How to get a property deduction at work. Registration of a tax deduction through an employer: description of the procedure

Read also

- Possibility of receiving a deduction immediately after the right to it arises.

- There is no need to fill out a declaration in form 3-NDFL.

- The period for document verification is 1 month.

Disadvantages of receiving a property deduction through an employer

- Refunds are not made in a single amount for the entire year at once, but monthly, in the form of full wages (without deducting personal income tax in the amount of 13%).

- If a citizen changes jobs during the year, he will not be able to receive a deduction at his new place of work until the next year.

- This method is not suitable for those who, for a number of reasons, do not want to report to their place of work the fact of purchasing residential real estate.

- The deduction is provided only from the month when the citizen submitted to the employer a notification from the tax authority confirming the right to the benefit.

Since the period for checking documents at the tax office is 1 month, a citizen will be able to start receiving the deduction no earlier than February, and therefore for January he will have to receive it at the end of the year at the tax office.

Features of refunds through the employer

The deduction is provided in the form of an exemption from income received by a citizen from personal income tax.

Every month a citizen receives a full salary without tax deduction.

Stepanova’s salary is 120,000 rubles, of which personal income tax is 15,600 rubles. In total, Stepanov receives 104,400 rubles monthly. When applying for a deduction at the place of work, Stepanov will receive a full salary - 120,000 rub. without tax deduction.

The deduction can be claimed immediately after the right to it arises

If the right to it arose in May, already this month you can submit documents to the tax office to confirm the right to return it at your place of work.

Note: At the moment, many questions arise regarding which month the employer should start providing the deduction. The Ministry of Finance, in a number of its letters, in particular, dated March 16, 2017. No. 03-04-06/15201, indicated that the employer can provide a deduction not from the month in which the employee brought the tax notice, but from the beginning of the year. It is worth noting that in most cases, accounting departments take such a step doesn't work and begins issuing deductions from the month of receipt of notification from the employee.

If you change jobs in the same year, you will not be able to get a deduction at your new job.

At the moment, the position of the regulatory authorities (for example, Letter of the Federal Tax Service for Moscow dated July 3, 2009 N 20-14/068304@) is such that in the event of a change of place of work in the year in which the citizen began to receive a deduction at the place job, start receiving it again in the same year, but at a different job it is forbidden.

In 2017, Stepanov received confirmation from the tax authority of the right to receive a deduction through his employer and began to return it, but a few months later he quit, and therefore, at his new job, he will only be able to start receiving this benefit next year.

The deduction can be received from several employers at the same time

If a citizen officially works in several jobs, he can receive a tax deduction from both employers. To do this, he needs to prepare a corresponding application, in which he will indicate the amount of the deduction received from each employer, and send it to the tax authority at the place of registration.

Belov S.S. works 2 part-time jobs. In 2017, he purchased an apartment worth RUB 1,800,000. Belov drew up an application to receive a deduction in the amount of 1,000,000 rubles for one place of work. and for the second in the amount of 800,000 rubles. The tax authority reviewed the submitted documents and confirmed the right to deduction in the proportions indicated by Belov.

The remainder of the deduction not received from the employer will have to be received from the Federal Tax Service at the end of the year.

If during the year a citizen did not receive the deduction in full (for example, he applied for it in the middle or end of the year, or changed jobs during the year), he will be able to receive the balance only at the end of the year from the tax authority in the order established for receiving a deduction through the Federal Tax Service.

Next year it will be necessary to obtain a new confirmation of the right to deduction from the Federal Tax Service

Confirmation of the right to deduction at the place of work received from the tax authority is valid only 1 year, and therefore must be obtained annually.

Procedure for claiming benefits at the place of work

1. Collection of necessary documents.

Submitted to the tax authority is similar to what is submitted when applying for a deduction through, with the exception of the 3-NDFL declaration.

It includes:

- on confirmation of the right to deduction from the employer.

- Documents confirming ownership of the purchased property.

- Payment documents confirming the purchase of housing.

