Manager's lines in binary options. Best Binary Options Strategy - Indicator Parameters

The challenge for every binary options trader is to be able to correctly identify the beginning and end of up and down price trends. For these purposes, it is customary to use trend indicators. The most informative and accurate among them are waves, lines or Bollinger bands. A strategy that works on the basis of this indicator is able to bring a consistently high income to a trader.

You can trade using Bollinger Bands on the electronic platforms of many brokerage companies. After all, the indicator in question is included in the set of standard tools for technical analysis on many of them. We tested the strategy described below on the Olymp Trade trader's site.

Experience shows that the price of any investment asset will almost always move within the price channel formed by the three Bollinger indicator lines. In those rare moments when it violates its boundaries, the trader will receive signals to open trading positions.

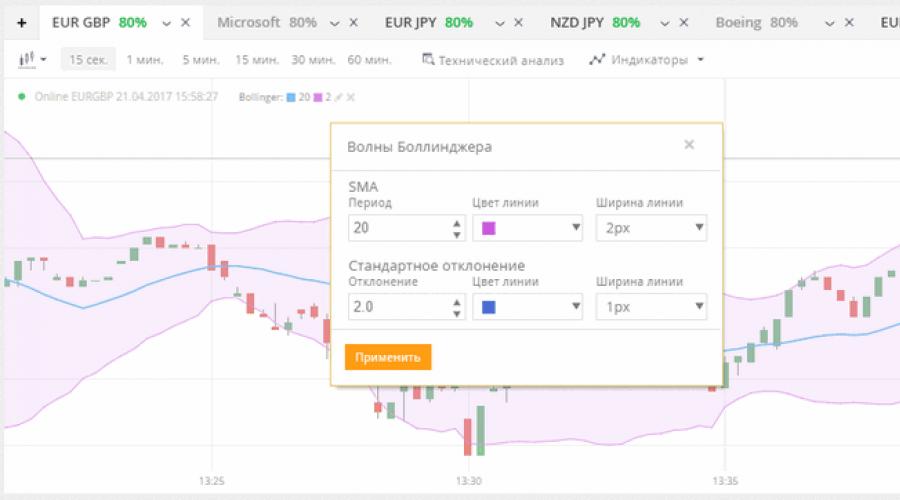

At the Olymp Trade broker's site, when this indicator is activated, the settings we need will already be set. The SMA period is 20 and the standard deviation is 2.0. You can set any color and thickness of the lines. The main thing is that the indicator is displayed on the live chart of quotes in a comfortable way.

As you can see in the attached screenshot, Bollinger Bands are formed using three lines. In the center is the usual moving average curve. In our example, it is colored blue. Above and below it, within the specified standard deviation, there are two more lines, which form the price channel. In our example, they are colored purple.

The strategy based on signals from Bollinger Bands is universal. You can use it on any timeframe you like.

Existing nuances

Before we introduce you to trading strategies, there are a number of aspects to consider when trading based on Bollinger Bands. Understanding these nuances can significantly increase the efficiency of a trader's trading.

Remember, the price of the selected underlying asset in most situations tends to move within the price corridor formed by the indicator lines.

In a situation when serious unrest begins on the exchange, which are characterized by an increase in volatility (increased volatility) of asset quotes, the extreme Bollinger bands tend to diverge. That is, the price channel is expanding. These changes are often the harbingers of a powerful new trend.

On the contrary, when everything is calm on the exchange, the level of volatility of the investment asset decreases. In response to a similar trend, the extreme Bollinger bands begin to converge. The price channel is narrowing. Often, such changes are forerunners of the beginning of a sideways movement or flat.

How strategy # 1 works

The trading system under consideration brings the best results on 15-minute timeframes. In this case, the expiration period of the purchased option is half an hour.

The trader needs to click on the Call button when the body of the bearish or red candlestick closes completely below the lower indicator line.

The trader needs to click on the Put button when the body of the bullish or green candlestick closes completely above the upper indicator line.

