What taxes go directly to the state budget. taxes

1. The concept of the budget. The economic relations that develop in society regarding the use of money are called finance. A significant part of them is accumulated by the government in the form of public finances. A significant part of GNP is redistributed through public finance. The main link of public finance is the budget.

The budget structure of unitary states differs from federal ones: the former have two levels of budget - national (federal) and local, and the latter have three: between the federal and local budgets there is an intermediate regional link in the form of state budgets (USA), states (Germany), subjects of the federation (Russia). If you bring all levels of budgets together, you can get consolidated state budget, which is used for special analysis and forecast of cash flows in the national economy.

The leading link in the budget structure of the country is the state budget- the financial plan of the state for the centralized attraction and expenditure of financial resources to perform its functions.

In countries with a developed market economy, the state budget performs, in addition to its direct functions of ensuring the country's security, maintaining the state administrative apparatus, implementing social policy and developing science, education, culture, another additional function - regulating the economy, indirectly influencing the market behavior of firms in order to achieve sustainable development.

2. Budget surplus and deficit. The state budget is drawn up in the form balance of income and expenses for the year. The equality of income and expenditure parts between themselves implies budget balance, however, the presence of cyclicality in the economy, the need for an active stabilization policy and structural changes in the national economy in order to implement the achievement of scientific and technical progress, often leads to a mismatch of their own parts of the budget and the emergence of a deficit (more often) and a surplus (less often).

budget deficit- the amount of excess of government spending over its revenues within the financial year. Distinguish current(temporary, not exceeding 10% of the budget revenue) and chronic(multi-year, critical, exceeding 20% of the revenue). When approving a deficit state budget, its maximum allowable value is usually set. If in the process of budget execution it is exceeded, then sequester budget, i.e., a proportional reduction in spending for the remaining budget period for all items of expenditure, with the exception of socially protected ones.

Budget surplus- the amount of excess of state revenues over its expenditures within the financial year.

The alternation of periods of budget deficit and surplus makes it possible to balance the budget not for a year, but for 5 years. This approach allows the state to maneuver its finances in order to smooth out the business cycle by about 30–40% (Fig. 50.1).

Rice. 50.1.Cyclical balancing of the state budget

R - government revenues; G - government spending; M - balanced budget.

3. Public debt- this is the excess of the sum of the total deficits of the state budget accumulated over the previous years over its surpluses. The state debt of the country is formed at the expense of both internal and external borrowings.

Domestic public debt- the debt of the government of their country. It is served by issuing government bonds and obtaining loans from the Central Bank of the country.

External public debt- the debt of the state to foreign creditors: individuals, states, international organizations. If the government is not able to pay its public debt and fails to meet the deadlines for payments, then a situation arises default- temporary waiver of obligations, entailing the sanctions of creditors up to a boycott and confiscation of state property located abroad.

A significant public debt disrupts the financial system of the state, worsens the business climate in the country and significantly limits the growth of the population's well-being.

4. The principle of taxation. taxes- These are mandatory payments of individuals and legal entities levied by the state. They form 90% of the revenue part of the state budget of the country.

Taxes, in addition to the fiscal function (i.e. filling the state budget), are intended for:

a) regulation;

b) stimulation;

c) income redistribution.

The principles of rational taxation, developed by A. Smith, have not lost their relevance to this day:

The principle of justice: the tax burden should be borne by the whole society, and tax evasion, the creation of various "gray schemes" of settlements with the state should be condemned by society.

Certainty principle: the tax must be specific in amount, term and method of payment. It is impossible to introduce taxes retroactively (modern practice in Russia).

convenience principle: the tax should be convenient primarily for the population, and not for the taxman.

Saving principle: the costs of collecting taxes should not be excessive, burdensome for society.

5. Direct and indirect taxation. According to the method of collection, taxes are distinguished direct and indirect.

Direct taxes- These are visible taxes, since they are established on the income received by a person or company, as well as on their property: income tax, corporate income tax, inheritance and gift tax, land and property tax, etc.

Indirect taxes- These are implicit taxes, invisible to consumers, since they are levied on producers who are obliged by the state to include them in the price of goods and transfer them to the state's income immediately after the sale. These are turnover tax, value added tax, sales tax, excises.

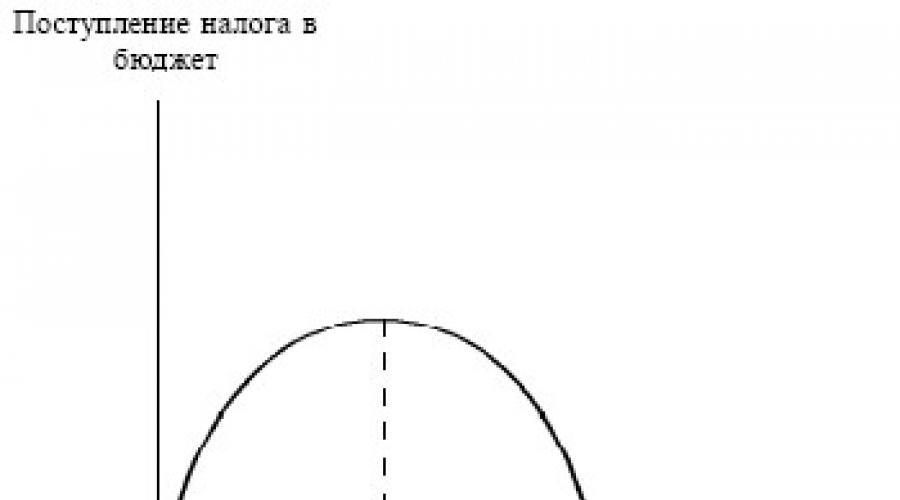

6. Laffer curve. play an important role in taxation tax rates- the amount of tax per unit of taxation. If they are excessively high, then the economic activity of the population will be restrained. In the early 80s. 20th century A. Laffer, then an adviser to President R. Reagan, found that the increase in rates increases the flow of taxes to the treasury only to a certain limit, after which the population goes into the shadow economy, preferring not to pay taxes at all. This situation in economic theory is described using Laffer curve(Fig. 50.2).

Rice. 50.2.Laffer curve

The economic relations that develop in society regarding the use of money are called finance. A significant part of them is accumulated by the government in the form of public finances. A significant part of GNP is redistributed through public finance. The main link of public finance will be the budget.

The budget structure of unitary states differs from federal ones: the former have two levels of budget - national (federal) and local, and the latter have three: between the federal and local budgets there is an intermediate regional link in the form of state budgets (USA), states (Germany), subjects of the federation (Russia) If all levels of budgets are brought together, then it is possible to obtain a consolidated budget of the state, which is used for a special analysis and forecast of cash flows in the national economy.

The leading link in the budget structure of the country will be the state budget- the financial plan of the state for the centralized attraction and expenditure of financial resources to perform its functions.

In countries with a developed market economy, the state budget performs, in addition to their direct functions of ensuring the country's security, maintaining the state administration apparatus, implementing social policy and developing science, education, and culture, another additional function - regulating the economy, indirectly influencing the market behavior of firms in order to achieve sustainable development.