2. Transfer of documents to the tax authority at the place of registration.

Documents to confirm the right to deduction can be submitted to the inspection in the following ways:

- Personally or through a representative (by proxy).

- By registered mail with a list of attachments.

- Through the “Taxpayer Personal Account” on the Federal Tax Service website.

3. Receipt of notification of confirmation of the right to deduction.

After 30 days from the date of receipt of the documents, the tax authority must send the citizen a notification confirming the right to a deduction or denying it.

4. Submission of notification at the place of work.

After the tax office issues a notice to confirm the deduction, it will need to be submitted to the accounting department at the place of work along with an application for this benefit. Starting from the month in which the notice was submitted, the citizen will begin to receive a deduction, namely, personal income tax will no longer be deducted from his salary.

An individual receives a notification of a tax deduction for an employer from the tax office and takes it to the accounting department of his company. From our material you will learn about what the notification looks like, as well as who and for what taxes can receive a deduction at the place of work.

What deductions and for what taxes are available at the place of work?

An individual can receive a personal income tax deduction:

- to the Federal Tax Service;

- at the employer.

The technology for obtaining deductions is different. For example, to receive a social deduction from the tax office you need:

- wait until the year is over;

- fill out 3-NDFL and submit it to the inspectorate along with supporting documents;

- wait again for the tax authorities to check the documents and transfer the money to the account.

More information about what expenses can be offset using a tax deduction is described in the publications:

However, an individual has the opportunity not to wait until the year ends. You can use the deduction immediately after purchasing an apartment (paying for training, treatment), if it is provided by the employer.

You can receive a deduction at your place of work:

- only for one tax - personal income tax;

- for two types of deductions - property and social.

Is a deduction possible when purchasing a residential building, see.

Unfortunately, not all individuals who receive income from an employer can claim a deduction at their place of work:

As can be seen from the figure, there are no obstacles to receiving a deduction at the place of work for persons who have entered into an employment contract with the employer. In this case, the term of its conclusion does not matter (for a certain period or without specifying it). Part-time workers also fall into the category of workers for whom a deduction is available at the place of work, regardless of the size of the rate (0.25; 0.1, etc.).

At the same time, persons who have entered into civil contracts will not be able to take advantage of the deduction from the employer - see the position of officials on this issue in the letter of the Ministry of Finance dated October 14, 2011 No. 03-04-06/7-271.

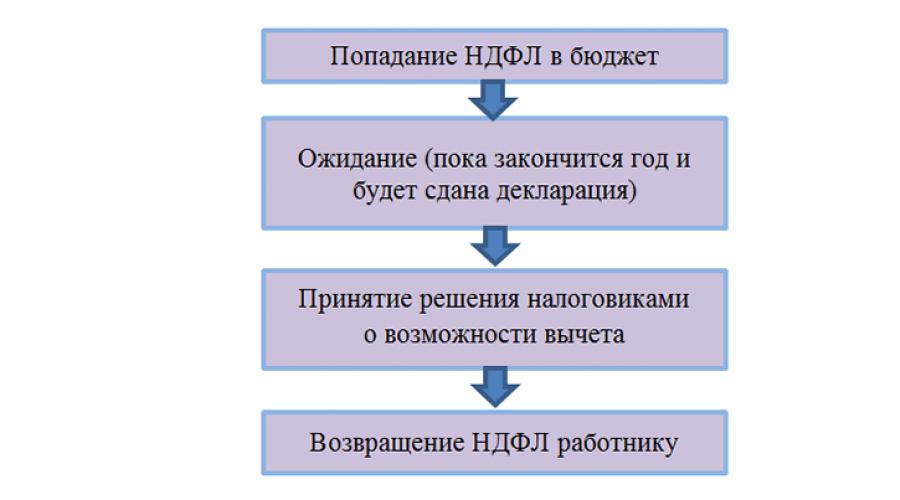

When you receive a deduction from the tax office, personal income tax from your salary goes a long way before returning to you in the amount of the deduction:

When applying for a deduction to the employer, significant time is saved, since it is spent only on receiving a notification from the Federal Tax Service (no more than 30 days - paragraph 3 of paragraph 3 of Article 220 of the Tax Code of the Russian Federation):

Example

An employee of Perimeter LLC, a fitter at workshop No. 3, I. R. Sadykov, purchased an apartment in March 2018. He has a choice - to apply for a deduction:

- to the Federal Tax Service at your place of residence;

- at the place of work.

