We register in pfr. Service "Personal account", information about pension - registration and work

Read also

Chapter 3 of the Civil Code of the Russian Federation establishes that every adult and capable citizen has the right to conduct business and register as an individual entrepreneur (IE).

In addition, registration of an individual entrepreneur with the FIU, subject to parental consent and a decision of the guardianship authorities or the court, can be carried out by adolescents aged 14 and over. You can not combine business and service to employees of state, municipal and security services, the military.

Federal Law "On Compulsory Pension Insurance in the Russian Federation" No. 167-FZ of December 15, 2001 established the foundations of compulsory pension insurance in the Russian Federation. Individual entrepreneurs must pay insurance "pension" contributions both for themselves and for hired employees. How an individual entrepreneur can register with the PFR as an insured in 2018 will be discussed further.

How to register an individual entrepreneur in the Pension Fund of the Russian Federation

A citizen, upon state registration as an individual entrepreneur, submits an application and all documents necessary for registration to the tax service. Within 3 days, the entrepreneur is entered into the single register of individual entrepreneurs (USRIP) and a certificate of registration with the IFTS is issued.

The data on the new individual entrepreneur are automatically transferred to the Pension Fund from the IFTS. Registration of an individual entrepreneur as an insured in the PFR is carried out within 3 days from the moment the Fund receives information from the tax authorities (subparagraph 1 of paragraph 1 of article 11 of Law No. 167-FZ).

The Pension Fund sends the confirmation of registration and registration number to the entrepreneur via the Internet to the IP address if it was indicated in the documents during registration, or using the State Services portal. Obtaining a paper version of the confirmation is not necessary, but an entrepreneur can apply for it to the Fund's branch and get it in his hands within 3 working days (clause 2 of article 11 of Law No. 167-FZ).

How to register with the Pension Fund of the Russian Federation for an individual entrepreneur

According to Art. 20 of the Labor Code of the Russian Federation, an individual entrepreneur has the right to use hired labor of other workers. As an employer that provides people with jobs and concludes employment contracts, the entrepreneur pays insurance payments for employees. The amount and procedure for calculating insurance premiums is regulated by Ch. 34 of the Tax Code of the Russian Federation.

The calculation in the future of pensions and other benefits to the entrepreneur himself and his employees depends on how timely the individual entrepreneur will pay contributions. Art. 122 of the Tax Code provides for the responsibility of individual entrepreneurs for late payments of insurance premiums.

Should an individual entrepreneur register with the FIU as an employer?

Before the transfer of the administration of insurance pension contributions to the IFTS, an individual entrepreneur who concluded at least one labor, civil or author's contract was obliged to apply to the FIU within 30 days and provide documents confirming his status as an employer, including an identity card and copies of concluded contracts ... As an employer, the entrepreneur received another registration number with the FIU.

Since January 1, 2017, when the Federal Tax Service began to be in charge of insurance premiums, self-registration of insured employers (including individual entrepreneurs) has ceased to be necessary. Since 2017, registration of an individual entrepreneur in the Pension Fund as an employer is carried out without his participation. Tax specialists receive information on the availability of hired personnel from the reports on insurance premiums submitted by the entrepreneur (Article 431 of the Tax Code of the Russian Federation). Guided by the agreement on information interaction of November 30, 2016, the data obtained from the calculation of insurance premiums by the Inspectorate of the Federal Tax Service electronically sends to the Pension Fund of Russia (letter of the Federal Tax Service of the Russian Federation dated January 31, 2017 No. BS-4-11 / 1628).

In the reports that the entrepreneur-employer (SZV-M, SZV-STAZH) will submit for his employees to the PFR, he must indicate the only registration number of the policyholder that the Pension Fund assigned to him during his initial registration.

Do an individual entrepreneur need registration with the FSS

The insurance premium for insurance against industrial accidents and occupational diseases is still paid to the Social Insurance Fund of the Russian Federation, therefore, registration with the FSS for an individual entrepreneur as a payer has not been canceled.

To do this, an individual entrepreneur is obliged, within 30 days after the conclusion of the first contract (labor or civil law), to submit an application and the necessary documents to the territorial office of the Social Insurance Fund of the Russian Federation and register as an employer (Article 6 of the Law of 24.07.1998 No. 125 -FZ).