Budget surplus and deficit

The state budget is compiled as a balance of revenues and expenditures for the year. The equality of revenue and expenditure between themselves implies a balance of the budget, however, the presence of cyclicality in the economy, the need for an active stabilization policy and the implementation of structural changes in the national economy in order to implement the achievement of scientific and technical progress, often leads to a mismatch of their own parts of the budget and the emergence of a deficit (more often) and a surplus (less common)

budget deficit- the amount of excess of government spending over its revenues within the financial year. There are current (temporary, not exceeding 10% of the budget revenue) and chronic (long-term, critical, exceeding 20% of the revenue). When approving a deficit state budget, its maximum allowable value is usually set. If it is exceeded in the process of budget execution, then a budget sequestration is carried out, i.e. a proportional reduction in spending for the remaining budget period for all items of expenditure, with the exception of socially protected ones.

Budget surplus- the amount of excess of state revenues over its expenditures within the financial year.

The alternation of periods of budget deficit and surplus makes it possible to balance the budget not for a year, but for 5 years. This approach allows the state to maneuver with their finances in order to smooth out the business cycle by about 30–40% (Fig. 50.1)

Figure No. 50.1. Cyclical balancing of the state budget

R - government revenues; G - government spending; M is a balanced budget.

State debt

State debt– ϶ᴛᴏ the excess of the total state budget deficits accumulated over previous years over its surpluses. The state debt of the country is formed at the expense of both internal and external borrowings.

Domestic public debt - the debt of the government of ϲʙᴏ her country. It is worth noting that it is serviced by issuing government bonds and obtaining loans from the Central Bank of the country.

External public debt - the debt of the state to foreign creditors: individuals, states, international organizations. If the government is unable to pay the ϲʙᴏth public debt and fails to meet the deadlines for payments, then a situation of default arises - a temporary waiver of obligations, entailing the sanctions of creditors up to a boycott and confiscation of state property located abroad.

A significant public debt disrupts the financial system of the state, worsens the business climate in the country and significantly limits the growth of the population's well-being.

The principle of taxation

taxes– ϶ᴛᴏ mandatory payments of individuals and legal entities collected by the state. It is worth noting that they form the revenue part of the state budget of the country by 90%.

Taxes, in addition to the fiscal function (i.e. filling the state budget), are intended for:

- regulation;

- stimulation;

- redistribution of income.

The principles of rational taxation, developed by A. Smith, have not lost their relevance to this day:

- The principle of justice: the entire society should bear the tax burden, and tax evasion, the creation of various "gray schemes" of settlements with the state should be condemned by society.

- The principle of certainty: the tax must be specific in amount, term and method of payment. It is impossible to introduce taxes retroactively (modern practice in Russia)

- The principle of convenience: the tax should be convenient, first of all, for the population, and not for the tax official.

- The principle of economy: the cost of collecting taxes should not be excessive, burdensome for society.

Direct and indirect taxation

According to the method of collection, taxes are distinguished direct and indirect.

Direct taxes – ϶ᴛᴏ visible taxes, as they are established on the income received by a person or company, as well as on their property: income tax, corporate income tax, inheritance and gift tax, land and property tax, etc.

Indirect taxes - ϶ᴛᴏ implicit taxes, invisible to consumers, since they are levied on producers who are obliged by the state to include them in the price of goods and transfer them to the state's income immediately after the sale. These are turnover tax, value added tax, sales tax, excises.

In taxation, a significant role is played by tax rates - the amount of tax per unit of taxation. If they are excessively high, then the economic activity of the population will be restrained. In the early 80s. 20th century A. Laffer, then adviser to President R. Reagan, found out the fact that the increase in rates increases the flow of taxes to the treasury only to a certain limit, after which the population goes into the shadow economy, preferring not to pay taxes at all. By the way, this situation in economic theory is described using the Laffer curve (Fig. 50.2)

Figure No. 50.2. Laffer curve

2 State budget, its functions and structure. Types of taxes

The state budget is the main financial plan of the state, which reflects its income and expenses for a specific period (for a year).

Functions of the state budget :

Redistribution of ND (from 20% to 60% of ND is redistributed in different countries through the state budget.

Stabilization of the national economy.

Implementation of state social policy.

The budget system of the Republic of Belarus:

republican budget,

local budgets.

Budgeting principles:

1. unity (concentration in the state budget of all expenditures and revenues of the state),

2. completeness (accounting for each item of all income and expenses),

3. reality (the state budget must take into account the specific economic and political situation),

4. publicity (as a condition for the observance of human rights).

Expenditure part of the state budget.

There are different classifications of government spending:

Transformation costs- public investment, public procurement of goods and services, salaries, transfer costs - expenditures as a direct transfer of funds.

Functional principle of distribution of expenses (according to the intended purpose).

economic,

for social purposes

for foreign economic activity,

Government revenues:

1. H tax and non-tax income.

2. About ordinary and extraordinary income.

The key is tax revenue.

Taxes are obligatory payments of individuals and legal entities collected by the state in order to fulfill its functions.

Tax functions:

1) fiscal (accumulation of funds to the state budget),

2) regulating,

3) stimulating.

The concept of “tax system” is connected with the concept of “taxes”.

The tax system is a set of taxes levied in the state, as well as the forms and methods of their construction.

The principles of building tax systems were determined by A. Smith:

1) justice,

2) efficiency (minimum negative consequences for resource allocation),

3) simplicity and cheapness.

To comply with all these principles, modern tax systems execute various types of taxes, the classification of which is based on different features.

taxes:

Depending on the object of taxation:

direct (established on income and property): income tax, income tax, social insurance;

indirect (taxes on goods and services included in their price): VAT, VAT, excise taxes on inheritance, on securities.

Depending on the authorities:

state (income tax, income tax, customs duties);

local (property taxes, excises).

Towards:

general (in the state budget) - depersonalized

special (target) - to eliminate the consequences of the Chernobyl accident).

Each tax contains the following elements:

subject (individuals and legal entities),

object (income, property),

tax salary (the amount of tax from one object),

source (salary, profit),

tax incentives (full or partial exemption from tax),

unit of taxation (unit of measurement of the object),

tax rate (the amount of tax per unit of measurement).

Ways to withdraw taxes:

1) cadastral (according to the register),

3) at the source of income (before receiving income) - wages, inheritance,

4) in the process of consumption (charges from owners of motor vehicles).

The “Laffer curve” model is known, which raises the question of the optimal value of the tax rate.

For r0 = max.R. A further increase in the tax rate is accompanied by a decrease in tax revenues. At r = 100%, production becomes meaningless. Laffer believed that the state should withdraw no more than 30% of the income of enterprises and the population.

| " |

Chapter 27

1. State budget

budget system

Articles of the state budget

The problem of external debt

2. Taxes

Types and groups of taxes

Basic taxes

Federal, state and local taxes

Structure of taxation

Tax rate and its types

Problems of tax collection

Harmonization of tax systems

3. Fiscal (fiscal) policy

Government and Aggregate Demand

State budget, savings and investments. Crowding effect

State budget and GDP dynamics

Taxes and Aggregate Supply

conclusions

Terms and concepts

Questions for self-examination

The main means of income redistribution and the most important instruments of state regulation of the economy and economic policy are the budget and taxes. These are closely related categories, so they often talk about fiscal policy (sphere, system, relationships, etc.). Often, instead of the term "budget-tax" they use its synonym - "fiscal" (from Latin fiscus - state treasury and fiscalis - related to the treasury).

As another synonym for the budget and taxes, the terms “public finances”, “country finances” are also used. To denote the totality of the fiscal and monetary systems, the term "financial and credit system" (sphere, relations, etc.) is used, or sometimes simply - "finance".

1. State budget

A significant part of the country's GDP is redistributed through the budget. In Russia, this value is approximately 1/3.