In this strategy, you should pay attention to three points.

1. A trading signal for us is the closing of the red candle below the lower line, and the green one above the upper one. Not the other way around.

2. Above or below the Bollinger indicator line, the body of the candle should be located. Shadows can return to the price corridor. This is not important for us.

3. The expiry period for the concluded deal must be twice as long as the timeframe set on the asset quotes chart. If the timeframe is M15 or 15 minutes, then buy an option on M30 or 30 minutes.

Also notice the first market entry point marked in the above screenshot. In this situation, 2 green or bullish candles remain at the top of the price corridor. This means that we can safely conclude two deals for a fall. As you can see, this decision was 100% justified. Both deals closed with a profit.

There are not too many such trading signals. However, when they do occur, you can safely open trading positions. At the same time, you need to understand that there are no strategies that give a 100% successful result. This trading system has an efficiency of 80–85%, which is an excellent result.

How strategy # 2 works

We understand that not every especially novice trader is ready to trade on M15 timeframes. Especially for such investors, we will consider the Japanese minute candlestick strategy. It should be remembered that the shorter timeframes are set on the live chart, the more the risks increase.

For those who want to increase the size of their own deposit as quickly as possible, the Martingale principle should be introduced into this trading system. According to this principle, upon receiving a loss on an open position, we increase the size of the next trade by 2.5-3 times. This approach will allow us in any case to cover losses and always remain with a profit. In other words, in case of unsuccessful deals, we will sequentially increase the size of the bets: 1, 3, 7, 12 dollars, and so on.

The principle of trading in accordance with this system is simple. The trader needs to wait for a situation in which three candles in a row close above or below the corresponding indicator line.

Now let's take a look at a specific situation on a live chart. As soon as the third bullish or green Japanese candlestick closes above the price corridor, we open a trade to decrease quotes by clicking on the Put button.

As soon as the third bearish or red Japanese candlestick closes below the price corridor, we conclude a deal to increase the asset quotes by clicking on the Call button.

If you analyze the situation in the above screenshot, you will see that after three red candles there was another fourth candlestick, which also closed with a decrease in price. That is, a perfect $ 1 trade brought us a loss.

However, it was here that we used the Martingale system and opened a second position for an increase already by $ 3. As you can see, the next candlestick closed with a profit. Thus, we won back the money lost on the first binary option and got our income.

In this situation, the use of the Martingale principle is justified precisely by the fact that in our trading strategy we rely on the Bollinger Band indicator. As you already understood, the price cannot stay outside the price corridor for a long time, which means that the use of such a risky technique is more than justified.

Use Bollinger Bands, Trade Binary Options and Make Profits!

To facilitate the work of a novice trader, binary options brokers post educational materials, signals of trade advisors, and economic news on their websites. Forex financial market traders apply proven strategies using proven technical analysis techniques, constantly developing new techniques for their application.

Similar to the Forex market (in terms of short-term scalping strategies), the terminal chart of binary options brokers is based on the real movement of the quotes of the currency pairs.

Therefore, many game strategies are based on technical analysis methods. To facilitate the trader's work, convenient terminals (brokers Alpari, Banc de Binary) are equipped with built-in indicators. Among the main indicators that serve as the basis for short-term strategies are:

- Bollinger Bands;

- moving averages (of varying frequency);

- Alligator;

- oscillators;

- Stochastic.

They are used as the basis for the strategies of "Two Sliders", "Price Action", "Equator Breakout". But the use of indicator strategies from novice traders requires studying, understanding the specifics of entering a position, working out to automatism on demo accounts.

Working with the Bollinger Bands indicator

Bollinger lines for binary options, which are also called "waves", "bands", are three moving averages of different frequency. Moving average (in English spelling "moving average") is a graphical display of quotes.

The principle of movement of the Bollinger Band is based on special formulas, automatic calculations of average quotes over a twenty-day period. One of the oldest indicators developed for the charts of the commodity, stock exchange, is also successfully used in Forex strategies, binary options terminals.