If this is not done within the specified period, the entrepreneur will receive a fine of 5 thousand rubles. If the registration period is exceeded by 90 days or more, the penalty will be 10 thousand rubles (Article 26.28 of Law No. 125-FZ).

Within 5 working days from the Social Insurance Fund, the entrepreneur will receive confirmation of his registration and data on the amount of the insurance rate for contributions for "injuries".

So, we found out whether an individual entrepreneur needs to register with the FIU. If an individual entrepreneur works in his business alone without hiring hired employees, then he does not need to visit the Pension Fund, since the registration of an individual entrepreneur in the PFR without employees occurs automatically, using electronic document flow between the Federal Tax Service and the PFR.

An individual entrepreneur with employees should also not register with the Pension Fund on their own - tax authorities will receive information about this from the entrepreneur's reporting and will themselves transfer it to the Pension Fund.

Being an employer is not easy, as it imposes responsibility for other people. The employer provides jobs, pays wages and transfers insurance premiums to all kinds of extra-budgetary funds in order to provide their employees with social guarantees. But in order to carry out these functions, the employer must register with all funds as an insured.

Who can be the insured

The insured- this is a person who enters into an agreement with funds, insuring their employees. Consequently, the insured can be any person or organization that uses hired labor.

The law states that anyone who qualifies as an employer can act as a policyholder:

- independent legal entity;

- a separate subdivision with its own balance sheet;

- an individual operating without registration as an individual entrepreneur (lawyers, notaries, arbitration managers).

Where to go

- To be considered a policyholder, you first need to be an employer. A legal or natural person must register with the tax office to gain official status. A legal entity must submit statutory documents in order for the IFTS to make an entry in the register of the Unified State Register of Legal Entities, as well as assign the TIN to the organization.

- Individual entrepreneur fills out a special application form and submits passport data. TIN is used the one that was assigned to an individual. After the fiscal authorities make an entry in the USRIP, the entrepreneur is considered registered.

- To become a policyholder, organizations and individuals had to apply directly to the pension fund and social insurance fund... However, since 2019, significant changes have been made to the registration procedure.

How to register with the FIU as an employer

Newly minted legal entities and individuals are invariably interested in the question “how to register with the FIU as an employer”? You need to know that as soon as a person is registered with the IFTS, the tax authorities within 5 days provide information on all newly appeared LLCs and individual entrepreneurs to all off-budget funds.

If information is submitted out of time, it threatens with penalties. Each form has its own set of rules.Documents for registration of an individual entrepreneur

Until 2019, an individual entrepreneur, in order to register with the PFR as an employer, had to independently go to the fund and submit documents in a declarative manner. He was required to:

- Certificate of registration with the tax authority.

- Business license.

- TIN and individual.

- Original and copy of the passport.

- An employment contract with an employee and the documents attached to it.

After reviewing all the documents, the pension fund took into account the entrepreneur's number as an employer and issued a notice of registration as an insured.

However, since 2019, the application form for individual entrepreneurs has been canceled. Now a businessman does not have to go to a pension fund on his own to register himself as an employer. The tax authority will do it for him.

But you still have to go for the notification yourself. In addition, since 2019, an individual entrepreneur has there will be two SNILS:

- One is assigned to him as an individual.

- The second is how.

In addition to registering with the PRF, an entrepreneur must identify himself as an employer in the FSS if he has employees. Wherein the FSS must provide documents:

- IP registration certificate;

- business license;

- the passport;

- copies of employment contracts and employee books;

- application on the model of the FSS.

SP establishment without employees

An individual entrepreneur may not hire employees, working independently. This circumstance does not obviate the need to register with the tax inspectorate and the Pension Fund of the Russian Federation. Even if an entrepreneur does not pay for employees, he is still obliged to pay them for himself, guaranteeing the possibility of a future pension.

In such cases, a fixed amount of contributions for the year is established, calculated according to the formula:

- In 2019 it is 27990 rubles.

- In case of exceeding the annual income of 300 thousand rubles, the insurance premium to the Pension Fund of the Russian Federation is calculated as 1% of the amount of earnings, but without exceeding 163,800 rubles.

An important nuance of the innovations of 2019 is that the individual entrepreneur does not pay anything directly to the pension fund, since all contributions are now collected by the tax office.