The concept of the state budget

State budget (state budget), according to the definition of the Budget Code of the Russian Federation, this is a form of formation and spending of a fund of funds intended for financial support of the tasks and functions of the state and local government. The draft budget is annually discussed and adopted by the legislative body - the parliament of the country, region or municipal assembly. During and at the end of the financial year, the executive authorities report on their revenue mobilization and expenditure activities in accordance with the adopted budget law. The activity regulated by the norms of law for the preparation and consideration of draft budgets, as well as for monitoring their execution is called budget process.

The state budget is always a compromise between the main socio-economic groups in the country. This is a compromise between the national and private interests of citizens regarding the taxation of income and property, between the center and the regions - regarding the distribution of taxes and subsidies, between the interests of individual industries and firms - in relation to government orders.

Theoretical approaches to the budget

Despite the decreasing role of the state in many areas of the modern market economy, it is forced to spend more and more money on the social sphere, science and culture. As a result, the share of GDP redistributed through the state budget, which increased sharply in the pre-war and war years, i.e. during the period of socio-political upheavals, continued to grow in the post-war decades, despite the economic, social and political stabilization in all countries with developed market economies.

Huge public expenditures on the social sphere, science and culture (in Russian statistics they are grouped under the name “socio-cultural events”) are caused by the very nature of modern society, which is becoming post-industrial (see 1.1). The rapid growth of science and scientific services, education, culture and art, health care and physical culture, housing and communal services and consumer services, social security and the recreation industry cannot be provided solely by the market. The state, refusing an active role in supporting material production, at the same time increases the cost of supporting these sectors of the service sector (for social and cultural events).

In a number of countries, both developing and with economies in transition, the share of government spending in relation to GDP has declined over the past decade, but this was due to the state's abandonment of a significant number of economic (but not socio-cultural) functions.

For developed countries with a market economy, attention is not so much paid to the size of budgets, but to their balance and structure.

Neoclassical and neoliberal directions consider it expedient for the country to have a balanced state budget. After all, an unbalanced budget (usually a budget with an excess of spending over income, i.e. with a deficit, and not with an excess of income over expenditure, i.e. with a surplus) increases inflation. So, to cover the state budget deficit, the state resorts either to printing money (which is less typical for modern conditions), or to issuing government loans. Both of these methods of covering the state budget deficit usually lead to inflation: high - in the first case, or lower - in the second, along with other problems (servicing the public debt, the rise in the cost of loan capital in the country). Neoliberal and neoclassical approaches have prevailed in recent years in the United States and Canada, whose governments manage to achieve budget surpluses.

The neo-Keynesian direction believes that a balanced state budget interferes with counter-cyclical and even anti-inflationary policies. At the same time, neo-Keynesians proceed from the fact that government spending is an important part of aggregate demand. Based on this, they point out that during a period of high unemployment and a corresponding fall in income, tax revenues to the budget are reduced (see 27.3). This pushes the government to cut spending to maintain a balanced budget or/and to increase tax rates, causing the country's aggregate demand to fall even further (Russia in the 1990s can serve as an example). During the period of excess demand with high inflation, tax revenues to the budget automatically increase, and in order to reduce a possible surplus, the government reduces tax rates and/or increases government spending, which further increases excess demand and, accordingly, inflation. Therefore, neo-Keynesians believe that during a recession, the state should be given the opportunity to increase government spending and reduce taxes to revive economic life, and during a period of excess demand, a restraining policy is needed in the form of reducing government spending and increasing tax rates. Both policies lead to an imbalance in the budget.

budget system

budget system called the totality of budgets of all levels (in Russia - the federal budget, the budgets of the subjects of the Federation and local budgets, i.e. the budgets of local governments) and state extra-budgetary funds.

State off-budget funds- these are state funds that have a designated purpose and are not included in the state budget. These funds are at the disposal of the central and territorial authorities and are concentrated in special funds, each of which is intended for specific needs. Examples are the Russian Pension Fund, the Social Insurance Fund, the Medical Insurance Fund, the State Employment Fund, the Social Support Fund. Extra-budgetary funds are created mainly for social purposes and are financed by social taxes (see 27.2) and subsidies from the budget. Such funds expand the possibilities of state intervention in the economy bypassing the budget and, consequently, parliamentary control. In addition, at the expense of state off-budget funds, it is possible to create the appearance of reducing the budget deficit.

There are also target budget funds, which, in contrast to state off-budget funds, are an integral part of the state budget. For example, in Russia it is the Federal Road Fund. Fund for the reproduction of the mineral resource base, etc. Like state extra-budgetary funds, they are aimed at ensuring that targeted taxes do not go into the “common pool” of the state budget, but are spent strictly for their intended purpose - for the construction and maintenance of roads, geological exploration, etc. . In Russia in 1998, the target budget funds accounted for about 5% of the expenditure side of the consolidated budget. Target budget funds are kept in banks and generate profit for the budget.

In the budget system of countries with a federal structure, three levels can be distinguished: the budget of the central (federal) government, the budgets of the subjects of the federation (regional budgets) and the budgets of local governments (local budgets). In other countries, the budget system has two levels: the central government budget and local budgets.

Through the budget of the federal government in Russia in the second half of the 90s. 10-14% of GDP was redistributed, judging by the revenue side of the federal budget. Expenditures exceeded revenues and amounted to 15-20% in relation to GDP.

If we add together the budget of the central (federal) government and the budgets of the territories, i.e. budgets of subjects of the federation and local self-government bodies, then this set of budgets is called consolidated budget. in Russia in the second half of the 1990s. its revenues were 24-25% of GDP, and expenses -28-34%.

Finally, if state off-budget funds are added to the consolidated budget, we get the so-called enlarged government budget. in Russia in the second half of the 1990s. its revenues were 33-34% of GDP, and expenses - 37-43%. For comparison, we point out that in the mid-90s. in the countries of Central Europe (Czech Republic, Slovakia, Poland, Hungary, Slovenia), the budget revenues of the enlarged government were at the level of 45-48% in relation to GDP; in South-Eastern Europe (Albania, Bulgaria, Croatia, Macedonia, Romania) - 31-38%; in the Baltic States - 33%; in Belarus - 41-43%; in Central Asia - 20-22%; in Transcaucasia - 11-13%. We add that sometimes the budget of the general government is also called the consolidated budget.

Budgetary federalism (interbudgetary relations).

concept budgetary federalism (interbudgetary relations) is used to refer to those relations that arise between the budgets of different levels: federal, regional, local.

The basis of fiscal federalism is the autonomy of all three levels of the budget, for example, through assigning their own taxes to them. However, it is rarely fully achieved due to the fact that tax revenues usually cannot cover all the expenses of regional and local budgets. As a result, higher level budgets tend to subsidize lower level budgets. And the more budgets depend on such subsidies, the more problems arise in interbudgetary relations.

As for Russia, in the consolidated budget, the share of territorial budgets accounts for more than 1/2 of revenues (the situation is similar in the USA). One part of taxes (regional and local) goes entirely to the territorial budgets, the other part goes entirely to the federal budget, and taxes on value added, on profits of enterprises and excises are distributed between the federal budget and territorial budgets. At the same time, non-tax revenues (from the use or sale of one's own property), as well as budget loans, subsidies and subsidies from higher level budgets, account for a significant share in the revenues of territorial budgets.

Although territorial budgets run into deficits, they are usually covered by higher-level budgets or by issuing their own securities.

Articles of the state budget

The structure of budget revenues and expenditures and the share of individual items in the consolidated budget will be considered using the example of the Consolidated Budget of Russia in 1998 (Table 27.1).