In the terminals of binary options brokers, work with Bollinger bands is configured as follows:

- you need to find the icons "Technical analysis", "Indicators";

- choose the Bollinger Bands (or Bollinger Waves) button among the indicators;

- leave the sections "Period", "Deviation%" unchanged;

- choose the colors of the indication of the three lines;

- the width of the lines for getting used to it can be thickened up to 2 px;

- press the "Apply" button.

The general moving values in the terminals are set according to Bollinger recommendations, but you can experiment by setting your own values in the "General" column. Forex practice shows that the default parameters are universal for the average volatility market. You can work with Bollinger Bands on any timeframe. They are equally effective in fifteen-minute, five-minute transactions, in turbo modes.

On the chart of the terminal of binary options, Bollinger bands look like an interval between two border lines. The middle line does not coincide with the chart of the real quote, which can pass in the middle of the band, move to the edges.

The best moment for applying the Bollinger strategy for binary options is when the bands diverge widely, have a pronounced direction (about 45 degrees down or up), coincide with the main hourly trend. In this case, the bet is placed in the direction of the main movement. A narrowing of the band indicates a decrease in buying (selling) activity, at this time it is better to stop trading.

If the Bollinger Bands for binary options are narrowing in a parallel horizontal movement, this indicates a decrease in volatility, an imminent jump in quotes. It is difficult to predict its direction, at such moments it is better to refrain from betting.

Other uses of the Bollinger Band strategy for binary options are based on price movement between the band boundaries. Most often, the quote, having started to fall (take off) from one boundary moving average, reaches the opposite border of the band. When decreasing from the upper line, sell deals are opened (the button "Below" is pressed). The downward trend stops when approaching the lower border of the band.

Bollinger waves in binary options are not recommended for use when:

- movement of quotes without a pronounced trend;

- high-profile events (political upheavals, statements by central bank leaders, publications of US statistics, announcements of changes in the base discount rate);

- the opening of the European stock exchange;

- the close of the Shanghai, Tokyo stock exchange (last hour of operation);

- the opening of the American stock exchange.

According to experienced traders, strategies with the Bolly lines indicator from reputable brokers Banc de Binary, Alpari successfully work both on the euro-dollar rates (with a high yield of 81-86%), and on calm quotes “Australian dollar / yen ”,“ dollar / Swiss franc ”(with 72% yield).

Progressive dealers of binary options, which include Banc de Binary, Alpari, attract traders with their main advantages: convenient terminals, clear interface of charts, minimum deposit size ($ 10), quick withdrawal of winnings, support of popular payment systems.

A specially selected set of indicators can be found in the trading systems of many traders. Many of them were created by successful economists who, thanks to their developments, created their own hedge funds and became millionaires. One of the most famous - Bollinger bands or lines.

The indicator of this level is used, among other things, on Wall Street and is considered legendary. It is good for them to complement candlestick analysis, and thanks to the bands, you do not have to jump like a flea from an indicator ("turkey", as traders jokingly call them) to another indicator, put them 20 per chart or buy worthless paid signals.

John Bollinger is one of the brightest representatives of the trading family. It is with his brainchild that beginners can start, that they prefer to master the difficult art of trading with indicators.

Bollinger Bands are a popular trend and volatility indicator

But before we get down to business, let's get to know John himself.

John Bollinger (aka John A. Bollinger) is a legend in the financial market. And the patriarch, far from whitened with gray hair, is not even 60. John is the owner of many financial awards (they are too lazy to even list - dozens) and the author of the worldwide bestseller "Bollinger on Bollinger Bands", which has been translated into 11 languages.

Why is this book good? This is not only a description of how the indicator works, but also a unique guide to trading any assets. And do you know what I liked the most about her? That it was written in human language. Without zazu, without the dominance of mathematical terms and formulas.