Is it necessary for individual entrepreneurs without employees to register with the FSS? That is unnecessary. However, the entrepreneur is also human. He can go:

- on maternity leave;

- for sick leave;

- get an occupational injury.

Since he is his own employer, in these circumstances he will not be able to work and provide financial support during the troubles of life. For this an entrepreneur can register with the FSS for himself. He submits:

- application for voluntary registration;

- passport and TIN (copy);

- a copy of the registration certificate;

- copy of the license.

The businessman is assigned a registration number and pays the minimum fee. In 2019, the amount of the contribution is set at 2,714 rubles.

Registration of LLC in a pension fund

The procedure for registering an LLC in a pension fund in 2019 is unusually simple. Registration of legal entities with the legal form "limited liability company" in the pension fund and the FSS has been canceled since 2019:

- Now the tax authority registers when registering a legal entity. Further, the funds must send notices of registration as an insured to the address indicated in the constituent documents of the LLC.

- If the public did not wait for the notification, then the trustee or the CEO will have to personally go to the funds for receipt. It must be remembered that the term "trustee" implies the presentation of a power of attorney to obtain documentation.

- Registration in the funds of a separate subdivision with an independent balance and current account presupposes self-registration. To do this, the unit applies directly to the funds, taking with them documents according to the legally approved list.

Application form

Since LLC and individual entrepreneur do not undergo self-registration with the PFR, they do not need to fill out applications. For a separate subdivision with its own balance, the procedure specified in Resolution of the PF Board No. 296p.

The application is drawn up according to the established form approved by the above Resolution. It indicates:

- OGRN;

- actual and legal address;

- information about the leader;

- information about a separate subdivision.

Procedure and terms of the procedure

It is believed that the registration number of the PFR is assigned to legal entities simultaneously with registration and entry into the Unified State Register of Legal Entities. In fact, the IFTS transfers information to the funds, and they assign registration numbers to new legal entities within 5 days after making an entry in the Unified State Register of Legal Entities.

The deadlines for applying to the FIU of a separate subdivision are not clearly spelled out, but it is believed that it must inform the funds about itself in the same way as to the tax authority, that is within a month after opening... Naturally, in reality it happens differently, since a certificate from the tax office must be provided to the FIU.

The unit must provide to the fund:

- certificate of registration of the OP in the IFTS;

- position of the OP;

- documents on the availability of a current account and balance;

- documents on the right to pay wages and pay contributions;

The service "Personal account of the insured person" appeared on the website of the Pension Fund of Russia in January 2015. This electronic tool allows every potential pensioner who has a computer with Internet access to monitor online how his future pension is growing. The account on the Pension Fund website is useful for those who dream of understanding the rules for converting savings into points, at least roughly presenting the amount of a pension or checking personal data in the system for errors and inaccuracies.

How to register?

The first step is to go to the site www.pfrf.ru and enter the section "Electronic services"."Personal account of the insured person" appears first in the list of services on this page. By clicking on this inscription, you will be taken to the login or registration page. A personal account has already been created for those who are registered on the portal of public services, and these users just need to click on the "Login" button.

Insured person's personal account

If you haven’t had to use www.gosuslugi.ru yet, choose the option “Register with ESIA”.

ESIA is a single database in which all users of the portal of public services are entered. After your data is entered into the memory of the Unified identification and authentication system, you will no longer have to re-enter them for registration on the PFR website.

Actions for registration:

- Click on "Register with the ESIA".

- Enter your last name, first name, email address or mobile number on the form.

- Click "Register".

- Receive an activation code and enter it in the "Personal data" section on the public services portal.

Registration in the personal account of the insured person of the PFR

Attention! Until the activation code is received and entered, you will not be able to use all the features of your personal account!

You can get the code either in person by contacting the nearest department of the multifunctional center or Rostelecom, or by mail. The option for obtaining the code is selected during registration. After the steps described above have been completed, you can enter the personal account page through the "Login" button on the page of this service.

Service capabilities

Let's figure out what registration in the personal account of the insured person gives? The opportunities provided by this tool can be divided into three groups: to replenish theoretical knowledge about; check information about yourself - work experience, cash receipts; quickly and comfortably receive services. Let's take a closer look at each block presented on the main page of your personal account.