Table 27.1. Consolidated budget of Russia in 1998.

It should be noted that taking into account state off-budget funds (and this is still about 9% in relation to GDP), the share of social and cultural events in the budget expenditures of the enlarged government is growing sharply - up to about 18% of the entire Russian GDP.

budget spending

State budget expenditures perform the functions of political, social and economic regulation.

The first place in budget expenditures is occupied by socio-cultural items: social benefits, education, healthcare, culture, science, etc. This manifests the main direction of budget policy, as well as state economic policy as a whole - stabilization, strengthening and adaptation of the existing socio-economic system to changing conditions. These expenditures are designed to mitigate the differentiation of social groups that is inevitable in a market economy. However, facilitating the access of representatives of relatively less wealthy segments of the population to obtaining qualifications, decent medical care, a guaranteed minimum pension and decent housing not only plays a socially stabilizing role, but also provides the economy with the most important factor of production - a qualified and healthy workforce, and therefore increases the national economy. wealth of the country.

In the costs of economic needs, budgetary subsidies to agriculture are usually allocated, which also have a social, political and economic orientation. Not a single state can be interested in the accelerated and massive ruin of its peasantry and farming. And although in its foreign economic policy the government sometimes temporarily sacrifices the interests of domestic producers of agricultural goods, allowing foreign agricultural products to the domestic market in response to concessions from trading partners, it usually supports its own farming.

Spending on national defense, law enforcement and security, as well as administrative and management costs affect the structure of demand.

The opportunistic goals of budgetary regulation can be spending on public debt (for example, early repayment of part of the debt), the amount of spending on loans and subsidies to private and state enterprises, agriculture, on the creation and improvement of infrastructure facilities, on the purchase of weapons and military construction.

During periods of crises and depressions, state budget expenditures for economic purposes, as a rule, grow, while during the "overheating" of the economy, they decrease.

The structure of state budget expenditures has a regulating effect on the size of demand and investment, as well as on the sectoral and regional structure of the economy, national competitiveness in world markets.

Expenditures on export credits, insurance of export credits and exported state capital, financed from the budget, stimulate exports and improve the balance of payments in the long term, open up new foreign markets for the country's economy, help strengthen the national currency, ensure the supply of necessary goods to the domestic market due to frontier. This is the external economic aspect of the policy of budget expenditures.

The effectiveness of state regulation of the economy with the help of budget expenditures depends, firstly, on the relative size of the amounts spent (their share in GDP); secondly, on the structure of these costs; thirdly, on the effectiveness of the use of each unit of expended funds.

The problem of balancing the state budget

As already noted, according to neoliberal and neoclassical theory, the ideal execution of the state budget is the full coverage of expenses by revenues and the formation of a balance of funds, i.e. excess of income over expenses. The resulting balance can be used by the government under unforeseen circumstances, for early payment of debts or transferred to next year's budget revenue.

The budget deficit resulting from the excess of expenditures over revenues is covered by government loans (internal and external). They take the form of selling government securities, borrowing from extra-budgetary funds (for example, from an unemployment insurance fund or a pension fund), and obtaining loans from banks (this form of financing the budget deficit is often practiced by local authorities).

State loans are not the only way to cover the state budget deficit. Since the transition from gold to paper-money circulation, most developed countries have accumulated significant experience in covering the budget deficit through additional emission of money. Governments especially often resort to this means in critical situations - during a war, a prolonged crisis. The consequences of such issuance are well known: uncontrolled inflation develops, incentives for long-term investment are undermined, the “price-wage” spiral unwinds, the savings of the population are depreciated, and a budget deficit is reproduced.

In order to maintain economic and social stability, the governments of developed countries do their best to avoid the unjustified issue of money. To do this, a special block-fuse is built into the market economy system: the independence of the national issuing bank from the executive and legislative authorities, constitutionally enshrined in most countries. The issuing bank is not required to finance the government, thus putting a damper on the inflationary explosion that could occur if money were printed at the government's behest.

State loans are less dangerous than emission, but they also have a certain negative impact on the country's economy. First, in certain situations, the government resorts to the forced placement of government securities and thus violates the market motivation for the activities of private financial institutions. Secondly, even if the government creates sufficient incentives for the purchase of government securities by legal entities and individuals, then government loans, by mobilizing free funds in the loan capital market, narrow the possibilities for private firms to obtain credit. Firms, especially small and medium-sized ones, are not as reliable borrowers for banks as government agencies. State loans in the loan capital market contribute to the rise in the cost of credit - the growth of the discount rate.

However, public loans also have positive aspects. First, the government securities market formed on the basis can attract some investors for whom other sectors of the stock market are unattractive. Secondly, by placing securities of new state loans on this market or by early redemption of papers of old loans, the state can actively influence supply and demand in the entire loan capital market. However, these positive aspects are manifested mainly in developed countries with stable economies.

State debt

Indebtedness of government bodies to holders of government securities accumulates and turns into public debt. It has to be paid with interest. It is said that today's government loans are tomorrow's taxes. Some taxpayers are owners of government securities. They receive interest on these services and at the same time pay taxes, which are partly used to pay off government loans. As a rule, it is not possible to fully pay interest from current budget revenues and repay state loans on time. Constantly in need of funds, governments resort to new loans; covering old debts, they make even bigger new ones. Public debt in different countries is growing at different rates. The excess of public debt over GDP is considered potentially dangerous for the stability of the economy, especially for stable money circulation. A more cautious estimate is the ratio of these two indicators as 0.6:1. In 1998, the public debt in relation to GDP was: in the USA - 62%, in Japan - 116, in Germany - 62, in France - 59, in Italy - 119, in Great Britain - 52, Canada - 91.5%. In Russia, the public debt in that year was estimated at 50%.

Public debt is divided into internal and external, as well as short-term (up to one year), medium-term (from one year to five years) and long-term (over five years). The heaviest are short-term debts. They soon have to pay the principal amount with high interest. Such debt can be rolled over, but this is due to the payment of interest on interest. Government agencies are trying to consolidate short-term and medium-term debt, i.е. turn it into long-term debt by postponing the payment of principal for a long time and limiting it to annual interest payments. In a number of countries, there are special departments of public debt under the Ministry of Finance, which carry out the repayment and consolidation of old debts and attract new borrowed funds. The payment of interest on a debt and the gradual repayment of its principal amount is called debt service(debt).

The problem of external debt

External debt is a subject of special attention. If payments on it make up a significant part of the proceeds from the export of goods and services of the country, for example, exceed 20-25%, then the situation becomes critical. This is reflected, in particular, in the credit rating of the country. As a result, it becomes difficult to attract new loans from abroad. They are provided reluctantly and at higher interest rates, requiring collateral or special guarantees.

Usually the governments of debtor countries take all possible measures not to fall into the position of bad debtors, as this limits access to foreign financial resources. We note several possible ways.

1. The traditional way - the payment of debts at the expense of gold and foreign exchange reserves; for inveterate debtors, this path is usually excluded, since they have exhausted these reserves or are very limited.

2. Restructuring (consolidation) of external debt, which is possible only with the consent of creditors. Lenders create special organizations - clubs, where they develop a solidarity policy towards countries that are unable to fulfill their international financial obligations.

The most famous are the London Club, which includes creditor banks, and the Paris Club, which unites creditor countries. Both of these clubs have repeatedly met the requests of debtor countries (including Russia) to defer payments, and in a number of cases partially canceled debts.