Amazingly, being a strong mathematician, John managed to describe the work of Bollinger Bands in a way that even a 10th grader would understand. In very simple language, without a single formula.

In this article, I will tell you everything there is to know about lines / stripes. But if you want to enjoy the full version, download this book. You will not regret.

John has been involved in technical analysis of financial assets since 1977, starting with completely antediluvian computers. Over time, he created his own system (Group Power), which allows identifying trends in various industrial groups and sectors.

In 1996, John created equitytrader.com, the first technical analysis site in the United States and still maintains its leading position today.

In general, this is a super-successful trader, the owner of a number of companies, an analyst and a scientist. He has also headed several industry financial organizations such as the International Federation for Technical Analysis (IFTA).

By the way, one of the most expensive champagnes in the world is called Bollinger. True, John has nothing to do with him (although, who knows).

These lines of his are a real gem in the world of binary options, forex and finance in general. Therefore, you should get to know them right now.

Bollinger indicator: how it works

In essence, Bollinger Bands, or Bollinger Bands (waves, channels and even “bands”, as they call it) are an indicator that perfectly shows volatility. This funny word hides how much the price changes, how much it "sausage" according to the schedule.

For further reading of the article. In it, click on the button Indicators(indicators) and select Bollinger Bands(Bollinger Bands).

It consists of only three lines, namely:

- simple moving average (SMA for 20 days, simple moving average), centered;

- top band: SMA 20 + (standard deviation x 2);

- bottom bar: SMA 20 - (standard deviation x 2).

The calculations used to draw these stripes are based on the so-called standard deviation (STD or standard deviation). It is calculated using a special formula, which is essentially not important for a trader, because all calculations are done automatically. So I do not give the formula, who needs it - he will find it.

The Bollinger Band is a corridor. Here it is, grayed out in the photo above and made from three stripes. It is he who is the essence of the indicator. And when a candlestick goes beyond the upper or lower limits of the corridor - therefore, this is where you need to look for trading opportunities.

In general, in essence, this is a typical oscillator. There are a great many of them, however, "Bolly", as traders affectionately call it, is one of the most popular oscillators in the world.

The higher the volatility, the wider the Bollinger Bands. Conversely, when the price creeps up or down like a dead turtle (low volatility), the bands also narrow.

Now let's look at specific examples.

Bollinger Trading: Basic Techniques

As we already understood, there are 3 Bollinger bands. The centerline is a simple moving average that is set to 20 days by default. The other two lines are calculated using the standard deviation. But these are all lyrics, let's get to practice.

Narrowing and expanding

Bollinger Bands are an ideal indicator of volatility that contracts or expands cyclically, showing a wave-like price structure.

Let's look at the graph. After each narrowing of the channel, expansion occurs - and the price moves sharply up or down. Therefore, after each "narrowing" it is quite logical to wait for expansion.

We wait until the channel is narrow and start trading after it starts to expand. Where will the price go when it expands?

Line punching or high / low prices

Typically, candlesticks on the chart are inside the channel. It’s good for them there. It only means that nothing interesting is happening. But as soon as the price approaches the upper or lower line, this is where the opportunity for trading appears.

For example, if a candlestick crosses the lower line, therefore, the price may soon go up. Indeed, let's look at the graph:

Another example works in the same way - the crossing of the upper line may mean an imminent fall.

However, remember: this will only work if there is no pronounced trend. If it is, then the crossing of the Bollinger line by the candlestick will only indicate that the trend will continue.

How can this be determined? This is called a lane walk.

Walk the strip

As we already understood, when a candlestick crosses the line, this is a good signal. But what about? That:

- price movement will change;

- or the trend will continue.

If the trend continues, it is called a strip walk. Like this:

As you can see, when a candlestick touches or crosses the upper Bollinger band, the price goes down for a very short time. Then she repels herself with renewed vigor and continues her upward movement.

Therefore, if there have already been several such touches - as in the example - the trend will continue, and each touch will only become its confirmation.