"Get information"

In this block there is a tab "About formed pension rights" - after going through it, you get access to several "shelves" with interesting information.

"General information about the order"- the scheme of work of the modern system for calculating pensions is given. The text is accompanied by pictures and tables. Useful reading for those who are used to understanding the issue thoroughly and want to confidently navigate the intricacies of calculating pension points, applying coefficients, and so on.

Possibilities of the "Personal Account" of the FIU

Experience tab contains information where and how long the owner of the personal account worked and how much he earned at each workplace. All information is presented in tables with division for the period before 2002 and after it.

Attention! It is very important to check in a timely manner whether your work experience and salary are taken into account correctly. Then you can correct the mistake in time and restore the missed experience by contacting your employer or the Pension Fund office.

"Create Document" button, which we regularly received in an envelope from. Its official name is a notice on the state of an individual personal account, and its popular nickname is “letter of happiness”. From it you can find out how much funds are in your account as of the current date, which organization manages these funds. And in the notification, receipts from the program of budgetary co-financing of pensions are indicated.

Tab “Calculation of retirement points” makes it possible to calculate the pension for years in advance. It is also called. To use this service, you need to enter in the windows the number of your salary before income tax, the duration of military service in the army, the number of children and the time spent on leave to care for a baby or a disabled relative.

Personal account of the insured person PFR

Attention! The length of service and the number of retirement points increase depending on whether a person has had a period of military service, maternity leave, parental leave or a disabled person.

But that is not all. After filling in the data about the past, it will be necessary to answer questions about the future. Think about whether you are going to have children in the remaining "working" years, take care of an elderly relative, or serve on a conscription basis? The amount of the insurance part of the pension, which will turn out in the end, depends on these answers.

The calculator takes the current salary as a basis, assuming that it remains unchanged. Of course, the figures obtained as a result will be approximate, but you can get some idea of future income.

"Contact the FIU"

- The name of the block speaks for itself - here the user is asked to choose any action from the list below:

- make a preliminary appointment at the PF branch;

- write a request or appeal;

- order a certificate or other document;

- create an account statement document.

Making an appointment with specialists in advance will help you avoid long waiting in line, choose a suitable day and time to visit the branch. And having ordered the necessary document or certificate in advance, a person can limit himself to one visit to the institution. This section of the personal account saves time and effort for both the user and the fund's employees.

"Apply"

Services for accepting applications through a personal account are now working in a trial mode. But by the end of 2015, the developers plan to complete the work with this section. Now residents of 82 regions of the country can apply in their personal account.

Apply to the FIU

Attention! Other services will also be available in the personal account - for example, it will be possible to apply for maternity capital, clarify the amount already determined for receiving a pension or social benefits assigned through.

PFR offers to use the service "Personal account"

An obvious plus of creating a personal account: it has become clearer, and personal accounts and all personal data are available for verification. You can also praise the creators of the service for the ease of registering an account and an intuitive work scheme that does not require special knowledge. With the development of electronic technologies, the possibilities of a personal account will grow. Perhaps in a few years we will not have to leave the house at all in order to receive all the necessary documents and government services in any direction.

There are several options for how you can register with all the necessary organizations. Let's take a closer look at each item.

Registration is carried out at the PFR Office of your district at the place of registration (see the addresses of the branches) and is mandatory. If there are no hired workers, then pay only for yourself to the pension fund, if someone does work for you, then you will have to pay for them too.

You will have to pay fixed payments to the Pension Fund, regardless of whether you are in business or not, whether you have income or not. You need to make payments to the pension fund from January 1 to December 31 of the current year. You can pay for the whole year at once, or in installments. Payment can also be made from the entrepreneur's current account, if there is one.

It is possible to pay for the whole year at the end of the year. And paid receipts must be saved and presented (and their photocopies) to the district PFR office for a report from January 10 to March 1.

If, after registering an individual entrepreneur, you were not given a notice of registration with the Pension Fund, then 2 options are possible.

- Wait until a letter comes to your mail. This usually takes 2 to 4 weeks. The confirmation of registration (for oneself) will be "Notification of registration of an individual with the territorial body of the Pension Fund of the Russian Federation at the place of residence." You don't actually need a letter, you need a registration number and details to pay taxes. Therefore, they can be recognized more quickly by the following option.