In the first case, more than a year will pass from the moment of purchasing the apartment until the personal income tax is returned (9 months before the end of the year + 3 months for a desk audit of 3-personal income tax + another month for the transfer of the “refundable” personal income tax to I.R. Sadykov’s account).

In the second case, you won’t be able to get a deduction right away either. It will take time to receive a notification from the tax authorities (to apply for a deduction to the employer). However, these time costs are significantly less than in the first case. And Sadykov I.R. will be able to start using the deduction within a month after contacting the tax authorities for notification.

Thus, applying for a deduction to the employer helps its recipient:

- Recoup your expenses faster. For example, the employer is obliged to provide a property deduction from the beginning of the year, regardless of what month the employee received the notification from the Federal Tax Service (personal income tax withheld from the beginning of the year until the month of receipt of the notification must be returned to the employee).

- Save time on registration and submission of 3-NDFL.

- Save your money from inflation and compensate for part of the expenses with the least financial and temporary losses.

Application form for receiving a notification confirming the right to a property or social deduction

If you decide to apply for a deduction to your employer, you must:

- fill out an application for deduction and submit it to the employer (see what to write in it below);

- Receive a notification from the tax authorities about your right to a deduction and attach it to your application.

When you contact the tax authorities for a notification, you will also need an application - after receiving it, a document check begins, after which the controllers confirm your right to a deduction or deny it.

Application forms depend on the type of deduction and are advisory in nature.

You can see what the application form for confirmation of property deduction looks like below:

The application form for confirmation of social deduction is as follows:

What does the tax authority's notification for deduction look like?

A separate notification form is provided for each deduction.

The form for notifying the tax authority about confirmation of a property deduction was approved by order of the Ministry of Finance and the Federal Tax Service dated January 14, 2015 No. ММВ-7-11/3@.

The form of notification confirming the right to a social tax deduction, recommended by tax authorities, is posted in the letter of the Federal Tax Service dated January 16, 2017 No. BS-4-11/500@.

The following materials will tell you about different types of non-tax notifications for different situations:

- “How to write a notice of termination of a contract - sample”.

- .

To receive a deduction at your place of work, you bring an application and a notice of tax deduction to the accounting department. The application must contain a request for a tax deduction, its type and amount. Such a statement is drawn up in free form addressed to the head of the company. You can use the text below as a sample:

After the application, together with the tax notice, reaches the accounting department of your company, personal income tax will no longer be withheld from your salary. In this case, the start date of application of the deduction is:

- for social deductions - the month in which the employee applied for the deduction (clause 2 of Article 219 of the Tax Code of the Russian Federation);

- for property deduction - from the beginning of the year (letter of the Ministry of Finance dated January 20, 2017 No. 03-04-06/2416).

You may need to receive a tax deduction notice from your employer again:

- if the deduction in the current year is not used in full and part of it is carried over to the next year;

- if during the year the company in which the employee received the deduction was reorganized, the employee must again contact the tax authority for a notification that will indicate the name and details of the reorganized company.

The notification received again must be brought to the accounting department with a new application. In it, indicate the amount of the balance of the deduction and the period for its provision.

Is it possible to get a deduction from an employer for expenses in favor of children?

You can claim a deduction from your employer (social or property) even if you spent money to pay not only your expenses (purchase of housing, education and treatment), but also when paying expenses for the benefit of your children (purchase for their name of the apartment, payment for their education or treatment). Tax officials recently recalled this in a letter dated February 16, 2018 No. ММВ-17-11/46.

