Description of some primary risks. Technical and technological risks of the development and functioning of the energy systems of Russia

Read also

Similar documents

The essence and content of professional risk, characteristics and specificity of social work in Russia and abroad. Description of the preliminary and final assessment of occupational risk. Possible ways to solve the problem of reducing professional risk.

term paper, added 01/22/2015

The essence of the hazard and the determination of its potential probability of occurrence. Risk as a quantitative measure of hazard. The main provisions of the theory of risk. The essence of individual and social (collective) risk. Basic methods for assessing its degree.

test, added 10/16/2013

The sequence of stages of the analysis of the risk of accidents. Identification of the hazards of accidents at a hazardous production facility. Key indicators for assessing the risk of accidents. Use of the frequency-severity matrix for accident risk analysis.

presentation added on 12/04/2016

Essence of potential danger and risk, causes of occurrence: "human factor", technical reasons. Methods for assessing dangerous situations. Standard safety indicators of technical systems and technological processes. Methods to improve their safety.

test, added 10/14/2017

Investigation of the risk of hazardous production facilities: general provisions, procedure and methods of analysis, requirements for the presentation of results, as well as characteristics of methods of analysis. Examples of application of methods of hazard analysis and risk assessment.

thesis, added 03/21/2011

Study of the features of accident risk analysis. Description of its goals and objectives. Stages of hazard identification and preliminary risk assessments. Methods for determining the frequency of undesirable events. Carrying out the development of recommendations to reduce the risk.

abstract added on 11/05/2013

Acceptable risk concepts, calculation and analysis. Assessment of the risk of death for the year, the probability of death from man-made disasters. Estimates of the contribution of various factors to the premature mortality of Russians. Biological agents used to kill people.

presentation added on 07/28/2014

The main methodology of the theory of risk. Comparative data of various methods of analysis. The need to protect the environment from hazardous industrial impacts on ecosystems. The characterization is carried out in accordance with the categories of criticality.

term paper, added 05/17/2010

The concept of risk and its place in the security system, approaches to management. The main approaches to the calculation method for assessing fire risk and to the complex of engineering and technical and organizational measures to reduce fire risk in office buildings.

test, added 03/29/2016

Comprehensive analysis of the state of industrial safety and the creation of empirical databases on accidents and injuries. Development of algorithms and methods for analyzing hazards and risks of industrial facilities. Risk analysis of typical hazardous facilities and industries.

If you are my reader, then every month I give $ 100 - open in a new tab.

Good day! Today the blog site will tell you what types of investment risks exist. The material provides examples of classifications.

And right at the beginning of the article I will say, risks are risks, but I managed to get serious earnings of $ 10,000 per month, which I talk about and prove everything with screenshots in the article - open this link in a new tab, then read it!

Some experts believe that it is enough to consider the risks by sources of occurrence and this will be enough to make an investment decision.

There are different types of risks that can affect your capital. Some of them can be reduced in affordable ways, others need to be taken as they are and taken into account when making investment decisions. In general, there are two main types of risks. These are systematic and non-systematic risks.

Here's a video review of this article:

Systematic risks Are risks that cannot be mitigated or predicted in many cases. Thus, you need to understand that it is impossible to foresee or protect yourself from this type of risk.

Examples of such risks include: increases in various interest rates, as well as changes in legislation. The most logical way to manage these risks is to simply be aware of the potential they may present and consider their impact on your investment.

Unsystematic risks- these are risks that affect some of the constituent parts of assets and can be mitigated using well-known diversification methods. An example of this type of risk would be an employee strike or a change in the course of a management decision policy.

As you noticed, macro-level risks (read -) can have a significant impact on investments. But there are also micro-risks, which are also important when it comes to the price of stocks or bonds. This type includes:

Business risks... Uncertainty in the level of income, which is related to the nature of the company's existence in the market, as measured by the volume of operating profit. This means that the less confident you are about a firm's income streams, the less profit you will receive as an investor. The source of business risks is:

- A product or service that a company produces.

- Types of property owned by the company.

- Industrial equipment used in business.

- Market position.

- Quality management and more.

An example of different levels of risk in a business would be two companies. The one that is busy with waste disposal and producing metal. A garbage company will have low risks compared to a steel company, where sales and earnings fluctuate. Steel production depends on the need for the product.