Here is the exact same example for a downward price movement. As you can see, the candlesticks cheerfully cross the lower lines, however, the trend does not even think to change - it also goes down.

Identifying a strong trend is not difficult - it will scream about itself all over the chart. Moreover, every touch of the upper or lower line is the perfect time for a trade.

Let's say the trend is going down and there is a touch? Wait for the price to bounce slightly to the middle line and sell.

How to understand that the trend will reverse? For this there is such a find as W- and M-shaped figures. John Bollinger found more than 45 such figures, but their principle, in general, is very similar.

W-shaped shapes

In fact, the W-shaped figures were first brought to light by Arthur Merrill, another light head. Bollinger used his works to develop the ideas of his indicator.

The W-shape is, quite simply, the regular letter W that you should look for at the bottom of the graph. In this case, the first part of the letter can be higher than the second, although not necessarily.

Let's find the letter W at the bottom of the graph - it's highlighted in blue.

It's simple: the price goes down and touches the lower Bollinger band. Then it bounces up and crosses the middle line. Then it goes down again, falls short of the lower band again, and a miracle happens - the trend completely changes and begins to briskly go up.

And as soon as you see that the upward growth crossed the price, which was with an average bounce, that means that the trend has changed.

Here are two more examples with our letter W, but on a different chart, for clarity:

All the same. We see the first touch of the bottom line, a rebound, the second fall, which does not reach the bottom line. Further growth begins, it crosses over the price that was in the middle line and a strong rise begins.

M is a slightly different story, albeit very similar.

M Shapes

Everything is the same here. Your task is to find the letter M at the top of the graph. In fact, we are talking about a double top, from which it is easy to see our letter, like this:

By the way, pay attention to who, when the letter M is drawn on the upper chart, another indicator - MACD - shows something different - that the price will fall.

That is, MACD does not coincide with Bollinger Bands. It is called divergence and suggests that the price movement will change very soon. We will talk more about the wonderful MACD in a separate article.

We see the first rise and the intersection of the upper line. Then there is a rebound downward, again an ascent. Note - on the second rally, the top does not cross the upper Bollinger line. Then the second fall, the price falls below the price with an average bounce and voila - the whole chart went down.

And here is another example of our letter:

As you can see, the letter "M" is strongly skewed, but the principle is still the same:

- the price did not reach the upper line;

- bounced down;

- rose again, but lower;

- it went down again, broke through the previous value and finally decreased.

So the strategy is simple. Look for the letters W and M on the chart - they will help you find a change in trend.

Best Bollinger Band Strategy

What trading strategy can you recommend?

Of course, you need to open the chart and just learn how to find all the elements, which we have already described:

- punching the line;

- walking on the strip;

- the letters W and M.

Often the strategy is to use bands with other indicators that complement it. Of these, two are well suited, namely:

- MACD;

- price oscillator.

And stop placing 20 indicators per chart. If the success of trading depended on the number of indicators, then we would all already be millionaires. But the reality, as you can imagine, is somewhat more complicated.

with Bollinger Bands, MACD and Price Oscillator

Bollinger + candlestick analysis + auxiliary indicator. But - it will take practice, a lot of practice. Study the graph, find the necessary examples on it, and in general - do not be lazy.

Bollinger Settings

In his book, John Bollinger advised not to touch the indicator settings without a good reason. Indeed, the indicator has been created for almost 10 years. When creating it, tens of thousands of transactions were analyzed, so John has already done all the work for us.

However, no one bothers you to delve into the settings in order to understand the principle of the indicator.

To open the Bollinger Bands settings, click on the gear icon. A window with three menus will appear.

Inputs Menu

In this menu we see the following parameters:

- Length Period. The default is 20, so leave it that way.

- Source... What data from the candle is used. You can change and see the difference (it is scanty).

- StdDev (standard deviation)... But this parameter can and should be changed. Put the values 3 or 4 and see how the graph changes.