An employer will provide these deductions if you:

- you work for a company under an employment contract and receive taxable income (13%);

- They brought a notification from the Federal Tax Service confirming the right to deduction and an application.

Find out about “children’s” tax deductions from this publication.

Results

An employee can receive a tax deduction (property and social) at his place of work if he brings to the accounting department an application for deduction and a notification from the Federal Tax Service. The forms of notification of tax deductions for the employer are different for each type of deduction. To receive a notice confirming the right to a property tax deduction or a notice confirming the right to a social deduction, you need to fill out an application in the form recommended by tax authorities.

Receiving a deduction at your place of work will help you quickly compensate for part of the money spent on treatment, training or buying an apartment.

I have already written on the topic “Obtaining a property deduction from an employer,” and I briefly touched on the issue of some changes in obtaining a deduction from an employer in . Today I will tell you how to get a deduction from your employer for a period that, as a rule, falls out for many due to receiving a notification from the tax service three months after the start of the new year.

So, as you know, a property deduction from an employer can only be obtained on the basis of a notification received from the tax service. Let me briefly repeat, in order to receive a notification from the tax service, you must submit the following documents to the tax office at your place of registration:

1. Statement.

2. Copies of documents confirming your right to receive a property tax deduction.

3. A certificate from the place of work issued by the employer, with the obligatory indication of: the name, INN and KPP of the organization, the actual and legal addresses of the location of the tax agent, or the last name, first name, patronymic and INN of the individual entrepreneur.

At the end of 30 calendar days, the tax service must issue you a notice confirming your right to receive a property deduction from your employer. You give the notice and application in any form about the provision of a deduction to the employer. There is no need to provide any other documents.

Based on your application, the employer provides you with a property deduction. If you submitted an application in March, then you will not receive a property deduction for January and February.

Now let's look at specific situations. You submitted your application and notice to your employer in April. You were not provided with a deduction for January, February, March. How can I get a deduction for these months?

At the end of the year, you take a 2-NDFL certificate from your employer for the past year and again contact the tax service to issue a new notification. Do not forget that the notification is issued for a specific employer and for a certain tax period (year) (Letter of the Ministry of Finance of the Russian Federation dated December 20, 2011 No. 03-04-05/5-1072).

You submitted your application and notice to your employer in April. You were not provided with a deduction for January, February, March. You quit in September. In October you start a new job. Which employer will pay you a deduction from October?

Starting from October, the deduction will not be provided to you by either your new or old employer. To receive a deduction from a new employer, you need to contact the tax service at the end of the year, since the notice is issued once a year and cannot be transferred to the new employer.

You receive a deduction from your employer. But your income is not enough to provide a deduction in full, and at the end of the year you will have a balance. Does the employer have the right to provide you with the unused portion of the deduction in the next year based on the Notice issued in the past year?

No, you have no right, to receive the unused part of the deduction, you need to contact the tax service again to receive a notification for the remaining part of the deduction.

Receiving property

tax deduction for personal income tax from the employer

According to paragraph 8 of Art. 220 of the Tax Code of the Russian Federation, effective from January 1, 2014, property tax deductions provided for in paragraphs. 3 and 4 clauses 1 art. 220 of the Tax Code of the Russian Federation (on acquisition (construction) and on interest), can be provided to the taxpayer before the end of the tax period when he submits a written application to the employer - tax agent, subject to confirmation of the taxpayer's right to property tax deductions by the tax authority. Moreover, in contrast to the procedure in force until the end of 2013, since 2014 the taxpayer has the right to receive property tax deductions from one or more tax agents of his choice (third paragraph of clause 8 of Article 220 of the Tax Code of the Russian Federation). To do this, the taxpayer must provide each employer with proof of entitlement to the deduction from the tax authority.