3. Reducing the size of external debt through conversion, i.e. turning it into long-term foreign investment, practiced in some countries. On account of the debt, foreign creditors are offered to purchase real estate, securities, equity participation, and rights in the debtor country. One of the options for converting external debt into foreign investment is the participation of economic entities of the creditor country in the privatization of state property in the debtor country. In this case, the interested firms of the creditor country redeem the obligations of the debtor country from their state or bank and, with mutual consent, use them to acquire property.

Such an operation leads to an increase in the share of foreign capital in the national economy without the flow of financial resources, material carriers of fixed capital, new technologies into the country from abroad, but it alleviates the burden of external debt, makes it possible to obtain new loans from abroad and stimulates the subsequent inflow private foreign investment and reinvestment in the economic objects acquired in this way.

4. Appeal of the debtor country, which has fallen into a difficult situation, to international banks - regional, the World Bank. Such banks usually provide soft loans to overcome the crisis, but condition their loans on strict requirements for national economic policy, in particular monetary policy, encouraging competition and privatization, and minimizing the state budget deficit. To such loans in the 90s. often applied by post-socialist countries, including Russia (see 37.3).

These and other measures are called external debt regulation. In the history of the twentieth century. there were other examples of external debt regulation. So, both after the First and after the Second World War, Great Britain and France paid off part of their external debt with their foreign assets. Some developing countries, in order to soften creditors, granted them the right to use their maritime economic zone, continental shelf, build military bases, satellite tracking stations.

2. Taxes

As already noted, the main item of budget revenues are taxes.

Essence of tax and tax system

Under tax, levy, duty and other payments is understood as a mandatory contribution to the budget of the appropriate level or to an off-budget fund made by payers in the manner and on the terms determined by legislative acts.

The totality of taxes, fees, duties and other obligatory payments levied in the state (hereinafter - taxes), as well as forms and methods of their construction forms tax system. The objects of taxation are income (profit), the cost of certain goods, certain types of activities of taxpayers, operations with securities, the use of natural resources, property of legal entities and individuals, the transfer of property, the added value of goods and services produced and other objects established by legislative acts. In Russia, the foundations of the tax system are enshrined in the Tax Code of the Russian Federation.

Types and groups of taxes

Taxes are of two types. The first type is taxes on income and property: personal income tax; corporate income tax (corporations, firms); tax on social insurance and on payroll and labor (so-called social taxes); property taxes, including taxes on property, including land and other real estate; taxes on the transfer of profits and capital abroad, etc. They are levied on a specific individual or legal entity, they are called direct taxes.

The second type is a tax on goods and services: a sales tax, which in most developed countries has now been replaced by a value added tax (VAT); excises (taxes directly included in the price of goods or services); inheritance tax, real estate and securities transactions, etc. These taxes are called indirect. They are partially or completely transferred to the price of a product or service. In Russia, approximately one half of tax collections come from direct taxes, the other half from indirect taxes.

Basic taxes

1. Personal income tax(tax on personal income) is a deduction from the income (usually annual) of the taxpayer - an individual. Payments are made during the year, but the final settlement is made at the end of it. The tax systems of different countries, while being largely similar, have their own sets of tax rates and exemptions, tax credits and payment terms. Typically, income tax is levied at a progressive rate that increases as the income of the taxpayer increases. Top income tax rates in developed countries range from 30 to 70%. The highest level of income tax is in Sweden. In Russia, the minimum rate of this tax is 12%, the maximum is expected to be increased to 45%.

In recent decades, there has been a noticeable downward trend in income tax rates in the world. Nevertheless, in developed countries, individuals spend a very significant part of their income on paying this tax. Personal income tax in these countries, unlike Russia, is the main component of budget revenues.

2. Income tax of enterprises, organizations (firms, corporations) levied if they are recognized as legal entities. However, for some firms in small businesses, an exception is made: they are recognized as legal entities, but it is not they who pay taxes, but their owners through individual income tax.

Corporate income tax (corporate tax) makes up the bulk of their tax payments. Profit, net income (gross proceeds minus all expenses and losses) is subject to taxation. In Russia, the rate of this tax is close to that in the leading developed countries - up to 35%.

The taxation of that part of the profit, which is subject to distribution among shareholders (shareholders) in the form of dividends, is carried out differently in different countries. Dividends received are subject to personal income tax, whereby the same amount may be taxed twice: first by corporation tax as part of profits, and then by personal income tax as distributable profits, which turn into income for tax purposes shareholders. The result is the so-called double taxation. It also occurs in other cases.

Depending on the approach to double taxation of distributable profits, national corporate income tax systems can be grouped as follows:

. the classic system, in which the distributed part of the profit is subject to corporate income tax first, and then personal income tax (Belgium, the Netherlands and Luxembourg, the USA, Sweden, Switzerland, and also Russia);

. company-level tax reduction system, in which distributed profits are either subject to a lower corporate tax rate (Austria, Germany, Japan) or partially exempt from taxation (Spain, Finland);

. a tax reduction system at the shareholder level, under which either shareholders are partially exempt from paying income tax on dividends they receive, regardless of whether corporate tax is withheld or not withheld from distributed profits (Austria, Denmark, Canada, Japan); or the tax paid by the company on distributable profits is partially offset in the taxation of shareholders (Great Britain, Ireland, France);

. a system of full exemption of distributed profits from corporate tax at the level of the company (Greece, Norway) or shareholders (Australia, Italy, Finland).

3. Social contributions(social taxes) cover social security contributions by businesses and taxes on wages and labor. They are payments made partly by the employees themselves and partly by their employers. They are sent to various off-budget funds: for unemployment, pension, etc. The state also participates in the financing of these funds. Payroll and labor taxes are paid only by employers. In Russia, enterprises' contributions to state off-budget funds account for about 39.5% of their payroll costs.

4. property taxes These are taxes on property, land and other real estate, gifts and inheritance. The size of these taxes is determined by the task of redistributing wealth. In some countries, such taxes are included in the excise taxes levied on transactions.

5.

Taxes on goods and services, especially customs duties and taxes, excises, sales tax and value added tax. The latter is similar to a sales tax, in which the entire burden is borne by the end consumer. Taxpayers who in the course of work add value to the objects of labor placed at their disposal are taxed on this added value. But each taxpayer includes this amount in the price of his goods, which moves along the chain up to the final consumer. In Russia, a somewhat simplified, so-called indirect model for calculating value added is used, i.e. not directly from the amount of value added, which is not easy to calculate, but based on the amount of sales of manufactured products minus purchased raw materials, materials, semi-finished products, etc.

Value added tax is levied in Russia (at the standard rate of 20%) and in almost all developed countries at the main (standard) rate, which fluctuates, for example, in the EU, around 15%. However, some goods and services are exempt from VAT, while others are charged at a higher or lower rate. In most regions of Russia, a sales tax is also levied (at a rate of up to 5%) on a number of goods and services. In some regions of Russia began to operate single tax on imputed income. Its payer is a small business in the service sector. The tax is paid quarterly at a rate of 20% of the estimated future tax.

Federal, state and local taxes

Tax payments, as we already know, go to the central, regional and local budgets. There is a certain procedure for the distribution of incoming funds. In Russia, local budgets receive all taxes on property of individuals and land tax, inheritance or gift tax and some minor taxes. Regional taxes in Russia include corporate property tax, real estate tax, sales tax, road and transport taxes and a number of less significant taxes. Federal taxes include value added tax, excises, corporate income tax, contributions to off-budget funds, customs duties and fees, and various taxes on users of natural resources. Receipts from a number of taxes (in Russia, these are VAT, corporate income tax, excises) are divided between the central and territorial budgets.