- Offset... Offset in relation to the market. I don't touch.

Style Menu

Here you can change the style of all three lines and the background. As a rule, I turn the thickness of the lines to the maximum with the help of the slider, so that they are better visible.

Well, you can change the background of the strip to a more pleasant color if it bothers you. There is nothing else to do here.

Properties menu

Cosmetic properties change here, in particular, whether the values of the upper, middle and lower bands are displayed.

Nothing interesting.

Bollinger Bands in Binary Options

All described tactics are fully applicable when trading binary options. Moreover, Bollinger bands are generally considered one of the most effective indicators for the binary trading type.

The indicator performs best on 5- and 15-minute timeframes. You can use it on a 1-minute one, however, be sure to compare the indicator indicators with larger timeframes.

We saw an opportunity at 1 minute, switched to 15 and 30 minutes, assessed the situation and came back. This is also true when using other indicators.

As for me, the Bollinger Bands are in my personal top-3. But this is not a magic loot button. For other factors come into play, such as experience, pair volatility, the influence of news on them, and so on.

Study Bollinger Bands. In the right hands, this is an absolutely amazing indicator, on the basis of which a bunch of trading systems are built. Since its inception, it has only confirmed its credibility and reliability. Thing. For those who understand this, of course.

In this article, we will look at what kind of strategy to trade Bollinger Bands for binary options and Forex. Also here you will find tips for its use and settings.

For a stable income on binary options, you need to learn how to conduct the correct analysis of charts. Based on this information received, further movement of quotations for the value of various assets is predicted. The process of training traders is associated with practical training, and novice users always run the risk of losing their own funds very quickly.

Increase

It is important to correctly use strategies based on Bollinger Bands when trading in order to close most trades with a profit. All the nuances can be worked out in practice using a demo account.

- In an uptrend, it is necessary to buy CALL options with a maturity depending on the time period used on an open chart. The most appropriate moment is when the value of a currency pair moves up in the upper channel, after which it is carried out to the middle band.

- During a downtrend, income from binary options trading should be obtained by purchasing a binary PUT contract. The time of completion of the transaction is selected in accordance with the timeframe of the chart. The ideal moment for opening an order will be the moment after a rollback to the middle line of quotes, but the value should move in the lower channel.

- If a sideways trend prevails on the international financial exchange, then the value moves from the upper to the lower Bollinger Bands. This means that trading on binary options CALL or PUT is conducted according to the following rules: when the quote of a currency pair has approached the upper line of the upper channel, then it is necessary to open a deal for the forecast of a fall in value (PUT option). If the value of an asset fell on the lower channel to the lower border, then it would be logical to buy binary options for further price growth (CALL binary option).

Increase

Both indicators, in addition to the direction of the trend, clearly show the level of spread of value quotes - volatility. If the Bollinger Bands are gradually narrowing, and the trend has a strictly sideways direction, then the moment is the most important, when you should be patient in order to confidently fix the profit.

It is necessary to remember that the more the Bollinger Bands narrow, the stronger and sharper the price jump in a particular direction will take place. With such a leap, binary contracts should be purchased. It is best to work with H1 and H4 timeframes, since the price jumps will turn out to be more confident and longer, and the expiration time of binary contracts is respectively 30 minutes - 1 hour.

Graphical parameters and functions of indicators

One of the best binary options trading strategies is based precisely on the Bollinger Bands indicator. This strategy demonstrates very strong signals for opening CALL and PUT contracts.

Unlike many others, it can be used to trade not only classic, but also OneTouch or Range contracts.

To work, you need to put the Bollinger indicator on a live chart. We will use the standard settings of this indicator in trading.

Trading rules follow from the capabilities of the indicator itself - the approach of the value to the extreme lines of the bands signals that there is already enough movement and it is necessary to wait for a market reversal. It looks like this.