If, having received a property tax deduction for personal income tax from one tax agent, the taxpayer applies for a property tax deduction to another tax agent, the deduction is provided in the manner prescribed by paragraphs 7 and 8 of Art. 220 Tax Code of the Russian Federation. The tax agent is obliged to provide such deductions upon receipt from the taxpayer of a confirmation issued by the tax authority indicating the amount of the deduction that the taxpayer is entitled to receive from each tax agent. For the purpose of execution by tax authorities of clause 8 of Art. 220 of the Tax Code of the Russian Federation to confirm the right of taxpayers to property deductions, indicating the amount of the deduction that the taxpayer has the right to receive from each tax agent specified in the confirmation, the tax authorities confirm the right to receive a deduction based on the amount indicated by the taxpayer in the application.

If, at the end of the tax period, the amount of the taxpayer’s income received from all tax agents was less than the amount of property tax deductions determined in accordance with paragraphs 3 and 4 of Art. 220 of the Tax Code of the Russian Federation, the taxpayer has the right to receive property tax deductions in the manner provided for in paragraph 7 of Art. 220 of the Tax Code of the Russian Federation, that is, when the taxpayer submits a 3-NDFL declaration to the tax authorities at the end of the tax period.

If, after the taxpayer submits in the prescribed manner an application to the tax agent to receive property tax deductions provided for in paragraphs. 3 and 4 clauses 1 art. 220 of the Tax Code of the Russian Federation, the tax agent withheld the tax without taking into account property tax deductions, the amount of tax withheld in excess after receiving the application is subject to return to the taxpayer in the manner established by Art. 231 Tax Code of the Russian Federation.

According to paragraph 3 of Art. 220 of the Tax Code of the Russian Federation, a property tax deduction for personal income tax for the construction (purchase) of housing (land) can be provided to the taxpayer before the end of the tax period when he contacts a tax agent, subject to confirmation of the taxpayer’s right to such a deduction by the tax authority.

The taxpayer has the right to receive a property tax deduction from one tax agent of his choice. The notification issued by the tax authority, in addition to the information of the employee to whom the deduction should be provided, indicates the information of the tax agent who will provide it, the amount of the deduction, as well as the tax period for which it is provided. The notification is issued by the tax authority only for one tax period within a period not exceeding 30 calendar days from the date of submission of a written application by the taxpayer and documents confirming the right to receive a property tax deduction.

The tax agent does not refund personal income tax withheld from the beginning of the year. At the same time, paragraph 3 of Art. 220 of the Tax Code of the Russian Federation established that if, at the end of the tax period, the amount of the taxpayer’s income received from the tax agent was less than the amount of the property tax deduction determined in accordance with paragraphs. 2 p. 1 art. 220 of the Tax Code of the Russian Federation, the taxpayer has the right to receive a property tax deduction in the manner provided for in paragraph 2 of Art. 220 of the Tax Code of the Russian Federation, when he submits a tax return 3-NDFL to the tax authority at the place of his registration.

Providing a deduction by the employer from the middle of the year.

If a taxpayer applies to an employer for a property tax deduction not from the first month of the tax period, this deduction is provided starting from the month in which the taxpayer applied for its presentation in relation to the entire amount of income accrued to the taxpayer on an accrual basis from the beginning of the tax period with offset of the previously withheld amount tax (see letters of the Ministry of Finance of Russia dated 06.20.2.013 No. 03-04-05/23258, dated 05.24.2013 No. 03-04-05/18792, dated 03.13.2013 No. 03-04-06/7592, dated 12.29.2012 No. 03-04-06/4-374).

Tax amounts withheld by the tax agent before receiving the employee’s application for a property tax deduction and notification of the tax authority are not excessively withheld personal income tax amounts. Therefore, the tax agent should not return them (see letters of the Ministry of Finance of Russia dated September 14, 2012 No. 03-04-08/4-301, dated December 15, 2011 No. 03-04-05/7-1044, dated October 26, 2011 No. 03 -04-06/7-286, dated 04/12/2010 No. 03-04-06/9-72, etc.).

Example

In February, an employee of the organization presented the employer with a notice issued by the tax authority confirming his right to a property tax deduction in the amount of 2,000,000 rubles. The amount of his monthly income is 100 thousand rubles. Personal income tax was withheld from the January salary in full without deduction: 100,000 rubles. x 13% = 13,000 rub.