Liquidity risks... Uncertainty caused by the existence of companies with short-term financial liabilities on the market. For example, an investor decided to purchase some financial assets. He intends to sell them after a while in order to make a profit. This is called an investment - the possibility of implementation at a certain date. As a rule, as you move up the asset allocation table, the risk of investment liquidity increases.

Financial risks... Financial risks are the risks that shareholders deal with in relation to the firm's debt. If a company raises capital through loans, then it will have to return this money in the foreseeable future, along with interest. This increases the level of uncertainty about the company because it raises the question of whether there was enough income to pay off the debt.

Exchange risks... Uncertainty over whether investments in foreign assets will return as a profit after conversion. This is important for those investors who have large foreign assets and constantly sell them for foreign currency and exchange it for national currency. If this type of risk is high, then the profit received from the sale may evaporate during the conversion.

Risks associated with strange... This type of risk is also determined by political processes. It is connected with the fact that you are investing in another country, where, in general, there may be a completely different situation in the economic and political plane. This can devalue your investment and reduce your profit margins. If you have to deal with such risks, then you will face an unstable economic as well as political arena.

Market risks... It is price fluctuations or, which increases or decreases daily markets. This type of risk can appear on any instrument, no matter where the rate moves up or down. In general, high volatility within the market can either increase or decrease your invested capital.

So, we got acquainted with two types of classification of investment risks: according to the sources of occurrence and the global nature of the consequences. There are other ways as well.

By spheres of manifestation

- Economic... They have an impact on the economic component of investment activities in the country. Economic risks include generative factors. Among them: the state of the economy; tax, investment, financial, budgetary policy; market conditions; cyclical nature of economic development and phases of the economic cycle; dependence of the economy; the possibility of non-fulfillment of obligations by the state and so on.

- Political... They are connected with the fact that the state has elections at various levels, changes in political course, political pressure, restrictions on investment activities, foreign policy pressure, freedom of speech, separatism, possible deterioration of the international climate associated with the state.

- Social... This is social tension, various strikes, the implementation of many special programs. Such a component appears on the basis of people's desire to create connections and help each other, the desire to adhere to obligations. This factor is influenced by the role they play in society, by service relationships, material and moral incentives, as well as by existing and possible conflicts. The ultimate risk that affects this group is the inability to predict the behavior of individuals in the process of life.

- Environmental... These are risks associated with environmental pollution, radiation, various specialized disasters, programs and movements.

- Technical and technological risks... They have an impact on the technical component of the project implementation.

- Legislative and legal... Associated with changes in legislation; inconsistency, inadequacy, incompleteness, incompleteness of the legislative and legal framework; legislative guarantees; lack of independence of the judiciary and arbitration system; incompetence or excessive importance of certain groups of persons during the adoption of legislation; inadequacy of the taxation system;

By forms of investment

- Real investment... May be associated with an interruption in the supply of materials and equipment; rising investment prices; selection of a low-quality contractor and other factors that delay the commissioning of the facility. They can also reduce operating income.

- Financial investment... These include: the wrong choice of financial instruments; unforeseen changes in investment conditions.

And here is another type of classification of investment risks:

Inflation risk... The likelihood of incurring losses that an economic entity is capable of experiencing as a result of the depreciation of the value of the investment and the loss of its original value by the assets. Depreciation of income and profit from investments in the conditions of outstripping growth of inflation over the rate of increase in investment income.

Deflationary risk... This is the likelihood that you will incur a loss as a result of reducing the money supply with the withdrawal of part of it, for example, by increasing taxes and interest rates, as well as reducing budget spending and increasing savings, and so on.

Functional investment risk... The probability of incurring losses due to errors in the formation of investment portfolios of financial instruments.

Selective investment risk... This is the probability of choosing the wrong investment object compared to other options.

Profit loss risk... This is the likelihood of collateral financial damage occurring due to the failure to implement any measure, such as insurance.

Effective entrepreneurial activity in many cases is associated with the development of new techniques and technologies, an increase in the level of labor productivity. However, the introduction of new equipment and technologies is associated with the occurrence of man-made disasters that damage the environment, the means of production, as well as the life and health of people. All this gives rise to technical risk.

Technical risk is risk due to technical factors. Technical risk is a complex indicator of the reliability of the elements of the technosphere and expresses the likelihood of an accident or catastrophe during the operation of machines, mechanisms, implementation of technological processes, construction and operation of buildings and structures.