Increase

This approach is very simple, it has both advantages and disadvantages. In particular, the pluses include universalism (suitable for any timeframes and assets), accuracy (high percentage of profitable transactions). The disadvantages include short-term.

It is important to know that the approach of value to the bands does not provide an unambiguous signal about a powerful change in trend. This will often be a local corrective movement.

Because of this, trades are opened, with rare exceptions, 1 - 3 candles ahead. In most cases, it makes no sense to open more than one candle ahead. If the strategy is often used in binary options, then in forex it is used only for scalping.

Trading signals

To demonstrate trading signals, let's take a 1 hour timeframe. Binary options are used as a basis, but the situation is similar for Forex.

Signal to rise

It is necessary to purchase a promotion contract when the following conditions are met at the same time:

- The candlestick crossed the lower band from top to bottom.

- A candlestick closed below the lower Bollinger Band.

Increase

This is a great signal and a good buying opportunity.

Signal for a decrease

The opposite situation is observed, when a signal to open a down trade appears:

- The current candlestick was opened within the Bollinger Bands.

- The candle crossed the upper band from the bottom up.

- A candlestick closed above the upper Bollinger Band.

Increase

Important conditions

The situations discussed above are classic. Quite often they give very accurate signals, but not 100%.

To improve the performance of this system, users can change the standard deviation (when setting the indicator, the basic parameter) from "2" to "3". As a result, the Bollinger Bands become wider, and the price approaches them.

This will reduce the value of the static probability of receiving a false signal. In this matter, practice should be used to determine for which underlying assets which deviation is considered optimal.

Another very popular modification of this system is when the user does not wait for the cost to go beyond the range. This strategy is classic for binary options. In it, the purchase of an option is done directly when the value approaches the bands.

This method is especially relevant for flat situations on the market and small timeframes.

Increase

The screenshot shows an example of this modification of the system along the Bollinger lines. It shows that during a calm market, which is not subject to a trend, such a modification is well suited. Out of 12 signals with a loss, 2 closed, and 10 brought profit.

How to use a binary options strategy. Instructions for beginners

For binary options, a large number of strategies have been created using Bollinger Bands. There are many similar techniques that have been developed for Forex, but are suitable for the binary options market.

For beginners, it is better to start with the most understandable and simple strategy, where many indicators are not used, so that there is no confusion. The experience of many traders says that it is the simplest strategy that will be the most effective, it allows you to "feel" the market. This largely determines the success of a binary options trader. The candlestick chart is very "eloquent", you need to learn how to read it correctly.

You can trade successfully using only Bollinger Bands and the above techniques. Sometimes they are enough to make successful bets, but you can use indicators that act as a safety net for a trader who doubts his own decisions. The value oscillator will also work best. The screenshot below shows a basic graph view.

Increase

Bollinger Bands are also perfectly combined with the RSI indicator (relative strength index. Together with it, a powerful financial instrument is formed, which very accurately determines the direction of value.

Signals are received very rarely, but quite accurate. Like Bollinger Bands, RSI can be found on most brokers on the base list. It is also present in all trading terminals.

In the settings for work, you need to set the level of 30 and 70. You can use 20 and 80, but there will be fewer signals.

To enter the market, the signal will be the crossing of the price of the lower (30) or upper (70) level on the RSI, the simultaneous crossing of the corresponding line on the Bollinger Band.

When using these indicators, it is undesirable to choose the option time of more than 4 candles, and the timeframe indicator is less than M15. Otherwise, losses are not excluded.

John Bollinger is the name of a very smart and well-known person who once needed a reliable way to measure volatility in the financial markets. Yes, volatility is very important, because, as we all know, the ability to see periods of high and low volatility can help us choose the right strategy.

In the early 1980s, John managed to find a solution to this problem - and it appeared in the form of two bands and a regular moving average (often MA with a period of 20) - which are collectively called Bollingera Bands or Waves. Have they become a “magic indicator” and a “100% way to determine the trend”? Of course not. But they bring a lot of benefits.