The employer does not return this amount to the employee or recalculate it.

The employee’s income for the remaining 11 months of the year will be 1,100,000 rubles. (RUB 100,000 x 11 months). This amount is less than the amount of the deduction specified in the notice, and therefore the employer must not withhold personal income tax from the employee when calculating wages until the end of the year (11 months). At the end of the tax period, the employee will have the right to receive a deduction in the amount of 900,000 rubles. (RUB 2,000,000 - RUB 1,100,000).

To continue receiving a property deduction at the place of work next year, the employee must submit a new notification from the tax authority to the organization.

You can get acquainted with the list of documents that we need to fill out the 3-NDFL tax return for you.

I I will help you get a tax deduction and correctly fill out the tax return for personal income in Form 3-NDFL for 2018, 2017 or 2016 for submitting it to the tax office.

You can get acquainted with the prices for services for filling out a tax return in form 3-NDFL in the section "Prices for services" .

Forms/templates of tax returns 3-NDFL

Declaration 3-NDFL for 2018 free download form (template) pdf

Last updated March 2019

There are two options for obtaining a property tax deduction when purchasing an apartment/house:

- through the employer(we will consider the process of obtaining a deduction through the employer in this article).

The essence of receiving a deduction through an employer is that income tax in the amount of 13% will not be withheld from your salary until the deduction is exhausted (although it is worth noting that the right to a deduction will need to be confirmed with the tax authority every calendar year) .

The procedure for obtaining a tax deduction through an employer

A special feature of receiving a deduction through an employer is the ability to claim a deduction immediately after the right to it arises, and not wait until the end of the calendar year, as in the case of receiving a deduction through the tax office (you can find information about when the right to a property deduction arises in our article “ When does the right to a property tax deduction arise?”).

Let's look at what steps you need to take to receive a deduction through your employer:

1) You need collect a package of documents for deduction.

It is worth noting several differences:

You do not need to fill out the 3-NDFL declaration;

2) After the documents for deduction have been collected, you need submit them to the tax office at your place of registration(in person or by mail) to confirm the right to deduct. Within 30 days after submitting the documents (paragraph 3, clause 3, article 220 of the Tax Code of the Russian Federation), the tax authority must issue you a Notification confirming your right to a tax deduction.

4) From the moment the application is submitted and notified to the accounting department, all further calculations necessary for the deduction will be made by the employer. Wherein , starting from the month of filing documents, income tax will not be withheld from your salary, and, accordingly, you will receive 13% more wages than usual. This will occur until the deduction is exhausted or until the end of the calendar year (whichever comes first).

Example: Ryzhov S.M. I purchased an apartment in February 2019. After preparing all the documents necessary to receive the deduction, he contacted the tax office at his place of residence with a corresponding application. In March 2019, the tax inspectorate issued Ryzhov S.M. notice confirming the right to deduction. Ryzhov S.M. submitted the notice along with a written application for receipt of the deduction to his employer. Since March 2019 Ryzhov S.M. began to receive wages without deduction of 13% personal income tax.

From what month is personal income tax not withheld and can an employer return tax for previous months?

In the example given in the previous section, it is clear that the taxpayer turns to the employer to receive a deduction not at the beginning of the year, but in March.

In this regard, the relevant question is: At what point does the employer stop withholding income tax?

Regulatory authorities have repeatedly changed their position on this issue. Until 2017, the position of the Ministry of Finance of the Russian Federation was as follows: a taxpayer can begin to receive a property deduction only from the month in which he submitted an application and notification to the employer, and at the end of the calendar year he has the right to return the tax paid for the remaining months by filing a 3-NDFL declaration (Letters of the Ministry of Finance of Russia dated March 21, 2016 No. 03-04-06/15541, dated July 20, 2015 No. 03-04-05/41417, as well as Determination of the Armed Forces of the Russian Federation dated December 26, 2014 N 304-KG 14-6337).