- Call by phone to the branch of your FIU or personally drive up to the branch.

Important! Since May 2, 2014, a regulation has been adopted that cancels the mandatory notification of the tax authority about the opening / closing of bank accounts.

Come on in the FIU as an employer

When an individual entrepreneur or head of a peasant farm hires employees, he must register with the FIU as an insurer. Now his responsibilities include paying insurance premiums for the employee.

If, during the state registration of an entrepreneur, his registration in the PF is carried out automatically, then the obligation to register as an employer lies with the entrepreneur himself or the head of the farm. This must be done no later than 30 days from the date of the first employment contract with the employee.

Documents you need to have:

- Application for registration of the policyholder. Download . You can familiarize yourself with the procedure for filling out an application there.

- certificates of state registration of an individual as an individual entrepreneur or a license to carry out certain types of activities;

- documents proving the identity of the policyholder and confirming registration at the place of residence (it is advisable to make a copy of both spreads (for example, a passport) on one sheet);

- certificates of registration with a tax authority on the territory of the Russian Federation (if any);

- documents confirming that an individual has an obligation to pay insurance premiums for compulsory pension insurance (an employment contract, a civil law contract, the subject of which is the performance of work and the provision of services, an author's contract, etc.).

Important! You must provide certified copies of documents.

Registration is carried out within 5 days.

Since September 30, 2014, the period for registration and the deadline for deregistration of policyholders with the Pension Fund and the FSS has been reduced from five to three working days.

After registration as an insured, an individual employer is issued a Notice of registration with the territorial body of the Pension Fund of the Russian Federation of the insured making payments to individuals.

Pay attention! If you violate the deadline for registering as an insured, then you will be fined 5,000 rubles (violation up to 90 days). And 10,000 rubles for violation of more than 90 days.

MHIF (Mandatory Health Insurance Fund)

On January 1, 2010, the MHIF does not register any individual entrepreneur or Yur. Persons. All are replaced by the FIU. FIUs must send a notice to the address of the entrepreneur. But they may not be sent, so it is safer and faster to go on your own + you will immediately receive the details for payment. Do not forget to take with you the originals and photocopies of the individual entrepreneur registration certificate, pension certificate and TIN.

Registration and withdrawal of individual entrepreneurs in the FSS. Required documents.

FSS is required only in a couple of cases:

- entering into an employment contract with an employee (when you become an employer),

- conclusion of a civil contract with the obligation to pay contributions to the FSS.

To register with the FSS, an individual entrepreneur is allocated a period of 10 days after signing the first employment contract with an employee. If this deadline is not met, a fine of 5,000 rubles will be imposed.

To register, you must submit an application and the necessary documents (submitted in originals and copies or notarized copies):

- application for registration as a policyholder;

- copy of the passport (employer);

- a copy of the certificate of state registration of an individual as an individual entrepreneur (OGRN certificate);

- a copy of the certificate of registration with the tax authority (TIN certificate);

- copies of work books of hired employees;

- copies of civil law contracts in the presence of conditions in them that the policyholder is obliged to pay insurance premiums for compulsory social insurance against industrial accidents and occupational diseases for the specified persons

If at the time of filing the application a bank account was opened with a credit institution, you must provide a certificate from the credit institution about the specified account.

Registration takes no more than 5 working days and is issued Notification.

If an individual entrepreneur carries out his entrepreneurial activity without using the labor of hired workers (does not conclude labor or civil law contracts with individuals), then such an entrepreneur is not obliged to register with the Fund.

Always check the current list of documents. You can find out in your department of the FSS (coordinates are presented on the website in the lower right menu "Regional departments").

On a quarterly basis, an individual entrepreneur must submit reports to the Fund's branches at the place of registration in accordance with the 4-FSS RF or 4a-FSS RF (for those paying voluntary insurance contributions to the FSS RF) no later than the 15th day of the month following the past quarter.

For violation of the deadline, a fine is threatened:

- 5% of the amount of insurance premiums payable (surcharge) on the basis of these reports, for each full or incomplete month from the date set for its submission, but not more than 30 percent of the specified amount and not less than 100 rubles;

- 30% of the amount of insurance premiums payable on the basis of these reports in case of failure to submit reports for more than 180 calendar days;

- 10% of the amount of insurance premiums payable on the basis of these reports for each full or incomplete month starting from the 181st calendar day, but not less than 1,000 rubles.

