. The information required for this can be found in the forms of financial statements (balance sheet, income statement).

The calculation based on the cost price looks like this:

With the cost price;

the average annual value of the enterprise's inventories.

With the option of calculating through revenue, the formula for the inventory turnover ratio will look like this:

In practice, both calculation options are encountered. The advantage of the second is that it excludes the influence of accounting policies - that is, the cost excludes administrative and selling expenses.

When the value is taken from the balance sheet, they consider lines 2120 and 1210. The formula for the calculation will look like this:

If the calculation is made by revenue, the values of lines 2110 and 1210 are substituted into the inventory turnover formula:

EXAMPLE

According to the data from the balance sheet of Mirage LLC, the cost of sales (line 2120) amounted to RUB 450,000 in 2016, RUB 520,000 in 2017, and RUB 534,000 in 2018. Inventories for these periods (line 1210), respectively 70,000, 75,000 and 80,000 rubles. Determine the turnover ratio for the periods considered.

Solution

We can perform the calculation based on the cost of sales, that is, we use the formula:

The obtained values are presented in the table.

| Year | 2016 | 2017 | 2018 |

| To vol. | 6,43 | 6,93 | 6,68 |

The business activity of the Mirage company in 2018 compared to 2017 decreased, since the turnover ratio decreased by 0.25 times.

Inventory turnover in days

The cycle from purchasing to selling products can be measured not only in the number of revolutions, but also in the length of days. To determine the duration of one revolution, we need K rev. and the number of days in the period under review. Take the value 360 or 365 - depending on the desired period.

Turnover ratio- a parameter by calculating which it is possible to estimate the rate of turnover (application) of specific liabilities or assets of the company. As a rule, turnover ratios act as parameters of an organization's business activity.

Turnover rates- several parameters that characterize the level of business activity in the short and long term. These include a number of ratios - working capital and asset turnover, accounts receivable and payable, and inventory. Equity and cash ratios are in the same category.

The essence of the turnover ratio

The calculation of business activity indicators is carried out using a number of qualitative and quantitative parameters - turnover ratios. The main criteria for these parameters include:

The business reputation of the company;

- the presence of regular buyers and suppliers;

- the width of the sales market (external and internal);

- the competitiveness of the enterprise, and so on.

For a qualitative assessment, the obtained criteria should be compared with those of competitors. At the same time, information for comparison should be taken not from financial statements (as is usually the case), but from marketing research.

The above criteria are reflected in relative and absolute parameters. The latter include the volume of assets used in the work of the company, the volume of sales of finished goods, the volume of its own profit (capital). Quantitative parameters are compared in relation to different periods (this can be a quarter or a year).

The optimal ratio should look like this:

Growth rate of net income> Rate of growth of profit from the sale of goods> Rate of growth of net assets> 100%.

3. Ratio of current (circulating) assets turnover displays how quickly accessed and used. Using this coefficient, you can determine what turnover was made by current assets for a certain period (usually a year) and how much profit was brought.

where About days - turnover in days, days

ТЗ Wed - average inventory for the period, pieces

Q– number of days in the period, days

Calculations showed that the turnover rate in days decreased in 2013 compared to 2012. This indicates an acceleration of the turnover of the “Standard pillow” commodity item by 3 days. The acceleration in turnover reflects positive dynamics.

Turnover at times tells how many times the product “turned around” and sold during the period. Calculated by the formula (9):

![]() (9)

(9)

where Ob times -, times

TO - turnover for the period, pieces

ТЗ Wed - average inventory for the period, pieces

12-13 times a year is the same as 28-31 days of turnover, so there is no fundamental difference in the method of counting. The conclusions can be drawn the same. But, in my opinion, the calculation of the turnover in days is more convenient, since you can more clearly trace the dynamics of the acceleration or deceleration of turnover.

When analyzing the data received, it is worth paying attention to the line of credit for this product, that is, after what time we need to pay for it. The supplier "BELASHOFF" in the contract prescribed the following calculation procedure:

20% prepayment

80% no later than 20 calendar days from the date of delivery

This means that the goods will not have time to turn around, the money for it will not yet be received, and the company will be forced to use borrowed funds.

For efficient operation, the turnover in days should not exceed the loan term.

Table 8 - Comparative data on margin and turnover

|

Purchase price |

Selling price |

Turnover in days |

Turnover (once a year) |

Profit from one unit of goods per year |

Priorities |

||

|

Pillow Standard | |||||||

|

Pillow Charm | |||||||

|

Pillow Dialogue |