This is how the Bollinger strategy for binary options works: its bands approach each other when the market is calm, and move away from each other when, on the contrary, it is very volatile. And also, when they are very close to each other, this indicates a high probability that it will literally explode.

To install an indicator on MT4 charts, you need to go to "Navigation" - "Indicators" and double-click on the corresponding item. It's all. The default period is 20, but with this setting you can always play around depending on your preferences and trading style.

A tool that is often used with an indicator such as Bollinger Waves is the rsi, that is, the Relative Strength Index. It is also often combined with MACD.

Bollinger Wave Strategy

Let's take a look at one of the many trading techniques based on this popular indicator. Among many others, it is distinguished by the fact that, apart from, in fact, the Stripes, nothing additional is used in it. And this is, at the very least, interesting.

Initially, it was posted by an anonymous trader at forexstrategiesresources com (at least we could not find his name or nickname). So, let's move on to the tactics and rules of the best Bollinger strategy for binary options. As already mentioned, it uses only Bollinger waves (hereinafter “B”) with different settings. Each of them must be added to the charts separately:

- B 1: period 50, deviation 2, red;

- B 2: period 50, deviation 3, orange;

- B 3: period 50, deviation 4, yellow.

Each indicator needs to be added separately using the above settings. Initially tailored for Forex, this technique works best with currency pairs.

How do I trade?

Attention should be paid to the touch and breakout of red B 1. It is also necessary that the price overcome at least half the distance between it and B 2. If the price touches yellow B 3, the probability of a successful entry point will become even higher - but this happens much less often. And when these conditions are met, you need to make a deal in the opposite direction, as this signals a high probability of a reversal. Here are the rules:

- Buying a Put option - the price crosses the upper red B 1 and is at least half approaching the upper orange B 2;

- Buying a Call option - the price crosses the lower red B1 and at least half approaches the lower orange B 2.

The Bollinger Band Strategy for Binary Options works against the trend - it is purely an anti-trend tactic. Trading against the trend is generally considered very risky - and this is no exception. During market trending periods, it will not work in principle, so it needs an additional filter to identify a trend, especially a strong one.

If a trader can identify a market within a range or even without a strong trend, the results of the application will be strikingly good. The thing is that in the range the price jumps between the lanes like a ping-pong ball - and you can make quick money on these movements.

It is on the market noise that all tactics are built. It will work as long as the price does not go in one direction for a long time. And in this case, it will trade even on a timeframe of 60 seconds, and with very good accuracy, which is actually a rarity.

Final grades

Bollinger Bands Strategy for Binary Options is unique in its own way and will suit, first of all, lovers of aggressive trading. It uses a 1 minute timeframe, which has a lot of market noise. Bollinger waves on turbo options work only during periods of a range - a trend, and especially a strong and stable one, will turn it into an account devastator, therefore, it is strongly not recommended to use it without the ability to distinguish market conditions. As, however, without testing it on a demo account.

Trading level (difficulty) - 5/10

This is not the simplest strategy and its success directly depends on the trader's experience and whether he knows how to correctly determine whether the market is in a trend or not. It is this skill that determines whether the trading technique in question will empty your account or bring a large profit, since it only works in a range.

Profitability and risks, reliability - 6.5 / 10

The considered tactic is quite risky if only because its author proposes to use it in a 60-second time frame. But at the same time, it is quite profitable.

Components - 6/10

Essentially, only one indicator is needed, which gave the name to this technique - but in triplicate and with different settings. The accuracy of forecasts depends on the asset used and the state of the market - in the range it reaches 90%.

Trading frequency - 5/10

The author suggests using his creation on a short-term (including 1-minute) timeframe during periods of the market in a range. The responsibility for determining such market conditions rests entirely with the trader.

Features - 7/10

The main feature is the use of only Bollinger Bands and no other additional indicators. Also, this point can be attributed to the fact that the tactic is applicable to very short-term timeframes, and the fact that it goes against the trend.