Due to certain contradictions between the interests of the central government and territorial economic interests, there is a political struggle around the division of tax revenues. Local residents and authorities are interested in more funds coming to the budgets of states, lands, municipalities, communities, since these funds finance education, health care, landscaping, local public construction, law enforcement and the environment. The central government constantly lacks funds for administrative and military expenses, the solution of global economic and social problems.

tax burden

The amount of the tax amount (the so-called tax burden) depends primarily on the tax base and the tax rate. The tax base is the amount on which the tax is levied, and tax rate is the amount in which the tax is levied.

In the USA, Great Britain, Italy and some other countries, the amount of income tax is determined solely by its value. In Germany, France, Japan, Sweden, part of the income tax is levied regardless of its size. In the 80-90s. most countries are reducing tax rates. As a result, while in the OECD as a whole firms paid more than 45% of their profits in taxes in 1986, in 1996 they paid about 30%. Along with the reduction in tax rates, tax incentives for the payment of public debt and interest on it increased.

In practice, most companies pay taxes on a share of profits that is less than the tax rate. First, various tax incentives are used, which will be discussed below. Secondly, companies can legally reduce the amount of taxable amount by increasing deductions to tax-free funds (amortization, etc.). Thirdly, companies with a small turnover in many countries are subject to lower taxes. Fourth, in a number of countries, corporate income tax can be paid not only by an individual firm, but also by its parent company (if the firm is part of a group of companies), which in practice makes it possible to reduce the tax base of companies included in the group. Fifth, almost everywhere there is a system of covering the losses of the company at the expense of its profits of several previous years or future profits.

tax credit(tax relief) is established, like a tax, in the manner and under the conditions determined by legislative facts. The following types of tax benefits are common:

. non-taxable minimum object of tax;

. exemption from taxation of certain elements of the tax object (for example, R&D costs);

. tax exemption for individuals or categories of payers (for example, disabled people); lowering tax rates; deduction from the tax base (tax deduction); change in the deadline for paying taxes and fees (in the form of a deferment, installment plan, tax credit);

. write-off of bad tax debts.

As a result, the average level of taxation of companies is much lower than the base (ie maximum). For example, in Germany it was in the late 80s. about 50% (baseline was 71%). In Russia, according to estimates, it is currently about 65%.

Structure of taxation

The share of individual taxes involved in the formation of the revenue side of the budget in different countries with a market economy is characterized by the following data, % of the total:

Taxes on Personal Income .............................................. 40

Taxes on profits of corporations (firms). .ten

Social contributions ................... ………….30

Value Added Tax.....……10

Customs duties......................……………5

Other taxes and tax revenues…5

In Russia, the role of individual taxes in budget revenues is somewhat different. Due to the relatively low standard of living of the majority of the population, income from taxes on personal income is small; instead of them, the main place in the revenue part of the budget is occupied by taxes on profits of enterprises and VAT (see Table 27.1).

Direct taxes are difficult to pass on to the consumer. The situation is easiest of all with taxes on land and other real estate: they are included in the rent and rent, the price of agricultural products.

Indirect taxes are passed on to the final consumer depending on the elasticity of demand for goods and services subject to these taxes. The less elastic the demand, the more of the tax is passed on to the consumer (see Chapter 8). The less elastic the supply, the less of the tax is passed on to the consumer, and the greater part is paid out of profits. In the long run, the elasticity of supply increases, and an increasing share of indirect taxes is passed on to the consumer.

When demand is highly elastic, an increase in indirect taxes can lead to a reduction in consumption, and when supply is highly elastic, it can reduce net income, which will lead to a reduction in investment or a transfer of capital to other areas of activity.

Taxes perform the following important functions:

. fiscal, i.e. financing of government spending. The state has traditional functions - the maintenance of public administration, law enforcement and security of citizens, national defense, environmental protection and natural resources, support for transport, roads, communications and informatics. In the twentieth century ever-increasing social and cultural functions were added to them. These traditional and modern functions account for the bulk of government spending;

. social, i.e. maintaining social balance by changing the ratio between the incomes of individual social groups in order to smooth out the inequality between them. One of the main ways to do this is to introduce progressive taxation: the higher the income, the disproportionately large part of it is withdrawn in the form of tax. Proportional taxation provides for the same share of tax in income, regardless of their size. Personal income tax is paid on a progressive scale. and often corporate income tax and property taxes, i.e. those taxes that are technically possible to levy at different rates depending on the income of the taxpayer. The social function is also carried out by the exemption from the payment of a number of taxes for certain categories of taxpayers (the poor, the disabled, pensioners, single mothers, large families, immigrants, students) or the non-taxation of certain socially significant goods and services (their exemption from VAT, sales tax, customs duties ), or, conversely, increased taxation of luxury goods (through high VAT, excises);

. regulating, i.e. state regulation of the economy, primarily cyclical fluctuations, structural changes, prices, investment, research and development, ecology, foreign economic relations. For this, new taxes are introduced and old taxes are abolished, their rates are changed and differentiated, and tax incentives are provided (see 27.3).

Principles of taxation

Throughout the history of mankind, no state could exist without taxes. Tax experience also suggested the main principle of taxation: "You can not cut the goose that lays the golden eggs", i.e. no matter how great the need for financial resources to cover conceivable and unimaginable expenses, taxes should not undermine the interest of taxpayers in economic activity.

This is clearly demonstrated by the Laffer curve, named after the American economist who substantiated the dependence of budget revenues on tax rates. Its meaning is that lowering tax rates has a powerful stimulating effect on the economy. When tax rates are lowered, the tax base eventually increases: since more products are produced, more taxes are collected, although this does not happen immediately (see Figure 7.3).

Modern principles of taxation are as follows.

1. The level of the tax rate should be set taking into account the possibilities of the taxpayer.

2. Obligation to pay taxes. The tax system should leave no doubt to the taxpayer about the inevitability of payment. The system of fines and penalties, public opinion in the country should be such that non-payment or late payment of taxes is less profitable than the timely and honest fulfillment of obligations to the tax authorities. ;

3. The system and procedure for paying taxes should be simple, understandable and convenient for taxpayers and economical for tax collection agencies.

4. The tax system should be flexible and easily adaptable to changing socio-political needs.

5. The tax system should ensure the redistribution of the generated GDP and be an effective instrument of the state economic policy. This principle applies to the regulatory function of taxation.

Tax rate and its types

We have already noted that the part of the tax base that the taxpayer is obliged to pay in the form of a particular tax is called tax rate(tax amount).

There are minimum, maximum and average tax rates. For example, in the US personal income tax is progressive: annual income up to and including $21,450 is taxed at a rate of 15% (this is the minimum income tax rate); from 21,450 to 51,900 dollars - at a rate of 3217.5 dollars + 28% on the amount exceeding 21,450 dollars; over $51,900 - at a rate of $11,743.5 + 31% of the amount in excess of $51,900 (this is the maximum rate).

Example 27.1. Suppose a young American has an annual income of $25,000. In this case, his tax liability is: $21,450X 0.15+ (25,000 -21,450) . 0.28 = $4211.5, i.e. he paid at the average tax rate. For this American, it was: (4211.5:25,000) . 100 = 16.8%.