Removal from the register occurs upon dismissal of employees, expiration of the term of employment contracts, or the corresponding civil law contracts concluded with employees.

To deregister, insurers must submit the following documents to the territorial body of the FSS of the Russian Federation:

- Withdrawal statement (download);

- certified copies of documents confirming the occurrence of the circumstances that are the reason for deregistration.

Register with RosStat

(Federal State Statistics Service)

This document is optional. However, some banks and organizations require it. The tax office itself transfers information there and must assign and issue codes to you. But you may never need codes. Unless the individual entrepreneur falls under the sample and he does not have to submit reports. The report is submitted to RosStat before March 2, once a year. And about whether you fall under the sample can be found as follows:

1. RosStat will send you a notification by mail or by phone.

2. Contacting the department, you can clarify this issue.

How do you get the codes?

Now it is available via the Internet for Moscow and some other cities. It is worth noting that the data does not appear immediately after the registration of the individual entrepreneur. And after a few days.

The regions will have to travel personally for now. At this link you can find the territorial bodies of the Federal State Statistics Service. You just need to select an area (by clicking on the map or in the list under the map) and a link to the site in the region will appear at the bottom.

We go to the site, scroll down and see at the end on the right all the contacts: address, phone number, regional office map.

Required documents from you:

Copy of TIN

copy of passport with registration and main page on one sheet

copy of OGRN

copy of EGRIP

Document you will receive:

Notification of the assignment of IP statistics codes with a seal

Registration with Rospotrebnadzor

You should notify this service before starting your business, i.e. before making a profit and at the place of actual provision of services.

There are certain types of activities in which registration of an individual entrepreneur with Rospotrebnadzor is mandatory.

There are 2 ways of notification:

- In the form of an electronic document sent using a single portal of public services. View.

- As usual, come in person to the department.

Required documents:

copy of OGRN;

copy of EGRIP;

copy of TIN;

notification in 2 copies (Template is possible).

Branch addresses can be found as follows:

Go to the official website of Rospotrebnadzor. We select the required subject. Click on it and go to the regional site. We go down to the bottom and see the addresses and phones:

In addition, Rospotrebnadzor (if you are already registered) must be notified of the changes:

a) change of the location of the legal entity and / or the place of actual implementation of activities;

b) change of the place of residence of an individual entrepreneur;

c) reorganization of a legal entity.

If this information was useful to you, tell your friends about it in social media. networks.

Carrying out activities with the involvement of employees imposes certain obligations on the individual entrepreneur. From the moment the first employee is hired, he becomes an employer, which means that he is obliged to ensure compliance with all social guarantees for employees. To this end, the individual entrepreneur must register with extra-budgetary funds as an employer.

Registration of an individual entrepreneur with the FIU

From the moment of state registration, an individual entrepreneur is registered with the branch of the Pension Fund of the Russian Federation at the place of residence. Here he pays, if necessary, provides certain forms of reporting.

The conclusion of an employment or civil law contract with an individual puts the individual entrepreneur in front of the need to re-register with the FIU, but already as an employer. The law clearly defines the period for such registration - 30 days from the date of the conclusion of the contract.