Technical risk is determined by the degree of organization of production, the implementation of preventive measures (regular preventive maintenance of equipment, safety measures), the possibility of repairing equipment on its own.

Technical risks include the likelihood of losses:

- due to negative results of research work;

- as a result of failure to achieve the planned technical parameters in the course of design and technological developments;

- as a result of low technological production capabilities, which does not allow mastering new developments;

- as a result of collateral or delayed problems when using new technologies and products;

- as a result of failures and breakdowns of equipment, etc.

One of the varieties of this risk is technological risk- the risk that, as a result of technological changes, the existing production and sales systems will become obsolete and thereby have a negative impact on the level of the company's capitalization and limit its opportunities for making a profit. At the same time, modernization and improvement (complication) of technical means, an increase in the number of technical elements also contributes to a decrease in their reliability and, accordingly, an increase in risk.

There is a technical risk in any new technological and constructive development, i.e. the likelihood that the developed technology or design will be unsuccessful and a different technical solution or revision, fine-tuning is required. Such fine-tuning is especially laborious in cases where the automatic line is unique, the technology of its operation and most of the design solutions are original, not having close well-studied prototypes.

Technical risks arise from:

- design errors;

- deficiencies in technology and the wrong choice of equipment;

- erroneous determination of power;

- deficiencies in management;

- lack of skilled labor;

- lack of experience with new equipment;

- disruption of the supply of raw materials, building materials, components;

- failure to meet the deadlines for construction work by contractors (subcontractors);

- higher prices for raw materials, energy and components;

- increasing the cost of equipment;

- growth in wage costs.

Safety studies of technical facilities show that danger is inherent in any system and operation. In practice, it is unrealistic to achieve absolute security from a technical point of view, and from an economic point of view, it is impractical. This is due to the fact that the reliability of technical systems cannot be absolute. The risks associated with the unreliability of systems can be reduced as a result of tests and modifications of equipment in order to improve its quality and reliability.

In addition, technical risks accompany the construction of new facilities and their subsequent operation. Among them are construction, installation and operational risks... The following risks belong to construction and assembly:

- loss or damage to building materials and equipment due to adverse events - natural disasters, fires, explosions, criminal actions of third parties, etc .;

- disruption of the object's functioning due to errors in its design and installation;

- getting physical injuries by the personnel involved in the construction of the facility.

Technical risk belongs to the group of internal risks, since the enterprise can directly influence these risks and their occurrence, as a rule, depends on the activities of the enterprise itself.

In connection with the development of scientific and technological progress, an increase in the capital intensity of production, an increase in the proportion of technological equipment in the production process, as well as in connection with an increase in the volume of construction and installation work, the negative impact of technical risks has significantly increased, which, in turn, contributed to the emergence of a separate industry. insurance (, etc.).

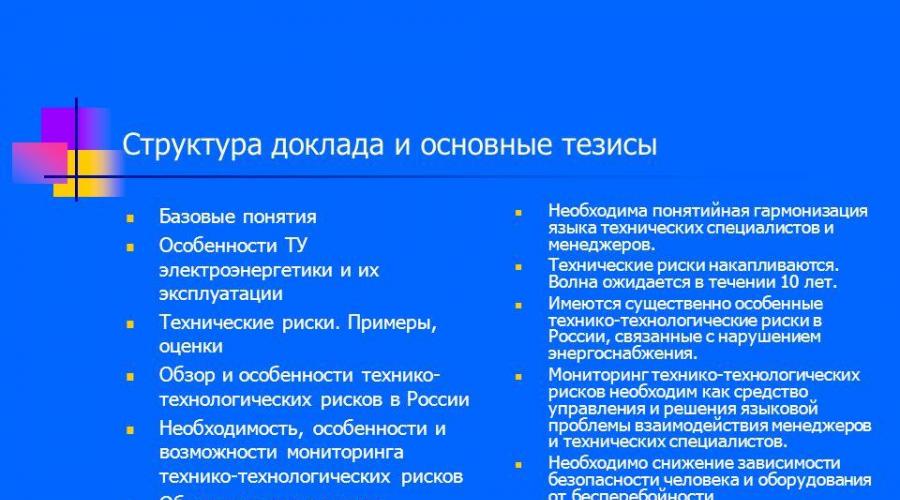

The structure of the report and the main theses Basic concepts Peculiarities of technical specifications of the electric power industry and their operation Technical risks. Examples, assessments Overview and specifics of technical and technological risks in Russia Necessity, specifics and possibilities of monitoring technical and technological risks On risk management Conceptual harmonization of the language of technical specialists and managers is necessary. Technical risks are piling up. The wave is expected within 10 years. There are essentially special technical and technological risks in Russia associated with power supply disruptions. Monitoring technical and technological risks is necessary as a means of managing and solving the language problem of interaction between managers and technical specialists. It is necessary to reduce the dependence of human and equipment safety on the uninterrupted centralized power supply