Problems of tax collection

The easiest way to collect taxes is on wages and salaries. Here, taxes are levied automatically at the time of payment of the money owed; there is no tax deferral and there is little to no tax evasion. The same applies to other social contributions (social taxes). It is easy to levy excises and value-added taxes, but while they generate immediate revenue, there is the possibility of artificially inflating material costs and minimizing taxable surpluses.

With the normal organization of the customs service, the collection of customs duties is also not associated with serious problems.

The greatest difficulties arise in obtaining taxes from corporations (firms) due to the various possibilities for reducing taxable balance sheet profits by artificially inflating costs and using various benefits, discounts, deferments, investment premiums, necessary deductions to various funds permitted by state bodies responsible for regulation economy.

There are problems of an objective assessment of the value of land and other real estate when levying taxes on this type of capital.

A lot of difficulties and troubles are brought to the tax authorities by the tax on personal income received not from hired labor, i.e. on the income of entrepreneurs, rentiers, freelancers. The final amount of tax on these incomes is determined at the end of the year, and they often pay tax during the current year as if in advance in the amount of the tax payment for the past year. The final recalculation is made on the basis of the tax declaration at the end of the year, i.e. in fact, these taxpayers receive a deferred payment of part of the tax and have the opportunity to significantly reduce its amount. In addition, checking the correctness of paying taxes on personal income from business activities, corporate profits and real estate requires the maintenance of a significant staff of financial inspectors, and in some countries even financial police (in Russia it is called the tax police).

International aspects of taxation

The choice and change of the tax system, the establishment of tax rates, the provision of benefits is solely within the competence of the national state legislative and executive bodies.

However, the governments of various states are increasingly cooperating with each other in the field of tax policy. The need for such cooperation is rooted in the intensification of bilateral and multilateral economic ties, the development of economic integration and the resulting desire to ensure equal conditions for competition in world markets.

The national competitiveness of exported goods and services, the ability of a country to export capital abroad depend not only on the efficiency of the national economy, but also on the degree to which it is burdened with taxes. This is partly mitigated by the stimulation of foreign economic activity of national firms, carried out, in particular, with the help of tax incentives.

VAT can serve as an example of the impact of taxes on international economic relations. Usually this tax does not apply to exports, but it is imposed on all goods and services sold in the country, regardless of the country of origin. As a result, the VAT encourages exports and discourages imports, and since the tax is indirect rather than direct, it is not subject to World Trade Organization (WTO) restrictions on direct export subsidies. In Russia, exports to non-CIS countries are also not subject to VAT.

Customs duties on imports are a classic example of protecting the domestic market from excessive foreign competition. Thus, in Russia in 1998 the size of the weighted average duty was about 13% of the customs value of imported goods. In addition, these goods are subject to VAT and excises (if they are excisable goods).

International regulation of double taxation

All developed countries usually tax income earned in their territory. Many countries (USA, Canada, Japan, Great Britain, as well as Russia) also tax the income of their individuals and legal entities received by them abroad. The result is the so-called double taxation.

In Russia, the tax authorities credit taxes paid abroad by Russian individuals and legal entities. Nevertheless, Russia has agreements with a number of countries on the avoidance (elimination) of double taxation of income and property.

Harmonization of tax systems

In integration groupings, there is a tendency towards convergence (harmonization) of the tax systems of their countries. It is most active in the EU, where it is planned to create common corporate tax rates in the future, and double taxation of profits of companies from EU member states that receive income in other countries of the Union has been eliminated. Now the profits transferred by the subsidiary to the parent company are either not taxed in the country of residence of the first, or are counted when taxing the second. An agreement was reached on the unity of the main VAT rate (15%) and the introduction of uniform minimum excise taxes. Here, national taxes on the issuance of loans (1-2%) have already been harmonized and fees on the issuance of securities have been abolished. Harmonization of tax systems is also expected in the CIS.

3. Fiscal (fiscal) policy

Huge funds collected in the form of taxes and redistributed through the state budget constitute the main economic force of the modern state. Hence such close attention to taxes and the budget and the great impact of fiscal policy on the entire life of modern society.

Fiscal policy can be aimed at stimulating economic life, for example, during a recession, and then it is called fiscal expansion. Its main levers are an increase in government spending or/and a reduction in taxes.

Aimed at limiting the economic boom, more precisely, at combating the inflation caused by this boom, fiscal policy is called fiscal restriction. It involves reducing government spending and/or increasing taxes. This reduces boom-driven inflation by lowering economic growth and rising unemployment.

Government and Aggregate Demand

The vast majority of budget expenditures (government purchases, salaries of the so-called state employees, credits, loans and subsidies) determine aggregate demand. Their large weight in it allows the state to influence the entire aggregate demand:

AD = C + I + G + X, (27.1)

where AD is aggregate demand; C - consumer demand; I - investment demand private investment); G - government demand (government spending); X is net export.

The government also influences aggregate demand through taxes: the higher their rates, the lower the amount of disposable income in the form of consumer demand of households and investment demand of enterprises. However, taxes can remain high regardless of their negative impact on aggregate demand, but simply because the fiscal function of taxation can prevail over the regulatory one, which is what happened in Russia in the 1990s.

State budget, savings and investments. Crowding effect

In an equilibrium economy, the amount of savings (S) must be equal to the amount of investment (I), i.e. S=I (see 4.3). However, in practice, the situation is usually close to that when state budget revenues are added to household savings (S) (they consist mainly of taxes and therefore are also denoted by the letter T (taxes), and government spending (G) is added to private investment (I), which for the economy perform the role of investment injections:

S + T = I + G. (27.2)

If we rearrange this equation, we get

S - I = G - T. (27.3)

This modified formula shows that the difference between savings and investment is equal to the difference between government spending and revenue, i.e. budget deficit. In other words, if investment is less than saving, then this difference often goes to cover the budget deficit, usually in the form of government loans. However, this is the part of the savings that could be private investment.

Another negative effect of government borrowing is even more well known. It consists in the fact that as a result of additional demand for savings, the interest rate in the loan capital market rises, which leads to a reduction in private investment and, accordingly, to a fall in production, exports and consumer spending. There is a so-called crowding out effect government loans to private investment.

State budget and GDP dynamics

An increase in government spending leads to a revival of the economy - an increase in income and GDP.

Rice. 27.1 demonstrates that with the growth of GDP (Y), the growth of government revenues (T) leads to the fact that they eventually begin to exceed government spending (G). As a result, the state budget deficit, typical for a period of GDP recession, turns into a surplus. Note that the size of both the deficit and the surplus depend on the slope of the T line, which is due to the extent to which tax revenues to the budget are susceptible (elastic) to changes in GDP.

Rice. 27.1. Change in government revenues depending on the dynamics of GDP

In turn, this susceptibility largely depends on the strength of the so-called built-in stabilizers. This is a progressive system of taxation, government transfers to the poor, and similar means of influencing income. They not only reduce the rate of decrease and increase in aggregate demand, but also soften cyclical fluctuations in state budget revenues.

Taxes and Aggregate Supply

Rice. 27.1 shows that in the course of the economic cycle, a budget deficit (in the recession phase) and a surplus (in the recovery phase) can automatically occur. To combat the state budget deficit and in order to revitalize economic life, supporters of the supply-side economy propose to reduce taxes. They believe that lower tax rates will not necessarily lead to an increase in the state budget deficit due to reduced tax revenues (as Keynesians believe), but a rise in production (supply) and demand will certainly be helped. As proof that a decrease in tax rates turns into an increase in tax revenues to the budget, the Laffer curve is given (see Fig. 7.3). However, the problem is that if this happens, then in the long run, and in the short run, the revenues of dogs to the budget may decrease.