However, in 2017, the opinion of the tax authorities changed. According to the current position, the employer can refund the tax from the beginning of the year, regardless of the month in which the notice was submitted(Letters of the Ministry of Finance of Russia dated March 16, 2017 No. 03-04-06/15201, dated January 20, 2017 No. 03-04-06/2416, paragraph 15 of the Review of the practice of considering cases by courts dated October 21, 2015).

Example: Shadrov G.G. bought an apartment and in June 2018 submitted an application to the tax office to receive a notice for the employer. In July Shadrov G.G. received a notice and submitted it to work in the accounting department. After receiving the notification, the employer must provide Shadrov G.G. property deduction in the following amount:

- From July until the end of 2018, do not levy a tax on his salary at a rate of 13% (Shadrov G.G. will receive a salary of 13% more);

- Refund the tax withheld from G.G. Shadrov’s salary. from the beginning of the year until the month preceding the date of submission of the notification (from January to June).

At the same time, it is worth noting that despite the new position of the tax authorities, in practice the accounting department may have difficulties with the return of tax paid for the months preceding the moment of providing notification to the employer. How to act in such a situation: agree with the accounting department (and return the tax by filing a 3-NDFL return) or defend your position, depends only on your decision.

Receiving a deduction in the event of a change of job or reorganization of the employer

A situation often occurs when a taxpayer, having received a notice of the right to a deduction for a specific employer, changes his place of work.

According to the previous opinion of the regulatory authorities, the taxpayer could not receive a deduction from the new employer before the start of the new calendar year (Letters of the Federal Tax Service of the Russian Federation for Moscow dated April 14, 2010 N 20-14/4/039129@, dated July 3, 2009 N 20-14/ 068304@, dated 04/30/2009 N 20-14/3/043204@). However, it is possible that this position will change due to recent changes in the Tax Code (the ability to receive a deduction from several employers). At the moment, there are no official documents defining the current position of the regulatory authorities.

Receiving a deduction through an employer if you have several jobs

Until 2014, if a citizen worked simultaneously in several jobs (part-time), he could receive a tax deduction from the employer only at one place of work (of his choice).

On January 1, 2014, changes were made to the Tax Code that allowed to receive property deductions from several employers at the same time(paragraph 4, clause 8, article 220 of the Tax Code of the Russian Federation). To do this, you must indicate in the application for deduction how you want to distribute the tax deduction between employers, and the tax authority will issue notifications to your employers with the specified amounts.

Example: Suslikov V.V. purchased an apartment in February 2019 for 2 million rubles. At the same time, Suslikov V.V. I officially worked two part-time jobs. Suslikov decided not to wait until the end of 2019 to receive the deduction through the tax authority, but instead receive the deduction through his employers. Suslikov V.V. applied to the tax office at his place of residence with a corresponding application, where he indicated that he wanted to receive a deduction from both employers (1,000,000 rubles from the first and 1,000,000 rubles from the second). A month later, the tax office sent him a notice confirming his right to the deduction. Suslikov V.V. sent notifications of receipt of the deduction to his employers. From that moment on, he began to receive wages from both jobs without deducting the 13% personal income tax (until the deduction is exhausted or the end of the calendar year).

The procedure for receiving the remainder of the deduction that has not been exhausted in the current year

In accordance with paragraphs. 2 p. 1 art. 220 of the Tax Code of the Russian Federation, the taxpayer has the right to receive the balance of the deduction from the employer in subsequent tax periods if the deduction has not been used in full in the current year.

However To do this, at the beginning of the year you will need to receive a new notification from the tax office. To receive a new notification, you will need to provide to the tax office, along with the application, a certificate in form 2-NDFL, which was issued by the employer for the previous year (Letters of the Ministry of Finance of Russia dated 04/22/2015 N 03-04-05/23108, dated 10/27/2011 N 03- 04-05/9-809).

Upon receipt of the new notice, the taxpayer submits it along with the application to the employer and receives the remaining deduction in the same manner as described above.