Basic concepts Risk is the possibility of not achieving goals (management factor). Technical risk - the possibility of losing the adequacy of the technical specifications to the conditions of its application. (RTN). (Risk of futility and danger of use). Technological risk - the possibility of ineffective use of technical conditions. (RTL). (Risk of technological errors). Monitoring - object observation and risk assessment at the pace of the process

Reproduction of production facilities with uniform input of capacities (idealization) Average service life years, taking into account extensions of years. Total commissioned capacities 200 thousand MW Cost of reproduction of gen. powerful (at 1000 $ / kW) 200 billion dollars. The cost, taking into account electrical and heating networks, is 400 billion dollars. The cost of annual reproducible capacities is 400/50 = 8 billion dollars.

Reproduction wave of production facilities, taking into account the actual schedule of capacities commissioning Average depreciation of production facilities in 2005 50% Average service life years, taking into account extensions of years. Total commissioned capacities 200 thousand MW Cost of reproduction of gen. powerful (at 1000 $ / kW) 200 billion dollars. The cost, taking into account electrical and heating networks, is 400 billion dollars. The cost of annual reproducible capacities in the years 400/50/4 = 2 billion dollars. / year in / 50 = 8 billion dollars. / year in / 50x2 = 16 billion dollars. / year in /50x1.5= 12 billion dollars. /year

Review of risk factors Meta level Inadequacy to demand High physical and obsolescence of the production facility Insufficient observability and controllability of processes Insufficient personnel competence Incorrectness of object models when making decisions The most significant factors of the first approximation Balance inadequacy of generation, a high proportion of unregulated generation in the European part Increased accidents and downtime of worn out equipment Balance inadequacy of the electrical network in terms of active power (many related sections with insufficient throughput) Balance inadequacy of the electrical network of 330 kV and higher in reactive power (insufficiency and poor controllability of reactive power compensation means) Insufficient observability of the modes of distribution electrical networks (110 kV and below) Inadequacy of distribution networks power transmission networks Insufficient emergency controllability of the mode in terms of active power Insufficient feedback (m monitoring of reliability, readiness and participation in management) Excessive dependence of life-supporting and hazardous industries on uninterrupted power supply Fuzzy responsibility

Features of the risks of power supply disruptions in Russia. Management Cohesion of heat and power supply Limited substitution of heat supply and power supply for heating Extreme cold weather and their unpredictability Lack of local backup means for life support and systems for the safe completion of technological processes Uncertainty of responsibility for safety in case of violations Reducing the degree of dependence of life support on centralized power supply: Preparation of TRs on safety in case of power failures. Development and application of local (reserve) sources. Application of systems for the safe completion of TP. Advance development of action plans and establishment of emergency response headquarters. Creation of systems for risk monitoring and early warning of threats. Dissemination of knowledge about individual and group actions, methods of survival in extreme conditions.

The need to monitor RTN and RTL is due to the aging of equipment Violation of the continuity of operation during the change of generations (not transfer of experience) Increased targeting of responsibility Changes in the modes of generation and transmission of electricity Implementation of power supply to the regions by many entities Complication of technical devices and technologies Mismatch of the dynamics of reform, revision of the regulatory and technical framework for design and operation power facilities, training and retraining of personnel.