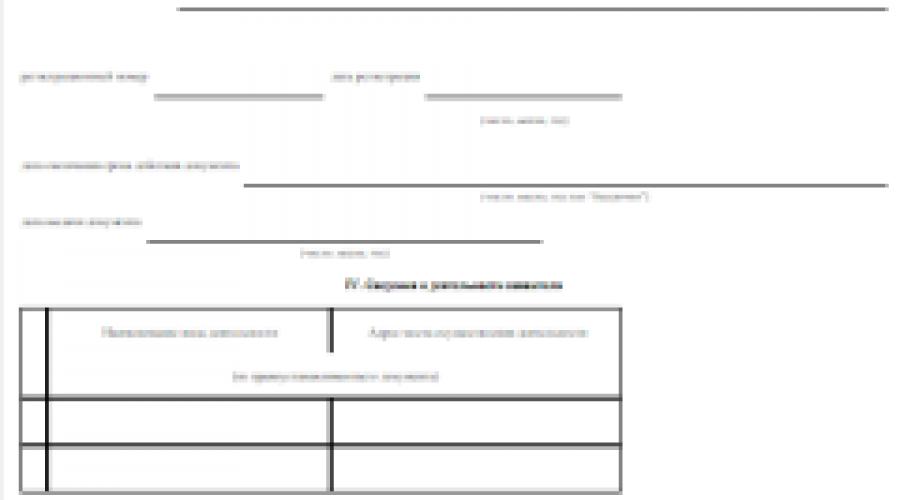

Registration of an individual entrepreneur with the FIU as an employer - a list of documents

To register an individual entrepreneur as an employer with the PFR, copies of the following documents must be submitted:

- IP registration certificate;

- The passport;

- An employment contract with an employee (even if there are several of them, it is enough to provide a copy for one employee);

- Application for registration as an employer in the prescribed form.

Application for registration of an individual entrepreneur with the Pension Fund of the Russian Federation as an employer - a sample of filling

The application form can be downloaded on the Internet - both on the official resource of the Pension Fund of the Russian Federation, and on specialized business websites. In addition, the form can be obtained at any branch of the PFR.

The application indicates:

- Passport data of individual entrepreneur;

- His registration address;

- Please register as a policyholder;

- Information from OGRNIP;

- Types and places of entrepreneurial activity;

- Planned dates for the issuance of wages to employees.

The Pension Fund checks the application and the submitted documents within three working days, after which it registers the entrepreneur as an employer. The fact of staging is confirmed by the issuance of a special notification, and from that moment the entrepreneur must submit all reports on employees, as well as make payments of contributions to the pension fund.

The legislation provides for liability for violation of the terms of registration as an employer in the form of a fine. Its size ranges from 5,000 to 10,000 rubles. Here it should be remembered that you can, but you cannot work with hired employees without registering as an employer.

Registration of an individual entrepreneur in the FSS

Currently, the registration of an individual entrepreneur with the Social Insurance Fund is carried out on a voluntary basis. If an individual entrepreneur wants to receive sick leave payments, then he registers and pays contributions. But if an entrepreneur enters into an employment contract with an employee, then he is already obliged to register with the FSS. The law sets aside 10 days for filing an application for registration with the FSS from the date of the conclusion of the first employment contract. To do this, you need to contact the territorial division of the FSS at the place of registration of the individual entrepreneur with a certain package of documents.

Registration of an individual entrepreneur with the FSS as an employer - a list of documents

To register an individual entrepreneur with the FSS, the following documents will be required:

- A copy of the individual entrepreneur's passport;

- Copy of OGRNIP;

- Copy of TIN;

- A copy of the employee's employment record book;

- Information about open settlement accounts of individual entrepreneurs;

- Application in the prescribed form.

A sample of filling out an application for registration of an individual entrepreneur in the FSS as an employer

An application for registration as an insured can be obtained directly from the Fund's office or downloaded from the official website.

The application must indicate:

- FULL NAME. entrepreneur;

- Passport data indicating the registration address;

- Details of the certificate of registration of the individual entrepreneur;

- The date of the conclusion of the employment contract with the employee;

- The main type of activity, indicating OKVED;

- Address of the place of business;

- TIN data of the entrepreneur;

- Information about an open current account;

- Planned date of payment of wages.

Registration is carried out within five working days, then the entrepreneur is issued a Notice of Registration. From that moment on, he is obliged to make contributions to the FSS for compulsory social insurance for temporary disability and in connection with maternity and insurance premiums for insurance against industrial accidents and occupational diseases.

For late registration with the Social Insurance Fund, an individual entrepreneur can be fined in the amount of 10,000 rubles. In addition, if as a result of this, the established reporting was not provided, then the individual entrepreneur may be held liable for this violation. It should be remembered that an individual entrepreneur can, but cannot but register with off-budget funds if he hires workers. The cash register can be replaced, but even a large salary cannot replace social guarantees.

Responsibilities of an individual entrepreneur as an employer

When hiring personnel, an entrepreneur also assumes the duties of a tax agent for withholding and transferring personal income tax to the budget. In this regard, there is no need to additionally register with the Federal Tax Service, but for all payments to individuals it is provided