We also note that indirect taxes, unlike direct taxes, are one of the built-in budget stabilizers. During the recession phase, when profits and other incomes tend to fall more than GDP, direct tax revenue also falls sharply. As for indirect taxes, the volume of transactions with goods and services is declining much less, as a result of which the state budget revenues from VAT, sales tax, and excises are not declining to the same extent as the volume of GDP. Moreover, indirect taxes reduce the negative impact of inflation on the budget. If direct taxes give the budget revenues mainly from those incomes and property, the size and prices of which usually grow more slowly than inflation, then indirect taxes are based on those goods and transactions, the prices of which do not lag behind, and sometimes even outperform the GDP deflator index.

conclusions

1. The main means of redistributing GDP are the budget and taxes.

2. The state budget is a form of formation and expenditure of a fund of funds intended for financial support of the tasks and functions of the state and local self-government. It consists of central and territorial budgets; their drafts and performance reports are annually adopted by Parliament.

3. The expenditure part of the budget is represented by appropriations for social, economic, military purposes, as well as for the maintenance of administrative bodies and payments on the public debt. Budget expenditures for economic purposes are carried out in the form of state loans, subsidies and guarantees.

4. In case of excess of expenses over incomes, the state internal and external debt arises. Some debtor countries resort to the consolidation of international debt and to the conversion of debts into foreign ownership on their territory.

5. A tax, duty, due is understood as a mandatory contribution to the budget or to an off-budget fund, carried out in the manner determined by legislative acts. Taxes are direct and indirect: they differ in the object of taxation and in the mechanism of calculation and collection, in their role in the formation of the revenue side of the budget.

6. The main functions of taxes: fiscal, social and regulatory.

7. Taxation (VAT, customs duties, double taxation) also has a great impact on foreign economic relations.

8. In modern conditions, taxes have become the subject of international agreements. First of all, this applies to customs duties agreed within the framework of the WTO, as well as to internal taxes in countries that are members of integration associations.

9. Budget and tax (fiscal) policy can be aimed at stimulating economic life or at its limitation. It is carried out through government spending and tax collection.

Terms and concepts

Finance

Financial and credit system

Financial and credit policy

The state budget

Budget Process

State off-budget funds

Target budget funds

budget deficit

Fiscal federalism (interbudgetary relations)

Restructuring (consolidation) of external debt

Foreign debt conversion

External debt regulation

debt service

taxes

Tax system

Direct taxes

Indirect taxes

Personal income tax

Income tax of enterprises (firms, corporations)

Social contributions (social taxes)

property taxes

excises

The tax base

tax rate

imputed income tax

Double taxation

Crowding effect

Questions for self-examination

1. What is the state budget?

2. What items do the revenue and expenditure parts of the budget consist of?

3. Why do central and territorial budgets exist, how are they financed?

4. Why is the state forced to resort to loans?

5. List the main taxes in Russia.

6. What impact do taxes have on the country's economy?

7. What are the fiscal and regulatory functions of taxes?

8. What are tax incentives; to whom and for what purposes are they provided?

9. For what purposes are budgetary funds spent?

10. How is double taxation avoided?

11. What is tax harmonization?

12. What is fiscal restriction?

13. What are the consequences of lowering tax rates predicted by Keynesians and supporters of supply-side economics?

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Hosted at http://www.allbest.ru/

1. Taxes and state budget

The economic relations that develop in society regarding the use of money are called finance. A significant part of them is accumulated by the government in the form of public finances. A significant part of GNP is redistributed through public finance. The main link of public finance is the budget.

The budget structure of unitary states differs from federal ones: the former have two levels of budget - national (federal) and local, and the latter have three: between the federal and local budgets there is an intermediate regional link in the form of state budgets (USA), states (Germany), subjects of the federation (Russia). If we bring all levels of budgets together, then we can get a consolidated budget of the state, which is used for special analysis and forecasting of cash flows in the national economy.

The leading link in the budget structure of the country is the state budget -the financial plan of the state for the centralized attraction and expenditure of monetary resources for the performance of its functions.

In countries with a developed market economy, the state budget performs, in addition to its direct functions of ensuring the country's security, maintaining the state administration apparatus, implementing social policy and developing science, education, and culture, another additional function - regulating the economy, indirectly influencing the market behavior of firms in order to achieve sustainable development.

Budget surplus and deficit

The state budget is compiled as a balance of revenues and expenditures for the year. The equality of revenue and expenditure between themselves implies a balance of the budget, however, the presence of cyclicality in the economy, the need for an active stabilization policy and the implementation of structural changes in the national economy in order to implement the achievement of scientific and technical progress, often leads to a mismatch of their own parts of the budget and the emergence of a deficit (more often) and a surplus (less often).

budget deficit -the excess of government spending over its revenues within a financial year. There are current (temporary, not exceeding 10% of the budget revenue) and chronic (long-term, critical, exceeding 20% of the revenue). When approving a deficit state budget, its maximum allowable value is usually set. If it is exceeded in the process of budget execution, then a budget sequestration is carried out, i.e. a proportional reduction in spending for the remaining budget period for all items of expenditure, with the exception of socially protected ones.

Budget surplus -the amount of excess of state revenues over its expenditures within the financial year.

The alternation of periods of budget deficit and surplus makes it possible to balance the budget not for a year, but for 5 years. This approach allows the state to maneuver its finances in order to smooth out the business cycle by about 30-40% (Fig. 1).

Fig.1. Cyclical balancing of the State budget R - government revenues; G - government spending; M - balanced budget.

State debt

State debt -this is the excess of the total deficits of the state budget accumulated over previous years over its surpluses. The state debt of the country is formed at the expense of both internal and external borrowings.

Domestic public debt - the debt of the government of their country. It is serviced by issuing government bonds and obtaining loans from the Central Bank of the country.

External public debt - state debt to foreign creditors: individuals, states, international organizations. If the government is unable to pay its public debt and misses the deadlines for payments, then a situation of default arises - a temporary waiver of obligations, entailing sanctions from creditors up to a boycott and confiscation of state property located abroad.

A significant public debt disrupts the financial system of the state, worsens the business climate in the country and significantly limits the growth of the population's well-being.

The principle of taxation

taxes -These are obligatory payments of individuals and legal entities levied by the state. They form 90% of the revenue part of the state budget of the country.

Taxes, in addition to the fiscal function (i.e. filling the state budget), are intended for:

1. regulation;

2. stimulation;

3. redistribution of income.

The principles of rational taxation, developed by A. Smith, have not lost their relevance to this day:

· The principle of justice: the entire society should bear the tax burden, and tax evasion, the creation of various "gray schemes" of settlements with the state should be condemned by society.

· The principle of certainty: the tax must be specific in size, term and method of payment. It is impossible to introduce taxes retroactively (modern practice in Russia).

· The principle of convenience: the tax should be convenient, first of all, for the population, and not for the taxman.

· The principle of economy: the cost of collecting taxes should not be excessive, burdensome for society.

Direct and indirect taxation

According to the method of collection, taxes are distinguished direct and indirect.

Direct taxes - These are visible taxes, since they are established on the income received by a person or company, as well as on their property: income tax, corporate income tax, inheritance and gift tax, land and property tax, etc.

Indirect taxes - these are implicit taxes, invisible to consumers, since they are levied on producers who are obliged by the state to include them in the price of goods and transfer them to the state's income immediately after the sale. These are turnover tax, value added tax, sales tax, excises. budget surplus debt property taxation

Laffer curve