Monitoring model 1. Group A (Fuel supply) A1. Mismatch (deficit) of real and planned-normative reserves of fuel and energy resources (FER) (coal, fuel oil). A2. Current and possible future shortages of gas, fuel oil. AZ. Current and possible future coal shortages. 2. Group В (Condition of fixed assets of the fuel and energy complex) 2.1. Sources of thermal and electrical energy. AT 11. The ratio of the maximum load and the available power. AT 12. Load Bearing Availability Ratio. B13. Residual service life of the equipment. B14. The ratio of the development and restoration of the operational resource. B15. The ratio of unit operating costs to the average regional level. В 16. The ratio of the level of harmful emissions with the regional average. 2.2 Heating systems. AT 21. The ratio of throughput and maximum load. B22. Factor of localization of accidents in distribution networks (presence and condition of shut-off equipment). B23. Residual operational resource of the heating network (pipelines, channels, heating units, pumping stations). B24. The ratio of the development and restoration of the operational resource. B25. The share of make-up in the coolant circulation. B26. The share of heat loss in a useful vacation. 2.3 Power grids B31. The ratio of network bandwidth and maximum capacity. B32. Load Bearing Availability Ratio. B33. Residual service life. B34. The ratio of the development and restoration of the operational resource. B35. The ratio of the unit operating costs for energy transmission with the average regional level. B36. The share of energy losses in the network bandwidth.

Monitoring RTN and RTL Requirements: Comprehensive coverage of relevant processes. A high degree of their structuredness, providing an opportunity for holistic perception and understanding of a multidimensional and heterogeneous phenomenon. Layered presentation of what is happening with efficient aggregation and consideration of relationships. Visualization of the situation (Example) for one time slice (D1) ABC a) normal state b) dangerous states c) critical states A B C

Inherent in only one country (one company).

They are an external risk in relation to the company's activities, because caused by external factors and does not depend on the specifics of the company's activities.

Feature of risk: the company cannot influence it, but is only able to deal with its consequences (exception: if the company can lobby with its own interests in the government or are themselves represented by the government).

Types of risks:

the risk of changes in industry legislation;

the risk of imposing restrictions on import-export operations;

rice changes in the customs system and customs legislation;

the risk of protectionism;

the risk of changes in labor legislation;

changes in income tax rates;

the risk of changes in basic tax rates (UST, UTII, personal income tax);

the risk of changes in the system of granting tax preferences and deductions.

The risk can be quantified. To work with him, you need to know the legislation and have qualified employees.

Technical and technological risks

Presented by:

technical;

technological.

Refers to internal risks.

Technical risk - the risk caused by disruptions in the organization of production, technological disasters and changes in the intensity of production.

Technical risk is expressed:

in sudden production stops;

in failures and breakdowns of equipment;

in failure to achieve the desired parameters of the organization's activities with a significant level of technology;

in the interaction of technology with existing technical means.

Its feature- is not able to lead to coverage of losses at the expense of the amortization fund; does not lead to losses; may be due to human factors.

Technological risk - associated with the peculiarities of the technologies used by the companies.

Types of risk:

Imperfection of technologies that accelerate the deterioration of technical means;

The technology does not give the company any competitive advantage;

Moral obsolescence of technology;

The risk of losing a technological advantage as a result of the activities of competitors;

Incompatibility of technology, or its inapplicability when changing the scale of the organization's activities;

The technology can be effective if it does not comply with legislation and product quality requirements;

Assessment methods:

all qualitative methods of technological risks;

assessment method accompanied by documentation.

Human Factors Risks

All risks that are capable of influencing human behavior or caused by it, affect the decision-making process and are capable of influencing the interests of the participants in the activity (extraction of interests).

Types of risks:

Behavioral risks;

Conflict risk;

The risk of disloyalty;

The risk of incompetence and unprofessionalism.

Behavioral risks

They arise in the course of the organization's activities, caused by the interaction between risk subjects, which are subjective in nature and aimed at changing human behavior.

Its subjects are:

All employees of the organization, including the management of the company;

Third-party specialists carrying out activities on a contractual basis;

Third parties with an interest in the company's activities;

Organization owners;

Government agencies and other regulatory agencies.

Peculiarity:

Unpredictable;

The consequences of their impact cannot be estimated in advance;

Difficult to identify;

It is impossible to regulate within the limits of manifestation;

They are subjective.

Factors causing behavioral risk:

Psychological characteristics of a particular person (associated with a person's temperament, etc.);

Dissatisfaction with the work (conditions), the level of its payment, as well as the moral and psychological climate in the team;

Ineffective management of the organization and personnel in particular.

Challenges of Behavioral Risk Management:

The impossibility of taking into account the mental characteristics of each employee of the organization;

The decision-maker may be too distant from the team in which this decision is implemented;

Personal benefit of business participants;

Influence of competitors (influence of the 3rd party).

Assessment methods:

psychological;

all quality.

Behavioral risk can become catastrophic and lead to bankruptcy of the organization.

31.03.2009 Lecture number 8